Investment banks serve enterprises and institutional investors. Investment banks may perform M&A transactions, sell securities, or finance significant commercial initiatives. Investment banks employ consultants, capital market analysts, banking analysts, research workers, and trading professionals. Various kinds of investment banks have different clients. Wholesale banking is offered to major clients such as banks, finance institutions, government agencies, companies, and real estate developers. It contrasts with retail banking, which targets individuals and small businesses. Wholesale banking offers currency conversion, operational financing, significant trade transactions, acquisitions and mergers, consulting services, and insurance.

The key difference between Investment banking and wholesale banking is that investment banking involves helping companies issue stocks or bonds to raise finance. Wholesale banking is commercial banking for institutions and large corporations. Retail banks help people secure mortgages, vehicle loans, etc.

The benefits of wholesale banking include additional depositor safety, huge finance for large firms, and minimized wholesale transaction fees. The drawbacks include high interest rates, processing costs, account upkeep, and big losses if the bank fails.

Benefits and Risks of Investment Banking: Investment bankers earn an average of USD 66,493, making a career in finance financially beneficial. Qualified investment bankers earn high commissions and base compensation. Investment banking may appeal to professionals who value their ability to make money. Investment banking needs a lot of time. This includes weekend employment and longer weekday shifts. Even though experts find it challenging, investment bankers can earn high salaries for working long hours.

What is investment banking?

Investment banking provides capital raising (underwriting) and M&A advising services to governments, corporations, and organizations. It connects investors with companies that require finance to expand and operate. This guide explains investment banking and what investment bankers perform.

Is Oliver Wyman an investment bank?

Yes! Oliver Wyman is an investment bank. It’s institutional and Corporate Banking team addresses and anticipates clients’ most important opportunities and difficulties. They believe this requires profound expertise, an unshakable dedication to evidence-based guidance, and long-term client relationships. Their multinational, multidisciplinary team can mobilize best-in-class experience in commercial strategy, stress testing, performance culture, and business re-engineering. Using these skills, they assist clients in restructuring and succeeding in a competitive industry.

Is Morgan Stanley a commercial bank or an investment bank?

Morgan Stanley is an investment bank. It is a global investment banking company trusted by corporations, groups, and governments. Morgan Stanley advises clients on mergers, purchases, restructurings, share repurchases, IPOs, convertible automobiles, debt issues, derivatives, and other matters.

What makes Morgan Stanley different from other investment banks?

Their expertise in capital markets, acquisitions and mergers, and asset management makes them a leading institution for complicated financial transactions and strategic guidance.

What is wholesale banking?

Wholesale banking services are supplied to government agencies, institutional customers, local governments, large enterprises, etc. They also cover financial institution lending and leasing. Indian banks use this business category, known as corporate or commercial banking. This contrasts with retail banking, which serves individuals.

It provides retail bank services to larger institutions at a lesser cost. To attract massive deposits, the financial institution offers significant discounts on services. If an entity’s cash resides in one place, its safety depends on the location’s stability.

Is wholesale banking and commercial banking the same?

Yes! Wholesale banking and commercial banking are the same. Wholesale banking involves currency conversions and huge transactions. Unlike retail banking, which serves consumers, wholesale financial services are often called commercial or corporate banking.

Does wholesale banking include investment banking?

Yes! Wholesale banking includes investment banking. Wholesale banking refers to the goods and services provided by commercial, corporate, and investment banking firms to corporate (SMEs, large corporations, multinationals), government, and institutional customers. Wholesale banking includes commercial lending, hedge funds, handling cash and payments, trade finance, custody, currency services, corporate finance advisory, capital markets underwriting, securitized and structured goods, FX, rates, equity, credit cash, and derivatives trade.

What banks are wholesale banks in the world?

List of the top 10 wholesale banks is:

- JPMorgan Chase & Co. (JPM)

- Bank of America Corp. (BAC)

- Industrial and Commercial Bank of China Ltd. (IDCBY)

- Wells Fargo & Co. (WFC)

- China Construction Bank Corp. (CICHY)

- HSBC Holdings (HSBC)

- Royal Bank of Canada (RY)

- HDFC Bank Ltd (HBC)

- China Merchants Bank (CIHKY)

- Mitsubishi UFJ Financial Group Inc. (MUFG)

- JPMorgan Chase & Co. (JPM)

JPMorgan Chase & Co., a worldwide bank and financial institution holding corporation, provides corporate financing, assets management, wealth management, investing, and consumer banking services.

- Bank of America Corp. (BAC)

Bank of America serves people and companies of all sizes in the U.S. Through its global offices, it offers business and financial management services and consumer banking savings accounts.

- Industrial and Commercial Bank of China Ltd. (IDCBY)

The Commercial and Industrial Bank Of China Ltd. is among the world’s highest AUM and gross revenues. This organization offers businesses and wealthy individuals credit cards, loans, business finance, and money management. The state owns this commercial bank.

- Wells Fargo & Co. (WFC)

Wells Fargo has proudly served consumers since 1852. It is a major U.S. bank that provides personal, commercial, investment banking, and wealth management to individuals, corporations, and institutions.

- China Construction Bank Corp. (CICHY)

The China Construction Bank, a significant commercial bank, offers electronic banking, commercial loans, and credit lines. Personal banking, loans, wealth management, deposit accounts, and credit cards are available through a distinct sector. A broadly traded company’s market capitalization is the number of outstanding shares times its share price, and it changes with the share price.

- HSBC Holdings (HSBC)

London-based HSBC is a multinational financial services firm. One of the largest banks by assets, it operates in over 62 countries and regions. HSBC, a U.K. high-street bank, provides retail, wealth management, commercial, and investment banking. The financial institution serves individuals, medium-sized and small-sized enterprises, and significant companies. HSBC offers insurance, asset management, and other monetary services besides banking.

- Royal Bank of Canada (RY)

The Toronto-based Royal Bank of Canada provides financial and banking services in Canada, the U.S., the U.K., the Caribbean and Europe. As one of the world’s central banks, the Royal Bank offers investing, retirement planning, wealth management, borrowing, auto loans, and payment options. With over 94,000 staff in 29 countries, the bank estimates 17+ million customers.

- HDFC Bank Ltd (HBC)

Mumbai-based HDFC Bank serves businesses and individuals in Dubai, India, Hong Kong, and Bahrain. It offers loans, banking, pensions, auto finance, remittances, investment, credit services, and more.

- China Merchants Bank (CIHKY)

Shenzhen-based China Merchants Bank (CMB) is a state-owned bank with branches across China and activities in Europe, Hong Kong, and the U.S. CMB is one of China’s leading banks and focuses on retail. It offers many personal services and a significant branch and ATM network. The bank offers investment and corporate banking services to medium-sized companies and major corporations.

- Mitsubishi UFJ Financial Group Inc. (MUFG)

Mitsubishi UFJ began as the Konoike Exchange Bureau in Osaka around 1656. It changed names and existed for millennia before becoming MUFG. About 160,000 individuals work for the bank in over 50 countries.

Is wholesale banking the same as investment banking?

Yes! Wholesale banking is the same as investment banking.

Is wholesale banking the same as commercial banking?

Yes! Wholesale banking is the same as commercial banking.

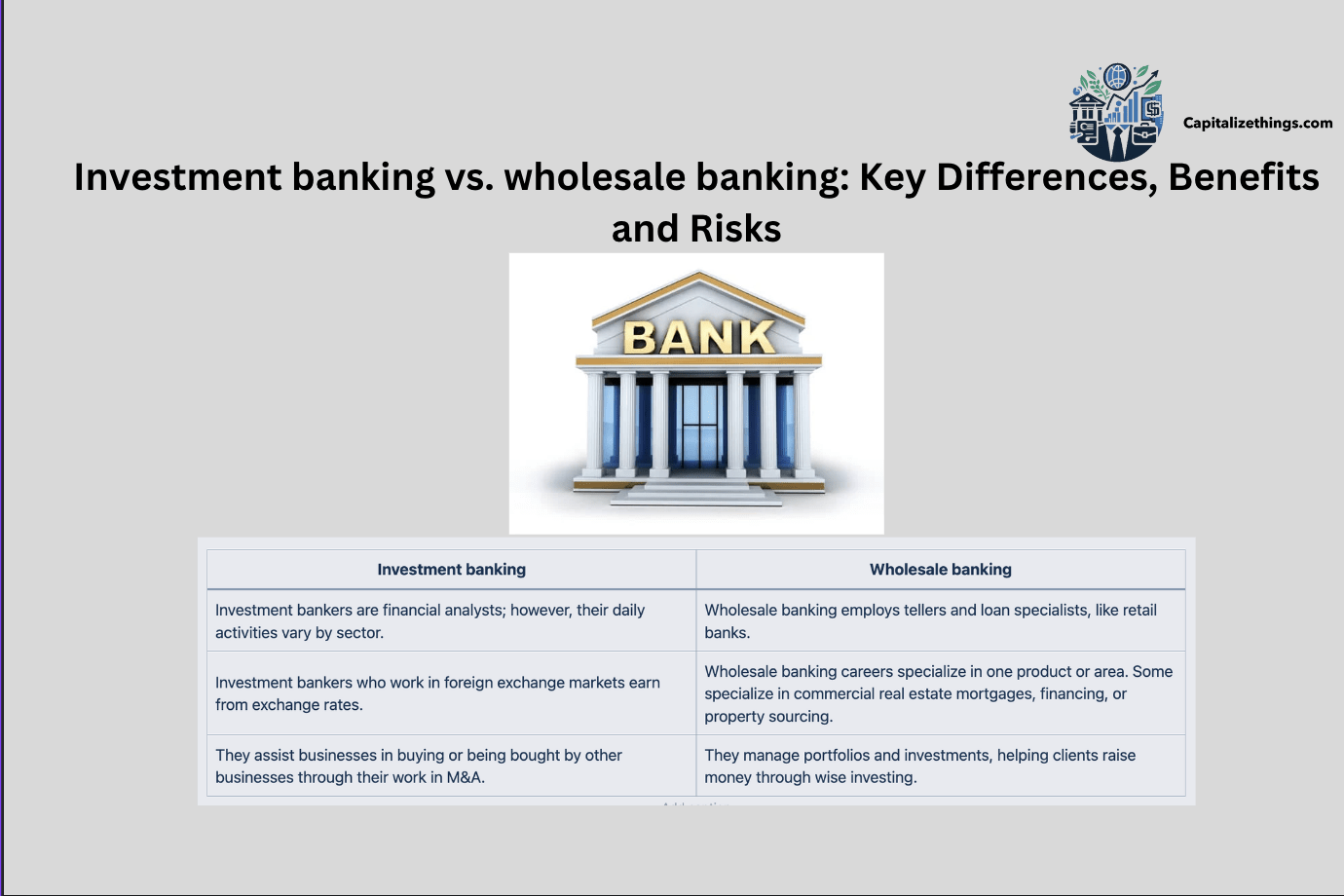

What is the difference between investment banking and wholesale banking?

The difference between investment banking and wholesale banking is given in the following table:

| Investment banking | Wholesale banking |

|---|---|

| Investment bankers are financial analysts; however, their daily activities vary by sector. | Wholesale banking employs tellers and loan specialists, like retail banks. |

| Investment bankers who work in foreign exchange markets earn from exchange rates. | Wholesale banking careers specialize in one product or area. Some specialize in commercial real estate mortgages, financing, or property sourcing. |

| They assist businesses in buying or being bought by other businesses through their work in M&A. | They manage portfolios and investments, helping clients raise money through wise investing. |

Unlock the Right Path for Your Business Growth. Our experts at CapitalizeThings.com can help you navigate the complexities – call us today at +1 (323)-456-9123.

What is a promising career, investment banking or wholesale banking?

Wholesale banking offers more career opportunities than investment banking. It works with large companies, while investment banking serves individual customers. Investment banking offers greater consumer interaction and relationship building than wholesale banking, which offers better wages. An individual’s best selection depends on their goals and interests.

What is the salary difference between investment banking and wholesale banking?

Salary difference between investment banking and wholesale banking is given in table below:

| Investment banking Salary | Wholesale banking Salary |

|---|---|

| Investment bankers earn some of the best salaries in the world. | Each position has a particular wholesale banking role. Individuals get different wages at different positions. |

| A New York City associate can earn $118,371 – $224,449. Investment bankers work 65–75 hours weekly, while entry-level analysts work more. Some institutions expect junior bankers to be available by email and phone on weekends, but most do not. | In 2020, the median teller salary was $32,620. New York City private bankers with five years or more experience as personal bankers or loan officers earn $117,318 – $224,098. |

| Investment banking offers excellent salaries but poor work-life balance. | Commercial banks have an advantage over investment banks in terms of staff hours. Although there are exceptions, many investment bankers work long hours. |

What is the marketing difference between investment banking and wholesale banking?

The marketing difference between investment banking and wholesale banking is given in table below:

| Investment banking | Wholesale banking |

|---|---|

| Investment banking values competence, trust, and partnerships. High-degree networking, innovative thinking (white paperwork, conferences), and customized advice services are common marketing strategies. | Wholesale banking involves flexibility, effectiveness, and complete services. Marketing strategies emphasize technology, efficiency, and global appeal. |

What are the significant advantages of investment banking and wholesale banking?

Advantages of investment banking: Investment banking offers services far beyond those of a typical corporate bank account. Investment banks boost economic growth by encouraging businesses to recruit more workers. Job growth boosts consumption, mass purchasing power, and wealth circulation. Established work models simplify deal lifecycle & refinancing approach. Investment banks retain data on current regulations and policies for company ownership, financing, and bankruptcy, leading to increased regulatory compliance. Authorities will not suddenly punish you for a business arrangement. Increased cross-border collaborations result from enterprises and investors accessing foreign resources for mutual financial benefits.

Advantages of wholesale banking: Depositors are protected in wholesale banking. It offers long-term funding, high-investment government initiatives, and better cash control. Large enterprises can get massive working capital.

Wholesale banking customers pay less for transactions, which aids large-scale business transactions. The most significant benefit of wholesale banking is that clients can have all their finances and data at one place. This simplifies internal stock, allocation, fund, and distribution transactions.

What are the significant disadvantages of investment banking and wholesale banking?

Disadvantages of investment banking: High risks are inherent in banking transactions, particularly electronic fund transfers. Additionally, unprofessional investment banks can boost business and investor risk. Investment banking relies on long-term investments to ensure stable funds. These financial commitments also tie up your resources. Competition authorities prioritize acquisitions and mergers.

Market volatility can impact finance and deal talks. A fair and balanced transaction today can become a problem later. To solve this problem, you need vital market analysis and research abilities.

Disadvantages of Wholesale Banking: They also charge processing fees. You even have to pay for unused services. Accounting and recordkeeping are costly. Bank closure could cause massive losses. Wholesale banking puts clients at risk because all their funds are in a single bank, and businesses rely on the bank’s financial viability. If banks fail during economic downturns, all reliant businesses stop immediately.

What is the difference between banking and universal banking?

Following table shows the difference between banking and universal banking:

| Universal banking | Universal Banking |

|---|---|

| Universal banking is a broader term that provides all services from one company, including investment and commercial banking. | Banking term involve basic bank institutes which provide commercial banking services. |

| A universal bank can also provide savings and checking. | Services offered include saving accounts, investment choices, and insurance. |

What is the difference between wholesale banking and capital markets?

Many people use wholesale banking and capital markets interchangeably, yet different concepts complement each other: investors trade bonds, stocks, and derivatives in capital markets. Investment banks, mutual funds, and pension funds use wholesale banking services from banks.

What is the difference between wholesale banking and corporate banking?

There is no difference between wholesale banking and corporate banking. Corporate banking, often known as wholesale banking, handles huge transactions and serves corporations wholesale.

What is the difference between retail banking and commercial banking?

The major difference between retail banking and commercial banking is explained below in the table:

| Retail banking | Commercial banking |

|---|---|

| Retail banking serves the public with strategically situated bank branches throughout a city that serves retail consumers regularly. | Commercial banking assists companies in raising finances, lending money, and advising. It provides customized finance to businesses |

Retail, merchant, investment, corporate, wealth, and credit management are all capabilities of a bank.

What is the difference between retail banking and investment banking?

The difference between retail banking and investment banking is given below:

| Investment banking | Retail banking |

|---|---|

| Investment banking organizes and oversees significant deals. | Retail banking manages smaller transactions. Investment banking provides underwriting, loan security, mergers, and acquisitions. |

| Investment banking is designed to help huge institutions raise funds and invest, while retail banking mostly facilitates daily public transactions. | Retail banking offers bank accounts, loans, deposits and withdrawals, ATM/Debit/Credit cards, etc. |

What is the difference between a retail bank and a wholesale bank?

The difference between Retail and wholesale banking is given in the below table:

| Retail bank | Wholesale bank |

|---|---|

| Retail banking targets individuals and small companies. | Wholesale banking serves corporations, governments, huge businesses, banks, and wealthy individuals. |

| Retail banks offer standard offerings to individual consumers | Wholesale banks handle substantial financial transactions, while retail banks handle small to medium-sized transactions like everyday banking. Wholesale banks offer complex financial services and goods |

Wholesale banking seeks long-term, strategic partnerships with corporate clients. Retail banking prioritizes interactions with clients and relationships. Retail banking concentrates on smaller, more conventional transactions with lower risk profiles, as its clients frequently have fewer assets or resources. Although they differ, many banks engage in both sectors, offering a variety of financial services to meet clients’ needs.

What is the difference between corporate finance and investment banking?

The major difference between corporate finance and investment banking is given below:

| Corporate finance | Investment banking |

|---|---|

| Corporate finance handles capital & strategic finance decisions. | Investment banking raises companies’ capital. |

| Corporate finance professionals control everyday finances and set short and continuing objectives | Investment bankers raise public market funds, put private equity and loan capital, and handle M&A deals |

What is the difference between corporate banking and investment banking analysis?

Investment banking and corporate banking are different in following ways:

| Investment Banking | Corporate banking |

|---|---|

| Transactional investment banking helps companies with one-time transactions like IPOs. | Corporations receive several financial services from corporate banking. Long-term corporate banking includes traditional banking, risk management, and finance. |

What is the difference between investment banking and venture capital?

The major differences between Investment bankers and Venture capitalists is in their investment pattern. Venture capitalists invest equity directly in a company, whereas investment bankers facilitate acquisitions, mergers, and other tasks.

What is the difference between investment banking and private equity?

Private equity and investment banking firms raise cash for investing in different ways. The difference between investment banking and private equity is given in table below:

| Investment banking | Private equity |

|---|---|

| Investment banks identify businesses and seek funding from investors in capital markets. | Private equity firms invest high-net-worth capital in other companies. |

What is the difference between investment banking and asset management?

The major difference between Asset management and investment banking is given below:

| Asset management | Investment banking |

|---|---|

| Asset management seeks high investment returns for customers. | Investment banking handles M&A and capital raising. |

| Asset management is ideal for security, work-life balance, and long-term client connections. | Investment banking suits those who successfully handle large deals in a fast-paced, demanding environment. |

What is the difference between investment banking and hedge funds?

The difference between investment banking and hedge funds is given below:

| Hedge funds | Investment banking |

|---|---|

| A hedge fund manages multiple portfolios to maximize returns. After investing, it offers portfolio shares to other individuals, profiting from portfolio returns | Investment banks support companies in generating capital and handling complex transactions for sellers and buyers. They earn money from client fees. |

What is the difference between investment banking and wealth management?

The major differences between investment banking and wealth management are given below:

| Investment banking | Wealth management |

|---|---|

| Investment bankers assist with acquisitions, mergers, and capital financing. | Wealth managers work closely with clients (typically individual investors) to understand their demands and fulfil their financial goals. |

| Investment banking is stressful, with a low work-life balance but high pay | Wealth management is less demanding but requires business development |

Wealth managers work closely with clients (typically individual investors) to understand their demands and fulfil their financial goals, while investment bankers assist with acquisitions, mergers, and capital financing. Investment banking is stressful, with a low work-life balance but high pay, while wealth management is less demanding but requires business development.

Conclusion

The critical difference between wholesale banks and investment banks is their clients. Commercial banks offer loans, savings accounts, and credit cards to consumers and SMBs. Internet banking, property loans, and limited investment possibilities are available. Investment banks serve governments, corporations, and investors. They offer corporations and wealthy individuals’ property and asset management, acquisitions and mergers, security financing, financial advising, and auditing services. The advantage of wholesale banks is that they profit from their massive transactions and interest and fees for loans. The major disadvantage of wholesale banks is that they risk a lot with huge loans. A major borrower default can cost the bank a lot.

The benefit of investment banks involves your compensation package, which makes this job appealing. Along with high salaries, investment bankers also receive significant benefit packages. This career is appealing due to commission, insurance, bonuses, and stock opportunities. Competition is a big drawback of investment banking. Competitive investments and high remuneration makes banking a competitive industry. Due to the competition, these professionals feel pressure to perform well and need help to seek peer advice.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.