Investment banking vs. private equity: Differences Pros & Cons

Investment bankers provide advisory and financial services to clients regarding market share capital. Private equity firms aggregate cash from…

Discover profitable investment strategies, asset allocation techniques, and risk management tools. Explore equity markets, fixed-income securities, real estate investments, and alternative assets. Learn about compound interest, diversification, market capitalization etc. Learn and grow your wealth by knowing about economic indicators to optimize your financial portfolio and achieve long-term wealth accumulation.

Investment bankers provide advisory and financial services to clients regarding market share capital. Private equity firms aggregate cash from…

Dollar Cost Averaging (DCA) is a way to invest cash. You placed the identical amount of money into an…

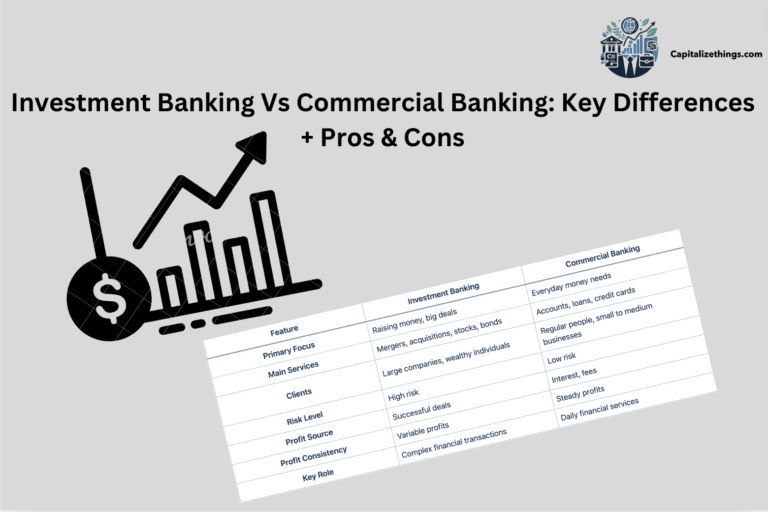

Investment banking focuses on helping organizations boost money and giving recommendations on big offers. They help with mergers, acquisitions,…

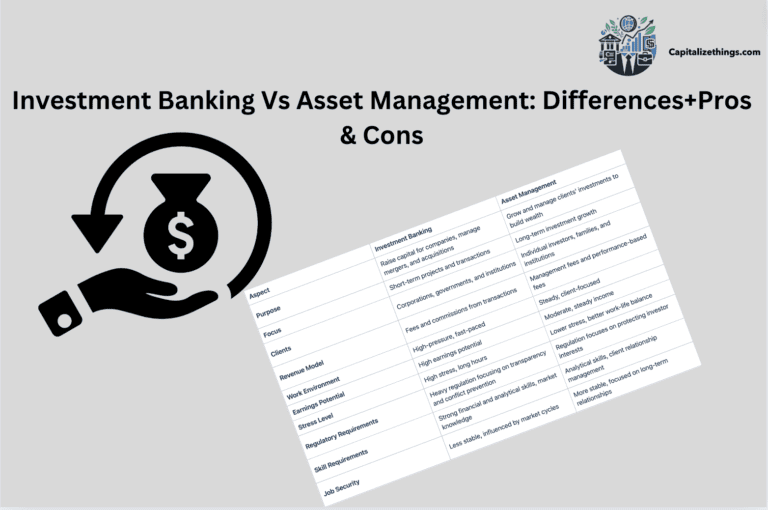

Investment banking facilitates companies to improve coins by way of issuing shares or bonds. Asset control invests for customers…

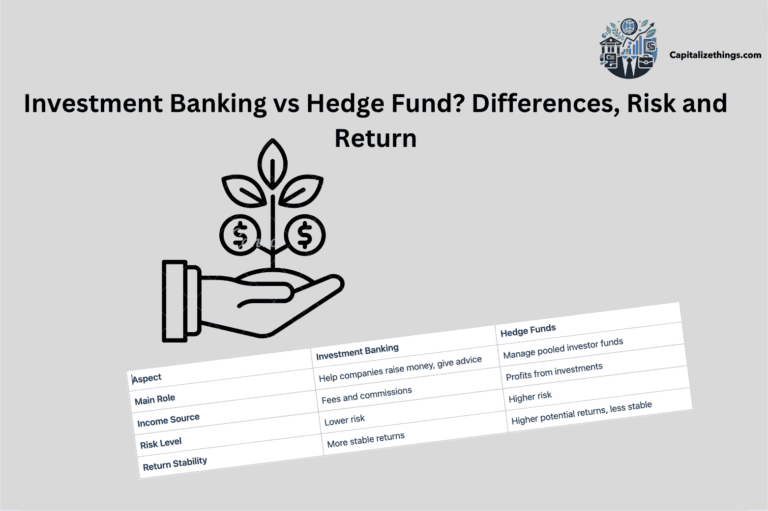

Investment Banking and Hedge Fund are distinct in many methods. Investment banking assist agencies to improve cash. They additionally…

Investment banking provides capital to other firms and enterprises. Issuers use investment banking for stock placement. Investment firm employees…

A diversified investment approach spreads cash throughout distinctive asset types, like shares, bonds, real estate, and commodities, to reduce…

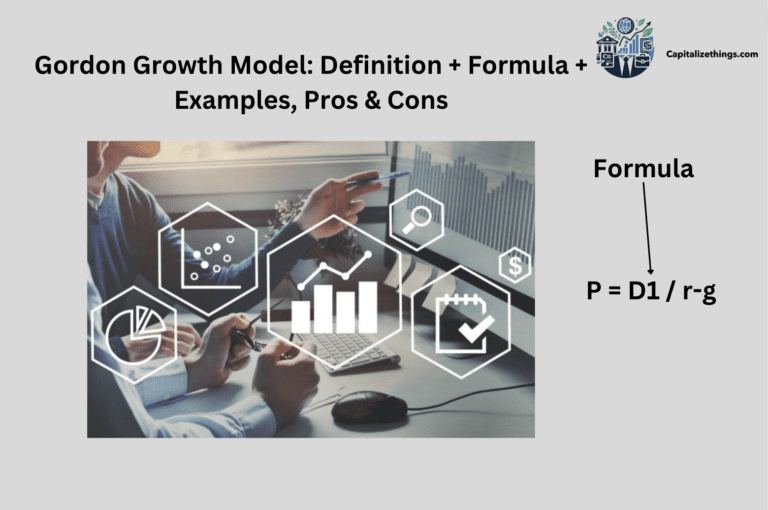

Gordon’s growth model (GGM) predicts a stock’s intrinsic value based on a future sequence of constantly growing dividends. Profitable…

The principles of investment are fundamental guidelines that help investors make informed decisions and achieve financial goals. They include…