Investment means buying something or putting money into something that will give you money back. Profits from your investments are known as returns. Investments include index funds, equities, bonds, mutual funds, ETFs, and options. Immediately accessible cash accounts are safe investments and allow you to withdraw money whenever you want. The same money invested in fixed-interest securities, property, or shares fluctuates, but should gain more over time in different amounts. Dynamic asset allocation responds to risks and economic downturns and capitalizes on trends to outperform a benchmark like the S&P 500. Due to portfolio allocation flexibility, investment managers rarely define a target asset structure. Dynamic asset allocation relies on portfolio managers making timely investment decisions.

Building an effective investment strategy requires financial knowledge. Budgeting helps you to keep check and balance of income, expenses, and savings. A budget can help you track your expenditures to calculate how much to save or invest. Set goals and determine how much revenue you want.

What are the basics of investing?

Investing means putting money into securities like bonds, stocks, and investment funds. People who own stock hold equity securities, meaning they have a stake in the firm that issued the shares and are part owners of that business. Bonds are debt securities. Bond issuers provide interest and the return on your initial investment to compensate you for the risk of lending them money. A book gives a complete introduction to managing assets. It talks about the basics of valuing stocks, bonds, derivatives, foreign stock markets, and other types of investments (Fundamentals of Investment Management, Geoffrey A. Hirt, Stanley B. Block, 2009). Securities can also be invested in mutual funds and ETPs.

Investment Regulations

Government regulators, such as the SEC state securities and government-authorized not-for-profit regulators, protect investors through rules, control, and enforcement. Transparency and disclosure govern several regulations and standards in U.S. financial markets. Understanding them helps investors and maintains market integrity.

- Transparency

Trading transparency allows market participants to learn about trading in securities. Transparency includes price, volume, order size, and trader identity. Transparent investment products and marketplaces are safer because regulators and investors can observe what’s happening. Investors benefit from transparency & disclosure. Investors must read and comprehend disclosures and pay attention to financial information.

- Disclosure

Stock and bond disclosure must disclose a company’s financial position and business. This information is crucial for investors choosing the company’s securities. Business disclosure includes earnings reports and announcements with substantial news that might impact a company’s finances.

Securities, including bonds, ETFs, variable annuities, and mutual funds, must also give disclosure documentation. If it’s right for them, these materials describe the investment, fees, risks, and other details to assist investors in deciding. To ensure investment products and services information is fair, balanced, and not deceptive, authorities can monitor a broker dealer’s social media and advertising. Securities firms must also provide information to clients.

SEC Regulation Best Interest encourages firms and their representatives to disclose their services and fees to retail customers when making recommendations. Companies must also declare and handle conflicts of interest that could affect consumer commitments. Retail investors must receive a concise client or customer relationship summary—Form CRS—from securities firms to help them choose a financial expert and services.

How do you learn to invest by yourself?

To teach yourself investing you must consider your overall goals before opening an account and evaluating investment possibilities. Do you want long-term investment or income from your portfolio? Understanding this will reduce investment alternatives and simplify investing. Knowing your goals and timetables can help you decide how much risk to accept and which investments to prioritize. After selecting your goal(s), choose investment vehicles (investing accounts). Several accounts can work collectively to achieve a goal. Consider how much money you’ll put in each investment type of account when choosing which ones to open.

Your investing goal from the first step and the time you have to attain it will decide how much you invest in each fund. It’s called the time limits. Certain accounts can limit investment amounts. Investor risk tolerance is their willingness to take on more risk for a higher return. The investments you add to your portfolio depend heavily on your risk tolerance. A risk tolerance survey can assess your risk tolerance.

These brief survey questions will determine your risk tolerance based on your answers. A conservative investor have more bonds and cash than equities, whereas an ambitious investor can own more stocks. There are only so many financial strategies that work for everyone.

Your risk tolerance and ability determine your investment style, as some techniques demand a more aggressive approach. It also depends on your investing objectives and timeline. Investors fall into two categories: short-term (trading) and long-term. After setting goals, assessing your risk tolerance, deciding how much money to invest, and choosing an investment style, it’s time to develop your portfolio. Building a portfolio involves choosing the finest assets to achieve your goals. After selecting your assets, you’ll need to monitor and adjust your portfolio a few times a year due to market volatility.

If the stock market grows higher than bonds, 70% in stocks and 30% in bonds might become 20% and 80%. When this happens, it’s called “portfolio drift,” if you don’t stop it, you might take on more risk than you planned, which could harm your returns.

Reallocating funds to fit your intended allocation is called rebalancing. It would help if you rebalanced your portfolio when it deviated more than 5% from its starting allocation. Another benefit of robo-advisors is automatic rebalancing.

What is a dynamic investment strategy?

A portfolio management technique known as “dynamic asset allocation” regularly modifies asset class distribution to consider market conditions. Adjustments often reduce stocks in the worst-performing asset classes and increase them in the best-performing ones. Due to confining utility functions to a few forms, previous investigations have found that dynamic methods have a limited variety of behaviour.

We consider the inverse issue: can we describe the results of following any dynamic strategy over time? Can we identify if it is self-financing, produces path-independent profits, and behaves optimally for an expected utility-maximizing investor? We give sufficient and necessary prerequisites for a dynamic approach to meet these features (On dynamic investment strategies, J. Cox, H. Leland, 2000).

Investing 101: what is it?

“Investing 101” means that your money can grow. This could enhance profits or give you enough income to reach your financial goals.

A study is for people who want to know what’s new in the field of investment science currently. It focuses on the basic ideas and how they can be learned and used to solve significant and intriguing investment issues. The book looks at the main ideas behind investment sciences, how they are shown, and how they can be utilized in real life when investing. There are also discussions about where the field might be going in the future, and the book covers many more mathematics topics with a range of difficulty levels. At the end of each chapter, there are also tasks to help people understand investment science better (Investment in Science, J. Cockcroft, 1962).

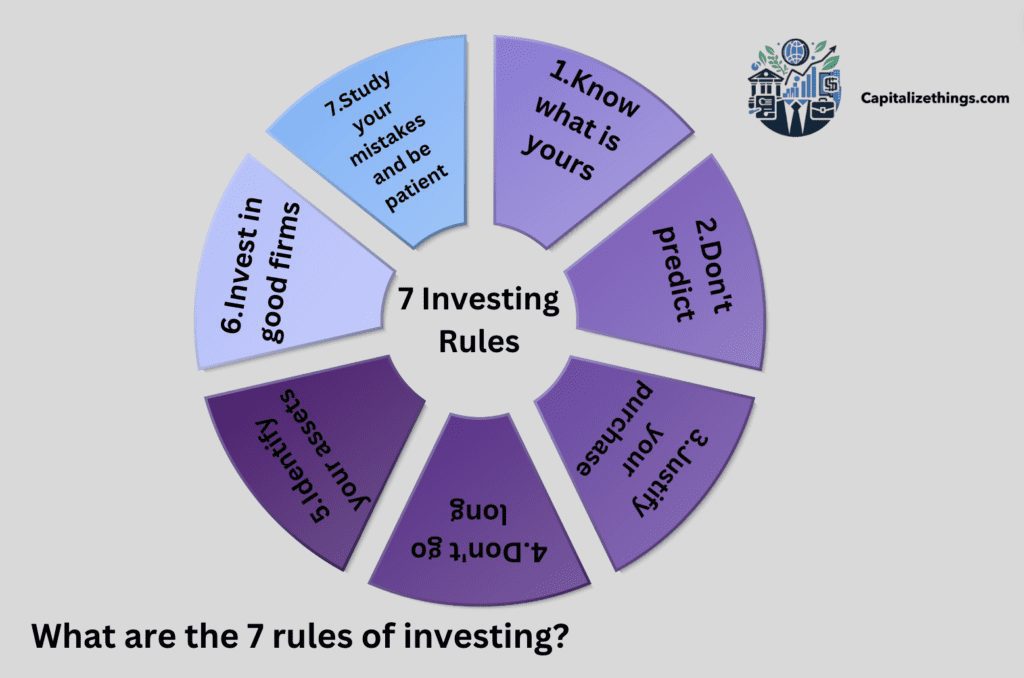

What are the 7 rules of investing?

Over the past century, top economists have explored investing in science or art. Many investing methods, models, and theories require a PhD to understand. Sometimes, the best investors are those who do it for a living. Consider Peter Lynch’s 7 Rules:

Lynch managed one of the most profitable mutual funds, averaging 29% annually from 1977 to 1990. Lynch preached many investment ideas, but all investors should remember seven.

- Know what is yours.

- Don’t predict.

- Justify your purchase.

- Don’t go long.

- Identify your assets.

- Invest in good firms.

- Study your mistakes and be patient.

1. Know what is yours.

Know your stocks, industries, and funds. What are their worth? Who uses their products? Would you want to deal with it?

2. Don’t predict

Avoid trying to predict business or economic trends. Instead, concentrate on what you can manage, such as your investments and savings.

3. Justify your purchase.

Can you tell relatives what you’re buying and why before investing? How does the organization or fund work? If not, be patient and research more.

4. Don’t go long.

Investing is not gambling. While we can’t control the markets, we can control our risk. Your portfolio isn’t for betting or speculation.

5. Identify your assets.

Invest in companies with solid management, business plans, and valuable products. Alternatively, you invest in firms you believe will be successful.

6. Invest in good firms.

Even the best investors make mistakes. Be humble and figure out how to improve.

7. Be patient

Investment isn’t a race. You have time to investigate your mistakes and invest in significant firms and keep patience.

What are the main types of investment?

There are 5 major types of investment:

- Exchange-traded funds

- Index funds

- Mutual funds

- Bonds

- Stocks

1. Exchange-traded funds

Index funds, like ETFs, monitor a benchmark index and try to match its performance. Due to their passive management, they are cheaper than mutual funds. ETFs investment on an exchange like stocks, so their prices move throughout the day.

2. Index funds

Index mutual funds passively track an index instead of paying management to pick assets. An S&P 500 stock index fund holds equity of S&P 500 firms to replicate its performance.

3. Mutual funds

You’re not alone if you dislike picking different bonds and equities. An investment is made explicitly for individuals like you: a mutual fund. Mutual funds allow novices to buy many investments at once. These funds invest investors’ money in stocks, bonds, and other assets with professional management. Professional fund managers manage a hedge fund, a restricted partnership of private investors. These managers make above-average investment returns using leverage (borrowed money) and unconventional asset trading.

4. Bonds

Bonds are loans to businesses or governments. Bonds allow the issuer to take on your money and return your interest.

5. Stocks

A stock is a method of investing in a company. Purchasing stock means getting a fractional share in a company’s profits and assets. Businesses raise cash by selling shares of stock, which buyers can then purchase and sell with each other.

How to start investing for beginners with little money?

To start investing If you have little money, the following 4 methods will help you! Buy stocks that you understand. Start with just one or two stocks and save money over time (Stock-picking warm up, T. Jacobs, 2002).

- IRA retirement account. You can establish one if your employer doesn’t offer a retirement account. You can choose a Roth or regular IRA. IRAs are tax-deferred. Roth IRA withdrawals are tax-free after 59½. You can save $7,000 annually in an IRA before 50 and $8,000 after 50. This is a quick approach to accumulate a lot in a few years.

- Workplace retirement account. Retirement investment is possible with an employer-sponsored plan. Most employers provide retirement savings accounts. Payroll is automatically deducted monthly. Pick a percentage of your gross money to put in this account.

- Buy stock fractions. The stock market is open to everyone. You don’t need much capital to invest in stocks, even if you want to choose your firm. Some new investment apps let you buy fractional stock and ETFs.

- Savings bonds. Savings bonds can be purchased for 30 days (minimum earnings) or 30 years. Ensure you can hold bonds until the end to earn the full reward. Small-dollar investments like savings bonds are fantastic. Expand your portfolio and retain certain risk-free funds.

How much should you invest in stocks the first time?

You should only invest the amount of money you can afford. Ensure you have enough money for an emergency to cover your two-month bills. The amount you start with is acceptable. Over the long term, the average yearly return you get is essential. You will have $237,376 if you start with $1,000 and earn 20% a year for 30 years. Beginning with $5,000 and achieving 12% yearly, you will have $149,799 after 30 years. Buying the appropriate stock is complicated.

Anyone can observe a stock that’s performed well, but predicting its future performance is more arduous. Individual stock investing requires much work to study a firm and handle the investment. You must research the business and predict future trends. After a period of five, an investor of an equivalent size would have had to put 44% more money into issues than non-issuers to have the same amount of money (The New Issues Puzzle, Tim Loughran, J. Ritter, 1995).

What is the best course for beginners to invest in?

The best course for starters is Udemy’s Stock Market from Scratch for Complete Beginners, because it is easy to understand and priced reasonably.

How does the investment work?

When you invest, you buy things like bonds and stocks to make more money over time. How much you spend depends on your objectives and how much risk you are willing to take. A risk ladder can measure risk. When investors sell goods for more than they spent for them, they make a profit. Investing can make money for you, but you sometimes get cash back.

An organizational-economic system to govern investments and maximize positive outcomes is essential to the investment process, said Violeta Heraymovych. The essay aims to define ‘the investment process’ and investment activities and their relationship. The theory and methodology of the investment method and operations are studied. It has been shown that investment operations as an organization and their execution method should be evaluated at the macro, meso, and micro levels, considering account industry features and the relationship between national economic levels and spheres.

The categories are interdependent since the investment process involves the inside content of consecutive transformations related to investment rationale and implementation. From investment aims and decision-making to results, its stages define investment activity. Establishing an organizational-economic framework of investment activity to govern investment flows and optimize benefits is crucial to the investment cycle (Process, Violeta Heraymovych, 2015).

How do you start Implementing investing sensibly and simply?

The best sensible and simple way to invest is by making a proper plan and setting goals. You can invest in a long-term strategy or accumulate “blocks” of funds and invest them separately if you save frequently. You can invest in more ways with a lump sum or ‘blocks’ of funds. Property investing and publicly traded share purchases are possible with funds and affordable property valuations. There are several levels of investment liquidity. “Highly liquid” investments let you get the cash immediately. Liquid assets include bank deposits and publicly traded stocks. Pension and property plans aren’t. Some investments last longer than others. For example, a 10-year savings plan stays a 10-year one as long as you don’t break the rules.

How do you invest in everyday items?

You can invest in the following 5 household items.

- Lighting

- Home Security

- Basic furniture

- Cleaning supplies

- Cookware

1. Lighting

Design professionals say proper lighting is crucial to a home. Bright lights aid in personal hygiene, reading, cooking, and playing. Cheap lights and fixtures burn out rapidly and waste electricity. Choose energy-saving lamps to brighten your home and set the mood for daily activities.

2. Home Security

The safety of your family is your primary priority in your house. When you move in, install locks, security systems, and solid doors and windows. You will need help installing these, which costs more, but you don’t want to cut corners. Many individuals realize the necessity of alarm systems after their home is broken, so be proactive. Thus, you can relax when your children or grandparents are home alone.

3. Basic furniture

If you want your house to be ‘liveable,’ get the best necessary furniture. The first step is to decide what’s ‘necessary furniture’ for you—a big bed to sleep on or a comfy couch to curl up on. Take time to decide, and then find things that fit. Choose strong, well-built things. Nice furniture improves lifestyle.

4. Cleaning supplies

You can invest in cleaning supplies. Good dust mops, handheld vacuums, and floor mops will assist you in cleaning every part of your home. Conduct research and evaluate your home size. The cleaning products market has risen rapidly recently, with new inventions, including wireless and robotic cleaners.

5. Cookware

Durable and practical kitchenware makes meal cooking and preparation easier and saves time. Quality kitchen utensils made of steel, copper, or brass last a lifetime, so buying them is safe. I recommend buying them fresh; this is a worthwhile house investment.

What are the best stock apps for beginners?

The 7 best stock apps for the beginners are:

- Fidelity

- E*TRADE

- Merrill Edge

- Charles Schwab

- Robinhood

- Interactive Brokers

- Ally Invest

How do you start investing in real estate as a beginner?

Real estate investing can be done indirectly or directly. Some real estate ventures involve little time or money, depending on your approach. Graham says the amount of money you need to invest in real estate depends on the property, location, market conditions, and investment type. In certain situations, investors need only a few hundred dollars. Residential, office, retail, securitization, industrial investments, and REITs are all real estate investment techniques (Real Estate Investment, G. Goddard, Bill Marcum, 2012).

- Investing applications

Brokerages and investing applications provide fractional investments, which let you buy partial shares of a property or real estate investment at a low cost and earn monthly dividends. This option will provide less revenue than holding 100% of an asset or parcel of land, but it’s an excellent way to start investing in real estate.

- Real estate sponsor

Sponsors find, buy, and manage properties for investors. Sponsors usually invest in the property, but less than other investors.

- Direct purchase

You buy all or part of a rental housing complex, home, shopping center, or industrial office building.

What is the best platform for beginners to trade?

Fidelity is the best trading platform for novices to start trading because it covers everything. All stock, ETF, and options trades with Fidelity are commission-free. Option trades often cost $0.65 per contract, especially at large, legacy corporations. Active traders, short sellers, and intermediate-to-advanced options traders need margin accounts. Fidelity warns investors about margin trading hazards. Fidelity offers competitive margin rates of interest beginning at 13.575% on balances under $25,000 as of June 2024.

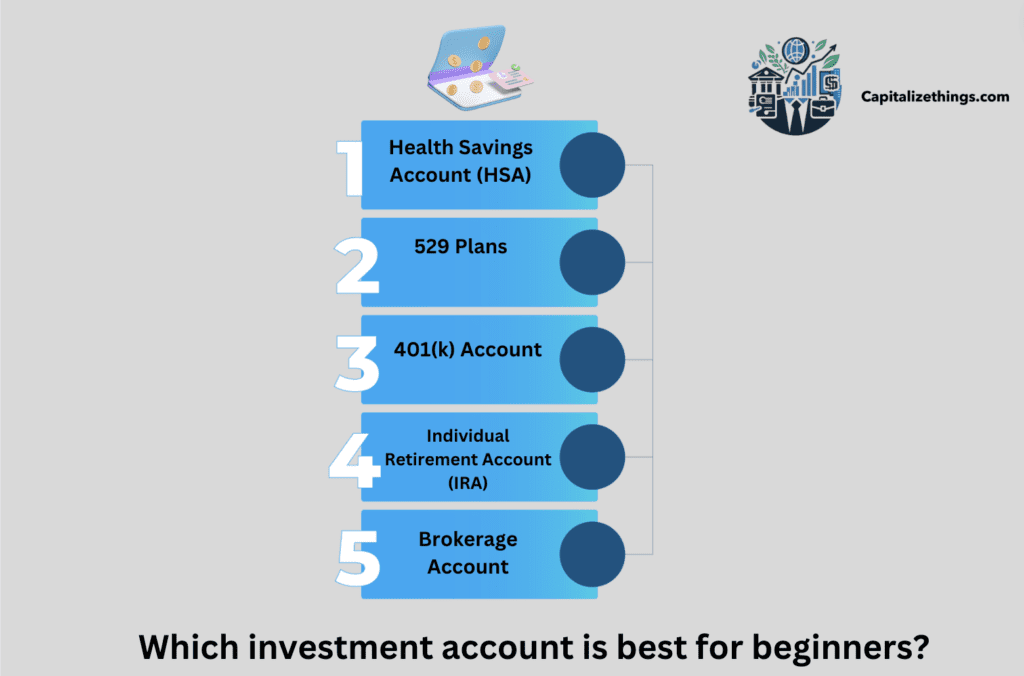

Which investment account is best for beginners?

There are 5 best investment accounts:

- Health Savings Account (HSA)

Consider an HSA a health-focused investing account. It works with health insurance plans with big deductibles. Your pre-tax contributions cover current medical bills or save for the future. The great thing is that the money can be put to work and rise over time.

- 529 Plans

A 529 plan works like a regular savings account to put money away for college. This plan, named after Section 529 of the IRS Code, lets you save for college while getting tax breaks. It is a great choice for parents who want to save money for their kids’ college.

- 401(k) Account

Companies provide retirement savings plans like 401(k). Please feel lucky if your boss gives it to you. Some companies will match a certain amount of your contribution. The money accumulates tax-deferred before retirement.

- Individual Retirement Account (IRA)

Individual Retirement Accounts (IRAs) are bonus savings accounts. It’s for retirement savings. The primary forms of IRAs are Conventional and Roth.

- Brokerage Account

A brokerage account is like a front door into the world of business. You can buy and sell many things with this account, such as stocks, mutual funds, bonds, and more.

How should a beginner invest in mutual funds?

First, check to see if a fund’s investment goals fit with your long-term budget. A low-cost S&P 500 index fund is a good choice for people just starting to trade or still in college. Due to the many options, picking a fund to invest in can take time and effort. People who are more experienced shareholders or want to put their money into an actively maintained fund needs to study more. If you’re going to put in a fund, you should learn about its general approach and financial thought, as well as the portfolio managers making decisions for you.

How much money is enough to start investing in the beginning?

You can make your first deposit anywhere from $500 to $5,000. You can spend any amount, but your right amount will depend on your finances. It’s essential to have a plan for when you need more money for a minimum payment or the fees of investing. Otherwise, if you have a lot of debt or haven’t saved enough for an emergency, those things should come before buying.

How to invest in stock market for beginners?

To invest in stock market, beginners should follow given tips:

- Buy the appropriate stock

- Avoid individual stocks.

- Diversify your portfolio

- Be ready for unexpected condition

- Use a stock market simulation before investing.

- Be dedicated to your long-term investment

- Start today and prevent short-term trading.

- Invest gradually.

What are the best investing books to learn investing?

The 5 famous books to learn investing are:

- Rich Dad Poor Dad

- A Beginner’s Guide to the Stock Market: Everything You Need to Start Making Money Today

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

- Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger

- The Intelligent Investor

What is the best investment to make fast money?

Stocks are the best investment for making fast money. Most people should own equities or stock-based assets like ETFs and mutual funds. Stocks are also the finest long-term investment for the typical person.

What is the best way to invest with Fidelity?

Pick your assets and make them last with these 4 steps:

- Prepare a strategy

- Choose investments

- Purchasing investments

- Check in

What are the Best Brokers websites for beginner?

Charles Schwab is the finest platform for beginners due to its paper trading features and ease of use. Beginner investors need trading platforms that are simple to use and can develop with them as they gain confidence in buying and trading. Charles Schwab, Fidelity, and Interactive Brokers scored good for platform capabilities and ease of use.

4 of the best Brokers websites for beginner:

- Charles Schwab

- Robinhood

- Vanguard

- J.P. Morgan Self-Directed Investing

What is the most profitable and sound investment for beginners?

The most profitable and sound investment for beginners that are investing for a car or housing, high-yield savings accounts or mutual funds for money markets can always help you earn more.

How to invest in a business while the business is new?

There’s no right or wrong way to invest in a new and small business. Jaime Raskulinecz, founder and CEO of Next Generation Trust Company, a financial services company that helps people with self-directed retirement plans, said, “It depends on what your small company needs and what you want from your investment.”

Most common ways to invest in a business while the business is new:

- Debt investments

- Equity investments

What are the main asset classes of investment risk ladder?

The 6 primary asset classes of investment risk ladder should be known by new investors, ordered from least to most significant risk.

- Cash.

- Bonds.

- Mutual Funds.

- Exchange Traded Funds (ETFs)

- Stocks.

- Other Investments Alternative

Which Asset Classes Are the Least Liquid?

One of the most minor liquid assets is real estate, since it takes time to purchase or sell at market price. Securities in the money market are among the most liquid since they can be traded for total value.

What asset classes perform good during inflation?

Several different types of assets do well, when prices go up. if you evaluate investment profits of, it’s clear that real estate and securities have traditionally been considered tangible investments to protect against inflation. Inflation-indexed bonds, certain sector stocks, and secured debt help retain a portfolio’s buying power.

Should I invest during a recession?

During a recession period, if you want to give up on stocks, the investment experts say the most effective technique to follow is not to do that. When the economy is unstable, a few areas usually keep going and give buyers steady returns.

Should I invest during an election year?

Election events don’t significantly affect long-term investment profits, research has shown that . Be ready for change, especially during the primary season, but don’t fear it. Look at it as a possible chance. Don’t try to time the markets around elections; stick to a long-term financial plan.

Conclusion

Investing is an organized method to get richer over time by buying stocks, bonds, or exchange-traded funds (ETFs) to make money back. Investment involves buying financial assets with growth potential, evaluating hazards, and following a long-term plan. Investing is a simple procedure. Speculation, panic, and anxiety can lead to significant losses and more risk, therefore avoid them when investing. New investors must be patient and consistent.

Dynamic asset allocation is a way to diversify your portfolio and to change the arrangement of your financial assets based on significant trends in the stock market or the economy. You can invest now and let your cash grow into a vehicle you can keep on for years and make more money. History suggests that the stock market gives the best return. Before inflation, the stock market returns 10%, which other kinds of assets rarely match.

Yet many believe it’s too hazardous, or they need to learn how to invest. While investing does include the risk of loss, a balanced portfolio will assist you weather market swings and achieve your objectives. Before investing, investigate and with a financial professional. Ensure you’ve paid off high-interest debt and saved for emergencies before investing.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.