Investment banking facilitates companies raising money by way of issuing shares, bonds, or coping with mergers. It focuses on company customers. Wealth management, on the other hand, serves people by handling their money, imparting economic advice, and making plans. Investment bankers’ paintings on offers that involve massive amounts of cash, while wealth managers work on non-public portfolios.

Investment banking can offer high returns via successful deals and huge transactions. Wealth control gives customized monetary plans, helping individuals grow and guard their wealth. It gives peace of thoughts with lengthy-term economic strategies. Both offerings offer understanding and help in reaching economic desires.

Investment banking entails high chances because of the unstable nature of markets and big-scale transactions. Mistakes can cause full-size losses. Wealth control risks consist of terrible investment choices and marketplace downturns that lessen a client’s portfolio cost. Both require careful choice-making and be laid low with monetary adjustments.

CapitalizeThings.com can help. Get a free consultation by reaching us at +1 (323)-456-9123 or email to get free consultation with our experts.

What Is Investment Banking?

Investment banking is a specialized economic service that assists groups and governments in raising capital. It involves underwriting new debt and equity securities, facilitating mergers and acquisitions, and providing strategic advisory services. Investment banks act as intermediaries between issuers of securities and traders. They assist in managing complicated economic transactions and provide insights into market developments. Their position is critical in ensuring green capital allocation within the financial system.

What Is Wealth Management?

Wealth control in banking is a comprehensive service that makes a speciality of coping with and growing a character’s economic assets. It includes investment recommendation, property making plans, tax offerings, and retirement making plans. Wealth managers create tailored strategies to preserve and beautify wealth through the years. They provide customized financial solutions to satisfy the wishes of every customer. The goal is to obtain financial security and boom through informed selection-making and expert steerage.

Is Investment Banking Part Of Wealth Management?

Investment banking isn’t normally part of wealth control. It makes a speciality of corporate clients, coping with massive-scale transactions like mergers and acquisitions (M&A). Wealth control is focused on individuals, managing and growing non-public belongings. While both require robust interpersonal abilities, they serve distinctive functions and purchaser bases.

Is Wealth Management Part Of Corporate Banking?

Wealth control is not a part of company banking. Corporate banking deals with offerings for groups, consisting of loans and coins control. Wealth management, however, specializes in personal financial planning for people. Both regions require sturdy interpersonal skills, however wealth control is distinct from the company-centered offerings furnished with the aid of corporate banking.

What Is The Difference Between Investment Banking And Wealth Management?

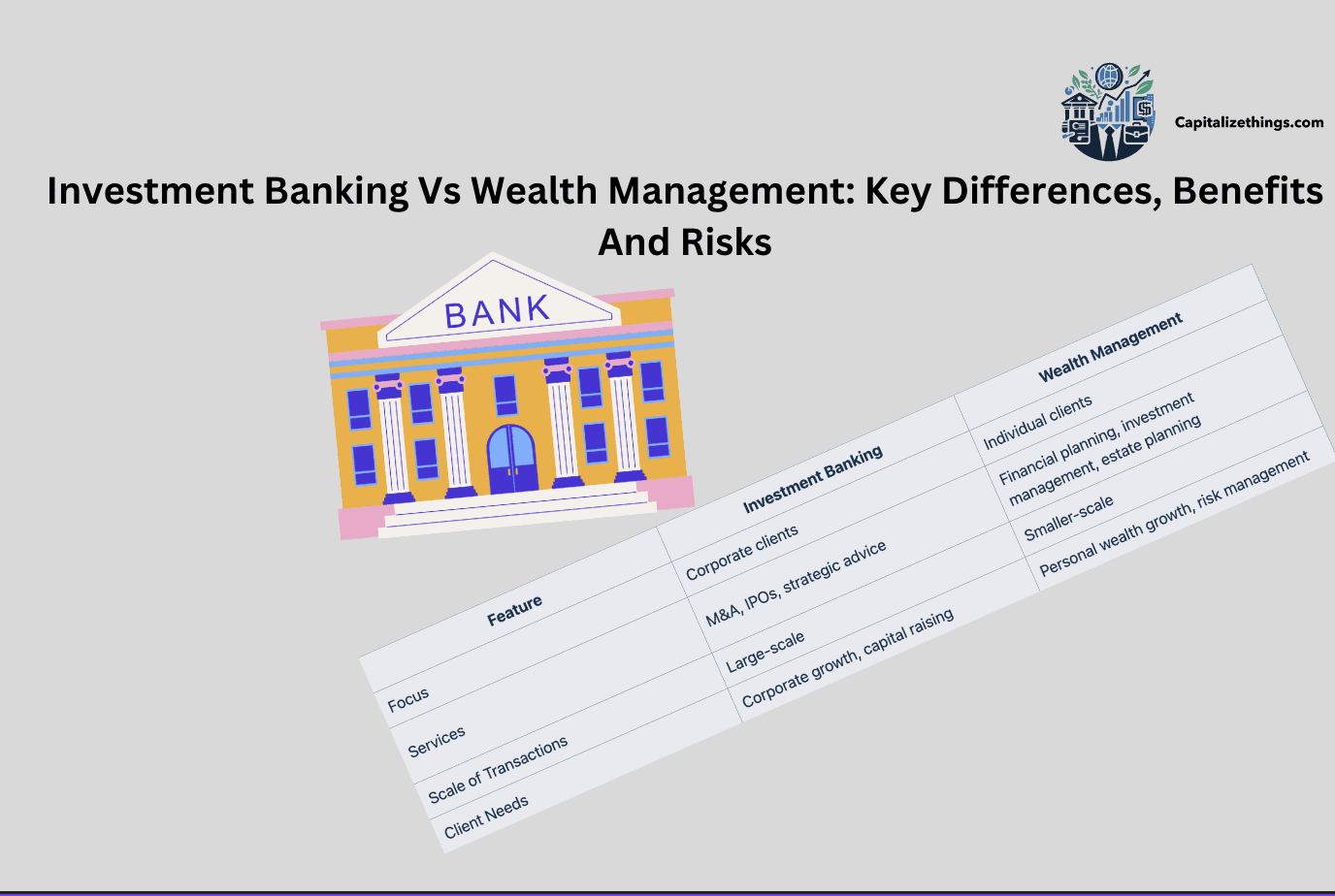

Investment banking focuses on assisting businesses boost capital, control mergers and acquisitions (M&A), and offer strategic recommendations. It serves company customers and offers massive transactions. Wealth control, however, caters to people, presenting personalized monetary planning, investment control, and estate planning. While funding banking is about large-scale company offers, wealth control focuses on growing and shielding man or woman wealth. Both require robust interpersonal abilities however serve one-of-a-kind patron wishes. The table below can help you understand the difference easily.

| Feature | Investment Banking | Wealth Management |

|---|---|---|

| Focus | Corporate clients | Individual clients |

| Services | M&A, IPOs, strategic advice | Financial planning, investment management, estate planning |

| Scale of Transactions | Large-scale | Smaller-scale |

| Client Needs | Corporate growth, capital raising | Personal wealth growth, risk management |

What Is The Salary Difference Between Investment Banking And Wealth Management?

Investment banking usually offers higher salaries as compared to wealth management. Investment bankers, particularly the ones in top firms, can earn big bonuses, regularly surpassing their base profits. Entry-stage positions in funding banking, like analysts, can begin with salaries around $100,000, with bonuses which could double this quantity. In assessment, wealth managers might also begin with lower base salaries, typically starting from $50,000 to $80,000, however their earnings often depend on commissions and consumer portfolios. However, wealth managers also revel in more solid hours and much less pressure, which can be an exchange-off for the decreased beginning income in comparison to investment banking. The table given below is quick to understand.

| Role | Investment Banking | Wealth Management |

|---|---|---|

| Entry-Level | $100,000+ (with potential bonuses doubling salary) | $50,000 – $80,000 (with commissions) |

| Senior | Significantly higher (based on bonuses and firm performance) | Varies (based on client portfolio and performance) |

Which Is Better, Wealth Management Or Investment Banking?

Choosing among wealth control and investment banking relies upon private alternatives and career desires. Investment banking gives better salaries, quicker-paced work, and the fun of massive transactions like mergers and acquisitions. It offers sturdy professional opportunities in company finance and capital markets. Wealth control makes a speciality of building lengthy-time period relationships with clients, offering personalized investment management and economic making plans. It’s perfect for those who feel client interaction and a more solid painting-life stability. Career possibilities in wealth control encompass roles as monetary advisors, portfolio managers, and property planners. Both fields require strong interpersonal and technical competencies however cater to one-of-a-kind consumer desires.

What Is The Educational Degree Need For Investment Banking And Wealth Management?

Investment banking normally calls for a robust educational historical past in finance, economics, or commercial enterprise. Many experts hold ranges from pinnacle universities, and an MBA is frequently desired, particularly from prestigious institutions.

Wealth control additionally values degrees in finance or enterprise, but it places greater emphasis on certifications just like the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). While each field requires a stable understanding of financial principles, wealth management additionally value ranges in psychology or communication, given its awareness on patron relationships. Continuous schooling and certifications are vital in each field to live competitively.

What The Skill Set Difference Between Investment Banking And Wealth Management?

Investment banking needs strong technical skills, together with monetary modeling, valuation, and evaluation. Professionals must excel in coping with complex transactions and know-how marketplace trends. Interpersonal abilities also are vital, as investment bankers want to construct relationships with company customers and negotiate offers.

Wealth management, then again, requires a stability of technical abilities and interpersonal talents. Wealth managers ought to recognize investment management, tax techniques, and estate planning while efficiently speaking with clients. Strong interpersonal talents are crucial for constructing accept as true with and understanding clients’ financial dreams. Both roles require a mix of technical information and the capability to engage customers.

| Skill | Investment Banking | Wealth Management |

|---|---|---|

| Technical Skills | Financial modeling, valuation, evaluation, complex transactions, market trends | Investment management, tax strategies, estate planning |

| Interpersonal Skills | Relationship building, negotiation | Client communication, trust building, understanding client goals |

Who Pays More Investment Banking Or Wealth Management?

Investment banking typically will pay greater than wealth management, specifically on the entry and mid-profession ranges. Investment bankers regularly obtain large bonuses on top of their base salaries, driven by using the success in their offers. In contrast, wealth managers’ income is extra strong but typically decrease, with income frequently tied to the overall performance of purchaser portfolios and commissions from income. At the best tiers, both fields can offer money making repayment, but the competitive nature of funding banking tends to result in higher standard pay. Wealth management, however, might also provide better paintings-life stability and longer-time period career pride.

What Is The Job Function Difference Between Investment Banking And Wealth Management?

Investment banking focuses on helping companies boost capital, manage mergers and acquisitions, and offer strategic advice. The task includes good sized financial evaluation, deal structuring, and market research. Investment bankers’ paintings on massive transactions which can impact complete industries.

Wealth management, by comparison, is focused on assisting individuals manage and develop their personal wealth. Wealth managers provide investment management, retirement making plans, and estate making plans offerings. Their activity entails knowledge of customers’ economic goals and crafting personalized monetary techniques. While investment banking is transaction-oriented, wealth management is dating-driven, focusing on long-time period customer delight and trust.

Does Investment Banking And Wealth Management Target The Same Market?

Investment banking and wealth control no longer targets the same clients. Investment banking in the main serves company clients that specialize in huge-scale transactions, capital elevating, and mergers and acquisitions. The purpose is to generate big revenue via high-cost deals and income. Wealth management, however, targets individual clients, supporting them to control and develop their private wealth. It focuses on offering personalized monetary advice, investment control, and property planning. While both fields require strong sales talents and client control, they cater to unique markets company versus man or woman every with wonderful needs and dreams.

Can We Move From Investment Banking To Wealth Management?

Yes, moving from investment banking to wealth management is possible. Both fields require robust economic information, analytical abilities, and the potential to build relationships with customers. However, wealth control focuses extra on non-public monetary making plans and investment control for people, whilst investment banking is more about corporate finance and huge transactions. Transitioning additionally involves getting to know about private finance, property making plans, and consumer management. Networking and acquiring certifications in wealth management can also assist in making this profession shift.

Can You Move From Wealth Management To Investment Banking?

Yes, shifting from wealth management to investment banking is possible but difficult. Wealth control focuses on people’ economic making plans, even as investment banking deals with corporate clients and massive-scale monetary transactions. Transitioning can also require gaining knowledge in areas like mergers and acquisitions (M&A), corporate finance, and understanding complex marketplace dynamics. Developing robust analytical and interpersonal capabilities is likewise crucial. Networking and possibly pursuing similar education or certifications can help in making the transition successful.

Unsure if a transition from wealth management to investment banking is right for you? Schedule a free consultation with a financial advisor at CapitalizeThings.com or call +1 (323)-456-9123 to discuss your options with our experts.

What Are The Benefits Of Investment Banking And Wealth Management?

Investment banking gives excessive incomes ability, exposure to large transactions, and possibilities for professional advancement. It’s speedy-paced and can be very profitable for people who thrive in dynamic environments. Wealth management affords customized paintings, supporting individuals to grow and protect their wealth. It permits for building lengthy-time period client relationships and gives a more balanced lifestyle as compared to the stressful hours of funding banking. Both fields provide valuable enjoyment in finance and might lead to diverse profession possibilities.

What Are The Risks Of Investment Banking And Wealth Management?

Investment banking involves excessive danger because of unstable markets and big-scale transactions. Mistakes or marketplace downturns can result in enormous financial losses. The pressure and long hours can also cause burnout. Wealth management includes risks like negative funding choices, market fluctuations, and the duty of coping with clients’ economic futures. Poor choices can cause client dissatisfaction and lack of belief. Both fields require cautious choice-making and an information of economic dangers to be successful.

Is There A Difference Between Wealth Management And Financial Advisor?

Yes, there is a difference between wealth management and a financial advisor. Wealth control is a complete service that includes funding control, property planning, tax offerings, and extra, specializing in high-net- worth individuals. An economic marketing consultant gives broader recommendations that could consist of budgeting, saving, and primary investment strategies for clients with varying earnings stages. While each role involves imparting financial guidance, wealth management is normally extra specialized and caters to clients with sizable property.

What Is The Difference Between Financial Investment And Wealth Management?

Financial investment includes allocating money into assets like stocks, bonds, or actual property to generate returns. It’s focused on growing wealth through funding alternatives. Wealth management is broader and includes monetary funding, but also covers monetary planning, tax services, and property planning. Wealth management targets to maintain and grow a man or woman’s commonwealth. While monetary investment is a component of wealth management, the latter affords a more comprehensive technique to handling finances.

What Is The Difference Between Corporate Investment Banking And Investment Banking?

Corporate funding banking is a specific location inside funding banking that deals with corporate customers. It focuses on services like mergers and acquisitions (M&A), elevating capital, and providing strategic advice.

Investment banking, in preference, consists of both corporate funding banking and different regions consisting of buying and selling, studies, and asset control. Corporate funding banking is about helping organizations with massive monetary transactions, at the same time as investment banking covers a broader range of monetary services.

What’s The Difference Between Private Banking And Wealth Management?

Private banking presents personalized banking services to high-internet-worth individuals, focusing on coping with their banking needs. Wealth management, however, offers a broader range of offerings, which include investment management, estate planning, and tax recommendation. While personal banking offers daily monetary topics, wealth control aims to keep and grow a character’s wealth over time. Both cater to rich customers, but wealth control covers extra factors of monetary making plans than private banking.

What Is The Difference Between Investment Banking Vs Private Equity?

The difference between investment banking and private equity is that Investment banking allows companies to enhance capital and manipulate mergers and acquisitions (M&A). It entails massive-scale transactions and serves corporate customers. Private fairness, on the other hand, involves making an investment in corporations, often buying them outright, to enhance their value and promote them for profit. While investment banking is set facilitating economic deals, private equity specializes in coping with and developing groups. Both require strong financial abilities, but their desires and strategies fluctuate appreciably.

What Is The Difference Between Wealth Management And Private Banking?

Wealth management offers a comprehensive variety of services, inclusive of funding control, property planning, and tax recommendation, geared toward keeping and growing a character’s wealth. Private banking, however, focuses more on offering personalized banking offerings like loans, deposits, and credit cards to high-net-worth people. While both cater to wealthy customers, wealth control covers greater factors of monetary planning. Private banking is narrower in scope, dealing specially with banking needs.

What Is The Difference Between Investment Banking And Private Banking?

Investment banking deals with elevating capital for groups, handling mergers and acquisitions (M&A), and offering strategic advice. It makes a speciality of huge-scale economic transactions and serves corporate customers. Private banking, on the other hand, caters to high-internet-worth people, imparting personalized banking offerings like loans and deposits. While funding banking is corporate finance, private banking makes a speciality of personal customers’ banking desires. Both require monetary understanding, but they serve distinctive markets. The video below will clear more of your doubts about private banking and investment banking.

Is Capital Markets The Same As Investment Banking?

Capital markets are a phase of funding banking that makes a speciality of elevating capital for groups and governments by using issuing shares, bonds, and different securities. While capital markets are a part of funding banking, investment banking additionally consists of other services like mergers and acquisitions (M&A) and financial advisory. Capital markets mainly cope with the shopping for and promoting of securities, while funding banking covers a broader range of financial offerings past simply capital markets.

What Is The Difference Between Investment Banking And Asset Management?

The difference between investment banking and asset management is that Investment banking specializes in raising capital, coping with mergers and acquisitions (M&A), and imparting strategic recommendation to company clients. It offers massive monetary transactions. Asset management, however, is set handling investments on behalf of customers, including people or establishments, to attain precise economic desires. While investment banking is transactional and corporate-targeted, asset management is ongoing and customer-targeted, aiming to develop and protect wealth over time.

What Is The Difference Between Investment Management And Commercial Banking?

Investment management control entails handling portfolios of assets like stocks, bonds, and actual property to gain economic goals for individuals or institutions. It makes a speciality of developing and keeping wealth. Commercial banking, offers ordinary banking offerings like loans, deposits, and credit to corporations and individuals. While funding management is about making funding choices, commercial banking deals with handling financial transactions and presenting credit offerings. Both serve one-of-a-kind economic needs.

What Is The Difference Between Investment Management And Corporate Finance?

Investment management involves managing portfolios of property like stocks and bonds for people or establishments to attain monetary dreams. It specializes in developing and retaining wealth via investment strategies. Corporate finance, however, deals with handling an employer’s budget, along with capital structure, budgeting, and investment decisions. While funding control is set managing investments, company finance specializes in optimizing an enterprise’s economic performance and price through strategic planning.

What Is The Difference Between Investment Banking And Hedge Fund?

The difference between investment banking and hedge fund is that Investment banking facilitates groups to boost capital, control mergers and acquisitions (M&A), and offer financial advisory offerings. It makes a speciality of company customers and huge-scale transactions. Hedge budgets, however, are non-public investment funds that use diverse strategies to maximize returns for his or her buyers. They often contain higher hazards and are looking to generate profits in both rising and falling markets. While investment banking is service-oriented, hedge funds are investment-orientated and earnings-driven.

What Is The Difference Between Venture Capital And Investment Banking?

The difference between venture capital and investment banking is that Venture capital includes making an investment in early-stage companies with excessive ability, presenting them with the important price range to expand in trade for equity. It’s centered on startups and rising organizations. Investment banking, however, allows mounted corporations to boost capital, manage mergers and acquisitions (M&A), and offer strategic recommendations. While task capitalists take on high-chance investments in new ventures, investment banking offers massive-scale economic transactions for more installed firms.

Conclude

Investment banking and wealth management serve wonderful roles in the financial world. Investment banking makes a speciality of corporate clients, managing huge transactions like mergers and acquisitions, while wealth control is adapted to people, imparting personalized financial planning and funding management. Both require sturdy economic abilities however cater to exceptional patron needs, with investment banking aiming at corporate increase and wealth control focusing on character wealth upkeep.

Understanding those differences is vital for making informed monetary choices. Whether you are a business enterprise looking to increase capital or an individual looking to grow your wealth, knowing the specific services each gives can guide you in deciding on the proper financial associate. Both fields play vital roles in the financial system, supporting customers to obtain their financial desires through professional steerage.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.