Investment risk tolerance refers to how much chance a person can cope with while investing. It measures how well a person can manage losing cash from their investments. Humans have different risk ranges, relying on their dreams, persona, and what sort they can afford to lose. Understanding chance tolerance is crucial for making smart investment choices. Investment chance entails the risk of dropping cash while investing. Some risks are more significant than others. It’s critical to realize your chance tolerance before finding out where to invest. Some traders can manage more considerable dangers; others sense safer with more diminutive dangers. Knowing what you can deal with can prevent losses. Many elements affect danger tolerance. Age is a huge one.

Young people can take more significant risks because they have time to recover. The income stage and goals also count. High-earning people can also take more risks because they can generate money for losses. Knowing those elements facilitates shaping investments to your degree of personal danger. There are one-of-a-kind styles of risks. Market threat happens while stock prices move up and down. Inflation threat is the hazard that your cash gained keeps up with rising charges. Interest price chance influences bonds when fees move up. Understanding those dangers helps make higher alternatives about where to place money. Diversification means spreading your cash across extraordinary investments to decrease threat. Instead of putting all your cash in a single area, spending money on distinct sorts of assets is smarter. For example, shopping for stocks, bonds, and actual estate can help stabilize the risk. Diversification can protect against losses if one funding isn’t done properly.

Risk tolerance changes through the years. As humans grow old, they become much less cushy with high-risk investments. As humans keep greater or trade life dreams, their potential to handle danger can shift. Adjusting investments to fit chance tolerance guarantees that the portfolio remains balanced as personal desires are exchanged. Finding the proper danger level is critical to investing. Too many hazards can result in massive losses; however, too little danger can mean a lack of gains. Understanding your chance tolerance and adjusting investments to match it could create a balanced and rewarding portfolio.

What Is Investment Risk?

Investment risk is the potential for loss or underperformance of an investment relative to expectations. Investment risk is losing money while investing in an enterprise or asset. Every investment has danger. Some have more enormous dangers, like stocks, while others, like bonds, are smaller. The extra hazard you take, the greater you could lose; however, the more you can gain.

Don’t let risk hold you back! CapitalizeThings.com (+1 (323) 456-9123) tailors investment strategies to your risk tolerance. Schedule a free consultation today!

How Do You Assess Risk Investment Strategies?

Risk assessment in investment strategies involves analyzing potential returns against possible losses, considering factors like market volatility, asset allocation, and individual risk tolerance. To assess risk, examine how much you could have the funds to lose. Think about your dreams and how long you want to invest. If you need the money soon, a more minor hazard can be better. If you could wait, you might take on a more significant threat. Match your threat to what you could manage.

How Much Risk Investment Is Too Much For Beginners?

Based on financial experts’ recommendations, beginners should generally limit high-risk investments to no more than 10-20% of their total investment portfolio. Beginners need to take smaller risks. They are nevertheless gaining knowledge of how investing works. A proper starting point is to choose more secure alternatives, like bonds. Over time, as they research, they could take larger risks. Losing money quickly can make it harder to preserve investing.

How Do You Measure Risk In Investment Portfolios?

You measure risk by searching how long you plan to invest (time horizon) and what sort of money you have (bankroll). If you’ve got a long time to invest, you could take on more enormous dangers. If you want the cash soon, more diminutive dangers are better. Your bankroll allows you to decide how a good deal to hazard.

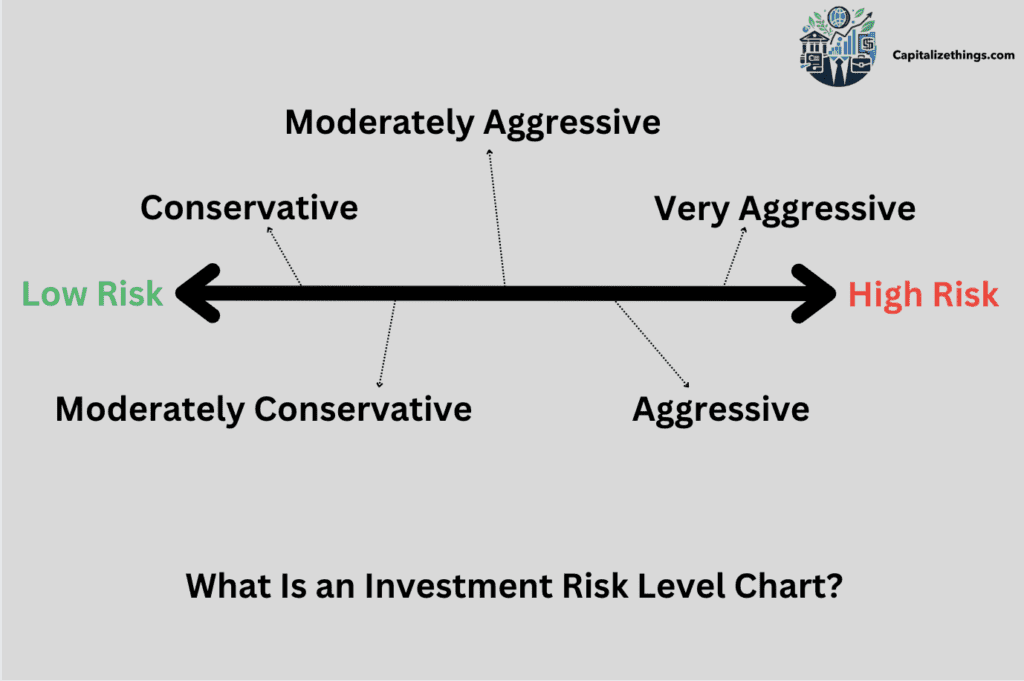

What Is an Investment Risk Level Chart?

An investment risk level chart is a investment risk degree chart that suggests how unstable exceptional investments are. It enables you to spot which investments have smaller or bigger dangers. Key phrases encompass low-hazard (safer choices like bonds), medium-hazard (stocks), and high-threat (more significant risk of losing cash, like cryptocurrencies). It enables you to choose the proper investment for your comfort.

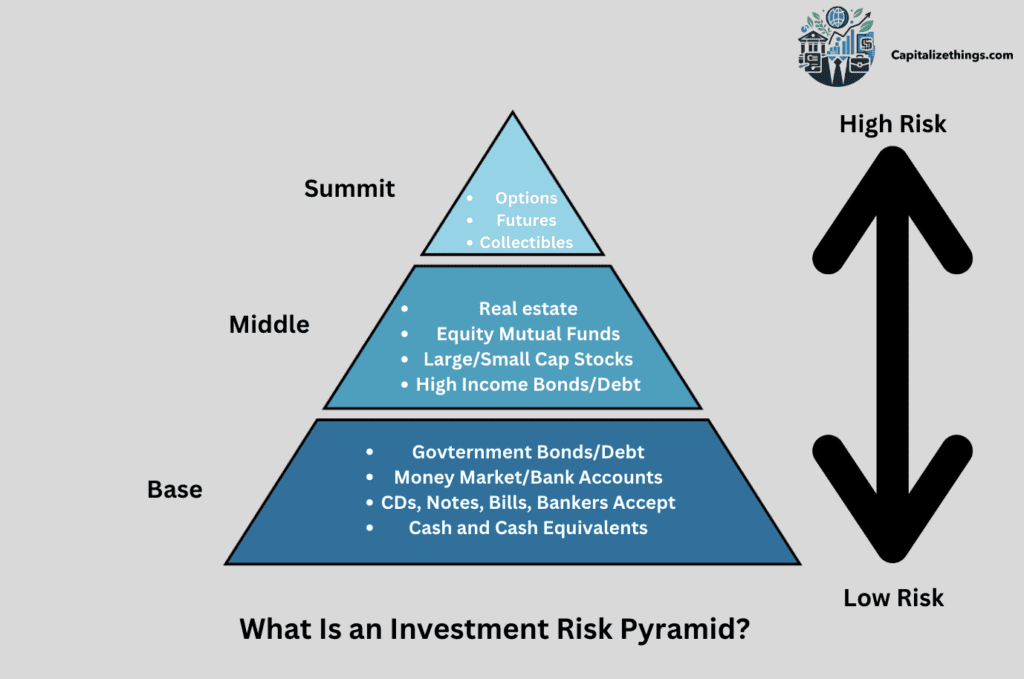

What Is an Investment Risk Pyramid?

An investment risk pyramid shows a way to balance danger. The base is for more secure investments like bonds. The center is for medium dangers like stocks. The top is for excessive dangers like real estate or cryptocurrency. Key phrases encompass safety at the lowest and most significant hazard as you move up.

What Are The Three Risk Tolerance Factors?

Three Risk Tolerance Factors are age, profits, and goals. Younger people can take larger risks. People with excessive earnings can take more risks because they can afford to lose more. People with short-term goals need more secure investments. Matching your tolerance to these factors enables you to avoid losing an excessive amount.

Why Is Understanding Your Risk Level Important For Investing?

Understanding your risk level is essential for investing because it enables you to avoid losing more than you can cope with. When you realize your level, you pick the proper investments. Taking too much risk is bad for your cash. Taking too little hazard won’t provide you with enough go back.

Investing shouldn’t be a guessing game. CapitalizeThings.com helps you understand your risk tolerance and make informed decisions. Reach out to us via email and let’s discuss your situation and let us help you with a perfect solution.

How To Balance Your Investments?

To balance your investments diversify across asset classes based on your risk tolerance, goals, and time horizon, typically following a mix of stocks, bonds, and cash reserves. Balance your investment approach to match the hazards of your lifestyle level. Before retiring, you could take more risks to develop your money. After retiring, you must take fewer risks because you need cash. Beginners must start with more secure alternatives, while senior traders recognize on the defensive their savings.

How Much Risk Should I Take When Trading?

Financial experts at capitlizethings.com typically recommend that individual investors risk no more than 1-2% of their trading capital on a single trade. You should take risks if you’re comfortable with them. Beginners ought to begin with smaller risks of 10% to 20% as per the experts of Capitalizethings.com advice. Experienced buyers might take bigger dangers, but it is best if they are ready to lose. Taking an excessive number of chances can cause huge losses. Knowing your threat tolerance facilitates trading wisely.

What Is The Appropriate Amount Of Risk To Take While Investing?

The appropriate amount of investment risk depends on individual factors like age, financial goals, and risk tolerance, but a common guideline is to subtract your age from 110 to determine the percentage of your portfolio to allocate to higher-risk investments. If you manage to drop more, you can take on bigger dangers. If you cannot come up with the money to lose lots, stay with more secure picks. Stability is always dangerous, considering how many advantages you need and how much you could lose.

How Does Standing On My Money Relate To Assessing Risk Tolerance In Investing?

Standing on your cash means maintaining it secure. If you feel nervous about losing, you opt for safer investments. If you are extra relaxed, you will be ok with taking on larger dangers. Assessing how you sense your money allows you to understand your threat tolerance and make clever alternatives.

How Do I Determine My Level Of Risk For Stocks?

To determine your level of risk for stocks, consider your level of experience. Beginners should take smaller risks, considering they’re still learning. Retirees need to guard their savings, so they ought to take fewer risks. People in between can also take medium risks. The high-quality stage suits your lifestyle and desires.

When Do You Typically Have The Highest Investment Risk Tolerance?

People generally have the best hazard tolerance when they’re young. They have time to recover from losses. Young investors can take larger risks because they are constructing wealth, which allows them to develop their cash faster. Over time, their chance tolerance might also change as their needs change.

When Do You Typically Have The Lowest Investment Risk Tolerance?

You have the lowest investment risk tolerance while you are near retirement. At this degree, you want your savings to be final. Taking minor risks enables you to protect your cash. Retirees want to avoid significant losses, considering they want their money for daily costs and do not have time to improve.

How Might Knowing Your Risk Tolerance Be Beneficial To You As An Investor?

Knowing your Risk tolerance as an investor enables you to make better picks. It prevents you from taking too significant risks that will cause losses. It also ensures you do not avoid all risks and miss out on gains. This stability makes your investment plan work better.

How Much Risk Should Retirees Take With High-Risk Investments?

Retirees need to take minimal hazards with high-risk investments. Their cognizance has to be on protecting the money they have saved. High-threat investments can motivate significant losses, which can be hard to recover from in retirement. Retirees should spend money on safer alternatives that supply regular returns.

What Are Low-Risk Investment Options For Retirement?

Government bonds, certificates of deposit (CDs), and money market budgets are low-risk investment options for retirement. These investments protect your cash while giving small returns. They are safe and steady, making them the correct alternatives for retirees who want to maintain their financial savings for everyday expenses.

How Does Risk Tolerance Affect Retirement Investment Choices?

Risk tolerance plays a prominent position in retirement investments. People with better threat tolerance can pick greater competitive investments like shares. Sherhasva has a higher growth capacity; however, it can be unstable. People with low-risk tolerance pick safer alternatives like bonds. These offer less increase but an extra balance.

It’s vital to suit your retirement funding with how a good deal you could take care of. Doing this will prevent the most essential losses that would harm your future. People near retirement frequently lower the chance of shielding their savings. This balance between increase and safety helps meet lengthy-term goals.

What Investment Types Are Considered Moderate?

Moderate investments include balanced mutual finances, dividend-paying stocks, and corporate bonds. These bring greater danger than financial savings money owed but less risk than stocks. Moderate traders need a boom but also protection from huge losses. Balanced mutual finances keep both shares and bonds. Dividend stocks provide profits but face market dangers.

Corporate bonds are safer than stocks but riskier than authorities’ bonds. These investment sorts are incredible for those who need growth but prefer to avoid big dangers. Understanding how dangerous those carry can help guide clever funding alternatives.

What Are The Risks Of Investing In A Roth IRA?

Roth IRAs deliver dangers based on what you put money into. If you select stocks, you lose cash when the marketplace drops. Bonds can be safer; however, they don’t usually keep up with inflation. Choosing the incorrect investment inside your Roth IRA could slow your increase. While Roth IRAs offer tax-unfastened increases, they nonetheless face investment dangers.

If you’re taking cash out too early, you could face penalties. These dangers mean choosing investments that suit your chance tolerance is vital. Even with a Roth IRA, the form of investments you are making will affect how much chance you face.

How Does Risk Tolerance Affect Roth IRA Investments?

Risk tolerance affects Roth IRA investments by determining the balance of conservative and aggressive assets chosen within the account, influencing potential returns and volatility. If you have an excessive hazard tolerance, you may select stocks. These offer massively increased ability but can result in losses in awful markets. If you have low tolerance, you can decide upon bonds or more secure property.

This offers balance; however, it is a slower increase. Picking investments based on risk tolerance can assist in defending your Roth IRA from huge losses. Younger buyers with greater time till retirement frequently have higher risk tolerance. Older traders want safer options to guard their financial savings. Balancing hazards and protection keeps your Roth IRA on track.

What Is The Ideal 401k Risk Level By Age For Investors?

The ideal 401(k) risk level decreases with age, starting with a higher allocation to stocks in your 20s (80-90%) and shifting toward bonds (60-70%) as you approach retirement. Younger traders can take more significant risks with stocks because they have time to overcome losses. As you age, shifting to more secure investments like bonds is clever. People nearing retirement usually decide on low-risk investments to shield their savings. The concept is to grow your money even while staying safe, as in retirement processes. A top mix of stocks and bonds can balance risk and praise at distinctive existence ranges. Matching your 401k’s danger degree at your age can help you reach your retirement dreams without dropping too much.

Here’s a table based on the experts guidance for 401(k) risk levels by age, balancing stocks and bonds to reflect changing risk tolerance over time:

| Age Range | Risk Level | Suggested Allocation |

|---|---|---|

| 20s to Early 30s | High Risk | 80-90% Stocks, 10-20% Bonds |

| 30s to Early 40s | Moderate-High Risk | 70-80% Stocks, 20-30% Bonds |

| 40s to Early 50s | Moderate Risk | 60-70% Stocks, 30-40% Bonds |

| 50s to Early 60s | Moderate-Low Risk | 50-60% Stocks, 40-50% Bonds |

| 60s and Beyond | Low Risk | 30-40% Stocks, 60-70% Bonds |

This table reflects the typical strategy of reducing risk exposure as retirement approaches by gradually increasing the allocation of bonds, which are generally less volatile than stocks. It’s important to note that these allocations can vary depending on individual financial goals and market conditions.

How Much Of Your Portfolio Should Be Risky?

The quantity of hazards in your portfolio relies upon your dreams and chance tolerance. Younger buyers are positioned more in riskier stocks but provide better returns. As you age, you should reduce the unstable parts of your portfolio. A correct rule is to hold much less hazard as retirement approaches. Many traders aim for 60% shares and 40% bonds. However, the proper blend depends on how many threats you can handle. It’s critical to preserve stability so that you don’t lose an excessive number of risky investments. This allows you to keep your portfolio strong over time.

What Are The Best Low-Risk Investments For Seniors?

The Best Low-Risk Investments For Seniors are authorities’ bonds, certificates of deposit (CDs), and money marketplace money owed. These provide safety and steady earnings but don’t grow as fast as stocks. Treasury bonds are backed by the authorities, making them awesomely safe.

CDs lock in a set interest price, limiting entry to your money. Money marketplace bills offer extra flexibility with lower returns. These options are quality for seniors who want to keep away from massive losses and maintain their money secure. Low-threat investments help maintain savings while providing small returns.

Should Seniors Prioritize Low-Risk Investments In Their Portfolios?

Seniors must focus on low-risk portfolio investments to defend their financial savings. Since they’re near or in retirement, dropping money can hurt their earnings. Low-chance investments like bonds, CDs, and money market money owed offer balance and safety. They do not grow as fast as stocks but keep away from principal losses.

Protecting the financial savings constructed over an entire life is more crucial than chasing huge profits. Lowering danger will become essential as seniors have much less time to recover from marketplace downturns. Seniors can make certain regular earnings by prioritizing low-chance investments while keeping their savings secure. This makes retirement extra steady.

What Types Of Funds Are Best For Conservative Investors?

Conservative traders usually opt for a low-danger price range, the Bond price ranges are a good choice because they offer steady profits with less risk than shares. Money marketplace price ranges are also safe, providing balance with low returns. Dividend-paying inventory budgets offer a few increases while being safer than regular stock finances.

Conservative investors search for a budget that shields their cash. They don’t need to threaten significant losses, even though it means giving up more considerable gains. Balancing threat with safety is prime for conservative investors. Low-chance funds can offer peace of thought, and small, however reliable, funds increase over time.

What Is An Example Of A Moderate Risk Tolerance?

An example of moderate risk tolerance is an investor allocating around 60-70% of their portfolio to stocks and 30-40% to bonds, balancing growth potential with stability. Someone with moderate risk tolerance likes a balance between increase and protection. They can also invest in a combination of stocks and bonds, seeking better returns without taking huge risks. For example, a mild investor might pick out a balanced mutual fund. This fund holds each share and bond, supplying growth capacity but with less hazard than an entire inventory portfolio. The purpose is to develop their money while warding off principal losses.

A moderate hazard tolerance investor is willing to accept a few. And downs but prefers constant boom. This balance makes mild risk tolerance ideal for lots of long-term investors.

Why Are Mutual Funds Very High Risk?

Mutual Funds are very high risk because they spend money on a combination of properties. Some mutual finances pay attention to shares, which can lose price fast. Market adjustments can cause the price of shares to drop rapidly. Even mutual budgets that maintain bonds can face risk if interest fees rise.

While mutual funds can provide diversification, they nonetheless observe marketplace moves. Investors in mutual finances hazard dropping money, specifically if the financial system turns awful. High-chance mutual price ranges regularly aim for massive returns, which indicates larger losses are also viable. Understanding the dangers is crucial before deciding on mutual funds.

What Strategies Minimize Risk In Volatile Markets?

The strategy that could minimize the risk of a volatile market is diversification. This method spreads your cash across distinctive assets like stocks, bonds, and real estate. This facilitates balancing out losses if one sort of funding drops. Another method is dollar-cost averaging, where you often invest a hard and fast quantity. This reduces the hazard of purchasing at the wrong time. Holding more coins during uncertain times can also help avoid essential losses.

Keeping an eye on the market and adjusting investments while wished can defend your portfolio. These techniques are top for minimizing losses when markets end up unpredictable.

How Would You Describe Your Tolerance For Risk?

Risk tolerance describes how many chances you manage, If you are comfortable losing money to make a more significant profit, you have excessive threat tolerance. You have a low chance tolerance if you need to avoid losses and prefer safety. Most human beings fall somewhere inside the center with moderate chance tolerance. Knowing your risk tolerance allows you to guide your funding selections.

It guarantees you don’t take on more threats than you could manage. You could avoid making horrific selections if you select investments that healthy your danger tolerance. Understanding risk tolerance is fundamental to constructing a balanced portfolio.

What Defines The Best Strategy For Managing Risk In Investments?

The best strategy for managing risk in investments is diversification. This manner spreads your cash across one-of-a-kind kinds of investments. Investing in shares, bonds, and different assets balances threat and praise. Another key strategy is staying knowledgeable about the market and adjusting your portfolio over time. Holding a mixture of quick-term and lengthy-time period investments allows protection against massive losses.

Keeping your portfolio balanced is essential for managing threats. This protects you from losing too much in a single location. Choosing safe investments alongside riskier ones guarantees that you could grow your cash even while staying blanketed from significant downturns.

What Does All Investment At Risk Mean?

All investments at trouble means that any money you invest can be misplaced. Even the safest investments carry a few levels of danger. Stocks, bonds, real estate, and mutual funds face dangers like marketplace crashes or interest rate changes. Knowing that your investment ought to lose a fee helps you decide how to take a good deal. Understanding this idea is vital to cleverly investing.

It’s essential to accept that no investment is completely secure. By understanding that all investments convey chance, you could make better selections and prepare for possible losses. This can help shield your usual portfolio.

What Investment Have The Highest Risk Stock Or Bonds?

Stocks convey the very best hazard in comparison to bonds. Stock costs can upward thrust or fall quickly, depending on market situations. If a business enterprise does poorly, the inventory fee can drop. Bonds are usually more secure because they pay regular interest. However, bond expenses also can fall if hobby prices go up.

While shares provide better returns, they also can cause larger losses. Investors who want growth might pick out shares but must apprehend the higher threat. Bonds are a better choice for those who decide on extra safety, and the choice between shares and bonds depends on how much risk you manage.

Can The Level Of Risk For Stocks Be Minimized?

The level of risk for stocks can be minimized with smart planning. Investors can pick out safer shares that don’t fluctuate too much. Diversifying allows, too. This manner spreads cash throughout many shares rather than simply one. People also can put money into bonds and different secure options. By being careful, inventory hazards are kept low. Good research allows buyers to pick the fine shares with decreased dangers. Always knowing the marketplace traits and having a balanced method makes it more secure.

Can Your Risk Level Change Over Time?

Yes, your risk level changes over time, Youngsters could take extra risks because they have time to recover. As people grow old, they won’t want to risk losing money. Life occasions like shopping for a residence or retiring could make people extra careful. Changes in earnings or savings also affect risk degrees. It’s crucial to check your investments for existing modifications. In that manner, you can suit the degree of danger in your modern-day situation.

Are Low-Risk Investments Best For Retirement Savings?

Yes, low-risk investments are best for retirement savings. These investments shield your money from massive losses. Many retirees want their money to grow but also stay safe. Bonds and financial savings debts are low-hazard picks. They don’t provide significant returns.

However, they’re safe. Retirement plans, like 401(k)s, additionally encompass low-threat alternatives. When you retire, you need your cash to be there for you. Low-chance investments assist in making sure that your financial savings are final. Safety is a pinnacle priority for retirement.

Can Risk Investment Be Minimized Without Lowering Returns?

Yes, the risk can be minimized without lowering returns by smart investing. Diversifying is a brilliant manner to spread chance even while still making money. Mixing shares, bonds, and different investments can create a balanced plan. Regularly checking and updating investments also helps. Index finances and mutual price range are proper alternatives.

They unfold your cash through many shares, reducing the hazard of losing an excessive amount. Smart traders preserve mastering and adjusting their plans to reduce risks. This way, you could aim for desirable returns.

Is Roth Ira A Good Option For Risk-Averse Investors?

A Roth IRA is a good option for risk-averse investors. It gives a tax-loose boom, facilitating cash development over the years. Roth IRAs can consist of low-chance investments like bonds or cash price range. This makes them safer for individuals who do not need to risk losing money. The potential to withdraw contributions tax-unfastened offers flexibility, too.

Roth IRAs are desirable for individuals who want to shop for retirement without taking huge risks. Choosing safer investments in a Roth IRA is a clever choice.

What Level Of Risk For Stocks Suits Beginners?

Beginners must begin with a low-danger level whilst making an investment in shares. Safer stocks like blue-chip groups are a fantastic choice. Index funds and mutual finances can also assist beginners because they unfold hazards across many shares. Novices must learn how the stock marketplace works before taking on significant dangers.

Starting gradually and choosing more secure investments will assist in building self-belief. Beginner investors must be cognizant of a constant, long-term boom. A low-chance plan lets them keep away from significant losses even as masters.

Can Seniors Achieve Financial Goals With Low-Risk Investments?

Yes, low-risk investments can help seniors achieve financial goals. Many seniors choose secure investments to protect their financial savings. Bonds, CDs, and savings debts are low-risk alternatives. These provide regular returns without risking the cash they have stored for years. Some seniors also invest in dividend-paying stocks for extra earnings.

It’s important for stability protection with a few booms, but low-threat investments are pleasant for the defensive retirement price range. Seniors can meet their monetary desires by selecting investments that secure their cash.

Are Higher-Risk Funds Suitable For All Investors?

No, higher-risk funds aren’t appropriate for all investors. These price ranges can also provide high returns, but they also come with the chance of losing money. Investors who cope with losses choose those funds, but others won’t be snug. Age, profits, and dreams all influence whether or not someone needs to spend money on better-risk finances.

People with lengthy-time period dreams and extra money can take additional risks. However, traders who must protect their financial savings must avoid these funds. It’s important to pick wisely.

How Can Diversification Enhance Your Risk Management Strategy?

Diversification enhances Your Risk Management Strategy by spreading money through exclusive investments. This approach does not place all your money into one inventory or asset. Diversifying reduces the danger of dropping the entirety. If one funding source doesn’t do well, others also carry out higher.

People can put money into stocks, bonds, real property, and alternatives to create a balanced portfolio. By diversifying, risk is unfolding, making it more secure. Investors who diversify their investments defend themselves from more enormous losses even as they nonetheless aim for profits.

What Psychological Factors Affect Risk-Taking In Investments?

Psychological factors like fear, greed, and self-belief affect hazard-taking in investments. Fear can keep humans from risk, while greed can push them into unstable choices. Some human beings experience confidence and take on extra risk, even as others doubt themselves. Personality developments and beyond reviews with money additionally form how a person handles threats. People who lost cash before avoid taking risks once more. Understanding these mental elements facilitates buyers in making smarter choices. Balancing feelings and staying calm leads to higher results.

How Do Seasoned Investors Assess Their Risk Tolerance Before Investing?

Seasoned investors assess their risk tolerance before investing by reviewing their desires, finances, and experience. They check how much they could find the money to lose and how they plan to invest. They also study beyond investments and spot how they handle profits or losses.

These traders regularly diversify their portfolios to manage hazards. They take time to analyze every investment and don’t forget market developments. By informing their threat tolerance, seasoned traders make higher picks and avoid taking on too many dangers.

What Role Does Beta Play In Assessing Your Investment Risk Tolerance?

Beta plays a large function in assessing your investment chance tolerance. Beta measures how many stock adjustments are compared to those in the marketplace. A better beta means more chance and a lower beta means much less chance. Investors observe beta to determine if they can deal with the ups and downs of specific stocks. For chance-averse investors, deciding on stocks with a decreased beta is safer. Knowing beta facilitates buyers in shaping their danger level to their investment selections. This encourages a balance of risk and returns.

What Factors Influence Risk Tolerance When Investing In The S&P 500?

Several factors influence risk tolerance when investing in the S&P 500. Age plays a role because more youthful traders can take more significant dangers. Income degree also matters because high-income humans can come up with money for more considerable dangers. Market understanding and enjoyment influence how many risks a person can take care of. Investors with more outstanding revel might also take extra risks. Goals like retirement savings or shopping for a residence also shape chance tolerance. Each thing enables one to decide how a hazard an investor is comfortable with when choosing S&P 500 stocks.

Can A Financial Advisor Help Me Understand My Personal Risk Appetite?

A financial advisor helped me understand my personal risk appetite by searching for my desires, profits, and enjoyment. They can explain the risks of various investments and help you choose ones that shape your consolation level. Financial advisors frequently ask questions about how you handle losses. They use gear to measure thread tolerance. This allows you to create a plan that fits your needs. By operating with an economic marketing consultant, you better recognize your risk urge for food and make smarter funding choices.

What Role Does Risk Tolerance Play In Effective Investment Management?

Risk tolerance plays a crucial function in powerful investment management. Knowing how many threats you can take care of allows you to create a plan that matches your consolation stage. Too much chance can cause huge losses, while too little hazard could imply missing out on gains. By experiencing danger tolerance, buyers can choose stocks, bonds, and other investments that provide stability, safety, and increase. Adjusting threat ranges over time additionally keeps the investment plan on target. Managing change is crucial for achieving a long-term goal.

What Are The Benefits Of Using A Systematic Investment Plan For Risk-Averse Investors?

A systematic funding plan (SIP) blesses risk-averse investors by assisting them in making investments slowly and thoroughly. With a SIP, traders often install small quantities, spreading risk through the years. This helps keep away from massive losses and lowers the chance of terrible timing within the market. SIPs also construct fields and make it easier to save for lengthy-term dreams. Risk-averse buyers can select more secure stocks or bonds for their SIP. By investing consistently, they can defend their cash while aiming for gradual, steady increases.

What Strategies Do Investment Companies In The USA Use To Manage Risk?

Investment companies in the USA use numerous techniques to manage risk. Diversification is a crucial approach because it spreads cash across distinct investments. Companies additionally use hedging strategies, like alternatives and futures, to protect in opposition to market changes. They analyze market tendencies and adjust investments as wanted. Some groups offer a decrease-threat price range: awareness of safer stocks and bonds. Risk evaluation tools help screen investments to keep away from huge losses. These strategies assist funding agencies in balancing threats and returns for their customers.

How Can Shareholders Evaluate Their Personal Risk Tolerance?

Shareholders can examine their private threat tolerance by asking how much they can afford to lose. They need to reflect on their financial dreams, age, and earnings. Knowing if they are cushy with inventory marketplace and downs is crucial, too. Past investment experiences can supply clues about risk tolerance. Some shareholders take quizzes or use online tools to measure them. By understanding their chance tolerance, shareholders can pick out shares and investments that match their consolation degree and avoid pointless dangers.

Conclude:

Investment risk is fundamental to making clever investment choices. It helps buyers determine a good deal they can take care of based on their age, income, and dreams. Low-danger investments offer protection, while higher-danger ones provide the risk for more significant returns. Diversification spreads hazard, decreasing the hazard of dropping money. Over time, danger tolerance can alternate, so it’s crucial to alter investments as private wishes shift. By cautiously assessing threats and using techniques like diversification, new and seasoned investors can stabilize threats and praise. Working with a financial advisor can also assist in locating the right stage of hazard. Managing the dangers of investments leads to better economic effects and long-term success.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.