Bonds are a good investment for investors seeking steady income and portfolio stability, as they provide fixed interest payments and return of principal at maturity. According to the Securities and Exchange Commission (SEC), bonds are fixed-income securities that represent loans from investors to borrowers, typically offering predictable returns through fixed interest rates and being considered one of the safest investment types.

Bonds play a vital role in portfolio diversification and risk management. According to a 2021 study by Vanguard, a well-diversified portfolio containing bonds has historically provided better risk-adjusted returns compared to portfolios solely invested in stocks. While bonds generally offer lower returns than stocks, with government bonds averaging 4.2% annual returns over the past 20 years according to Federal Reserve data, they provide essential stability during market downturns and act as a reliable source of income for conservative investors.

What Are Bonds?

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically corporate or governmental. According to the Securities and Exchange Commission (SEC), when an investor buys a bond, they are lending money to the issuer in exchange for regular interest payments and the return of the bond’s face value at maturity. Bonds are considered one of the safest types of investments due to their fixed interest rates and repayment of principal. They are widely used for financing governments, companies, or large projects.

Bonds play a crucial role in helping investors achieve their financial objectives. Investors choose bonds to generate steady income streams over a set period. Bonds offer predictable returns because they have fixed interest rates, known as coupon rates. Investors commonly use bonds to diversify their portfolios and reduce overall investment risk. Different types of bonds have varying terms, risk levels, and potential returns. For example, U.S. Treasury bonds are backed by the federal government and are considered one of the safest investments, while corporate bonds typically offer higher yields but carry more risk. Investors value bonds for their dependability and ability to provide a structured approach to saving and investing.

At Capitalizethings.com we offer a wide range of bond investment options to help our clients achieve their financial goals. Contact our experienced financial advisors at +1 (323)-456-9123 or email us today to learn how bond investing can benefit your portfolio.

Why Are Bonds Considered Fixed-Income Investments?

Bonds are classified as fixed-income securities because they provide investors with a steady stream of payments at predetermined intervals. These payments, known as coupon payments, are calculated based on a fixed interest rate that is set when the bond is issued. According to a 2021 report by the Investment Company Institute (ICI), this predictable income stream makes bonds an attractive option for investors seeking stability and reliability in their portfolios. The fixed nature of bond payments is essential for investors engaged in long-term financial planning, such as saving for retirement or funding education expenses.

The fixed-income characteristic of bonds is instrumental in helping investors achieve their financial objectives. For instance, when governments issue bonds to raise funds for infrastructure projects, they commit to paying bondholders interest at specific intervals, usually semi-annually or annually. This system ensures a reliable income source for bondholders, which can be particularly appealing to risk-averse investors or those with shorter investment horizons. Similarly, corporations may issue bonds to finance expansions or refinance existing debt, providing investors with a predictable return on their investment.

Another key aspect of bonds as fixed-income investments is their well-defined maturity dates. When an investor purchases a bond, they know precisely when they will receive their principal amount back, barring any default by the issuer. This structure adds an element of certainty and predictability to bonds, making them a cornerstone of fixed-income investing. By strategically incorporating bonds with different maturities into their portfolios, investors can create a ladder of income streams to meet their short-term and long-term financial needs.

What Are The Different Types Of Bonds To Invest In?

The 7 major types of bonds to invest in are:

- Government Bonds – Issued by national governments, offering low-risk investment opportunities

- Corporate Bonds – Debt securities issued by companies to raise capital for business operations or expansion

- Municipal Bonds – Issued by local governments to fund public projects, often with tax advantages for investors

- Treasury Bonds – Long-term government bonds offering stable returns and backed by the U.S. Treasury

- Zero-Coupon Bonds – Bonds sold at a discount, with no periodic interest payments, and redeemed at face value upon maturity

- Convertible Bonds – Corporate bonds that can be converted into company stock, providing potential for capital appreciation

- High-Yield Bonds – Bonds with higher risk and higher potential returns, issued by companies with lower credit ratings

1. Government Bonds

Government bonds are a low-risk investment option issued by national governments to finance public projects and expenditures. These bonds provide investors with fixed returns and are backed by the full faith and credit of the issuing government, making them one of the safest investment vehicles available in the market.

2. Corporate Bonds

Corporate bonds are investment instruments issued by companies to raise capital for various purposes, such as funding business operations, expansions, or acquisitions. These bonds typically offer higher returns compared to government bonds, but investors must carefully consider the creditworthiness and financial stability of the issuing company before making an investment decision.

3. Municipal Bonds

Municipal bonds are investment vehicles issued by local governments, such as cities, counties, or states, to fund public projects like schools, roads, or infrastructure improvements. These bonds often provide tax advantages for investors, as the interest earned may be exempt from federal, state, or local taxes, making them an attractive investment option for those seeking tax-efficient income.

4. Treasury Bonds

Treasury bonds are long-term investment securities issued by the U.S. Department of the Treasury, typically with maturities of 20 or 30 years. These bonds are considered one of the safest investment options, as they are backed by the full faith and credit of the U.S. government, and are often used by investors to generate stable returns over extended periods.

5. Zero-Coupon Bonds

Zero-coupon bonds are unique investment instruments that do not provide periodic interest payments throughout their term. Instead, investors purchase these bonds at a significant discount to their face value and receive the full face value upon maturity, with the difference representing the return on their investment. Zero-coupon bonds can be an effective investment tool for those planning for specific future financial goals, such as funding college education or retirement.

6. Convertible Bonds

Convertible bonds are investment securities that combine features of both bonds and stocks, allowing bondholders to convert their bonds into a predetermined number of shares of the issuing company’s common stock. These bonds offer investors the potential for capital appreciation through the underlying stock, while still providing the stability and income of a fixed-income investment.

7. High-Yield Bonds

High-yield bonds, also known as “junk bonds,” are investment instruments that offer higher potential returns due to the increased risk associated with the issuing company’s lower credit rating. These bonds are issued by companies with less-than-stellar credit histories, and while they provide the opportunity for higher income, investors must carefully manage the risks involved and conduct thorough research before investing in high-yield bonds.

What Types Of Bonds Should Beginners Invest In?

Beginners should start with government bonds. They are most of the safest sorts of bonds. Treasury bonds provide low risk and strong returns. These bonds provide fixed interest payments, making them ideal for new investors. Corporate bonds can also be considered, though they carry more risk. Beginners should aim for bonds with shorter maturities for more stability.

A nicely-assorted bond portfolio is right for novices. Diversification reduces the danger of losses. Beginners ought to search for bonds from specific sectors. Government bonds, municipal bonds, and funding-grade corporate bonds provide protection. These bonds also offer regular income through the years. It is vital to research the provider’s creditworthiness.

How Do Bond Ratings Protect Investors?

Bond ratings protect investors by providing an independent assessment of the creditworthiness and default risk associated with a particular bond issue. According to a 2022 report by the Securities and Exchange Commission (SEC), these ratings, typically assigned by agencies such as Moody’s, Standard & Poor’s (S&P), and Fitch, help investors make informed decisions by evaluating the likelihood of an issuer defaulting on its debt obligations. Bonds with high ratings, such as AAA or AA, are considered less likely to default, while lower-rated bonds, like junk bonds, carry a higher risk of default.

Bond ratings serve as a crucial tool for investors to navigate the complexities of the bond market and avoid excessive risk. By assessing the financial strength and stability of bond issuers, these ratings enable investors to determine whether the potential returns of a bond justify the associated risks. For example, an investor seeking a stable income stream may prefer highly-rated bonds, which offer lower yields but greater security, while an investor with a higher risk tolerance might consider lower-rated bonds with the potential for higher returns.

It is important to note that bond ratings are not static and can change over time based on the issuer’s financial health and market conditions. A downgrade in a bond’s rating can signal potential financial difficulties for the issuer, leading to a decrease in the bond’s price. Conversely, an upgrade can indicate an improvement in the issuer’s creditworthiness, making the bond a more attractive investment. Therefore, investors must regularly monitor bond ratings and adjust their portfolios accordingly to ensure they are making informed decisions based on the most current information available.

What Are The Best Strategies For Investing In Bonds?

Diversification is one of the most effective strategies for investing in bonds, as it helps spread risk across various types of bonds and issuers. A well-diversified bond portfolio typically includes a mix of government bonds, corporate bonds, and municipal bonds, each of which responds differently to market changes and economic conditions. By allocating funds across different bond categories, investors can minimize the impact of underperformance in any single bond type, ultimately enhancing overall portfolio stability and potential returns.

Another key strategy for successful bond investing is to construct a bond ladder, which involves purchasing bonds with different maturity dates. This approach ensures that a portion of the investor’s bond holdings mature at regular intervals, providing a steady stream of income and the opportunity to reinvest in new bonds with potentially higher yields. Additionally, bond laddering helps mitigate the risk associated with interest rate fluctuations, as the investor is not locked into a single rate for an extended period.

Monitoring interest rate trends is also crucial for bond investors, as changes in rates can significantly impact bond prices and overall portfolio performance. When interest rates rise, the value of existing bonds typically falls, as newer bonds are issued with higher yields. In such scenarios, investors may consider selling shorter-term bonds and reinvesting in bonds with higher yields to capitalize on the changing market conditions. Conversely, when interest rates decline, investors may opt for longer-term bonds to lock in favorable yields. By staying attuned to market trends and adjusting their bond investment strategies accordingly, investors can effectively navigate the dynamic nature of the bond market.

Are Bonds Currently A Good Investment?

The attractiveness of bonds as an investment option depends on various factors, including the current market conditions, interest rate environment, and an individual investor’s financial goals and risk tolerance. In the current low interest rate environment, bonds may not offer the same level of returns as they have in the past. When interest rates are low, the value of existing bonds with higher coupon rates typically increases, making them more expensive for investors to purchase. Consequently, investors may find it challenging to generate substantial income from bonds in such conditions.

However, bonds can still play a crucial role in a well-diversified investment portfolio, particularly for conservative investors prioritizing capital preservation and stable income. Government bonds, such as U.S. Treasury bonds, are generally considered one of the safest investment options, as they are backed by the full faith and credit of the U.S. government. While these bonds may offer lower yields compared to other investment vehicles, they can provide a reliable source of income and help balance the overall risk in a portfolio.

Investors seeking higher returns may consider corporate bonds or bond mutual funds, which offer exposure to a diverse range of bonds. Corporate bonds typically provide higher yields than government bonds, but they also carry more risk, as the issuer’s ability to repay the debt is dependent on its financial health. Bond mutual funds can help mitigate this risk by spreading investments across multiple bond types and issuers, providing greater diversification and potential for higher returns. Ultimately, the decision to invest in bonds should be based on an individual’s financial objectives, risk tolerance, and overall investment strategy.

Are Bonds Safe Investment If The Market Crashes?

Bonds, particularly government bonds, are generally considered to be a safe haven during market downturns, as they tend to maintain their value better than stocks and other riskier assets. In the event of a market crash, investors often flock to the relative safety of bonds, especially U.S. Treasury bonds, which are backed by the full faith and credit of the U.S. government. This increased demand for bonds can drive up their prices, providing a buffer against the losses experienced in other parts of an investor’s portfolio.

However, it is important to note that not all bonds are created equal, and some may be more vulnerable to market volatility than others. Corporate bonds, particularly those issued by companies with lower credit ratings, can be more susceptible to defaults during economic downturns, as businesses may struggle to meet their debt obligations. To mitigate this risk, investors should focus on high-quality, investment-grade bonds from financially stable companies, as these are more likely to weather market turbulence.

Bond investors can also benefit from the stable income streams provided by regular interest payments, even during market crashes. While stock dividends may be reduced or eliminated during economic downturns, bond interest payments are legally binding obligations that must be met by the issuer. This predictable income can help investors maintain a steady cash flow and provide a measure of financial security during uncertain times. However, it is crucial to remember that no investment is entirely risk-free, and factors such as inflation and interest rate changes can still impact the performance of bonds over time.

What Is The Average Return On Bonds?

The average return on bonds varies depending on the type of bond, its maturity, and the prevailing market conditions. Generally, government bonds, such as U.S. Treasury bonds, offer lower returns compared to corporate bonds, as they are considered to be less risky. According to data from the Federal Reserve, the average annual return on 10-year Treasury bonds over the past 20 years has been around 4.2%. However, in the current low interest rate environment, yields on government bonds have been hovering around 1-3% per annum.

Corporate bonds, on the other hand, typically offer higher returns than government bonds, as they carry more risk. The average return on corporate bonds depends on factors such as the issuer’s creditworthiness, the bond’s maturity, and the overall economic conditions. Investment-grade corporate bonds, which are issued by companies with strong credit ratings, typically offer annual returns ranging from 3-6%. High-yield corporate bonds, also known as “junk bonds,” can provide even higher returns, often exceeding 6%, but they also come with a greater risk of default.

It is essential for bond investors to consider the impact of inflation on their real returns. For example, if an investor earns a 3% return on a bond while inflation is running at 4%, the real return (adjusted for inflation) would be negative. Additionally, the creditworthiness of the bond issuer plays a significant role in determining the potential return, as bonds from highly-rated issuers generally offer lower yields compared to those from issuers with weaker credit profiles. Investors should carefully assess the balance between risk and return when making bond investment decisions, and consider diversifying their bond holdings across different maturities, sectors, and credit qualities to manage overall portfolio risk.

What Are The Advantages Of Investing In Bonds?

One of the primary advantages of investing in bonds is the potential for steady, predictable income through regular interest payments. Bonds are often referred to as fixed-income securities because they provide investors with a stable stream of income over the life of the bond. This predictability makes bonds an attractive option for conservative investors, retirees, and those looking to preserve capital while generating a reliable cash flow. Unlike stocks, which can experience significant price fluctuations, bonds tend to be less volatile, offering a measure of stability to an investment portfolio.

Another key benefit of bond investing is the opportunity for portfolio diversification. By allocating a portion of their assets to bonds, investors can potentially reduce the overall risk of their portfolios, as bonds often have a low or negative correlation with stocks. This means that when stock prices fall, bond prices may remain stable or even increase, helping to offset losses in other parts of the portfolio. A well-diversified portfolio that includes a mix of stocks, bonds, and other asset classes can help investors weather market volatility and achieve their long-term financial goals.

Moreover, certain types of bonds, such as municipal bonds, may offer tax advantages to investors. Interest earned on municipal bonds is often exempt from federal income taxes and, in some cases, state and local taxes as well. This can be particularly appealing to investors in higher tax brackets, as tax-free income can help them keep more of their investment returns. However, it is important to note that tax-exempt bonds may offer lower yields compared to taxable bonds, so investors should carefully consider their individual tax situations and investment objectives when evaluating the potential benefits of tax-advantaged bonds.

At Capitalizethings.com, our knowledgeable financial advisors can help you navigate the complex world of bond investing and develop a personalized strategy to meet your unique financial goals. Contact us via email or call at +1 (323)-456-9123 today to learn more about how incorporating bonds into your investment portfolio can help you achieve financial stability and growth.

How Do Bonds Provide Portfolio Diversification?

Bonds are essential for portfolio diversification because they help spread risk across different asset classes and typically have a low correlation with stocks. According to a 2021 study by Vanguard, a well-diversified portfolio containing a mix of stocks and bonds has historically provided better risk-adjusted returns compared to a portfolio solely invested in stocks. By including bonds in a portfolio, investors can potentially offset losses from stock market downturns, as bonds tend to be less volatile and provide more stable returns.

Moreover, the performance of bonds often differs from that of stocks, further enhancing the diversification benefits. During periods of economic uncertainty or market stress, investors often flock to the relative safety of bonds, particularly government bonds, which can help balance overall portfolio performance. This phenomenon is known as the “flight to quality,” where investors seek to reduce their exposure to riskier assets and prioritize capital preservation. By diversifying with bonds, investors can create a more resilient portfolio that is better equipped to weather various market conditions and achieve long-term financial goals.

Can Bonds Offer Stability During Market Volatility?

Bonds, particularly government bonds, are widely regarded as a haven during times of market volatility, providing stability and preservation of capital. When stock markets experience significant declines or turbulence, investors often turn to bonds as a safer alternative. The fixed income payments and principal repayment at maturity offered by bonds can provide a reliable stream of income, even during economic downturns. This predictability is especially valuable for risk-averse investors, retirees, or those with shorter investment horizons.

During periods of market stress, the demand for bonds typically increases, which can lead to rising bond prices and lower yields. This inverse relationship between bond prices and yields can help offset losses in other parts of an investor’s portfolio. While corporate bonds may be more susceptible to economic conditions and company-specific risks, government bonds, such as U.S. Treasury bonds, are considered one of the safest investments due to their backing by the full faith and credit of the U.S. government. Municipal bonds, issued by state and local governments, can also offer stability and tax advantages, making them an attractive option for income-seeking investors during market volatility.

Why Are Bond Yields Currently Improving?

Bond yields are currently improving primarily due to rising interest rates and stronger economic growth. Central banks around the world, including the Federal Reserve, have been raising interest rates to combat inflation and normalize monetary policy after years of ultra-low rates. As interest rates rise, newly issued bonds must offer higher yields to attract investors, as the opportunity cost of holding bonds increases. This shift in monetary policy has led to a repricing of bonds across the market, with investors demanding higher yields to compensate for the increased risk of holding fixed-income securities in a rising rate environment.

In addition to the impact of monetary policy, the improvement in bond yields is also supported by stronger economic growth. As economies recover from the COVID-19 pandemic and businesses expand, the demand for credit rises. Governments and corporations issue more bonds to finance their activities, leading to an increased supply of bonds in the market. With a growing economy and higher demand for borrowing, bond yields tend to rise, reflecting the market’s expectation of future growth and inflation. Investors can potentially benefit from these improving bond yields by allocating a portion of their portfolios to fixed-income securities, taking advantage of the higher returns while still maintaining a level of stability and diversification.

At Capitalizethings.com we understand the importance of portfolio diversification and the role that bonds can play in achieving your financial goals. Our experienced financial advisors are here to help you navigate the ever-changing bond market and develop a personalized investment strategy tailored to your unique needs. Contact us today to learn more about how bonds can provide stability and growth potential for your investment portfolio.

What Are The Risks And Downsides Of Investing In Bonds?

Investing in bonds carries several risks that investors should be aware of. One of the primary risks is interest rate risk, which refers to the inverse relationship between bond prices and interest rates. When interest rates rise, the value of existing bonds decreases, as newer bonds are issued with higher yields, making the older bonds less attractive to investors. This can lead to a reduction in the market value of bonds, potentially resulting in losses for investors who need to sell their bonds before maturity.

Another significant risk associated with bond investing is credit risk, which is the possibility that the bond issuer may default on their debt obligations. If a bond issuer is unable to make the promised interest payments or repay the principal at maturity, bondholders could lose a portion or all of their investment. This risk is particularly relevant for corporate bonds, as the financial stability and creditworthiness of the issuing company play a crucial role in determining the likelihood of default.

Inflation risk is another factor that can negatively impact bond performance. Bonds typically provide a fixed stream of income, which can lose purchasing power over time if inflation rates exceed the bond’s yield. This is especially concerning for long-term bonds, as they are more susceptible to the erosive effects of inflation. Additionally, bonds are generally less liquid than stocks, meaning that investors may face challenges when trying to sell their bonds quickly, particularly during times of market stress. This liquidity risk can result in investors having to sell their bonds at a discount, leading to potential losses.

How Does Inflation Affect Bond Performance?

Inflation has a direct and significant impact on bond performance. As inflation rises, the purchasing power of the fixed interest payments provided by bonds diminishes. Although bondholders continue to receive the same nominal interest payments, the real value of these payments decreases as the cost of goods and services increases due to inflation. Consequently, the inflation-adjusted returns on bonds may be lower than anticipated, particularly if inflation rates exceed the bond’s coupon rate.

Moreover, inflation erodes the real value of the principal amount that bondholders receive when the bond matures. If inflation has been high over the life of the bond, the principal repayment may have significantly less purchasing power compared to when the bond was initially purchased. This can make bonds less attractive to investors during periods of elevated inflation, as they seek investments that can keep pace with rising prices.

Why Might Long-Term Bonds Lose Value When Rates Rise?

Long-term bonds are particularly vulnerable to losing value when interest rates rise due to their higher duration risk. Duration measures the sensitivity of a bond’s price to changes in interest rates, with longer-term bonds typically having higher durations than shorter-term bonds. When interest rates increase, the market value of existing bonds with fixed coupon rates declines, as investors can purchase newly issued bonds with higher yields. Consequently, the prices of long-term bonds tend to fall more sharply than those of short-term bonds when rates rise.

Furthermore, the longer the maturity of a bond, the greater the impact of interest rate changes on its price. This is because investors are exposed to the fixed coupon rate for an extended period, during which market interest rates may fluctuate significantly. As a result, long-term bonds experience more substantial price declines when rates rise, as investors demand higher yields to compensate for the opportunity cost of holding a lower-yielding bond over a longer time horizon.

What Historical Data Supports Bonds Over Cash?

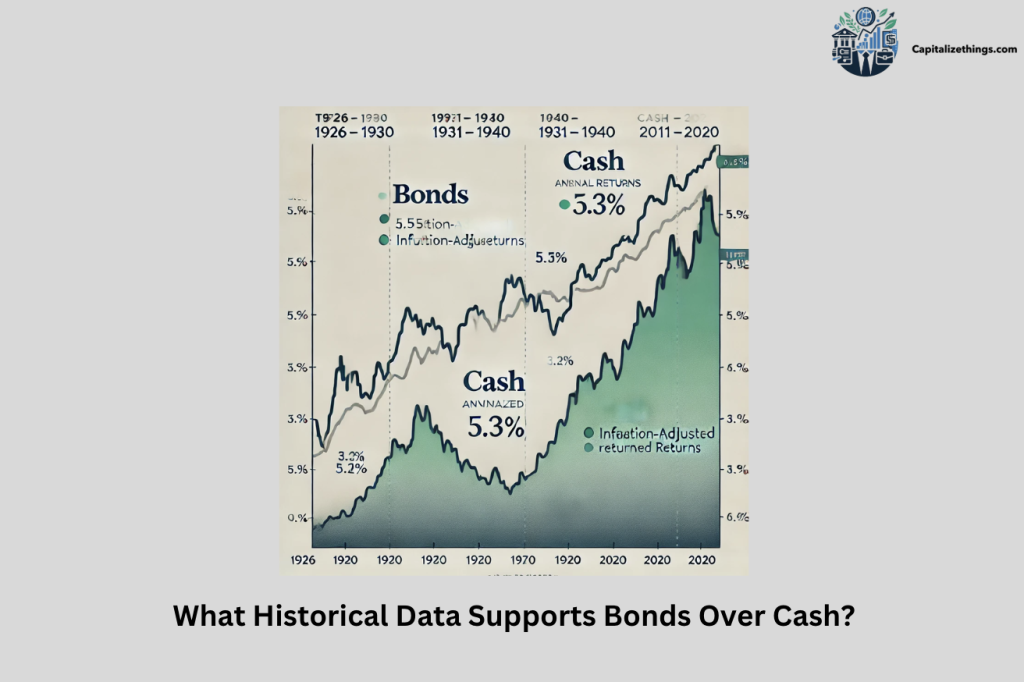

Historical data demonstrates that bonds have consistently outperformed cash over long investment horizons, providing investors with better returns and protection against inflation. According to a study by Ibbotson Associates, which analyzed market data from 1926 to 2020, bonds have delivered an annualized return of 5.3%, compared to just 3.3% for cash investments. This outperformance is primarily attributed to the power of compound interest, as the regular interest payments from bonds are reinvested over time, leading to significant wealth accumulation.

Bonds have proven to be particularly effective in preserving purchasing power during periods of elevated inflation. While cash investments struggle to keep pace with rising prices, bonds offer a fixed rate of return that can help mitigate the erosive effects of inflation. For example, during the inflationary period of the 1970s, bonds provided investors with an average annual return of 5.5%, while cash investments returned just 0.2% per year after adjusting for inflation. This highlights the importance of bonds as a long-term investment vehicle for protecting and growing wealth.

Moreover, historical data reveals that bonds have exhibited greater stability than cash investments, particularly during times of market uncertainty. While cash investments may provide a sense of safety, they often fail to deliver meaningful returns, especially in low interest rate environments. In contrast, bonds have consistently generated positive real returns over extended periods, making them an attractive option for risk-averse investors seeking a reliable income stream. The chart below illustrates the long-term performance of bonds versus cash over the past 50 years, emphasizing the superior returns and inflation-hedging characteristics of bonds.

The chart clearly demonstrates the widening gap between bond and cash returns over time, with bonds consistently outperforming cash, particularly during inflationary periods. This historical data supports the notion that bonds are a superior long-term investment compared to cash, offering investors the potential for higher returns, greater stability, and enhanced protection against the erosive effects of inflation.

Are Current Bond Yields Attractive For New Investors?

Current bond yields, although lower than in past decades, still offer new investors a steady income stream and a relatively secure investment option, particularly during times of market uncertainty. Government bonds provide stable, reliable returns, while corporate bonds offer slightly higher yields but come with increased risk. New investors should carefully assess their risk tolerance and financial goals when selecting bond investments, focusing on those that align with their individual needs.

Bond yields are influenced by various factors, including economic conditions and interest rates. As interest rates fluctuate, yields can vary across different bond types, presenting opportunities for investors seeking lower volatility in their portfolios. High-yield bonds may appeal to risk-tolerant investors looking for higher returns, but the specific choice of bond should be based on a thorough analysis of current market conditions and the investor’s risk profile.

While some investors may hesitate to enter the bond market due to the current low yields, it is essential to recognize the role that bonds play in providing stability, income, and diversification within an investment portfolio. Bonds have historically outperformed cash investments, making them a valuable tool for managing risk and achieving long-term financial objectives. For new investors who prioritize safety and a steady income stream, bonds remain an attractive choice, offering the potential for long-term security and moderate returns.

How Do Bonds Perform In Periods Of Falling Interest Rates?

Bonds typically perform well during periods of falling interest rates, as the inverse relationship between interest rates and bond prices leads to capital appreciation for existing bondholders. When interest rates decrease, the value of bonds with higher coupon rates increases, making them more attractive to investors compared to newly issued bonds with lower yields. This increased demand drives up bond prices, allowing investors to benefit from both regular interest payments and potential capital gains.

In a falling interest rate environment, long-term bonds tend to experience the most significant price increases. This is because the fixed payments provided by these bonds become more valuable relative to new bonds issued at lower interest rates. As a result, investors holding long-term bonds can potentially realize substantial returns during periods of interest rate declines. Short-term bonds also benefit from falling rates, although the price appreciation may be less pronounced.

The sensitivity of bond prices to interest rate changes highlights the importance of bonds as a stable investment option during times of market uncertainty. As interest rates fall, investors holding bonds are more likely to experience positive returns, as the value of their holdings increases. This performance characteristic underscores the role that bonds can play in diversifying an investment portfolio and providing a measure of stability during periods of economic volatility.

Are Junk Bonds Worth Their High Returns?

Junk bonds, also known as high-yield bonds, offer investors the potential for higher returns compared to investment-grade bonds, but these returns come with a significantly higher level of risk. Issued by companies with lower credit ratings, junk bonds carry an increased likelihood of default, meaning that the issuer may be unable to make interest payments or repay the principal when the bond matures. While the high yields associated with junk bonds can be attractive to investors seeking greater returns, it is crucial to carefully consider one’s risk tolerance and ability to withstand potential losses before investing.

Junk bonds compensate investors for the added risk by offering higher interest rates. These bonds are often viewed as speculative investments, as the higher yields reflect the market’s assessment of the issuer’s creditworthiness and the potential for default. While some investors may successfully navigate the junk bond market and realize significant profits, others may experience losses if the issuing companies encounter financial difficulties or fail to meet their debt obligations.

Investing in junk bonds requires thorough research, risk management, and a clear understanding of the potential downsides. Although the returns associated with junk bonds are generally higher than those of other bond types, investors must carefully evaluate the financial health and future prospects of the issuing companies. Junk bonds are most suitable for investors with a higher risk appetite and a long-term investment horizon, as well as those who can effectively diversify their portfolios to mitigate the impact of potential defaults. Proper diversification across different issuers, industries, and credit ratings can help manage the risks inherent in junk bond investing.

Should I Buy Long-Term Bonds Now?

The decision to buy long-term bonds should be based on an individual investor’s financial goals, risk tolerance, and an assessment of current market conditions. Long-term bonds can be an attractive option for investors seeking a stable income stream over an extended period, as they typically offer higher interest rates compared to shorter-term bonds. However, it is important to consider the potential impact of interest rate changes on the value of long-term bonds, as they are more sensitive to rate fluctuations than their short-term counterparts.

If interest rates are expected to rise in the near future, purchasing long-term bonds may not be the most advantageous strategy. When interest rates increase, the prices of existing bonds tend to fall, as newer bonds are issued with higher yields to reflect the changing market conditions. This can lead to potential losses for investors who need to sell their long-term bonds before maturity. Conversely, if interest rates are expected to remain stable or decline, long-term bonds may be more attractive, as they allow investors to lock in the current yields for an extended period.

Ultimately, the decision to invest in long-term bonds should be made within the context of an investor’s overall financial plan and investment strategy. It is important to carefully assess one’s investment timeline, liquidity needs, and risk tolerance before committing to long-term bonds. For investors with a longer investment horizon who do not require immediate access to their funds, long-term bonds can provide a reliable income stream and a degree of stability within a diversified investment portfolio. However, it is always advisable to consult with a financial professional to determine whether long-term bonds are an appropriate investment choice based on one’s unique financial circumstances and market outlook.

When Is The Best Time To Buy Bonds?

The best time to buy bonds is when interest rates are high, as this allows investors to lock in higher yields and potentially benefit from capital appreciation if rates subsequently decline. When interest rates are elevated, the prices of existing bonds tend to be lower, presenting an opportunity for investors to purchase bonds at a discount. By buying bonds during periods of high interest rates, investors can secure a higher income stream and position their portfolios to take advantage of potential price increases if market conditions change.

Another favorable time to consider bond investments is during periods of economic uncertainty or market volatility. In such environments, investors often seek the relative safety and stability offered by bonds, particularly government bonds, which are backed by the full faith and credit of the issuing government. This “flight to quality” can drive up demand for bonds, leading to price appreciation and providing a measure of protection against stock market downturns. Investing in bonds during market instability can help to balance the overall risk within an investment portfolio and provide a source of steady income.

In addition to monitoring interest rate trends and market conditions, investors should also consider the impact of inflation on their bond investments. Periods of low inflation can be an optimal time to buy bonds, as the purchasing power of the fixed interest payments is more likely to be preserved over time. When inflation is high, the real returns generated by bonds may be diminished, as the rising cost of goods and services erodes the value of the fixed income stream. As such, investors should be mindful of the inflation outlook and consider the potential impact on their bond holdings when making investment decisions.

What Is The Market Forecast For Bonds For Next 5 Years?

The market forecast for bonds over the next 5 years is largely dependent on the expected path of interest rates and the overall economic outlook. If interest rates continue to rise, as many experts anticipate in response to a recovering global economy and potential inflationary pressures, bond prices could come under pressure. Rising interest rates tend to have a negative impact on bond prices, as the fixed interest payments provided by existing bonds become less attractive compared to newly issued bonds with higher yields. In this scenario, bond investors may experience lower total returns, particularly for longer-dated bonds, which are more sensitive to interest rate changes.

However, the pace and magnitude of interest rate increases are likely to be gradual and will depend on a variety of factors, including the strength of the economic recovery, inflation dynamics, and central bank policy decisions. If the economic recovery proves to be uneven or if inflationary pressures remain subdued, the impact on bond markets may be less pronounced. In such an environment, bonds could continue to provide investors with a measure of stability and a reliable income stream, albeit with potentially lower yields compared to historical norms.

Bond investors should also closely monitor inflation trends over the coming years, as changes in inflation expectations can have a significant impact on bond performance. If inflation remains well-anchored and within the target ranges set by central banks, bonds are more likely to maintain their value and provide investors with a degree of protection against market volatility. However, if inflation begins to accelerate and central banks are forced to take more aggressive action to curb price pressures, bond yields could rise, and prices could come under pressure. As always, investors should maintain a well-diversified portfolio and regularly review and adjust their bond holdings in light of evolving market conditions and their individual investment objectives.

Can Bonds Offset Stock Market Losses Effectively?

Yes, bonds can play an important role in offsetting stock market losses and providing a measure of stability within a diversified investment portfolio. Due to their generally low or negative correlation with stocks, bonds tend to perform differently than equities during periods of market stress, helping to mitigate the impact of stock market downturns on an investor’s overall portfolio. When stock prices decline, investors often seek the relative safety and predictable income provided by bonds, particularly government bonds, which are backed by the full faith and credit of the issuing government.

The effectiveness of bonds in offsetting stock market losses depends on several factors, including the specific types of bonds held, the duration of the market downturn, and the overall composition of the investment portfolio. Government bonds, such as U.S. Treasury securities, are generally considered to be the most effective in providing a buffer against stock market volatility, as they are among the safest and most liquid investments available. Investment-grade corporate bonds can also help to stabilize a portfolio, although they may be more susceptible to credit risk and economic uncertainties compared to government bonds.

It is important to recognize that while bonds can help to mitigate stock market losses, they are not a perfect hedge and cannot completely eliminate portfolio risk. The performance of bonds during market downturns will depend on a variety of factors, including the severity and duration of the decline, changes in interest rates, and investor sentiment. Moreover, while bonds can provide a measure of stability and income, they typically offer lower long-term growth potential compared to stocks. As such, investors should view bonds as a complementary component of a well-diversified portfolio, rather than a complete substitute for equity investments.

Are Government Bonds Safer Than Corporate Bonds?

Yes, government bonds are generally considered to be safer than corporate bonds, as they are backed by the full faith and credit of the issuing government. In the case of U.S. Treasury securities, for example, the risk of default is considered to be extremely low, as the federal government has the power to raise taxes and print money to meet its debt obligations. This perceived safety makes government bonds a popular choice among risk-averse investors and those seeking a reliable source of income.

In contrast, corporate bonds are issued by private companies and are subject to credit risk, which refers to the possibility that the issuer may default on its debt obligations. The creditworthiness of a company, as well as its ability to generate sufficient cash flows to service its debts, largely determines the level of risk associated with its bonds. While some high-quality corporate bonds issued by financially stable companies may be considered relatively safe investments, they still carry a higher level of risk compared to government bonds.

What Percentage Of Your Portfolio Should Be In Bonds?

The percentage of an investor’s portfolio that should be allocated to bonds depends on a variety of factors, including age, risk tolerance, investment goals, and overall financial situation. A common guideline is the “age-based rule,” which suggests that the percentage of a portfolio allocated to bonds should roughly correspond to an investor’s age. For example, a 40-year-old investor might consider allocating around 40% of their portfolio to bonds. This rule is based on the idea that as investors approach retirement, their primary focus should shift from growth to capital preservation and income generation.

However, it is important to recognize that the age-based rule is a general guideline and may not be appropriate for everyone. Investors with a higher risk tolerance and a longer investment horizon may choose to allocate a smaller portion of their portfolio to bonds, while those who are more risk-averse or have shorter investment timelines may opt for a higher allocation. Ultimately, the key is to strike a balance between potential growth and stability, taking into account one’s individual financial circumstances and investment objectives.

Should You Invest In Short-Term Or Long-Term Bonds?

The decision to invest in short-term or long-term bonds depends on an investor’s specific financial goals, risk tolerance, and market outlook. Short-term bonds, which typically have maturities of less than five years, are generally less sensitive to interest rate fluctuations and offer greater liquidity compared to long-term bonds. These characteristics make short-term bonds an attractive option for investors who prioritize capital preservation, have shorter investment horizons, or anticipate a need for their funds in the near future. However, short-term bonds also tend to offer lower yields than their long-term counterparts.

Long-term bonds, with maturities of ten years or more, typically provide higher yields to compensate investors for the increased risk associated with tying up their funds for an extended period. These bonds can be an attractive option for investors seeking a steady income stream and those with longer investment horizons, such as individuals saving for retirement. However, long-term bonds are more sensitive to changes in interest rates, meaning that their prices can fluctuate more significantly in response to market conditions. If interest rates are expected to rise, the value of long-term bonds may decline, exposing investors to potential losses if they need to sell before maturity.

How Do Bond Funds Differ From Individual Bonds?

Bond funds and individual bonds are two distinct ways for investors to gain exposure to the fixed-income market, each with its own advantages and considerations. Bond funds are professionally managed investment vehicles that pool capital from multiple investors to purchase a diversified portfolio of bonds. When an investor buys shares in a bond fund, they gain exposure to a wide range of bonds with varying maturities, credit qualities, and issuer types. This diversification can help to mitigate the impact of any single bond’s performance on the overall portfolio and provides investors with a degree of professional management and expertise.

In contrast, individual bonds represent a direct investment in a specific bond issued by a government, municipality, or corporation. When an investor purchases an individual bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Individual bonds offer investors greater control over their fixed-income investments, as they can select specific bonds that align with their risk tolerance, income needs, and investment horizon. However, investing in individual bonds also requires more research and due diligence on the part of the investor, as well as a larger initial capital commitment to achieve adequate diversification.

Are Bonds Better Than Cash Investments?

Whether bonds are better than cash investments depends on an investor’s specific financial goals, risk tolerance, and investment timeline. Bonds and cash investments serve different purposes within an investment portfolio and offer distinct advantages and trade-offs. Bonds, which represent a loan to a government or corporation, generally provide higher potential returns than cash investments, such as savings accounts or money market funds. By investing in bonds, investors have the opportunity to earn regular interest income and potentially benefit from capital appreciation if interest rates decline.

However, bonds also carry a higher level of risk compared to cash investments. While cash investments provide a high degree of liquidity and principal stability, they typically offer very low returns that may not keep pace with inflation over time. Bonds, on the other hand, are subject to various risks, including interest rate risk, credit risk, and liquidity risk. The value of bonds can fluctuate in response to changes in market conditions, and investors may face the possibility of losing a portion of their principal if they need to sell their bonds before maturity in an unfavorable market environment.

When Should You Choose Cash Instead Of Bonds?

Choosing cash over bonds is most appropriate when liquidity and capital preservation are top priorities, or when market conditions make bonds less attractive. Cash investments, such as savings accounts, money market funds, or short-term certificates of deposit (CDs), offer a high degree of safety and easy access to funds. This liquidity can be crucial during times of economic uncertainty or when an investor anticipates a near-term need for their money. In contrast, bonds typically require a longer investment horizon, as investors may face penalties or market losses if they need to sell their holdings before maturity. For risk-averse investors or those with short-term financial goals, cash can provide peace of mind and flexibility.

Another scenario where cash may be preferable to bonds is when interest rates are exceptionally low, or when inflation is running high. During periods of low interest rates, the yields offered by bonds may not provide a significant enough return to justify the added risk and reduced liquidity compared to cash investments. Similarly, when inflation is elevated and outpacing bond yields, the purchasing power of the fixed interest payments from bonds can erode over time. In these situations, holding a portion of one’s assets in cash or cash equivalents may help preserve capital and mitigate the impact of inflation on an investor’s overall portfolio. However, it’s important to note that a well-diversified investment strategy typically includes a mix of both cash and bonds, with the allocation determined by an individual’s unique financial circumstances, risk tolerance, and long-term objectives.

What Are The Best High Return Alternative Investments Of Bonds?

For investors seeking high-return alternatives to bonds, stocks are often the first consideration, as they have the potential to generate substantially higher returns over the long term. According to historical data from Ibbotson Associates, large-cap stocks have delivered an annualized return of 10.2% between 1926 and 2020, compared to just 5.3% for bonds over the same period. However, it’s crucial to recognize that the higher return potential of stocks comes with increased volatility and risk. Stock prices can fluctuate significantly in response to various factors, such as economic conditions, company performance, and market sentiment, leading to the possibility of both larger gains and losses. Investing in stocks requires a long-term perspective and a tolerance for short-term market fluctuations, but for those who can stomach the volatility, stocks can be a powerful tool for building wealth over time.

Real estate is another compelling high-return alternative to bonds, offering investors the potential for both regular income and long-term capital appreciation. Real estate investments can take various forms, such as rental properties, real estate investment trusts (REITs), or participation in real estate development projects. Historically, real estate has delivered strong returns, with the NCREIF Property Index showing an average annual return of 8.8% between 1978 and 2020. However, like stocks, real estate investing comes with its own set of risks, including market downturns, property maintenance costs, and the potential for vacancies or tenant issues. Despite these challenges, real estate has proven to be a profitable long-term investment for many, often outperforming bonds in terms of total return.

For accredited investors with a higher risk tolerance, private equity and venture capital investments can offer the potential for outsized returns and greater control over the underlying assets. These investments typically involve providing capital to private companies or startups in exchange for an ownership stake, with the goal of realizing significant gains through a future sale or initial public offering (IPO). While private equity and venture capital investments have the potential to generate substantial profits, they also come with a high degree of risk, as many early-stage companies fail to achieve their growth objectives.

Moreover, these investments are often illiquid, meaning that investors may have difficulty selling their holdings if they need to access their capital before a planned exit. Cryptocurrencies have also emerged as a high-return alternative investment in recent years, attracting investors with their potential for rapid price appreciation. However, the cryptocurrency market is highly speculative and prone to extreme volatility, with prices often driven by factors such as investor sentiment, regulatory developments, and media attention. While some investors have realized significant profits from cryptocurrency investments, many others have experienced substantial losses, underscoring the importance of thorough research and risk management when considering this asset class as an alternative to traditional bond investments.

Are Government Bonds A Good Investment?

Yes, government bonds are generally considered a good investment for those seeking safety and reliability. While their returns may be lower compared to other assets like stocks, government bonds provide steady income backed by the full faith and credit of the issuing government.

Are Premium Bonds A Good Investment?

It depends on your investment goals. Premium bonds offer the chance to win tax-free prizes but do not provide guaranteed returns or steady income like traditional investments. They may be suitable for those who enjoy the excitement of potentially winning prizes, but they are not ideal for investors seeking consistent returns or income.

Are Municipal Bonds A Good Investment?

Yes, municipal bonds can be a good investment for those seeking lower-risk, tax-advantaged income. However, it’s important to consider the financial health of the issuing municipality, as local economic conditions can impact the risk of default. Municipal bonds are particularly attractive to investors in high tax brackets who can benefit from the tax-free income.

How Do Bonds Compare To Cash During Rate Hikes?

During rate hikes, bonds typically underperform compared to cash investments. As interest rates rise, bond prices tend to fall, reducing their value, while cash investments benefit from the higher interest rates. However, bonds still offer long-term income and stability, making them a safer choice for investors with a longer time horizon.

Why Did Bonds Underperform In 2022?

Bonds underperformed in 2022 primarily due to rising interest rates and inflation concerns. As central banks increased rates to combat inflation, bond prices dropped, making newly issued bonds with higher yields more attractive than older, lower-yielding bonds. This created a challenging environment for bond investors.

Are Bonds Effective In A Recession?

Yes, bonds can be effective during a recession, as they provide stability and predictable income during economic downturns. Government bonds, in particular, tend to perform well during recessions, as investors seek safe-haven investments with low risk. High-quality bonds remain a strong choice for preserving capital and managing risk during recessionary periods.

Do Bonds Outperform Active Investment Strategies?

No, bonds do not always outperform active investment strategies. Active and Passive Investment Comparison bonds provide consistent returns and decrease chance, energetic strategies like stock choosing or actual property investing can lead to higher earnings. The performance of bonds relies upon interest costs and economic conditions. Active techniques, however, provide more possibilities for increase, even though they also carry better dangers.

Can Bonds Replace Traditional Stock Investment Returns?

No, bonds typically do not replace traditional stock investment returns. Stocks offer higher boom capacity, regularly outperforming bonds within the long term. While bonds provide steady, lower returns with lower threat, they do not match the high returns of stocks in the course of durations of strong marketplace growth.

Should Investment Beginners Start With Bonds?

Yes, Investment beginners can start with bonds as they offer low risk and predictable returns. Bonds offer a solid creation to investing without the excessive volatility of stocks. Beginner’s Guide to Investment Options are less hard to understand and manipulate, making them a really perfect starting point for contemporary buyers.

Do Risk-Averse Investors Prefer Bond Markets?

Yes, risk-averse investors regularly opt for bond markets due to the fact bonds offer predictable income with lower risk. Government bonds, specifically, are considered secure, with minimum danger of default. Risk-Averse Investment bonds are lots tons much less unstable than shares, making them best for traders who prioritize protection and balance.

Are Bonds Good For Investment Portfolio Growth?

Yes, bonds can be beneficial for investment portfolio growth by providing stability and steady income. They are typically less volatile than stocks and can balance risk. Bonds offer diversification, reducing overall portfolio risk. However, their Investment growth potential is lower compared to equities. A portfolio that includes both stocks and bonds can achieve better overall growth while managing risk through diversification

Do Bonds Have Lower Investment Risk Today?

Yes, bonds today have lower investment risk than in previous years, especially government bonds. In a low-interest-rate environment, bonds are less prone to interest charge hikes. However, in measuring investment risk inflation and economic situations nevertheless pose risks to bond buyers. Government bonds are usually safer, while company bonds convey more risk. In assessment to shares, bonds continue to be a lower-risk investment preference for conservative investors.

Can Alpha Investors Profit From Bonds?

Yes, alpha investors can profit from bonds by seeking above-average returns relative to the market. While bonds normally offer consistent, predictable profits, they also can be part of an approach that pursuits for advanced returns. Alpha investors also look for undervalued bonds or possibilities in less liquid markets. However, bond returns generally decrease as compared to equities, so reaching alpha through bonds calls for careful selection and strategy.

Are Insurance Products Better Than Bonds?

Insurance products and bonds serve different purposes and cannot be directly compared as better or worse. Insurance products, such as whole life policies, offer financial protection with a cash value component. Bonds provide steady income but are less flexible. Investment and Insurance have their benefits, depending on individual financial goals. While bonds offer lower risk, insurance products provide long-term security, making each suitable for different needs.

Do Investment Management Skills Matter For Bonds?

Yes, investment management skills are important for bonds, especially when selecting corporate bonds or managing a diversified bond portfolio. Skilled managers can navigate interest price adjustments and market conditions to optimize returns. In the essential investment management skills guide government bonds require less energetic management because of their balance. Still, for maximizing bond performance, in particular in a complicated marketplace, funding control capabilities play an essential position in minimizing risks and improving returns.

Do REITs Provide Better Returns Than Bonds?

Yes, REITs (Real Estate Investment Trusts) can provide better returns than bonds, especially in a strong real estate market. REIT investment returns analysis typically offers higher yields and potential for capital appreciation. However, they carry more risk due to market fluctuations. Bonds, by contrast, offer stability and lower returns. REITs are more volatile than bonds, making them a better choice for investors willing to take on additional risk for higher returns.

Are FedEx Routes Safer Than Bond Investments?

Yes, FedEx routes can offer stable income with less volatility compared to bond investments, but they come with unique risks. The income from FedEx routes depends on the business’s performance and operational costs. Bonds, particularly government bonds, provide fixed returns with less risk. FedEx routes can offer higher profits but require active management and carry the risk of business-related issues, making them riskier than bonds in some cases.

Can Amazon Routes Beat Bond Market Returns?

Yes, Amazon routes can potentially outperform bond market returns, especially in the growing e-commerce sector. However, running an Amazon route involves higher operational risks, such as market competition and logistical challenges. Bonds provide predictable income with lower risk, making them more reliable. While Amazon routes offer profit potential, their returns depend on managing the business effectively, making them riskier but possibly more rewarding than bonds.

Do Annuities Offer Better Bond Interest Rates?

Yes, Annuities can offer better interest rates than bonds, particularly in the context of fixed annuities. Fixed annuities provide a guaranteed income over time, with rates potentially higher than bond yields in some cases. However, annuities are less liquid and come with specific terms. Bonds, on the other hand, provide more flexibility with easier access to funds. While annuities offer better rates, bonds offer more liquidity and market flexibility.

Conclude

Bonds offer a stable investment option with lower risk, making them ideal for conservative investors seeking predictable income. However, they do not provide the equal excessive returns as shares or other more risky investments. While bonds can supplement an assorted portfolio, their performance is motivated by way of factors like interest values and financial situations. It is crucial to evaluate private financial desires and chance tolerance while identifying if bonds are the right investment. Diversifying among bonds, stocks, and other property can assist attain a balanced, growth-oriented portfolio.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.