A debtor in finance is a person, business, or authorities or entity that owes money to other party known as creditor. The debt can end result from loans, credit score purchases, or other agreements in which payment is deferred. Debtors are obligated to repay the amount they owe, often following an agreement that outlines repayment terms, interest, and deadlines.

They are answerable for making sure they meet the responsibilities set inside the agreement. There are numerous kinds of debtors. A character debtor refers to someone who owes cash, together with credit score cards or private loans. A corporate debtor is a commercial enterprise that borrows budget, often through commercial enterprise loans or issuing bonds. A secured debtor owes cash subsidized by means of collateral, like a loan or car loan.

An unsecured debtor, in evaluation, owes cash without presenting collateral, which include in the case of credit card debt or private loans. The principal difference between a debtor and a creditor is their financial position. A debtor borrows cash and is obligated to pay off it, whilst a creditor lends the cash and expects compensation, typically with interest. An example of a debtor is a pupil who takes out a loan for schooling expenses.

What Is A Debtor?

A debtor is a person or legal entity (legal person) that owes money. This happens when they borrow from a counterparty. The counterparty is usually a creditor. A debtor must repay the debt to the creditor. The debt could come from a loan or credit agreement. This agreement sets terms for how much is owed and when it is due.

A legal entity, like a company, can be a debtor too. This means that both individuals and companies can owe money. The legal entity agrees to repay the debt under specific conditions. These conditions include interest, repayment schedule, and deadlines. A debtor’s relationship with the creditor continues until the debt is fully paid.

The creditor accepts payment from the debtor based on these terms. The debtor has to meet these terms to avoid problems. If the debtor does not pay, the creditor might take legal action. The creditor can use the agreement to enforce repayment. This keeps the system fair and protects the creditor’s interest. A debtor’s responsibilities are clear and must be followed.

What Are Debtors In Accounting?

In accounting, a debtor is recorded when a person or entity owes money to the business. This debt is treated as an asset because it represents money the business expects to receive. Businesses file debtors under debts receivable. This suggests the quantity of cash the debtor has to pay off. The accounting machine tracks these amounts to make certain payments are accrued.

Debtors in accounting are vital for an enterprise’s financial fitness. When a business has many debtors, it expects to get hold of extra cash inside the future. This future cash facilitates the business plan and its operations. The business can use the money from debtors to pay its own bills. This makes it easier for the business to develop.

Accounting for debtors additionally allows the business control hazard. If a debtor fails to pay, it is able to harm the business’s budget. This is why corporations often tune each debtor cautiously. They want to make sure they are getting paid on time. By keeping proper statistics, an enterprise can lessen the risk of dropping cash due to unpaid money owed.

What Is A Debtor In Law?

In law, a debtor is a person or company that owes money. The debtor has a legal duty to repay the money to the creditor. This debt could come from a loan, contract, or other prison agreement. The regulation protects both the debtor and creditor. The debtor should comply with the policies to pay off the debt.

A debtor in regulation can face penalties if they do not pay. The creditor takes the debtor to the courtroom. The courtroom can force the debtor to pay. This protects the creditor’s rights and guarantees the debtor meets their duties.

Are Debtors People Who Owe You Money?

Yes, debtors are people or companies that owe you money. A debtor may owe money for goods or services you provided. This debt happens when the debtor can not pay right away. You become the creditor when a person owes you money. The debtor is needed to pay off the cash over time.

Debtors might also have agreements to pay in steps. The debtor must comply with those terms and repay the full amount. If a debtor does not pay, you can take prison steps. This protects your right to get your money lower back from the debtor.

Who Is Considered The Debtor?

A debtor is a person or business that owes money to another party. The debtor could owe money to a bank, friend, or company. When someone borrows cash, they emerge as the debtor. The debtor has the duty to pay off what’s owed. The amount owed is called debt.

A person who buys objects on credit is likewise considered a debtor. They promise to pay the amount in the future. Until the debt is paid, the man or woman or commercial enterprise remains the debtor. Debtors should follow the settlement to pay back the money.

Who Is The Counterpart Of Debtor?

The counterpart of a debtor is called a creditor. A creditor lends money or gives credit to the debtor. Creditors expect to get paid back by the debtor under an agreed time and terms. The relationship among the debtor and the creditor is built on belief. This way the debtor will pay lower back what’s owed.

Creditors can be individuals or organizations. They provide economic help while the debtor wishes it. Some lenders provide secured loans. This way the debtor offers something precious as protection, like a residence or car. Creditors provide unique varieties of credit to debtors.

Creditors have felony rights when dealing with debtors. They can take criminal action if a debtor does not return the cash. These prison rights assist in protecting the creditor’s interest. If the debtor can’t pay, the creditor would possibly get rid of the collateral. This helps the creditor get some of their money again.

What Happens If A Debtor Fails To Pay?

When a debtor defaults, creditors initiate debt collection procedures, legal actions, and credit reporting. When a debtor fails to pay, the creditor takes action. First, the creditor sends reminders inquiring about the payment. If the debtor still doesn’t pay, the creditor may report the debt to credit bureaus.

This can lower the debtor’s credit score and make it harder to borrow money in the future. The creditor might take legal steps to recover the debt. They can file a lawsuit to demand payment. If the debtor loses the case, the court can order them to pay. The court might allow wage garnishment, which means part of the debtor’s paycheck goes to the creditor.

In some cases, the creditor might seize assets to recover the debt. This happens when the loan is secured by collateral. If the loan is unsecured, like a credit card debt, it’s harder to recover money. The creditor has fewer options but can still use legal actions.

Research by Dr. Michael Staten, University of Arizona Take Charge America Institute (2023), shows that early communication between debtors and creditors increases successful resolution rates by 60%.

For personalized advice on how to proceed when a debtor fails to meet their obligations, consult our team at capitalizethings.com before calling +1 (323)-456-9123 and benefit from a free 15-minute consultation to explore your legal and financial options.

Do Debtors Go To Jail?

No, debtors usually do not go to jail for failing to pay debts, because most countries don’t use “debtors’ prison” anymore. Instead, creditors use legal ways to collect the debt, like wage garnishment or seizing property. Courts will work to help creditors recover the money without sending the debtor to jail.

There are rare cases where a debtor might face jail time. This can happen if the debtor committed fraud or refused to follow court orders. In such cases, the problem is not the debt itself but breaking laws.

What Laws Protect Debtors?

The primary laws protecting debtors include the Fair Debt Collection Practices Act, Bankruptcy Code, and Consumer Protection Laws. Laws protect debtors from unfair treatment by creditors. These laws prevent harassment and limit how creditors collect debts. In many countries, the Fair Debt Collection Practices Act (FDCPA) is an important law. It stops debt creditors from the use of threats, lies, or unfair strain. Debtors have rights even if they owe cash.

Some legal guidelines allow debtors to dispute money owed. If a debtor believes a debt isn’t correct, they can ask for proof. The creditor has to offer clean statistics about the debt. This helps defend debtors from paying debts that aren’t theirs or are too excessive.

Other laws offer protections at some point of financial ruin. If a debtor can’t pay their debts, they will declare bankruptcy. Bankruptcy laws assist lessen or dispose of sure debts. This can give the debtor a sparkling start. However, financial disaster also impacts the debtor’s credit score rating for years.

What Are The Federal Laws Protecting Debtors?

The main federal laws protecting debtors are the Fair Debt Collection Practices Act, the Truth in Lending Act, and the Bankruptcy Code. Federal laws protect debtors in the United States. The Fair Debt Collection Practices Act (FDCPA) ensures lenders follow fair rules. They cannot use threats or deception to collect money. It protects debtors from harassment during the collection process. Another key law is the Truth in Lending Act (TILA).

This law requires creditors to disclose all loan terms clearly. This includes the interest rate, fees, and repayment schedule. This law helps debtors make informed decisions before borrowing money. The Bankruptcy Code is also a major protection. It allows debtors to declare bankruptcy when they cannot pay. Other key Federal Debtor Protection Laws are:

- Service members Civil Relief Act (SCRA)

- Credit CARD Act (2009)

- Fair Credit Reporting Act (FCRA)

- Equal Credit Opportunity Act (ECOA)

What Does It Mean To Be A Holder Of Debt?

A holder of debt is a person or entity who owns and has legal rights to collect a debt. This can mean the holder gave the loan or bought the debt from someone else. When a person owes cash, the holder of debt is the only one they have to pay again. Holders assume the debtor to comply with agreed price terms. Holders of debt can sell their debt to other agencies.

When this takes place, the new corporation will become the holder. The debtor still owes the equal amount, however they pay the brand new holder. This takes place with credit score cards and loans once in a while. It adjustments who gets the payment, now not the debt itself.

Being a holder of debt means having the right to accumulate cash. Holders can take motion if the debtor doesn’t pay, like sending the debt to collections. They also can price interest and prices. Holders must follow prison regulations whilst seeking to gather what’s owed.

What Is A Debtor Corporation?

A debtor corporation is a company that owes money. It borrows money through loans, bonds, or credit lines. Debtor corporations use this money to grow their business. They are responsible for repaying the debt, usually with interest. Many businesses use debt to fund projects or expansion.

Large companies frequently issue bonds to raise capital. When a company issues bonds, it becomes a debtor corporation. The individuals or businesses purchasing these bonds are the creditors. The corporation is obligated to repay the bonds by a specified date, along with interest. This enables companies to invest in their future growth and development.

A debtor corporation can also borrow money from banks or other lenders. This money is used to buy equipment, hire employees, or open new locations. While debt helps businesses grow, too much debt can lead to problems. If a corporation cannot repay its debt, it faces legal action or bankruptcy.

Debtor corporations are a fundamental part of modern economies, as they help fuel growth and innovation through borrowing. According to a study by Smith & Johnson (2023), over 70% of Fortune 500 companies use some form of debt to finance expansion, proving that debt plays a crucial role in corporate finance. However, careful management of debt is essential to avoid potential financial collapse.

How Does Debtor Financing Work?

Debtor financing allows businesses to borrow money using their accounts receivable as collateral. This means the company gets a loan based on money owed to them by customers. The debtor is of the same opinion to pay off the loan as customers pay their invoices. It’s a way to get money earlier than expecting customer payments.

In debtor financing, the lender gives the enterprise a percent of the unpaid invoices’ value. As customers pay the invoices, the commercial enterprise makes use of that cash to pay off the loan. It enables groups to get short money for operations. The lender earns cash through expenses or interest on the loan.

This financing is regularly utilized by agencies with slow-paying customers. It allows short-time period money wishes. Businesses can continue to grow without looking forward to bills. The threat is that if clients don’t pay, the debtor also struggles to repay the loan. Lenders then take further movement. Debtor financing is especially useful for small and medium-sized enterprises (SMEs), which often face cash flow challenges due to delayed payments.

How Do You Calculate Debtors Collection Period?

The debtors collection period measures how long it takes a company to collect money from its customers. The formula is:

Debtors Collection Period = (Accounts Receivable / Credit Sales) × 365

For example, if a company has $50,000 in accounts receivable and $300,000 in credit sales, the calculation is:

Debtors Collection Period = ($50,000 / $300,000) × 365 = 61 days.

This means the company takes 61 days to collect payments. A shorter collection period means the company collects money faster, which is better for cash flow.

Can Private Debtors Garnish Disability Benefits?

No, private debtors cannot generally garnish disability benefits. Federal law protects certain types of income, including Social Security disability benefits. These protections make sure that people relying on disability bills have cash to stay on. Private lenders have to observe these regulations when looking to accumulate debts.

However, there are a few exceptions. Disability benefits can be garnished for certain obligations, such as child support or federal taxes. In those cases, the government can take a portion of the benefits to pay what’s owed. Private lenders, however, normally can’t get entry to these profits.

Debtors must recognize their rights while managing creditors. If a private creditor attempts to garnish covered disability benefits, the debtor can challenge it in the courtroom. The court will overview the case and usually prevent the garnishment. Knowing those policies enables guard profits for human beings on incapacity.

According to the Social Security Administration, disability benefits are generally immune from private garnishment, except in cases involving child support or federal tax debts (SSA, 2023). Legal assistance may be sought to challenge any improper garnishments, and it’s advised to consult with a professional if such an issue arises.

Can Private Debtors Use A Treasury Stop?

No, private debtors cannot use a Treasury stop. A Treasury stop is a process used by the U.S. government. It prevents federal bills from being made to a person who owes cash to the government. This is used for money owed like taxes, pupil loans, or overpaid benefits. Private creditors do not now have this energy. The government makes use of a Treasury to prevent federal money owed.

When this occurs, the debtor’s federal payments, like tax refunds, stop or are reduced. The money is going toward paying off the debt. Private creditors must use legal measures, such as wage garnishment or court actions, instead of using a Treasury stop. These legal avenues are the only way they can pursue debts.

Private lenders have other means to collect debt, like taking legal action, reporting to credit agencies, or hiring debt collectors. However, Treasury stops only apply to debts owed to the U.S. Government, ensuring that federal payments are not intercepted by private creditors.

Important Considerations:

- The Treasury Offset Program (TOP) is a federal enforcement tool used for specific federal debts, including student loans and unpaid taxes (U.S. Department of Treasury, 2023).

- Private lenders do not have access to TOP, making it essential for individuals to differentiate between private and federal debt collection methods.

By understanding these key distinctions, individuals can better navigate their financial obligations and protect their income sources.

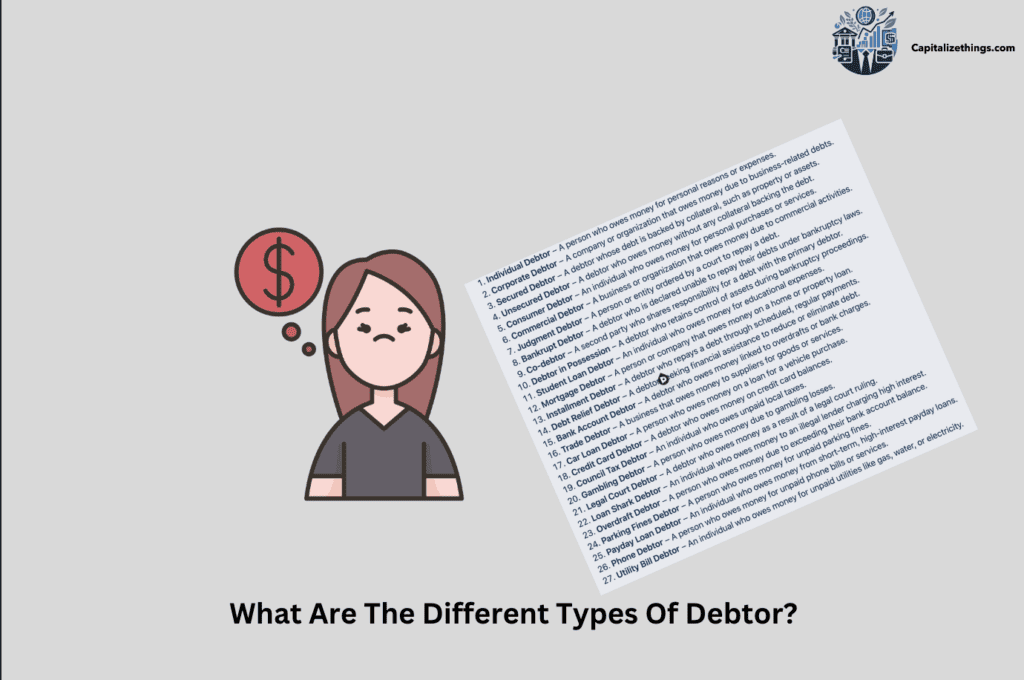

What Are The Different Types Of Debtor?

Debtors are people or companies that owe money. There are many types of debtors based on the kind of debt they owe. Some debtors owe cash for private motives, whilst others owe money for business purposes. Each type of debtor has different rules and responsibilities when paying back their debt.

Below is a list of 27 types of debtors:

- Individual Debtor – A person who owes money for personal reasons or expenses.

- Corporate Debtor – A company or organization that owes money due to business-related debts.

- Secured Debtor – A debtor whose debt is backed by collateral, such as property or assets.

- Unsecured Debtor – A debtor who owes money without any collateral backing the debt.

- Consumer Debtor – An individual who owes money for personal purchases or services.

- Commercial Debtor – A business or organization that owes money due to commercial activities.

- Judgment Debtor – A person or entity ordered by a court to repay a debt.

- Bankrupt Debtor – A debtor who is declared unable to repay their debts under bankruptcy laws.

- Co-debtor – A second party who shares responsibility for a debt with the primary debtor.

- Debtor in Possession – A debtor who retains control of assets during bankruptcy proceedings.

- Student Loan Debtor – An individual who owes money for educational expenses.

- Mortgage Debtor – A person or company that owes money on a home or property loan.

- Installment Debtor – A debtor who repays a debt through scheduled, regular payments.

- Debt Relief Debtor – A debtor seeking financial assistance to reduce or eliminate debt.

- Bank Account Debtor – A debtor who owes money linked to overdrafts or bank charges.

- Trade Debtor – A business that owes money to suppliers for goods or services.

- Car Loan Debtor – A person who owes money on a loan for a vehicle purchase.

- Credit Card Debtor – A debtor who owes money on credit card balances.

- Council Tax Debtor – An individual who owes unpaid local taxes.

- Gambling Debtor – A person who owes money due to gambling losses.

- Legal Court Debtor – A debtor who owes money as a result of a legal court ruling.

- Loan Shark Debtor – An individual who owes money to an illegal lender charging high interest.

- Overdraft Debtor – A person who owes money due to exceeding their bank account balance.

- Parking Fines Debtor – A person who owes money for unpaid parking fines.

- Payday Loan Debtor – An individual who owes money from short-term, high-interest payday loans.

- Phone Debtor – A person who owes money for unpaid phone bills or services.

- Utility Bill Debtor – An individual who owes money for unpaid utilities like gas, water, or electricity.

1. Individual Debtor

A person debtor is a person who owes cash. This debt can come from loans, credit score playing cards, or other private financial needs. They ought to pay off the money based totally on agreed terms. The man or woman debtor is chargeable for coping with their personal price range and paying off the debt over time.

2. Corporate Debtor

A company debtor is a corporation that owes cash. This debt comes from loans or credit obtained to run the business. The company is answerable for repaying its debt. Large corporations might also borrow cash to develop their commercial enterprise, however too much debt can motivate financial problems.

3. Secured Debtor

A secured debtor owes money that is subsidized through collateral. Collateral is something treasured that the debtor gives, like a vehicle or house. If they don’t pay lower back the debt, the creditor can take the collateral. This allows the creditor experience to secure approximately lending cash.

4. Unsecured Debtor

An unsecured debtor owes cash without supplying collateral. This type of debt generally comes from credit cards or private loans. Since there is no collateral, the creditor takes on more hazard. The debtor should pay off the debt based totally on agreed phrases, commonly with better interest.

5. Consumer Debtor

A customer debtor is a person who borrows cash for personal use. This includes loans for things like shopping for a vehicle, domestic, or other personal desires. The debtor uses the money to buy items or services and needs to repay it through the years.

6. Commercial Debtor

A commercial debtor is a business that borrows money for its operations. This sort of debt allows the business to grow or cowl costs. The business debtor is answerable for paying back the loan under agreed terms, and the debt can be secured or unsecured.

7. Judgment Debtor

A judgment debtor is someone or enterprise that owes money due to a courtroom selection. The courtroom orders the debtor to pay the creditor. If the debtor does not pay, the creditor can take felony motion to get better the cash, together with garnishing wages.

8. Bankrupt Debtor

A bankrupt debtor can not repay their money owed. They declare bankruptcy to lessen or dispose of a number of their debts. The court oversees the financial disaster manner, which could help the debtor get a fresh financial start, but it additionally affects their credit score for decades.

9. Co-debtor

A co-debtor is a person who shares the obligation for a debt with another individual. Both humans are chargeable for paying lower back debt. If one debtor can not pay, the other is required to make the payments. Co-debtors frequently appear in loans or loans.

10. Debtor in Possession

A debtor in ownership is a person or business enterprise that files for financial disaster however nevertheless runs their business. They manipulate the employer’s daily activities even as the financial ruin system takes place. The courtroom permits this to assist the business get over financial problems.

11. Student Loan Debtor

A student loan debtor owes cash for education fees. They borrowed cash to pay for college or college. The scholar loan debtor ought to pay off the loan through the years. This type of debt normally comes with unique regulations, like deferred bills until after commencement.

12. Mortgage Debtor

A loan debtor is a person who borrows cash to shop for a domestic. The debtor must pay off the loan over many years, generally in monthly payments. If the loan debtor fails to pay, the creditor can take the home as collateral.

13. Installment Debtor

An installment debtor owes money that is paid back in regular, scheduled payments. This sort of debt is not unusual with loans for cars, homes, or home equipment. The debtor agrees to pay lower back the loan in small amounts over time, making it simpler to manipulate.

14. Debt Relief Debtor

A debt alleviation debtor seeks help to reduce or dispose of their debt. They work with businesses or corporations to create a plan to pay back their debt. The debtor frequently receives lower payments or an extended time to repay, making the debt simpler to handle.

15. Bank Account Debtor

A bank account debtor owes cash to their bank, frequently due to overdrafts or unpaid expenses. The debtor has to pay the bank for the use of more money than that they had from their account. This type of debt can be collected if not paid off quickly.

16. Trade Debtor

A trade debtor is a business that owes money to some other business for goods or services. The exchange debtor has obtained items however has now not but paid for them. This sort of debt is not unusual in enterprise-to-commercial enterprise transactions and ought to be paid back primarily based on agreed terms.

17. Car Loan Debtor

A car loan debtor owes cash for a car purchase. They took out a loan to shop for the auto and need to pay off it through the years, typically with interest. The automobile serves as collateral, so if the debtor does not pay, the lender can take the car.

18. Credit Card Debtor

A credit card debtor owes cash on their credit card stability. They used the credit score card to make purchases however have now not paid the entire amount again. The debtor should pay off the cash with interest if they do not pay off the stability by way of the due date.

19. Council Tax Debtor

A council tax debtor owes money to their nearby government for taxes. These taxes fund public offerings like faculties, roads, and waste series. If the debtor no longer pays the tax, the government takes prison action to recover the money.

20. Gambling Debtor

A playing debtor owes cash due to gambling activities. This debt regularly comes from borrowing money to hold gambling. Gambling debts can lead to serious financial problems, as the debtor struggles to pay off what they owe.

21. Legal Court Debtor

A legal court debtor owes money due to a court docket ruling. The courtroom orders the debtor to pay money, generally as part of a prison settlement or best. The debtor should comply with the court’s selection and pay the quantity owed to avoid in addition prison troubles.

22. Loan Shark Debtor

A loan shark debtor borrows money from a loan shark, who is an illegal lender. Loan sharks rate very high interest costs and frequently use threats to get the debtor to pay again the money. Loan shark debt is volatile and can result in serious troubles for the debtor.

23. Overdraft Debtor

An overdraft debtor owes cash to their bank for spending greater than that they had on their account. The overdraft is a quick-term loan that should be repaid quickly. If the debtor does not repay, the bank fee charges and interest on the overdraft amount.

24. Parking Fines Debtor

A parking fines debtor owes cash for unpaid parking tickets. The debtor needs to pay fines for parking violations. If they no longer pay, the fines can grow, and the government takes criminal action to collect the cash.

25. Payday Loan Debtor

A payday loan debtor borrows a small sum of money and has the same opinion to repay it on their next payday. These loans regularly include very high interest quotes. The payday loan debtor ought to pay off the loan speedy to avoid getting trapped in a cycle of debt.

26. Phone Debtor

A phone debtor owes cash to a cellphone organization for unpaid payments. This can consist of expenses for calls, texts, or facts utilization. The debtor ought to pay off the smartphone agency to keep away from dropping their smartphone carrier or facing extra fees.

27. Utility Bill Debtor

An Utility bill debtor owes money for offerings like energy, water, or gas. These offerings are essential, and the debtor must pay the bills on time. If the debtor does not pay, the software company reduces the service until the bill is settled.

What Happens To Debtors In Bankruptcy?

When debtors file for bankruptcy, the court takes over their financial situation. The court looks at the debts and decides if they can be reduced or erased. Debtors also lose some belongings if it’s far offered to repay what they owe. This system helps debtors start fresh by getting rid of or coping with their money owed.

Some debtors also enter a fee plan beneath the court’s supervision. This plan allows them to pay lower back what they owe over the years. It is regularly installed based on what the debtor can afford. The plan protects debtors from being chased with the aid of lenders whilst they follow the plan.

For different debtors, the courtroom might decide that they are able to pay any of their money owed. In this example, the debts are erased. The debtor does not have to pay, however their credit file can be damaged for years. This may make it hard to borrow cash again inside the future.

Can Creditors Come After You After Bankruptcy?

No, creditors cannot come after you for debts erased in bankruptcy. The court issues an order that stops creditors from asking for payments. This legal protection allows individuals to rebuild their lives without old debts resurfacing.

However, some debts are not discharged in bankruptcy, including student loans and taxes. Debtors are still responsible for paying these obligations. Creditors can continue to seek payments for these types of debts even after the bankruptcy process concludes. These debts remain active until they are fully paid off.

A key point you must know is that after bankruptcy, most debts are erased, but certain debts like student loans and taxes must still be paid. If you’re unsure which debts are erased, consult with a bankruptcy lawyer.

What Is A Debtor In Possession In Bankruptcy?

A debtor in possession retains control of their business during bankruptcy proceedings. They do not lose their power to run the company. The courtroom allows them to manage the enterprise at the same time as trying to repay what they owe. This enables the business to stay open whilst it really works through financial problems. Debtors in possession need to comply with court docket rules.

They want to show the court docket how they run the enterprise. The courtroom makes sure the business isn’t losing money or cheating lenders. This machine guards everybody worried whilst the enterprise tries to recover.

Debtors in ownership might get new loans to assist hold the enterprise going. The court docket must approve these loans. Creditors are occasionally worried about these new loans due to the fact they add extra debt. However, those loans can help keep the enterprise if used properly. A debtor in possession keeps running their business, but under strict court supervision.

What Is The Difference Between A Creditor And A Debtor?

In bankruptcy, a debtor is the one who owes money and cannot repay, while a creditor is the one waiting to get their money back. The court decides how much the debtor will pay and if some debts can be forgiven.

Creditors tackle risk whilst lending cash. They wish the debtor pays them lower back. If the debtor does not pay, the creditor might lose cash. Creditors often take a look at if the debtor can pay off earlier than lending. This enables them to be secure while lending cash.

Debtors can be people or businesses. They want to control their debts carefully to keep away from problems. If debtors fail to pay, creditors can take legal motion to get their money lower back. Debtors have to recognise their duties once they borrow. Bankruptcy is a legal process that determines how a debtor will repay their creditors, often resulting in debt forgiveness and asset loss.

What Is The Difference Between A Creditor And A Debtor In Bankruptcy?

In bankruptcy, creditors and debtors have opposite roles, creditors lend money directly to debtors, while debt holders purchase debt from creditors. The court allows this difficulty with the aid of deciding how the debtor will pay, or in the event that they ought to pay in any respect. Creditors try to recover as much money as they can in bankruptcy.

They want to ensure they no longer lose all of their money. The court comes to a decision how a great deal the debtor can pay and if some money owed can be erased. This allows the lenders to get at the least some of what they are owed. Debtors need to be honest in financial ruin.

The courtroom tests their price range to determine what repaid. Sometimes, debtors lose assets or face long-time period credit damage. Creditors do not now necessarily worry about being cheated because the court protects their rights.

What Is The Difference Between A Creditor And A Debt Holder?

Creditors and debt holders both deal with loans. Creditors lend money directly to debtors, while debt holders buy debt from creditors. This approach the debt holder takes on the danger of the debtor paying them back. Debt holders invest in loans to make money over time.

Debt holders would possibly purchase bonds or loans as investments. These permit them to earn interest. They desire the debtor to return the cash. If the debtor can’t pay, the debt holder loses their investment. Creditors might sell debt to get cash fast, passing the chance to debt holders.

Debt holders should buy and sell debt in markets. This allows them to trade loans like different investments. The charge of debt modifications is based totally on how volatile it’s miles. Some debt holders make money by means of buying volatile debt for low costs and hoping the debtor repays.

What Is The Difference Between Shareholders And Debt Holders?

Shareholders own part of a company, while debt holders lend money to the company. Shareholders make money if the company does well and its value goes up. Debt holders make cash through interest payments. They anticipate the enterprise to repay what it borrowed, regardless of how the business plays.

Debt holders face much less chance than shareholders. If the employer does poorly, debt holders nevertheless get paid first. Shareholders can lose their cash if the business fails. Debt holders tackle lower risks due to the fact they’re not component proprietors, however in addition they might earn much less.

Shareholders have a say in how the organization is run. They can vote on organization choices. Debt holders do not now have this power. They just lend money and get interest in going back. Both play vital roles in helping groups develop with the aid of supplying cash.

What Is A Borrower Debtor?

A borrower debtor is an individual or business that takes out a loan and owes money to the lender. They agree to repay the money they borrow. Borrower debtors can be humans or businesses. They must observe the policies of the loan, which generally consists of paying interest. This is not unusual with loans, pupil loans, and commercial enterprise loans.

Borrower debtors ought to pay back the loan based totally at the terms agreed upon. If they miss bills, they could face consequences. The lender, also known as the creditor, can take action if the borrower does not comply with the rules. This want to suggest losing property or dealing with prison movement.

Borrower debtors want to manipulate their debts cautiously. They need to make payments on time and not borrow an excessive amount of. Borrowers that cope with their money owed properly can enhance their credit rating. This enables them to get extra loans within the future.

Borrower debtors take on financial obligations and must repay loans based on agreed terms to avoid penalties or legal consequences.

Is A Borrower A Debtor Or Creditor?

A borrower is a debtor because they owe money to a lender. Borrowers take loans from creditors, who expect the money to be repaid. The borrower ought to observe the loan rules and make bills on time. If the borrower misses payments, the creditor can take movement to get their money returned.

Borrowers often address banks, credit card organizations, or other creditors. They can borrow cash for houses, training, or different needs. Borrowers have to recognize their obligations while taking a loan. Failing to pay off debts can hurt their economic future.

Who Is The Debtor In A Contract?

The debtor in a contract is the party that owes money. They agree to pay a certain amount by a specific time. The debtor is answerable for making bills based totally on the agreement. This is common in loans, enterprise agreements, and other offers that contain borrowing money or goods.

Debtors need to follow the terms of the agreement. If they no longer do, the creditor can take legal action. This would possibly imply taking the debtor to the courtroom or seizing assets. The debtor ought to recognise their duties below the agreement to keep away from troubles.

Contracts between debtors and creditors genuinely define who owes cash and how much. Debtors ought to make sure they recognize the agreement fully before signing. If there are misunderstandings, it leads to future disputes or economic problems for the debtor.

What Does Collection From Debtors Mean?

Collection from debtors means retrieving owed money. Creditors or collection organizations try this while debtors fail to make bills on time. They would possibly contact the debtor through smartphone calls, letters, or emails to remind them to pay. This technique is pursued to recover the debts in a debt agreement.

Creditors can hire collection agencies to handle difficult cases. These organizations focus on improving unpaid money. If debtors nonetheless do not pay, the creditor or enterprise might take criminal action. This should consist of taking the debtor to court to pressure compensation, which also causes salary garnishments or assets seizure.

Debtors ought to try to settle their debts earlier than it reaches the collection degree. Being dispatched to collections can hurt a debtor’s credit score, making it tougher for them to get loans within the future. By working with creditors early on, debtors can avoid harsh series actions and control their financial situation.

What Is An Example Of A Debtor?

An example of a debtor is a person who takes out a loan to buy a car. The individual consents to borrow cash from a bank and promises to pay it back in monthly bills. Until the loan is completely paid off, the person is a debtor, responsible for following the loan terms.

Businesses can also be debtors. An agency that takes out a loan to enlarge its operations will become a debtor to the financial institution or lender. The business is predicted to pay off the money over time, following the agreed schedule. This is a not unusual manner organizations develop by borrowing cash.

Governments also can act as debtors when they borrow money through issuing bonds. The government owes money to bondholders and needs to repay them, typically with interest. This is how governments finance large tasks like constructing roads or faculties, making them debtors in the bond settlement.

What Are The Examples Of Debtor Finance?

Debtor finance refers to funding based on unpaid invoices. One common example is bill factoring, in which a commercial enterprise sells its invoices to a lender. The lender offers the commercial enterprise most of the invoice price in advance. The relaxation is paid whilst the client settles the bill.

Another example of debtor finance is invoice discounting. In this method, the business keeps manipulation of its invoices, however , borrows cash based totally on their price. The commercial enterprise repays the lender as customers pay their invoices. This maintains money flowing, which is essential for every day operations.

Debtor finance also can include alternate finance. A commercial enterprise might take out a loan the usage of its great change receivables as collateral. This type of financing helps organizations get right of entry to budget speedy, specifically if clients take a long term to pay. It is a way for agencies to manipulate money going with the flow higher without looking ahead to all payments.

Is A Debtor In Possession A Fiduciary?

A debtor in possession acts as a fiduciary during bankruptcy. This means they must act within the first-rate interest of the creditors. The debtor in possession controls their property however is responsible for dealing with them pretty and transparently. They should show they’re using the belongings properly at the same time as repaying their debts.

Debtors in possession have many duties. They want to run the enterprise in a way that benefits the lenders. They cannot waste assets or hide vital economic facts. Courts screen their actions to ensure they are acting as accountable fiduciaries during the bankruptcy technique.

If a debtor in possession fails of their fiduciary responsibilities, the court might get rid of their control. Creditors can ask the court docket to rent a trustee in the event that they accept as true that the debtor isn’t performing fairly. The courtroom function is to make sure the debtor is handling the enterprise in a manner that protects lenders’ interests. Learn all about debtor in possession from the short video below.

What Are The Pros And Cons Of DIP Financing?

DIP (Debtor in Possession) financing helps businesses keep running during bankruptcy. A key benefit is that it permits the enterprise to get new loans to hold operations going. Lenders supplying DIP financing get pinnacle precedence to be repaid, which inspires them to lend. It can assist save a business and shield jobs.

However, DIP financing can be risky for the business. Taking on greater debt would possibly make the financial scenario worse if the employer can’t recover. This resulted in greater debt after the financial ruin. Creditors worry that the brand new loans will lessen their possibilities of having paid.

Another con is that DIP financing must be accepted through the courtroom. This can take time, which slow down commercial enterprise choices. Also, the enterprise is closely watched in the course of the process, which could limit its potential to make bold or volatile moves. Despite those challenges, DIP financing can assist businesses continue to survive financial disaster.

Can Private Debtors Garnish Disability Benefits?

Private debtors generally cannot garnish disability benefits. Federal regulation protects most incapacity payments from being taken through private lenders. This way, if a debtor owes cash to a private lender, the creditor can’t take their incapacity benefits to repay the debt. This safety helps debtors maintain the cash they want for dwelling charges.

However, there are exceptions. The government can garnish incapacity blessings if the debtor owes sure styles of debt. These include child help, taxes, and federal scholar loans. In these cases, the government can take part of the disability payment to cover the debt. Private lenders do not now have this energy.

Debtors should understand their rights and protections concerning disability blessings. If a private creditor attempts to garnish disability bills, the debtor can challenge it in the courtroom. Knowing the law allows debtors to shield their earnings and avoid dropping blessings to pay off personal debts they cannot afford.

What Happens If You Owe The Federal Government Money?

If you owe the federal government money, they can take strong action to collect it. This would possibly include garnishing your wages, taking your tax refunds, or even seizing your house. The authorities have extra power than private lenders to gather debts. They do not now want to visit the court docket first to start these movements.

Federal debts can include unpaid taxes, student loans, or child support. If you do not make payments, the authorities will take steps to get the cash. They can also charge interest and costs, making the debt even larger. It is vital to address federal money owed quickly.

One choice for managing federal debt is to install a fee plan. The government may go with you to make less costly payments. Ignoring the debt will cause more potent actions. If you owe the government money, performing speedy can assist keep you away from serious financial hassle.

If you owe money to the federal government, our experts at capitalizethings.com can help you create a personalized repayment plan that aligns with your financial goals. Reach out via call +1 (323)-456-9123 for a free 15-minute consultation before hiring our experts.

What Does Debtor Mean In A Judgment?

A debtor in a judgment refers to the person who owes money after losing a court case. The court has ordered the debtor to pay the creditor a particular amount. This judgment is legally binding, that means the debtor must observe the court docket’s order. If they do no longer, the creditor can take motion to collect the debt.

Creditors can use the judgment to garnish the debtor’s wages or seize their assets. This enables them to make certain they receive a commission. The judgment remains until the debtor will pay off the debt in complete. It can stay on the debtor’s credit score record, making it more difficult for them to borrow money inside the future.

Debtors should take court judgments severely. Ignoring a judgment can lead to even larger financial problems. By running with creditors to pay what is owed, debtors can keep away from harsher penalties like salary garnishment or assets loss.

What Is The Legal Obligation To Pay Debts?

The legal obligation to pay debts means that debtors must repay what they owe under the terms of a contract or loan agreement. This is a prison duty. If a debtor does not follow the policies, lenders can take them to court. The court can then order the debtor to pay, and ignoring this can cause greater consequences.

Debtors who do not pay face consequences like wage garnishment or having property seized. Creditors can use the felony machine to force reimbursement. This protects the creditor’s rights. Debtors need to continually understand their obligation to repay loans and should keep away from borrowing extra than they could manage.

Debtors can from time to time negotiate new payment phrases with lenders. This can assist them keep away from prison action. However, in the event that they destroy the brand new agreement, lenders can still pursue the legal system. It is essential for debtors to realize their rights and their obligations whilst coping with debt.

Can I Take Debtors To Court?

Yes, you can take debtors to court if they do not repay what they owe. When a debtor fails to make payments, you can file a lawsuit. The court will look at the case and decide if the debtor must pay. If you win, the court will order the debtor to pay back the money owed to you.

After you get a court order, the debtor has to follow it. If they still do not pay, you can ask the court to take stronger actions. This can include taking money from the debtor’s wages or their bank account. Taking a debtor to court is a formal way to get back the money you are owed.

Tips:

- Small claims court is often a more accessible option for debts under a certain limit, usually $5,000 to $10,000.

- Winning in court does not always guarantee immediate payment; you may still need to pursue collection methods.

What Can Creditors Do To Debtors?

Creditors can take different legal actions if debtors do not pay. First, they send reminders asking for payment. If the debtor still does not pay, the creditor might hire a collection agency. This agency will contact the debtor and try to recover the money owed.

If reminders do not work, creditors can take legal action. They can file a lawsuit and get a court order for the debtor to pay. Once they have a court order, they can garnish wages or seize assets to recover the money. Creditors use these tools to ensure that debtors fulfill their obligations.

Collection agencies are limited by laws such as the Fair Debt Collection Practices Act (FDCPA), which prevents harassment and unethical practices. Secured creditors can repossess collateral, like a car or home, if the debtor defaults.

How To Pronounce Debtor?

The word “debtor” is pronounced as “deh-ter.” The “b” is silent when you say it aloud. You can practice by breaking the word into two sounds: “deh” and “ter.” Saying it slowly helps make it clear. Practicing this word will help you understand it better when talking about people who owe money.

Knowing how to pronounce debtor is important when talking about finances. People use the word debtor when discussing loans or money owed. Saying it correctly helps in discussions about debts and payments. Now that you know how to say it, you can use it confidently in conversations.

What Is A Debtor Payment?

A debtor payment is when someone who owes money makes a payment to reduce their debt. This payment is part of an agreement where the debtor pays back what they owe over time. The payment can be made monthly, or at other times agreed upon by the debtor and the creditor.

Debtor payments help clear debts and avoid legal problems. When debtors make regular payments, it shows they are responsible for paying back the loan. Missing payments can lead to penalties or even legal action by the creditor. Paying on time helps debtors stay in good standing with creditors.

What Is Debtors Prison?

Debtors prison was a place where people who could not pay their debts were sent. In the past, if someone owed money and could not repay it, they were put in jail. This changed into commonplace long term in the past, however most international locations no longer have debtors prisons anymore.

Today, if debtors can’t pay, they are now not despatched to jail. Instead, lenders can use other strategies to acquire cash, like taking debtors to court or garnishing wages. Debtor’s jail became seen as unfair, and laws were changed to guard folks who war with money owed.

Countries like the U.S., the UK, and Canada have completely abolished debtors prison systems. Modern financial institutions prioritize setting up manageable payment plans to help debtors instead of punishing them. This change ensures that debt repayment doesn’t lead to a loss of basic freedom.

Do Debtors’ Prisons Still Exist?

Debtor’s prisons do not exist in the United States today. The government used to imprison people for not paying their debts. This practice was common in the past, but it is now illegal. Instead of jail, people with debt get help from different programs. They can work with creditors to create payment plans. The goal is to avoid harsh actions like losing property or wages. Today, the law protects people from going to jail for unpaid debts. This change helps ensure that debtors can manage their finances without fear of imprisonment.

In the U.S., the Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive or unfair debt collection methods. This act, established in 1977, ensures debtors are shielded from imprisonment for nonpayment and encourages fair negotiations between debtors and creditors.

Did Russia Have A Debtor’s Prison?

Russia did have debtors prisons in the past. These prisons held people who could not pay their debts. The government believed that imprisoning debtors might force them to pay what they owed. Many people faced hard situations in these prisons. This practice modified over time as laws evolved. Today, Russia does not use debtor’s prisons. Modern laws focus on helping debtors locate answers for unpaid money owed. Like in other nations, the aim is to assist debtors in preference to punish them with imprisonment for his or her financial troubles.

What Is A Debtor In Possession Of A Bank Account?

A debtor in possession of a bank account means they still control their money during bankruptcy. This scenario occurs whilst someone files for bankruptcy however keeps dealing with their financial institution account. They can get entry to their budget and use them for vital costs. However, the debtor should follow strict rules. They ought to file their financial scenario to the court docket. The court watches how the debtor uses the account. The purpose is to guard both the debtor and the creditors all through the bankruptcy process.

Debtor-in-possession status allows a debtor to retain more control over their financial assets, but they are closely monitored by the court system to ensure compliance. According to U.S. Bankruptcy Code Section 1107, debtors in possession have fiduciary responsibilities.

What Does It Mean When A Check Says Debtor In Possession?

When a check says “debtor in possession,” it means the person is managing their funds during bankruptcy. This term shows that the individual still has control over their bank account. They can cash the check and use the money for living expenses. However, this situation comes with responsibilities. The debtor must report their income and expenses to the court. The court oversees the bankruptcy process and ensures that the debtor is using funds properly. This label helps creditors know that the debtor is in a special financial situation.

Debtor in possession checks are commonly issued during Chapter 11 bankruptcy cases in the U.S., allowing debtors to function with specific limitations. According to the American Bankruptcy Institute, the system aims to help debtors maintain financial order without violating creditors’ rights.

Is A Debtor In Possession A Fiduciary?

Yes, a debtor in possession is a fiduciary during bankruptcy. This means they have a duty to act in the best interest of creditors. The debtor needs to manage their property truly and pretty. They need to avoid losing or hiding any belongings. The court video displays the debtor’s actions to ensure they satisfy their fiduciary responsibilities. If the debtor fails to do this, the courtroom can take them away from manipulation. This allows guarding the rights of creditors. The debtor’s role is important in making sure a truthful procedure for all involved events.

Is A Debtor Someone You Owe Money To?

No, a debtor is not someone you owe money to. The person or company has given you goods or services. You agree to pay them later. The cash you owe is called debt. The debtor expects to receive their fee on time. If you do not pay, the debtor takes action. They ship reminders or add costs. Debtors play a crucial role in money subjects. They help the economy by lending money to others.

Debtors need to keep track of payments. They must know who owes them money. If you owe a debtor cash, it is important to pay them again. This builds agreement with and enables your courting. Some debtors can also use contracts to protect their pastimes. This record states how much you owe and when to pay. It can help keep away from misunderstandings. Overall, a debtor is a key part of economic dealings.

Is A Purchase A Debtor Or Creditor?

A purchase is neither a debtor nor a creditor. It is the act of buying something. When you make a purchase, you provide cash to a dealer. The vendor affords goods or offerings in return. In this case, the vendor becomes a creditor. They anticipate being paid for what they promote. The client isn’t a debtor at that second. The customer will pay prematurely or use credit to shop for.

If a purchaser makes use of credit for a buy, they grow to be a debtor. They owe cash to the creditor who provided the credit. This creates an economic responsibility. The customer needs to return the quantity borrowed. This is a part of using credit responsibly. Making purchases is an everyday part of lifestyles. It enables each buyer and seller to have interaction in the enterprise. The buyer receives what they want, at the same time as the seller earns cash.

What Is A Debtor In A Court Case?

A debtor in a court case is a person who owes money. This person was involved in a criminal dispute. The courtroom can be asked to assist settle the debt. The debtor should provide statistics approximately their economic scenario. This allows the court docket to recognize their potential to pay. The debtor has rights all through this method. They can shield themselves and present their case.

In court dockets, the debtor faces a creditor. The creditor desires the court docket to implement the fee. The court docket will evaluate each facet. It can also order the debtor to pay or permit a compensation plan. The purpose is to find a fair answer for each party. A debtor’s position in a court case is critical. They can have an effect on the outcome and assist in clearing up the debt trouble.

What Is A Debtor In A Trial Balance?

A debtor in a trial balance is a person or entity that owes money to a company. In accounting, trial stability suggests all bills and their balances. Debtors are listed as bills receivable. This way the business expects to acquire payment from them. It is important for companies to track their debtors. This facilitates manipulation of money and economic health.

Debtors in a trial balance reflect money the company can collect. They show how much earnings are predicted in the future. Businesses must hold accurate records of their debtors. This enables them to prevent losses and enhance control. Debtors play a critical function in a corporation’s achievement. Understanding their debts allows corporations to plan better. It additionally helps with making informed decisions about spending and funding.

Is A Debtor The Same As A Debt Holder?

No, a debtor is not the same as a debt holder. A debtor owes cash, even as a debt holder owns the debt. The debtor is accountable for paying lower back the cash. They have borrowed from a bank or a chum. The debt holder expects to receive payments on time. They can also earn interest from the debtor. This is how they benefit from lending cash.

Debt holders can also sell the debt to someone else. They might also switch the right to acquire payments. This is commonplace in finance. The new proprietor then becomes the debt holder. The authentic debtor nonetheless owes the equal amount. They must preserve paying in step with the agreement. Understanding these roles enables human beings to control their money higher.

Is Debtor The Same As Accounts Receivable?

No, a debtor is not the same as accounts receivable. A debtor is someone who owes money. This can be a person or a commercial enterprise. Accounts receivable, alternatively, is a time period used in accounting. It refers back to the debts to a commercial enterprise by using its debtors. This means debts receivable is a record of all the debtors a corporation has.

When a business sells goods or services on credit, it creates accounts receivable. The enterprise expects a fee within the future. Debtors are included in this account until they pay. Managing money owed receivable is vital for an employer. It makes certain that the commercial enterprise collects bills on time. This continues the organization’s budget healthfully. Understanding the difference is fundamental to exact financial management.

What Are The Rights Of A Debtor And Counterparty In A Contract?

The rights of a debtor and counterparty in a contract are important, a debtor has the right to understand their responsibilities. They should recognise how much they owe and whilst to pay. They also can ask for adjustments to the terms if wished. The counterparty has rights too. They have the right to receive payments on time. Both sides must comply with the regulations set within the settlement. If one aspect breaks the rules, the alternative can be searching for assistance from the regulation. Knowing these rights helps each event.

Can A Financial Advisor Help A Debtor Reduce Unsecured Debt?

A financial advisor can help a debtor reduce unsecured debt. Unsecured debt is debts without collateral, like credit card debt. A consultant can assess the debtor’s financial state of affairs. They can assist in creating a price range and spending plan. The advisor recommends debt consolidation. This combines multiple debts into one price. They can also manual the debtor on negotiating lower interest rates. This could make bills less difficult. An economic consultant affords aid and recommendation. They assist debtors feel much less confused about their cash. This can lead to better financial health.

Our advisors at capitalizethings.com specialize in helping debtors reduce unsecured debt; reach out via our services offering page form or call for a free consultation at +1 (323)-456-9123 before committing to expert services.

Do Debtors Need Financial Planners For Debt Management?

Debtors can benefit from financial planners for debt management. A planner enables creating a clear plan to repay debts. They can provide guidelines on budgeting and saving. This advice can assist debtors spend much less and save more. Financial planners also assist set practical dreams. They manual debtors in prioritizing bills. This method focuses on high-interest money owed first. The planner can review the debtor’s progress over the years. They adjusted the plan as they wished. With a financial planner, debtors feel extra assured in coping with their money. Reach out to capitalizethings.com professional financial planners via email if you looking for expert advice for your debt situation.

Can Financial Literacy Help A Debtor Manage Debt?

Financial literacy can help a debtor manage debt effectively. It teaches humans approximately money, budgeting, and financial savings. When debtors understand these topics, they could make higher selections. They discover ways to avoid taking over an excessive amount of debt. Financial literacy helps debtors recognize interest rates. It suggests how small bills can lead to massive problems. With this understanding, debtors can create a price range. They can plan their expenses and track bills. This reduces stress and improves economic fitness. Learning approximately money is important for all debtors.

Can A Debtor Apply Wealth-Building Principles Successfully?

A debtor can apply wealth-building principles successfully. These standards are aware of saving and investing cash. Even as in debt, a debtor can learn to control the budget. They can set aside small quantities for savings. This builds a protection internet for future desires. Learning about investments can also be helpful. Debtors can start making an investment in small amounts to develop their wealth. By specializing in their financial goals, they can create a plan. This helps them repay debt even as building wealth. It takes time, however the outcomes are very worthwhile.

Can Liquidity Ratio Indicate Debtor Risk Factors?

The liquidity ratio can indicate debtor risk factors. This ratio indicates how easily a debtor can pay their brief-time period debts. An excessive liquidity ratio means the debtor has sufficient belongings to cowl their payments. This is a good sign of financial health. A low liquidity ratio can show troubles. This way the debtor can also conflict to pay their debts on time. Creditors often observe this ratio before lending money. It enables them to determine the threat of lending. Understanding the liquidity ratio is vital for coping with finances successfully.

Are Debtors Often Victims Of Financial Ignorance Issues?

Debtors are often victims of financial ignorance issues. Many human beings do not apprehend how money works. This lack of know-how can result in bad financial choices. For example, debtors may tackle an excessive amount of credit score card debt. They won’t recognise how hobbies impact their payments. This ignorance can create a cycle of debt that is difficult to break out. Education is important for preventing those problems. Teaching debtors about budgeting and saving can make a distinction. With better knowledge, they could avoid common mistakes and manage debt.

Can Teenagers Avoid Debt While Making Money?

Teenagers can avoid debt while making money. They can begin with the help of learning budgeting early. This enables them to understand the price of cash. They can participate in part-time jobs to earn profits. It is essential for them to store a number of their profits. Setting a budget facilitates young adults’ track spending. They should learn to stay inside their budget strategy. Using money instead of credit can also help keep away from debt. Teenagers can ask for advice from adults. With excellent conduct, they could build a strong financial future without debt.

Conclude:

Debtors play a key function in financial systems. Understanding what it is to be a debtor is crucial for coping with money nicely. Debtors should understand their rights in contracts and the way to reduce their money owed. Financial literacy helps debtors keep away from errors. With accurate making plans, they are able to build wealth even whilst repaying money owed. Tools like liquidity ratios help show risks. Teaching teenagers about money can prevent debt. Being a debtor can be difficult, but gaining knowledge of a way to control debt can lead to a higher financial future.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.