Investment banking facilitates companies to improve coins by way of issuing shares or bonds. Asset control invests for customers to develop their wealth. Investment banking handles quick-time period responsibilities. Asset management makes a specialty of lengthy-time period boom. Both fields provide extraordinary salaries and need sturdy skills. Investment banking increases capital for clients through mergers, acquisitions, and issuing securities.

Asset management manages shares, bonds, and other belongings. Investment bankers’ paintings on brief-term initiatives. Asset managers awareness of the lengthy-time period wealth boom. Investment banking offers excessive earnings ability, a fast-paced environment, and professional development. It entails primary offers and excessive-profile transactions. High strain, long hours, severe competition, and strain to meet time limits represent funding banking. It can cause burnout.

Asset management gives steady work-lifestyles stability, stable earnings, much less stress, strong consumer relationships, and mastering possibilities. It focuses on lengthy-time period goals. Asset management has decreased profits capacity, marketplace volatility affects profits, calls for continuous marketplace analysis, and has a danger of consumer dissatisfaction. Investment banking has higher profits and risks. Asset management offers steady, mild income with lower risks. Both fields control financial risks.

What Is Investment Banking?

Investment banking helps corporations and governments boost cash. It does this via issuing stocks or bonds. Investment bankers additionally assist with mergers, acquisitions, and different large monetary deals. They paintings on short-term initiatives and consciousness on high-profile transactions. This discipline requires sturdy financial competencies, analytical competencies, and a deep know-how of the marketplace. Investment bankers regularly deal with complex monetary systems and strategic making plans. Their work is crucial for organizations looking to extend or restructure.

What Is Asset Management?

Asset management entails investing money on behalf of clients. The intention is to develop their wealth over time. This consists of coping with investments in shares, bonds, actual estate, and other assets. Asset managers attention on lengthy-term monetary desires and intention to provide steady returns. They build and maintain sturdy relationships with clients, information about their monetary desires and threat tolerance. This area calls for non-stop marketplace evaluation, endurance, and a strategic approach to investment. Asset managers need to conform to market modifications to shield and develop their clients’ investments.

What Is the Difference Between Investment Banking and Asset Management?

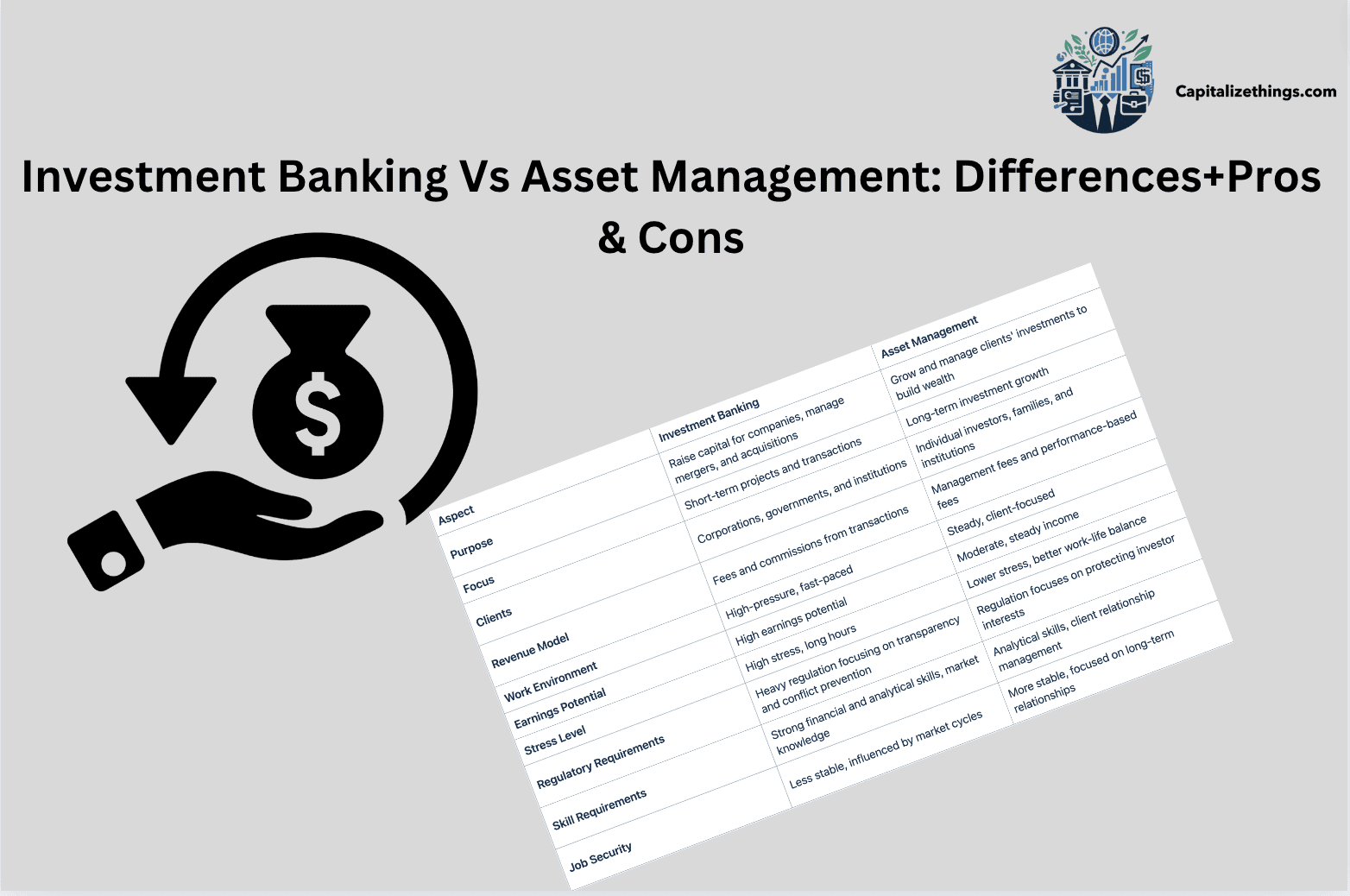

The table outlines the important differences between investment banking and asset management. Investment banking ordinarily deals with elevating capital for organizations, managing mergers, and dealing with brief-time period transactions. It serves businesses, governments, and establishments, income sales via fees and commissions. The work surroundings are rapid-paced and excessive-pressure, supplying high earnings however additionally excessive stress and lengthy hours.

| Aspect | Investment Banking | Asset Management |

| Purpose | Raise capital for companies, manage mergers, and acquisitions | Grow and manage clients’ investments to build wealth |

| Focus | Short-term projects and transactions | Long-term investment growth |

| Clients | Corporations, governments, and institutions | Individual investors, families, and institutions |

| Revenue Model | Fees and commissions from transactions | Management fees and performance-based fees |

| Work Environment | High-pressure, fast-paced | Steady, client-focused |

| Earnings Potential | High earnings potential | Moderate, steady income |

| Stress Level | High stress, long hours | Lower stress, better work-life balance |

| Regulatory Requirements | Heavy regulation focusing on transparency and conflict prevention | Regulation focuses on protecting investor interests |

| Skill Requirements | Strong financial and analytical skills, market knowledge | Analytical skills, client relationship management |

| Job Security | Less stable, influenced by market cycles | More stable, focused on long-term relationships |

Asset management makes a specialty of developing and dealing with customers’ investments over a long time. It serves personal buyers, households, and institutions, earning sales via control charges and overall performance-based costs. The painting’s surroundings are greater client-targeted and consistent, with lower pressure and better paintings-lifestyle balance. Asset management requires robust analytical abilities and purchaser relationship control, and it tends to provide extra strong process safety. The most common point among is the analytical investment skills between both of them.

What Is the Salary Difference Between Investment Banking and Asset Management?

Investment banking typically gives higher salaries than asset control. Investment bankers frequently earn greater because of excessive-pressure paintings and long hours. Asset management salaries are commonly decreasing however offer better paintings-existence stability. Both fields provide suitable pay, but funding banking commonly pays extra prematurely.

What Is the Difference Between Asset Management Company And Investment Bank?

An asset control organization invests clients’ cash to develop their wealth. It manages shares, bonds, and different assets. An investment financial institution facilitates corporations to increase money by using issuing stocks or bonds and dealing with mergers. Asset control makes a specialty of managing investments long-time period. Investment banks manage economic offers and capital raising.

What Is the Difference Between Asset Management Vs Investment Management?

Asset management and funding management are comparable. Asset control focuses on developing customers’ wealth through diverse investments. Investment control additionally includes making choices about investments however might also include unique strategies for accomplishing economic goals. Both manage investments, but asset management is broader, at the same time as funding management can be more specialized.

What Is the Difference Between Investment Banking and Wealth Management?

Investment banking increases capital for businesses via deals like mergers and issuing securities. Wealth management allows people to manage and grow their personal wealth. Investment banking makes a specialist of corporate finance, and high stakes offers. Wealth management is more about non-public monetary planning and lengthy-term investment strategies.

Which Is Better, Asset Management or Investment Banking?

Choosing between asset control and investment banking depends on your career desires. Investment banking gives higher salaries and dynamic paintings however comes with excessive strain and lengthy hours. Asset control offers constant earnings, higher work-lifestyles balance, and makes a specialty of lengthy-term client relationships. Both fields have their pros and cons, so the better preference depends on what you cost in your career.

What Type of Clients Do Investment Banks and Asset Management Serves?

Investment banks serve big groups, governments, and establishments. They assist with elevating capital and fundamental financial deals. Asset control serves character investors, households, and institutions. They pay attention to dealing with and growing clients’ investments over the years. Investment banks work on large transactions and financial strategies. Asset managers build lengthy-time period investment plans for customers.

How Does the Revenue Model Differ Between Investment Banking and Asset Management?

Investment banking earns sales through expenses and commissions from deals like issuing stocks, bonds, and mergers. They fee for advisory offerings and transaction execution. Asset management earns money by means of charging management fees based totally on a percentage of property below control. They may also earn overall performance costs if investments exceed goals. Investment banks are conscious of excessive-fee, brief-term transactions, even as asset managers rely upon ongoing control prices.

How Do Regulatory Requirements Vary Between Investment Banking and Asset Management?

Investment banking is heavily regulated because of its involvement in big economic transactions and market sports. Regulations recognition on transparency, disclosure, and preventing conflicts of interest. Asset management is likewise regulated however it focuses extra on safeguarding customers’ investments and making sure fair practices. Regulations for asset management encompass guidelines on investment techniques, reporting, and purchaser disclosures. Both fields need to follow strict compliance however with special focuses.

What Is the Difference Between An Asset Manager And An Investment Advisor?

An asset supervisor handles and grows customers’ investments, making choices on their behalf. They manage portfolios and belongings lengthy-time period. A funding consultant provides economic advice and hints to clients. They assist with funding picks and making plans but may not control property at once. Asset managers cognizance on handling investments, even as funding advisors provide steering and recommendation.

What Is Asset Management in Banking?

Asset management in banking entails handling and making an investment clients’ property to develop their wealth over time. Banks provide asset control services to individuals, families, and institutions. This includes growing and coping with funding portfolios with stocks, bonds, actual property, and other economic assets. Asset managers investigate client’s economic dreams, risk tolerance, and investment choices to construct tailor-made strategies.

They frequently evaluate and adjust portfolios to fulfill changing marketplace situations and customer needs. The goal is to maximize returns even when coping with danger. Asset management offerings also include strategies like monetary planning, retirement making plans, and wealth protection. This carrier facilitates customers to gain long-term monetary dreams and make certain their investments align with their ordinary monetary approach. Learn more about asset management in the video below.

What Are the Best Asset Management Companies?

Here are 7 of the great asset management agencies globally, recognized for their robust overall performance, popularity, and range of services:

- BlackRock – The biggest asset supervisor within the world, providing an extensive variety of investment answers across diverse asset training.

- Vanguard – Known for its low-priced index finances and ETFs, Vanguard offers vast investment alternatives and robust overall performance.

- Fidelity Investments – Offers comprehensive asset management services, together with mutual budget, ETFs, and retirement making plans.

- State Street Global Advisors – Specializes in investment control and is understood for its modern financial answers.

- J.P. Morgan Asset Management – Provides diverse funding strategies and has a sturdy international presence.

- Goldman Sachs Asset Management – Offers various investment merchandise and is understood for its expertise in market insights.

- Morgan Stanley Investment Management – Provides tailored funding answers with a focus on consumer desires and marketplace tendencies.

These organizations are diagnosed for his or her understanding, strong economic performance, and comprehensive asset control services.

What Are the Pros and Cons Of Asset Management And Investment Banking?

Asset control gives a strong work environment and consistent profits. Professionals in this area recognize lengthy-time period growth, which may be less demanding as compared to the short-paced global funding banking. They construct robust purchaser relationships and offer personalized financial recommendations. However, the sector has decreased profits potential in comparison to funding banking. Market volatility can affect income, and the paintings may be gradual paced. Asset managers ought to always examine market trends and adapt techniques. Additionally, patron dissatisfaction and the stress to outperform benchmarks can be hard.

Investment banking offers high incomes capacity and a dynamic, rapid-paced painting surroundings. Professionals in this area work on fundamental deals and transactions, presenting big professional advancement possibilities. They benefit from publicity to big-scale economic activities and build good sized networks. However, investment banking is understood for its high strain stages and long working hours. The competitive nature and strain to meet tight cut-off dates can lead to burnout. Work-lifestyles balance is difficult, and task stability can be unsure because of the enterprise’s volatility.

What Are the Key Differences in Risk Exposure For Investment Banks Compared To Asset Managers?

Investment banks face big market and credit score dangers from buying and selling and big loans. They also cope with excessive operational dangers due to their rapid-paced surroundings. Asset managers, however, are frequently uncovered to investment risks from fluctuating asset values and customer risks if performance falls short. They also face regulatory dangers, desiring to comply with investor protection policies. Overall, investment banks address greater volatile and operational risks, while asset managers are aware of investment and consumer-related risks.

Does Asset Management Pay More Than Investment Banking?

No, asset management normally does not pay extra than funding banking. Investment banking normally offers better salaries and bonuses due to the high-stress, excessive-stakes nature of the paintings and the vast sales generated from fundamental monetary offers. Asset management salaries usually decrease but can consist of performance-primarily based bonuses. Overall, investment banking tends to offer higher overall compensation compared to asset management.

Is Asset Management the Same as Investment Management?

Yes, asset control and funding management are the same. Both involve handling customers’ investments to reap monetary boom. This includes creating and overseeing portfolios with property like shares and bonds. The purpose is to maximize returns while managing hazard primarily based at the consumer’s monetary targets.

How Do You Become an Investment Banker?

To become an investment banker, you commonly want a bachelor’s diploma in finance, economics, or commercial company. Many pursue an MBA or different superior degrees. Gaining experience via internships is essential, at the side of sturdy analytical abilities. Networking and information financial markets are critical for achievement in this location.

What Do I Need to Become An Asset Manager?

To emerge as an asset supervisor, you usually need a bachelor’s degree in finance, commercial employer, or an associated discipline. Professional certifications just like the Chartered Financial Analyst (CFA) are frequently required. Experience in finance and sturdy analytical abilities are essential, on the facet of the ability to build purchaser relationships and communicate investment strategies successfully.

What Is the Major Difference Between Investment Banking and Hedge Fund?

The difference between investment banking and hedge fund is that investment banking specializes in elevating capital, managing mergers, and providing economic recommendation. Whereas Hedge budget control investments the use of diverse strategies to generate high returns, regularly the usage of excessive-threat techniques. While funding banking deals with organization finance and advisory services, hedge charge range supply interest to reaching returns thru aggressive funding strategies.

Conclude

Investment banking and asset management serve wonderful roles in finance. Investment banking focuses on raising capital, managing mergers, and coping with fundamental monetary transactions, frequently related to high stress and sizable profits potential. Asset management, however, centers on growing and dealing with clients’ investments over the long time, imparting steady profits and better work-lifestyles stability. Both fields demand robust financial abilities and know-how however present precise challenges and blessings.

Ultimately, choosing between funding banking and asset control relies upon personal profession desires and choices. Investment banking gives higher pay and a dynamic environment but comes with excessive stress and lengthy hours. Asset management offers extra balance and consumer-centered work but commonly has lower profits potential. Each discipline calls for a distinct ability set and method to monetary control.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.