Investment banking focuses on helping organizations boost money and giving recommendations on big offers. They help with mergers, acquisitions, and promoting stocks and bonds. Investment banks work with massive businesses and rich clients. Commercial banking facilitates human beings and organizations with normal cash desires. They provide checking and savings accounts, loans, and credit cards. Commercial banks paintings with everyday humans and small to medium corporations. Investment banking is excessive risk however will have excessive profits. The income relies upon a hit offer. Commercial banking decreases risk however has consistent earnings from interest and costs. Each has its own blessings and disadvantages based on your wishes.

Investment banking makes a speciality of raising cash and big deals. It facilitates mergers, acquisitions, shares, and bonds. Commercial banking specializes in everyday cash desires. It gives accounts, loans, and credit score cards. Investment banking is an excessive threat with excessive profits. Profits depend on successful deals. Commercial banking is low risk with steady profits. Profits come from interest and fees. Both have execs and cons.

What Is Investment Banking?

Investment banking enables agencies and governments to raise cash. They advocate large offers like mergers and acquisitions. They additionally help promote stocks and bonds. Investment banks paintings with large companies and rich clients. They pay attention to making big earnings through investments. They try this through high-chance deals. They offer expertise in complex financial transactions. This makes them key gamers inside the monetary international.

What Is Commercial Banking?

Commercial banking enables ordinary human beings and groups with normal money wishes. They offer checking and savings money owed. They also offer loans and credit playing cards. Commercial banks work with small to medium-sized corporations. They are conscious of consistent profits. They earn cash from their hobby on loans and fees. They offer critical services for every day monetary sports. This makes them critical for the financial system.

What Is the Difference Between Investment Banking And Commercial Banking?

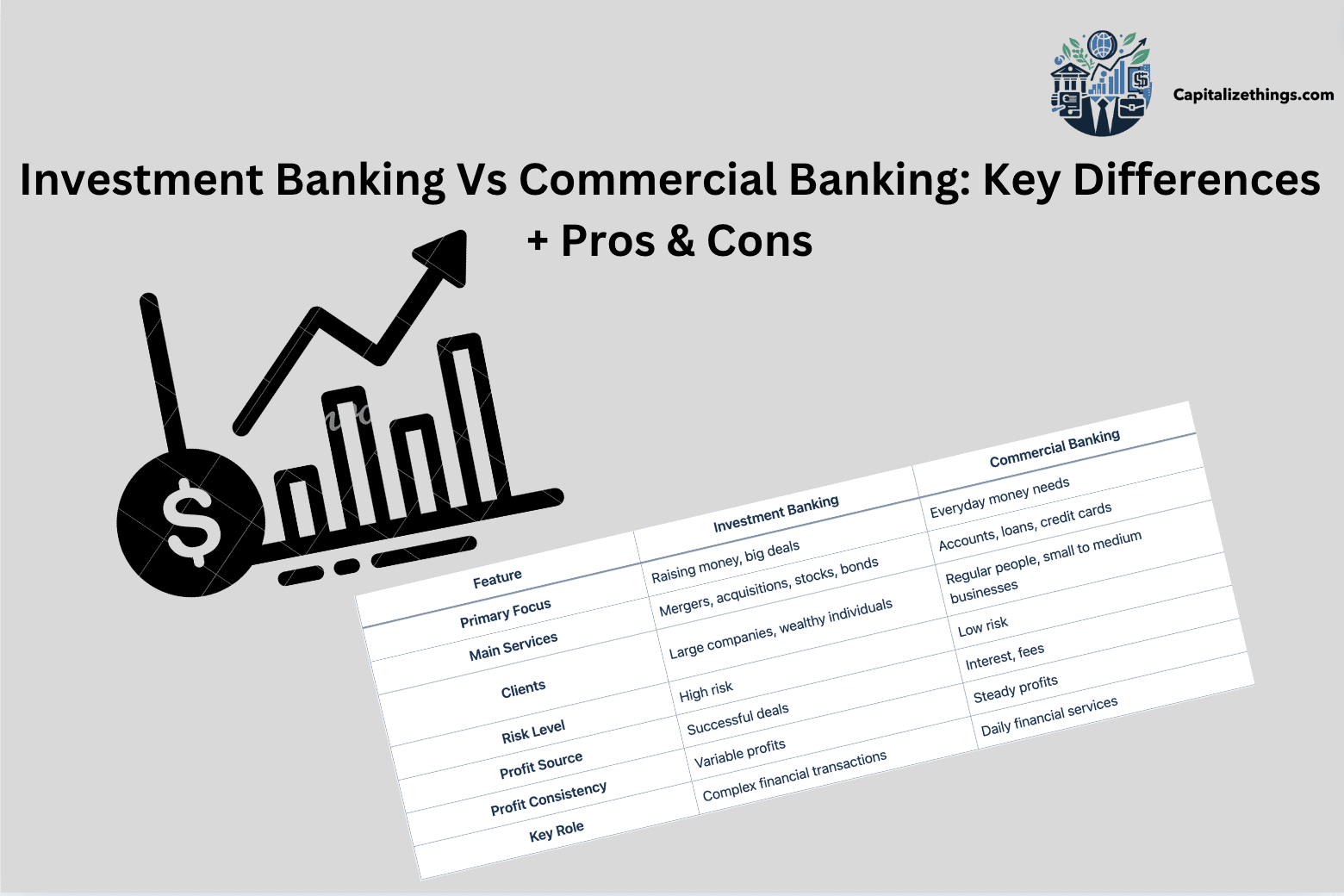

| Feature | Investment Banking | Commercial Banking |

|---|---|---|

| Primary Focus | Raising money, big deals | Everyday money needs |

| Main Services | Mergers, acquisitions, stocks, bonds | Accounts, loans, credit cards |

| Clients | Large companies, wealthy individuals | Regular people, small to medium businesses |

| Risk Level | High risk | Low risk |

| Profit Source | Successful deals | Interest, fees |

| Profit Consistency | Variable profits | Steady profits |

| Key Role | Complex financial transactions | Daily financial services |

The table indicates the key variations among investment banking and commercial banking. Investment banking focuses on elevating cash and massive deals. Their principal services include mergers, acquisitions, shares, and bonds. They serve large corporations and rich people. They involve excessive chances with variable income from a hit offer. Commercial banking focuses on ordinary cash desires. Their principal offerings include debts, loans, and credit cards. They serve normal people and small to medium agencies. They contain low threat with consistent earnings from hobby and costs. Each form of banking plays a completely unique and critical function within the monetary world.

What Is the Salary Difference Between Investment Banking and Commercial Banking?

The salary difference between investment banking and commercial banking is that investment bankers typically earn better salaries than commercial bankers. This is due to the fact their jobs involve high threat offers and huge earnings. They may additionally get huge bonuses for successful deals. Commercial bankers have extra constant and predictable salaries. Their profits come from normal interest and costs. The better danger and reward in investment banking led to larger paychecks in comparison to the steady, decrease-threat work of commercial banking.

What Type of Clients Do Investment Banks and Commercial Banks Serves?

Investment banks serve massive agencies, governments, and wealthy individuals. Their clients want to assist with huge monetary deals and elevating capital. Commercial banks serve everyday people and small to medium-sized organizations. Their clients need regular financial offerings like bills and loans. The type of customers differs based totally on the offerings and know-how every financial institution offers. Investment banks handle complex transactions, while business banks handle financial desires each day.

What Is the Financial Difference Between Investment Banking And Commercial Banking?

The financial difference between investment banking and commercial banking is that investment banking entails high-risk, excessive-reward deals. They make money from successful mergers, acquisitions, and stock income. Their profits can be huge however range greatly. Whereas commercial banking includes lower-chance, constant earnings from interest and fees on loans and money owed. Their income is extra predictable and regular. The economic distinction lies inside the stage of danger and the source of income. Investment banks intention for big wins, at the same time as business bank’s purpose for regular earnings.

What Positions Do Investment Banking and Commercial Banking Offer?

The positions offered by investment banks are an analysts, an associates, and handling administrators. These roles awareness on financial evaluation, deal-making, and consumer advisory. Whereas commercial banks offer positions like tellers, loan officers, and branch managers. These roles awareness on customer service, mortgage processing, and branch operations. Each banking area has distinct profession paths. Investment banking positions are excessive-pressure and excessive-reward, while commercial banking positions are more stable and patron-orientated.

How Does Investment Banking and Commercial Banking Differs In Performance?

In performance investment banking depends on the fulfillment of massive deals and marketplace conditions. High-hazard deals can cause huge earnings or large losses. Their performance can be risky. Whereas Commercial banking overall performance is greater. It relies upon the regular go with the flow of hobby and charges from regular banking activities. Their risk is lower, leading to more consistent overall performance. The essential difference is inside the danger and variability in their monetary effects.

What Are the Pros And Cons Of Investment Banking And Commercial Banking?

The pros and cons Of investment banking and commercial banking is that the Investment banking gives high earning capability. Professionals can earn massive salaries and bonuses from success offers. It provides opportunities to work on complicated, excessive-profile transactions, presenting precious revel in and networking. The field is dynamic and speedy paced, which may be exciting for those who thrive below pressure. Cons: The excessive-danger nature of the work method there can be tremendous monetary losses. The process often requires lengthy hours and high pressure, impacting paintings-lifestyle’s balance. The competitive surroundings also can be excessive and challenging.

Whereas commercial banking offers solid and predictable earnings. Employees typically have a better work-life balance with more regular hours. The job specializes in presenting vital services to regular humans and agencies, which may be worthwhile. There is generally a decreased risk of worry, making the work surroundings less worrying. Cons: Earnings normally decrease as compared to investment banking. The work may be repetitive and less dynamic. Career advancement can be slower, and the possibilities of paintings on excessive-profile transactions are constrained. The field might also offer fewer networking possibilities.

Which Is Better, Investment Banking or Commercial Banking?

Investment banking is better for individuals who are seeking excessive earnings and enjoy a quick-paced, excessive-chance environment. It offers the ability for large bonuses and the excitement of large deals. However, it comes with long hours and excessive stress. Commercial banking is better for individuals who choose balance and a balanced work-existence. It affords regular profits, normal hours, and a decrease-chance environment. The choice depends on a person’s career desires and life-style options.

Is Deutsche Bank a Commercial Or Investment Bank?

Deutsche Bank is a business and funding bank. It affords an extensive variety of monetary offerings. As a commercial bank, it gives regular banking wishes like checking and financial savings accounts, loans, and credit score playing cards. As an investment bank, it enables mergers, acquisitions, and capital elevating. Deutsche Bank serves everyday clients and massive organizations. Its twin position makes it a key participant in both sectors.

Is Jp Morgan a Commercial Bank Or Investment Bank?

JP Morgan is an commercial and investment economic organization. On the industrial facet, it gives conventional banking offerings collectively with economic financial savings and checking debts, mortgages, and enterprise loans. On the funding factor, JP Morgan offers offerings like underwriting, mergers and acquisitions, and asset control. The bank serves an in-depth variety of clients, from people to large organizations and governments. This versatility makes it one of the primary global economic establishments.

Is Morgan Stanley A Commercial Bank Or Investment Bank?

Morgan Stanley is ordinarily a funding bank. It specializes in massive economic deals, wealth management, and funding services. Unlike many different banks, Morgan Stanley does not now offer conventional industrial banking offerings like checking bills or retail loans. Instead, it focuses on offerings consisting of mergers and acquisitions, trading, and advisory for massive agencies and rich people. Its expertise in these regions makes it a dominant pressure in the funding banking zone.

Can You Get into Investment Banking From Corporate Banking?

Yes, you could get into funding banking from corporate banking. The abilities and enjoyment received in corporate banking, consisting of financial evaluation, client management, and information of commercial enterprise budget, are valuable in investment banking. To make the transition, networking is crucial. Building relationships with experts in funding banking can open doorways. Additionally, gaining relevant certifications or in addition education in finance can improve your qualifications.

Can You Transition from Commercial Banking To Investment Banking?

Yes, you could transition from business banking to investment banking. The transition may require extra education and a strategic method. Many skills in business banking, like consumer carrier and economic management, are transferable. However, funding banking requires knowledge in areas such as mergers and acquisitions, capital markets, and complicated economic modeling. Pursuing similar education, including an MBA or specialized finance guides, can help. Networking and gaining relevant enjoyment through internships or projects also are vital steps in making this profession switch.

Can Commercial Banks Be Investment Banks?

Yes, business banks additionally can be investment banks. Many large financial establishments perform in every region. They offer commercial enterprise banking services like savings and checking money owed, private loans, and commercial enterprise loans. At the same time, they offer investment banking offerings which includes underwriting, mergers and acquisitions, and capital elevating. This dual role permits them to serve a huge range of customers and meet numerous financial goals.

Are Investment Banks and Commercial Banks Separate?

Investment banks and industrial banks can both be separate entities, however often they’re not. Traditionally, they operated as incredible entities with capabilities. Investment banks cognizance of excessive-chance, high-praise sports activities like mergers, acquisitions, and buying and selling. Commercial banks manipulate regular economic services like deposit payments and loans. However, many massive banks nowadays provide every funding and commercial banking services inside a single corporation, offering a broader form of monetary answers.

What Is the Key Difference Between Retail Banking Vs Commercial Banking?

The key difference is that retail banking focus on person to person model whereas commercial banking targets organizations. The business banking serve precise varieties of customers. Retail banking focuses on individual clients and their private economic wishes. It gives services like savings and checking debts, non-public loans, and credit score playing cards. On the other hand, commercial enterprise banking objectives organizations, both small and large. It gives services consisting of business money owed, enterprise loans, and features of credit score. The primary distinction lies in the customers and the varieties of services provided.

What Is the Key Difference Between Corporate Banking And Commercial Banking?

Corporate banking and enterprise banking each serve businesses however the key difference is in their scope and services. Corporate banking focuses on big businesses and gives specialized economic services which encompass big-scale loans, complicated financing solutions, and treasury control. Commercial banking, in evaluation, serves smaller businesses and affords more favored banking offerings. While enterprise banking gives with high-fee transactions and tailored answers, business banking handles normal agency financial needs.

What Is the Key Difference Between Wholesale Banking Vs Investment Banking?

The main difference is that wholesale banking and investment banking serve exceptional functions within the financial corporation. Wholesale banking consists of large-scale economic transactions, regularly between financial institutions and fundamental businesses. It consists of offerings like big deposits, bulk loans, and cash management. Investment banking, however, specializes in immoderate-stakes financial sports activities along with elevating capital, facilitating mergers and acquisitions, and presenting advisory offerings for major economic offers. The essential difference is in the scale and sort of monetary transactions they deal with.

What Is the Key Difference Between Investment Banking And Hedge Fund?

The key difference between investment banking and hedge fund is that investment banking focuses on supporting agencies and governments growth capital through sports like underwriting, mergers, and acquisitions. They assist with economic transactions and provide advisory offerings. Hedge Funds, alternatively, are investment motors that pool money from buyers to generate immoderate returns through numerous techniques like quick selling, leverage, and derivatives. The key distinction is that funding banks offer services to clients, whilst hedge price variety make investments right away in financial markets.

What Is the Key Difference Between Investment Banking And Private Equity?

The key difference between investment banking and private equity is that investment banking generally offers advisory and capital-elevating services for businesses, along with help with mergers, acquisitions, and issuing stocks or bonds. Whereas private equity involves investing straight away in personal businesses or searching for out public businesses to take them personally. Private equity organizations commonly consciousness on improving and growing groups before selling them for an income. The critical distinction is that funding banks provide services, even as non-public fairness organizations make investments.

What Is the Key Difference Between Investment Banking And Asset Management?

The key difference between investment banking and asset management is that investment banks address monetary transactions and advisory, at the same time as asset control specializes in funding increase and portfolio management. Investment banking facilitates businesses with capital-elevating and economic transactions like mergers and acquisitions. They offer advisory services and facilitate offers. Asset manage specializes in managing investments for customers, which include people and establishments, aiming to grow their portfolios through numerous investment strategies.

What Is the Key Difference Between Investment Banking And Corporate Banking?

The key difference between investment banking and corporate banking is that investment banking assists with massive-scale economic transactions like elevating capital, mergers, and acquisitions. They offer advisory services to companies and buyers. Corporate banking serves businesses by providing traditional banking services including loans, credit rating, and cash control. The primary distinction is that investment banking focuses on high-profile financial gives and advisory, at the identical time as corporate banking handles ordinary banking needs for agencies.

Conclude

Investment banking and commercial banking serve different desires in the financial world. Investment banking makes a speciality of excessive-stakes deals, assisting corporations boost capital and advising on mergers and acquisitions. It entails vast threats but offers high rewards. In contrast, industrial banking addresses everyday financial wishes like financial savings accounts and loans for individuals and small groups, offering regular profits with decreased hazard. Each sort of banking has its unique benefits and downsides, making them appropriate for exceptional professional paths and economic desires.

Investment banking and commercial banking play important but distinct roles in the financial machine. Investment banking offers huge monetary transactions and advisory services for primary businesses and wealthy customers, aiming for high returns but with extra danger. Commercial banking specializes in providing normal monetary offerings along with loans and debts for individuals and groups, supplying solid earnings and lower risk. Understanding these differences helps in deciding on the right banking profession primarily based on one’s options for risk and praise.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.