Investment Banking and Hedge Fund are distinct in many methods. Investment banking assist agencies to improve cash. They additionally propose mergers and acquisitions. Their income comes from costs and commissions. Hedge Fund range manipulates pooled funds from buyers. They aim for high returns through numerous strategies. These strategies can be unstable. Investment banks face much less chance in comparison to hedge finances. Hedge finances take more risk for higher profits. Hedge fund returns may be high, but so can losses. Investment banks usually have more stable returns.

Investment banks help boost money and advise on deals. Hedge budgets manipulate pooled funds aiming for excessive returns. Hedge finances take extra risk for higher income, but also face higher capacity losses.

Investment Banks:

- Help companies boost money.

- Advice on mergers and acquisitions.

- Income from prices and commissions.

- Lower threat, solid returns.

Hedge Funds:

- Manage pooled investor finances.

- Aim for high returns via unstable strategies.

- Higher capacity profits and losses.

What is Investment Banking?

Investment banking helps companies raise money. They also give advice on big business deals. Their income comes from fees and commissions.

What is a Hedge Fund?

A hedge fund is a pooled fund managed by experts. They aim for high returns by using different strategies. Hedge funds can be risky but profitable.

What is the Difference Between Investment Banking and Hedge Fund?

Investment banking enables businesses to enhance money and advises on big business deals. Their earnings come from costs and commissions. Hedge funds control pooled investor funds and intention for high returns using volatile techniques. Hedge funds have higher potential income however additionally face higher dangers. Investment banks commonly have greater solid and lower-danger returns.

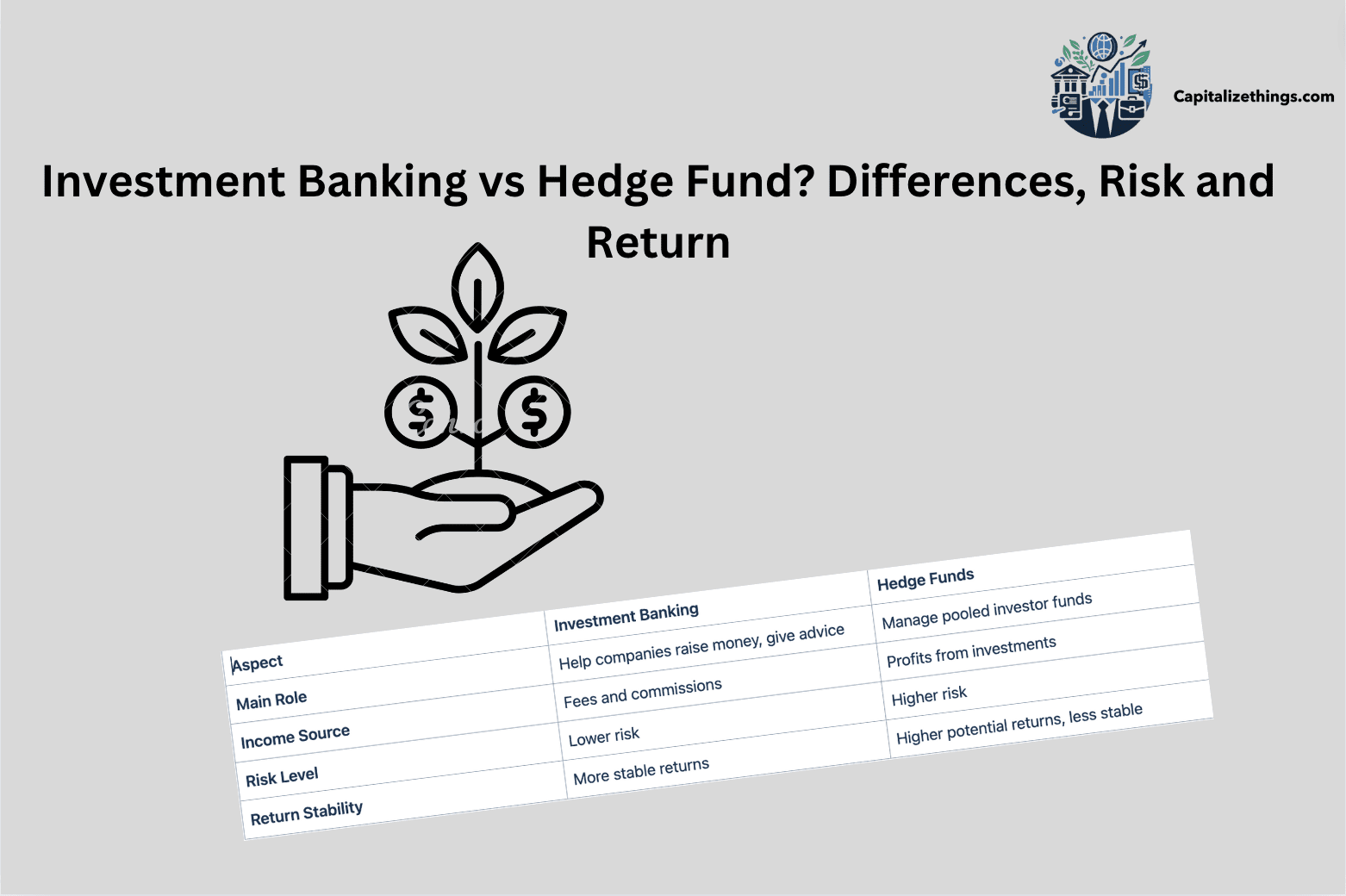

| Aspect | Investment Banking | Hedge Funds |

| Main Role | Help companies raise money, give advice | Manage pooled investor funds |

| Income Source | Fees and commissions | Profits from investments |

| Risk Level | Lower risk | Higher risk |

| Return Stability | More stable returns | Higher potential returns, less stable |

The major difference points between investment banking and hedge funds are as follows:

Primary Function

The primary function of investment banks help organizations boost investment money and deliver recommendations on massive offers. They work on public offerings, mergers, and acquisitions. Their predominant task is to help commercial enterprise boom. Hedge budget control money from traders to make high returns. They use specific strategies like trading shares, bonds, and different properties. Their cognizance is on generating income.

Client Base

Investment banks serve clients, which are businesses, governments, and huge establishments. Their clients want help with raising the price range or making large deals. Hedge price ranges have rich individuals, institutions, and accredited traders as clients. These clients search for excessive returns on their investments. Hedge funds do no longer typically deal with small traders.

Revenue Sources

Earning source of investment bank is they earn money through costs and commissions. They charge for supporting companies, boosting price range, advising on offers, and different offerings. Hedge finances make money from overall performance prices and control costs. Performance fees are a percentage of the income made. Management costs are a percent of the full assets managed.

Risk Profile

Investment banks commonly face low risk. Their earnings come from charges and commissions, which might be more stable. Hedge funds take higher risks to attain high returns. They use strategies like leverage, brief promoting, and derivatives. These techniques can result in excessive earnings but additionally huge losses.

Regulatory Oversight

Investment banks are heavily regulated. They must comply with strict rules and pointers set via the government. This helps protect the financial gadget and investors. Hedge Funds have much less regulatory oversight. They have more freedom to apply distinct funding techniques. However, they nevertheless comply with simple policies to defend traders.

Investment strategies

Strategy of investment banks is focused on raising capital and advising on transactions. They do not commonly make investments with their own cash. Hedge funds use diverse strategies to make high returns. They spend money on stocks, bonds, currencies, and more. They use techniques like leverage and short promotion to decorate income. Their strategies are riskier but may be very profitable.

Compensation Structure

Investment bankers earn salaries and bonuses primarily based on deals they near. Their bonuses depend upon the bank’s overall performance and individual contribution. Hedge fund managers receive a commission through a “2 and 20” charge structure. They earn 2% of the entire property they control and 20% of the profits. This structure aligns their income with fund overall performance. Investment banking compensation is more solid, at the same time as hedge fund pay can range significantly.

Size of organizations

In size the Investment banks are often massive international firms. They rent lots of people and have many workplaces worldwide. Examples encompass Goldman Sachs and JPMorgan Chase. Hedge funds are generally smaller. They can vary from some employees to three hundred. Hedge finances have fewer places and recognition in investment sports. Large hedge funds, like Bridgewater Associates, are exceptions but are nonetheless smaller than fundamental investment banks.

Capital requirements

Investment banks want large capital to help big offers and trading activities. They have strict capital requirements set through regulators. This guarantees they can cope with financial shocks. Hedge finances additionally want capital, but they depend on buyers’ cash. They do no longer have the equal regulatory capital necessities as banks. Hedge price range can enhance and manage large sums, however their capital is greater and tied to performance.

Liquidity of investments

Investment banks address liquid belongings, like shares and bonds, which might be smooth to shop for and promote. This lets them quickly respond to marketplace adjustments. Hedge funds may additionally put money into less liquid assets, like personal fairness or real property. These investments can take longer to sell and may be more difficult to price. The liquidity of hedge fund investments depends on their strategy and can impact investors’ capability to withdraw cash.

Performance Measurement

Investment bank overall performance is measured with the aid of deal success, sales, and profitability. They are conscious of the quantity of transactions and advisory prices. Hedge fund overall performance is measured through the return on investments. Investors examine the fund’s performance relative to benchmarks and friends. Hedge fund managers’ goal to outperform the market and control hazards. The overall performance of each is carefully monitored, but metrics fluctuate based on their roles.

Timeframe of Operations

Timeframe of operations for Investment banks is frequently lengthy, from months to years. They interact in mergers, acquisitions, and IPOs, which require good sized planning and negotiation. Hedge price range function with shorter timeframes. They regularly exchange belongings to capitalize on marketplace opportunities. Some hedge funds can also hold investments longer, but they usually focus on faster returns. The operational time-frame influences their strategies and goals.

Market Influence

Market influence of Investment banks is enormous. They work with large groups and governments, shaping fundamental monetary offers. They assist with mergers, acquisitions, and IPOs, impacting stock expenses and financial trends. Hedge Fund ranges also influence the market however in a different way. They spend money on various properties and use complex strategies. Their trades can affect expenses and volatility. However, their impact is extra on unique securities instead of the whole marketplace.

Transparency

Investment banks are more transparent. They are regularly publicly traded and need to expose their financials. Regulations require them to report their activities. This transparency allows buyers and the general public to agree with them. Hedge funds are less transparent. They are privately owned and feature fewer disclosure requirements. They don’t need to proportion their strategies or holdings publicly. This lack of transparency can make it more difficult for buyers to recognize their risks.

Barriers to Entry

There are alot of barriers of starting an investment banks. It requires a strong educational background, often in finance or economics. Candidates generally need degrees from pinnacle colleges and applicable internships. The hiring procedure is aggressive. Starting a hedge fund additionally has excessive obstacles however distinct challenges. It requires vast capital and a strong track document in funding. Regulatory necessities and the want to draw buyers add to the problem.

Employee Skill Sets

Investment banking personnel need sturdy analytical abilities in an employee. They working on complicated economic models and transactions. Communication abilities are critical for advising clients. Hedge fund personnel want deep expertise in economic markets and diverse investment techniques. Analytical and quantitative capabilities are crucial. They need to additionally manipulate hazards efficiently. Both fields require high degrees of dedication and understanding however recognition in exclusive regions.

Work Culture and Hours

Investment banking is known for its annoying work lifestyle. Employees regularly workt lengthy hours, together with nights and weekends. The environment is excessive-stress and fast-paced. Hedge fund work also can be extreme but varies more. Some Hedge Funds have long hours just like funding banking, whilst others may provide more flexibility. The recognition in hedge finances is on overall performance and effects, that may have an impact on work hours and subculture.

Global Presence

Investment banks usually have a strong international presence. They perform in foremost financial centers internationally. This global reach facilitates them working on global deals and serving global customers. Hedge Fund ranges also operate globally but on a smaller scale. They may additionally invest in international markets but do not have as many offices worldwide. Their recognition is extra on funding overall performance in preference to having a bodily presence in more than one country.

Public Perception

Investment banks often have a mixed public perception. They are visible as influential however can also be viewed as contributing to financial crises. Their role inside the economy is both reputable and criticized. Hedge price ranges even have a combined notion. They are well known for their potential high returns however criticized for taking high risks. Their lack of transparency can cause distrust among a number of the public. Both sectors face scrutiny however for one of a kind motives.

Impact of Market Cycles

Market cycles impact funding banks and hedge funds in a different way. Investment banks experience the results for the duration of economic downturns. Their deals glide and income from prices can lower. However, they will nonetheless earn from advisory services. Hedge budget, alternatively, can income in each growing and falling markets. They use strategies like brief selling to make cash while fees drop. This can result in excessive returns even during bad market cycles. But, their excessive-risk techniques can also result in large losses. Investment banks are normally extra stable throughout marketplace cycles, while hedge budget revel in more variability in performance.

Use of Leverage

Investment banks and hedge Funds use leverage in a different way. Investment banks use leverage to aid huge offers and transactions. They borrow money to help customers boost finances or to finance mergers and acquisitions. This leverage is generally controlled and controlled by means of regulatory requirements. Hedge Funds use leverage extra aggressively. They borrow price ranges to increase their funding positions. This can result in higher returns but also will increase the risk of losses. The use of leverage in hedge finances can increase both profits and losses. Investment banks usually use leverage in a more managed and regulated way as compared to hedge price range.

Reporting Requirements

Investment banks and hedge fund ranges have one-of-a-kind reporting necessities. Investment banks are heavily regulated. They must file targeted economic records to the regulatory government. They additionally have to reveal their sports to the general public. This ensures transparency and protects investors. Hedge price ranges have fewer reporting necessities. They frequently operate with much less transparency. They document commonly to their traders and have greater freedom in how they disclose information. However, hedge funds nevertheless have some regulatory responsibilities to protect buyers. The higher stage of law in investment banking ensures more public duty compared to hedge funds.

Investment Products Offered

Investment banks and hedge funds provide special investment products. Investment banks offer a wide variety of services. They offer products like stocks, bonds, and structured finance. Hedge budget consciousness on investment strategies to generate excessive returns. They use merchandise like derivatives, currencies, and commodities. Hedge finances appoint numerous strategies, which includes long-quick fairness, worldwide macro, and arbitrage. Hedge budgets provide extra specialized and excessive-risk investment products.

Decision-making Processes

The choice-making methods in investment banking and hedge price are of different nature. Investment banks make decisions primarily based on client wishes and regulatory tips. Their choices involve big studies, danger assessment, and compliance exams. They observe dependent methods to make certain regulatory compliance and control risk. Hedge funds make choices based totally on marketplace possibilities and techniques. Fund managers have extra flexibility and autonomy. They can quickly adapt to market changes and employ diverse techniques. Hedge fund managers regularly depend upon quantitative models and marketplace insights. Investment banking selections are extra based and controlled, at the same time as hedge funds are more dynamic and bendy.

Technology Utilization

Technology utilization differs among investment banking and Hedge Funds. Investment banks use technology for buying and selling, chance control, and patron offerings. They rent complicated structures for economic modeling, facts evaluation, and transaction processing. Technology allows them to control big volumes of statistics and ensure regulatory compliance. Hedge price ranges use technology by and large for buying and selling and approach implementation. They depend on superior algorithms, high-frequency buying and selling, and massive information evaluation. Technology allows them to perceive marketplace opportunities and execute trades quickly. Both sectors use technology drastically, but hedge funds pay extra attention to advanced trading technology and analytics.

What are the Overall Pros and Cons of Investment Banking and Hedge Funds?

Pros and Cons Of Investment Banking

- Stability: Investment banks have greater solid earnings from costs and commissions.

- Diverse Services: They offer an extensive range of services, which includes underwriting, advisory, and mergers and acquisitions.

- Regulation: High regulatory oversight ensures transparency and investor safety.

- Lower Risk: Generally involves lower risk in comparison to hedge funds.

- Regulation: Heavy law can restrict flexibility and gradual down procedures.

- Economic Sensitivity: Their overall performance is sensitive to market cycles and monetary downturns.

- High Pressure: The enterprise is known for long operating hours and excessive-pressure environments.

Hedge Funds Pros and Cons

- High Returns: Potential for high returns through aggressive investment strategies.

- Flexibility: Less regulatory constraints permit for extra progressive and numerous techniques.

- Market Adaptability: Can income in each rising and falling markets thru techniques like quick selling.

- High Risk: The pursuit of excessive returns includes tremendous threat, leading to potential massive losses.

- Less Transparency: Fewer reporting necessities can bring about much less transparency for buyers.

- Volatility: Returns may be tremendously risky, making them much less predictable.

Investment banks provide stability and various services but face excessive law and monetary sensitivity. Hedge funds have the potential for high returns and flexibility but include higher danger and volatility.

Which is Better Investment Banking or Hedge Funds?

Which is better relies upon for your dreams. Investment banking offers solid profits, established work, and lower chances. It’s correct for folks that decide on a regulated environment. Hedge finances provide higher capability returns however come with higher threat. They fit those who thrive in dynamic, high-danger settings. Both fields have their blessings and challenges. Your preference depends on your risk tolerance, career desires, and working preferences.

How Many Hours Do Hedge Funds Work vs Investment Banks?

Hedge funds and investment banks they both require lengthy hours. Investment bankers regularly work 70-one hundred hours a week, mainly all through deal times. Hedge fund managers work 60-80 hours per week, however hours can range with marketplace conditions. Hedge price range might also offer barely better working-life balance in comparison to investment banking. However, both call for big time and willpower, with funding banking generally having longer hours.

Can you Get into a Hedge Fund from Investment Banking?

Yes, you could pass from investment banking to hedge fund. Investment banking affords sturdy financial talents and marketplace knowledge. Many hedge price ranges feel this experience. Networking, strong overall performance, and relevant abilities can help you make the transfer. Investment bankers frequently transition to hedge budgets for greater direct involvement in trading and investment choices. The pass is not unusual and possible with the proper historical past and connections.

Who has the Highest Returns and Low Risk Investment Banking or Hedge Fund?

Investment Banking

Investment Banking generally does not provide the best returns and less risks compared to hedge funds. Investment banks focus on raising capital for organizations, advising on mergers, and dealing with securities. They earn profits mostly via costs and commissions in place of direct investment returns. While their business model is strong and less unstable, it does not contain taking big market risks for excessive returns. Their returns are greater predictable and tied to the extent of transactions.

Investment banks function below strict regulatory frameworks that limit their hazard-taking. This results in stable returns but normally lower than the ones of the hedge price range. They gain from a varied variety of offerings that offer consistent sales streams but do not usually have interaction in excessive-danger, high-return investments. Their role is essential inside the financial machine, presenting important services and retaining stability.

Hedge Fund

Hedge Fund ranges are recognised for aiming to acquire the very best returns, however they arrive with high hazard. Hedge funds use diverse techniques, consisting of leverage, short promoting, and derivatives, to achieve extensive returns. These techniques can increase both profits and losses. Hedge finances goal high returns through competitive funding tactics, frequently related to sizable danger. They function with more flexibility in comparison to investment banks, allowing them to adapt fast to market modifications.

Hedge budgets can enjoy widespread volatility and losses, in particular while their strategies do not perform as anticipated. Despite the potential for excessive returns, investors should be organized for the possibility of substantial losses. Therefore, even as hedge funds aim for the highest returns, they accomplish that with a better degree of hazard in comparison to investment banks, which are usually extra strong and less centered on excessive-go back strategies.

Do Hedge Funds Pay More than Investment Banks?

If we compare hedge funds to investment banks, the hedge finances regularly pay more than funding banks. They provide better salaries and bonuses to attract pinnacle skills because of the excessive-threat, excessive-praise nature in their work. The compensation can be sizable, mainly if the fund plays well. Investment banks offer competitive pay however generally provide greater stable and lower bonuses in comparison to hedge finances. Overall, hedge funds can offer higher profits ability for their personnel.

Why Hedge Fund over Investment Banking?

People might pick hedge fund over investment banking for better incomes capacity and greater flexible work environments. Hedge funds offer overall performance-based bonuses, which can be full-size if the fund does well. They additionally provide opportunities to paintings with complicated funding techniques and progressive economic models. The paintings’ surroundings in hedge funds can be less dependent as compared to the extra formal putting of funding banking.

How can a Beginner Learn Investment Banking and Hedge Fund?

A beginner investor can learn about Investment Banking and Hedge Funds through a few key steps. Start with the aid of reading books and online sources that designate the fundamentals of finance, investment banking, and hedge fund operations.

Websites like Investopedia and economic news systems offer precious records. Taking online courses or attending workshops can provide established learning. Look for publications on structures that cover monetary markets and funding techniques. Seeking internships or access-degree positions at economic companies can offer hands-on enjoyment.

Additionally, networking with professionals inside the area through LinkedIn or industry activities can provide insights and guidance. It’s also useful to comply with monetary information and tendencies to apprehend marketplace dynamics. Combining those assets will give a well-rounded foundation in funding banking and hedge budgets.

What Skills are Necessary for Investment Banking and Hedge Funds?

Different skills are necessary for investment banking and hedge funds. For investment banking, essential abilities encompass financial modeling, valuation techniques, and strong analytical talents. Proficiency in Excel and PowerPoint is vital for growing presentations and reviews. Communication and negotiation abilities also are essential for client interactions and deal-making. In Hedge Funds, key skills include quantitative analysis, programming (e.G., Python, R), and familiarity with complicated financial contraptions. Strong analytical and strategic thinking skills are essential for figuring out worthwhile opportunities and coping with dangers.

Conclusion

Investment banking and hedge budget offer wonderful career paths with specific possibilities and demanding situations. Investment banking focuses on financial advisory, deal-making, and raising capital with a dependent surroundings. Hedge Funds ranges, however, emphasize excessive-danger, high-reward investment techniques, presenting probably higher income and extra flexible working situations.

Choosing among them depends on man or woman career dreams and hazard tolerance. Investment banking suits those searching for balance and consumer interaction, while hedge finances attract those interested in complex monetary strategies and enormous earnings capacity. Both require sturdy analytical competencies; however the work environments and repayment structures vary drastically.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.