Investment appraisal uses financial planning and financing techniques to evaluate potential investments or projects. Traders use it as an essential evaluation to discover long-term patterns and a company’s perceived profitability. The three most frequent investment appraisal methods for businesses are listed here. A payback period is the time between investing and breaking even. Divide the investment cost by the yearly revenue to calculate the payback period. Shorter payback periods are better since investors get their money faster. This method is qualitative and simple to comprehend. The payback period does not account for project risk and opportunity costs. Since investments are reimbursed sooner, shorter payback periods reduce risks. This is the major drawback of this method.

The difference between cash inflows and withdrawals over a specific time is net present value (NPV). NPV is a capital budgeting method that accounts for the time value of cash and estimates project profitability. The disadvantage of the NPV method is that it can give ambiguous answers. Money is worth more now than later because it has time to earn interest. Outflows and cash inflows are adjusted for the time value of money and interest rates. Capital budgeting calculates an investment’s expected return versus its initial cost using the accounting rate of return (ARR). The project is profitable if the ARR is equivalent to or greater than the needed rate of return, unlike NPV, which accounts for the time worth of money. Each method has pros and cons. Therefore, most projects use multiple! For a large project, qualitative assessment is also crucial. A project may not have the desired return, but you can proceed with it because of its effect on the business’s long-term plan.

What is Investment Appraisal?

Investment appraisal is an analytical process used to assess the viability and profitability of projects and investments. The process involves evaluating the risks, profits and benefits connected to the project or investment.

What are the different types of appraisal?

The 3 most important types of investment appraisal are following:

- Payback Period

- Accounting Rate of Return

- Net Present Value

1. Payback Period

The payback period is the time it takes a project to recoup its investment. In other words, it determines when the purchase will pay for itself. There is no profit or loss when the project generates the original capital. Investors want faster payback. It suggests sustainability, greater cash flow, and financial interest.

The formula for calculating the payback Period:

Payback period = Initial Investment/Cash flow per year

The payback period approach determines the time needed for an investment to recoup its initial cost, making it simple and understandable. It is ideal for quick evaluations and initiatives that require liquidity or cash flow. However, its fundamental drawback is ignoring the cash flows and time value of money after the payback period. This can cause investors to overlook long-term profits and miss out on better possibilities.

2. Accounting Rate of Return

The accounting rate of return is annual accounting earnings, net profit, or net profit as a proportion of investment. According to the market or business, shareholders or management approve projects with good ARRs over the necessary level and vice versa. The one with a high ARR is better than the two projects.

The formula for calculating ARR:

ARR = Average net profit / Average Investment

Investors and managers can readily calculate profitability compared to the initial investment using the accounting rate of return. This method simplifies calculation by using primary and publicly available accounting figures. ARR only considers accounting profits and ignores cash flow timing and project profitability, misleading it. This can favour projects with substantial short-term accounting profits but lesser economic value.

3. Net Present Value

The NPV method looks at how much money is worth over time. It figures out if a project will make money by taking the present value of the cash flows that will happen over a certain period and subtracting that amount from the original cash investment.

The formula for calculating Net Present Value:

NPV = Present value of future cash flows – Initial cash investment

If the NPV is positive, it means that the project makes money. On the other hand, a negative NPV means the opposite, so you shouldn’t go ahead with the task or investment choice.

The net present value method discounts future cash flows to their current value to account for the time value of money, improving project profitability. The opportunity cost of capital is considered in NPV, helping investors maximize shareholder wealth. However, evaluating discount rates and future cash flows for NPV is complicated and susceptible to assumptions. NPV can only sometimes give clear answers compared to projects with very different start-up costs or lengths of time.

What is project appraisal?

Project appraisal is a consistent procedure of reviewing a project and evaluating its material to approve or dismiss it by assessing the problem or need of the project. It generates solution options (alternatives), chooses the most feasible choice, executes a potential analysis of that choice, creates the solution statement, and determines all people and businesses engaged with or affected by the project. It analyzes the cost-effectiveness and project’s viability to justify it.

There are two techniques of project appraisal: Results Orientation and financial Appraisal (cost-benefit analysis). Results Orientation begins a project before any financial or material costs are spent. Results-oriented project appraisal identifies and predicts risks and their effect on project plans and contract outcomes. This appraisal identifies hazards using project management procedures, including initiation, execution, planning, and control. Outcome-oriented project assessment compares actual and predicted results to ensure they meet project objectives and goals.

Financial Appraisal project evaluation determines if a funding request or investment can be justified by predicted savings or income. Cost-benefit analysis helps you decide if an investment will benefit your company. It compares the investment or modification to alternatives based on cost, technical considerations, services, resource use, etc. The cost-benefit analysis contrasts project resources with predicted benefits. It’s common to compare a project’s advantages to its expenditures. This strategy accepts projects with a balance of advantages and expenses, rejects projects with an overflow of costs over benefits, and defers initiatives with excessive benefits over costs.

Some organizations take a different approach, accepting projects with projected benefit-cost ratios above one, borderline for further consideration, and rejecting those below zero before investing in or working on plans.

A project appraisal should examine how well a project will work for a business. It often evaluates a project’s financial and technological feasibility. An analytical framework that emphasizes non-technical and non-financial variables and provides instructions for incorporating them into project appraisal is because they are not thoroughly studied. Interviews with many US project-oriented organizations and a detailed analysis of one large and complex project are used to build such a framework. The framework identifies and analyzes non-financial project characteristics, how to assess them, their importance to project success, and how to include them in the assessment process. Non-financial factors include management, strategic and beneficial interactions with the company, social, environmental, political, and technical ties, and organizational issues (Project appraisal—a framework to assess non-financial aspects of projects during the project life cycle, M. D. S. Lopes, R. Flavell, 1998).

What does an investment project mean?

An investment project means a structured plan to spend liquid resources to make money. Before the actual investment, an investment project is created. Spending resources on an investment doesn’t always mean using our own resources; many investments are made by taking money. Expenses and gains are obtained at different times, and profits are delayed. Capital budgeting must consider this crucial reality. The investment aims to transform future reality by meeting people’s needs.

Investment projects must be carefully planned and include accurate revenue and expenditure estimates. They often involve evaluating profitability with capital budget indicators like IRR and NPV and discussing investment risks.

Capital investment projects have planned and emergent strategies. The emergent strategic aspects create a project plan to achieve corporate goals and adapt to organizational and market conditions. We discuss project strategy using corporate venturing literature. Project studies considering purposeful strategic factors have explained a project to implement its parent organization’s strategy exclusively. This paper discusses the parent-project connection and how its dimensions affect a project’s approach, which differs from its parent’s. The empirical study examines four Nestle Oil ventures. Depending on the parent’s capabilities, projects have some autonomy (Investment project as an internal corporate venture, E. Vuori, K. Artto, L. Sallinen, 2012).

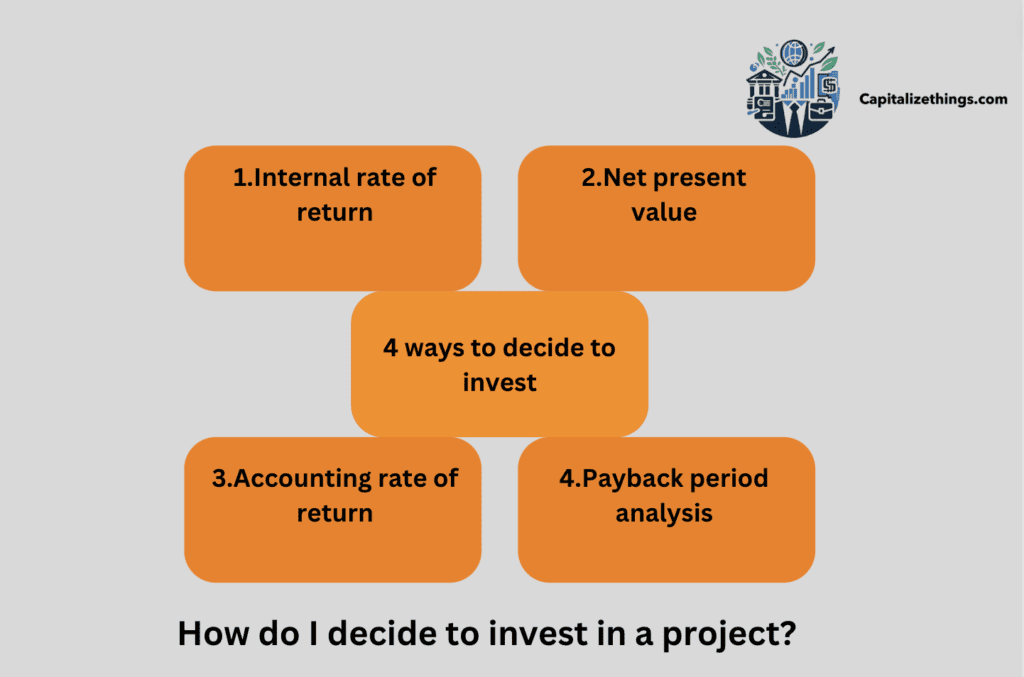

How do I decide to invest in a project?

There are 4 ways to decide to invest in a project:

- Internal rate of return

- Net present value

- Accounting rate of return

- Payback period analysis

1. Internal rate of return

The internal rate of return (IRR) is a project’s average annual return over its lifetime. Like the NPV, the IRR is a deferred cash flow analysis that accounts for money’s declining value. This strategy makes projects with higher expected IRRs more desirable. The IRR gives the investment’s rate of return, while the NPV gives its current monetary value.

NPV and IRR are often used together. Some projects have low IRRs but large NPVs, depending on initial investment inflows and net future outflows. This suggests that the project’s return can be lower than projected but that it adds value to the company.

2. Net present value

The net present value (NPV) method estimates a project’s net monetary gain or loss by bringing all future cash outflows and inflows to the present. The NPV helps business owners determine the worth of a long-term project by considering that money grows less quickly over time.

3. Accounting rate of return

A project’s accounting rate of return (ARR) is the annual net income divided by its initial investment. Say you want to acquire $1 million in equipment. If goods earned $80,000 a year, the project has an 8% ARR. High ARR projects are more desirable when compared. ARR is often used for project appraisal due to its simplicity, although it leaves out essential details. ARR ignores the time value of money, which gives a dollar now more value than a dollar in five years since you can invest it to earn a return. ARR also ignores cash flows, which are vital to investment projects.

4. Payback period analysis

The payback period is when it takes to return a project’s net original investment in cash inflows. It is often used to assess investment risk. Shorter payback periods are safer investments. This strategy ignores the time value of money and net cash flows after the original investment is recovered.

What are the best projects to invest in?

The following 6 are the best projects to invest in:

- Inclusive healthcare investing

- Adaptation and resilience

- BIPOC-led small businesses

- Demographic Business

- Technical assistance services

- Impact Investment

1. Inclusive healthcare investing

Emerging market inclusive healthcare investing is rising. Investors in private clinics, biotech, hospitals, diagnostics, and pharmacies solving service access and quality issues for $5-30-a-day consumers are succeeding. We found this in a market landscape research report for Investors for Health.

2. Adaptation and resilience

Adaptation and resilience programs receive only 5% of climate finance pledges, suggesting that donors and financiers must better balance mitigation, resilience, and adaptation investment. When adapting to climate change, most of the work will fall on the countries that can be the least affordable.

3. BIPOC-led small businesses

Historically, women-led small and BIPOC enterprises have had less equity or loan financing in the US. BIPOC-led small businesses had lower loan acceptance rates and more minor loan levels than non-minority entrepreneurs, while BIPOC-led and women small firms obtained less VC funding.

4. Demographic Business

Demographic, behavioural, and business criteria, such as financial literacy, revenue growth, and managerial expertise, are best for identifying high-potential female small business owners and personalizing their financial and other services.

5. Technical assistance services

Technical assistance, Undervalued, and enterprise support services that use five essential concepts, the acronym SCALE, have been shown to increase efficacy. They boost small and growing firms’ performance, income, and job creation.

6. Impact Investment

Responsible exits in impact finance are as important as responsible entries because the exit levers to ensure impact are considerably fewer than before and during investing. The most crucial levers are aligning the investor and investee’s impact strategy before investment and helping the investee implement impact initiatives.

What is the purpose of investment appraisal?

The main purpose of investment appraisal is the traders need of this method, because it is a form of basic analysis. As such, it can tell a trader if a stock or business has long-term potential by looking at how profitable its future projects and efforts will be. Cash flow suffers, if a corporation has multiple long-term investment initiatives, costs, profits, expenses, and cash flows. This is something traders must examine before buying a company’s shares.

A company management investment appraisal primary goal is to assess its profitability and viability. Capital budgeting, or investment assessment, is essential to corporate management. Financial methods are used to evaluate investment opportunities. The goal is to analyze if a proposed investment would deliver more value to the organization than it costs. Investment assessment informs managers’ resource allocation decisions. It objectively compares investment alternatives based on the predicted rate of return, hazards, and time value of money. This lets managers prioritize investments that will yield the maximum returns and support the company’s strategic goals.

The investment appraisal methodologies include the payback period, IRR, NPV, and profitability index. Each method has cons and pros, and choosing one can significantly affect the appraisal. Therefore, managers should understand each method’s assumptions and limits and apply a mix of ways where appropriate. Investment appraisal considers environmental, social, and company values, strategic orientation, and financial aspects. Today, businesses are expected to be socially responsible and sustainable, making this crucial.

What is investment appraisal in a level business?

Investment appraisal is a method businesses use to assess anticipated investments and their worth. Many IA methodologies are used to compare projects that are contesting for a business’ investment resources. Investment evaluation uses discounted cash flow, IRR, payback, and cost-benefit analysis to calculate ROI and NPV. Investment appraisal evaluates investments’ profitability and cost-effectiveness. The goal is to assess investor interest in the investment. Internal Rate of Return, Net Present Value, and Annuity are employed. Small-scale investments use the payback and ROI methods (Investment Appraisal Methods, P. Konstantin, Margarete Konstantin, 2018).

What is the investment appraisal process?

A business appraisal uses two main ways to measure things. The first can be made more easily than the other because it is a payback estimate. Payback calculations are used to anticipate cash flow for change or development projects. The expert must make a list of all the real costs and benefits to calculate the payback. After seeing this, the analyst can guess how much cash will come over a certain amount of time. Cumulative cash flow over the years shows that benefits exceed expenditures by Year 3 and accrue afterwards.

The next method is NPV/DCF. This method takes into account how much money is worth over time. It implies that all cash flows are changed to account for things like inflation. Most of the time, accountants figure out the DCF rate, but anyone can do it by looking at a number of financial factors.

Now, you should be working on finishing the business case. Remember that only some companies’ cases will use every business analysis method. Which techniques or tools you use to make your business case will base on the project’s size and type. After making your business case, you can show it to the top managers and ask them to approve it. As soon as a choice is accepted, you can begin making plans for the accepted change or venture.

Why is the investment appraisal process so important?

Investment Appraisal is important because it helps managers determine if and how much project revenues will overcome risk. Investment appraisal calculates financial income and expenditures to evaluate an investment. Investment Appraisal is becoming more widespread in firms before new investments are approved or abandoned. Managers improve at using business tools to analyze investments.

What are the limitations of traditional investment appraisal?

The limitations of the traditional investment appraisal commonly overlooks return timing, Risk, and non-financial elements. Methodologies like payback period, ARR, and NPV typically overlook risk. These strategies usually consider investment returns without considering their likelihood. The appraisal must assess risks and uncertainties, which might lead to unduly optimistic investment decisions.

Return timing is another issue. Traditional methodologies like the payback period only examine how long it will take to recoup the initial amount invested, not when the rewards will come. Due to inflation and other circumstances, money values change over time, making this troublesome. Thus, a faster-returning investment is better than one with larger yields over time.

Furthermore, standard investment appraisal methodologies often ignore non-financial issues. Environmental impact, social impact, and strategic alignment with company goals are examples. These characteristics do not directly affect an investment’s financial performance but can affect its long-term profitability. An investment with a high return but an adverse effect on the environment can encounter regulatory issues or reputational damage, affecting its profitability.

Last, traditional methods can only accurately forecast future performance using historical data. This is important in today’s fast-changing corporate climate, when prior performance only sometimes predicts success. Thus, traditional investment evaluation techniques can be valuable, but they should be combined with other tools and procedures to offer a more complete and precise evaluation of possible investments.

What is the formula of investment appraisal?

The formula of investment appraisal depends on the appraisal method used. Using the profitability index technique, the formula is “present value of future cash flows divided by the initial investment.” Payback period formula: original investment divided by cash flow per year.

What are the advantages and disadvantages of investment appraisal?

Here are the negative and positive sides of the business evaluation methods we’ve discussed. By looking at the good and bad points of each technique, you can choose the best one to use at different times:

Payback period

Pros: Helpful when there isn’t enough cash flow. The importance of getting a return is emphasized.

Cons: The post-payback situation is ignored.

Average rate of return

Pros: The only method that takes profit into account.

Cons: The average earnings can be false and hide significant changes.

Net profit value

Pros: Knows that money gets less valuable over time.

Cons: Deciding at the proper rate of discount.

What are non-financial appraisal methods?

Non-financial appraisal methods assess an organization or person’s non-financial attributes. These strategies expand performance and effectiveness perspectives. 6 of the standard non-financial assessment methods are given below:

- Skill-Based Methods: Using job-specific skills and competencies to evaluate performance.

- Psychological Appraisals: Evaluating a person’s psychological features, motives, and behaviour for job performance

- Assessment Centres: Inspectors evaluate candidates or employees on job-related duties and behaviours during simulated work exercises.

- Performance Appraisal Interviews: Managers and staff meet to analyze performance, evaluate strengths and flaws, and set improvement targets.

- Peer Review: Evaluation by colleagues in the same organization on cooperation, teamwork, and professional connections.

- Management by Objectives: Managers and staff set goals together and evaluate performance based on their achievements.

What are the non-financial factors to consider in an investment appraisal?

Non-financial factors for consideration in an investment appraisal are:

- Ensure compliance with existing and future laws, industry standards, and best practices.

- increasing team morale, making recruitment and retention simpler

- enhancing supplier-customer interactions

- boosting your business’s reputation and relations with the community

- enhancing your business’s capabilities, such as learning new skills or improving management systems

- Predicting and addressing future threats, such as preserving IP from competition

How to Include Non-Financial Factors in NPV Evaluation?

Following 3 methods can be used to include non-financial factors in NPV evaluation:

1. Qualitative analysis

Before calculating a project’s payback period and NPV, qualitatively analyze its non-financial elements. PEST, SWOT, and stakeholder evaluation can help you identify project stakeholders’ strengths, opportunities, weaknesses, threats, political, social, economic, and technological variables, and interests and expectations. This will assist you in comprehending the project’s context and effects beyond finances.

2. Sensitivity analysis

Using a sensitivity analysis, you can determine how sensitive project results are to assumptions and variables after calculating the payback period and NPV. Adjust the discount rate, cash flow estimates, inflation rate, or exchange rate to see how they affect payback duration and NPV. You can also measure or score non-financial elements to examine how they affect project ranking or selection. This can help you understand project risk, uncertainty, and how non-financial elements affect financial outcomes.

3. Scoring method

Scoring method can also include non-financial aspects in the payback period and NPV calculations. Non-financial elements are rated by importance or preference and given numerical values. You can rank non-financial variables, including strategic fit, economic benefit, social effect, and consumer loyalty, on a 1–5 scale. To calculate a weighted score, multiply the scores by the project’s payback period or NPV. Evaluate the weighted scores of several projects and pick the highest.

4 Decision matrix

Decision matrices can help you include non-financial considerations in the payback period and NPV calculations. Decision matrix tables give criteria and choices for decision problems. NPV, Payback period, and other project-related non-financial considerations can be used. Give each criterion weight based on importance and rate each alternative on how well it meets each criterion. Multiply the weights and ratings and add them to get each alternative’s score. You can choose the one with the highest score.

5. Judgment and Intuition

While judging and foreknowledge, do not base your investment decision exclusively on payback duration and NPV. Use your judgment and intuition to examine non-quantifiable aspects like your vision, ethics, values, and gut feeling. Consulting with experts, participants, or co-workers can provide new project views. Review and adjust your decision occasionally. Know your assumptions and biases that influence your decision-making.

How to Adjust Hurdle Rate for Non-Financial Factors?

Always change your hurdle rate for non-financial factors after assessing its reasons. Your base hurdle rate, usually defined by the weighted average cost of capital, can be increased or decreased by a premium or discount. The price or discount should represent non-financial impacts on your project or investment. A project with significant environmental or social benefits have a reduced barrier rate to reflect these benefits. You boost your hurdle rate for strategic or competitive projects to represent the higher potential cost. The change should reflect your analysis and your company’s goals.

What are the non-financial factors that influence project risk?

Non-financial factors include management, strategic and collaborative impacts with the company, political, social, environmental, and technical ties, and organizational issues.

What is the payback period in financial management?

THe payback period in financial management is actually the time it takes to break even. The payback period is crucial because people and businesses invest to get paid back. Shorter paybacks make investments more appealing. Anyone can calculate the payback period by dividing the initial amount invested by the average cash inflow.

The payback period calculation is easy. It ignores the time value of currency, rising inflation, and complex investments with unequal cash flow. The discounted payback period is calculated to address flaws using the present value of future cash flows. The discounted payback period suggest an undesirable investment, while the quick payback time can indicate a positive. The video below explains payback period in simplest possible way.

What is the payback period in finance?

The Payback Period in finance displays how long a corporation takes to repay an investment. If time is crucial, corporations can use this methodology to assess investment options and choose the one that returns their investment the fastest.

What is the formula for the payback period?

The formula for the payback period is following:

Payback Period = Initial investment / Cash flow per year

What are good payback periods?

Five years is a good investment payback period. The payback period is important in the energy list, which contains EIA-subsidized measures. Many initiatives must pay back in five to 25 years.

How do you know if a project is worth investing in?

The fundamental principle of investment is that money today is worth more than money tomorrow guides the calculation of NPV. A project with a positive NPV value is acceptable.

Conclusion

Investment appraisal evaluates a project’s viability. It covers methods for assessing long-term project profitability. Three investment appraisal methods are the average rate of return, payback period, and net present value. Project payback time is the time it takes to make up an investment. It estimates when revenues will pay costs. Its downside is that the payback time reveals how long it takes for the ROI; it does not show the ROI itself. ARR is an investment’s average annual return (profit). It’s a proportion of the initial investment. Calculation of the ARR method is easy. Its disadvantage is that it’s unable to forecast the timings of cash flow. Future projected financial flows are valued at net present value (NPV). Predicted cash flows are applied to determine NPV. It is a simple and helpful method to predict future trends. The third method of investment appraisal is IRR. Its calculation process is easy to understand. It is unable to find risk and uncertainty, which is its big drawback.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.