Investment Banking makes a speciality of raising capital, mergers, and acquisitions for huge corporations. They assist companies’ cross public or sell assets. Venture capital (VC) finances startups in change for fairness, assisting them develop. Investment banks work with set up corporations, whilst VCs goal early-stage corporations. The important distinction is the stage of enterprise they guide.

Investment Banking dangers encompass marketplace volatility, regulatory changes, and deal screw ups. These can cause substantial financial losses. In challenge capital, risks are higher because startups fail. VCs invest in agencies that might not prevail, leading to a total lack of the investment. However, a hit venture can yield excessive returns, balancing the threat.

Investment Banking gives balance and gets right of entry to huge offers. It’s ideal for the ones seeking a dependent boom. For undertaking capital, the gain is excessive capacity returns. VCs can earn extensive profits if the startups they invest in prevail. This excessive-danger, high-reward model appeals to the ones inclined to tackle more uncertainty for more financial gains.

What Is Investment Banking?

Investment Banking is a specialized monetary provider that enables the creation of capital for groups, governments, and different entities. It involves underwriting new debt and fairness securities, aiding in the sale of securities, and assisting with mergers, acquisitions, and reorganizations. Investment bankers act as intermediaries between buyers and corporations, providing strategic recommendation and guidance on complex financial transactions. Their information lies in navigating complicated regulatory environments and optimizing economic systems to maximize returns and minimize risks.

What Is Venture Capital?

Venture Capital is a form of private equity financing that gives funding to early-level, excessive-capacity startups and rising agencies. Venture capitalists invest capital in exchange for equity possession, frequently gambling an active role inside the business enterprise’s boom by way of offering strategic steering and get admission to networks. This investment is critical for organizations that lack access to standard financing avenues, as it supports innovation and expansion in exchange for the potential of substantial financial returns, no matter the inherent risks related to nascent companies.

Launch your VC career with expert guidance. Call us to book appointment at +1 (323)-456-9123 or reach out to the capitalizethings.com team through email.

How To Become A Venture Capitalist?

Becoming a Venture Capitalist commonly requires a mixture of revel in, education, and networking. Start by gaining enjoyment in finance, consulting, or entrepreneurship, as these fields provide precious insights into enterprise operations and marketplace traits. An MBA or advanced diploma can beautify your credentials, even though it is not mandatory. Build a strong network inside the startup atmosphere by attending enterprise events and connecting with marketers and traders. Eventually, seek a role at a task capital company, starting as an analyst or associate, wherein you can learn the ropes and steadily enhance.

Venture Capitalists and investment bankers earn considerable salaries, but their compensation structures vary. Investment bankers often acquire high base salaries with widespread bonuses, reflecting the acute painting hours and strain. Entry-stage investment bankers earn between $100,000 to $a hundred and fifty,000 annually, with bonuses doubtlessly doubling that amount.

Senior bankers can earn appreciably more, often exceeding $1 million annually. Venture capitalists, especially at the partner level, begin with salaries starting from $eighty,000 to $150,000, with bonuses. However, the actual economic gain in task capital comes from carried hobby, which is a proportion of the income from successful investments, doubtlessly leading to multi-million-greenback earnings for successful VCs.

What Is Venture In Banking?

Venture banking refers to assignment capital, that is investment supplied to startups or small companies. Unlike conventional financial institution loans, project capital includes giving cash in alternate for possession inside the organization. Banks companion with task capital corporations or provide similar offerings. However, they do not commonly provide venture capital directly. This sort of funding is targeted on excessive-growth potential agencies.

Is Venture Capital A Bank Loan?

Venture Capital is not a financial institution loan. It entails investing money in an organization in trade for equity or ownership. Venture capitalists tackle greater hazards than banks due to the fact they no longer count on regular bills like a mortgage. Instead, they desire to make money while the enterprise grows and will become treasured. This type of funding is common for startups and excessive-boom companies.

Is Venture Capital High Paying?

Venture Capital can be excessive paying, especially for the ones in senior positions. Venture capitalists frequently earn money via revenue, bonuses, and a proportion of profits from successful investments. Entry-level positions begin with lower pay, but the ability for substantial profits will increase with revel in and a hit deal. The maximum profitable part of undertaking capital is regularly the proportion of profits, called carried hobby, which may be very worthwhile.

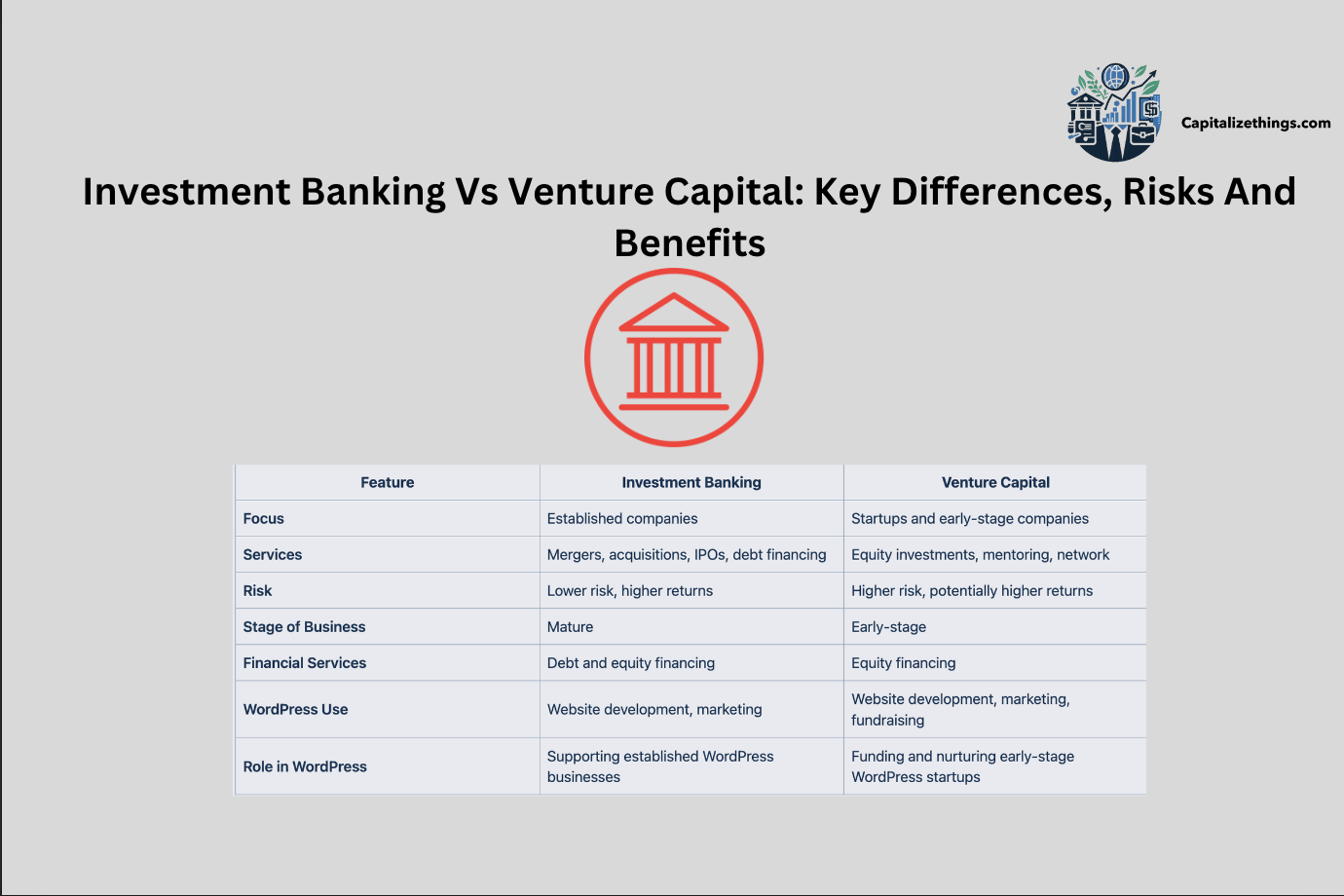

What Is The Difference Between Investment Banking And Venture Capital?

Investment Banking focuses on raising capital for mounted corporations, handling mergers, acquisitions, and different large economic transactions. They work with mature businesses that want to grow, merge, or pass public. Venture capital, alternatively, price range startups and early-degree corporations with high increase ability. VCs put money into exchange for equity, taking over greater hazards for potentially higher rewards. The most important difference is the degree of the business they aid and the kind of monetary services they offer. Reading the table below can help you understand major differences.

| Feature | Investment Banking | Venture Capital |

|---|---|---|

| Focus | Established companies | Startups and early-stage companies |

| Services | Mergers, acquisitions, IPOs, debt financing | Equity investments, mentoring, network |

| Risk | Lower risk, higher returns | Higher risk, potentially higher returns |

| Stage of Business | Mature | Early-stage |

| Financial Services | Debt and equity financing | Equity financing |

| WordPress Use | Website development, marketing | Website development, marketing, fundraising |

| Role in WordPress | Supporting established WordPress businesses | Funding and nurturing early-stage WordPress startups |

What Is The Salary Difference Between Investment Bankers And Venture Capitalists?

Investment Bankers often earn high salaries with considerable bonuses, reflecting the intense work surroundings. Entry-stage bankers might make $a hundred,000 to $one hundred fifty,000, with bonuses that can substantially boom their profits. Senior bankers earn over $1 million annually. Venture capitalists, especially on the entry level, would possibly earn $80,000 to $150,000, with bonuses. The actual monetary gain in project capital comes from carried hobbies, that’s a percentage of the income from successful investments, probably leading to massive income for successful VCs. The table below can help you understand the salary differences of investment banker and venture capitalist quickly.

| Role | Investment Banking | Venture Capital |

|---|---|---|

| Entry-Level | $100,000 – $150,000 | $80,000 – $150,000 |

| Senior | $1,000,000+ | Varies (based on carried interest) |

What Is The Difference Between A Bank Loan And A Venture Capital Investment?

A Bank Loan involves borrowing cash with a dedication to pay off it through the years, with hobby. The financial institution expects normal payments, regardless of the corporation’s fulfillment. Venture capital, however, is an investment wherein the challenge capitalist affords investment in alternate for fairness inside the enterprise. There are not any normal repayments; alternatively, the VC earns returns if the organization grows and will become treasured. Unlike a loan, undertaking capitalists take on more chances, hoping for higher rewards from the organization’s achievement.

Which Is Better, Investment Banking Or Venture Capital?

Choosing among Investment Banking and Venture Capital depends on your profession dreams and hazard tolerance. Investment banking gives a greater established environment with high salaries and bonuses, but it comes with extreme hours and strain. It’s perfect for people who opt for working with established businesses and big monetary transactions. Venture capital, on the other hand, gives the exhilaration of running with startups and the ability for high returns via fairness. However, it involves extra threat and uncertainty. If you enjoy innovation and are inclined to take risks, venture capital might be a higher suit.

Does Investment Banking And Venture Capital Target The Same Type Of Clients?

No, Investment Banking and Venture Capital target exceptional kinds of customers. Investment bankers work with set up organizations, businesses, and governments. They assist these customers enhance capital, control mergers and acquisitions, and deal with massive monetary transactions. Venture capitalists is an early-level organization, specifically startups with excessive boom ability. They invest in those groups in exchange for equity, taking over more risk in hopes of sizable returns. The client base differs primarily within the degree and length of the groups they serve.

What Should A Beginner Investor Consider Investment Banking Or Venture Capital?

A beginner investor ought to consider their danger tolerance, pastimes, and lengthy-term goals whilst deciding on investment banking and undertaking capital. Investment banking gives an extra established environment with lower danger and regular earnings. It’s applicable for people who pick working with installed agencies and huge financial transactions. Venture capital, however, involves higher hazard however gives the capability for sizable rewards thru fairness in excessive-boom startups. If you experience innovation and are willing to take risks for doubtlessly better returns, challenge capital might be more appealing.

What Is The Difference Between The Role Of An Investment Banker And Venture Capitalist?

An Investment Banker facilitates companies to improve capital, manipulate mergers, acquisitions, and facilitate large monetary transactions. They act as intermediaries among corporations and buyers, imparting strategic advice and ensuring offers are established correctly. A project capitalist, then again, invests in early-stage companies in exchange for fairness. They actively paint startups, presenting investment, strategic steering, and get admission to networks. The key distinction lies inside the level of commercial enterprise they help and the extent of involvement within the employer’s increase and operations. Check out the table below to understand their roles quickly.

| Role | Investment Banking | Venture Capital |

|---|---|---|

| Focus | Facilitating capital, mergers, acquisitions, and financial transactions | Investing in early-stage companies |

| Involvement | Intermediary between companies and buyers | Active involvement in startup growth and operations |

| Level of Business | Mature companies | Startups |

What Are The Advantages Of Investment Banking And Venture Capital?

Investment Banking gives the advantage of running with large, hooked up agencies on excessive-profile deals, like mergers, acquisitions, and IPOs. It affords financial balance, high incomes capability, and opportunities to learn about complex economic systems. Venture capital has the advantage of excessive ability returns with the aid of making an investment in early-stage corporations with excessive boom capability. It allows investors to be part of progressive startups, presenting mentorship and guidance to entrepreneurs whilst probably earning significant earnings.

What Are The Disadvantages Of Investment Banking And Venture Capital?

The disadvantages of Investment Banking is that it may be stressful, with lengthy hours, excessive pressure, and intense opposition. The painting’s surroundings can result in burnout and stress. It additionally entails large financial hazards, as market fluctuations can affect deals. Venture capital is volatile due to the fact most startups fail, mainly due to capability losses. It requires patience, as returns take years to materialize. The enterprise is distinctly aggressive, with constrained opportunities to enter and prevail in the subject.

Is Corporate Finance The Same As Investment Banking?

Corporate Finance and Investment Banking are related however no longer the same. Corporate finance specializes in managing an agency’s financial activities, which include budgeting, capital structuring, and funding selections. It aims to optimize the organization’s economic performance. Investment banking, then again, offers raising capital, advising on mergers and acquisitions, and facilitating large financial transactions. While both contain finance, funding banking is greater transaction-centered, while company finance is concerned with common financial control.

Is Debt Capital Markets The Same As Investment Banking?

Debt Capital Markets (DCM) are a part of investment banking but are not the same. DCM makes a speciality of elevating capital through the issuance of debt, like bonds or loans, for corporations and governments. It involves advising customers on debt structure, pricing, and marketplace conditions. Investment banking, however, consists of a broader variety of offerings, such as equity offerings, mergers and acquisitions, and monetary advisory, similarly to DCM sports.

Can You Go From Investment Banking To Venture Capital?

Yes, it’s miles viable to transition from funding banking to project capital. Many undertaking capital companies value the monetary information, deal-making revel in, and network that investment bankers bring. The transition often entails shifting cognizance from big-scale corporate offers to early-stage investments and operating closely with startups. Building a robust knowledge of the startup ecosystem and growing relationships with marketers can facilitate the circulate from investment banking to task capital. The video below explains personal experience of a person who moved from IB to VC.

Why Vc Over Ib?

Choosing Venture Capital (VC) over Investment banking (IB) often comes all the way down to personal pursuits and profession dreams. VC offers the opportunity to work with innovative startups, helping them develop and be successful. It may be greater dynamic and innovative, with the capacity for excessive returns if investments pay off. In assessment, IB is extra structured and entails larger, established groups. VC may be greater satisfying for the ones enthusiastic about entrepreneurship and innovation.

What’s The Difference Between Pe And Ib?

Private Equity (PE) and Investment Banking (IB) are both finance-associated however differ in consciousness and operations. PE firms invest without delay in businesses, frequently managing and working to improve them earlier than selling at an earnings. They recognize lengthy-time period investments. IB, then again, assists companies in raising capital, facilitating mergers and acquisitions, and other economic transactions. IB is greater transaction-focused, even as PE is extra about dealing with and growing investments over time.

What Is The Difference Between Venture Capital Vs Private Equity?

Venture Capital (VC) and Private Equity (PE) each contain investing in corporations, however they fluctuate in degrees and techniques. VC focuses on early-degree startups with high growth capability, imparting funding in exchange for equity. These investments are riskier but can yield excessive returns. PE, on the other hand, invests in greater mature organizations, often buying them out to enhance their operations and sell them at a profit. PE deals with mounted organizations and pursuits for constant, long-time period gains.

What Is The Difference Between Venture Debt And Venture Capital?

Venture Debt and Venture Capital are both funding sources for startups but fluctuate in shape. Venture capital includes making an investment money in exchange for equity or ownership inside the organization. Venture debt, is a loan that startups repay through the years, frequently with interest and warrants, without giving up possession. Venture debt is much less dilutive than challenge capital, meaning founders retain more manipulation, but it also adds a repayment duty that can pressure cash float.

What Is The Difference Between Investment Banking And Corporate Banking?

Investment Banking and Corporate Banking serve distinct monetary desires. Investment banking makes a speciality of raising capital, mergers, acquisitions, and advisory offerings for large transactions. It works with companies, governments, and establishments. Corporate banking, however, provides financial offerings to agencies, which include loans, credit score, cash management, and treasury offerings. While funding banking is more about huge-scale financial deals, corporate banking specializes in everyday monetary operations and long-time period financing for agencies.

What Is The Difference Between Investment Banking And Commercial Banking?

Investment Banking and Commercial Banking serve distinct functions. Investment banking deals with elevating capital, advising on mergers and acquisitions, and facilitating massive financial transactions for agencies and institutions. It is centered on excessive-degree financial services. Commercial banking, however, includes supplying fundamental economic services to people and groups, like checking and financial savings, money owed, loans, and mortgages. Commercial banking is more about ordinary banking offerings, while investment banking handles complicated financial offers.

What Is The Difference Between Investment Banking And Wealth Management?

Investment Banking and Wealth Management cater to one of a kind customers and wishes. Investment banking makes a speciality of raising capital, mergers, acquisitions, and large financial transactions for corporations and establishments. It is deal-oriented and involves complicated financial services. Wealth control, is tailored to people and families, presenting personalized economic planning, investment management, and property making plans. Wealth managers help customers grow and shield their wealth over time, specializing in long-term financial goals rather than large-scale transactions.

What Is The Difference Between Investment Banking And Asset Management?

Investment Banking and Asset Management are awesome sectors inside the finance industry. Investment banking makes a speciality of raising capital, advising on mergers and acquisitions, and dealing with large-scale financial transactions for companies, governments, and establishments. It involves complicated deal-making and economic structuring. Asset management entails handling investments on behalf of clients, along with people, pension price range, or establishments. Asset managers create and oversee portfolios of assets like stocks, bonds, and real estate, aiming to develop and shield customers’ wealth through the years. While investment banking is transaction-oriented and focused on big financial offers, asset management is ready lengthy-term funding strategies and preserving purchaser portfolios

What Is The Difference Between Investment Banking And Hedge Fund?

Investment Banking and Hedge Funds are each a part of the economic enterprise however have distinct roles. Investment banking entails elevating capital, advising on mergers and acquisitions, and coping with large financial transactions. It works with companies and establishments. Hedge finances, however, are investment motors that pool capital from investors to pursue loads of strategies aimed toward producing excessive returns. Hedge price range can invest in an extensive range of property, using leverage and other advanced strategies.

What Is The Difference Between Venture Capital And Growth Investment?

Venture Capital and Growth Investment both fund businesses however at different levels. Venture capital specializes in early-stage startups with high increase capacity, offering funding in exchange for equity. These investments are riskier but provide the possibility of excessive returns. Growth funding is a more mature corporation which have already validated their commercial enterprise model. It offers capital to assist these groups increase further, often without taking as many hazards as mission capital.

What Is The Difference Between Angel Investors And Venture Capitalists?

Angel Investors and Venture Capitalists both provide investment to startups but fluctuate in scale and method. Angel buyers are commonly people who invest their very own cash in early-degree startups, often in alternate for fairness. They additionally provide mentorship and steerage. Venture capitalists, however, paintings for corporations that pool money from more than one buyer to fund startups. They commonly invest big sums than angels and have more structured strategies and expectancies.

Conclusion

Investment Banking and Venture Capital play essential roles in the economic global, however they fluctuate in recognition, risks, and advantages. Investment banking offers elevating capital and advising on mergers and acquisitions for massive, established businesses, supplying balance and structured growth. Venture capital makes a speciality of investment in early-degree startups with high growth capability, accepting better risks for doubtlessly sizable returns. Both fields provide money making possibilities, but they goal different forms of clients and require wonderful skill units.

When considering a career or investment path, expertise in the differences among investment banking and project capital is crucial. Investment banking is ideal for the ones interested in large-scale financial transactions, while undertaking capital appeals to those passionate about innovation and startups. Salary systems additionally range, with investment banking supplying excessive base salaries and bonuses, whilst undertaking capitalists frequently advantage great wealth via equity and carried hobby. Beginners ought to compare their pursuits and threat tolerance earlier than selecting among these paths.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.