A counterparty is one of the parties involved in a financial transaction. It refers to any man or woman, organization, or group that takes part in a change. In any trade or economic agreement, each party are required for the deal to occur, and every facet is known as a counterparty. Whether it’s a stock alternate, a loan agreement, or a coverage settlement, counterparties are crucial in making the transaction work. For example, in an inventory alternate, the client and seller are the counterparties. There are diverse forms of counterparties relying on the transaction. Buyers and dealers are the maximum not unusual counterparties in exchanges like inventory buying and selling or vehicle income.

In lending agreements, the lender and borrower are the counterparties, in which one party presents a mortgage, and the alternative borrows money. In the insurance global, the insurer and the insured act as counterparties, with one promising insurance and the opposite paying premiums. Derivatives investors, who trade contracts based totally on underlying property, are also counterparties. The function and duties of counterparties range depending on the transaction. For example, a lender faces the risk that the borrower might not repay the mortgage, even as a purchaser risks having the asset lower in value after buy. Each counterparty assumes an exclusive level of threat primarily based on their role inside the agreement.

This distinction highlights the significance of expertise the precise obligations and dangers counterparties take on in diverse transactions. An example of a counterparty dating is determined in a car sale. The consumer and the seller are the two counterparties involved. The consumer provides payment to buy the auto, at the same time as the vendor transfers possession of the vehicle to the buyer. Both events play unique roles, however they’re critical to completing the transaction. This simple principle of counterparties applies across all forms of financial transactions, from simple purchases to complex financial deals.

What Is A Counterparty?

A counterparty is one of the parties involved in a financial transaction or contract, such as a buyer, seller, lender, or borrower. In every trade, there are two parties, and each party is called a counterparty. One party offers something, and the other party receives something. For example, in a stock sale, the buyer and the seller are both counterparties. They work together to make the trade happen.

Counterparties are essential in all kinds of trades. They need to complete a deal. If one party does not participate, the transaction cannot be completed. The two parties make the exchange work. In a loan, the lender and the borrower are counterparties. They each agree to the terms of the deal.

Counterparties exist in many areas. They are found in business, finance, and other places. Without counterparties, no trades can take place. This is why counterparties are very important in all financial transactions. Each one plays a key role in making deals work.

What Is A Counterparty In A Contract?

In a contract, a counterparty is one of the entities that enters into the agreement and assumes contractual obligations and rights. A contract has two or more parties that agree to do something. Each party has its own obligations to fulfill. These parties are called counterparties. They make the agreement viable by agreeing to work together.

Each counterparty has its role within the contract. One party provides goods or services, while the other pays for them. In a contract to build a house, one counterparty is the builder, and the other is the person who pays for the house. The two counterparties agree on what needs to be done.

Counterparties in a contract must trust each other. They rely on each other to follow the terms. If one counterparty breaches the contract, the other may incur financial losses or face other problems. This makes the role of the counterparty in a contract very important for both parties.

What Is A Counterparty In Business?

In business, a counterparty is an entity with which a company conducts a financial transaction, such as a supplier, customer, or business partner. Businesses often trade goods or services with other companies. Each business in the exchange is called a counterparty. They make the trade happen by working together. Each counterparty provides something of value in the deal.

In business, counterparties must fulfill their obligations. One business delivers products, and the other may pay for them. For example, if a store orders shoes from a supplier, the store is one counterparty, and the supplier is the other. Both counterparties must adhere to the terms of the trade.

Counterparties in business face risks. One party may worry that the other will not deliver as promised. They also hope that the trade will help them grow. Businesses choose their counterparties carefully to avoid losses. This helps them ensure their business runs smoothly and remains strong.

What Is A Counterparty In Insurance?

In insurance, a counterparty is one of the parties involved in an insurance contract, typically the insurer and the insured. Insurance deals always involve two parties: the insurer and the insured. The insurer is the company that provides insurance, and the insured is the person who pays for it. Both of these parties are counterparties. The insurer provides financial protection.

The insured pays regular premiums for this protection. If a covered loss occurs, the insurer covers the loss. For example, in car insurance, the driver is the insured, and the insurance company is the insurer. These counterparties agree to the terms of the insurance contract.

Counterparties in insurance must adhere to the agreement. The insurer expects the insured to pay premiums on time. The insured expects the insurer to provide coverage when needed. Both parties need to stick to the terms for the insurance to work properly. Counterparties play a significant role in ensuring insurance protects both parties.

What Is A Trading Counterparty?

A trading counterparty is the other party with which a trader executes a financial transaction, such as the buyer or seller in a securities trade. In every trade, there are two parties: the buyer and the seller. Each one is a counterparty. They exchange stocks, bonds, or other financial products. Both parties need to agree on the price and terms for the trade to take place.

In buying and selling, counterparties need to agree that the opposite aspect will meet its duties. The purchaser affords money, and the vendor affords the asset. For example, if a person buys stocks of an organization, the buyer and the seller are both counterparties in the alternate. They both help the trade work.

Counterparties in trading face risks. The buyer risks the asset losing value, and the seller risks the value increasing after the trade. Each party must determine if the trade is worth it. These counterparties are essential to making financial markets work smoothly and fairly. They keep the market active.

What Is Counterparty Management?

Counterparty management is the process of identifying, evaluating, and monitoring the risks associated with doing business with another party in a financial transaction or contract. It ensures both parties fulfill their obligations and adhere to the deal’s terms. Counterparty management helps avoid problems by assessing the other party’s creditworthiness and reliability. It plays a significant role in ensuring trades and contracts are executed smoothly.

In counterparty management, companies monitor the other party’s risk. They watch for signs of financial distress, such as missed payments or declining credit ratings. This helps companies avoid losses and better manage risk. Counterparty management protects both parties by reducing the likelihood of default or non-performance in a deal.

Effective counterparty management builds trust between parties. When both parties trust each other, trades and contracts are more likely to be executed successfully and with fewer issues. Counterparty management employs various tools to assess the other party’s background and ensure they can fulfill their obligations. This improves the efficiency and security of transactions for both parties.

Is Counterparty The Same As A Third Party?

No, a counterparty is not the same as a third party. A counterparty is directly involved in a transaction, while a third party is an entity that is not a principal party to the transaction but may have an interest or role in it. They are directly involved in the deal, such as a buyer or seller. A third party is not directly part of the trade. They help in the deal but do not take on the same roles or risks as the counterparties.

A third party might be a service provider that helps both counterparties. For example, a payment processor helps with transactions but is not one of the counterparties. They make the trade easier but do not get the same benefits or take the same risks.

What Is A Central Counterparty?

A central counterparty (CCP) is an entity that interposes itself between counterparties to a trade, becoming the buyer to every seller and the seller to every buyer, to mitigate counterparty risk. The CCP helps reduce risks by guaranteeing the trade will happen, even if one party cannot meet its promise. CCPs are often used in big financial markets to protect buyers and sellers.

Central counterparties help manage risk by checking both parties credit. This reduces the chances of a failure during a trade. They also make sure the trade goes through smoothly, no matter what happens. CCPs are important in keeping markets safe for all traders.

A central counterparty takes on risk for both parties. They provide a middle step to make sure trades are done correctly. They protect both the buyer and the seller. CCPs are trusted by many traders because they help prevent losses in large markets. They play a key role in modern financial systems.

What Is The Role Of A CCP?

The primary role of a central counterparty (CCP) is to mitigate counterparty risk by acting as an intermediary between buyers and sellers, guaranteeing the performance of the contractual obligations of both parties. They take on the responsibility of ensuring the trade happens as agreed. The CCP becomes the buyer to every seller and the seller to every buyer. This reduces the risk for all involved.

CCPs also manage risks by checking credit. They make sure both parties can meet their promises before agreeing to the trade. This helps avoid failures that can hurt both buyers and sellers. The CCP keeps trades running smoothly in large financial markets.

Is Counterparty Default An Operational Risk?

Yes, counterparty default is considered an operational risk because it arises from the failure of a counterparty to meet its contractual obligations, which can disrupt a company’s operations and lead to financial losses. It occurs when one party in a trade cannot fulfill its promise. This risk can cause big problems for the other party. Businesses must watch for counterparty default to avoid losses. Managing this risk is important for smooth operations.

When a counterparty defaults, the other party loses money or faces delays. This risk affects all types of trades, from small deals to big financial transactions. Operational risk from counterparty default can harm a company’s business and reduce trust in the market.

Are Countries Sources Of Counterparty Risk?

Yes, countries can be sources of counterparty risk, particularly when a country’s economic, political, or financial stability is in question, which can impact the ability of its government or companies to meet their contractual obligations. When a country’s economy faces problems, its businesses do not meet their promises. This can cause issues for companies trading with them. Businesses must watch the financial health of the countries they trade with to reduce this risk.

If a country’s government changes its rules or faces financial trouble, companies in that country default. This increases the risk for counterparties dealing with those businesses. Countries with unstable economies are often seen as higher risks in financial markets.

What Happens When A Counterparty Defaults?

When a counterparty defaults, it means they fail to meet their promise in a trade, such as making a payment or delivering goods or services, which can result in financial losses and legal consequences for the other party. A default can lead to financial losses, delays, or even the end of a deal. This is why managing counterparty risk is important.

In financial markets, a counterparty default can create big issues. It can lead to loss of trust and make other traders worry about future deals. Companies often have plans in place to handle a default and protect their business from large losses.

What Is The Risk That A Counterparty Will Default?

The risk that a counterparty will default is known as counterparty credit risk or default risk, which refers to the possibility that a party to a contract or financial transaction will fail to meet its contractual obligations. It occurs when one party in a trade does not fulfill its promise. This risk can lead to financial losses or delays. Managing counterparty risk is very important for businesses and traders to avoid big problems.

Counterparty risk is higher in unstable markets. When the economy is weak, businesses find it hard to meet their promises. This increases the chance of default. Companies must carefully check their counterparties to make sure they can follow through with their promises.

How Does A Counterparty Work?

A counterparty works by entering into a contractual agreement with another party, such as a buyer or seller, and fulfilling its obligations as outlined in the contract, such as making payments or delivering goods or services. Each party in the trade is a counterparty, and they both have promises to meet. One party offers goods or services, while the other provides payment. Counterparties make sure trades happen by working together and following the terms of the deal.

Each counterparty has its own role in the trade. For example, in a stock trade, one counterparty buys the stock, and the other sells it. They both need to follow through for the trade to be completed. Without counterparties, no trade can take place.

How To Assess Counterparty Credit Risk?

Assessing counterparty credit risk involves analyzing the financial health, creditworthiness, and ability of a counterparty to meet its contractual obligations, using tools such as credit ratings, financial statements, and market data. Companies do this by examining the counterparty’s financial history and credit score. This helps them understand if the counterparty can fulfill its promises. Credit risk is a key component of managing safe trades.

Companies use credit checks and other tools to assess risk. They look at things like payment history, debts, and financial stability. This gives them an idea of whether the counterparty might default. The more information they have, the better they can manage this risk.

Let our dedicated team conduct a comprehensive counterparty credit risk audit for your organization with our proven assessment framework Connect with our specialists at capitalizethings.com via emailing us or call +1 (323)-456-9123 to schedule your free 15-minute discovery call.

What Is Counterparty Default And Its Impact On Economy?

Counterparty default occurs when a party to a contract or financial transaction fails to meet its contractual obligations, such as making payments or delivering goods or services, which can lead to financial losses for the other party and potentially trigger broader economic consequences. Counterparty default is a serious risk, especially in large financial markets. It can affect trust and lead to larger issues in the economy.

When many counterparties default, it can harm the entire financial system. Banks and businesses lose money, which can slow down the economy. This is why managing counterparty default risk is so important. A default in one sector can lead to problems in many others.

What Are Common Types Of Counterparties?

There are many types of counterparties in different financial agreements. Here are the 8 most common types of counterparties:

- Buyers: They purchase goods or services in a deal or trade. Buyers agree to pay the seller a set amount, fulfilling their part of the agreement.

- Sellers: They provide goods or services in exchange for payment. Sellers are key counterparties, delivering what the buyer needs.

- Lenders: These are financial institutions or individuals who provide loans. Lenders expect to be repaid with interest as part of the agreement.

- Borrowers: Borrowers are counterparties who take loans from lenders. They promise to repay the money within a specific time frame.

- Investors: These are counterparties that provide capital for a business or financial project. In return, they expect a profit or return on investment.

- Insurers: Insurers are counterparties in insurance agreements. They agree to cover certain risks in exchange for regular premium payments.

- Policyholders: They pay premiums and expect the insurer to cover certain risks. Policyholders are key participants in insurance contracts.

- Traders: Traders are buyers or sellers in financial markets. They exchange securities, commodities, or currencies based on agreed terms.

How To Evaluate A Counterparty’s Creditworthiness?

To evaluate a counterparty’s creditworthiness, companies analyze their financial history, including past payments, debts, defaults, and credit ratings, to assess the counterparty’s ability to fulfill their contractual obligations. This helps companies reduce the risk of default. Companies also review financial statements to understand the counterparty’s financial health.

They examine revenues, assets, and liabilities to determine whether the counterparty is financially stable enough to adhere to the terms of the transaction. This information aids in decision-making. Past relationships are another crucial factor.

Companies consider how the counterparty has performed in previous transactions. A good track record increases trust. By assessing these factors, companies can determine if the counterparty is reliable and mitigate their risk in the transaction.

How To Manage Counterparty Risk?

Managing counterparty risk involves assessing the counterparty’s creditworthiness, diversifying transactions across multiple counterparties, and using legal agreements to outline the consequences of default and protect against potential losses. Companies use credit checks, financial reports, and payment history to determine if the counterparty can fulfill their obligations. This helps mitigate the risk of default and protects the company from financial losses. Planning is essential to managing this risk.

Diversifying transactions is another way to manage risks. By spreading transactions across different counterparties, a company reduces its dependence on any single party. This protects the company if one counterparty fails to meet their obligations. Diversification is a powerful tool in managing counterparty risk.

Using legal agreements also helps manage risk. These agreements specify the consequences if the counterparty fails to meet their obligations. They provide protection by establishing clear terms for both parties. With these agreements, companies can reduce their exposure to counterparty risk.

What Is An Example Of A Counterparty?

An example of a counterparty is a buyer in a stock trade, where the buyer agrees to purchase shares from the seller, and both parties have obligations that must be fulfilled for the transaction to be completed. The seller is the other counterparty in the trade. Both have responsibilities, and the trade only works when both parties meet their commitments.

Another instance is a borrower in a loan deal. The borrower is a counterparty who agrees to repay the loan with interest. The lender, who provides the funds, is the other counterparty. Both parties work together to complete the deal as agreed.

In insurance, the policyholder is a counterparty. They pay premiums to the insurer, who agrees to cover specific risks. Both parties have obligations, and the agreement functions when both follow through. Counterparties exist in many types of transactions and contracts.

What Is An Example Of A Counterparty Risk?

An example of counterparty risk is when a buyer fails to make the agreed-upon payment for a purchase, leaving the seller exposed to the risk of financial loss. The seller faces the risk of not receiving the expected payment. This is why sellers assess the buyer’s creditworthiness before entering into a deal. It helps protect against the risk of default.

Another instance is a borrower who fails to repay a loan. The lender faces the risk of losing the money. This is why lenders take a look at credit ratings and financial fitness before giving loans. These steps help reduce the hazard of default.

In a stock trade, counterparty risk arises when one party cannot complete the transaction. If the buyer or seller fails to meet their obligation, the other party incurs a financial loss. Managing counterparty risk is crucial in all types of transactions and contracts.

Is Counterparty A Credit Risk?

Yes, counterparty risk is closely related to credit risk, as both refer to the possibility that one party in a transaction will fail to meet their financial obligations, resulting in a loss for the other party. Credit risk specifically refers to the risk that a borrower will default on a loan or credit agreement. Counterparty risk involves the same concept, where one party may default on their contractual obligations. Both are significant risks that must be managed in transactions and financial agreements.

When a counterparty fails to pay, it creates credit risk. This occurs in loans, bonds, or different financial contracts. Lenders face this chance after they lend money to debtors. Checking credit ratings and financial health facilitates reducing the risk of this occurring.

Credit risk is a major component of counterparty risk. Both involve the risk that one party cannot pay what they owe. Companies must carefully manage these risks to avoid losses in transactions. Understanding these risks is essential in any financial agreement.

Which Contracts Have Counterparty Risk?

Contracts involving loans, trades, or financial agreements often carry counterparty risk, as they require both parties to fulfill their respective obligations, and the failure of one party to do so can result in financial losses for the other. For example, loan agreements between lenders and borrowers carry the risk that the borrower will not repay the loan. This is a common type of counterparty risk in financial markets.

In stock or bond trades, counterparty risk exists if one party cannot meet their obligation. If the buyer or seller defaults, it creates losses for the other party. This is why financial contracts often include protections to mitigate this risk and ensure smooth transactions.

Insurance contracts also carry counterparty risk. The policyholder risks that the insurer will not cover a claim, while the insurer risks that the policyholder will not pay premiums. All contracts with financial obligations involve some level of counterparty risk, making it crucial to manage carefully.

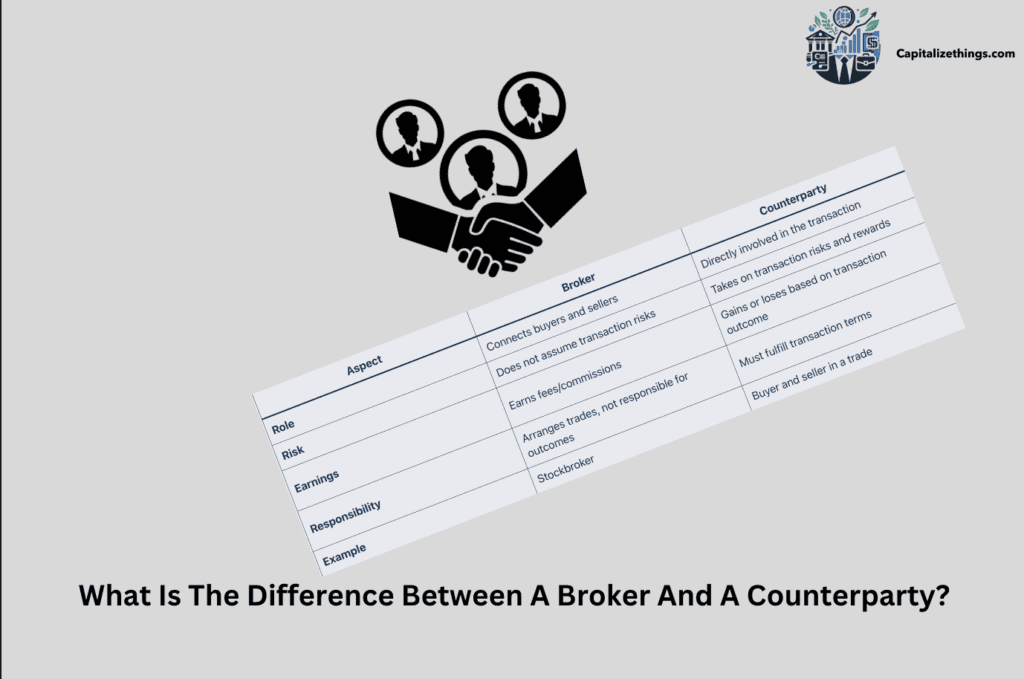

What Is The Difference Between A Broker And A Counterparty?

The main difference between a broker and a counterparty is that a broker facilitates transactions between buyers and sellers without taking on the risks and obligations of the transaction, while a counterparty is directly involved in the transaction and assumes the associated risks and rewards. A broker helps arrange trades between buyers and sellers. They connect both parties but do not take on the same risks. Brokers earn a value for their services but are not responsible for the trade’s outcome. They play a key role in making the trade easier.

A counterparty, alternatively, is without delay concerned inside the change. They take at the threat and rewards of the deal. For example, the purchaser and vendor in a stock exchange are counterparties. They need to meet their guarantees for the change to be finished.

The main distinction is that brokers do not take part in the deal itself. They act as intermediaries, helping the counterparties make the alternate take place. Counterparties are the ones who trade items, offerings, or payments directly in the change.

| Aspect | Broker | Counterparty |

|---|---|---|

| Role | Connects buyers and sellers | Directly involved in the transaction |

| Risk | Does not assume transaction risks | Takes on transaction risks and rewards |

| Earnings | Earns fees/commissions | Gains or loses based on transaction outcome |

| Responsibility | Arranges trades, not responsible for outcomes | Must fulfill transaction terms |

| Example | Stockbroker | Buyer and seller in a trade |

What Is The Difference Between A Client And A Counterparty?

The key difference between a client and a counterparty is that a client receives services from a company without being directly involved in transactions or assuming the associated risks, while a counterparty is a party to a transaction and shares the risks and obligations involved. A client is a person or company that receives services from another company. They pay for these services but are not directly involved in trades or deals. A patron depends on the corporation to offer what they want, whilst a counterparty takes part in a trade.

A counterparty, in evaluation, is concerned inside the change or deal. They take on risks and rewards, even as clients do no longer. For example, in a mortgage deal, the borrower and lender are counterparties, but the client might be someone receiving advice at the deal.

The major distinction is that clients do not share the equal duties in trades as counterparties do. Counterparties need to meet their guarantees to finish the change. Clients truly obtain services without the equal stage of danger worried in the deal.

| Aspect | Client | Counterparty |

|---|

| Role | Receives services, not in transaction | Directly involved in the transaction |

| Risk | No transactional risk | Assumes transaction risks and rewards |

| Responsibility | Pays for services | Fulfills contract obligations |

| Example | Investment advice recipient | Borrower and lender in a loan |

What Is The Difference Between Counterparty And Credit Risk?

While counterparty risk and credit risk are closely related, counterparty risk refers to the broader risk that a party to a contract will fail to meet their obligations, while credit risk specifically focuses on the risk of default in loans, bonds, and other credit agreements. Counterparty risk happens when one party in a trade does not meet its promise. Credit risk is similar but focuses more on loans and bonds. Both risks involve the chance that one party will fail to pay or complete their part of the deal.

Credit risk is a big part of counterparty risk. In loans, credit risk is about whether the borrower can repay. In trades, counterparty risk covers the chance that either party will default. Both are important risks to manage in financial agreements.

The main difference is the focus. Credit risk often applies to loans, while counterparty risk applies to many types of trades. However, both are about the risk that one party will fail to meet their financial promise. They must be managed carefully to avoid losses.

| Aspect | Counterparty Risk | Credit Risk |

|---|

| Definition | Risk any contract party fails to fulfill obligations | Risk of default on loans/bonds |

| Scope | Broad: contracts, derivatives, swaps | Specific: loans, bonds, and credit agreements |

| Example | Missed payment in a trade | Loan default |

| Management | Collateral, guarantees | Credit scoring, collateral, interest rates |

What Is The Difference Between A CCP And A CSD?

The primary difference between a central counterparty (CCP) and a central securities depository (CSD) is that a CCP manages risk in transactions by acting as an intermediary and guaranteeing the completion of trades, while a CSD focuses on the safekeeping and administration of securities. A CCP interposes itself between the buyer and seller in a trade, reducing the risk of default by ensuring that both parties meet their obligations. They guarantee the trade by taking on the risks involved in the transaction.

A central securities depository (CSD), in evaluation, holds and manages securities. They do not now assure trades like a CCP but offer safekeeping and report-retaining offerings. CSDs ensure that securities are safely saved and transferred whilst wanted.

The main difference is that CCPs control danger in trades, even as CSDs cognizance of the safekeeping of securities. Both play crucial roles in economic markets but serve exclusive functions. CCPs guard investors, whilst CSDs control securities.

| Aspect | Counterparty Risk | Credit Risk |

|---|

| Definition | Risk any contract party fails to fulfill obligations | Risk of default on loans/bonds |

| Scope | Broad: contracts, derivatives, swaps | Specific: loans, bonds, and credit agreements |

| Example | Missed payment in a trade | Loan default |

| Management | Collateral, guarantees | Credit scoring, collateral, interest rates |

What Is A Counterparty Manager?

A counterparty manager is responsible for overseeing relationships between counterparties in transactions, ensuring that both parties fulfill their obligations, and mitigating the risks associated with the transaction. They play a crucial role in maintaining the smooth execution of trades and reducing the risk of default.

They additionally track the financial health of counterparties. This helps them spot capacity issues before they take place. By managing those relationships, counterparty managers reduce the dangers concerned in trades and help maintain both facets safe.

Counterparty managers often use tools to assess risks and manage agreements. They make sure that both aspects comply with the phrases of the deal. Their process is to reduce dangers and ensure that trades occur as agreed. This enables each counterparties from losses.

What Does A Counter Credit Mean?

A counter credit is a financial guarantee provided by one party to ensure that the other party in a transaction receives payment, even if the first party defaults on their obligation. It is often used in international trade to guarantee payments. The counter credit ensures that if one party cannot pay, the other party is still protected.

In this agreement, a bank or economic group usually provides the counter credit score. They promise to pay if the counterparty can not meet their promise. This facilitates reduced risk for the events worried in the change and affords more safety.

The counter credit score acts as a safety net in financial offers. It gives each party confidence that the exchange will go through as agreed. By providing this guarantee, the counter credit reduces the risk of default in worldwide or high-risk trades.

What Does It Mean To Counter Something?

To counter something means to take action to oppose, neutralize, or mitigate the effects of an action or proposal. When you counter, you attempt to stop or reduce the impact of something. For example, if someone makes a negative statement, you counter by making a positive statement. In a trade, to counter means to offer a different deal or response to what the other party proposes.

In sports, gamers counter with the aid of defending or reacting to the opposite group’s moves. They do that to forestall the opposing group from scoring. Countering is a manner to react quick and block movements that would cause damage. It is essential in lots of areas like arguments, video games, and negotiations.

What Is Counterparty Code?

A counterparty code is a unique identifier assigned to each party in a financial transaction to ensure accurate record-keeping and facilitate the smooth processing of trades. Each counterparty gets a specific code so that others can recognize them in the system. The counterparty code enables making sure that trades happen between appropriate events without confusion.

This code is utilized in economic markets to track trades and bills. Companies use the counterparty code to make sure they’re dealing with the right associate. It makes buying and selling more secure and less difficult. The counterparty code helps keep away from mistakes via ensuring correct identification in big structures.

What Is The Abbreviation Of Counterparty?

The abbreviation of counterparty is often written as “CP“. This short form is used to save space and make it easier to refer to counterparties in trades. The abbreviation “CP” is seen in financial documents and systems when tracking trades between two parties.

“CP” makes communication faster in complex financial markets. Instead of writing “counterparty” every time, traders and companies use “CP” to keep things simple. The abbreviation helps speed up work without changing the meaning. It is important to know what “CP” means when reading about trades.

How Secure Is Markit Counterparty Manager?

Market Counterparty Manager is designed to be very secure. It is a tool that helps companies manage their trades and partners. Security features like encryption and person verification guard records from being stolen or modified. This ensures that sensitive data remains safe all through transactions.

The device uses advanced safety to protect each party of an exchange. Market Counterparty Manager reduces risk through maintaining all the information personal and correct. It additionally tests that most effective authorized users can get entry to the device, making it one of the most secure gear for coping with trades and counterparties.

Get expert guidance on securing your Markit Counterparty Manager implementation with a personalized security assessment from our certified professionals at CapitalizeThings.com. Contact our team for a complimentary 15-minute consultation at +1 (323)-456-9123 to discuss your specific needs.

Can Financial Advisors Act As Counterparties?

Financial advisors can act as counterparties in certain deals. They might also buy or promote products on behalf of their clients. In this position, they participate within the change and are liable for assembling their guarantees. Advisors act as counterparties once they constitute clients in an exchange and ensure the deal is completed properly.

Do Financial Planners Deal With Counterparty Risk?

Financial planners deal with counterparty risk when helping clients with trades. They take a look at the opposite aspect to make sure they are dependable. Counterparty risk is critical in making safe trades. Financial planners help clients manage this hazard through choosing secure trades and fending off problems.

Do Certified Financial Planners Advise On Counterparty Selection?

Certified financial planners advise on counterparty selection. They help clients choose reliable counterparties for trades. Planners look at a counterparty’s history and financial stability. They guide clients to pick the safest counterparties. Certified planners focus on reducing risk by helping clients choose the best partners in trades.

Can A Counterparty Become A Debtor In Transactions?

A counterparty can become a debtor in transactions if they owe money. In a trade, one party agrees to pay later. If they do not pay on time, they become a debtor. This happens when a counterparty fails to meet their payment promise. It creates risk for the other party.

Is Counterparty Analysis A Crucial Budgeting Skill?

Counterparty analysis is a crucial budgeting skill. It helps people check the risk of trading partners. By looking at a counterparty’s reliability, people avoid bad deals. Counterparty analysis protects budgets by helping to avoid financial losses. It is an important skill for making safe trades.

Does Counterparty Risk Affect Personal Budgeting Skills?

Counterparty risk affects personal budgeting skills by adding financial risk. When trading with others, humans face the risk that the opposite facet might also fail. This threat can lead to losses that affect the private price range. Understanding counterparty danger allows in making higher budgeting alternatives and fending off awful deals.

Should Financial Literacy Courses Cover Counterparty Credit Assessment?

Financial literacy courses should cover counterparty credit assessment. This skill helps people manage risk in trades. By gaining knowledge of checking a counterparty’s credit, human beings make more secure economic selections. It is essential to know how to determine credit to avoid dropping money. Teaching this talent improves financial protection in trades.

Is Counterparty Risk Linked To Financial Ignorance?

Counterparty risk is linked to financial ignorance when people do not understand the risks. Without knowing how to check counterparties, people face bad deals. Financial lack of information can cause bad selections that motivate losses. Learning approximately counterparty chance facilitates humans make smarter economic picks and keep away from trouble.

Conclude:

Counterparty danger performs a crucial function in dealing with economic trades and personal budgets. It is critical to apprehend how counterparties work, assess their credit score, and understand the risks they convey to a transaction. Financial advisors and planners assist customers navigate these dangers by advising on counterparty choice and handling capacity defaults. Learning about counterparty analysis and threat in financial literacy publications is vital for making smarter financial choices. Understanding counterparty risk helps avoid losses, improve budgeting competencies, and shield financial balance. Whether in massive trades or personal transactions, being privy to the risks tied to counterparties ensures safer, more reliable financial decisions and higher safety against capability financial damage.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.