Investment corporations in Australia help human beings and companies grow their cash by coping with funds and investing in belongings like shares, bonds, and real estate. They offer investments consisting of mutual price range, ETFs, and private fairness, supplying expert management for potentially better returns. However, they arrive with charges, dangers, and less control over cash.

Fintech companies enhance financial offerings through generation, that specialize in bills, lending, and wealth management. They provide comfort but face protection worries and strict guidelines.

Private equity firms invest in and grow corporations, but can also prioritize profits over personnel, leading to layoffs or closures. Investing with these organizations can result in higher returns however includes charges and potential conflicts of hobby. Understanding their products and strategies may be complex, adding to the risks.

What Is An Investment Company In Australia?

A funding employer in Australia is a business that pools cash from traders to shop for a lot of assets, such as stocks, bonds, actual estate, or different investments. These corporations manipulate the investments on behalf of their clients, aiming to grow their money through the years. They provide distinct styles of investment alternatives, like mutual funds, exchange-traded funds (ETFs), and private equity. By investing via these groups, individuals and corporations can benefit from professional control, diversification, and access to markets that can be hard to attain on their own.

What Are The Largest Investment Companies In Australia?

10 of the largest investment companies in Australia, along with their estimated number of clients are provided in the table below:

| Company | Clients (Approx.) | Market Cap/Assets |

| Commonwealth Bank of Australia | 17 million | A$182.2 billion |

| Westpac Banking Corporation | 13 million | A$85.4 billion |

| Australia and New Zealand Bank | 8.5 million | A$66.6 billion |

| National Australia Bank | 9 million | A$97 billion |

| Macquarie Group Ltd | 14,000 institutional | A$55.1 billion |

| AMP Limited | 5 million retail | A$4.5 billion |

| Australian Foundation Investment Co. (AFIC) | Over 130,000 | A$9 billion |

| Magellan Financial Group | 500,000 | A$8.39 billion |

| Suncorp Group | 9 million | A$13.1 billion |

| QBE Insurance Group | Global reach | A$14.4 billion |

These companies are some of the largest in terms of marketplace capitalization and number of customers in Australia, offering a number of funding and economic offerings.

What Is The Biggest Investment Company In Australia?

The largest investment organization in Australia by property under control (AUM) is Macquarie Group. Macquarie is an international economic services group, handling a huge variety of investments and financial products.

| Company | Assets Under Management (AUM) | Clients (Approx.) |

| Macquarie Group | A$737 billion | 14,000 institutions |

Who Is The Largest Investor In Australia?

The largest investor in Australia is the Future Fund, that’s the United States’s sovereign wealth fund, dealing with investments on behalf of the Australian government.

| Investor | Assets Under Management (AUM) | Clients (Approx.) |

| Future Fund | A$248 billion | Australian Government |

Who Are The Top 10 Fund Managers In Australia?

Top 10 Fund Managers in Australia are provided in the table below:

| Company | Assets Under Management (AUM) | Clients (Approx.) |

| Macquarie Group | A$737 billion | 14,000 institutions |

| AMP Capital | A$190 billion | 5 million retail |

| Commonwealth Superannuation | A$150 billion | 2 million |

| AustralianSuper | A$244 billion | 2.4 million |

| IFM Investors | A$179 billion | 6 million |

| Vanguard Australia | A$150 billion | 900,000 |

| QIC | A$92 billion | N/A |

| BT Financial Group | A$88 billion | 3.5 million |

| Colonial First State | A$142 billion | N/A |

| Schroders Australia | A$27 billion | N/A |

What Are The Largest Asset Management Companies In Australia?

10 Largest Asset Management Companies are provided in the table below:

| Company | Assets Under Management (AUM) | Clients (Approx.) |

| Macquarie Group | A$737 billion | 14,000 institutions |

| AMP Capital | A$190 billion | 5 million retail |

| Commonwealth Superannuation | A$150 billion | 2 million |

| AustralianSuper | A$244 billion | 2.4 million |

| IFM Investors | A$179 billion | 6 million |

| Vanguard Australia | A$150 billion | 900,000 |

| QIC | A$92 billion | N/A |

| BT Financial Group | A$88 billion | 3.5 million |

| Colonial First State | A$142 billion | N/A |

| Magellan Financial Group | A$98 billion | N/A |

What Are The Top 19 Crypto Currency Companies In Australia?

Top 19 Cryptocurrency Companies operating in Australia are provided in the table below:

| Company | Market Capitalization | Clients (Approx.) |

| Independent Reserve | N/A | 200,000+ |

| CoinJar | N/A | 400,000+ |

| BTC Markets | N/A | 325,000+ |

| Swyftx | N/A | 500,000+ |

| Digital Surge | N/A | 200,000+ |

| CoinSpot | N/A | 2 million+ |

| Binance Australia | N/A | N/A |

| ZebPay | N/A | 3 million+ |

| CoinTree | N/A | 80,000+ |

| Easy Crypto | N/A | N/A |

| Mycelium | N/A | N/A |

| TenX | N/A | N/A |

| Power Ledger | N/A | N/A |

| Chronobank.io | N/A | N/A |

| Immutable X | N/A | N/A |

| Bamboo | N/A | N/A |

| CoinLoft | N/A | N/A |

| ACX.io | N/A | N/A |

| Living Room of Satoshi | N/A | N/A |

Is Investing In Crypto Legal In Australia?

Yes, investing in cryptocurrency is a felony in Australia. The Australian authorities regulate cryptocurrency through the Australian Transaction Reports and Analysis Centre (AUSTRAC). Crypto exchanges must sign in with AUSTRAC, comply with anti-money laundering (AML) and counter-terrorism financing (CTF) legal guidelines, and follow patron safety regulations. Additionally, cryptocurrencies are treated as assets for tax purposes by means of the Australian Taxation Office (ATO), this means that capital gains tax (CGT) applies to profits made from buying and selling or selling cryptocurrencies.

What Is The Best Cryptocurrency To Invest In Australia?

The best cryptocurrency to spend money on in Australia is Bitcoin, but it also relies upon your investment goals, chance tolerance, and market research. Commonly, Bitcoin (BTC) is taken into consideration because of its marketplace dominance and vast attractiveness. Ethereum (ETH) is likewise famous for its clever agreement functionality and growing ecosystem. Other alternatives consist of Binance Coin (BNB), Cardano (ADA), and Solana (SOL), each providing functions and potential for growth. However, it is important to conduct thorough research and recognize the dangers earlier than making an investment.

What Is The Best Bank For Crypto In Australia?

The quality financial institution for crypto in Australia depends on the services you want. Banks like Commonwealth Bank (CBA) have begun supplying crypto-associated offerings, allowing clients to buy, promote, and hold cryptocurrencies via their app. ANZ and Westpac also are becoming extra crypto-friendly, though they may now not at once provide crypto offerings. Many crypto buyers in Australia decide on the usage of dedicated crypto exchanges like CoinSpot or Swyftx for better help and decrease costs, at the same time as the use of traditional banks for fiat currency transactions.

What Are The 10 Top Rated Investment Management Companies In Australia?

10 top-rated funding control corporations in Australia, at the side of their predicted belongings under control (AUM) and range of customers are listed below:

| Company | Assets Under Management (AUM) | Clients (Approx.) |

| Macquarie Group | A$737 billion | 14,000 institutions |

| AMP Capital | A$190 billion | 5 million retail |

| Commonwealth Superannuation | A$150 billion | 2 million |

| AustralianSuper | A$244 billion | 2.4 million |

| IFM Investors | A$179 billion | 6 million |

| Vanguard Australia | A$150 billion | 900,000 |

| QIC | A$92 billion | N/A |

| BT Financial Group | A$88 billion | 3.5 million |

| Colonial First State | A$142 billion | N/A |

| Schroders Australia | A$27 billion | N/A |

These agencies are identified for their big presence within the investment control industry in Australia, presenting a huge range of economic products and services to each institutional and retail customer.

What Are The Top 3 Companies In The North Region Of Australia?

Top 3 companies in North Region of Australia based on cardinal regions are listed below:

- Top End (Northern Territory): The pinnacle corporations right here are Horizon Power, Power and Water Corporation, and Jemena Gas Network. These organizations focus on utilities, inclusive of electricity and gasoline supply, critical for the region’s faraway and expansive regions.

- Cape York Peninsula (Queensland): Leading organizations are Cape York Land Council, Kowanyama Aboriginal Shire Council, and Northern Gulf Resource Management Group. These groups assist neighborhood development and environmental control inside the remote vicinity.

What Are The Top 3 Companies In Northeast Region Of Australia?

Top 3 companies in Northeast Region of Australia based on cardinal regions are listed below:

- Great Barrier Reef Coast: Key players include Great Barrier Reef Marine Park Authority, Tourism and Events Queensland, and Queensland Government’s Environmental Protection Agency. They are aware of tourism, conservation, and maintaining the reef’s health.

- Wet Tropics of Queensland: Leading companies are Wet Tropics Management Authority, Tropical North Queensland Tourism, and Cairns Regional Council. These groups are involved in rainforest management, tourism, and local governance.

What Are The Top 3 Companies In South Of Australia?

Top 3 companies in South of Australia based on cardinal regions are listed below:

- Great Australian Bight Coastline: Key corporations are Bight Petroleum, Beach Energy, and BP Australia. They are concerned in oil and gas exploration and manufacturing alongside the coast.

- Limestone Coast (South Australia): Prominent firms consist of Limestone Coast Local Government Association, Penola and District Community Centre, and the Southeast Water Conservation and Drainage Board. They pay attention to local improvement, community offerings, and water management.

What Are The Top 3 Companies In Southeast Region Of Australia?

Top 3 companies in Southeast Region of Australia based on cardinal regions are listed below:

- Gippsland (Victoria): Leading agencies are EnergyAustralia, Gippsland Water, and Baw Baw Shire Council. They offer electricity, water offerings, and neighborhood governance.

- Tasmania (Island State): Major gamers are Hydro Tasmania, TasNetworks, and the Tasmanian Government. They are key in power, utilities, and country control.

What Are The Top 3 Companies In Southwest Region Of Australia?

Top 3 companies in Southwest Region of Australia based on cardinal regions are listed below:

- Southwest Australia (Western Australia): Notable companies include South32, Wesfarmers, and BHP. They are worried about mining, retail, and business services.

- Margaret River Region: Prominent agencies are Margaret River Wine Association, Vasse Felix, and Leeuwin Estate. They pay attention to winemaking, tourism, and nearby development.

What Are The Top 3 Companies In East Region Of Australia?

Top 3 companies in East Region of Australia based on cardinal regions are listed below:

- East Coast (New South Wales and Queensland): Key businesses are Qantas Airways, Crown Resorts, and Sydney Water. They are leaders in aviation, hospitality, and water management.

- Great Dividing Range: Major players are Agriculture Victoria, NSW Department of Primary Industries, and the Great Dividing Range Tourism Association. They are conscious of agriculture, tourism, and natural useful resource management.

What Are The Top 3 Companies In West Region Of Australia?

Top 3 companies in West Region of Australia based on cardinal regions are listed below:

- Pilbara Region: Leading corporations encompass Rio Tinto, BHP Billiton, and Fortescue Metals Group. They are essential gamers in mining and resources.

- Coral Coast: Notable firms are Coral Coast Tourism, Ningaloo Reef Resort, and Exmouth District High School. They are aware of tourism and local offerings.

What Are The Top 3 Companies In Northwest Region Of Australia?

Top 3 companies in Northwest Region of Australia based on cardinal regions are listed below:

- Kimberley Region: Key agencies are Kimberley Regional Planning and Development, Tourism WA, and the Kimberley Development Commission. They are aware of nearby improvement, tourism, and making plans.

- Red Centre (Including Uluru): Major corporations are Parks Australia, Uluru-Kata Tjuta National Park, and Indigenous Land Corporation. They are involved in park management, tourism, and Indigenous affairs.

What Are The Top 3 Companies In Central Region Of Australia?

Top 3 companies in Central Region of Australia based on cardinal regions are listed below:

- Murray-Darling Basin: Leading corporations encompass Murray-Darling Basin Authority, Riverina Water County Council, and Goulburn-Murray Water. They are key in water management and nearby development.

- Nullarbor Plain: Notable businesses are Nullarbor Links, Norseman Gold, and the Nullarbor Roadhouse. They pay attention to tourism, mining, and neighborhood services.

What Are The Top 3 Companies In Central East Region Of Australia?

Top 3 companies in Central East Region of Australia based on cardinal regions are listed below:

- Great Barrier Reef Coast: Major businesses are Great Barrier Reef Marine Park Authority, Tourism and Events Queensland, and the Environmental Protection Agency of Queensland. These agencies are dedicated to preserving the reef and selling tourism in the area.

- Central Coast (New South Wales): Leading corporations encompass Central Coast Council, Central Coast Mariners FC, and The Entrance Leagues Club. They pay attention to neighborhood governance, sports, and community offerings.

What Are The Top 3 Companies In Central West Region Of Australia?

Top 3 companies in Central West Region of Australia based on cardinal regions are listed below:

- Central West (New South Wales): Key gamers are Borenore State Forest, Central West Councils, and Orange City Council. They take care of forestry, local improvement, and neighborhood governance.

- Central Highlands (Queensland): Prominent organizations consist of Central Highlands Regional Council, Queensland Rail, and Central Highlands Development Corporation. They recognize neighborhood authorities, rail delivery, and nearby improvement.

What Are The Most Popular Real Estate Companies In Australia?

10 Most popular actual property organizations in Australia, alongside their client numbers are given in the table below:

| Company | Total Number of Clients |

| REA Group | 11 million+ monthly users |

| Domain Group | 8 million+ monthly users |

| McGrath Estate Agents | 16,000+ listings |

| LJ Hooker | 25,000+ transactions yearly |

| Ray White | 500,000+ clients annually |

| Harcourts | 350,000+ clients annually |

| Belle Property | 30,000+ clients annually |

| First National Real Estate | 50,000+ clients annually |

| Jellis Craig | 2,500+ properties listed annually |

| Sotheby’s International Realty | Not publicly available |

Client numbers can be dynamic and may not be continually pronounced. The records supplied are based on the latest available statistics and may range.

What Is The Largest Reit In Australia?

The largest Real Estate Investment Trust (REIT) in Australia through marketplace capitalization is Scentre Group. It operates and manages a portfolio of purchasing centers across Australia and New Zealand. Scentre Group has enormous impact inside the retail actual property sector and holds a giant percentage of the market.

Is Australia A Good Place To Invest In Real Estate?

Australia is usually considered an amazing location to put money into actual property due to its strong financial system, robust belongings rights, and developing population. Major towns like Sydney, Melbourne, and Brisbane offer strong funding opportunities with diverse property kinds. However, potential traders should be aware about high property expenses in foremost cities and fluctuating market situations. Research and expert advice are crucial for making knowledgeable investment choices.

What Is A Fintech Investment Company?

A Fintech Investment Company is a business that invests in generation-pushed monetary services and answers. Fintech, short for financial technology, involves the use of virtual technology to improve or automate economic services like banking, payments, and investing.

Fintech Investment Company:

- Fintech: Technology used to beautify economic services.

- Investment: The act of placing cash into something to earn a profit.

- Company: A corporation that provides goods or services.

So, a fintech investment enterprise is a business enterprise that places money into tech organizations or startups which can be growing new economic technologies.

What Is The Difference Between Fintech And Finance?

Fintech refers to technology that improves financial offerings, like apps for bills and investing. Finance is a broader field that includes managing cash, investments, and banking. Fintech is a part of finance but specializes in using technology to make financial methods quicker and less difficult. While finance covers all factors of money management, fintech especially targets tech-pushed innovations in financial offerings.

What Are The Top 50 Fintech Companies In Australia?

The Top 50 Fintech Companies In Australia are given in the table below:

| Company | Total Number of Clients |

| Afterpay | 16 million+ |

| Zip Co | 8 million+ |

| Revolut | 1 million+ |

| Prospa | 30,000+ |

| MoneyMe | 500,000+ |

| Airwallex | 2,000+ |

| Xero | 3 million+ |

| Plaid | Not publicly available |

| Judo Bank | 30,000+ |

| Spaceship | 300,000+ |

Is Fintech In Demand In Australia?

Yes, fintech is in high demand in Australia. The USA tech area is developing, and many humans and companies are searching for new financial solutions. Fintech gives progressive methods to address cash, making it popular. The upward thrust in virtual bills, online banking, and investment systems drives this call for. Australia’s strong generation quarter and tech-savvy populace contribute to this fashion.

What Does Fintech Australia Do?

Fintech Australia is an enterprise body supporting the fintech region. It allows fintech groups with the aid of presenting assets, networking possibilities, and advocating for favorable policies. The company aims to foster boom and innovation in the financial era. It connects startups with investors and offers guidance on regulatory issues. Fintech Australia promotes the fintech enterprise and allows it to thrive within the aggressive marketplace.

Is It Good To Invest In Fintech?

Investing in fintech is good due to the fact the world is growing hastily. Fintech agencies regularly provide innovative answers that attract users and buyers. However, the market may be volatile, and not all fintech startups are successful. Investors should research very well and apprehend the risks. Diversifying investments and searching for expert advice can assist control risks and maximize ability returns.

What Is A Private Equity Company?

A Private Equity business enterprise invests in private agencies. These agencies buy stakes in groups to assist them develop and enhance. They regularly provide capital and know-how to grow the organization’s value. Unlike public groups, personal fairness companies do not now trade on stock exchanges. They intend to make earnings through promoting their investments later, usually after the business has accelerated in value.

Who is the largest private equity company?

The biggest personal fairness organization is Blackstone. It manages billions of dollars in belongings and invests in diverse sectors. Blackstone is understood for its huge-scale investments and sizable effect inside the private fairness marketplace. It has a global presence and manages a numerous portfolio of investments throughout special industries.

What Are The Top Rated Private Equity Companies In Australia?

16 Top-rated private equity companies in Australia, along with their available statistics are given in the table below:

| Company | Total Assets Under Management (AUM) |

| Macquarie Group | $605 billion+ |

| TPG Capital | $100 billion+ |

| Crescent Capital Partners | $2 billion+ |

| Ardent Ventures | $1 billion+ |

| IFM Investors | $180 billion+ |

| Quadrant Private Equity | $5 billion+ |

| BGV Partners | $500 million+ |

| Pacific Equity Partners | $3 billion+ |

| Advent Partners | $1.5 billion+ |

| Next Capital | $1 billion+ |

| The Blackstone Group | $936 billion+ |

| Australian Super | $275 billion+ |

| Blue Sky Alternative Investments | $2 billion+ |

| EQT Partners | $60 billion+ |

| Pendal Group | $30 billion+ |

| Hermes Investment Management | $70 billion+ |

The statistics for assets under management (AUM) are approximate and can vary. The list includes both Australian-based and international private equity firms with a strong presence in Australia.

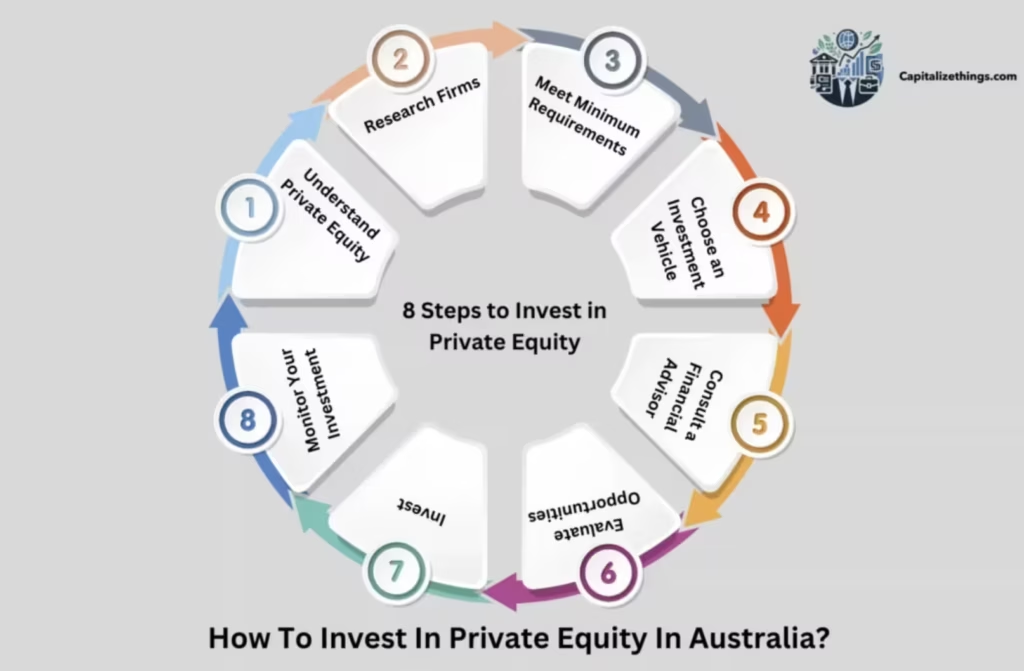

How To Invest In Private Equity In Australia?

Investing in private equity in Australia involves 8 steps are listed below:

- Understand Private Equity

- Research Firms

- Meet Minimum Requirements

- Choose an Investment Vehicle

- Consult a Financial Advisor

- Evaluate Opportunities

- Invest

- Monitor Your Investment

1. Understand Private Equity:

Private equity consists of making a funding in private companies or searching for out public organizations to lead them to non-public. It typically requires a prolonged-term determination and higher chance.

2. Research Firms:

Look for respectable personal fairness organizations in Australia. Some pinnacle companies encompass Macquarie Group and TPG Capital. Research their investment strategies, past typical performance, and costs.

3. Meet Minimum Requirements:

Private fairness investments regularly have immoderate minimum funding amounts and require buyers to be authorized or contemporary buyers. Check in case you meet these requirements.

4. Choose an Investment Vehicle:

You can invest immediately thru private equity funds or via controlled funding schemes. Choose the vehicle that fits your economic goals and threat tolerance.

5. Consult a Financial Advisor:

Seek recommendation from a monetary representative or funding expert. They can provide steerage on suitable private fairness opportunities and help with the funding manner.

6. Evaluate Opportunities:

Review the terms of investment, in conjunction with functionality returns, charges, and lock-all through periods. Ensure you recognize the dangers.

7. Invest:

Once you’ve decided on a funding possibility, study the organization’s system to dedicate your price variety. This may additionally contain signing contracts and transferring budgets.

8. Monitor Your Investment:

Keep song of your investment’s basic overall performance and stay knowledgeable approximately the personal fairness organization’s sports. Private fairness investments often have long-term horizons, so be organized for an extended investment length.

What are the Pros and Cons of investing in Australia?

The advantages and disadvantages of investing in Australia are given in the table below:

| Pros | Cons |

| Stable Economy | High Cost of Living |

| Australia’s economy is robust and stable, making it a haven for investors. | The high cost of living, especially in major cities, can affect the overall return on investment. |

| Regulated Market | Market Volatility |

| The Australian market is well-regulated, ensuring investor protection and transparency. | Australian markets can experience volatility, impacting investment returns. |

| Diverse Investment Opportunities | Currency Risk |

| There are several chances in a variety of fields, including real estate, mining, and technology. | Fluctuations in currency exchange rates can affect international investment returns. |

| High Quality of Infrastructure | Geographic Isolation |

| Australia offers high-quality infrastructure to facilitate corporate operations and investments. | Australia’s geographic isolation can impact trade and market accessibility. |

| Strong Legal System | High Taxes on Investments |

| The legal system is strong, offering a dependable foundation for settling conflicts. | There may be high taxes on capital gains and income from investments. |

What is the Australian Foundation investment company?

The Australian Foundation Investment Company (AFIC) is certainly one of Australia’s biggest and oldest indexed funding groups. It mostly invests in Australian equities and ambitions to offer shareholders with regular and growing dividend profits, in conjunction with capital growth. AFIC is known for its lengthy-time period investment approach and varied portfolio. It trades at the Australian Securities Exchange (ASX) and is managed with the aid of a team of experienced experts.

What Companies Does Afi Invest In?

The Australian Foundation Investment Company (AFIC) invests in technology finance and business fields necessarily. These consist of principal corporations throughout numerous sectors, inclusive of banks, utilities, and business corporations. AFIC focuses on businesses with robust financials and solid increase ability. The portfolio is assorted to lessen threat and enhance returns. Some famous investments may additionally encompass companies like Commonwealth Bank, BHP, and Woolworths. The aim is to offer constant dividends and capital appreciation.

How Do I Buy Shares In Afic?

To purchase stocks in AFIC, observe those steps: First, open an account with a certified stockbroker or a web buying and selling platform. Next, deposit the price range into your buying and selling account. Then, look for AFIC on the Australian Securities Exchange (ASX) the usage of its ticker code, “AFI.” Place an order to shop for the stocks via your broker or buying and selling platform. Review and affirm the transaction. Finally, monitor your investment and hold music of AFIC’s performance.

Is AFI A Good Stock To Buy?

AFIC is an excellent inventory to buy for investors seeking regular dividends and long-term increase. It is thought for its assorted portfolio of Australian equities, which enables spread chance. The organization has a tune document of solid overall performance and steady returns. However, it is vital to remember your funding goals and threat tolerance. Research AFIC’s recent performance, charges, and management before you decide. Consulting a monetary consultant also can be helpful.

Which Is Better, Afic Or Argo?

Choosing among AFIC and Argo depends on your investment desires. Both are large investment agencies with a focal point on Australian equities. AFIC is thought for its robust dividend yield and different portfolio. Argo, alternatively, also offers a diversified approach with a focal point on long-term boom. Compare their ancient overall performance, management costs, and dividend yields. Consider your funding preferences and consult with a monetary marketing consultant to decide which choice fits you better.

What Is The Minimum Investment In Afic?

The minimum funding in AFIC is not constant and may range relying on the way you purchase the stocks. If shopping via a stockbroker or online platform, the minimum amount is usually the rate of 1 share plus any associated prices. It’s an awesome concept to check together with your broking for unique info. Additionally, don’t forget the transaction fees and make certain that the funding aligns along with your financial goals and budget.

Which Company Is Best For Mutual Fund Investment?

Top agencies for mutual fund investments include Vanguard, Fidelity, and MLC, acknowledged for his or her various range of mutual funds and robust overall performance. Vanguard gives low-cost funds with a focus on lengthy-term increase. Fidelity affords a big choice of actively controlled funds. MLC offers complete investment alternatives and professional management. Compare fund overall performance, expenses, and offerings to discover the nice in shape for your funding method.

What Is The Safest Investment With The Highest Return In Australia?

The most secure funding with the best return in Australia is Government bonds, it is considered safe with strong returns. There are other investments considered with high return on them. High-first-rate dividend-paying stocks provide protection and capacity for better returns. Investment-grade assets and a diverse managed price range also provide a balance of risk and reward. However, all investments carry a few chances, and returns vary. Diversifying your portfolio and consulting a financial marketing consultant can help manipulate risk and beautify returns.

Who Is The Largest Foreign Investor In Australia?

The largest foreign investor in Australia is usually The United States. American businesses and investment corporations have sizable holdings in Australian businesses and property. Key sectors for U.S. Investment include actual estate, mining, and finance. U.S. Investments make contributions greatly to the Australian economic system. This relationship is supported via robust monetary ties and trade agreements between the two nations. Foreign funding plays a crucial position in Australia’s monetary boom and development.

Do Investment Companies Have To Pay Tax In Australia?

Yes, investment businesses in Australia need to pay tax. They are challenged by company tax fees on their profits, much like other organizations. The preferred company tax rate is 30%. Companies may also be required to pay other taxes, which include Goods and Services Tax (GST) on positive transactions. Investment groups should follow Australian tax legal guidelines and policies, filing returns and making payments as required with the aid of the Australian Taxation Office (ATO).

Is It A Good Decision To Invest In Australian Companies As A Beginner?

Investing in Australian businesses as a beginner can be a great choice. Australia has a solid economy and a regulated marketplace, supplying a secure environment for investments. Beginners can benefit from diverse opportunities in sectors like mining, finance, and generation. However, it’s vital to investigate very well and apprehend the risks. Starting with properly installed groups or various budgets can assist manage threats. Seeking advice from a monetary guide is also advocated.

Is It A Good Idea To Diversify Investment?

Yes, diversifying investments is a good concept. It entails spreading your investments throughout distinct asset sorts, sectors, and areas. This method facilitates reducing risk because one-of-a-kind investments can perform in a different way underneath various marketplace situations. Diversification can defend your portfolio from great losses if one funding performs poorly. It additionally increases the threat of normal portfolio boom by means of balancing ability profits and losses. Consulting with an economic guide can assist in creating a powerful diversification strategy. If you looking for premium advice book our service.

Can An Australian National Invest In an Albanian Company?

Yes, an Australian country wide can put money into an Albanian organization. Australians are allowed to spend money on overseas companies, together with the ones based totally in Albania. However, it’s far crucial to understand Albanian guidelines and investment opportunities. Researching the local market and searching for advice from monetary experts who are familiar with Albanian funding legal guidelines can assist. Additionally, be privy to any tax implications and global funding guidelines that might affect your investment.

What Are The Top Gold Investment Companies In The Word?

The top 10 gold investment companies globally, including notable companies from China and companies from the USA:

| Company | Country | Description |

| Barrick Gold Corporation | USA | One of the world’s largest gold mining companies, operating mines globally. |

| Newmont Corporation | USA | The largest gold mining company by market capitalization, with global operations. |

| China National Gold Group | China | The largest gold producer in China, involved in mining and refining. |

| AngloGold Ashanti | South Africa | Major gold mining company with operations in multiple countries, including China. |

| Gold Fields Limited | South Africa | A significant global gold producer with a presence in various countries. |

| China Shenhua Energy Company | China | Primarily an energy company but has substantial gold mining operations. |

| Kinross Gold Corporation | USA | A global gold mining company with operations in North and South America. |

| Franco-Nevada Corporation | USA | Specializes in gold royalties and streaming, providing investment opportunities in gold. |

| Agnico Eagle Mines Limited | Canada | A major gold producer with operations in North America and Finland. |

| Sibanye Stillwater | South Africa | Focuses on gold and platinum group metals, with operations in various countries. |

These companies represent some of the largest and most influential players in the global gold investment market.

What Are The Principles Of Investment?

The Principles of Investment concepts of funding include diversification, danger control, and long-term making plans. Diversification approach spreading investments across distinctive belongings to reduce threat. Risk control involves understanding and handling potential losses. Long-term planning focuses on setting and achieving financial desires over time. Investors should additionally recall asset allocation, that’s dividing investments among diverse asset training like shares, bonds, and real estate. Understanding these ideas helps investors make knowledgeable decisions and construct a balanced portfolio.

What Skills Are Needed For Investment?

Skills that are Needed for Investment are the key abilities wished for investment encompass analytical wandering, studies, and choice-making. Analytical wandering facilitates comparing investment opportunities and understanding marketplace developments. Research abilities are crucial for accumulating information about capability investments and assessing their price. Decision-making entails selecting the right investments based on research and evaluation. Other useful talents consist of economic literacy, chance control, and the potential to stay updated on market news. These skills assist investors make informed and strategic funding alternatives.

What Is An Investment Appraisal Company?

An investment appraisal corporation evaluates capability investment possibilities to decide their fee and danger. These organizations examine monetary information, marketplace conditions, and other factors to provide tips. They assist traders and groups make knowledgeable choices by means of assessing the potential go back on investment and dangers worried. Investment appraisal organizations use various strategies, which includes discounted coins flow evaluation and economic modeling, to offer unique reports and insights. Their offerings assist strategic planning and funding decision-making.

What Are The Top Investment Valuation Techniques?

Top investment valuation techniques consist of discounted coins float (DCF) analysis, rate-to-earnings (P/E) ratio, and net asset fee (NAV). DCF analysis estimates the value of an investment primarily based on its anticipated destiny cash flows, adjusted for danger. The P/E ratio compares an agency’s share fee to its income in keeping with proportion to assess price relative to profits. NAV calculates the value of an organization’s assets minus liabilities. These strategies help investors assess the worth of ability investments.

What Is Intermediary And Collective Investment?

An intermediary in funding is a person or corporation that helps transactions between buyers and funding possibilities. Examples encompass brokers and monetary advisors. Collective investment involves pooling budgets from multiple investors to put money into a diversified portfolio, along with mutual funds or investment trusts. This approach lets in buyers to get admission to a broader variety of property and gain from professional management. Intermediaries assist manage those collective investments and ensure efficient fund allocation and management.

Conclude

Investment organizations in Australia provide various alternatives, inclusive of fintech and private fairness companies. Fintech companies use technology to enhance economic services, at the same time as personal equity companies spend money on private businesses for boom. Both kinds of corporations have their execs and cons. Fintech gives innovation but may be risky, even as non-public equity gives excessive returns, however, regularly calls for considerable capital and lengthy-time period commitment. Understanding these factors facilitates investors to make knowledgeable choices.

A funding organization in Australia manages and invests in the price range on behalf of clients. These companies pool money from traders to spend money on numerous belongings like shares, real estate, and private equity. Their purpose is to generate returns for their customers via strategic investments. Investment corporations can be worried about handling mutual price range, managing assets, or offering economic offerings. They play a key role in supporting individuals and institutions to grow their wealth.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.