An angel investor is an individual who provides financial support to startups or small businesses in exchange for equity or convertible debt. These investors often step in during the early stages when other funding sources, such as banks or venture capital, are not available. Angel investors are commonly rich folks that invest their own cash, betting at the capacity success of the commercial enterprise they guide. Their purpose is to sooner or later earnings through promoting their shares after the employer grows.

Angel investing includes presenting important funding to startups that need capital to develop before they come to be profitable. Angels normally make investments in their private budget, differing from undertaking capitalists, who manage pooled funds from numerous investors. They frequently get actively concerned with the organizations they put money into, offering steerage, mentorship, and commercial enterprise know-how.

Angel investments can vary from small amounts to considerable sums, relying on the commercial enterprise’s wishes and the investor’s sources. The execs of angel investing include getting entry to capital for startups while different sources are unavailable, as well as the mentorship and understanding that angel investors frequently carry to the table. They also tend to offer extra flexible investment terms and personalised interest in comparison to large investors. However, the cons include loss of equity, as startups give up ownership shares, and potential conflict if the investor pushes for rapid growth or exerts too much control over business decisions. Additionally, angel investments won’t completely meet the enterprise’s economic desires, and there are continually risks involved for both parties.

What Is An Angel Investor?

An angel investor is a private individual who provides early-stage capital and business expertise to startups. They offer funding when other financing sources, such as banks or venture capital, are unavailable. In return, they receive ownership equity or convertible debt as a part of the agreement.

These private investors play a crucial role in helping small businesses and startups succeed. By providing capital, they enable entrepreneurs to grow their companies. The investment terms vary, but the investor generally gains a stake in the business, benefiting if the startup becomes profitable or successfully exits the market through a sale.

Angel investors typically invest their own personal funds rather than managing large investment pools. Their involvement often includes providing not just financial support but also guidance and expertise to help the business succeed. This combination of capital and business advice makes angel investors valuable to startups in their early growth stages.

What Is Angel Investments?

Angel investing is a form of private equity financing where wealthy individuals provide startup capital to emerging businesses. This type of investment occurs when other funding sources, like banks or venture capital firms, are not available. The investor’s price range normally helps organizations through their critical early stages. The remaining aim is to earn earnings because the commercial enterprise grows and gains cost.

Angel making an investment can involve small or big investments depending on the investor’s resources and the wishes of the startup. These investments often include greater flexible phrases in comparison to institutional investment. Angel investors commonly search for a mixture of possession equity or convertible debt, which means that their preliminary investment can later convert into stocks or be repaid below certain conditions.

For companies, angel investing provides a chance to secure early funding and mentorship, while for investors, it provides an opportunity to support innovative ideas. The success of angel investing depends on the investor’s ability to evaluate risks and the startup’s potential for future profitability and growth.

What Are Angel Investors In Business?

Angel investors are private business financiers who provide seed capital and industry expertise to startups. They invest their own funds and, in return, receive ownership equity or convertible debt in the company. Their function is vital in supporting organizations secure preliminary capital, mainly while conventional financing resources are unavailable or inaccessible to young organizations.

In the business world, angel investors are highly valued for the mentorship and knowledge they bring to the table. They don’t just provide cash; they provide expertise and advice that help guide the business toward growth. Entrepreneurs often seek out angel investors to build relationships that can accelerate their company’s success.

Business angels generally invest in industries they understand well, allowing them to contribute valuable insights to the companies they support. By getting involved in the business, they ensure that their investment is managed effectively. Their active participation helps startups not only survive but also thrive in competitive markets.

How Do I Find An Angel Investor For My Business?

To find angel investors for your business, utilize investor networks, industry events, and online platforms. Look for business angels who have a history of investing in startups like yours. You also can attend startup activities and pitch competitions in which angel buyers are possibly scouting for brand spanking new enterprise opportunities.

Another way to connect with angel investors is through online platforms that cater specifically to startups seeking funding. Websites and networks, such as AngelList and SeedInvest, can help you post your business idea and attract interested private investors. These platforms make it easier to match companies with potential investors who can provide both capital and mentorship.

Networking inside your enterprise is also key. Attend industry conferences and activities to meet capability angel buyers. Building private connections increases your chances of securing investment. Investors are much more likely to spend money on corporations wherein they feel a private connection or shared understanding of the market and enterprise.

The Angel Capital Association 2023 Networking Study reveals that 72% of successful angel investments come through personal referrals or established angel networks.

What Is The Purpose Of A Term Sheet In Angel Investing?

A term sheet in angel investing serves as the preliminary agreement outlining investment conditions and ownership terms between investors and startups. It is a non-binding agreement that sets the stage for the formal contracts. The time period sheet covers key components, together with the quantity of investment, valuation, possession equity, and any situations attached to the deal.

The motive of a time period sheet is to make clear both events’ expectations before formal legal agreements are made. It guarantees that the investor and the startup are at the same web page concerning the economic elements of the funding. This document prevents misunderstandings later on inside the negotiation method via laying out clean phrases from the start.

By setting up the framework for the investment, a term sheet additionally reduces the chance of disputes. It ensures that each startup and the angel investor have agreed on important info, consisting of the equity stake, the structure of convertible debt, and any ability to go out strategies. This early agreement makes future dealings greater straightforward.

What Are The Repayment Terms For Angel Investors?

The repayment terms for angel investors typically involve equity stakes or convertible debt. Investors often receive equity in the company instead of repayment right away. If the business does well, they sell their shares later. Sometimes, the investment is structured as convertible debt, which means the loan can be turned into equity under specific conditions instead of cash repayment.

Angel investors do not expect quick repayment. They are typically looking for long-term growth. This means they wait until the company becomes successful or is sold. The terms are agreed upon before the investment is made. The investor and business work together to decide when and how the money is returned or converted.

What Does An Angel Investor Do?

An angel investor funds startups, provides strategic guidance, and offers industry connections. They invest in businesses that need early funding to grow. They also offer advice and guidance. Angel investors usually invest their own money in exchange for a share of the company. This allows them to benefit if the company becomes successful in the future.

Angel investors don’t expect quick repayment. They are typically looking for long-term growth. This means they wait until the company becomes successful or is sold. The terms are agreed upon before the investment is made. The investor and business work together to determine when and how the money is returned or converted.

If a company is sold or goes public, the angel investor can get a large return. This is one of the ways angel investors make money. Their compensation depends on the agreement made at the time of investment. Each deal is unique, so the compensation method can look different for every company and investor.

What Angel Investors Provide To Startups?

Angel investors provide capital, mentorship, and strategic guidance to startups when they need it most. This funding helps businesses grow in their early stages. Without this money, startups might struggle to get off the ground. In return, the angel investor gets ownership in the company, which could make them money later if the business succeeds.

Angel investors assist startups by providing support beyond simple cash. They can use their business experience to guide the company in the right direction. Their involvement can enhance the organization’s chances of success. Angel investors often take an active role, supporting decisions or strategies to grow the business quickly.

Angel investors take risks when they put money into new organizations. They select companies they believe will grow. Their goal is to make money when the company grows or is sold. Angel investors recognize companies that show potential, even though they are small or just starting out.

What Happens To Angel Investors If A Startup Fails?

If a startup fails, angel investors lose their investment. Since they typically invest in risky early-stage businesses, there is no guarantee the company will succeed. When a business closes or fails to grow, the investor does not get their money back. The investment is lost if the company cannot repay or sell.

Angel buyers recognize the risks of investing in new organizations. They recognise that a few startups will fail. This is why they unfold their investments throughout many companies. While one investment also fails, any other might succeed. This facilitates reducing the overall chance, although there continually the risk of losing money.

According to a 2023 study by CB Insights, approximately 70% of venture-backed startups fail to provide any return to investors. Harvard Business School Professor William Kerr’s research published in the Journal of Financial Economics (2023) shows that experienced angel investors who diversify across 15+ investments achieve successful exits in 25-30% of their portfolio companies. The Stanford Angel Investment Database, analyzing 18,000 angel investments between 2018-2023, found that angels lose their entire investment in roughly 50% of cases.

What Is The Process Of Angel Investors?

The angel investing process consists of pitch evaluation, due diligence, and investment execution. The angel investor reviews the company and decides whether to invest. They examine the business plan, the team, and the market potential. If they believe the company can grow, they offer investment in exchange for equity or convertible debt.

Once the deal is made, the angel investor provides the money. They often get involved with the company by offering advice and support. Their aim is to help the business grow and succeed. The process can take time, but the investor remains involved to ensure the company is on the right track.

The final step in the process comes when the business grows or is sold. The angel investor then cashes out by selling their equity. This is when they make a profit. The entire process can take several years, but the investor remains focused on helping the business succeed.

How Do Angel Investors Cash Out?

Angel investors cash out through exits, acquisitions, or IPOs. They sell their shares in the company for a profit. This usually happens after the business has grown and increased in value. Cashing out allows the angel investor to make money from their early investment in the startup.

Angel investors can also cash out while the company goes public. If the commercial enterprise gives stocks on the inventory marketplace, the investor can promote their shares for a profit. This can provide a huge return on the initial funding. The timing depends on the commercial enterprise’s success and market conditions.

What Is The Role Of Angel Investors In An Entrepreneurial Pursuit?

Angel investors serve as financial backers, strategic advisors, and industry connectors in entrepreneurial ventures. They give money to help startups grow. Angel investors take on early risks while the business is still small. Their role is crucial in helping entrepreneurs get the resources they need to build their business from the ground up.

Angel investors additionally serve as mentors. They use their enjoyment to guide the entrepreneur via demanding situations. This mentorship is essential in the early degrees while the enterprise faces many uncertainties. The investor’s involvement will increase the entrepreneur’s chances of creating the proper decisions to grow the agency.

Beyond cash and recommendation, angel investors carry credibility to the commercial enterprise. Their support signals to others that the commercial enterprise has ability. This can assist attract more buyers or customers. The angel investor’s position is to support the entrepreneur in each manner possible to make certain the fulfillment of the business.

How To Start Angel Investing?

To become an angel investor, you need to identify opportunities, conduct due diligence, and structure investments. Look for startups in industries you understand. You need to evaluate the business plan and meet the founders. It’s important to invest in companies that you believe will grow. Start small and diversify your investments to manage risks.

Once you find a company, discuss the terms of your investment. Decide whether you want equity or convertible debt. Make sure to understand the risks involved. Angel investing can be risky, so it’s important to be prepared for the possibility of losing money if the startup doesn’t succeed.

After making your investment, stay involved. Offer guidance and support to the company. Your experience can help the startup grow. As the business expands, you have opportunities to invest further or to eventually sell your shares for a profit. Angel investing is a long-term process that requires patience and commitment.

At What Stage Do Angel Investors Invest?

Angel investors typically invest in seed-stage and early-stage companies, usually between the pre-revenue and early-revenue phases. They provide funding before the business has reached profitability. This is while the startup wishes money to grow and develop its products or services. Early-degree investment permits angel buyers to take risks and benefit from the corporation’s future achievement.

Angel buyers get concerned when the organization has a marketing strategy however wishes capital to move forward. The commercial enterprise has products or services in development; however it isn’t always yet generating revenue. This is a critical time for the commercial enterprise, because it requires funding to continue operations and extend.

The early level is volatile for both the investor and the commercial enterprise. Angel buyers understand that not all organizations will prevail. However, they pick out to invest at this degree because the capability for growth and earnings is excessive. If the agency succeeds, the early investment can cause large returns for the angel investor.

What Stage Company Does An Angel Investor Typically Invest In?

Angel investors typically invest in companies that are in their early stages. These businesses have a strong idea but need capital to grow. They are not yet worthwhile or have a steady revenue move. The organization is regularly small and nonetheless in improvement, making it an excessive-risk however high-reward investment possibility.

At this stage, the enterprise has operating products or services, but it needs extra funding to scale. The business frequently needs aid to refine its operations, advertising, and purchaser base. Angel investors step in to provide both capital and guidance to assist the enterprise reach its next level of increase.

How Profitable Is Angel Investing?

Angel investing can be highly profitable but carries significant risks. Investors have the chance to make significant returns if the company they invest in grows and becomes successful. Since angel investors get in early, their shares can increase greatly in value if the company’s worth goes up over time.

However, angel investing can also lead to losses. Not all startups succeed, and some fail completely. This means that angel investors might lose their entire investment if the company does not do well. The key to profitability is choosing the right businesses and understanding the risks involved.

How Much Money Do You Need To Become An Angel Investor?

To become an accredited angel investor, you need a minimum net worth of $1 million or annual income of $200,000. Most angel investors start with $25,000 to $100,000 per investment, but the amount can vary based on the company and the investor’s financial situation.

Angel investors must have enough money to invest in multiple companies. This is because the risk of losing money is high, and investing in only one company is risky. By spreading their investments, angel investors increase their chances of finding a successful business that will provide a return on investment.

How Much Do You Need To Be An Angel Investor?

To be an angel investor, you need a minimum net worth of $1 million or annual income of $200,000, with typical investments ranging from $25,000 to $100,000 per deal. The amount needed can depend on the company and the industry. Some investors invest more, especially if they believe in the startup’s potential. Angel investors typically have significant personal wealth and are prepared for the risks involved.

The total amount you want relies upon what number of organizations you intend to spend money on. It’s commonplace for angel investors to spend money on several groups to diversify their portfolios. By doing this, they grow their probabilities of creating an income, even though a few investments fail. The standard economic dedication can be quite huge.

Angel investors need to also have an economic cushion. Since there’s no assurance of achievement, it’s essential to make investments simplest that you manage to pay for to lose. Having extra money to cowl ability losses is crucial. Angel investing can offer huge rewards, but it calls for a strong economic base and a know-how of the dangers.

The Angel Capital Association’s 2023 Member Survey indicates that the average angel investor maintains an active portfolio of 10 investments totaling $1.2 million. Research by Dr. William Wetzel at the University of New Hampshire’s Center for Venture Research shows that successful angel investors typically allocate no more than 10-15% of their total investment portfolio to angel investments.

How Much Do Angel Investors Invest?

Angel investors typically invest between $25,000 and $100,000 per startup. The exact amount varies depending on the business and the investor’s financial situation. Some angel investors invest more if they believe in the company’s potential. This early-stage funding is essential for helping startups grow and reach their goals.

The total amount invested by an angel investor varies across different companies. Many investors spread their money across several startups to reduce risks. By diversifying their investments, they increase their chances of making a profit, even if some businesses fail. This strategy helps balance out the risks involved.

Does an Angel Investor Really Work?

Angel investing has a proven track record of successful returns and company growth. Many successful companies have grown because of angel investors. These investors provide the early funding that startups need to build their business. If the startup succeeds, the angel investor can make a large profit. The key is to choose the right companies to invest in.

Do Angel Investors Get Paid?

Yes, angel investors get paid through exits, dividends, and equity appreciation when the companies they invest in succeed. They usually make money when the business grows and becomes profitable. The return is based on how much the company grows. If the company does well, the investor can get a large payout.

Angel investors often get paid when the business sells or goes public. This means they get a share of the profits when the company is sold to a bigger company or starts selling stock to the public. This is called an “exit.” Sometimes, angel investors receive a commission through dividends. Dividends are payments from the company’s profits. If the business is doing nicely, they could share earnings with buyers on a normal foundation.

What Percentage Do Angel Investors Take?

Angel investors typically take between 20% to 30% ownership stake when investing in early-stage companies. This is their reward for providing early money to help the business grow. The percentage depends on the size of their investment and the company’s value. Bigger investments result in a higher percentage.

The percent an angel investor takes can range via deal. In a few instances, they might take less if they trust the agency will grow quickly. The phrases of the deal are discussed between the investor and the enterprise owner.

Angel investors take this percentage because they’re taking a large threat. They want to ensure that if the agency succeeds, they get a terrific return. The possession stake helps guard their investment.

What Types Of Investors Are Angel Investors?

Angel investors are high-net-worth private individuals who invest their personal capital in startups. They invest their own money in startups. They believe in the business’s potential and are willing to take risks. Angel investors are usually wealthy and want to help new companies grow. They often have experience in the industry they invest in.

Angel investors are distinctive from assignment capitalists. Venture capitalists use other people’s money to make investments, whilst angels use their personal. This makes angel investors extra impartial of their choice-making. They pick out which companies to help.

Some angel investors like to be involved inside the enterprise. They provide recommendations and use their enjoyment to assist the startup develop. Others prefer to stay hands-off, letting the business make its own selections.

Who Are The Top Angel Investors?

Leading angel investors include Reid Hoffman, Chris Sacca, Peter Thiel, and Ron Conway who helped create LinkedIn and invests in many tech companies. Another top angel is Chris Sacca, who invested early in companies like Twitter. These investors have made huge profits by picking successful businesses.

Peter Thiel is also a top angel investor. He was one of the first investors in Facebook. His early investment made him a lot of money when Facebook grew into a large company. He focuses on tech startups with high growth potential.

Ron Conway is another famous angel investor. He invested in companies like Google and PayPal before they became successful. His ability to spot promising startups has made him one of the most successful angel investors in the world.

What Is A Typical ROI For An Angel Investor?

The typical ROI for angel investors ranges from 20% to 30% annually, but it can be much higher for successful businesses. If the startup does well, the investor can make a large profit. However, there’s also a risk of losing the entire investment.

Some angel investors see an ROI of 10 times or more if the business grows quickly. This kind of high return happens when a small company becomes very successful. It’s one reason why people become angel investors, even though it’s risky.

Other angel investments might only return the original amount or less. This happens when the business doesn’t perform as expected. Angel investing is risky, but the potential for high ROI makes it attractive to wealthy individuals.

Do Angel Investors Pay Taxes?

Yes, angel investors pay capital gains taxes on their investment profits when they sell their shares for a profit, they must pay capital gains tax. This is a tax at the take advantage of selling an investment. The charge of tax depends on how lengthy they held the investment.

Angel investors additionally pay taxes on dividends. If the company pays the investor a portion of its income, that cash is taken into consideration taxable income. The investor will need to report it on their tax return. The quantity of tax depends on at the investor’s earnings stage.

Governments offer this incentive to draw more angel buyers. It enables startups to get the cash they want to develop. The investor advantages through retaining greater in their profits, which inspires them to hold making an investment.

What Is The Angel Investor Tax Incentive?

The angel investor tax incentive is a government tax reduction program that gives investors a break on taxes. In some places, governments encourage angel investing by offering tax cuts. If the investor places cash into a brand-new commercial enterprise, they’ll pay less tax on the earnings. This incentive allows companies to get investment from investors.

The tax incentive is often tied to how long the investor holds their shares. If they keep the investment for a certain period, they qualify for a lower tax payment. This encourages lengthy-term guidance for the startup, rather than a quick sale.

What Are Angels In Venture Capital?

Angels in venture capital are private individuals who invest personal funds in startups. They differ from venture capital firms, which use pooled funds from many investors. Angels offer early funding to assist new companies grow. They often take larger risks due to the fact they put money into corporations at an advanced stage.

Angels in venture capital are essential for startups. Their money allows the business to take off while it’s still small. Many successful companies, like Facebook and Google, got early funding from angel investors. Without this early assistance, the business wouldn’t survive.

Some angels work independently, while others form groups. Angel groups pool money to expand investments in startups. This lets them support more companies and improve their chances of finding a successful business.

How Do Angel Investors Make Money?

Angel investors generate returns by selling shares at a higher valuation than they paid. If the company grows and becomes valuable, they can sell their shares at a higher price. This is called an “exit.” Most angel investors wait for a company to go public or be sold to a larger company.

Angel investors can also make money from dividends. If the business is profitable, it can pay out a portion of its profits to investors. This provides a consistent income stream for the investor, even if they don’t sell their shares.

Sometimes, angel investors make money by investing in successful companies early. If the company grows fast, they can sell their shares for a large profit. Angel investors take risks, but when their investments are successful, the rewards are very high.

Who Is An Angel Investor Example?

Reid Hoffman stands as a prominent example of an angel investor, having been one of the early investors in Facebook and LinkedIn. He was one of the early investors in Facebook and LinkedIn. He used his own money to support these companies earlier before they became successful. His investments paid off when both companies grew into large corporations, making him substantial returns.

Another example is Peter Thiel, who invested in PayPal and Facebook. Thiel’s early investment helped PayPal grow into a major online payment system. When the company succeeded, Thiel earned significant profits. He is known for picking companies with high potential.

Chris Sacca is also a famous angel investor. He invested in Twitter while it was a small company. His early belief in Twitter’s potential helped him make a large profit when the company became popular worldwide.

How Risky Is Angel Investing?

Angel investing carries an extremely high risk with a typical failure rate of 90%. Many startups fail, and the investor can lose all of their money. It’s not unusual for angel buyers to spend money on numerous groups to spread the threat. Even with careful making plans, a few companies won’t be successful, but the rewards are big if the organization grows.

Angel investors take risks because they believe in the company’s potential. The startup might grow quickly, leading to a large return on investment. However, because the business is new and unproven, there’s a high risk that it won’t survive. This is what makes angel investing so risky.

Some angel investors use their experience to lower the risk. They search for strong business plans and experienced teams. By selecting carefully, they increase their chances of picking a winner. Even with careful selection, though, the risk of losing money is high.

How To Get An Angel Donor For Non Profit?

Angel donors for nonprofits can be secured through strategic networking and impact demonstration. Many angel donors want to support causes they care about. Start by reaching out to people in your network who might have an interest in your nonprofit’s work. Personal connections can help.

Another way to attract an angel donor is to showcase the impact of your nonprofit. Donors want to know their money is making a difference. Highlight your successes and show how their assistance will help you achieve more. Transparency and clear goals are important.

You can also look for angel donors through donor networks or events. Many donors are part of groups that connect them with causes. Attending events or joining these networks will help you find the right donor who wants to support your work.

How Do I Find An Angel Investor For My Business?

To find an angel investor for your business, start by startup events and industry conferences. Attend events where investors gather, such as startup fairs or industry conferences. Personal connections help you meet potential investors who might be interested in your business. Networking is key in finding the right angel investor.

Another manner to find an angel investor is to apply on-line systems. Websites like AngelList connect startups with investors. You can create a profile in your commercial enterprise and show off your plans. This allows investors to discover you and find out about your business.

You can also search for neighborhood angel investor corporations. Many towns have groups in which investors meet and talk about new opportunities. Reaching out to these corporations will let you discover a person interested by funding your enterprise.

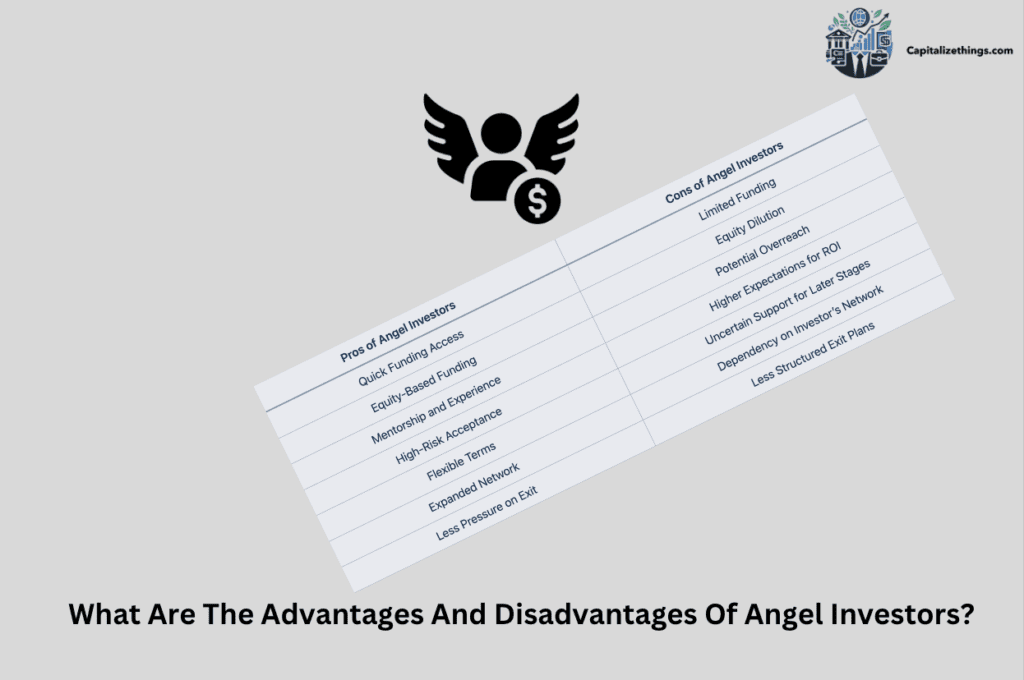

What Are The Advantages And Disadvantages Of Angel Investors?

Quick funding access and expert mentorship are the main advantages, while equity dilution is the primary disadvantage of angel investors. They provide money early on, helping startups grow. Many angel investors have experience in the industry and offer guidance. This can help the business make better decisions and avoid mistakes.

One disadvantage is giving up a percentage of the business enterprise. Angel buyers often take a proportion of possession in return for his or her cash. This manner the commercial enterprise owner has much less control over decisions. The investor can also need to influence how the organization is administered.

Another disadvantage is the danger of dropping the funding. If the employer fails, both the business owner and the investor can lose money. The risk is excessive, but so are the capability rewards. Angel investing is a big dedication for each event.

| Pros of Angel Investors | Cons of Angel Investors |

|---|---|

| Quick Funding Access | Limited Funding |

| Equity-Based Funding | Equity Dilution |

| Mentorship and Experience | Potential Overreach |

| High-Risk Acceptance | Higher Expectations for ROI |

| Flexible Terms | Uncertain Support for Later Stages |

| Expanded Network | Dependency on Investor’s Network |

| Less Pressure on Exit | Less Structured Exit Plans |

.

What Is A Common Exit Strategy For Angel Investors?

The common exit strategies for angel investors is Trade sales and acquisitions by larger companies. When a bigger company buys the startup, the investor gets paid. This exit can be very profitable if the company has grown a lot since the investment.

Another exit strategy is an initial public offering (IPO). When the startup sells shares to the public, the investor can sell their shares on the stock market. This can provide a large return if the company is successful, and its shares are valuable.

Some angel investors also exit through mergers. When the startup merges with another company, the investor receives cash or shares in the new company. This gives the investor a way to get paid without waiting for a full sale or IPO.

What Is An Early Stage Investor?

Early-stage investors are financial backers who provide initial capital to businesses before they become established. They invest when the company is just starting out. Early-stage investors believe in the company’s potential. They take a significant risk because the business is new and hasn’t proven itself yet.

Early-degree investors assist the business develop. Their money is frequently used for product improvement or marketing. These investors desire the business enterprise to become a hit and give them an amazing return on their investment. Many startups rely upon early-level buyers to get off the ground.

These investors frequently have experience within the company. They provide recommendation and steering to the commercial enterprise. Their guide is crucial in assisting the company make critical early selections. The funding is unstable, but the rewards are high if the commercial enterprise succeeds.

What Types Of Business Do Most Angel Investors Focus On?

Technology startups and high-growth potential ventures are the primary focus of angel investors. They invest in new businesses with the best growth potential. Many investors prefer tech companies because they can grow quickly. Startups in healthcare, biotech, and consumer products are also popular. Investors like businesses with unique ideas, as they offer the greatest rewards.

Angel investors also look for businesses solving big problems. They invest in companies with clear solutions and strong leadership. Investors want to support passionate teams. Businesses with a well-planned strategy are the most attractive to angel investors. Their goal is to help small companies grow fast and succeed.

What Is Meant By Angle Fund?

An angel fund is a pooled investment vehicle managed by experienced angel investors to invest in startups. Each investor places money into the fund, which then supports new companies. Angel funds assist investors spread their risk by helping a couple of organizations. This way, they’ve more chances for fulfillment.

Angel finances are regularly controlled by experienced investors. These managers select which startups to invest in. They select businesses with high-quality increased capacity. Angel budgets assist new businesses get the money they want to grow. By pooling sources, investors can aid more startups and grow their possibilities of success.

What Is The Difference Between Angel Financing And Angel Investor?

Angel financing is the capital provided, while an angel investor is the individual providing it. Angel financing is the money given to startups. This money comes from angel investors. The intention of angel financing is to assist small organizations develop. Startups use the money for things like product development, advertising, and hiring. Angel financing is a key part of startup growth.

An angel investor is the person that provides the financing. They offer their own cash to support startups. In return, they regularly get equity or a share of the enterprise. The investor provides advice to assist the enterprise succeed. Both angel financing and investors are critical for startup success.

Do Angel Investors Get Paid Back?

Angel investors receive returns through equity appreciation rather than loan repayment. Instead, they get a return when the company grows. If the company becomes successful, the investor can sell their share for profit.

However, there is continually a threat. If the employer fails, the investor also loses their cash. Angel investors apprehend this threat when they invest. They are aware of organizations with sturdy potential for boom. Their goal is to guide the business and subsequently earn an income while the business enterprise succeeds.

Who Is The Most Famous Angel Investor?

One of the most famous angel investors is Jeff Bezos. He is best known for creating Amazon. Bezos also invests in many startups. His success with Amazon has made him one of the richest people in the world. This makes his investments in other groups very precious.

Another famous angel investor is Peter Thiel. Thiel co-based PayPal and invested early in Facebook. He has a strong track record of locating successful agencies. Many startups are seeking his investment due to his revel in and success. These buyers are famous for supporting organizations with the greatest boom ability.

What Is The Main Difference Between Angel Investors And VCS?

The main difference between angel investors and VCs is the amount of money they invest. Angel investors use their own money, while venture capitalists manage funds from others. Angel buyers usually invest smaller quantities in early-stage startups. VCs frequently invest more in groups that are already developing.

Another distinction is management. Angel investors can also take a palms-on method, presenting recommendation and steering. VCs, alternatively, also take greater manipulation of the organization’s decisions. VCs frequently demand extra money in change for their large investments. Both play essential roles in assisting startups develop.

Here’s a precise comparison table between angel investors and venture capitalists (VCs):

| Factor | Angel Investors | Venture Capitalists (VCs) |

|---|---|---|

| Source of Funds | Personal wealth | Pooled funds from institutions and wealthy investors |

| Investment Stage | Early stages (Seed, Pre-seed) | Later stages (Series A and beyond) |

| Investment Size | Typically $10,000 to $500,000 | Usually $1 million and above |

| Involvement Level | High, with personal mentorship and close guidance | Strategic oversight, often through board seats |

| Risk Tolerance | High tolerance, willing to take early-stage risks | Moderate to high but prefers proven business models |

| Expected Returns | Flexible; often patient for long-term growth | Strict; focuses on high returns within a set time frame |

| Exit Pressure | Generally lower, with longer-term focus | Higher pressure for profitable exits within 5-10 years |

| Decision-Making Power | Limited, with minimal interference | Often significant, including potential control over decisions |

How To Find Angel Investors Online?

To find angel investors online, use websites like AngelList. This platform connects startups with investors. You can create a profile and pitch your business. Other websites like Gust and Funded.Com also assist startups meet angel investors. These structures are the quality tools to find online buyers.

Social media is every other way to hook up with angel investors. LinkedIn, for example, permits you to attain out to investors without delay. Many buyers are active on Twitter, in which you could comply with them and research extra about their pastimes. Building relationships online is a key step in finding the right investors.

What Is The Best Angel Investor Site?

AngelList is one of the best websites for finding angel investors. It connects startups with investors from around the world. The platform allows entrepreneurs to create a profile and pitch their business. This makes it easier to find investors who are interested in specific industries or ideas.

What Do Angel Investors Invest?

Angel investors invest their own money in startups. They offer early-level investment to help small organizations develop. The quantity they invest can vary, however it’s typically smaller than task capital. Angel buyers are often the primary to aid new corporations before different buyers’ step in.

Besides money, angel investors additionally make investments with their time. They also provide steering and advice to assist the startup prevail. They revel in being precious for making key choices. By making an investment both money and time, angel investors play a critical role in helping new corporations develop and succeed.

How Much Does An Angel Investor Make A Year?

How much an angel investor makes in a year depends on their investments. Some earn millions if their startups succeed. Others make less or even lose money if a business fails. Angel investing is risky, but the rewards can be high for successful investors.

Angel investors usually make money when their companies grow and get sold. This can take years, so returns aren’t always immediate. Some angel investors have regular incomes from multiple investments. However, many focus on long-term growth and big profits when startups reach success.

When Can An Angel Investor Exit?

An angel investor can exit when the startup is sold. This is a common time to leave. If the company grows and gets bought by a bigger company, the investor can sell their shares for profit. This is one way for investors to get a return on their investment.

Another time to exit is during an preliminary public providing (IPO). When the business enterprise is going public, the investor can promote their shares on the stock market. This can offer a huge return if the business is a hit. Angel buyers also go out throughout mergers or different business events.

What Do Angel Investors Want In Return?

Angel investors usually want equity in return for their investment. They take a share of the company. This means they own part of the business. If the company grows, the value of their share increases. This can provide a high return when they sell their equity.

Some angel investors additionally want involvement in the business. They offer advice and assist with decision-making. In alternate, they assume the organization will pay attention to their ideas. Investors need to peer the enterprise grow, and they will need a say in how it’s run.

What Is Angel Tax In India?

Angel tax in India is a tax on the money startups receive from investors. If a startup raises money from angel investors, it has to pay this tax. The tax applies when the investment is above the company’s value. This rule was created to stop illegal money from entering businesses.

However, the tax has induced issues for a few startups. Many new groups were to raise cash due to the angel tax. The authorities have made changes to reduce the weight, however the tax nevertheless impacts a few startups. It’s a vital rule for buyers and startups to understand in India.

What Do Business Angels And Venture Capitalists Look At Before Investing?

Business angels and venture capitalists look at the team behind the business. They want to see strong leadership and a clear plan. The group’s experience and ardor are very essential. Investors also check if the product solves an actual problem. Businesses with unique answers are extra attractive to investors.

Both angels and VCs additionally study the capacity for growth. They want agencies with the very best chances of becoming large. A strong marketplace and demand for the product are key factors. Financial info, like revenue and earnings capability, also are reviewed earlier than making an investment selection.

What Is The Difference Between Angel Investors And Venture Capital?

Angel investors is money from individuals who invest their own funds. This is usually smaller amounts given to early-stage businesses. Angel investors often focus on startups before they become big. They take high risks in exchange for equity in the company.

Venture capital is money from firms that manage funds for others. VCs usually invest larger amounts in businesses that are already growing. They provide more money but also demand more control. Venture capital often comes after angel investing when the business is ready to scale. Both are key for startup growth. Check the video below to understand the common differences between angel investors and venture capitalist.

Do Angel Investors Get Equity?

Yes, angel investors get equity when they invest in a startup. This means they own a part of the business. The amount of equity depends on the investment deal. In return for their money, investors receive shares in the company. These shares grow in value as the business grows.

Equity gives angel investors a stake in the company’s success. If the company does well, the value of their share’s increases. Angel investors can sell their shares for profit when the business is sold or goes public. Equity is the most common way investors earn returns on their investment.

Are Shark Tank Angel Investors Or Venture Capitalists?

Shark Tank investors are angel investors. They invest their own money in startups. Each “shark” uses personal funds to support the businesses on the show. They often focus on early-stage companies, making them angel investors. Their goal is to help these companies grow and make a profit later.

Venture capitalists, on the other hand, manage other people’s money. While Shark Tank investors act like VCs at times, they primarily use their own funds. This makes them angel investors. The sharks take risks by investing in new ideas, hoping to see high returns from their personal investments.

Why Are Angel Investors Preferred Over VC?

Angel investors are often preferred because they invest early. Startups need money before they become big. Angel investors take the first risk, while VCs usually invest later. This makes angels essential for new companies. They provide the funding when it’s needed the most.

How Do I Contact An Angel Investor Successfully?

To contact an angel investor, start by doing research. Find investors who focus on your industry. This will increase your probabilities of having their attention. Send a clear, targeted message explaining your business. Investors need to see a robust plan for increase and a completely unique concept.

Networking is key. Attend startup activities and be part of commercial enterprise corporations to satisfy capacity buyers. Many buyers recognize personal connections. Be prepared with a stable pitch while you make touch. Investors want to recognize why your business is worth their money and time. A clear, confident message will increase your probabilities of fulfillment.

How To Write A Proposal To An Angel Investor?

Writing a proposal to an angel investor starts with a clear introduction. Explain your business and its mission. Investors need to recognize why your idea matters. Highlight the problem your commercial enterprise solves. This is critical for catching an investor’s interest.

Next, awareness of the capability for growth. Show the investor how your commercial enterprise will expand. Include financial projections and a timeline for success. Investors want to see how they’ll get a return on their funding. A well-organized thought with clean dreams is key to impressing an angel investor.

Do Angel Investors Sit On Board?

Angel investors sometimes sit on the board of the company they invest in. This allows them to provide guidance and help make key choices. Investors who’re more involved also need a seat at the board. They can offer advice on strategy and boom.

However, not all angel investors take a seat at the board. Some opt to live in the background. They offer investment however do no longer get concerned in everyday selections. Whether or no longer an investor sits on the board depends on the agreement with the enterprise. Some buyers opt for a hands-off method.

Do You Have To Be Wealthy To Be An Angel Investor?

Yes, you need to be wealthy to be an angel investor. Most angel investors are accredited, meaning they meet certain income or asset requirements. This is because investing in startups is risky, and only individuals who can afford to lose money are allowed to invest in certain opportunities.

However, there are other ways to invest in startups without being extremely wealthy. Some platforms allow smaller investments in startups, but these are limited. Most angel investors have significant funds to invest in new businesses. Their wealth allows them to take high risks for potential high rewards.

What Is The Difference Between Angel Investors And Investors?

The main difference between angel investors and regular investors is the stage of investment. Angel investors provide early-stage funding to startups. They take risks by way of making an investment in new corporations that might not yet be profitable. Regular buyers regularly spend money on hooked up companies with validated fulfillment.

Angel buyers generally invest their personal cash. Regular investors also use private finances or control cash for others. Angel buyers commonly take greater danger however have the capability for higher returns. Both forms of investors are important for business increase, but they cognizance of specific degrees of funding.

Do Angel Investors Require High Financial Literacy?

Angel investors need high financial literacy to be successful. They must understand financial statements, business models, and risk. Investing in startups requires a deep understanding of how businesses grow and make money. Financial literacy helps investors make smart decisions about where to put their money.

While a few investors depend upon financial advisors, it’s first-class to have a strong expertise of price range. This helps buyers investigate the risk of every funding. Successful angel investors often have revel in commercial enterprise or finance. High financial literacy is important for making knowledgeable investment decisions in the startup world.

Can Risk Averse Individuals Become Successful Angel Investors?

Risk-averse individuals struggle to become successful angel investors. Investing in startups involves high risk, as many new businesses fail. Angel buyers want to be snug with the opportunity of dropping their cash. This makes it difficult for risk-averse individuals to be triumphant. However, with careful research, even risk-averse investors can discover lower-chance possibilities.

Some investors are conscious of agencies with a demonstrated track record. These investments provide smaller returns but lower chances. Diversifying investments across more than one startups is any other strategy for decreasing risk. Still, risk tolerance is essential for angel investing.

Are Angel Investors Essential For USA Small Business Growth?

Angel investors are essential for USA small business growth. They provide the early funding that many businesses need to get started. Without angel investors, many startups would struggle to find the money they need. This makes angel investors crucial for supporting innovation and entrepreneurship.

Angel investors also offer guidance and advice. Their experience helps small businesses make smart decisions. By supporting startups, angel investors help create jobs and grow the economy. They play a key role in the USA’s small business ecosystem. Angel investors are important for driving growth and innovation.

Do Angel Investors Have High Risk Capacity?

Angel investors often have high risk capacity. They invest in early-stage startups, which can be risky. Many startups fail; however buyers receive this threat for the threat of high returns. Angel buyers typically have the economic resources to take on those dangers without dealing with financial trouble.

High risk capacity permits investors to make a couple of investments. This increases their probabilities of finding a successful organization. By diversifying their portfolio, investors can spread their risk. Angel investors apprehend the risks concerned but awareness at the capability rewards. Their excessive risk ability is critical for supporting new groups.

Do Financial Planners Help Structure Angel Investment Deals?

Yes, financial planners can help structure angel investment deals. They provide advice on how to manage the risks involved in investing. A financial planner can help investors understand the potential returns and risks of an investment. This helps investors make informed decisions.

Financial planners also assist with tax planning. They help investors reduce taxes on their returns. Planners also guide investors in creating a diverse portfolio. By working with a financial planner, angel investors can better manage their investments. This can increase the chances of a successful deal.

Are Angel Investments Riskier Than S&P 500 Index?

Yes, angel investments are riskier than the S&P 500 Index. The S&P 500 includes large, stable companies, while angel investments focus on early-stage startups. Many startups fail, making angel investing much riskier. Investors in the S&P 500 generally experience more stable and consistent returns.

Angel investors take high dangers in exchange for the risk of higher rewards. While the S&P 500 offers safer, lengthy-term funding, angel investors are looking for fast growth. However, angel making an investment can result in big earnings if the startup succeeds. Investors ought to stabilize the risks and ability rewards of every choice.

Let our investment specialists create a balanced portfolio strategy combining angel investments and index funds tailored to your risk tolerance. Book your free strategy call with our experts at CapitalizeThings.com by calling +1 (323)-456-9123 or you can email us to get to know our services for how we can help you.

Conclude:

Angel investors play a vital role in the startup ecosystem by providing early-stage funding and guidance. Their investments are riskier than conventional alternatives like the S&P 500, however they provide the potential for excessive returns. Unlike undertaking capitalists, angel investors use private finances, making them extra flexible and short to behave. Although the dangers are high, angel buyers help small organizations develop and be successful by providing financial help and mentorship. For marketers, securing investment from an angel investor can be key to early increase. While it calls for economic literacy and danger tolerance, angel investing fosters innovation and entrepreneurship, especially within the U.S. Economic system, assisting job advent and financial development.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.