People who are smart, young, and ambitious want to work in investment banking and management consulting because they offer tough business training, high starting salaries, and great ways to get out of the field. But what do these industries really do? The Investment banking vs. Consulting is compared here. They help big businesses grow, change, and adapt to changing economic and political conditions. For example, management consultants give top management advice on how to increase sales, cut costs, and improve the performance of the business. Bankers specialize in business finance. They help organizations get equity and debt funds by offering capital-raising services. They also advise on mergers and purchases and help businesses buy other businesses or sell a part of their business or the whole company.

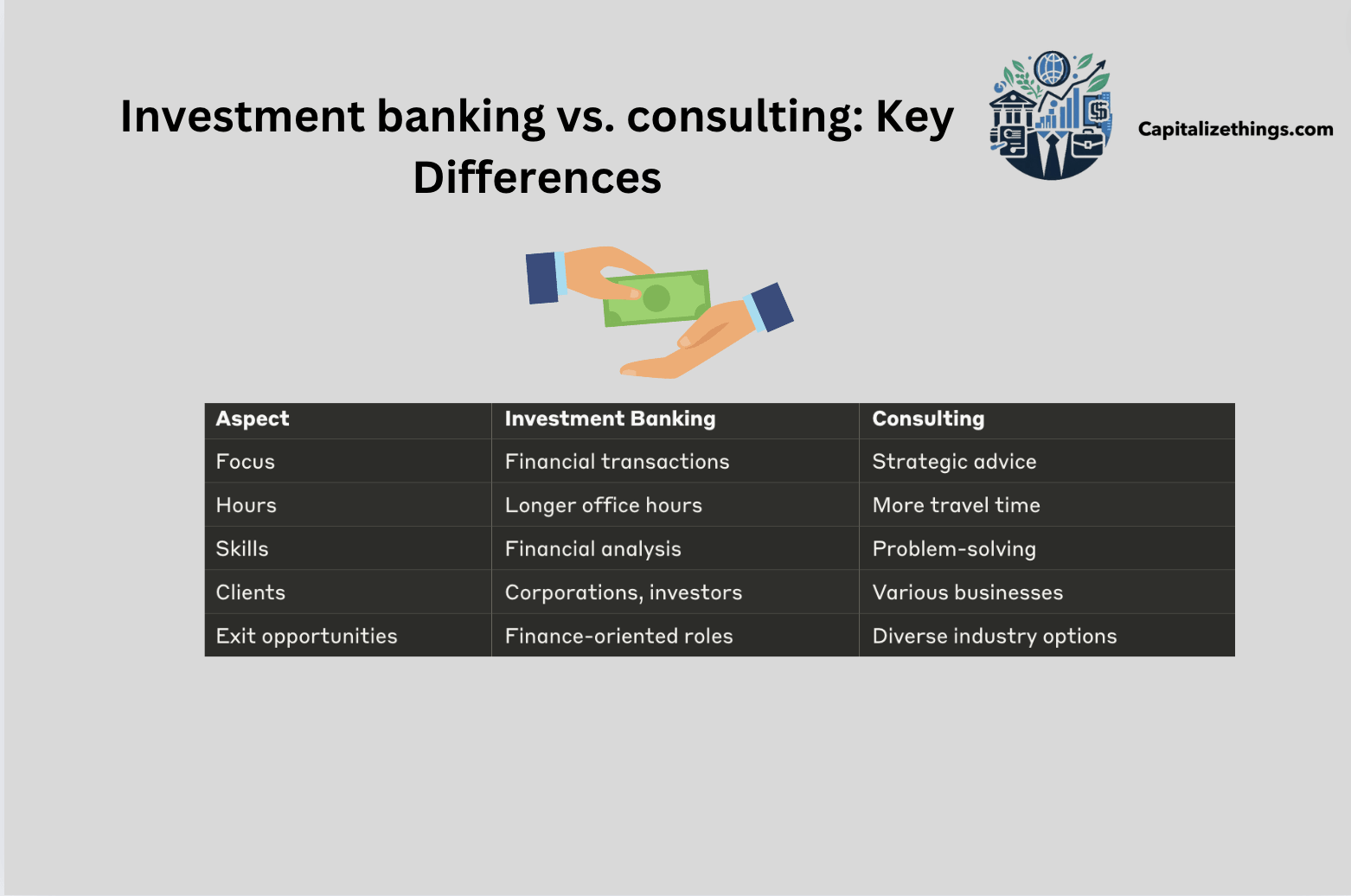

Key Differences between investment banking and management consulting are that Consulting firms advise corporations on their most complex strategic difficulties, while investment banks assist businesses in completing significant financial transactions. So, the sectors have distinct organizational structures, create different skill sets over time, and have distinct lifestyles, too.

What is investment banking?

Investment banking helps capital markets and the business community. Investment bankers match investors with companies selling stocks and bonds. They usually offer broker-dealer services to help institutional clients purchase and sell securities and advise corporations on mergers, buyouts, and other strategic transactions. Their role in the financial system is to allocate capital to productive uses.

It assist corporations in raising capital in the stock and bond markets. Bankers must follow financial regulations in public, regulated markets. Investment bankers write and file prospectuses, approximate valuation, and solicit investors for public offerings. Securities are first offered to investors in this primary market. After the issue, securities are exchanged on the stock exchange and in bond markets are also called secondary markets. Capital markets include secondary and primary markets.

What is consulting?

Consulting can cover corporate strategy, marketing, product development, IT, and operational advancement, but most people imply management consulting. Consultants are business specialists. They may guide clients through fact-based business problem analysis and alternate courses of action. They can also use their firm’s industry and functional knowledge to fix the problem. Consultants also offer expertise on rare business topics. Financial consulting is vital to financial decision-making because client-consultant trust encourages reciprocity and opportunity costs (Financial consulting: A qualitative study on its role in economic decision-making, Julia Sprenger, 2017).

Manufacturing companies may only contemplate mergers or acquisitions every ten years, so it’s not practical to hire full-time M&A experts. Acquisitions and mergers are essential business choices that clients shouldn’t make wrong. Consultants regularly review M&A deals so clients can use their knowledge as needed.

What is the difference between investment banking and consulting?

A management consultant must analyze a company’s operations, detect inefficiencies, and identify areas for process reduction or elimination. Strong people skills are vital for management consulting. Lawyers with solid logic and problem-solving skills but require more negotiation skills or introversion can pursue behind-the-scenes careers.

Management consultants earn more than lawyers on fewer hours, but frequent travel upsets their work-life balance. Road warrior management consultants often fly out on Sunday night to work in a city over the country on Monday morning and return on Friday afternoon. Since the COVID-19 outbreak, some management consultants have served local customers entirely, although many are still abroad. When local clients are available, firms prefer senior staff and expect new associates to travel.

Investment banking employs consultants, capital market analysts, banking analysts, research associates, trading professionals, and others. Each requires specific education and expertise. A degree in finance, accounting, economics, or mathematics is a good start for any financial career. This is often enough for entry-level commercial banking occupations like teller or personal banker. An MBA or equivalent professional credentials is recommended for investment bankers—any financial career benefits from good social skills. Even dedicated research analysts operate in teams and advise clients. Some jobs involve more sales, so being confident in a professional social atmosphere is crucial. Effective communication (explaining themes to clients or other organizations) and initiative are also important.

While management consultants work fewer hours per week, travel time must be considered when comparing hours. Even though more consultants are working remotely, especially early on, many still travel for most of their workweeks. Family-oriented people dread this element of the job, whereas wanderlusts adore it. Years of experience are needed to attain seniority and be assigned to local clientele. The banker came back to the apartment at 2 am, considerably later than the consultant, and left at 7 am, ahead of the consultant. Bankers invest 90% of their time at work, but consultants may travel 25% to 75%.

What career path is better, investment banking or consulting?

Both investment banking and consulting have advantages. Investment banking offers more financial exit prospects in private equity, corporate growth and hedge funds. Still, management consulting offers more exit opportunities in strategy, non-profits, operations, new businesses, and more!

What is the salary difference between investment banking and consulting?

The salary difference between investment banking and consulting is given in the following table:

| Level | Consultant | Investment Bankers |

| Director/Partner-level | $750,000 | $800,000 |

| Manager-level | $350,000 | $400,000 |

| Senior-level | $220,000 | $250,000 |

| Junior-level | $150,000 | $170,000 |

Investment bankers make more than consultants, but they work 100 hours a week vs 80. Taking into account the Reversed Diminishing Margin factor (which says that working an hour on top of 100 is more complex than working an hour on top of 80), a job as a consultant might be better for your well-being and pay more per hour.

What is the difference between investment banking and M&A consulting?

There are significant distinctions between investment banking and M&A consultancy. Investment bankers ensure the transaction goes well for business owners, but M&A advisory firms help with the next steps.

A former business owner will require help managing profits after the sale. Long after the sale or merger, an M&A consulting firm will help a business owner with taxes and investment.

What is better, investment banking or consulting for private equity?

Investment banking is better for private equity. There are more ways to leave management consulting than investment banks. You can go into operations, strategy, non-profit organizations, startups, and other areas. Investment banking facilitates private equity, hedge fund, and corporate growth exits! Most agree that consulting is the best option for operational or strategy roles in businesses and organizations.

What type of skills develop during investment banking and consulting?

Investment bankers’ skills change considerably as they advance. Entry-level investment bankers must grasp technical and analytical abilities as their foundation. Relationship building, managing clients, and transaction execution become priorities in mid-level roles. Senior Investment Bankers need strategic thinking, leadership, and knowledge of market dynamics. Investment bankers who want to succeed and advance in the company must recognize and develop their investment skills talents at each stage.

Starting in investment banking requires a solid basis in quantitative analysis, valuation and financial modelling. Investment bankers at the entry level should be fluent in Excel and able to develop complex financial models to examine numerous situations. They must also be meticulous when developing pitch books and conducting due diligence. Knowing accounting principles and financial accounts is crucial, as is working long hours and managing time under pressure.

Mid-level Investment Bankers need strong deal structure, negotiating, and client management skills. They lead transactions and must understand capital raising, mergers and acquisitions, and other financial services at this stage. Effective communication, interpersonal skills, and mentoring junior personnel become more vital. Mid-level bankers must network to acquire and retain customer and industry contacts for business growth and career advancement.

Senior Investment Bankers must excel in new business and high-stakes partnerships. They need to exhibit a visionary approach to market prospects and client advice, typically contributing to the overall strategy of the firm. Leading teams, divisions, or departments requires leadership qualities. Senior bankers need regulatory risk management and compliance skills. They should have a strong awareness of global markets, economic indicators, and politics that could affect client portfolios and investment strategies to make good decisions.

Management consultants and investment bankers share the following skills:

Commercial Awareness

Both roles must comprehend the market and how it will react to their recommendations to help their client firm. These are particularly applicable to investment bankers who handle finances directly, but management consultants’ advice can affect the firm’s earnings.

Teamwork

Bankers and consultants work together, especially if their customers are huge companies that need help managing funds or business procedures. This could also include improving teamwork within the client organization, as poor collaboration and communication may be affecting their financial growth or production.

Networking

Management consultants talk to more corporate personnel, but both professions require strong interpersonal and networking skills to establish a long-term commercial partnership. This also helps bankers and consultants to network with other sector specialists to find new clients and explore new sectors.

Communication

Both responsibilities entail talking to executives and workers to evaluate where the client company could enhance operations and offering advice. This involves clarifying complex company processes to leaders who may need help understanding their long-term effects and recommending alternate strategies.

How do you decide between finance and consulting?

The decision depends on you, your favourite lifestyle, your soft and technical skills, your interests, your priority for travel, and how engaging you are with others. In the end, your interests, skills, job goals, and personal preferences will determine whether you should go into corporate finance or management consulting. Both areas have their opportunities and problems.

Can you go from banking to consulting?

Yes! You can go from banking to consulting. Planning and transferable abilities might help you switch from banking to consulting or vice versa. Cross-industry migrations entail proving one’s knowledge in the new field, whereas staying in the same business often requires lateral shifts.

Does McKinsey do investment banking?

Yes! They assist investment banking clients with organizational, strategic, and operational needs.

Does investment banking pay more than consulting?

Banking pay is 50-100% greater than consultancy salaries, and the difference grows with seniority. Consulting offers larger travel allowances, and retirement remuneration than banking.

Do you need help getting into consulting or banking?

Yes! It takes more work to get into consulting or banking. Management consulting recruiting is one of the most competitive worldwide. With so many applicants for restricted seats, it is impossible to get into consulting.

What is the difference between consulting investment banking and private equity?

Investment banks help clients with mergers, acquisitions, reconfiguration, and capital-raising. Corporate transaction advice fees are how investment bankers make money. However, private equity firms invest in businesses using capital from wealthy individuals, pension funds, endowments, insurance companies, etc. PE investors are investors, not advisors.

Entry-level investment banking analysts/associates create pitch books, model, and do administrative work. Although private equity funds engage their partners differently, they all perform certain essential functions. Management consulting and investment banking offer high-paying professions to top students at top colleges, often with a bachelor’s degree. Management consulting and investment banking have no set educational prerequisites, unlike medicine, law, and pharmacy. Instead, hiring firms set their standards. However, most of the top corporations that pay the most have challenging application and interview competition, hiring only the sharpest students from top institutions. MBAs, especially from elite programs, have always helped job chances.

Management consulting and investment banking require problem-solving and diplomacy abilities. Management consulting involves understanding a client’s identifying inefficiencies, complex management structure, and areas for improvement, creating solutions, and explaining them to the client so they can implement them. Consultants need strong critical thinking and people abilities.

Investment banking demands similar skills. Because they handle large sums of money, investment bankers must be disciplined and quantitative. Common mistakes cost companies millions. Some areas in the broad field involve more personal interaction than others. Great people skills boost an investment banker’s appeal and demand. Investment bankers handle large company transactions and moderate mergers and acquisitions (M&A), which require nearly superhuman diplomacy abilities.

Does investment banking have a good work-life balance?

No! Investment banking needs a better work-life balance. Enter-level investment banking analysts often work more than 40 hours a week in a competitive culture where working long hours is a badge of honour. A 9-to-5 routine is considered standard.

Does consulting have an excellent work-life balance?

No! Consulting doesn’t have a good work-life balance.Consultants typically struggle with this. Awareness alone cannot address the problem, but it can lower false expectations. Being mentally ready for a full day’s work reduces stress when it doesn’t go as planned.

Is Goldman Sachs a consulting firm?

No! Goldman Sachs is not a consulting firm. It is an Investment banking firm.

Does consulting have good exit ops?

Yes! Consulting has good exit ops. Big consulting businesses offer clear career prospects. You should advance if you perform well. If money is an issue, you may shift to another consulting business and obtain a big raise. Career progression depends on your motivation and role.

What are exit opportunities in investment banking?

Investment banking offers the following exit opportunities:

Asset management

Asset management, or wealth management, involves buying and selling investments to improve an organization’s or individual’s wealth. Asset managers help at least many clients make intelligent financial decisions that can increase their wealth. These experts assist clients with real estate and cash management. Their first step with a new customer is to assess their finances, investing strategy, and risk tolerance.

Asset managers are less affected by global economic downturns than investment bankers, making it a steady job. Their cost are generally a proportion of investment profits. Unlike other investment occupations, asset management focuses on both cash and wealth. As an asset manager, you may deal with individuals and businesses, diversifying your revenue.

Business development

Business developers assist companies in finding and exploring profitable strategic opportunities to increase value. They can operate in-house for one company or as freelancers or agency members developing businesses. Using their problem-solving skills, they help firms solve difficulties quickly and realistically. For this profession, you must be empathic and have good active listening abilities to grasp clients’ problems.

Consulting

If you have empathy, flexibility, and data analytics skills, try consulting. You might work in cycles as an expert. After a few days of hard work at a customer’s location, you may relax for the remainder of the week to prepare for a new work cycle or client. You may assist companies to find and maximize possibilities. A client may ask your team to articulate their strategic vision and establish a detailed business growth strategy. This profession has several job options, including large consultancies that provide end-to-end solutions. Consider working for an organization’s in-house consulting department.

Corporate finance

Another exit opportunity from investment banking to corporate finance managers oversee how large companies fund operations to maximize revenues and cut costs. They manage everything from capital raising to ownership changes at the heart of a corporation. This role may be more straightforward for a proactive, strategic thinker. Corporate finance may involve foreign travel, so being flexible is essential. Prepare for the transition by improving your analytical skills and the information you have.

A financial modelling course may help you land a corporate finance position after a few years in investment banking. Working as an audit team member or investment analyst is another way to advance your qualifications. Accountancy experience can boost performance in interviews and make your CV more appealing to hiring employers.

FinTech

FinTech develops, generates, and distributes banking and financial services software and other technology. Due to their knowledge of finance clients’ needs, investment bankers can work with FinTech companies. As a product team member, you can assist your employer in developing creative ideas to change finances or improve the banking experience for ordinary consumers and users. Improve your technical and IT skills to improve your FinTech job prospects. You may even start coding to understand what’s better.

Hedge funds

An opportunity which is great when we compare investment banking with hedge funds in hedge funds. In this field of finance, you can run hedge funds, which are private investor partnerships. Hedge funds let you use different methods. Even in investment banking, create your reputation and trustworthiness to seek this role. To show investors you can manage their money and build solid financial product expertise.

Private Equity

Work in a minor team and invest investors’ funds in private and public enterprises in private equity (PE) which is better when compared with investment banking. Thus, you empower clients to govern their organizations and make strategic or organizational changes.

Is investment banking one of the most challenging jobs?

Yes! Investment banking is one of the most challenging jobs. Many investors want investment banking jobs. A typical investment banker’s day is long and stressful. Survivors of the adjustment stage frequently have long and lucrative careers.

Can you go from consulting to hedge funds?

Yes! You can go from consulting to hedge funds.However, consulting opportunities in hedge funds are restricted, like private equity hiring. Choose funds that appreciate your consulting abilities. Macroeconomic and equity long-short funds prioritize market research and operational due diligence.

Conclusion:

Consulting involves more PowerPoint presentations than Excel modelling. Excel modelling is allowed in consultancy cases. You will communicate more with the staff and client than in banking to adjust the “answer” as new information emerges. Consulting is a fantastic area in which to practice analytical and “soft” skills like communication and influence. Investment banking teaches financial transaction execution from pitch to closing. Complex financial models for leveraged buyouts, mergers, and firm valuations will take up most of your time.

As a banker, you’ll need to master Excel and produce a lot of analytical data quickly. Investment bankers need PowerPoint skills, although they create and deliver slides less than consultants. Junior levels have more individual work and less client contact. One big difference between consulting and investment banking is that consulting jobs tend to be more stable. Consulting firms are less affected by recessions than investment banks because their clients stop fundraising and M&A, although they may still hire consultants to decrease costs.

How does one advance in these fields? Both industries are hierarchical: Analysts/Associates analyze, Managers oversee, and Directors manage client connections. Similar timelines exist for reaching the top level. Analysts spend 10–15 years advancing to senior roles. Both sectors have an “up or out” culture where you can’t stay still. You must improve your talents or get a new career.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.