Investment banking enables agencies to increase money. It does this by selling stocks and bonds. It also helps with mergers and acquisitions. It has high risk but excessive earnings. Corporate banking serves organizations by giving loans, coping with coins, and providing different services. It has lower danger but consistent profit. Investment bankers paint large deals and get high pay. They face strain and lengthy hours.

Corporate bankers have strong jobs with ordinary hours. Investment banking facilitates boosting money and merging agencies. Corporate banking gives loans and manages coins. Investment banking has an excessive chance but excessive income. It gives large offers and excessive pay, however it is annoying. Corporate banking has low threat however regular income. It gives strong jobs and regular hours.

What is Investment Banking?

Investment banking allows companies to enhance cash. It sells shares and bonds. It allows mergers and acquisitions. Investment bankers give advice on massive deals. They work with big amounts of cash. They assist groups grow and extend. Investment banking is an excessive chance however can bring high income. It includes long hours and strain. Investment bankers often earn high salaries. They play a key role inside the economic market.

What is Corporate Banking?

Corporate banking serves corporations. It offers loans and manages cash. Corporate bankers offer many offerings. They assist with everyday financial wishes. Corporate banking is a decreasing threat and offers steady earnings. It involves working with small to big businesses. Corporate bankers build robust relationships with customers. They provide financial recommendation and support. Corporate banking jobs are stable and feature everyday hours. They play a critical position in the business boom.

What Is the Difference Between Investment Banking and Corporate Banking?

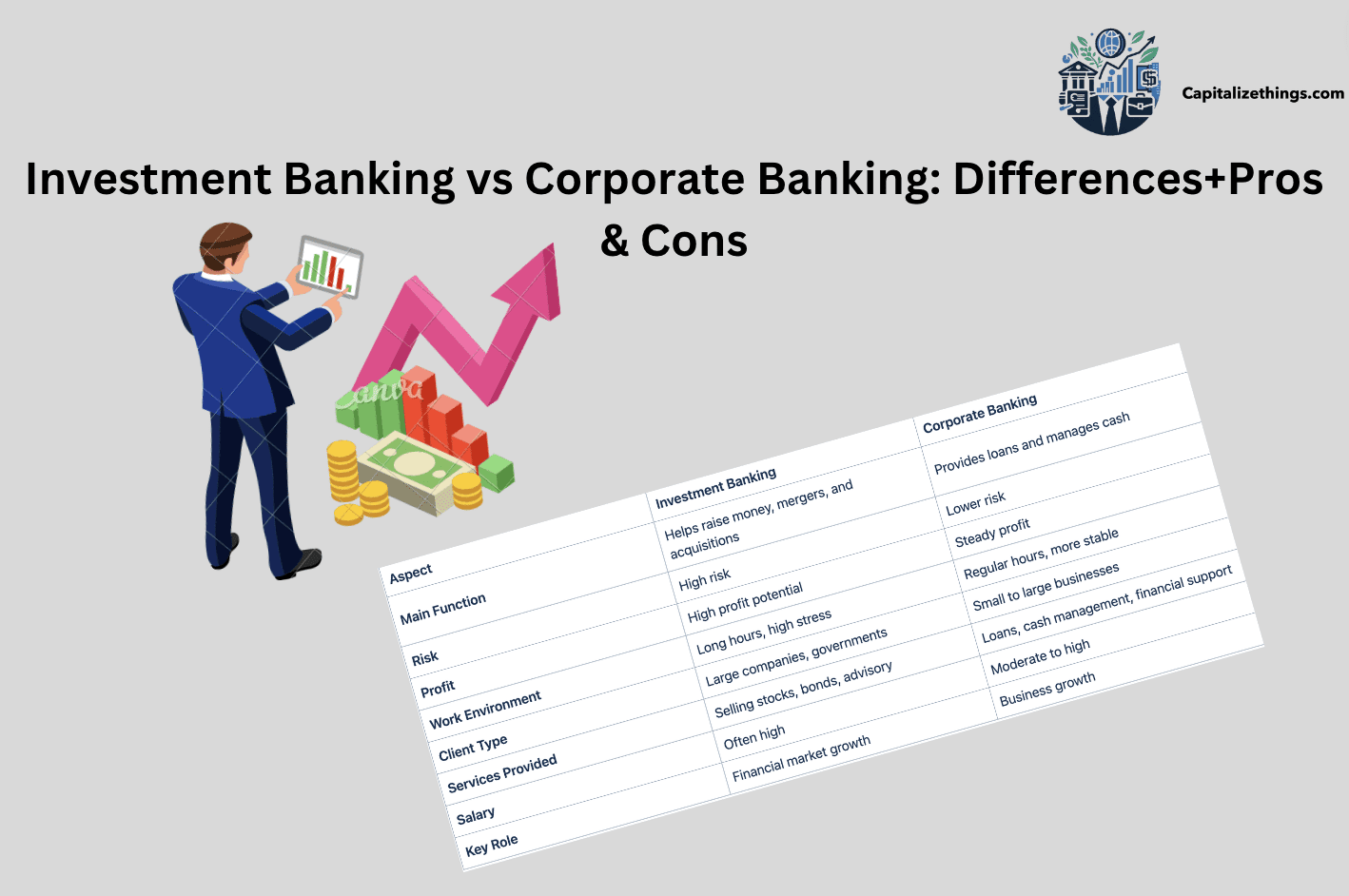

The major differences between investment banking and corporate banking are given below:

| Aspect | Investment Banking | Corporate Banking |

| Main Function | Helps raise money, mergers, and acquisitions | Provides loans and manages cash |

| Risk | High risk | Lower risk |

| Profit | High profit potential | Steady profit |

| Work Environment | Long hours, high stress | Regular hours, more stable |

| Client Type | Large companies, governments | Small to large businesses |

| Services Provided | Selling stocks, bonds, advisory | Loans, cash management, financial support |

| Salary | Often high | Moderate to high |

| Key Role | Financial market growth | Business growth |

The table suggests the key variations between funding banking and corporate banking. Investment banking involves high hazard and capability for high profit. It facilitates raising cash and mergers. Investment bankers work long hours and face stress but earn excessive salaries. Corporate banking is a decreasing threat with steady earnings. It provides loans and manages coins for agencies. Corporate bankers have normal hours and stable jobs, supplying financial aid to organizations.

What Is the Salary Difference Between Corporate Banking Vs Investment Banking Salary?

In finance banking, salaries vary greatly. Investment bankers typically earn greater than company bankers. Starting salaries for investment bankers may be around $100,000 to $one hundred fifty,000, including bonuses. Corporate bankers’ starting salaries are generally between $60,000 and $ninety,000. As careers boost, investment bankers often see higher will increase in pay because of the excessive-hazard, excessive-reward nature of their paintings. Corporate bankers have extra strong however slight profits growth.

What Is the Difference Between Corporate Banking and Commercial Banking?

Corporate banking serves big organizations. It offers loans, cash control, and economic services. Commercial banking serves people and small to medium-sized organizations. It offers personal banking services, loans, and deposits. Corporate banking deals with complicated economic desires. Commercial banking handles regular banking wishes. Corporate banking clients are large and feature higher transaction volumes. Commercial banking customers consist of individuals and smaller organizations with fewer economic needs. The major distinction is the scale and complexity of the clients they serve.

What Is the Difference Between Corporate Banking and Corporate Finance?

Corporate banking offers financial offerings to agencies. It includes loans, coins management, and economic advisory. Corporate finance entails coping with an employer’s financial sports. This includes budgeting, funding, and capital structuring. Corporate banking makes a specialty of offering outside monetary offerings. Corporate finance makes a specialty of inner economic management. Corporate banking deals with commercial enterprise clients. Corporate finance is involved with a company’s internal financial health. The key distinction is that company banking is an outside carrier provider, while corporate finance manages a company’s internal finances.

How Do the Primary Client Bases Differ Between Investment Banking and Corporate Banking?

Investment banking serves large companies, governments, and establishments. It enables elevating capital, mergers, and acquisitions. Corporate banking serves corporations of numerous sizes. It gives loans, coins management, and financial services. Investment banking customers searching for complex financial transactions. Corporate banking customers want normal banking offerings. Investment banking deals with excessive-fee customers and transactions. Corporate banking handles a broader variety of commercial enterprise clients. The number one distinction is the sort and length of clients they serve.

What Are the Key Differences in Revenue Generation Models for Investment Banks And Corporate Banks?

Investment banks generate revenue via advisory costs, underwriting services, and trading sports. They charge expenses for helping groups increase capital and manipulate mergers. They additionally make cash from buying and selling securities. Corporate banks generate revenue via interest on loans, service costs, and transaction expenses. They earn cash from lending to corporations and presenting financial services. Investment banks rely upon excessive-fee, high-chance transactions. Corporate banks rely upon steady, habitual earnings from loans and offerings. The principal distinction is of their revenue sources and threat stages.

What Are the Pros and Cons Of Using Investment Banking And Corporate Banking?

Investment banking offers high capability income. It helps organizations improve large quantities of capital quickly. It also gives expert advice on mergers and acquisitions, helping companies grow and increase. However, it comes with excessive risks and may be very high-priced. The complex nature of transactions can result in sizable financial losses if not managed nicely.

Corporate banking gives regular and reliable economic help. It gives loans, cash management, and other vital services to agencies. These offerings are commonly lower hazards in comparison to funding banking. Corporate banking helps businesses manipulate their daily monetary desires successfully. However, it can now not provide the same stage of high-profit opportunities as funding banking. It focuses extra on balance and consistent growth in place of rapid enlargement.

Both banking sorts serve special needs, and choosing the proper one depends on an agency’s economic dreams and threat tolerance.

What Does J.P. Morgan Investment Banking Do?

J.P. Morgan Investment Banking affords several financial services to businesses, governments, and institutions. They assist with raising capital through issuing stocks and bonds. They offer advisory offerings for mergers, acquisitions, and restructurings. J.P. Morgan facilitates corporations with complex economic transactions and strategic planning. Their services also encompass underwriting, trading, and dealing with investments. They intend to guide their clients in accomplishing increases and navigating financial markets.

What Is the Major Difference Between Middle Market Banking and Investment Banking?

Middle market banking makes a specialty of small to mid-sized companies. It gives loans, coins manipulation, and financial offerings. Investment banking offers with big corporations and complicated financial gives. It permits raising capital and mergers. Middle market banking is extra about normal economic dreams. Investment banking handles excessive-cost transactions and strategic making plans.

Is Commercial Banking and Investment Banking Same?

No, industrial banking and investment banking are not the same. Commercial banking serves people and small to medium-sized companies. It offers non-public loans, deposits, and easy financial offerings. Investment banking works with huge companies and governments. It offers elevated capital, mergers, and complex financial gives. Commercial banking is extra about regular banking wishes, even as investment banking specializes in big transactions and strategic advice.

What Is the Major Difference Between Investment Banking and Hedge Fund?

The major difference between investment banking and hedge fund is that investment banking helps corporations enhance capital and presents advisory offerings. It gives with massive transactions and monetary techniques. Whereas Hedge finances invest in various belongings to gain excessive returns. They use techniques like brief selling and leverage. Investment banking focuses on financial offerings for organizations. Hedge budget attention on making a funding and generating high returns for his or her buyers.

What Is the Major Difference Between Investment Banking and Asset Management?

The difference between investment banking and asset management is that investment banking enables companies with capital elevating, mergers, and monetary advice. It deals with massive-scale transactions and company finance. Whereas Asset management manages investments for human beings and institutions. It specializes in growing and retaining wealth through diverse investment strategies. Investment banking is ready corporation economic offerings, even as asset manipulation is about managing and growing investments.

Conclude

Investment banking facilitates groups to raise large amounts of money via shares and bonds. It also advises on mergers and acquisitions. While it gives high earnings capacity, it comes with excessive danger and strain. Corporate banking offers loans and manages coins for businesses. It has decreased chance and extra strong profits. Corporate bankers experience ordinary hours and task balance. Investment bankers face long hours and high stress however earn more.

Investment banking specializes in principle monetary deals, imparting excessive returns but with extensive danger and pressure. Corporate banking helps daily enterprise needs with decreased hazard and regular earnings. Investment bankers work on big, complicated transactions and face long hours. In evaluation, company bankers have stable jobs with everyday hours, serving a broader variety of companies.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.