Investment companies in the British Virgin Islands: BVI, Crypto, Bank, Road Town Tortola, Offshore, Policy

Investment Company is the any issuer that invests, reinvests, or trades securities (Section 4. an of Republic Act No….

Discover profitable investment strategies, asset allocation techniques, and risk management tools. Explore equity markets, fixed-income securities, real estate investments, and alternative assets. Learn about compound interest, diversification, market capitalization etc. Learn and grow your wealth by knowing about economic indicators to optimize your financial portfolio and achieve long-term wealth accumulation.

Investment Company is the any issuer that invests, reinvests, or trades securities (Section 4. an of Republic Act No….

In Cambodia, investment companies play a big position in sectors like banking, travel, and production. Acleda Bank Plc and…

In Canada, numerous top companies dominate numerous sectors. First National Financial and MCAP lead inside the mortgage enterprise, presenting…

ESG investing evaluates investments based totally on Environmental, Social, and Governance (ESG) factors. Environmental elements examine an enterprise’s effect…

An investment company invests investors’ pooled funds in financial securities. Closed-end or open-end funds (mutual funds) are usually used…

A shareholder is someone, agency, or group that owns as a minimum one proportion of an organization’s inventory. They…

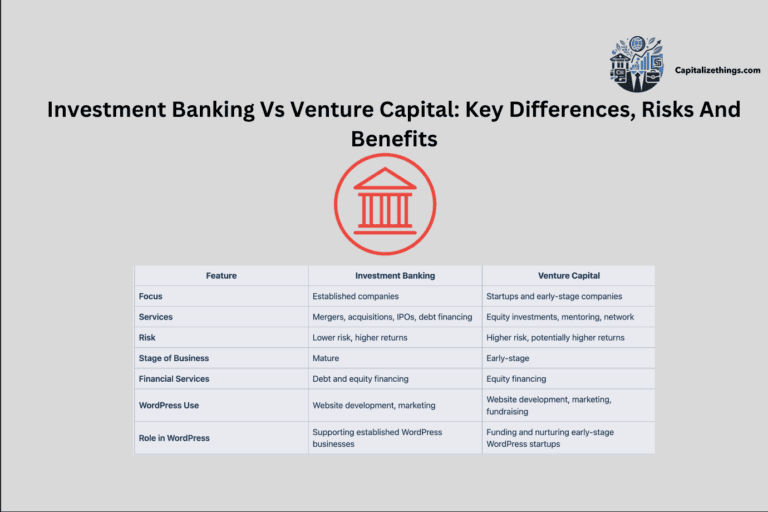

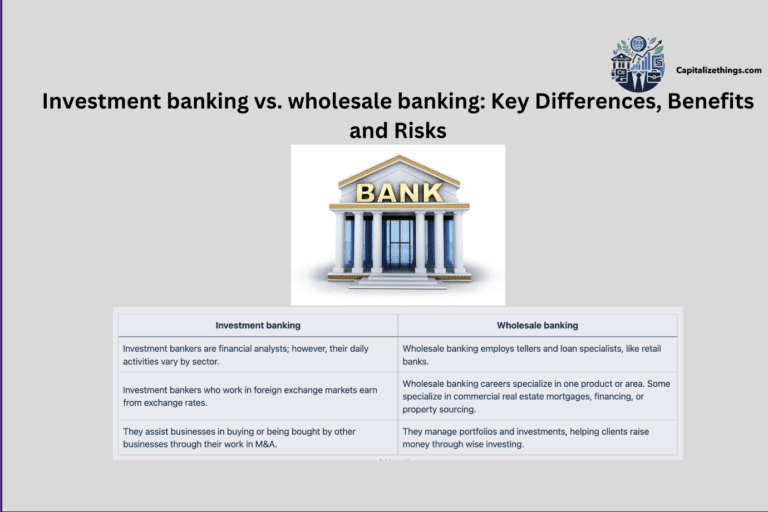

Investment Banking makes a speciality of raising capital, mergers, and acquisitions for huge corporations. They assist companies’ cross public…

Investment banking facilitates companies raising money by way of issuing shares, bonds, or coping with mergers. It focuses on…

Investment banks serve enterprises and institutional investors. Investment banks may perform M&A transactions, sell securities, or finance significant commercial…

Investment opportunities include stocks, bonds, real estate and mutual funds. Investment opportunities are assessed for profits, risks and liquidity….