Intermediaries and Collective Investment Fund(CIF) – Process + Pros & Cons

Collective investment funds (CIFs) are bank or trust company’s pools of accounts. The financial institution combines individual and organizational…

Discover profitable investment strategies, asset allocation techniques, and risk management tools. Explore equity markets, fixed-income securities, real estate investments, and alternative assets. Learn about compound interest, diversification, market capitalization etc. Learn and grow your wealth by knowing about economic indicators to optimize your financial portfolio and achieve long-term wealth accumulation.

Collective investment funds (CIFs) are bank or trust company’s pools of accounts. The financial institution combines individual and organizational…

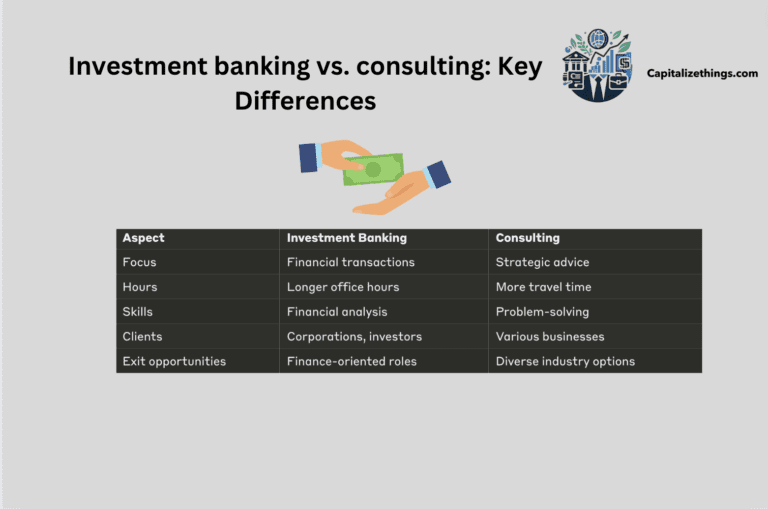

People who are smart, young, and ambitious want to work in investment banking and management consulting because they offer tough…

Investment means buying something or putting money into something that will give you money back. Profits from your investments…

Investment appraisal uses financial planning and financing techniques to evaluate potential investments or projects. Traders use it as an…

Yes! Investment property can be depreciated. Investment Property covers land and structures owned for rental or capital appreciation. Investment…

The Dividend Discount Model (DDM) is a method utilized in monetary economics to cost a corporation’s inventory price based…

A company’s dividend growth rate (DGR) is its percentage growth over time. DGRs are often calculated annually. It can…

Growth investing involves investing in firms, sectors, or industries likely to increase. It is considered provocative in the investment…

Investment refers to producing things that will be utilized to make other things. In regular language, buying bonds or…

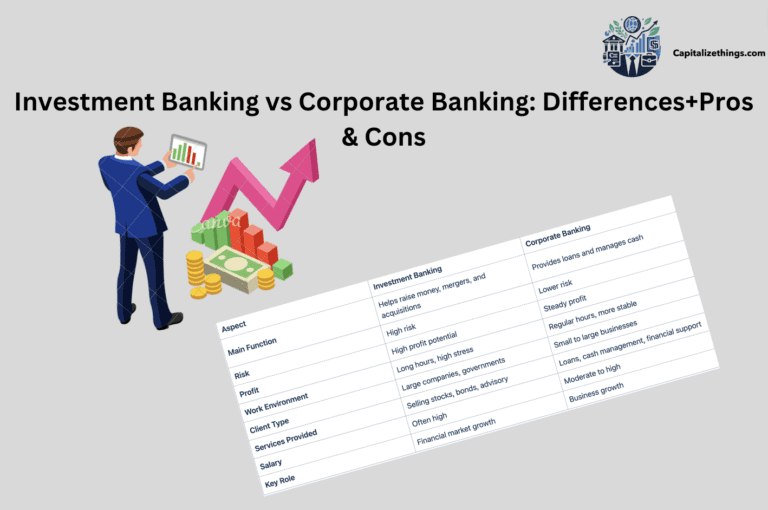

Investment banking enables agencies to increase money. It does this by selling stocks and bonds. It also helps with…