Annuities are a good investment for those seeking guaranteed retirement income and financial security, according to a 2021 study by the Employee Benefit Research Institute (EBRI) which found that 73% of retirees who own an annuity reported feeling more confident about maintaining their standard of living throughout retirement. Annuities serve as financial contracts between individuals and insurance companies, providing steady income payments over a specified period in exchange for either a lump sum or series of premium payments. According to the Secure Retirement Institute’s 2021 research, annuity sales in the United States totaled $219.6 billion, demonstrating their significant role as a retirement planning tool.

Fixed annuities offer lower minimum investment requirements starting at $5,000, while variable annuities typically require $10,000 to $25,000 initial investments, as stated by the National Association of Insurance Commissioners (NAIC) in their 2021 Annuity Disclosure Model Regulation. The 2021 LIMRA Secure Retirement Institute report shows that fixed income annuities accounted for 54% of all income annuity sales, with features like tax-deferred growth and customizable payout options tailored to individual needs. According to the 2021 Alliance for Lifetime Income study, 80% of retirees reported that having a guaranteed income source from products like annuities increased their confidence in maintaining financial security throughout retirement.

What Are Annuities?

Annuities are financial contracts between individuals and insurance companies that provide a steady stream of income payments over a specified period, in exchange for either a lump sum or series of premium payments. According to a 2021 study by the Secure Retirement Institute, annuity sales in the United States totaled $219.6 billion, demonstrating their popularity as a retirement planning tool. Annuities offer several benefits, such as guaranteed lifetime income, tax-deferred growth, and customizable payout options tailored to individual needs.

For example, a 65-year-old retiree could purchase an immediate annuity with a lump sum of $100,000, which would provide them with monthly payments of approximately $500 for the rest of their life, based on current annuity rates. This reliable income stream can help mitigate the risks of outliving one’s savings or experiencing market volatility during retirement. Connect with capitalizethings.com qualified financial advisor to determine if annuities align with your long-term financial goals and retirement plan.

What’s The Minimum Investment Needed For Annuities?

The minimum investment required for annuities varies depending on the specific type of annuity and the insurance company offering the product. Fixed annuities generally have lower minimum investment requirements compared to variable annuities, with some fixed annuities allowing initial investments as low as $5,000. On the other hand, variable annuities often require higher minimum investments, typically starting around $10,000 to $25,000, as stated by the National Association of Insurance Commissioners (NAIC) in their 2021 Annuity Disclosure Model Regulation.

Some annuity contracts also offer flexible premium payment options, allowing investors to make smaller periodic contributions, such as monthly payments of $50 or more, to build their annuity balance over time. These flexible premium annuities can be a suitable choice for those who prefer to invest smaller amounts regularly rather than committing a large lump sum upfront. For example, according to a 2020 survey by the Insured Retirement Institute (IRI), 45% of annuity owners reported making regular monthly or quarterly contributions to their annuities.

When considering an annuity investment, it is essential to carefully review the specific terms and conditions of the annuity contract, including the minimum investment requirements, fees, and surrender charges. Comparing offerings from multiple insurance companies can help investors find the most suitable annuity product that aligns with their financial goals and budget. Consult with capitalizethings.com trusted financial advisor to determine the appropriate annuity type and investment amount based on your unique retirement planning needs and objectives.

Reach out to us via email from services page or call at: +1 (323)-456-9123

How Do Income Annuities Work?

Income annuities function by converting a lump sum investment into a stream of guaranteed income payments over a specified period or for the remainder of the annuity owner’s lifetime. When an individual purchases an income annuity, they enter into a contract with an insurance company, agreeing to provide a single premium payment in exchange for regular income payouts. The insurance company then invests the premium to generate returns and fund the promised income payments.

Income annuities can be structured as either fixed or variable. Fixed income annuities provide a stable, guaranteed payout based on a predetermined interest rate, ensuring a predictable income stream for the annuity owner. Conversely, variable income annuities offer the potential for higher returns by investing the premium in a selection of mutual funds or other investment options. However, the income payments from variable annuities can fluctuate depending on the performance of the underlying investments. According to a 2021 study by the LIMRA Secure Retirement Institute, fixed income annuities accounted for 54% of all income annuity sales in the United States.

The duration of income payments from an annuity can be customized based on the annuity owner’s preferences and financial needs. Some income annuities provide payments for a fixed term, such as 10 or 20 years, while others offer lifetime payments that continue until the annuity owner’s death. Additionally, income annuities can include joint and survivor options, which extend payments to a designated beneficiary, typically a spouse, after the primary annuity owner’s passing.

How Does Annuity Work In Retirement?

Annuities serve as a valuable retirement income planning tool by providing a guaranteed stream of payments to help retirees meet their ongoing financial needs. During the accumulation phase, which occurs before retirement, individuals can make either a lump sum investment or a series of premium payments into an annuity. The funds within the annuity grow tax-deferred, allowing the investment to compound without the burden of annual taxation. Upon reaching the designated retirement age or triggering event, the annuity enters the payout phase, and the insurance company begins distributing regular income payments to the annuity owner.

The amount and frequency of annuity payments in retirement depend on several factors, including the type of annuity (fixed, variable, or indexed), the initial investment amount, and the selected payout option. Fixed annuities offer the most predictable income, with payments remaining consistent throughout retirement. Variable annuities provide the potential for higher returns but also introduce market risk, as payments can fluctuate based on the performance of the underlying investment portfolio. Indexed annuities offer a balance between the two, with payments based on the performance of a specified market index, subject to caps and participation rates. According to a 2021 report by the Alliance for Lifetime Income, 73% of retirees believe having a guaranteed lifetime income source, such as an annuity, would increase their confidence in maintaining a comfortable retirement lifestyle.

Retirees can also choose from various annuity payout options to suit their specific needs. Life annuities provide guaranteed payments for the remainder of the annuity owner’s life, mitigating the risk of outliving one’s savings. Period certain annuities offer payments for a fixed term, such as 10 or 20 years, providing income certainty for a specific timeframe. Joint and survivor annuities continue payments to a designated beneficiary, usually a spouse, after the primary annuity owner’s death, ensuring ongoing financial support for the surviving partner. Work closely with capitalizethings.com financial professional to select an annuity type and payout option that aligns with your retirement lifestyle goals and risk tolerance.

How To Buy An Annuity For Retirement?

To purchase an annuity for retirement, begin by assessing your financial objectives and determining the role an annuity will play in your overall retirement income strategy. Consider factors such as your desired retirement lifestyle, anticipated expenses, and the amount of guaranteed income you will need to supplement other sources like Social Security or pension benefits. Evaluate whether a lump sum investment or a series of premium payments better aligns with your current financial situation and long-term goals.

Next, research and compare different types of annuities available in the market, including fixed, variable, and indexed options. Each type offers distinct features, benefits, and risk levels, so it is essential to select an annuity that aligns with your risk tolerance and income needs. According to a 2021 survey by the Insured Retirement Institute (IRI), 73% of respondents reported that having a source of guaranteed lifetime income was a top priority when considering an annuity purchase. When comparing annuity products, pay close attention to factors such as fees, surrender charges, rider options, and the financial stability of the issuing insurance company.

Before making a final decision, consult with a trusted financial advisor who can provide personalized guidance based on your unique financial situation and retirement goals. An experienced professional can help you navigate the complexities of annuity contracts, assess the potential benefits and drawbacks of different products, and ensure that an annuity purchase aligns with your overall retirement income plan. They can also assist in evaluating the reputation and financial strength of insurance companies offering annuities, helping you make an informed decision. Contact capitalizethings.com qualified financial advisor to discuss your retirement income needs and determine if an annuity is a suitable addition to your retirement portfolio.

What Is The Primary Reason For Buying An Annuity?

The primary reason individuals purchase annuities is to secure a guaranteed stream of income during retirement, helping to mitigate the risk of outliving their savings. As life expectancies continue to rise, retirees face an increasing challenge of ensuring their retirement assets last throughout their lifetime. According to a 2021 study by the World Economic Forum, the average U.S. life expectancy is projected to reach 85.6 years by 2050, highlighting the need for reliable, long-term income sources. Annuities address this longevity risk by providing a predictable income stream that can last for a specified period or the remainder of the annuity owner’s life.

In addition to providing guaranteed income, annuities offer several other compelling benefits that make them attractive to retirement investors. One key advantage is the potential for tax-deferred growth during the accumulation phase. Funds within an annuity can grow without the burden of annual taxation, allowing investments to compound more quickly over time. This tax-deferred growth can help individuals build a larger retirement nest egg, ultimately leading to higher income payments during the payout phase. Furthermore, annuities can provide a measure of protection against market volatility, particularly in the case of fixed annuities, which offer stable, predictable returns regardless of market conditions.

Another primary reason individuals buy annuities is for estate planning purposes. Many annuity contracts include death benefit provisions, which ensure that designated beneficiaries receive a specified payout upon the annuity owner’s passing. This feature can help provide financial security for loved ones and facilitate the efficient transfer of wealth. Some annuities also offer long-term care riders, which allow annuity owners to allocate a portion of their funds to cover potential long-term care expenses, providing an additional layer of financial protection in retirement.

Who Should Buy Annuities?

Annuities are a suitable investment for retirees and individuals nearing retirement who prioritize a guaranteed income stream to support their desired lifestyle. For those concerned about outliving their savings, an annuity can provide a reliable source of income that lasts for a specified term or the remainder of the annuity owner’s life. This can be particularly beneficial for individuals who have limited or no access to other guaranteed income sources, such as pension benefits. According to a 2021 survey by the Alliance for Lifetime Income, 80% of retirees reported that having a guaranteed income source, such as an annuity, would increase their confidence in maintaining financial security throughout retirement.

Annuities may also be appropriate for individuals with a low risk tolerance or those who prefer a more conservative approach to retirement investing. Fixed annuities, in particular, offer stable, predictable returns that are not subject to market fluctuations, providing a measure of security for those who are uncomfortable with the potential volatility of traditional investments like stocks or mutual funds. Additionally, annuities can be a valuable tool for individuals who have maxed out other tax-advantaged retirement savings vehicles, such as 401(k)s or IRAs, as they offer the potential for tax-deferred growth.

However, it is essential to note that annuities may not be the best fit for everyone. Younger investors with a longer time horizon until retirement may benefit more from the growth potential of other investment options, such as stocks or mutual funds. Additionally, individuals who prioritize liquidity and flexibility in their investments may find the surrender charges and limited access to funds associated with some annuity contracts to be too restrictive. Consult with capitalizethings.com trusted financial advisor to assess your unique financial situation, risk tolerance, and retirement goals to determine if an annuity is a suitable addition to your retirement portfolio.

When Is Buying An Annuity A Good Idea?

Purchasing an annuity is a good idea when you are nearing retirement and seeking a guaranteed income stream to supplement other retirement income sources, such as Social Security or pension benefits. Annuities provide a reliable, predictable income that can help ensure you have sufficient funds to support your desired lifestyle throughout retirement. For example, if you are concerned about outliving your savings or want to ensure a stable income during market downturns, an annuity can offer peace of mind and financial security. According to a 2021 study by the Employee Benefit Research Institute (EBRI), 73% of retirees who own an annuity reported feeling more confident about maintaining their standard of living throughout retirement.

Buying an annuity can also be a wise choice if you are looking to maximize the tax-deferred growth potential of your retirement savings. Funds within an annuity grow tax-deferred, allowing your investment to compound more quickly over time without the burden of annual taxation. This can be particularly advantageous if you have already maxed out other tax-advantaged retirement savings vehicles, such as 401(k)s or IRAs. Additionally, if you have a lump sum of money from a pension payout, inheritance, or sale of a business, investing a portion of those funds into an annuity can help ensure a steady income stream throughout retirement.

Another situation where buying an annuity might be a good idea is when you want to mitigate the impact of market volatility on your retirement income. Fixed annuities, for instance, offer stable, guaranteed returns that are not tied to market performance, providing a measure of security during periods of economic uncertainty. Similarly, indexed annuities offer the potential for growth based on the performance of a specified market index, while also providing downside protection through features like guaranteed minimum income benefits.

How Do Annuity Returns Compare To Other Retirement Investments?

Annuity returns can vary depending on the type of annuity and the specific features of the contract, but generally, they tend to offer lower returns compared to more aggressive retirement investment options, such as stocks. Fixed annuities, for instance, provide stable, guaranteed returns based on a predetermined interest rate, which may be lower than the potential returns of equity investments over the long term. However, fixed annuities also offer the benefit of predictability and security, as the returns are not subject to market fluctuations. According to a 2021 report by the National Association of Insurance Commissioners (NAIC), the average credited rate for fixed annuities was 2.86%, providing a modest but reliable return.

When compared to bonds, annuities can offer similar levels of stability and predictability, but the returns may vary. Fixed annuities often provide returns comparable to high-quality corporate bonds or Treasury securities, while indexed annuities offer the potential for higher returns based on the performance of a specified market index. However, it is essential to note that indexed annuity returns are subject to caps, participation rates, and other limitations, which may result in lower overall returns compared to investing directly in the underlying index. A 2021 study by the Insured Retirement Institute (IRI) found that the average annual return for indexed annuities over a 10-year period was 3.27%, demonstrating the potential for steady, moderate growth.

In comparison to traditional retirement investment options like mutual funds, annuities may offer lower overall returns but provide the added benefit of guaranteed income and downside protection. While mutual funds have the potential for higher returns during strong market conditions, they also expose investors to greater levels of risk and volatility. Annuities, on the other hand, prioritize income stability and security, making them a valuable tool for retirees seeking to mitigate risk and ensure a reliable income stream.

Are Annuities A Good Idea For Retirement Income?

Yes, annuities are a good idea for retirement income, as they provide a guaranteed stream of payments that can help ensure financial stability and peace of mind throughout retirement. One of the primary benefits of annuities is their ability to mitigate longevity risk, which is the risk of outliving your savings. With a lifetime income annuity, you can receive guaranteed payments for the remainder of your life, regardless of how long you live. This can be particularly valuable for retirees who are concerned about managing their expenses and maintaining their standard of living as they age. According to a 2021 survey by the Alliance for Lifetime Income, 80% of retirees reported that having a guaranteed lifetime income source, such as an annuity, would increase their confidence in maintaining financial security throughout retirement.

Another advantage of annuities for retirement income is the potential for tax-deferred growth during the accumulation phase. Funds within an annuity can grow tax-deferred, allowing your investment to compound more quickly over time without the burden of annual taxation. This can help you build a larger retirement nest egg, ultimately leading to higher income payments during the payout phase. Additionally, annuities offer the flexibility to choose from a variety of payout options, such as lifetime income, period certain payments, or joint and survivor benefits, allowing you to tailor your income stream to your specific needs and goals.

However, it is important to consider the potential drawbacks of annuities, such as the lack of liquidity and the associated fees and surrender charges. Some annuity contracts may impose penalties for early withdrawals or limit your access to funds, which can be a concern if you anticipate needing access to your money in the short term. Additionally, annuities may carry higher fees compared to other retirement investment options, which can impact your overall returns.

Are Annuities Worth It For Early Retirees?

Yes, annuities are worth considering for early retirees, as they provide a guaranteed income stream that can help bridge the gap between early retirement and the age at which you become eligible for Social Security benefits or other retirement income sources. For individuals who retire before the traditional retirement age, an annuity can offer financial stability and peace of mind, ensuring a reliable income to cover living expenses and maintain their desired lifestyle. According to a 2021 study by the Employee Benefit Research Institute (EBRI), 45% of workers aged 55 and older reported that they plan to retire before age 65, highlighting the need for early retirement income planning strategies.

One of the key benefits of annuities for early retirees is the potential for lifetime income. With a lifetime income annuity, you can receive guaranteed payments for the remainder of your life, regardless of how long you live. This can be particularly valuable for early retirees who may face a longer retirement horizon and are concerned about outliving their savings. Additionally, annuities offer the flexibility to choose from a variety of payout options, such as joint and survivor benefits, which can provide ongoing income for a surviving spouse in the event of the primary annuity owner’s death.

However, it is essential for early retirees to carefully consider the potential drawbacks of annuities, such as the lack of liquidity and the opportunity cost of tying up funds in a long-term investment. Annuity contracts often impose surrender charges or penalties for early withdrawals, which can limit your access to funds if you need them for unexpected expenses or changing life circumstances. Additionally, investing a significant portion of your retirement savings in an annuity may limit your ability to take advantage of other investment opportunities or adjust your portfolio as your needs and goals evolve over time. Assess your early retirement income needs, risk tolerance, and overall financial situation to determine if annuities are a suitable option for your retirement income strategy, and consult with capitalizethings.com trusted financial advisor for personalized guidance tailored to your unique circumstances.

How Do Fees And Costs Impact Annuity Performance?

Fees and costs can have a significant impact on annuity performance, as they can erode investment returns and reduce the overall value of the annuity over time. Annuity contracts often include various fees, such as administrative fees, mortality and expense risk charges, and investment management fees, which can vary depending on the type of annuity and the specific features of the contract. According to a 2021 report by the National Association of Insurance Commissioners (NAIC), the average fees for variable annuities range from 2% to 3% per year, while fixed annuities typically have lower fees, ranging from 0.5% to 1.5% annually.

One of the most significant costs associated with annuities is the surrender charge, which is a penalty imposed for withdrawing funds from the annuity before a specified period, typically ranging from 5 to 10 years. Surrender charges can be substantial, often starting at around 7% to 10% of the withdrawn amount and gradually decreasing over time. These charges can significantly impact the liquidity of the annuity and the overall return on investment, particularly for investors who may need to access their funds before the surrender period expires. Additionally, some annuities may include optional riders, such as guaranteed minimum income benefits or long-term care insurance, which can provide additional features but also increase the overall cost of the annuity.

To minimize the impact of fees and costs on annuity performance, it is essential to carefully review and compare the fees associated with different annuity products before making a purchase. Look for annuities with competitive fees and transparent cost structures, and consider the long-term impact of these expenses on your investment returns. Additionally, be mindful of the surrender period and charges associated with the annuity, and ensure that the contract aligns with your liquidity needs and long-term financial goals.

How Do Market Conditions Affect Variable Annuities?

Market conditions can have a significant impact on variable annuities, as the performance of these products is directly tied to the underlying investment options, such as mutual funds, that make up the annuity’s subaccounts. During periods of strong market performance, variable annuities have the potential to generate higher returns, as the value of the underlying investments increases. Conversely, during market downturns or periods of volatility, the value of a variable annuity may decline, resulting in lower account balances and potentially reduced income payments. According to a 2021 study by Morningstar, Inc., variable annuity subaccounts experienced an average return of 12.1% during the bull market of 2020, demonstrating the potential for growth during favorable market conditions.

However, it is essential to note that variable annuities also expose investors to greater levels of risk compared to fixed annuities, which offer guaranteed returns. The performance of a variable annuity is not only influenced by overall market conditions but also by the specific investment options chosen within the annuity’s subaccounts. Poor investment selection or lack of diversification can exacerbate losses during market downturns, while well-managed and diversified portfolios may help mitigate some of the impact of market volatility. Additionally, variable annuities often include optional riders, such as guaranteed minimum income benefits or death benefits, which can provide a measure of protection against market fluctuations but may also increase the overall cost of the annuity.

To manage the impact of market conditions on variable annuities, investors should work closely with a financial advisor to develop a well-diversified investment strategy that aligns with their risk tolerance and long-term financial goals. Regularly reviewing and rebalancing the annuity sub account allocations can help ensure that the portfolio remains aligned with the investor’s objectives and market conditions. Additionally, consider the use of optional riders, such as guaranteed minimum income benefits, to provide a measure of protection against market volatility and ensure a reliable income stream during retirement.

When Is The Optimal Age To Purchase An Annuity?

The optimal age to purchase an annuity depends on various factors, including your retirement income needs, risk tolerance, and overall financial situation. Generally, annuities are most commonly purchased by individuals nearing retirement age, typically in their 50s or 60s, as they begin to focus on creating a reliable income stream to support their desired retirement lifestyle. According to a 2021 survey by the Insured Retirement Institute (IRI), the average age of annuity purchasers is 63 years old, with 85% of annuity owners being age 50 or older.

One of the primary reasons to consider purchasing an annuity in your later years is to secure a guaranteed income stream for retirement. As you approach retirement age, you may have a clearer picture of your expected expenses and income needs, allowing you to make a more informed decision about the type and size of annuity that best fits your financial goals. Additionally, purchasing an annuity later in life may result in higher income payments, as annuity rates are often based on life expectancy, and older individuals typically receive higher payout rates due to their shorter life expectancy.

However, there are also potential benefits to purchasing an annuity earlier in life, such as in your 40s or early 50s. Buying an annuity at a younger age allows more time for the investment to grow tax-deferred, potentially resulting in a larger account balance and higher income payments during retirement. Additionally, purchasing an annuity earlier in life may allow you to lock in favorable interest rates or payout rates, which can be particularly advantageous in a low interest rate environment. Ultimately, the optimal age to purchase an annuity will depend on your unique financial situation, retirement income needs, and long-term goals. Consult with capitalizethings.com experienced financial advisors to evaluate your options and determine the most appropriate timing for incorporating an annuity into your retirement income strategy.

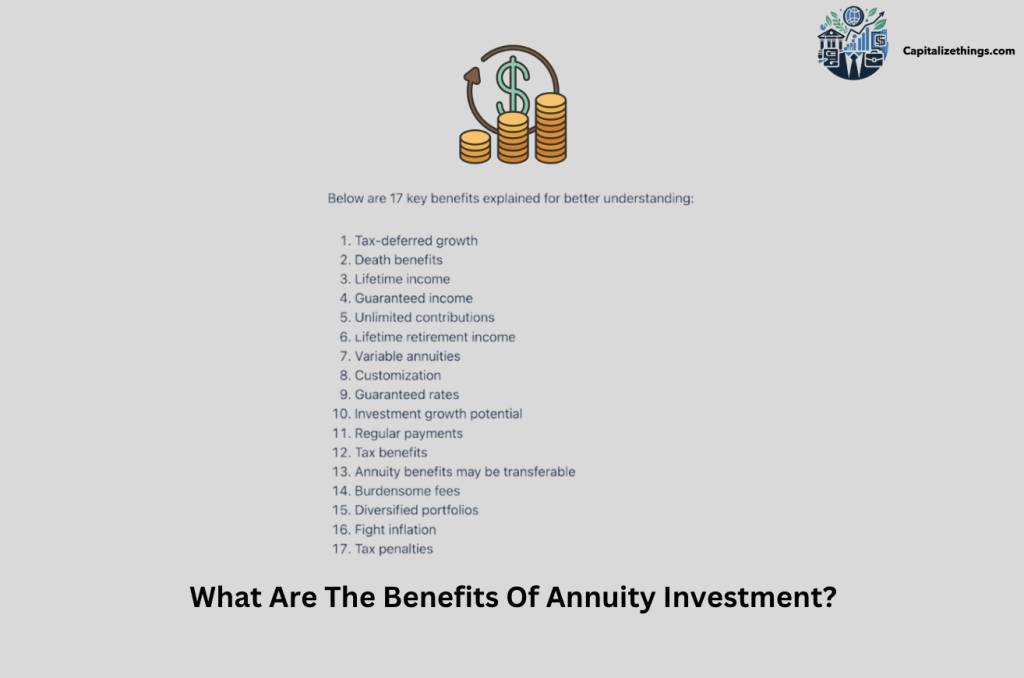

What Are The Benefits Of Annuity Investment?

An annuity investment provides multiple financial advantages. These include steady income, tax benefits, and secure growth opportunities. Each benefit supports different retirement goals, making annuities versatile.

Below are 17 key benefits explained for better understanding:

- Tax-deferred growth

- Death benefits

- Lifetime income

- Guaranteed income

- Unlimited contributions

- Lifetime retirement income

- Variable annuities

- Customization

- Guaranteed rates

- Investment growth potential

- Regular payments

- Tax benefits

- Annuity benefits may be transferable

- Burdensome fees

- Diversified portfolios

- Fight inflation

- Tax penalties

1. Tax-Deferred Growth

Annuity investments offer tax-deferred growth, meaning earnings grow without immediate tax obligations. This feature maximizes long-term savings. The funds compound until withdrawal, increasing retirement income potential.

2. Death Benefits

Annuity investments provide death benefits, ensuring financial support for beneficiaries. These payments protect loved ones by transferring remaining funds directly. This ensures wealth continuity after the investor’s passing.

3. Lifetime Income

Lifetime income from annuity investments guarantees payments that last throughout life. This benefit reduces the risk of outliving financial resources. It is a key reason retirees consider annuities.

4. Guaranteed Income

Annuity investments deliver guaranteed income through fixed payments. These stable payouts help meet essential living costs during retirement. This option ensures consistent financial security.

5. Unlimited Contributions

Some annuity investments allow unlimited contributions, unlike other retirement accounts. This feature supports significant savings over time. Investors with larger income sources can benefit greatly.

6. Lifetime Retirement Income

Lifetime retirement income is a standout feature of annuity investments. Retirees can plan for consistent funds through their retirement years. This supports financial independence.

7. Variable Annuities

Variable annuities in investments link returns to chosen funds, like stocks or bonds. This creates opportunities for higher growth. It suits individuals willing to take calculated risks.

8. Customization

Annuity investments offer customization through added features like inflation protection. Investors can tailor contracts to suit unique needs. This flexibility enhances suitability for varied goals.

9. Guaranteed Rates

Fixed-rate annuity investments ensure guaranteed returns over the term. This eliminates uncertainty and provides secure growth. It appeals to conservative investors.

10. Investment Growth Potential

Some annuities link to market-based funds, increasing growth potential. Investors aiming for long-term growth choose these products. They offer higher rewards with calculated risks.

11. Regular Payments

Regular payments from annuity investments provide predictable income. This feature helps retirees cover expenses consistently. Scheduled payouts support effective financial planning.

12. Tax Benefits

Annuity investments provide tax benefits like deferred taxes on earnings. This feature increases net returns over time. It supports efficient retirement savings.

13. Annuity Benefits May Be Transferable

Some annuity investments allow benefit transfers to heirs. This ensures wealth reaches designated individuals. Transferable benefits improve financial legacy planning.

14. Burdensome Fees

Annuity investments include burdensome fees that reduce returns. Understanding fee structures is important for maximizing outcomes. Proper planning minimizes unnecessary costs.

15. Diversified Portfolios

Annuity investments support diversified portfolios through variable products. Investors can spread funds across multiple assets. This reduces risks and improves overall returns.

16. Fight Inflation

Inflation-protected annuity investments adjust payouts to match rising costs. This preserves purchasing power over time. It helps retirees maintain financial stability.

17. Tax Penalties

Early withdrawals from annuity investments incur tax penalties. Understanding these rules ensures informed financial decisions. Proper planning avoids unnecessary charges.

What Happens To Annuity Benefits After Death?

The distribution of annuity benefits after the annuitant’s death is determined by the specific terms of the annuity contract and the payout options selected at the time of purchase. Some annuity contracts include a death benefit provision, which ensures that designated beneficiaries receive either the remaining annuity payments or a lump sum equal to the initial investment amount, depending on the terms of the contract. However, if the annuitant chooses a life-only payout option with no death benefit, the annuity payments will typically cease upon the annuitant’s death, and no further benefits will be paid to beneficiaries. According to a 2021 study by the Insured Retirement Institute (IRI), 70% of annuity owners reported that the death benefit was an important factor in their decision to purchase an annuity.

Joint and survivor annuity options provide a way to ensure that annuity benefits continue to be paid to a designated beneficiary, typically a spouse, after the primary annuitant’s death. Under a joint life annuity, payments continue until the death of both the primary annuitant and their designated joint annuitant. Alternatively, a survivorship annuity option allows the annuitant to specify a percentage of the original payment that will continue to be paid to the survivor after the primary annuitant’s death. These options can provide peace of mind and financial security for the annuitant’s loved ones.

In some cases, beneficiaries may receive the remaining annuity benefits as a lump sum payment after the annuitant’s death. This option can provide flexibility for beneficiaries to use the funds as they see fit, whether to cover immediate expenses, pay off debts, or reinvest the money. However, it is essential to note that any lump sum payments received by beneficiaries may be subject to income taxes, depending on the type of annuity and the tax status of the original contributions.

Which Types Of Annuities Offer The Best Tax Advantages?

Deferred annuities offer significant tax advantages by allowing the investment to grow tax-deferred until funds are withdrawn, making them an attractive option for long-term retirement savings. With a deferred annuity, investors can contribute money to the annuity over time, and any investment gains or interest earned within the annuity are not subject to income tax until the funds are withdrawn. This tax deferral can allow the annuity to grow more quickly, as the funds that would have been paid in taxes each year can instead be reinvested and continue to compound over time. According to a 2021 report by the National Association of Insurance Commissioners (NAIC), deferred annuities accounted for 82% of total annuity sales in the United States.

Fixed indexed annuities combine the tax-deferral benefits of deferred annuities with the potential for higher returns based on the performance of a specified market index. These annuities offer the opportunity to participate in market gains while still protecting the principal investment from downside risk. The interest credited to the annuity is based on the performance of the selected index, subject to caps and participation rates set by the insurance company. Like other deferred annuities, fixed indexed annuities allow the investment to grow tax-deferred, providing a tax-efficient way to save for retirement.

Qualified longevity annuity contracts (QLACs) offer unique tax advantages for those seeking to extend their retirement savings and ensure a guaranteed income stream later in life. QLACs are deferred annuities funded with qualified retirement account assets, such as 401(k)s or traditional IRAs, and are designed to begin payouts at an advanced age, typically 80 or 85. The key tax benefit of a QLAC is that the funds used to purchase the annuity are excluded from the account balance when calculating required minimum distributions (RMDs) from qualified retirement accounts at age 72. This allows investors to reduce their RMDs and associated tax liabilities while ensuring a guaranteed income stream in their later years. It is essential to carefully consider your retirement income needs and consult with capitalizethings.com financial professional to determine the most appropriate annuity type and tax strategy for your unique situation.

What Are The Top 10 Risks Attached With Annuity Investment?

Annuity investments come with risks that investors must consider before committing. These risks include fees, limited returns, and tax consequences. Understanding these challenges ensures informed decisions. Below is the list of the top 10 risks attached with annuity investment:

- Lack of inflation protection

- Annuities are confusing

- Tax penalties

- Annuities have high fees

- Earnings are taxable

- High fees

- Limited liquidity

- Limited returns

- Payouts can end abruptly

- Surrender charges

1. Lack of Inflation Protection in Annuity Investment

Annuity investments often lack inflation protection, which reduces purchasing power over time. Fixed payouts do not adjust for rising costs, impacting retirees’ ability to maintain their lifestyle. Choosing options with inflation riders increases costs but mitigates this risk. Investors should evaluate their contract to ensure income matches future expenses. Inflation risk makes planning essential for long-term financial stability.

2. Annuities Are Confusing in Investment Planning

The complexity of annuity investments can confuse investors. Varied options, payout structures, and fees make understanding contracts difficult. Misunderstanding terms can lead to poor decisions, limiting retirement benefits. Investors must research thoroughly or consult advisors to comprehend their choices. A clear understanding reduces risks associated with misaligned expectations or inadequate returns.

3. Tax Penalties in Annuity Investment Withdrawals

Early withdrawals from annuity investments incur tax penalties. Investors below age 59½ face additional charges, reducing available funds. These penalties can disrupt financial plans if funds are needed urgently. Understanding withdrawal rules helps avoid unnecessary costs. Proper planning ensures tax obligations do not overshadow the benefits of long-term growth.

4. Annuities Have High Fees in Investment Contracts

Annuity investments come with high fees that impact returns. Fees include administrative costs, mortality charges, and rider expenses. These deductions reduce overall gains, especially in contracts with additional features. Investors must assess all costs before purchasing to understand their impact on earnings. High fees make comparing options crucial.

5. Earnings Are Taxable in Annuity Investment Returns

Earnings from annuity investments are subject to taxation during withdrawals. Gains are taxed as ordinary income, unlike capital gains rates, which are lower. This taxation structure can significantly reduce the amount available for retirement. Planning withdrawals carefully minimizes tax liabilities and preserves returns for essential expenses.

6. High Fees in Certain Annuity Investment Products

Some annuity investments involve additional high fees that reduce profitability. Variable annuities, for instance, charge for fund management and guarantees. These costs erode returns, making other investments more appealing. Transparent disclosure of fees allows investors to weigh costs against potential benefits. Understanding fee structures improves decision-making.

7. Limited Liquidity in Annuity Investment Options

Annuity investments often come with limited liquidity, restricting access to funds. Contracts impose penalties for early withdrawals, making them unsuitable for emergencies. Investors needing flexibility should consider this limitation carefully. Reviewing contract terms helps ensure the product aligns with financial goals. Limited liquidity makes planning essential.

8. Limited Returns in Annuity Investment Growth

The growth potential in annuity investments is often limited, especially with fixed options. Returns do not match market performance, reducing overall wealth accumulation. Investors seeking higher gains need alternatives like mutual funds or stocks. Understanding these limitations ensures realistic expectations. Limited returns emphasize the need for diversification.

9. Payouts Can End Abruptly in Annuity Investment Plans

Payouts from certain annuity investments can end abruptly upon the annuitant’s death. Contracts without survivor benefits or guarantees leave beneficiaries with nothing. Reviewing payout terms and selecting joint-life options ensures continued support for loved ones. Abrupt terminations highlight the importance of contract customization to meet family needs.

10. Surrender Charges in Early Annuity Investment Withdrawals

Surrender charges apply to early withdrawals from annuity investments during the surrender period. These charges reduce the amount available significantly. Investors needing immediate funds face substantial penalties. Understanding surrender terms ensures funds remain accessible when required. Surrender charges underscore the importance of matching annuities to long-term goals.

What Are The Risks Of Early Withdrawal From Annuities?

Early withdrawal from annuities can result in significant penalties and surrender charges, which may substantially reduce the value of your investment. Many annuity contracts include surrender charges that apply during the initial years of the contract, typically ranging from 5 to 10 years. These charges can be as high as 10% of the withdrawn amount and gradually decrease over time. According to a 2021 survey by the Insured Retirement Institute (IRI), 84% of annuity owners reported being aware of surrender charges associated with their annuities.

In addition to surrender charges, withdrawals made before age 59½ may be subject to a 10% early withdrawal penalty imposed by the IRS. This penalty is in addition to any regular income taxes owed on the withdrawn amount. The combination of surrender charges and early withdrawal penalties can significantly erode the value of your annuity investment, making early withdrawals a costly decision. It is essential to carefully review the terms of your annuity contract and understand the potential consequences of early withdrawals before making any decisions.

Another risk of early withdrawal from annuities is the potential loss of guaranteed lifetime income. Many annuities are designed to provide a steady stream of income throughout retirement, and early withdrawals can disrupt this benefit. By withdrawing funds prematurely, you may miss out on the opportunity for your investment to grow tax-deferred over time, which can have a significant impact on your long-term retirement income. Before considering an early withdrawal from your annuity, it is crucial to explore alternative options and consult with a financial professional to assess the potential impact on your retirement plan.

Consult with us by calling at: +1 (323)-456-9123

How Does Inflation Affect Fixed Annuity Payments?

Inflation can have a significant impact on the purchasing power of fixed annuity payments over time, as the fixed payment amounts do not automatically adjust to keep pace with rising prices. When an annuity owner chooses a fixed payment option, they will receive a guaranteed, consistent income stream for the specified term or their lifetime. However, as inflation increases the cost of goods and services, the real value of these fixed payments may decline, potentially affecting the annuity owner’s standard of living in retirement. According to a 2021 report by the Bureau of Labor Statistics, the average annual inflation rate in the United States over the past 20 years has been approximately 2.1%.

To mitigate the risk of inflation eroding the value of fixed annuity payments, some insurers offer inflation protection riders. These riders allow for annual payment increases based on a specified inflation index, such as the Consumer Price Index (CPI). By opting for an inflation-protected annuity, retirees can help ensure that their income keeps pace with rising costs. However, it is essential to note that annuities with inflation protection typically come with higher costs or lower initial payment amounts compared to standard fixed annuities.

When considering a fixed annuity for retirement income, it is crucial to factor in the potential impact of inflation over the long term. While fixed annuities can provide a stable and predictable income stream, they may not be the optimal choice for those seeking to maintain their purchasing power throughout retirement. Diversifying your retirement income sources and considering inflation-protected investment options can help mitigate the risk of inflation and ensure a more secure financial future. Consult with capitalizethings.com financial advisor to determine the most appropriate annuity strategy for your unique retirement needs.

Do Hybrid Annuities Combine Features of variable and fixed annuities?

Hybrid annuities, also known as indexed annuities, combine features of both fixed and variable annuities to offer a balance of guaranteed income and growth potential. These annuities provide a guaranteed minimum return, protecting the principal investment from market losses, while also offering the opportunity to participate in market gains through indexing. The performance of a hybrid annuity is typically tied to a specific market index, such as the S&P 500, allowing investors to benefit from positive market performance without the risk of losing their principal during market downturns. According to the Secure Retirement Institute, indexed annuity sales reached $58.2 billion in 2020, demonstrating their growing popularity among retirement investors.

One of the key features of hybrid annuities is the potential for higher returns compared to traditional fixed annuities, while still maintaining a level of principal protection. When the linked market index performs well, the annuity’s credited interest rate may increase, allowing the account value to grow. However, hybrid annuities often impose caps or participation rates that limit the maximum return an investor can receive. For example, an annuity with a 5% cap would credit interest up to 5%, even if the linked index performed better. These caps and participation rates can vary among different hybrid annuity products and insurance companies.

Another important aspect of hybrid annuities is the downside protection they offer. Unlike variable annuities, which directly expose investors to market fluctuations, hybrid annuities typically guarantee a minimum return, even if the linked index performs poorly. This feature can provide peace of mind for risk-averse investors who seek growth potential but also want to safeguard their principal.

Which Insurance Companies Offer The Most Reliable Annuities?

Among the most well-regarded insurers in the annuity market are New York Life, Northwestern Mutual, and Pacific Life. When seeking reliable annuity providers, it is essential to consider insurance companies with strong financial ratings, a history of stability, and a diverse range of annuity products. These companies consistently receive high ratings from independent agencies such as A.M. Best, Moody’s, and Standard & Poor’s, indicating their financial strength and ability to meet their obligations to policyholders. For example, as of 2021, New York Life holds an A++ rating from A.M. Best, the highest rating possible, reflecting its superior financial stability.

Another factor to consider when evaluating annuity providers is their track record of delivering competitive rates and robust customer service. Companies like MassMutual, Nationwide, and AIG have earned praise for offering attractive annuity rates and a wide array of product options, including fixed, variable, and indexed annuities. These insurers also prioritize customer support, providing resources and guidance to help annuity owners make informed decisions and manage their investments effectively. In a 2021 J.D. Power study on annuity customer satisfaction, Nationwide ranked among the top providers, demonstrating its commitment to client service.

It is also essential to consider the longevity and reputation of an insurance company when assessing its reliability. Established providers like MetLife, Prudential, and Lincoln Financial Group have a long history of financial stability and have demonstrated their ability to navigate various economic conditions. These companies have built trust among annuity investors by consistently honoring their commitments and providing secure retirement income solutions. While it is crucial to research and compare multiple annuity providers, the companies mentioned above have a proven track record of offering reliable and competitive annuity products. As always, it is recommended to consult with our financial professional by calling at +1 (323)-456-9123 or email us via services form to determine which annuity provider and product best align with your unique retirement income needs and goals.

What Does Warren Buffett Think About Annuities?

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has expressed reservations about certain types of annuities, particularly those with high fees and complex structures. In his annual letters to shareholders and public appearances, Buffett has cautioned against investing in annuities that come with substantial commissions and hidden costs, as these fees can significantly erode investment returns over time. He has also criticized the lack of transparency surrounding some annuity products, making it difficult for investors to fully understand their terms and potential drawbacks.

However, Buffett has acknowledged that certain types of annuities, such as fixed annuities, can be suitable for specific investors seeking guaranteed income in retirement. In a 2019 interview with CNBC, Buffett stated that for individuals who are risk-averse and prioritize a steady income stream, a simple, low-cost fixed annuity can be a reasonable choice. He emphasized the importance of understanding the terms of the annuity contract and ensuring that the fees are minimal, allowing the investor to benefit from the guaranteed income without excessive costs.

Buffett’s overall philosophy on investing emphasizes low-cost, transparent, and easily understandable investment vehicles. He has long advocated for index funds as a simple and effective way for most investors to gain exposure to the stock market and build long-term wealth. While he recognizes the potential benefits of annuities for certain individuals, he cautions against relying too heavily on complex, high-cost annuity products as a primary investment strategy. Ultimately, Buffett’s views on annuities underscore the importance of thoroughly researching and understanding any investment product before committing funds, and prioritizing low fees, simplicity, and transparency when making investment decisions.

What Is Dave Ramsey’s Opinion About Annuity Investment?

Dave Ramsey, a popular personal finance author and radio host, generally takes a critical stance on annuity investments, particularly variable and indexed annuities with high fees and complex structures. Ramsey argues that these types of annuities often come with hidden costs, surrender charges, and limited liquidity, making them a poor choice for most investors. He has expressed concern that the commissions and incentives associated with certain annuity products may lead some financial professionals to recommend them inappropriately, even when they may not be the best fit for a client’s needs.

Ramsey does acknowledge that fixed annuities can be a suitable option for certain investors, particularly those nearing retirement who prioritize a guaranteed income stream. However, he emphasizes the importance of thoroughly understanding the terms of the annuity contract, including any fees, surrender charges, and riders, before making a purchase. Ramsey advises investors to shop around and compare annuity options from multiple providers to ensure they are getting the best possible terms and rates.

In general, Ramsey encourages investors to prioritize low-cost, transparent investment options that offer greater flexibility and control over their money. He often recommends investing in a diversified portfolio of mutual funds within tax-advantaged retirement accounts, such as 401(k)s and IRAs, as a more effective long-term wealth-building strategy. While Ramsey acknowledges that annuities can serve a purpose for some investors, he cautions against relying on them as a primary investment vehicle and emphasizes the importance of carefully evaluating their costs and benefits before making a decision.

How Much Does A $100,000 Annuity Pay Per Month?

The monthly payout from a $100,000 annuity can vary significantly depending on several factors, including the type of annuity, the annuitant’s age, gender, and life expectancy, as well as prevailing interest rates at the time of purchase. Fixed annuities, which provide a guaranteed interest rate and a predictable income stream, typically offer monthly payouts ranging from $400 to $600 for a $100,000 investment. However, these payouts can fluctuate based on the specific terms of the annuity contract and the current interest rate environment. According to a 2021 report by ImmediateAnnuities.com, a 65-year-old male purchasing a $100,000 single-life fixed annuity could expect to receive approximately $545 per month, while a 65-year-old female would receive around $525 per month due to her longer life expectancy.

For variable annuities, which offer the potential for higher returns by investing in a portfolio of mutual funds, the monthly payout can be less predictable and will depend on the performance of the underlying investments. If the investments perform well, the monthly payout may increase over time, while poor investment performance could lead to reduced payouts. Some variable annuities offer optional riders, such as guaranteed minimum income benefits, which can provide a baseline level of income regardless of market performance, but these riders typically come with additional fees that can impact the overall payout.

It is essential to note that the actual monthly payout from a $100,000 annuity will depend on the specific product and the individual investor’s circumstances. Factors such as the chosen payout period (e.g., lifetime vs. a fixed term), the inclusion of inflation protection, and any additional riders or benefits can all impact the monthly income received. Before purchasing an annuity, it is crucial to carefully review the terms of the contract and consult with capitalizethings.com financial professional to ensure that the product aligns with your retirement income goals and expectations. Additionally, comparing quotes from multiple annuity providers can help you secure the most competitive rates and maximize your monthly payout.

What Is Annuity Income Retirement?

Annuity income retirement refers to the use of annuities as a source of guaranteed income during retirement. When an individual purchases an annuity, they typically make a lump-sum payment or a series of payments to an insurance company. In exchange, the insurance company agrees to provide the annuity owner with a steady stream of income payments, either for a fixed term or for the remainder of their life. This guaranteed income can help retirees manage their expenses and maintain financial stability, even in the face of market volatility or uncertainty.

One of the primary advantages of using annuities for retirement income is the ability to customize the payout structure to meet individual needs and preferences. Retirees can choose from a variety of annuity options, such as immediate annuities, which begin paying out income shortly after the initial investment, or deferred annuities, which allow the invested funds to grow tax-deferred until the annuity owner chooses to start receiving payments. Additionally, some annuities offer inflation protection, ensuring that the purchasing power of the income stream keeps pace with rising costs over time.

Another benefit of annuity income retirement is the potential to alleviate the risk of outliving one’s savings. With a lifetime annuity, the annuity owner is guaranteed to receive income payments for as long as they live, regardless of how long they may live in retirement. This can provide peace of mind and financial security for retirees who are concerned about the possibility of exhausting their retirement savings. However, it is essential to carefully consider the costs and terms associated with annuities, as well as how they fit into an overall retirement income strategy.

Are Annuities A Good Investment For Seniors?

Yes, annuities are a good investment for seniors seeking a reliable and steady income stream during retirement. Fixed annuities, in particular, provide predictable payments that can help seniors maintain financial security and avoid the impact of market fluctuations. The guaranteed income from annuities can help seniors manage their expenses and budget more effectively.

However, seniors should carefully evaluate the specific terms of an annuity contract, including fees, surrender charges, and any potential limitations. Some annuities may come with high costs or lack flexibility, which can erode the value of the investment over time. It is essential for seniors to thoroughly understand the terms of the annuity and choose products that align with their long-term financial goals and needs.

Are Annuities A Good Investment In Australia?

Yes, annuities are a good investment option for retirees in Australia who prioritize consistent and tax-efficient income. Annuity products, such as lifetime annuities, can provide Australian seniors with long-term financial security and help them manage their retirement funds effectively. By offering predictable income streams, annuities can help mitigate the impact of market volatility and provide peace of mind to retirees.

However, annuities in Australia may have some limitations, such as reduced flexibility in accessing invested capital and the potential for inflation to erode the purchasing power of annuity payments over time. Retirees should carefully assess their financial needs and consider the specific features of annuity products to determine whether they are a suitable investment option for their individual circumstances.

Are Fixed Annuities A Good Investment?

Yes, fixed annuities are a good investment for individuals seeking guaranteed returns and predictable income streams. Fixed annuities provide investors with a stable and reliable income source, making them an attractive option for retirees or conservative investors who prioritize financial security. Because fixed annuity returns are not tied to market performance, investors can count on consistent payments regardless of market conditions.

However, it is important to note that the growth potential of fixed annuities may be limited compared to other investment options, such as stocks or mutual funds. Additionally, fixed annuities may come with surrender charges or other fees that can impact the overall return on investment. Investors should carefully review the terms and conditions of a fixed annuity contract and consider their long-term financial goals before making a decision.

Are Indexed Annuities A Good Investment?

Yes, indexed annuities are a good investment for those seeking a balance between stability and growth potential. Indexed annuities offer returns that are linked to the performance of a market index, such as the S&P 500, allowing investors to benefit from market gains while still providing protection against market downturns. This combination of features makes indexed annuities an appealing option for investors who want to participate in market growth while maintaining a level of security.

However, indexed annuities often come with caps or participation rates that limit the maximum return an investor can receive, even if the linked index performs exceptionally well. Additionally, indexed annuities may have complex terms and conditions that can be difficult for some investors to fully understand. It is crucial to carefully review the specific features and limitations of an indexed annuity product and consult with a financial professional before making an investment decision.

Are Tiaa Annuities A Good Investment?

Yes, TIAA (Teachers Insurance and Annuity Association) annuities are a good investment option for individuals in the academic, research, medical, and cultural fields. TIAA offers a range of annuity products with competitive rates and strong financial backing, making them an attractive choice for those seeking guaranteed income in retirement. The company’s long history and reputation for stability can provide peace of mind to investors.

However, TIAA annuities may not be the best fit for everyone. Some TIAA annuity products may come with complex terms and conditions, as well as fees that can impact overall returns. It is essential for investors to thoroughly review the specific features and costs associated with TIAA annuities and compare them with other investment options to determine whether they align with their financial goals and needs.

Are Insurance Annuities A Good Investment?

Yes, insurance annuities are a good investment for individuals who prioritize financial security and predictable income streams. Insurance annuities are backed by the financial strength and stability of the issuing insurance company, which can provide investors with a sense of confidence in the safety of their investment. These annuities can be particularly attractive to those who are risk-averse or seeking a reliable source of income in retirement.

However, insurance annuities may also come with some drawbacks, such as higher fees and limited liquidity compared to other investment options. The complex nature of annuity contracts can also make it challenging for some investors to fully understand the terms and conditions of their investment. It is important to carefully consider the costs and benefits of insurance annuities and consult with a financial professional to determine whether they are a suitable choice for an individual’s specific financial situation and goals.

Are Guaranteed Annuities A Good Investment?

Yes, guaranteed annuities are a good investment for individuals who prioritize stable, lifetime income over potential growth. Guaranteed annuities provide investors with the assurance that they will receive a predetermined income stream for the rest of their life, regardless of market conditions or changes in personal circumstances. This predictability can be especially valuable for retirees who want to ensure they have a reliable source of income to cover their essential expenses.

However, it is important to recognize that the guarantees provided by these annuities come at a cost. Guaranteed annuities typically offer lower returns compared to other investment options, as a portion of the investment goes towards securing the lifetime income guarantee. Additionally, once an investor commits to a guaranteed annuity, they may have limited flexibility to access their funds or make changes to their investment. It is crucial to carefully weigh the benefits of a guaranteed income stream against the potential limitations and costs associated with these products.

Are Fixed Annuities A Good Investment For Retirement?

Yes, fixed annuities are a good investment option for retirement, particularly for those who prioritize stability and predictable income streams. Fixed annuities provide retirees with a guaranteed income source, which can help them manage their living expenses and maintain their desired lifestyle in retirement. By offering a fixed rate of return, these annuities can help protect retirees from the potential negative impacts of market volatility.

However, it is essential to consider the potential drawbacks of fixed annuities, such as their limited growth potential and the impact of inflation on the purchasing power of the guaranteed income stream over time. Additionally, some fixed annuities may come with surrender charges or other fees that can reduce the overall value of the investment. Retirees should carefully evaluate their financial needs and goals, and consider the specific terms and conditions of a fixed annuity contract before making a decision.

Are Deferred Fixed Annuities A Good Investment?

Yes, deferred fixed annuities are a good investment option for those who are planning for their long-term financial future. These annuities allow investors to contribute funds over time, often with the benefit of tax-deferred growth, which can help them build a substantial savings balance for retirement. When the annuity reaches the payout phase, the investor will receive a guaranteed income stream based on the terms of the contract.

However, it is important to be aware that deferred fixed annuities may come with high surrender charges if the investor needs to access their funds before the agreed-upon payout date. These charges can significantly reduce the overall value of the investment. Additionally, the fixed rate of return offered by these annuities may not keep pace with inflation over the long term, which can impact the purchasing power of the guaranteed income stream in the future. Investors should carefully consider their financial goals and liquidity needs before committing to a deferred fixed annuity.

Are Income Annuities A Good Investment?

Yes, income annuities are a good investment option for retirees who are looking for a reliable, lifelong income stream. These annuities provide guaranteed, fixed payments for the remainder of the annuity owner’s life, which can help seniors manage their living expenses and maintain financial stability in retirement. By removing the risk of outliving one’s savings, income annuities can provide peace of mind and a sense of financial security.

However, income annuities may not be the best choice for everyone. Because these annuities typically offer lower returns compared to other investment vehicles, they may not provide sufficient growth to keep pace with inflation over the long term. Additionally, once an investor commits to an income annuity, they generally cannot access the principal investment, which can limit financial flexibility. Retirees should carefully consider their overall financial picture, including their income needs, growth expectations, and liquidity preferences, before deciding whether an income annuity is right for them.

Is An Annuity An Investment?

Technically, yes, an annuity is considered an investment product, as it involves an individual committing funds to an insurance company with the expectation of receiving future benefits. Annuities are designed to provide a steady income stream, either immediately or at a later date, and can offer protection against market volatility and longevity risk. In this sense, annuities can serve as a valuable tool for retirement planning and financial security.

However, it is important to recognize that annuities differ from traditional investment vehicles, such as stocks or mutual funds, in several key ways. Annuities generally offer lower growth potential and may come with higher fees and less liquidity compared to other investment options. Additionally, the primary focus of an annuity is typically to provide a guaranteed income stream rather than to maximize returns. As such, while annuities can play a role in an individual’s overall investment strategy, they should be considered in the context of their unique features and benefits rather than as a direct alternative to other investment products.

Why Might Liquid Investments Be Preferable To Annuities?

Liquid investments, such as stocks, bonds, and mutual funds, offer several advantages over annuities that make them a more attractive option for many investors. One of the primary benefits of liquid investments is their flexibility, allowing investors to access their funds whenever needed without incurring significant penalties or surrender charges. This liquidity is particularly important in cases of unexpected financial emergencies or changes in personal circumstances, as it provides investors with greater control over their assets and the ability to adapt to evolving needs.

In contrast, annuities typically involve locking up funds for extended periods, limiting an investor’s access to their capital. Early withdrawals from annuities often result in substantial fees or penalties, which can significantly reduce the overall value of the investment. For individuals who may require access to their funds for purposes other than retirement income, such as major purchases or investment opportunities, the lack of liquidity associated with annuities can be a significant drawback.

Moreover, liquid investments have the potential to generate higher returns compared to the fixed or guaranteed payouts offered by most annuities. While annuities provide a predictable income stream, the growth potential of liquid investments like stocks and mutual funds can lead to greater long-term wealth accumulation. This is particularly important for investors with longer time horizons who are seeking to maximize their retirement savings and maintain purchasing power in the face of inflation.

What Is The Difference Between Income Annuity And Fixed Annuity?

Income annuities and fixed annuities are both types of annuity contracts, but they differ in their primary purpose and payout structure. An income annuity is designed to provide a guaranteed stream of income for a specified period, often for the remainder of the annuitant’s life. The amount of each payment is determined by factors such as the initial investment, the annuitant’s age, and prevailing interest rates at the time of purchase. Income annuities are often chosen by retirees who prioritize a stable, predictable income stream to cover living expenses, without the need to worry about market fluctuations or the risk of outliving their savings.

In contrast, a fixed annuity focuses more on the preservation and growth of the invested principal, while still offering a guaranteed rate of return. With a fixed annuity, the insurance company agrees to pay the annuitant a fixed interest rate on their investment for a specified term, typically ranging from one to ten years. At the end of the term, the annuitant can choose to withdraw the accumulated funds, reinvest them in another annuity, or begin receiving annuity payments. Fixed annuities provide a lower but more predictable return compared to other investment options, making them attractive to risk-averse investors seeking stability.

While both income annuities and fixed annuities offer some level of guaranteed returns, they serve different purposes in retirement planning. Income annuities are primarily used to ensure a steady, lifelong income stream, while fixed annuities are chosen for their principal protection and modest growth potential. Ultimately, the choice between an income annuity and a fixed annuity will depend on an individual’s specific financial goals, risk tolerance, and retirement income needs.

What Is Better Than An Annuity For Retirement?

While annuities can provide a guaranteed income stream in retirement, there are several alternative investment options that may be better suited to an individual’s financial goals and risk tolerance. One of the most attractive alternatives is a well-diversified investment portfolio, which combines a mix of stocks, bonds, and mutual funds. A diversified portfolio offers the potential for greater long-term growth compared to the fixed returns of most annuities, while also providing flexibility to adjust the asset allocation as market conditions or personal circumstances change. This adaptability allows investors to optimize their retirement savings based on their evolving needs and risk profile.

Another popular retirement savings vehicle is a tax-advantaged account, such as a 401(k) or Individual Retirement Account (IRA). These accounts allow investments to grow tax-deferred, potentially leading to larger account balances over time. Additionally, 401(k)s and IRAs typically offer a wider range of investment options compared to annuities, giving investors more control over their portfolio composition and the ability to tailor their investments to their specific goals. Furthermore, these accounts provide greater liquidity than annuities, allowing investors to withdraw funds as needed, subject to certain rules and potential tax consequences.

Real estate investments and dividend-paying stocks can also be attractive alternatives to annuities for retirement income. Owning rental properties can generate a steady stream of passive income, while also offering the potential for long-term capital appreciation. Similarly, investing in high-quality, dividend-paying stocks can provide a combination of regular income and capital growth, with the added flexibility to sell shares if needed. Both real estate and dividend stocks can help diversify a retirement portfolio and provide a hedge against inflation, which is a key concern for many retirees.

Are Annuities Safer Than High-Risk Investment Types?

Yes, annuities are generally considered safer than high-risk investments due to their guaranteed income streams and protection from market volatility. While high-risk investments may offer the potential for greater returns, annuities provide a more stable and predictable option for risk-averse investors seeking reliable income in retirement.

Should Beginners Choose Annuities Over Stocks?

No, beginners should not necessarily choose annuities over stocks. While annuities offer predictable returns and guaranteed income, stocks have the potential for higher long-term growth. As beginners gain more knowledge and confidence in investing, a well-diversified portfolio that includes both stocks and annuities can provide a balance of growth and stability. The Essential Investment Guide for Beginners suggests starting with a mix of low-cost index funds or ETFs to build a strong foundation before considering more complex investments like annuities.

Can Annuities Replace Traditional Investment Diversification?

No, annuities cannot fully replace traditional investment diversification. Although annuities offer guaranteed income, they lack the growth potential and flexibility provided by a well-diversified portfolio consisting of stocks, bonds, and real estate. Investment Portfolio Diversification Strategies help mitigate risk while enhancing potential returns, making them a crucial component of a comprehensive retirement plan.

Do Active Investors Prefer Annuities Today?

No, active investors typically do not prefer annuities today, as they prioritize flexibility and control over their investments. Annuities provide guaranteed income but limit the ability to actively manage portfolios, whereas active investment differs by focusing on high-return, high-risk options like stocks and mutual funds that offer capital appreciation potential.

Are Risk-Averse Investors Better With Annuities?

Yes, annuities can be a better investment choice for risk-averse investors who prioritize stability and predictable returns over potential growth. By providing guaranteed income streams, annuities help protect risk-averse investors from market fluctuations and ensure a reliable income source in retirement. Understanding Risk-Averse Investment Behavior is crucial for these investors, as it allows them to align their investment decisions with their financial goals and emotional tolerance for market volatility.

Can Annuities Match S&P 500 Returns?

No, annuities cannot match S&P 500 returns. The S&P 500 historically delivers 10.4% average annual returns according to Goldman Sachs research from 2023, while fixed index annuities cap returns at 3-7% annually. Investors seeking market-level growth potential benefit from exploring the Guide to S&P 500 Investing for direct market exposure, though this approach carries higher volatility risk than annuities. Fixed index annuities trade growth potential for guaranteed income and principal protection.

Do Annuities Support Investment Growth Goals?

Yes, annuities do not support robust investment growth goals. Investment Growth Strategies typically provide 5-10% higher annual returns than fixed annuities according to a 2023 Morningstar investment performance study. Fixed annuities generate 2-4% average annual returns, while diversified stock portfolios historically deliver 7-12% annual returns over 10-year periods. Therefore, investors seeking capital appreciation choose growth-oriented investments like mutual funds, exchange-traded funds (ETFs), or individual stocks instead of annuities, which prioritize income stability over investment growth potential.

Are Annuities Good For Retirement Management?