Investment organizations in Bahrain are firms that pool money from investors to shop for belongings or fund tasks. Their purpose is to generate returns for his or her customers via investments in shares, bonds, real property, or different economic units. These organizations help control and develop wealth. They offer numerous financial services and products, inclusive of asset management and funding advisory. Their position is critical in driving monetary growth and supporting enterprise improvement in Bahrain.

The Public Investment Fund (PIF) is Bahrain’s sovereign wealth fund. It invests in diverse sectors, which include finance, real property, and era. PIF aims to help Bahrain’s economic growth and development. It specializes in excessive-capability investments to boost the country wide financial system. The fund has significant holdings and performs a main position in shaping the United States investment landscape.

Venture capital firms in Bahrain focus on helping startups and early-stage businesses. They provide investment to innovative organizations with excessive boom ability. These corporations assist entrepreneurs with capital, advice, and assets. They target sectors like era, fitness, and fintech. Their aim is to foster innovation and drive economic development in Bahrain.

What Is An Investment Company In Bahrain?

An investment company in Bahrain is an enterprise that manages and invests cash on behalf of its customers. It collects budget from individuals or establishments and makes use of them to buy property like shares, bonds, or actual property. The goal is to develop the cash and generate returns. These companies offer monetary products and services, supporting clients build wealth and attain their monetary goals. They play a key role in Bahrain’s financial system by supporting numerous sectors and agencies.

What Are The Top Rated Investment Companies In Bahrain?

10 Top Rated Investment Companies In Bahrain are:

- Bahrain Mumtalakat Holding Company

- Investcorp

- Gulf Finance House

- Arcapita

- KIPCO Asset Management

- SICO

- Al Baraka Banking Group

- Bank of Bahrain and Kuwait (BBK)

- Al Salam Bank

- Arab Banking Corporation (ABC)

- National Bank of Bahrain (NBB)

- Bahrain Islamic Bank (BisB)

- Bahrain Development Bank

- Eagle Capital

- Amwaj Properties

- Bahrain Real Estate Investment Company (Edamah)

- Bahrain Commercial Facilities Company

- Bahrain Investment Wharf

- Al Khaleej Investment

- Gulf Investment Corporation

Unfortunately, specific consumer information is regularly proprietary and not publicly available. For specific records and more particular information, I recommend checking character corporation websites or economic reports, or contacting the monetary regulatory government in Bahrain.

What Are The Top Real Estate Investment Companies In Bahrain?

The Top real property investment businesses in Bahrain consist of Gulf Real Estate, Kooheji Properties, and Al Hamad Real Estate. These companies are aware of property development, control, and funding. They offer numerous residential, commercial, and blended-use initiatives. Each corporation has a robust reputation for turning in great real property and may assist traders discover worthwhile possibilities in Bahrain’s belongings marketplace.

Is Bahrain Real Estate A Good Investment?

Yes, Bahrain Real Estate property can be a great funding. The market offers opportunities in residential, commercial, and blended-use residences. Bahrain has a solid economic system, and the authorities support investments. High demand for nice residences and ongoing improvement tasks upload to its beauty. However, as with every investment, it’s essential to research and don’t forget market tendencies and capacity risks before investing.

Which Real Estate Company Is Best For Investment?

Determining the exceptional real estate property agency for investment in Bahrain relies upon personal desires. Companies like Gulf Real Estate, Al Hamad Real Estate, and Kooheji Properties are especially rated. They offer several investment options and feature a sturdy market. Evaluating their portfolios, project excellent, and purchaser reviews can assist in deciding on the proper agency that fits your investment needs and objectives.

Can Foreigners Own Real Estate In Bahrain?

Yes, foreigners can own actual property in Bahrain. The authorities let overseas possession in certain areas. These encompass certain freehold areas and traits. Foreign traders can purchase residential and business properties beneath precise rules. It is critical to understand the nearby laws and necessities. Consulting with an actual estate marketing consultant or legal expert can ensure a clean procedure and compliance with all rules.

How To Buy Real Estate In Bahrain?

To buy real estate in Bahrain, study the market and find assets, check if it’s in a freehold place, and stable financing if wished. Engage with a nearby real estate agent or guide who knows the market. Verify prison necessities and conduct due diligence. Complete the acquisition settlement and check in the property with the relevant government. Ensure all prison files are so as.

What Is Bahrain International Investment Park?

Bahrain International Investment Park (BIIP) is an enterprise park providing facilities for buyers. It provides quite a few offerings and infrastructure for various industries. The park is designed to draw global groups and aid their operations. BIIP offers incentives like tax breaks and streamlined techniques. It aims to boost monetary boom and attract overseas funding by means of presenting a strategic place and favorable enterprise environment.

What Is 100 Foreign Ownership Business In Bahrain?

The 100 foreign ownership enterprise model in Bahrain permits foreign buyers to personal a business fully without a local associate. This applies to companies in positive sectors and monetary zones. It affords extra management and versatility for traders. This version supports Bahrain’s aim to attract international groups and boost monetary improvement. Understanding zone-precise rules and getting felony advice can assist in putting in place a commercial enterprise beneath this model.

What Are The Free Zones In Bahrain?

Bahrain has several Free zones offering advantages like tax exemptions and 100 overseas possessions. Key unfastened zones consist of Bahrain International Investment Park (BIIP), Bahrain Financial Harbour, and Bahrain Bay. These zones cater to one-of-a-kind industries and offer infrastructure, regulatory help, and business incentives. They aim to attract foreign investment and foster monetary boom with the aid of developing favorable conditions for companies and buyers.

Is Bahrain A Good Country To Invest In?

Yes, Bahrain is a great use of money to spend money on. It gives a stable economic system, supportive government policies, and favorable business situations. Bahrain presents entry to nearby markets, tax incentives, and numerous investment possibilities. Its strategic location inside the Gulf vicinity makes it appealing for worldwide buyers. However, like several funding, it’s essential to investigate and understand the market and legal factors earlier than making funding decisions.

What Are The Major Financial Investment Companies?

Given below are the 5 major financial investment companies, but patron statistics are frequently no longer publicly available. You can look at each corporation’s internet site or economic reviews for certain consumer information.

- BlackRock

- Vanguard Group

- Fidelity Investments

- State Street Global Advisors

- J.P. Morgan Asset Management

For more detailed statistics and client numbers, visit their official websites or financial reports.

What Are The Top Investment Management Companies In Bahrain?

The top 10 investment management companies in Bahrain. Specific client numbers are not usually disclosed publicly. For exact figures, refer to their financial statements or contact them directly.

- SICO (Securities & Investment Company)

- Gulf Finance House

- Arcapita

- Kuwait Finance House Bahrain

- Al Baraka Banking Group

- Al Salam Bank

- Bahrain Mumtalakat Holding Company

- National Bank of Bahrain (NBB)

- Bank of Bahrain and Kuwait (BBK)

- First Energy Bank

What Are The Top 3 Investment Companies In Capital Governorate (Al-Manamah) Of Bahrain?

The top 3 investment companies in the Capital Governorate (Al-Manamah) of Bahrain are:

- SICO (Securities & Investment Company)

- Gulf Finance House

- Arcapita

What Are The Top 3 Investment Companies In Muharraq Governorate Of Bahrain?

The top 3 investment companies in the Muharraq Governorate of Bahrain are:

- Kuwait Finance House Bahrain

- Al Baraka Banking Group

- Bahrain Islamic Bank

What Are The Top 3 Investment Companies In The Northern Governorate Of Bahrain?

The top 3 investment companies in the Northern Governorate of Bahrain are:

- Bahrain Mumtalakat Holding Company

- Al Salam Bank

- First Energy Bank

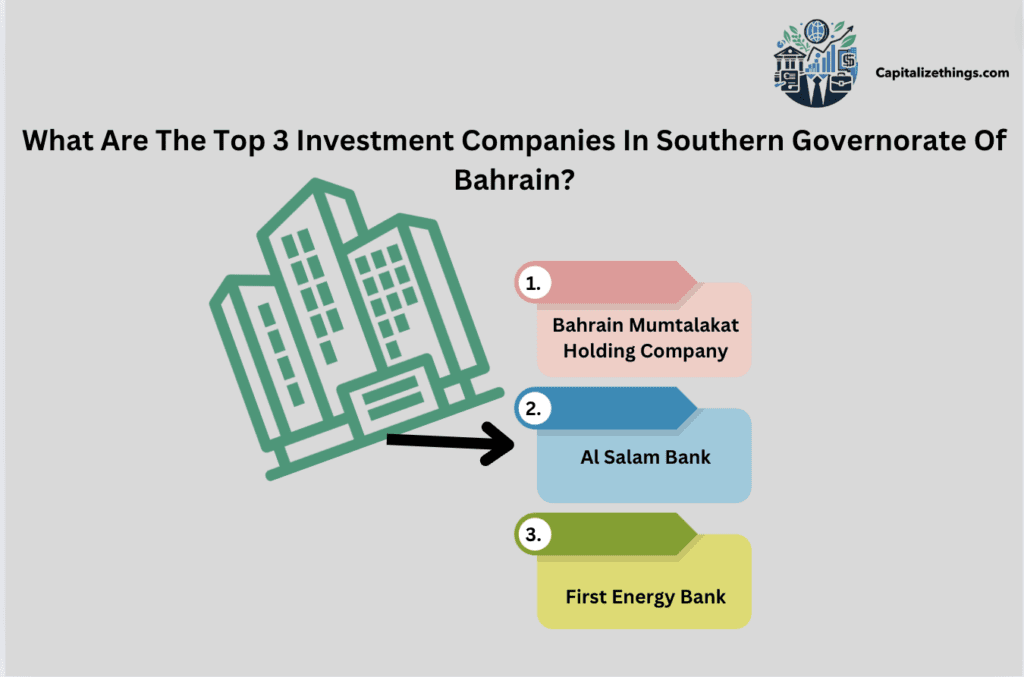

What Are The Top 3 Investment Companies In Southern Governorate Of Bahrain?

The top 3 investment companies in the Northern Governorate of Bahrain are:

- Bahrain Mumtalakat Holding Company

- Al Salam Bank

- First Energy Bank

What Is The Name Of The Arab Investment Company?

The arab investment company is named as TAIC, which is owned by almost 17 arab countries. The company is known as a joint stock company established in 1974.

What Is The Public Investment Fund(PIF) Bahrain?

The Public Investment Fund (PIF) Bahrain is a country-owned fund that invests in numerous sectors to support Bahrain’s financial growth. It pools the budget from the government to put money into initiatives and agencies. The fund makes a speciality of strategic areas like generation, actual property, and finance. By investing in high-capability sectors, PIF aims to reinforce Bahrain’s economic system and create task possibilities. It plays a key role in countrywide development.

Who Controls The PIF?

The Public Investment Fund (PIF) Bahrain is managed with the aid of the authorities of Bahrain. It is managed by means of a board of directors appointed by the authorities. This board oversees funding techniques, approves tasks, and guarantees the fund meets its desires. The management team handles everyday operations and investment selections. The authorities manipulate guarantees that PIF’s sports align with country wide monetary goals and improvement plans.

Who Owns a Public Investment Fund?

In Bahrain, the Public Investment Fund (PIF) is owned by the Government of Bahrain. Because a Public Investment Fund is usually owned by the authorities or a national entity. It is a state-owned entity that makes use of the public budget to make investments. The possession lets in the authorities to direct investments towards strategic sectors and countrywide priorities. This helps in reaching financial growth and improvement desires set with the aid of the government.

What Is The Purpose Of The Public Investment Fund?

The motive of the Public Investment Fund (PIF) Bahrain is to sell economic development and diversification. It invests in tasks and groups which could force a boom in various sectors. By specializing in strategic investments, PIF aims to enhance the countrywide economic system, create jobs, and help innovation. The fund additionally seeks to attract foreign investment and decorate Bahrain’s global financial role. It performs a vital role in shaping Bahrain’s monetary destiny.

What Companies Have PIF Invested In?

The Public Investment Fund (PIF) Bahrain invests in a variety of companies throughout distinctive sectors which includes investments in technology corporations, real estate initiatives, and financial institutions. Some top-notch agencies PIF has invested in are Gulf Finance House and Arcapita. The fund targets excessive-boom capability corporations to maximize returns and guide countrywide financial goals. For a complete list of investments, checking PIF’s respectable reports or announcements is suggested.

How Big Is The Public Investment Fund?

The size of the Public Investment Fund (PIF) Bahrain is vast, with billions of bucks in belongings. The fund manages a large portfolio of investments across diverse sectors. It’s length displays the authorities’ dedication to monetary development and strategic investments. The genuine size of the fund can vary based on market conditions and investment performance. For specific figures, seek advice from the contemporary monetary reviews or respectable statements from PIF.

Where Does The PIF Get Its Money?

The Public Investment Fund (PIF) Bahrain gets its money generally from the government. It uses public finances allotted via the state for investments. The fund additionally receives additional assets from returns on its investments. The authorities’ contribution supports PIF’s funding activities and strategic desires. This funding technique ensures that PIF can pursue tasks that align with Bahrain’s monetary and development objectives.

What Is a Venture Capital Firm in bahrain?

A venture capital organization in Bahrain is a specialized economic group that provides investment to startups and early-level agencies with excessive capacity. These corporations put money into modern groups, often in era or different contemporary sectors, in exchange for fairness or possession stakes. Venture capital corporations no longer offer capital but also strategic guidance, mentorship, and enterprise connections to help those companies prevail. Their goal is to generate sizable returns by means of nurturing corporations that can disrupt markets and reap enormous success.

What Are The Top 20 Venture Capital Firms In Bahrain?

Bahrain has several pinnacle project capital companies, consisting of Al Waha Fund of Funds, 500 Startups, and Tenmou. These corporations put money into revolutionary startups with high boom ability. They pay attention to sectors like era, fintech, and healthcare. A full list of the pinnacle 20 corporations would encompass companies like BECO Capital, Faith Capital, and C5 Capital. For client data, it’s fine to visit each corporation’s internet site or seek advice from their monetary reports.

Who Is The Largest Venture Capital Firm worldwide?

The largest mission capital firm globally is Sequoia Capital. Sequoia has invested in lots of successful businesses, such as Apple, Google, and Airbnb. They manage billions of dollars in belongings and feature a strong worldwide presence. They invest in numerous industries, by and large focusing on generation startups. Sequoia is understood for its expertise in figuring out and assisting excessive-increase agencies. For extra information and information, you could go to their reputable website or monetary reports.

How Much Money Do You Need To Invest In Venture Capital?

Investing in project capital normally calls for a big sum of money. Typically, people want to make investments between $25,000 to $250,000 in line with deals. Institutional investors need hundreds of thousands. The genuine amount can vary primarily based on the firm and the precise funding. Venture capital is considered excessive-hazard and is commonly reserved for approved traders. It’s critical to have a stable understanding of the market and a well-different portfolio before investing.

How Do I Find Venture Capital Companies?

Finding undertaking capital corporations may be performed via online research, networking activities, and enterprise meetings. Websites like Crunchbase and PitchBook listing challenge capital corporations and their investment activities. You also can be a part of startup accelerators or incubators, which regularly have connections with VCs. Engaging with the startup community and attending activities like demo days also can help you connect to mission capitalists interested in funding new ventures.

Which Country Is Best For Venture Capital?

The United States is taking into consideration the fine. For the challenge capital. It has a sturdy surroundings with top corporations like Sequoia Capital, Andreessen Horowitz, and Accel. The U.S. Leads in project capital investments, particularly in generation hubs like Silicon Valley. Other sturdy contenders consist of China, Israel, and the United Kingdom. These nations offer a supportive environment for startups, plentiful funding possibilities, and access to global markets, making them attractive for challenge capital.

What Is Investcorp?

Investcorp is a worldwide alternative funding corporation, based in 1982 and centered in Bahrain. It specializes in personal fairness, real estate, credit score management, and other alternative investment answers. Investcorp is understood for its strategic acquisitions and investments in mid-sized corporations, luxury manufacturers, and high actual estate property. The firm manages belongings across North America, Europe, the Middle East, and Asia. Investcorp’s technique blends local understanding with international reach, making it a prominent participant in the funding panorama.

Who Owns Investcorp Bahrain?

Investcorp Bahrain is owned via a numerous organization of shareholders, which include institutional investors and high-internet-really-worth individuals. The enterprise turned in in 1982 and has grown to end up a main international opportunity investment company. The ownership structure consists of sizable stakes held by way of Gulf Cooperation Council (GCC) traders. The organization is founded in Bahrain and operates globally, coping with a huge variety of assets, inclusive of personal equity, real property, and credit score management.

Is Investcorp Fake Or Real?

Investcorp is a real and professional funding company. Established in 1982, it is based in Bahrain and operates globally. The organization manages a diverse portfolio of property, together with personal fairness, real property, and credit score control. Investcorp is known for its successful investments in numerous industries. It is regulated by way of economic authorities in distinct regions, making sure transparency and compliance. Investcorp has a strong tune file and is recognized inside the economic industry.

Is Gucci Still Owned By Investcorp?

No, Gucci is no longer owned by Investcorp. Investcorp bought a stake in Gucci within the late Eighties and played a vast function in its turnaround. However, in 1999, Investcorp sold its ultimate shares in Gucci to the French luxury institution PPR (now called Kering). Kering presently owns Gucci, and it remains one of the largest luxury manufacturers within the world. Investcorp’s involvement with Gucci ended with the sale.

Is Investcorp Sharia Compliant?

Investcorp gives Sharia-compliant funding alternatives, adhering to Islamic finance standards. These alternatives are designed to meet the needs of traders seeking moral and religiously compliant investments. Investcorp’s Sharia-compliant products include non-public fairness, actual property, and different opportunity investments. The firm works with Sharia students to make sure that its services align with Islamic laws. While not all Investcorp’s products are Sharia-compliant, they offer alternatives for traders interested in this kind of investment.

How Much Does It Cost To Start A Company In Bahrain?

Starting an organization in Bahrain can cost between BHD 1,000 to BHD 10,000, depending on the sort and size of the business. The cost includes registration charges, licensing, and preliminary capital requirements. Other fees consist of renting office areas, hiring personnel, and other operational expenses. Bahrain offers numerous incentives for agencies, such as low taxes and streamlined tactics. It’s essential to research and finances hence to make sure a clean startup technique. Check video below to learn step by step process of setting up tax free business in bahrain.

Can A Foreigner Set Up A Company In Bahrain?

Yes, a foreigner can install an organization in Bahrain. The country gives an enterprise-friendly surroundings with streamlined tactics for foreign buyers. Bahrain permits 100% foreign possession in maximum sectors, making it easier for global marketers to begin organizations. The technique entails registering the employer, obtaining the essential licenses, and assembling the prison necessities. Foreign investors can benefit from Bahrain’s strategic region, low taxes, and get right of entry to regional markets.

How Can I Start A Trading Company In Bahrain?

To begin a buying and selling corporation in Bahrain, follow these steps. Choose a commercial enterprise shape, sign up the organization with the Ministry of Industry, Commerce, and Tourism, and reap a business registration (CR). You’ll want to secure the necessary licenses for buying and selling sports and follow neighborhood policies. Open a corporate bank account and install your enterprise operations. Bahrain’s strategic location and supportive commercial enterprise environment make it an excellent region for trading organizations.

What Is The Most Profitable Business To Start In Bahrain?

The most worthwhile companies to start in Bahrain include financial services, generation, and real property. Bahrain’s developing economic system and strategic place make these sectors incredibly profitable. The monetary services quarter blessings from a robust regulatory framework and get admission to nearby markets. Technology businesses, especially in fintech and cybersecurity, also are thriving. Real estate improvement and management offer sturdy returns because of ongoing infrastructure projects and excessive demand for industrial and home homes.

What Are The Top Gold Investment Companies In Bahrain?

Top gold investment corporations in Bahrain encompass Bahrain Jewellery Centre, Malabar Gold & Diamonds, and Bahrain Exchange Company (BEC). These groups offer various gold funding options like bodily gold, gold savings plans, and gold ETFs. They have strong reputations and serve a huge customer base. Gold is a popular funding in Bahrain due to its stability and cost retention.

What Are The Principles Of Investing In Gold?

Investing in gold includes understanding key standards including diversification, marketplace timing, and lengthy-time period fee. Gold is often visible as a hedge against inflation and foreign money fluctuations. It’s important to diversify investments, consisting of gold, to manipulate hazards. Understanding market trends and timing your funding is important. Gold commonly retains its cost over time, making it a great lengthy-time period of funding. Research and financial advice can assist in making informed selections about gold investments.

Do You Need Skills To Invest In A Company?

Yes, making an investment in a company requires positive competencies. Understanding financial statements, market tendencies, and threat control is important. Investors ought to recognize how to compare an enterprise’s overall performance, assess its increased ability, and recognize enterprise dynamics. Basic know-how of economics and financial concepts is also important. While a few competencies can be discovered, consulting with financial advisors can assist. Continuous getting to know and staying updated with marketplace modifications are crucial for a successful business enterprise investments.

What Are The Top Investment Valuation Strategies To Learn?

Top funding valuation strategies include Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transactions. DCF includes forecasting an enterprise’s coin flows and discounting them to provide value. Comparable Company Analysis compares an enterprise to comparable businesses to evaluate price. Precedent Transactions examine past deals inside the identical enterprise. Understanding those techniques allows buyers to examine capability investments and make knowledgeable choices. Learning those methods is critical for success in making an investment.

Do Investors Pay Tax On Their Investments?

Yes, investors regularly pay taxes on their investments. Taxes can apply to capital gains, dividends, and hobby earned from investments. The tax fee depends on the type of investment and the investor’s vicinity. In some instances, tax exemptions or reductions apply, which includes for lengthy-term investments or certain retirement bills. Investors must recognize the tax implications of their investments and consult with tax specialists to ensure compliance and optimize tax efficiency.

Conclude

Investing in gold requires an understanding of key concepts along with marketplace timing, diversification, and lengthy-time period price but if you are looking for our financial expert advice than reach out to us through email. Gold is a solid asset that acts as a hedge towards inflation. Investors should diversify their portfolios with gold to manipulate chance. Analyzing market tendencies and looking for monetary advice can manual powerful gold investment selections, ensuring a balanced and steady financial approach.

Valuation strategies are vital for comparing investments. Key strategies include Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transactions. DCF calculates an organization’s future coin flows to decide its present value. Comparable Company Analysis and Precedent Transactions investigate fees based totally on similar companies and beyond offers. Understanding these techniques enables buyers to make informed decisions, improving their investment achievement and portfolio control.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.