Wealth requires time, work, and dedication. There are ways to build and preserve money over time. Early implementation increases the likelihood of success. Labor brings profit; skill brings opportunity and quick wealth wastes. Wisdom and innocence are spiritual wealth formation regulations. Setting objectives, controlling debt, investing and saving, understanding taxes, and maintaining a good credit history are philosophical principles crucial to growing wealth. Psychological principles of wealth creation include proactiveness, internal locus of control, goal orientation, abundance, and continuous learning.

What is wealth building principles?

Wealth-building principles are essential frameworks for long-term financial growth. Saving, investing intelligently, limiting debt, and generating numerous income streams are shared ideas for long-term financial stability and freedom. These principles form a solid foundation that individuals can use to improve their financial situation over time.

We provide discount offers for personalized investment strategies that emphasize spiritual and psychological alignment in wealth building. To learn how to secure your future, connect with us at capitalizethings.com and don’t forget to call +1 (323)-456-9123 for more information before proceeding, allowing you to receive a complimentary 15-minute consultation.

What are wealth-building principles?

The 41 significant principles of creating wealth are:

- Diversify investments: Spread your investments across various asset classes to minimize risk.

- Control debt: Manage and reduce debt to avoid high interest payments and financial strain.

- Clear budgeting: Maintain a clear budget to track expenses and manage finances efficiently.

- Save money: Regularly set aside a portion of income for future needs and emergencies.

- Establish financial goals: Set clear, achievable financial targets to guide your wealth-building strategy.

- Earn money: Focus on increasing income through multiple sources or career growth.

- Invest in yourself: Improve your skills and education to enhance earning potential.

- Invest regularly: Consistently put money into investments to build wealth over time.

- Maximize retirement contributions: Contribute the maximum allowed to retirement accounts to benefit from tax advantages and compound interest.

- Protect your assets: Use insurance, legal strategies, and smart investment practices to safeguard your wealth.

- Spend less than you earn: Ensure that your expenses are lower than your income to save and invest the difference.

- Be disciplined: Stay committed to your financial plans and long-term wealth-building goals.

- Diversification: Invest in a variety of sectors and assets to reduce the risk of loss.

- Invest early: Start investing as soon as possible to take advantage of compound growth.

- Reinvestment Risk in Investment Management: Manage the risk that arises when reinvesting returns at a lower interest rate than expected.

- Gratitude for Abundance: Appreciate the wealth you have to foster a positive relationship with money.

- Generosity in Wealth Creation: Share your wealth with others, creating a cycle of prosperity and goodwill.

- Faith in Provision: Trust that there will always be enough resources to meet your needs.

- Delayed Gratification for Wealth: Resist the urge for immediate rewards in favor of long-term financial success.

- Wealth Mindset: Cultivate a mindset focused on opportunities, growth, and abundance.

- Managing Reinvestment Risk: Take steps to minimize the effects of lower reinvestment rates on your portfolio.

- Balance in Wealth-Building: Create a balanced approach to saving, spending, and investing for sustainable wealth growth.

- Mitigating Reinvestment Risk: Use strategies like diversification or laddering to reduce the impact of reinvestment risk.

- Service to Others: Build wealth with a purpose, contributing positively to society.

- Mindful Stewardship: Be intentional about managing and growing your resources responsibly.

- Influence of Reinvestment Risk on Decisions: Consider how reinvestment risk affects your investment choices and strategies.

- Self-Discipline in Financial Success: Practice restraint and perseverance to achieve financial independence.

- Emotional Resilience in Wealth: Stay calm and focused during financial challenges and uncertainties.

- Positive Visualization of Wealth: Use visualization techniques to imagine and attract future financial success.

- Living in Harmony with Nature: Make investment choices that align with environmental sustainability.

- Karma of Wealth: Believe that positive financial actions will lead to positive outcomes in wealth creation.

- Reducing Reinvestment Risk: Implement investment techniques to avoid the pitfalls of reinvestment risk.

- Virtue of Prudence: Make careful and thoughtful financial decisions to build and preserve wealth.

- Rational Self-Interest in Wealth: Prioritize your financial well-being in a logical and strategic manner.

1. Earn Money

Start making money initially. You cannot preserve what you don’t have, therefore this step is crucial. You’ve undoubtedly seen charts illustrating how a modest amount saved and compounded can develop into a large sum. However, those charts never answer the question: How do you save initially? Two main ways to make money are earned and passive. Investments generate passive income, whereas earned money comes from work. Passive income will arrive once you’re earning enough to invest.

2. Set Goals and Develop a Plan

Use your fortune for what? Want to fund your retirement—can be early? Pay for your kids’ college? Buy a second home? Giving your wealth to charitable organizations? Setting goals is crucial to wealth creation. When you know what you want, you can plan to attain it. Determine your financial objectives, such as retirement savings, property ownership, or debt repayment. Specify how much money and time you need to reach each goal.

After setting goals, develop a plan to achieve them. This can involve making a budget to save more, earning more through schooling or career progression, or investing in assets that increase over time. Realism, flexibility, and long-term emphasis should guide your plan.

3. Save Money

Making money and spending it all won’t produce wealth. Saving is your top priority if you can’t pay your payments or have an emergency. Most experts advocate saving up to six months’ salary for such scenarios.

4. Invest

After saving money, invest it to grow it. Note that savings account interest rates are low, and inflation could devalue your money. Diversification can be the most crucial investment idea for beginners or investors. Your goal is to diversify your investments. This is because investments behave differently over time. If the stock market is down, bonds can perform well. If Stock A falls, Stock B can rise.

Mutual funds invest in various securities, providing diversification. You’ll diversify more if you invest in equity and bond funds (or many of each). Another standard guideline is that younger people can afford to take more significant risks because they have more years to recover.

5. Protect Your Assets

You worked hard for your money and wealth. A single disaster or unplanned incident could ruin everything. Insurance protects you from risks, helping you develop money. Home, auto, and life insurance will pay for your home and goods after a fire, automobile accident, or premature death, respectively. Long-term disability insurance replaces your income when you become injured, unwell, or unable to work. Insurance goods get more expensive with age, so even healthy young people should consider them. That makes life insurance cheaper for a 25-year-old alone than a 10-year-old having a husband, kids, and mortgage.

6. Minimize the Impact of Taxes

Taxes slow wealth-building yet should be addressed. We all pay income and sales tax, but our investments and assets might be taxed. You must understand your tax exposures and devise measures to reduce them.

Tax-advantaged accounts are an easy method to reduce taxes. Individual retirement accounts (IRAs), 529 college savings plans, and 401(k) plans offer tax incentives to help you save more and lower your tax burden. Traditional IRA and 401(k) contributions are tax-deductible, so you can save cash on taxes in the year you make them. They also grow tax-deferred, so you’ll retire with less and be in a lower tax bracket. Roth IRA and 401(k) investment profits are tax-exempt, so you can grow and remove money tax-free.

Consider investment timing and location to reduce taxes. Long-term capital gains tax rates are lower than short-term and income tax rates; thus, holding investments for longer than a year can pay off. Consider where assets are held. Invest in a dividend-paying stock or company bond in a Roth IRA, where payments are not taxed. A taxable account can be best for a growth stock that generates capital gains.

7. Diversify investments

Diversification means not adding all of your eggs in a one basket. The premise is that additional investments will compensate for losses in one. Diversification doesn’t protect your assets from market losses, but it can reduce the likelihood that you will lose money or lose less than if you weren’t diversified.

8. Control debt

To ensure you can afford your monthly debt payments, create a budget based on your income and expenses. Then, you can choose which loan to pay off first and spend your surplus income.

Additionally, debt consolidation might help manage debt. That way, you can pay off debt faster and save interest. If you can’t pay your loan, seek debt settlement with your financial institution. A reputable debt settlement organization can negotiate a lesser late account payment with lenders. As a final resort, declare bankruptcy. Be warned that debt settlement and bankruptcy might damage your credit for years.

9. Establish financial goals

Any money plan is a financial goal. Short-term goals include saving $1,000; long-term goals involve purchasing a house or investing for pension. Setting goals for all aspects of your life is essential, but having financial goals involves planning for both saving and spending money for your dreams. Depending on how you interact with money, deciding what to do with it can be as stressful as picking a Netflix show or as exhilarating as booking a Disneyland vacation. Options abound. You can only watch some home remodeling shows or ride all coasters simultaneously. You must select, and I propose, achieving your goals for lifelong success. First, let’s discuss a goal-setting mindset.

10. Invest regularly

Regularly investing what you have to spend and forgetting about it could turn those tiny amounts into something valuable. Here are some benefits of frequent investing. If you invest a lump sum and the market falls, it can take time for your money to climb again. By investing consistently, you can gain from market highs and lows (called ‘pound cost averaging’) and reduce the danger of investing in high markets.

Regular investing eliminates the stress of deciding when to invest or withdraw. Timing the market is tricky and emotional. Some consider it dangerous and short-term. Regular monthly payments over five years or more ensure you invest, whether times are positive or negative.

11. Protect your assets

Determine if your business offers a “match” or matches what you contribute up to a particular amount each year for your 401(k) or 403(b) retirement plan. This could be a proportion of your salary, contributions, or a dollar amount. After learning their policies, calculate how much you need to give to reach the maximum employer match. Like free money! Fidelity recommends contributing enough to the company’s plan to win the game. Next, determine how long you must work there to keep the cash they provide. But you own that money once it vests.

12. Invest in yourself

Pay attention now. Understanding this is crucial and will improve your life. Take charge of your life. Your life and everything in it are yours to manage. Not your parents, teachers, boss, or lover. You decide your life. This doesn’t mean you can ignore others’ viewpoints or the consequences. Your choices in life and work have created 99% of your current situation. The good news is that you can ultimately improve things. Cease to blame your parents, economy, or boss for your problems. Please take charge of your life and make it great.

13. Spend less than you earn

Like reducing weight by eating more calories than you burn, wealth is achieved by spending less than you earn. Living by this rule is difficult for many. To increase personal wealth, you must reduce consumption. Americans spend, no doubt. We spend our hard-earned money on a house, car, and education. Over 70% of our economy is based on users spending. That’s why signs, ads, and endorsements everywhere say: SPEND!

The American work ethic is rooted in financial competence and daily effort. It encourages children to pursue school and secure a career they enjoy, enabling them to support themselves. We pursue wealth because we can spend our money on the life we want. Overspending can be harmful. It’s especially true if you strain your finances by taking out loans to buy unnecessary items. The only way to live well is to spend only what you require.

Spending less means saving more. As simple as it sounds. You will have enough money once you save some of your monthly wages. That involves investing less and saving more to avoid debt. American consumers have several financial aspirations. They range from significant issues like debt repayment to vacation savings and home buying. Some ambitions are more important than others, but they all require money.

14. Be disciplined

Self-discipline unlocks our potential. It motivates us to achieve previously difficult personal and professional goals. John Wooden remarked, “Honest yourself so that others won’t need to.” However, most people lack self-discipline. Every turn offers distractions, luring us off course. Impulses favour short-term satisfaction over long-term satisfaction. Procrastination keeps us putting things off.

15. Diversification

Risk management tool diversification tries to smooth clients’ investment journeys while decreasing portfolio volatility over time. Diversification entails investing in various asset classes, locations, currencies, and sectors to offset losses in one asset or product. A portfolio cannot avoid losses since not all risks can be dispersed.

16. Invest early

Young people often need to pay more attention to investment wisdom. They care about the present, not the future. They don’t have to give up their lifestyle, but investing regularly over time will ensure their savings and net worth are there when needed.

17. Reinvestment Risk in Investment Management

Due to reinvestment risk, an investor can have to reinvest the coupon, principle, or interest at a lesser rate. Investors usually experience this when interest rates fall during their investment horizon. Traditionally connected with fixed-income expenditures, reinvestment risk applies to any investment that provides cash flows or expires throughout the investor’s investment horizon.

Interest rate risk is linked to rate changes. This shows the risk of investment losses owing to interest rate changes affecting valuation. A rise in interest rates could lower the price of a fixed-rate bond, resulting in a capital loss if sold before maturity. The bond will be redeemed at par if held until maturity. Interest rate risk shows how interest rate changes affect an investment’s value, while reinvestment risk is the danger of not getting the exact yield on reinvested money.

Reinvestment risk can affect investment returns. Investors should align portfolios for the upcoming period to take advantage of increased short-term returns and anticipate the full impact of interest rate rises over their investment horizon.

When the yield curve inverts, reinvestment risk increases. Securities yields vs maturity is plotted on the yield curve. This is frequently upward-sloping because locking up assets longer requires a more significant return. Inverted yield curves suggest shorter-term securities have a higher rate of return than longer-term ones. This happens when short-term rates of interest are high but predicted to fall.

18. Gratitude for Abundance

The Law of Gratitude and abundance are linked. By shifting our focus from scarcity to sufficiency, gratitude invites abundance. Focusing on gratitude attracts more good things. Gratitude attracts abundance in love, health, career, and individual growth.

19. Generosity in Wealth Creation

Business generosity is about creating a sustainable environment where each transaction and interaction provides value, not just giving. It challenges the scarcity paradigm by arguing that true wealth comes from contributing, not accumulating. For those building our corporate environments, remember that starting with generosity bakes a bigger pie for everyone.

20. Faith in Provision

Faith in Provision: God wants us to trust him even in bad times. In Proverbs 3:5- 6, we are told to trust in the Lord and not lean on our understanding, and He will straighten our paths. God tests us to see if we would trust him before he gives and before we know the outcome. We take some risks to believe in God, but God took much more to save us from ourselves by sending Jesus because God is faithful and promises to give when we have confidence!

You can be looking at your spending plan and wondering how you’ll pay for living expenses this month. I have been there… However, those moments challenge our trust. The enemy wants you to doubt your father and work to support yourself. We don’t want to do anything, but prayer has worked for generations in times like this. Take a moment today to trust God to resolve your circumstances.

21. Delayed Gratification for Wealth

Our daily decisions are often influenced by quick gratification. When we see something enticing, we generally indulge instantly. The expert advised taking a step back and contemplating if you find yourself spending more on ‘desire’ than ‘need.’ Take a day or two to consider whether buying something is necessary now.

If the desired item fits your budget, it can be considered, says Roongta. However, if it surpasses the budget, a more careful evaluation can be needed.” He believes poor budgeting causes expenditures—financial decisions like whether to buy now or later must be carefully considered.

22. Wealth Mindset

There are many ways the wealthy differ from the poor or middle class. Mindset can be the biggest difference between a poor doctor and a multi-millionaire. The rich and those expected to become wealthy (HENRYs—High Earner, Not Wealthy Yet) think differently in six ways.

More than anything, individuals who will remain poor don’t worry about their lives in 20 or five years. They’re contemplating Friday night or lunch. The wealthy usually plan their retirement in their 20s, when they get their first paycheck. While the middle class considers retiring in their mid-50s, rich people are structuring their estates to span several generations. Middle-Class Mike buys a new car on credit because he doesn’t understand that it will need to be replaced. Rich Willy pays cash for the vehicle, having saved for years.

23. Balance in Wealth-Building

This unique approach lets clients diversify their capital and choose to earn returns from invested assets or cash. Let’s examine why mid- to long-term investors need this balance. In the fast-paced world of investments, bonds, stocks, and ETFs are alluring. These vehicles promise significant gains and financial security. While we believe in the power of investments to build wealth, we also value capital preservation and liquidity. Consider a medical emergency, home repair, or financial opportunity that requires immediate attention. Interest payment on uninvested cash is often underestimated. Financial markets are volatile, and investing is risky. Building wealth requires higher returns and protection from market downturns and economic turbulence.

24. Mitigating Reinvestment Risk

Reinvestment risk is the chance that an investor cannot reinvest investment cash flows like payments for coupons or interest at their present rate of return. The new rate is reinvestment. Since bonds with a zero (Z-bonds) never pay coupons, they are a single fixed-income instrument without investment risk.

An investment’s cash flows can yield less in a new security, causing opportunity costs. The investor can need more time to be ready to reinvest cash flows at their current rate of return. An investor purchases a 6% 10-year $100,000 Treasury note. Investor expecting $6,000 annually from security. After one year, interest rates drop to 4%. With $6,000, the investor would receive $240 annually instead of $360 if they buy another bond.

25. Service to Others

People always want more from business, relationships, and physical achievements. We must be servant leaders to be truly fulfilled and not just enjoy temporary bliss. Service support helps us stop thinking about ourselves. People eventually become altruistic and focus on others. Because serving others makes us feel good differently, it makes people feel good about themselves, like buying a new car, smartphone, or whatever, we need the next high eventually. Serving others allows us to see the beauty and good that pulls us beyond ourselves. To be fulfilled, we must grow and make it about others.

26. Mindful Stewardship

By taking leadership, you assume moral and ethical obligations to care for your department or company. It is not for the fainthearted. It is more of a responsibility than a financial sheet. It is making sure our activities achieve our goals, serve our constituents well, and benefit our community. A servant leader needs “global thinking.” It will affect all business areas. We will negotiate win-win-win to reach a profitable and accountable arrangement for all.

Are we giving our constituents clear goals, policies, objectives, and standards and keeping them accountable? Are we ensuring the people we serve have the skills, tools, and talent for achievement while setting goals?

We hold our constituents accountable by incorporating them in goal setting and standards. Involving diverse voices and perspectives in our organizational objectives and rules will help us ensure every component has a personal stake and that our view is as complete as feasible. Each employee can enhance our knowledge.

Giving our constituents unachievable tasks does not assist them. Matching the person to the job is crucial. The bus metaphor from Jim Collins’ Good to Outstanding compares businesses to buses that need the right people on the appropriate bus in the right seats to reach a new destination. If a constituent cannot fulfil their goals and objectives despite adequate training and equipment, they should be moved to a new seat on the bus. Do not let the bus drag forward while others try to help.

27. Influence of Reinvestment Risk on Decisions

Reinvesting investment funds at a lower rate of return might increase uncertainty and risk. This happens with bonds and CDs that reinvested interest or capital.

Fixed-income investors must consider reinvestment risk. This emphasizes the need to monitor market interest rate swings and has a well-planned investment strategy to minimize their impact. Changing your portfolio and reinvesting wisely might help you overcome reinvestment risk and reach your financial goals.

28. Self-Discipline in Financial Success

Financial success requires self-control, especially when it comes to spending. Self-control helps you identify wants from needs and make smarter spending decisions, saving you money over time. Avoiding impulse buys and adhering to your budget will improve your finances now and in the future.

Financial success begins with economic goals. Keeping your goals in mind over time demands self-control and discipline. Self-control can help you achieve financial success by staying focused on your goals. Tracking your financial goals will help you avoid excessive spending and make smarter financial decisions.

29. Emotional Resilience in Wealth

Finance-related emotional resilience is managing financial change and adapting to stressful events. Emotional Responses: First, recognize how financial changes affect your emotions. Can market downturns generate anxiety? Does talking estate planning make you sad or uncomfortable? Stress can greatly affect financial decisions. Resilience helps you stay calm and make sensible judgments in challenging times.

30. Positive Visualization of Wealth

Visualization manifests prosperity and success. Seeing your financial objectives can attract them to you. For a few minutes, visualize your financial goals as accomplished daily. Consider the feelings, events, and lifestyle of success. Visualize your financial goals with words and graphics. Keep them visible to inspire and remind you daily.

31. Living in Harmony with Nature

Our unconscious, disconnected harmony lacks the capacity to deal with, fear, or allow Nature in. St. Francis of the Assisi, the Catholic protector of ecologists for his intuitive affinity with animals, is celebrated tomorrow. A century-old Italian tradition, hundreds of devotees bring a variety of pets to the Cathedral of St. John God in New York City for blessings.

This current interpretation of St. Francis’s teachings can surprise him, as medieval ascetics considered dogs frivolous distractions. How does he feel about pesticides and chemical brush killers? I can need forgiveness and pardon.

32. Karma of Wealth

After years of studying abundance, I’ve found something important. Life might be happy or sad for some. But why? Why can one individual benefit from a situation while another suffers? We usually hear that it relies on your mindset or whether you are positive or negative. These responses seem reasonable.

We believed in karma and had seen its unexplained power, good and evil, so we wanted to measure it. We categorized our experiences and assigned numbers to each issue based on its impact on our daily lives.

We measure karma. What I call karma, you can call something else. I’ve heard karma called spirit, the universe, God, or something else. We want to establish a behaviour spectrum for ourselves. We revealed our baseline multipliers in part 1, and today, we will share the total calculations. Remember that everything in life has a positive (+) and negative (-) outcome. Our behaviour is light and dark. This is not a judgment of anyone’s habits.

But you’ll be shocked how often we must choose brightness or dark. For reference, our stages are: The baseline multiplier for the Ego Stage is zero. The physical/Decision Stage multiplier is +1 or -1. The Social Stage multiplier is +2 or -2, the Emotional Stage +3 or -3, and the Financial Stage +4 or -4. The Spiritual Stage should have a +5 or -5 multiplier. Wrong!

A year of behaviour will be measured. Our narratives from yesterday yielded these results for “John” and “Jane.” When John is depressed and has a negative attitude, he enters the zero-multiplier Ego Stage. 365 x 0 = 0. Anything multiplied by zero is zero. Thus, John finds zeros everywhere. John thinks that bad luck follows him everywhere. John must be more optimistic. But getting stuck is easy. Despite her problems, Jane remains upbeat and accepts. Jane’s open mind and positivity alone move her from the Ego Stage to the Physical/Decision Stage, which has a multiplier of 1.

Jane admires her tutor. Opening out to the mentor, she pleads for accountability. This is a huge milestone for her and provides a 2x Social Stage multiplier. 365 x 2 = 730. John benefits from Jane meeting him. John gets out of the Ego Stage and imitates Jane after telling her how he feels. They debate emotional intelligence and create a book club. They both enter the Emotional Stage 3x faster. 365 x 3 = 1,095.

They start their reading club with a financial book that explains money. They remain humble, maintain their past behaviour, and actively make two financial adjustments. The financial Stage multiplier is 4x. 365 x 4 = 1,460.

John and Jane invite someone to the book club. Call him George. George suggests reading a Tony Robbins book that inspires and provides a well-rounded daily routine. They all promise to study and apply new adjustments. A few weeks pass. Everyone has experienced these shifts. Opportunities find them, and they are pleased. So many positive things are happening; it’s strange. Our final multiplier was 1,460. Book club three enters the Spiritual stage, expanding its number. Instead of 5x, 1,460 gets 1,460x. 1,460 x 1,460 = 2,131,600.

33. Virtue of Prudence

Prudential, a mirror-and-snake embodiment of virtue, is sometimes represented with Justitia, the goddess of Rome of Justice. Prudence is the capacity to distinguish between good and evil, both generally and in relation to specific situations. Prudence regulates all virtues despite its knowledge-only Nature. Prudence includes separating heroic from irresponsible or cowardly conduct.

34. Rational Self-Interest in Wealth

Actions that benefit one are self-interest. Adam Smith, the pioneer of modern economics, says self-interest usually yields the most significant economic benefit. According to his Invisible Hand argument, dozens or thousands of self-interested people develop goods and services that benefit customers and producers. Smith and other analysts have also studied rational self-interest, which suggests that most individuals will act economically rationally when making decisions that affect their financial status and well-being, which can also boost the unseen Hand.

Economic and psychological self-interest exist. Self-interest generally refers to personal actions and behaviours that benefit one. For years, economists have examined rational self-interest and its effects on economic theories and assumptions.

35. Detachment from Materialism

Money comes and goes. Thinking doesn’t construct a house. You don’t enjoy life properly. Designer handbags, expensive vehicles, and a good home are excellent but fail to make anyone happy. Their happiness was fleeting. Happiness comes from loving what you have, not what you want. Once you realize the beauty in daily life, your attitude will change. More life contentment is needed. This can come from helping others, making new non-materialistic acquaintances, or, most significantly, connecting with God. The water of life is Jesus. Drinking him will never leave you thirsty. There’s no explanation for this peace. He’s one chat away and waiting for you.

36. Sustainability in Wealth Creation

Sustainable real estate wealth benefits investors and the environment. It demands investing in low-energy, green, and renewable-energy properties. Investors in sustainable real estate can build wealth, reduce carbon emissions, and promote sustainable communities.

Based on a vision of sustainability and how to get there, sustainable property investment includes four essential investment techniques and can be used for direct and indirect property investment (RICS, 2008). It might boost income creation and fight global warming. Real estate investments in energy-efficient buildings and renewable energy projects can cut emissions and improve sustainability. Green infrastructure projects Real estate investments can reduce urban runoff, enhance air quality, and provide local jobs and economic possibilities. Urban green spaces promote cooler temperatures, cleaner air, and better mental and physical health; real estate investments can fund them.

If sustainability principles are followed, more wealth will be created, and real property investment will likely be sustained. Sustainable property investment seeks to improve the durability, adaptability, usability, and efficiency of buildings and the building stock, boosting productivity, well-being, and economic benefit in terms of financial, natural, human, manufactured, and social capital (RICS, 2008). They also advocated for research-based best practices and timely consideration of the entire building life cycle, including building, management, acquisition, use, maintenance, decommissioning, deconstruction, and processes both before and after.

37. Adaptability in Wealth-Building

Understanding yourself and your abilities is the first step to flexibility. Self-assessment, feedback, and coaching can help you identify financial strengths and problems. For example, you can be skilled at data analysis but need to enhance your communication skills. You can excel at accounting but need help with risk management. Knowing where you need improvement will assist you in setting objectives, scheduling learning, and tracking progress.

The second step to adaptation is taking on new problems that push your talents. Find initiatives, jobs, or roles introducing you to different finance markets, industries, or functions. Volunteer for projects that require collaboration with diverse teams, customers, or partners. Take on new challenges to learn and prove yourself.

Third, embrace learning and feedback as part of your career growth to become more adaptive. Your manager, peers, or mentors can provide constructive comments on your work, strengths, and weaknesses. You can also ask clients or stakeholders for service improvements. Feedback can help you find problems, improvements, and work gaps to increase quality and efficiency.

38. Overcoming Limiting Beliefs

Limiting beliefs can come from many sources, not only a bad experience. Finding out where the limiting belief came from can help you go forward. Negative experiences from childhood or criticism can shape self-esteem and ability. Parental, instructor, and peer criticism might limit our potential and self-esteem.

If a teacher tells a pupil they’ll never pass an exam, it will affect their confidence later in life. Expectations and conventions from society shape our beliefs. Social forces can limit our options and set boundaries. For instance, missing a milestone can lower your confidence. Failure to satisfy KPIs or other productivity measures can limit your potential in a competitive company.

39. Self-Worth in Wealth

Self-esteem and self-worth are based on mental strength and willpower, not wealth or worldly power. Even with lots of money, a weak-minded individual can feel poor self-esteem. Money can buy comfort but not self-worth. Accepting oneself and following good characteristics in all aspects of life can boost self-esteem and self-worth.

40. The Middle Path to Wealth

I often quote Buddha’s advice to find the middle ground when describing ethereal notions like this one. He characterized the middle path as a method to find harmony between life’s extremes, like yin and yang, masculine and feminine, dark and light.

This lesson can be visualized as a pendulum that swings from extreme to extreme but has numerous gradations in between. On the money pendulum, we have one end where we want money at any cost, regardless of how it affects our mental and physical health, others, the environment, etc. Conversely, we avoid cash at all costs, including handling, attracting, controlling, and taking responsibility. Looking at money on this spectrum is effective because it highlights our money habits. Everyone (and I mean everyone) goes to extremes with cash, which causes personal and social difficulties.

Finding the middle ground between these money extremes is a lifelong journey because it requires experiencing harmony and balance in the present. It is different for us, but we aim to think it is possible and keep working toward this more natural and holistic condition. Your life will be more pleasurable, meaningful, and serene once you start this trip. Money is everywhere, and we’re so wrong with it. Therefore, it makes us feel fantastic. If you believe and work to improve your money connection, I know amazing things are in store.

41. Continuous Learning for Wealth

Today’s information economy requires specialized knowledge and ongoing learning for financial success. You gain market value by gaining in-depth knowledge and remaining current with industry trends. This quest involves technology, lifelong learning, networking, and mentorship. Remember that specialized knowledge requires continual work. Investment in education and skills generates financial and employment prospects. Keep curious, motivated, and open to new learning. Continuous learning keeps professionals ahead in the fast-changing workplace. Invest in your expertise today and watch your finances change. Your commitment to learning and progress unlocks your potential and creates permanent prosperity and success.

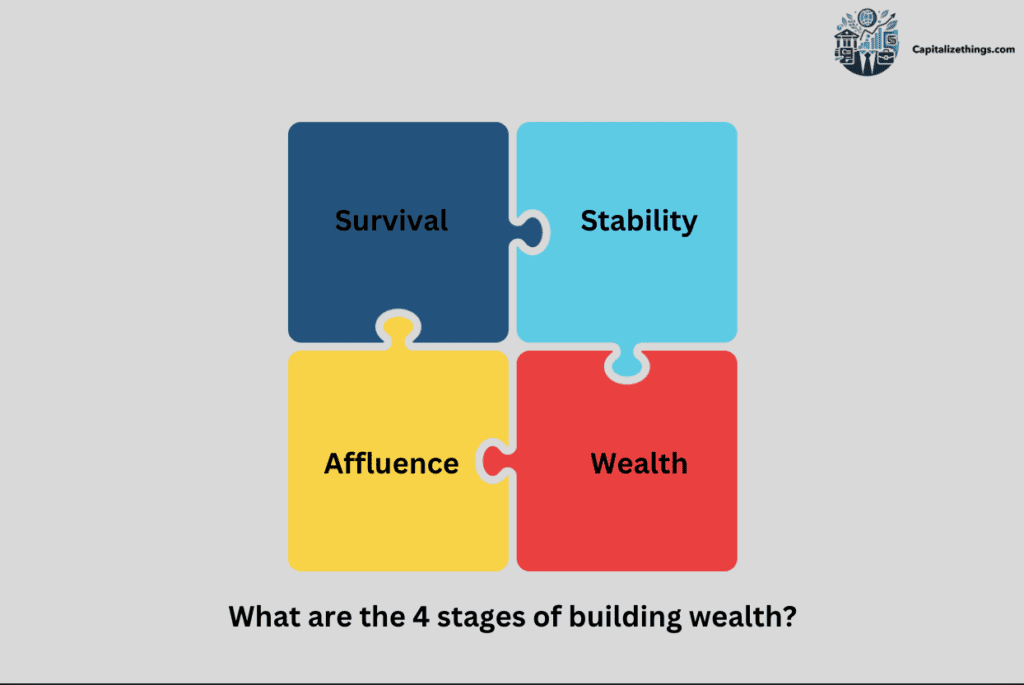

What are the 4 stages of building wealth?

According to Barbara Stanny, the 4 stages of building wealth are Survival, Stability, riches, and Affluence.

- Survival: Living paycheck to paycheck with constant financial anxiety and basic expense management struggles.

- Stability: Steady income and timely bill payments, allowing for some savings, though setbacks may still lead to reliance on credit.

- Wealth: Abundant resources enabling personal growth and giving back, while still facing some financial stress.

- Affluence: Leveraging wealth to generate more wealth, enjoying luxuries, and contributing significantly to society, while managing the risks of excess.

Based on thousands of hours spent as a client and counsellor, here is a summary of each step of the financial coaching process.

1. Survival

Survival mode means stashing unopened mail, counting the days and hours until the next salary, and running out of money faster than intended. Fear, negativity, and financial uncertainty plague you. Money worries seem never to stop when you live on salary.

2. Stability

When your taxes are current, your income is constant, and your bills are paid on time each month, you have stability in your finances. Your house fits your budget and lifestyle. You can save for non-monthly needs like auto maintenance, holidays, and Christmas without using credit or panicking. Though they generally manage their finances well, people at this stage can have financial and emotional setbacks. In this stage, people save money only to rapidly transfer it back and use credit cards to pay for the previous month’s spending. A significant number of 20- to 40-somethings need more financial stability.

3. Wealth

Wealth is an abundance of money or valuables, per the dictionary. Well-being or prosperity is the old definition. Wealthy folks are secure and choose freely. These people have moved beyond daily and monthly bank account worries to give back to themselves, their families, and society. Being wealthy does not prevent you from worrying about your money; it requires taking responsibility. This stage has abundance, meaning adequate time, energy, money, and resources to improve the world. All financial necessities are addressed, and enjoyment, self-care, and exploration are planned.

4. Affluence

The Affluence wealthy leverages their money. They utilize money to grow money. The danger zone is excess. A wealthy single man had 26 subscriptions to magazines and no time to read one every week.

Affluent people can access amenities, savings, investments, taxation, wealth accumulation, and business loopholes. They have an incredible chance and obligation to use this energy for good. Want to visit Turks and Caicos spontaneously? Let’s recognize the Bill & Linda Gates Foundation, Oprah Winfrey’s schools and hospitals worldwide, and countless more non-profits founded by wealthy people with missions to assist.

Of course, you can have actions, experiences, and feelings from multiple stages. Conflict and worry about money develop when the exterior and inside don’t match. Some have the things but are emotionally frustrated over cash, while others have less and have joy, thankfulness, and faith to live longer. Money coaches work with people at every wealth stage to align. Peace of mind about money is attainable when your vision of monetary and emotional security is realized, or your actions align with your aspirations and goals.

What are the 3 pillars of building wealth?

The 3 pillars of building wealth are:

- Expense Management

- Invest

- Increase Income

1. Expense Management

Effectively managing your expenses is crucial for creating a budget that allows you to save and invest. This involves tracking your spending, identifying areas where you can cut back, and ensuring that your expenditures align with your financial goals. By minimizing unnecessary expenses, you can allocate more of your income towards savings and investments, ultimately helping to build wealth over time.

2. Investing

Investing is a powerful tool for wealth accumulation. By putting your money into various assets—such as stocks, bonds, or real estate—you can benefit from compound interest and potential appreciation over time. The earlier you start investing, the more your money can grow. Diversifying your investments across different asset classes can help mitigate risk while maximizing returns. Consider using tax-advantaged accounts like IRAs or 401(k)s to enhance your investment strategy.

3. Increasing Income

Finding ways to increase your income can significantly impact your wealth-building journey. This can include seeking promotions, changing jobs, acquiring new skills, or starting a side business. The more income you generate, the more you can invest and save. Passive income sources, such as rental properties or dividends from stocks, can also provide additional financial security and contribute to long-term wealth.

What are the 4 key things you need to build wealth?

To build wealth, focus on 4 key strategies: invest in yourself, budget wisely, understand assets versus liabilities, and manage debt effectively.

- Invest in Yourself:

Make yourself a valuable asset. To increase your income:- Read something inspiring daily for at least 30 minutes.

- Surround yourself with successful people.

- Learn from others’ success; don’t assume you know their path without studying them.

- Budget Wisely (80% Rule):

Use the 80% rule to manage your finances:Allocate 80% of your income for living expenses, including housing, food, and entertainment. Save 10% for investment with a professional and 10% for personal savings. This method forces you to give every dollar a purpose. While it may be tough at first, sticking to this budget will create a habit that leads to financial growth. - Understand Assets vs. Liabilities:

Know the difference between assets that build wealth and liabilities that drain it:Liabilities (like cars, electronics, and vacations) lose value. Assets (like real estate, stocks, and businesses) appreciate over time. Avoid spending on things that don’t generate income. For example, spending $1,000 on a TV might seem appealing, but investing that money will pay off long-term. - Manage Debt:

American consumer debt is a barrier to wealth. Reducing debt is crucial because:- Interest payments drain your finances.

- High debt limits your ability to save and invest.

For example, using a credit card to buy a $2,000 TV can take 31 years and 2 months to pay off with minimum payments. This TV will ultimately cost $10,202, including $8,202 in interest. Consider how that TV will look in 31 years! This realization is crucial to reaching your first financial milestone and ensuring you earn more than you spend.

Look at these Strategies too for Wealth Building:

- Invest in Education: Pursuing education and skill development can lead to higher income potential.

- Start a Side Business: Creating additional income streams can accelerate wealth growth.

- Diversify Investments: Spread your investments across different asset classes to reduce risk.

How to build wealth from nothing?

To build wealth from nothing, follow the following 8 steps:

- Plan Your Finances: Create a financial plan. Consider hiring a financial counselor or using a robo-advisor for cost-effective guidance.

- Stick to Your Budget: Establish and follow a budget to track expenditures and avoid overspending, boosting your chances of achieving financial goals.

- Create an Emergency Fund: Set aside money for unexpected expenses to protect your credit and ensure financial stability during emergencies.

- Automate Finances: Set up automatic savings, investments, and bill payments to avoid missing contributions and help build wealth effortlessly.

- Manage Debt: Prioritize paying off high-interest debts while maintaining manageable debts like a mortgage, which can be viewed as “good” debt.

- Maximize Retirement Savings: Contribute to employer-sponsored 401(k) plans and individual retirement accounts, taking advantage of any company matching.

- Be Diverse: Diversify your investment portfolio to mitigate risks and capitalize on market fluctuations instead of concentrating on a single asset.

- Earn More: Increase your income through promotions or side gigs, and save a portion of any raises to enhance your investment potential.

1. Start by Planning

Plan your finances to build wealth. Hire a financial counsellor to start your wealth-building plan. It’s more expensive, especially for beginners, but a licensed financial planner gives you planning experience. Searching around for a robo-advisor with financial professionals can be cheaper. Betterment and Ellevest offer managed investment portfolios and adviser consultations.

2. Stick to your budget.

Budgeting is essential to wealth creation, yet many individuals hate it. Following a budget boosts your chances of reaching your financial goals. Budgets also help you track your monthly expenditures and avoid risky spending habits like overspending.

3. Create an Emergency Fund

How do you pay for a broken furnace or fridge without emergency reserves? Lori Gross, an investment and financial advisor at Outlook Financial Centre, said credit cards make you pay high interest rates and other expenses. By constructing an emergency fund, you can safeguard your credit, collect interest on an online savings account, and know you have money in the bank for life’s surprises.

4. Automate finances

Automatically saving, investing, and paying bills eliminates the possibility of forgetting to save or paying off debt. Michael Morgan, owner of TBS Retirement Planning, advocates having your whole budgeted amount for each item and objective automatically withdrawn from your paycheck and allocated to each expense. He claims this is useful for saving and investing. You avoid spending rather than investing by doing so. Soon, you won’t be missing the automatic deductions, and your donations will be regular, he added.

5. Manage Debt

Mortgages can be called “good” debt with low interest rates and wealth-building potential. Some experts consider a mortgage payoff a forced savings account because you’ll get at least part of your monthly payment back when you sell. Every month, you endanger your financial objectives by rolling over undesirable debts, including high-interest bank card payments. Gross advises planning your payback to achieve debt freedom. If you need help figuring out how to start, try debt snowball or debt avalanche payback.

Remember: Saving and paying off debt is doable (and frequently recommended). Your balances will drop, giving you more money for emergency savings and investing.

6. Maximize Retirement Savings

Experts recommend taking advantage of Uncle Sam’s retirement savings options. That includes contributing as much as possible to your employer’s 401(k) and individual retirement accounts. If donating the legal maximum is too much right now, save enough to obtain your company’s 401(k) match. You must contribute 3% of your wage each pay period if your company matches 3%.

Don’t worry if you can’t invest much initially. Most of my clients invested a little money for a long time, adds Casciotta. The magic of compounding turns tiny investments into fortunes. A target-date fund or robo-advisor that runs a tailored portfolio of funds based on your retirement age can be a good approach to starting to invest in your 401(k) or IRA.

7. Be Diverse

If you believe that only highly concentrated positions—like holding enormous quantities of Bitcoin—make people wealthy, reconsider. A diverse portfolio of investments can protect your money and position you to profit during market downturns.

8. Earn More

Investment in yourself by increasing your income is crucial in building wealth, but it can’t be done at an online brokerage. Earning more over your lifetime means more money to invest. Financial expert Michael Kitces advises saving 50% of every rise to guarantee your retirement. This lets you gradually increase your quality of life and avoid retirement-unaffordable ways of living. If you don’t think you deserve a raise, talk to your manager about how to advance. A side gig or passive income option can also interest you.

How do you build wealth with low income?

To create wealth with low income follow these 8 steps:

- Utilize Free Financial Resources: Access free educational materials and tools from government agencies and community organizations to enhance financial literacy.

- Budget: Create a budget by listing income and expenses, focusing on essential needs, and identifying areas to cut discretionary spending.

- Minimize Debt: Prioritize paying off high-interest debts, such as credit cards, to free up funds for saving and investing while improving your credit score.

- Auto-Save: Set up automated transfers to a savings account to encourage consistent saving without temptation.

- Slowly Invest: Begin investing in low-cost index funds or ETFs, starting small and gradually increasing contributions to benefit from compounding returns.

- Use Tax Benefits: Take advantage of tax deductions and contributions to retirement accounts like 401(k)s and IRAs to reduce taxable income and increase savings.

- Seek Additional Income: Explore side jobs, freelance opportunities, or part-time work to supplement your income and accelerate wealth-building efforts.

- Continuous Education: Stay informed about personal finance through books, podcasts, and workshops to make better financial decisions over time.

1. Utilize Free Financial Resources

Low-income people can enhance their financial literacy and stability with several free financial resources. Government agencies provide free financial education. For instance, the Consumer Financial Protection Bureau (CFPB) offers many budgeting, savings, and debt management tools. Its website provides interactive tutorials and instructional information to help people make financial decisions.

These groups aid with budgeting, debt management, and financial planning. Their workshops and webinars cover critical economic issues. Free financial training and lectures are available at public libraries and community centres. Community centres can help people find pro bono financial consultants and counsellors. In contrast, libraries offer many books, e-books, and online materials on personal finance, investment, and money management.

2. Budget

Budgeting is crucial to financial management. Begin by listing your income and spending. This can reveal cost-cutting opportunities. You should prioritize accommodation, food, and transportation while lowering discretionary spending. Small deposits add to your riches over time.

3. Minimize debt

When growing wealth with a limited salary, pay down high-interest debt. Pay off high-interest obligations like credit cards and payday loans first. Eliminating these debts frees up funds for saving and investing. Additionally, minimizing debt raises your credit score, which can cut future borrowing costs for large purchases like a home or car.

4. Auto-Save

Automating savings encourages consistent saving. Automate payday transfers from your bank account to a savings account. This strategy can help you develop a financial cushion without ongoing effort by reducing spending temptation. These systematic deposits can expand, creating a financial cushion and sustaining long-term wealth.

5. Slowly invest

Even tiny investments can grow your wealth over time. Start with index funds or ETFs, which give diversified stock market exposure at modest costs. Small investments can grow significantly with compounding returns. Start small and gradually increase your investment contributions to establish a strong portfolio that supports long-term financial goals.

6. Use Tax Benefits

Tax breaks can also aid wealth-building. 401(k) and IRA contributions reduce taxable income. Utilize low-income tax deductions. These perks can increase savings and investing.

What are the principles of building wealth in business?

The principles of building wealth in business are:

- Build a Financial Foundation: Establish a strong financial base through detailed personal and corporate budgets, a solid business plan, and an emergency fund to safeguard against unexpected setbacks.

- Spread Your Earnings: Diversify income sources by exploring investments in stocks, bonds, real estate, or partnerships to reduce risk associated with relying on a single business.

- Develop Yourself Personally and Professionally: Continuously improve your skills through workshops and networking to enhance business performance and open up new opportunities.

- Think Long-Term: Adopt a disciplined savings and investing strategy, automate retirement contributions, and leverage compounding for sustainable wealth growth.

1. Build a Financial Foundation

Build a solid financial foundation before concentrating on wealth-building techniques. It prepares you for long-term financial success and security as you build money. The latter includes:

Personal and corporate budgets should be detailed. A good business plan guides fund distribution. Determine needs and wants and allocate resources. Establish an emergency fund to safeguard your finances and business from unexpected catastrophes or downturns. To reduce debt, pay off high-interest bills, and avoid unneeded borrowing. Debt limits investment and wealth accumulation.

2. Spread Your Earnings

Being dependent on one business is perilous. The following are options:

Explore investing opportunities in stocks, bonds, and other financial instruments. Check with a financial counsellor about your risk tolerances and long-term goals. Consider diversifying your portfolio with real estate investments or investment trusts (REITs). Side Businesses or Partnerships: Seek complementary ventures or partner with other entrepreneurs to generate additional revenue.

3. Develop yourself personally and professionally.

Constantly investing in your personal and professional improvement can boost your wealth-building prospects:

Enhance your talents by attending workshops, seminars, and courses to learn new skills and remain current with industry trends. Specialized expertise can boost business performance and earnings. Promote professional networking and relationships. Being among like-minded people, mentors, and advisers can provide direction, business prospects, and support.

4. Think Long-Term

Wealth creation takes time. Remember these guidelines: Encourage consistent savings and investing through a disciplined strategy. Automate your retirement account contributions, such as IRAs or 401(k)s. Understand its power. Use compounding to grow your investments. Avoid short-term market-driven rash decisions.

How can I become rich quickly?

- Start saving early.

- Avoid wasteful expenditure and debt.

- Save at least 15% of each paycheck.

- Increase your income.

- Resist spending more when you earn more.

- Consult an experienced financial professional to stay on track.

How do rich people get rich?

Wealthy individuals become rich primarily through finance and investing. The world’s wealthiest have grown rich in anything from soybean sauce to palm oil to damaged vehicles, but hedge funds, private equity, and venture capital are the most popular ways. About 15% of billionaires, or 427 people from Estonia, Kazakhstan, Japan, and the U.S., made their cash in finance and investing.

That’s an increase from 372 names a year ago and includes 37 newcomers like Sherman Financial Group founder Ben Navarro ($1.5 billion), Nubank founder Cristina Junqueira ($1.4 billion), and Valor Equity Partners chief executive officer Antonio Gracias ($1.1 billion). Bankers, fintech innovators, and full-time investors are among these $2.17 trillion billionaires. Almost two-thirds are more prosperous than in 2023, led by Warren Buffett, who gained $27 billion in net worth amid high Berkshire Hathaway share prices.

In addition to traditional investments, wealthy individuals often diversify their portfolios. Many invest in real estate, technology startups, and emerging markets to mitigate risk and maximize returns. Wealth accumulation can also be attributed to strategic networking and leveraging financial knowledge to identify lucrative opportunities.

According to a 2023 report by Wealth-X, the following sectors contributed significantly to billionaire wealth:

- Technology: 30%

- Finance and Investments: 15%

- Consumer Goods: 10%

- Healthcare: 10%

- Energy: 8%

This diversification allows billionaires to not only increase their wealth but also to safeguard it against market fluctuations. Furthermore, reports indicate that the rise of digital assets, including cryptocurrencies, is beginning to shape the landscape of wealth generation.

How do you use debt to build wealth?

There are various ways to prepare your finances to use good debt to produce wealth. Here are 7 effective strategies:

- Debt Consolidation: Reduce interest payments by consolidating multiple debts into one loan with a lower interest rate, such as increasing your mortgage to pay off credit cards and personal loans.

- Working Savings Harder: Instead of holding cash in a low-interest savings account, consider using an offset account linked to your mortgage to save on interest and shorten your loan term.

- Improve Cash-flow Management: Manage your cash flow to minimize bad debt by making more frequent mortgage payments or using interest-free credit cards for daily expenses.

- Borrowing to Build Wealth: Once you’ve minimized bad debt, use positive debt to invest in appreciating assets like property or shares, allowing the revenue to cover the costs of servicing the debt.

- Use Lump Sums Wisely: Apply any large cash inflows, such as bonuses or inheritances, to pay down bad debt or increase retirement contributions.

- Recycle Debt: Turn bad debt into good debt by using home equity to invest in shares or properties, allowing for potential earnings and tax benefits while paying off the original loan.

- Buy a Geared Management Share Fund: Invest in a managed share fund that is internally geared, leveraging borrowing to maximize investment returns without needing a personal loan.

1. Debt Consolidation

Interest and fees from managing several debts are excessive. For instance, increasing your mortgage can help you pay down unproductive debt like balances on credit cards and personal loans. Continue making home loan payments but use the reduced interest rate to pay off higher-interest debt.

2. Working Savings Harder

Many people retain money in a cash savings bank account as a ‘buffer’ or ’emergency’ funds to feel safer. An ‘offset’ account tied to your mortgage might be better for this money. You will lower your home loan term and get a greater after-tax return without tying up funds.

3. Improve Cash-flow Management

Minimizing bad debt requires cash flow management. To reduce interest payments, you can increase the frequency of making mortgage payments, decrease the amount paid, pay your entire earnings into an offset account, or use an interest-free credit card to pay for daily expenses (freeing up money for paying off your home loan).

4. Borrowing to Build Wealth

After reducing lousy debt, start building positive debt. We term this gearing. Gearing helps you develop wealth if you invest intelligently and your assets appreciate, as the revenue (and capital growth) from investing pays off the debt and surpasses the costs of servicing it. Property or shares work well here. Extra cash can be obtained by borrowing on home equity, taking out an amount loan, or participating in a managed share fund.

5. Use Lump Sums Wisely

You can receive massive cash via bonuses, inheritance, etc. Use this cash to pay off bad debt or increase retirement contributions.

6. Recycle Debt

Debt recycling is when you pay off your home loan and use the equity to invest in shares or other property, turning bad debt into good debt that can earn you money and pay off the loan while giving you tax savings. Any extra money can be used to pay down your house loan faster and save interest.

7. Buy a Geared Management Share Fund

A controlled share fund is internally geared, so you don’t need a loan to invest, but you still get the ‘gearing’ impact. The fund management borrows wholesale for investors to invest in foreign or local share markets.

What is the best way to get rich fast?

Stock trading, Airbnb rentals, lease rental reduction, and digital marketing are expert-recommended strategies for quickly accumulating wealth.

How do you create wealth investing in real estate?

To create wealth investing in real estate, Invest in the following:

- Private Equity Fund Investment

- Investment Qualified Opportunity zone capital gains

- REIT investment

- Complete 1031 swap

- Syndicate investment

- Participate in mini-IPO

- Private debt fund investment

How do you make your money grow?

To make your money grow, follow these 6 points:

- Maintain cash in a high-interest account.

- Give money market time.

- Resist volatility.

- Don’t allow taxes to reduce profits.

- Set away investment funds intentionally.

- Balanced or diversify your portfolio.

What are the keys to building wealth through investments?

Establish goals and create a plan as foundational steps to building wealth through investments:

- Save, invest, and protect your assets

- Minimize tax impacts

- Control debt and build credit

What are the top 10 money-earning apps without investment?

The top 10 money-earning apps without investment are:

- Shopkick.

- Rakuten.

- Branded Surveys.

- Meesho.

- Fiverr.

- OfferUp.

- Upwork

- Pawns. app

- Monetha

- Mistplay

What is God’s way of making money?

God’s principles for earning money emphasize that God created everything, as stated in Genesis 2:2, “By the seventh day God had finished the work he had been doing; so on the seventh day he rested from all his work.”

Being righteous and suitable signifies that God’s work is good. Being in “God’s image” means being a worker by nature and purpose. God commands Adam and Eve to reproduce, fill, subjugate, rule, and care for creation (Gen 1:28-29, 2:15, 20).

What is the 72 rule in wealth management?

The 72 Rule states that you can estimate the number of years required to double your investment by dividing 72 by your projected annual interest rate (percentage).

For example, if you earn 4% a year, it will take about 18 years to double your money.

What is the formula for building wealth?

To build wealth, simply spend less than you earn and reinvest the difference. Adopt wealth-building behaviors consistently to apply this method effectively and see results. Simply spend less than you earn and reinvest the difference to develop wealth. Simply adopt wealth-building behaviours to apply the method and see results. Only whether you are going to do what it takes remains.

What are the biblical teachings about wealth?

Biblical teachings emphasize stewardship of wealth and trusting that God has made you a blessing. Matthew 25:14–30 encourages us to work hard, invest wisely, and give generously rather than hoarding wealth. Trusting that God has proven you to be a blessing and will continue to bless you is stewardship of wealth. Again, Matthew 25:14–30 says we should work hard, invest effectively, and give abundantly, not keep.

How to build sustainable wealth?

To build sustainable wealth, it’s essential to develop strong leadership skills and set clear goals that guide your wealth creation journey. Practicing smart spending habits is crucial, as it allows you to allocate more resources towards increasing your earnings and investing wisely. Focus on expanding your income streams while simultaneously diversifying your investments to mitigate risks and maximize potential returns. By following these steps consistently, you can create a solid foundation for long-term financial success and sustainable wealth accumulation.

What financial literacy skills are needed to build wealth?

To build wealth, several key financial literacy skills are essential which includes effective money management, with an emphasis on paying yourself first. Understanding your income and tax obligations is crucial. It’s important to borrow wisely and recognize that not all money is equal. Preparing to invest by defining your goals is a critical step. Investing for success is another vital skill. Finally, preparing your estate is an important aspect of long-term financial planning and wealth building.

How can a financial advisor help in building wealth effectively?

A financial advisor can help you create and prioritize goals, manage debt, invest wisely, and preserve capital. A skilled financial counselor will regularly review your plan and adjust it as your life and aspirations evolve, ensuring you remain on track. Their experience helps you create and prioritize goals, manage debt, invest wisely, and preserve your capital. A skilled financial counsellor will also review your plan often and adjust it as your life and aspirations change, keeping you on track.

If you’re looking to build wealth effectively, our financial advisors at capitalizethings.com are ready to guide you with personalized strategies. Email us or Call at +1 (323)-456-9123 for a free 15-minute consultation before hiring our experts, and learn how we can optimize your investments and grow your wealth.

Conclusion:

Over time, building wealth needs smart investing, asset protection, and debt management. First, earn enough to satisfy your basic requirements and save some. In your financial plan, evaluate your goals, such as acquiring a home, preparing for retirement, or putting your kids to college. Changing your investments protects you from market downturns. Business is spiritual. Building a business engages your spirit. Why not intentionally make the version of yourself (and your company) that the world wants? Surround yourself with Like-Minded People, Practice Financial Discipline, and Challenge Limits Psychological beliefs create riches.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.