An investment company invests investors’ pooled funds in financial securities. Closed-end or open-end funds (mutual funds) are usually used for this. A fund sponsor or fund company is an investing company. Mutual fund sales are generally done through third parties. They must register, disclose, and report under the Securities Act of 1933 and the Investment Company Act of 1940. Mutual funds, unit investment trusts and Closed-end funds are investment companies. Investment companies vary in qualities, rewards, and hazards. Investors should thoroughly evaluate offering documentation, past performance, and potential risks before investing in any firm or fund.

Top Investment companies in Belgium are discussed in this article. COFRA Holding AG’s Redevco is a real estate Investment Company focused on thriving European cities. As urban real estate partners, they invest in assets to build future-proof buildings in active metropolitan areas where individuals want to live, perform, and work. Their investment clients and occupiers benefit from the investment strategy, local real estate expertise, and Pan-European platform.

Equity Firms and venture capital (VC) help start-ups and small business with development potential. Most venture financing comes from investors, financial institutions and investment banks. Technical or managerial competence could qualify for venture capital.

Unsure about navigating Belgium’s investment landscape? CapitalizeThings.com connects you with experts (+1 (323)-456-9123) for Equity Firms, Real Estate, & Venture Capital.

What is an investment company in Belgium?

An investment or any private limited company in belgium is defined under Belgian law. The Belgian Investment Company helps emerging economies in building vital private sectors for sustainability and long-lasting growth. BIO directly funds private projects. The company’s asset base was €712.9 million in December 2017, with €485.6 million in funded investments and €227.3 million pledged but uncommitted. Investment companies specialize in investing pooled cash in financial securities. Investment businesses, whether publicly traded or privately owned, manage, sell, and market investment goods. The purchase and sale of shares, bonds, property, cash, funds, and other assets makes investment companies money.

What are the top investment companies in Belgium?

The top 10 investment companies in Belgium are:

- Astanor Ventures

- Groupe Bruxelles Lambert SA

- Sofina SA

- KBC Ancora SCA

- TINC Comm. VA

- GIMV NV

- LRM

- Hummingbird Ventures

- Inventures Investment Partners

- Capricorn Partners

- Astanor Ventures

Astanor Ventures is a venture funding business focused on technology-driven agriculture and sustainability solutions.

- Groupe Bruxelles Lambert SA

Groupe Bruxelles Lambert is a significant asset management company in Belgium that focuses on long-term investments.

- Sofina SA

Sofina SA is a leading investment business that specializes in private equity and listed stock investments across numerous sectors.

- KBC Ancora SCA

KBC Ancora SCA, part of the KBC Group, specializes in long-term shareholding and investment management.

- TINC Comm. VA

TINC Comm. VA is an investment business that focuses on infrastructure and associated projects.

- GIMV NV

GIMV NV is a top European investment firm specializing in private equity and venture capital.

- LRM

LRM is a Hasselt-based venture capital business that invests in climate, sustainability, and innovation industries.

- Hummingbird Ventures

Hummingbird Ventures is a venture capital firm that specializes in early-stage investments in fintech, medical care, and SaaS.

- Inventures Investment Partners

Inventures Investment Partners Impact fund invests in European entrepreneurs focusing on SaaS and transportation.

- Capricorn Partners

Capricorn Partners is an investment business specializing in digital, health, and clean technology.

What is the Federal Holding and Investment Company in Belgium?

Federal Holding and Investment Company, founded in 2006, centrally oversees the federal government’s stakes, collaborates with the government on special projects, and pursues its investment policy in the Belgian economy.

What are the 4 biggest investment companies?

The 4 biggest investment companies are:

- BlackRock

- The Vanguard Group

- UBS Group

- Fidelity

- BlackRock

BlackRock, the world’s largest asset manager, is also a financial institution. Established in 1988, the corporation went public in 1999. Through iShares, the company has helped ETFs flourish. In 2021, more than 25% of BlackRock’s assets under management were iShares.

- The Vanguard Group

Vanguard specializes in passive investing, which involves investing in mutual funds that track an index or the stock market. Many Vanguard funds have low expense ratios. Vanguard also provides asset management, brokerage, annuities, financial planning, and more.

- UBS Group

UBS Group has four global divisions. The Swiss corporation claims to be the only truly international assets manager. UBS offers wealth and asset management.

- Fidelity

Asset management and discount broker Fidelity had over 30 million customers in the third quarter of 2021. It allows ordinary investors to trade securities online and administers entire portfolios for clients. In the summer of 2018, it made waves by offering zero-expense investment options with minimum investments.

What is the biggest company in Belgium?

The biggest company in Belgium is ANHEUSER-BUSCH INBEV SA/NV, worth $124 billion as of August 5, 2024. It’s followed by UCB ($31.61 billion) and ARGENX SE ($29.95 billion).

Why is Belgium a high-income country?

Belgium is a high-income country due to world trading. Despite its substantial industrial component, services account for 77.2% of GDP and agriculture 0.7%. Belgium relies on global trade for nearly two-thirds of its GDP.

What are the top investment management companies in Belgium?

The top 10 investment management companies in Belgium:

- Euroclear

- Investsuite

- Keyrock

- Sweepatic

- PMV

- Capricorn Partners

- Degroof Petercam

- Delen Private Bank

- Capfi Delen Asset Management

- AG Real Estate

- Euroclear

Euroclear handles securities settlement, storage, and asset servicing.

- Investsuite

Investsuite is a global fintech offering automated investment solutions for banks of all sizes.

- Keyrock

Keyrock creates transparent, scalable, and unique algorithmic technologies that improve financial asset liquidity.

- Sweepatic

Sweepatic provides global external attack surface management (EASM) to make customers cyber-resilient.

- PMV

PMV is a private equity firm that focuses on initiatives that promote prosperity and well-being.

- Capricorn Partners

Belgian project capital and equity fund manager Capricorn Partners invests in technology startups.

- Degroof Petercam

Private and institutional investors and companies utilize Degroof Petercam, a reference independent financial institution.

- Delen Private Bank

Family-owned Delen Private Bank specializes in asset management.

- Capfi Delen Asset Management

Financial and administrative funds management is Capfi Delen Asset Management’s speciality.

- AG Real Estate

AG Real Estate is a real estate manager, investor, and developer.

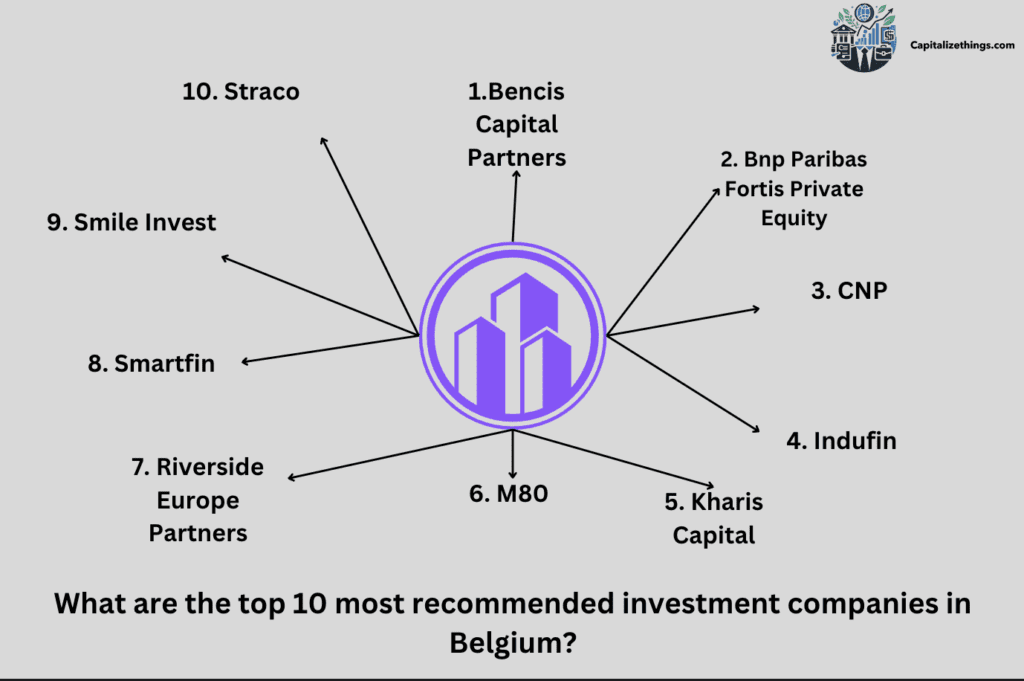

What are the top 10 most recommended investment companies in Belgium?

The top 10 most recommended investment companies in Belgium are:

- Bencis Capital Partners

- Bnp Paribas Fortis Private Equity

- CNP

- Indufin

- Kharis Capital

- M80

- Riverside Europe Partners

- Smartfin

- Smile Invest

- Straco

How big is Groupe Bruxelles Lambert’s investment?

Groupe Bruxelles Lambert (“GBL”) is a long-standing investment holding company having €16 billion in net assets, and €9 billion in market cap as of June 2024, with 70 years of stock exchange listing.

How many employees does Groupe Bruxelles Lambert have?

Groupe Bruxelles Lambert has 69 Employees.

What is Groupe Bruxelles Lambert’s annual revenue?

Groupe Bruxelles Lambert’s annual revenue is $7.17B.

Who owns Groupe Bruxelles Lambert?

Pargesa SA controls GBL’s stock with 32.9% of outstanding shares and 47.0% of voting rights.

What type of company is KBC?

KBC is an integrated bank-insurance group that serves retail, private banking, SME, and mid-cap clients. Its main markets are Belgium, Hungary, the Czech Republic, Slovakia, and Bulgaria. Some other countries have them in small amounts.

Is KBC a big bank?

Yes! KBC Group is Belgium’s second-largest bancassurer in the country.

What does KBC do?

KBC Group NV, a Belgian universal multi-channel bank insurer, serves private clients and SMEs in Belgium, the Czech Republic, Hungary, Bulgaria, and Slovakia.

Is KBC a good company?

Yes! KBC is a good company. Based on 545 Glassdoor company reviews, KBC has a 3.9-star employee rating, indicating that most people enjoy working there. KBC’s employee rating is within one standard deviation of the financial services industry average (3.7 stars).

What is an Incofin investment management company?

In 2001, ncofin began managing emerging country funds and investments. Top development funds, banks, pension funds, insurance companies, other investment funds, high net worth, and regular investors invest in them.

How big is the Incofin Investment Management Fund?

Incofin Investment Management Fund has US$ 1.4 billion in Assets.

Who is the founder of Incofin Investment Management?

Loïc De Cannière and Geert Peetermans are the founders of Incofin Investment Management.

Does incofin operate in other countries of europe too?

Yes! incofin operates in other countries of europe too. The group is launching its integrated business & personal banking ideas across the Mediterranean, Turkey, and Eastern Europe.

What is a private equity company in Belgium?

A private equity firm in Belgium focus on investing in private and non-public companies aiming to achieve highest performance. These companies in belgium focuses on long term value creation and create potential for high returns on investments. Belgian Venture Capital & Private Equity Association is a perfect example of private equity company in Belgium. The BVA represents Belgian VC and PE investors in public policy. As the voice of the Belgian VC and PE industry and the business owners they support, the BVA highlights the industry’s beneficial economic impact and provides market research, speciality training, and more.

What are the leading equity Firms in Belgium?

The 15 leading equity Firms in Belgium are:

- Gimv

- Rivean Capital

- BNP Paribas Fortis

- Volta Ventures

- Cobepa

- Scale Investment Funds Belgium

- Smartfin

- Axa

- Capricorn Partners

- KBC

- LRM

- Ventures

- Tikehau Capital

- Verlinvest

- Deutsche Bank

- Gimv

European private equity and venture capital company Gimv has over 30 years of experience. NYSE Euronext Brussels lists Gimv. Gimv invests 1.8 billion EUR (including third-party capital) in 85 portfolio firms, which generate over EUR 6 billion in revenue and employ over 28,000 people.

Gimv, a world leader in chosen investment platforms, finds entrepreneurial and creative firms with significant growth potential and helps them become market leaders. Four Gimv investment platforms are Consumer 2020, Health & Care, Smart Industries, and Sustainability Cities. Each platform has a professional and devoted workforce in Gimv’s core markets of Benelux, Germany, and France, as well as an international network of specialists.

- Rivean Capital

Private equity firm Rivean Capital invests in transportation, business services, chemicals, food and beverage, IT, consumer goods and services, and industrial companies.

- BNP Paribas Fortis

Paribas Belgian international bank Fortis is a BNP Paribas affiliate. In May 2009, BNP Paribas bought 75% of Belgian Fortis Bank from the Federal Participation & Investment Company, creating the bank. It was Fortis’ banking arm, along with Fortis Bank Nederland. The subprime crisis and GFC forced the selling of the Dutch & Luxembourg banking branches to the Dutch & Luxembourg governments after the failed ABN-AMRO merger. Fortis Bank was partially bought by the Belgian government for €4.7 billion, then fully acquired by and transferred to BNP Paribas.

- Volta Ventures

Volta Ventures provides seed and early-stage VC to Benelux online and software firms. With the help of 30 business angels, the fund’s team plans to help founders and management find new markets and customers, employ top personnel, provide continuous coaching, and arrange further financing for each company.

- Cobepa

Cobepa is Independent, privately held investment corporation. It has a net worth of EUR 1.8 billion. Since 1957, Cobepa has developed into a prominent private equity firm with operations in Brussels and New York.

Cobepa’s success is based on its exceptional investment team, flexible investment methodology, and capacity to invest in medium- to long-term firms. This allows Cobepa to help its investee firms throughout their development, working with their management and shareholders. Cobepa’s investment activity is guided by its fundamental values: respect, transparency, honesty, and independence.

- Scale Investment Funds Belgium

Hummingbird Ventures invests in maverick founders who are developing generational firms. Hummingbird worked with innovative startups such as Kraken, Peak Games, Showpad, Deliveroo, BillionToOne, OneCard, Pristyn Care, Gram Games, and others.

- Smartfin

SmartFin targets exceptional B2B technology enterprises in Europe. It has €500m in assets under management, 1-25m investment tickets, 7 investment professionals, and 23 portfolio companies.

- Axa

Holding business AXA SA provides insurance and asset management services. It has segments for France, Asia, Europe, AXA XL, the US, International, and Transversal & Central Holdings. The France segment includes Life & Savings, Property & Casualty, AXA Banque France, and France holdings. The Europe segment includes Property & Casualty and Life & Savings in Switzerland, Germany, Belgium, Spain, the UK & Ireland, and Italy. The Asian sector includes Property & Casualty and Life & Savings in Japan, Hong Kong, and Asia High Potentials. AXA XL includes XL Group’s Property & Casualty, AXA Art and Corporate Solutions Assurance. The US sector covers AB’s Asset Management and Life & Savings activities.

The International sector includes Property & Casualty and Life & Savings in 14 European, Middle Eastern, African, and Latin American nations, Malaysia, Singapore, and India. Transversal & Central Holdings includes AXA Investment Management, AXA Assistance, AXA Liabilities Managers, AXA Life Europe, AXA Global Re, AXA SA, and other Central Holdings. This Paris-based company was started in 1985.

- Capricorn Partners

An independent pan-European venture capital fund manager, Capricorn Partners NV invests in emerging European technology startups. Capricorn’s investment administer are technology and industry experts.

- KBC

KBC Group NV, a Belgian universal multi-channel bank insurer, serves private clients and SMEs in Belgium, Bulgaria, Hungary, the Czech Republic, and Slovakia. Kredietbank (KB), CERA Bank [nl], ABB Insurance, and Fidelitas Insurance merged in 1998 to become it. KBC stands for KredietBank and CERA.

Belgium’s second-largest bancassurance is KBC Group. As of late 2020, it was the 15th bigest bank in Europe by market capitalization. It is a major financial player in Eastern and Central Europe, employing 41,000 people (more than half in CEE) and serving 12 million consumers worldwide.

- LRM

Smart money from LRM venture capitalists fuels company growth. They also operate 3 corporate campuses and supply industrial estates to entrepreneurs. Their be-MINE and Terhills mine sites are undergoing excellent modifications. Limburg has 7 incubators with over 300 businesses. Finally, Their ambitious climate projects have earned us a reputation for creativity and sustainability over the years.

- Ventures

Company Ventures is an early-stage venture company that promotes peer interactions and provides a dynamic shared expertise. The company helps all sizes of organizations realize value. It was created in 2018 and is based in NYC.

- Tikehau Capital

Global alternative asset manager Tikehau Capital manages €46.1 billion (as of June 30 2024). Tikehau Capital specializes in private debt, tangible assets, private equity, multi-asset, capital markets, and unique opportunity strategies. The founder-led Tikehau Capital team has a unique business model, robust balance sheet, global deal flow, and a history of supporting top firms and individuals. Tikehau Capital, rooted in the real economy, offers unique alternative funding solutions to firms it invests in to build long-term value for its investors and benefit society.

With €3.1 billion of shareholders’ equity as of June 30, 2024, the firm invests its own capital alongside investor-clients in each strategy. Tikehau Capital, controlled by its managers and major institutional partners, had 762 workers (as of March 30, 2024) in 17 locations across Europe, the Middle East, Asia, and North America who share a strong entrepreneurial culture and DNA.

- Verlinvest

Verlinvest accelerates customer revolutions by teaming with outstanding leaders to establish iconic, health care, mission-driven technology, and food & beverage companies.

- Deutsche Bank

Frankfurt-based Deutsche Bank AG is a worldwide investment bank and financial services corporation that is traded on the New York stock exchanges and Frankfurt. Berlin’s Deutsche Bank was formed in 1870. After merging, Deutsche Bank und Disconto-Gesellschaft (DeDi-Bank) was its name from 1929 to 1937. Other landmark acquisitions include Mendelssohn & Co. in 1938, Bankers Trust in 1998, Morgan Grenfell in 1990, and Deutsche Postbank in 2010.

As of 2018, the bank operated in 58 countries, mostly in Europe, the Americas, and Asia. Deutsche Bank owns the majority position in DWS Group, which has 2.2 trillion euros in assets, surpassing Sparkassen-Finanzgruppe. It is part of the DAX stock market index.

What is the highest-paying private equity firm in Belgium?

Bencis Capital Partners is the highest-paying private equity firm in Belgium.

Who is the largest private equity company in Belgium?

Cobepa is Belgium’s largest private equity company. It is an independent business firm with a net worth of EUR 1.8 billion. Cobepa has been around since 1957 and has grown into a well-known player in private equity. It has offices in Brussels and New York.

Cobepa has grown well so far due to its good investment team, adaptable investment strategy, and willingness to put money into businesses with a medium to long-term view. This lets Cobepa assist and back its invested companies as they grow, working together with their management and in a partnership-like way with the other shareholders. As Cobepa grows its investment business, it always stays true to its core company values, which are honesty, integrity, honesty, and independence.

What does Flanders Investment and Trade do?

Flanders Investment and Trade enables Flanders-based entrepreneurs and companies to export and internationalize to flourish. They attract foreign investment and expansion to Flanders. They create the Flanders internationalization policy with partners. Capitalizethings.com expert team is offering services related to investment and financial advisory to get you started based on your situation and liquid cash you hold. To book an appointment call us at +1 (323)-456-9123 or email us for free consultation.

What is Flanders, Belgium, famous for?

Flanders was Europe’s textile and commercial centre since the Middle Ages. East Flanders is one of Europe’s most heavily inhabited regions, while Flemish Brabant’s western parts, dominated by Brussels, are overpopulated.

Why was Flanders so rich?

Flanders is so rich due to trading and weaving. Ghent and Bruges of the medieval County of Flanders and, subsequently, Antwerp of the Duchy of Brabant established one of the most prosperous and most urbanized sections of Europe by trading and weaving neighbouring wool into cloth for home and export usage.

What is Belgium’s ESG rating?

The BEL® ESG Index/rating helps investors adopt mainstream ESG investments. It is the fifth national blue-chip ESG Index variation after the CAC® 40 ESG (France), AEX® ESG (The Netherlands), MIB® ESG (Italy), and OBX® ESG (Norway).

Euro next partners with Sustainalytics, a major worldwide ESG research, ratings, and data supplier, for index market data. Sustainalytics evaluates firms’ ESG for index composition. The BEL® ESG meets the Central Labelling Agency’s ‘Towards Sustainability’ certification, a high-quality criteria for sustainable financial goods, including indexes and ETFs.

Who are the big ESG investors?

Institutional investors and retirement savings plans invest in ESG. The world’s leading institutional investors and retirement savings plans believe ESG can unleash shareholder value and make businesses and markets more sustainable. Most mainstream institutional investors and their rating agencies now believe firms must have high-quality social and environmental (“ESG”) practices to create long-term prosperity.

Which countries are best for ESG investing?

The top 8 countries that are best for ESG investments are given below:

- Sweden

- Denmark

- Finland

- Germany

- The Netherlands

- Switzerland

- Norway

- New Zealand

- Sweden

Due to its comprehensive environmental legislation and solid social welfare programs, Sweden routinely leads ESG rankings. The Swedish government pledged net-zero greenhouse gas emissions by 2045—significant investments in wind and hydroelectric electricity support this ambitious goal. Sweden has one of the world’s most generous welfare programs, ensuring education, high healthcare, and social security standards.

- Denmark

Denmark leads ESG due to its renewable energy efforts. The country plans to generate 100% of its electricity from renewable sources by 2030, with offshore wind projects making progress. Gender equality, labour rights, and corporate transparency are also good aspects of Denmark’s social policies. ESG norms show Denmark’s dedication to sustainability and ethical governance, and its enterprises are widely praised.

- Finland

Finland is known for its excellent education and environmental regulations. Finnish authorities aim to be carbon neutral by 2035, one of the most passionate climate goals. In addition, strict ecological restrictions and public engagement are high in sustainability concerns. Finland’s inclusive, high-quality education system promotes social fairness and innovation.

- Germany

Germany, Europe’s largest economy, leads ESG integration within its industrial sector. Transfering from fossil fuels to renewable energy reduces carbon emissions under the Energiewende concept. Strong labour unions and worker-friendly social policies are also hallmarks of German social government. German corporations are setting high corporate responsibility standards by implementing ESG reporting and ecological business practices.

- The Netherlands

The Netherlands is known for its water management and social programs. Low-lying terrain has forced the country to create innovative flood protection technologies and sustainable urban planning. Progressive educational, health, and social security policies in the Netherlands promote inclusivity and equality. Dutch enterprises pioneered circular economy strategies to reduce waste and promote sustainability.

- Switzerland

Global financial centre Switzerland leads ESG investing. Swiss banks use ESG criteria in their investing strategies, encouraging sustainable finance worldwide. The country’s environmental policies reduce greenhouse gas emissions and protect biodiversity. Switzerland ranks high in ESG rankings due to its good governance, openness, and social welfare.

- Norway

Norway funds environmental efforts using its oil revenue, a unique technique. The Norwegian Government Pension Fund, one of the world’s most significant sovereign wealth funds, prioritizes ESG investments. Norway also has aggressive electric vehicles and renewable energy ambitions to reduce its carbon footprint. Strong social policies ensure good living conditions and social justice in the country.

- New Zealand

New Zealand has led the world in social sustainability by integrating Indigenous rights into its governing system. The country’s environmental policies conserve its biodiversity while lowering carbon emissions. The Treaty of Waitangi, which recognizes Maori rights, shows New Zealand’s commitment to social governance and fairness.

Is ESG reporting mandatory in Belgium?

Yes! ESG reporting is mandatory in Belgium. Smaller and bigger SMEs must now disclose ESG. In 2022, 200 Belgian enterprises reported mandatory under the NFRD. From 2026, 2,800 enterprises must reveal.

Which companies have the highest ESG ratings?

ASML Holdings NV, Check Point Software Technologies, Hermes International SCA and Linde have the highest ESG ratings.

What are the top real estate investor companies in Belgium?

The top 10 real estate investor companies in Belgium are:

- The Century 21

- Allten

- TREVI

- Structura.biz

- E&V

- Aximas

- Sotheby’s

- Brikman

- Switch

- BARNES

- The Century 21

THE CENTURY 21, the Benelux real estate group, is stable, dynamic, and global. It monitors industry developments and updates its offices daily on market and opportunity developments.

- Allten

ALLTEN, a Belgian commercial real estate brokerage, provides properties for rent or sale by surface and location.

- TREVI

TREVI is a residential and commercial real estate integrated group that provides sale, rental, specialization, and property management. It has 160 employees.

- Structura.biz

Agent Structura (1989) specialized in residential real estate in Brussels’ northern periphery, which led to Structura.biz.

- E&V

Engel & Völkers offers rentals, purchasing or selling homes, houses, villas, condos, lofts, or other move-in properties, rehabilitation, and new construction.

- Aximas

Belgian commercial real estate agent Aximas has 25 years of experience and market understanding in Brussels, Flandres, and Wallonia. They provide many business properties, such as office space.

- Sotheby’s

Sotheby’s century-long reputation, inventiveness, and love for their profession are its strengths. They work hard to discover your dream property based on your needs.

- Brikman

Brikman has extensive real estate knowledge and negotiation skills. Their developing firm has completed hundreds of real estate transactions since its founding, demonstrating its seriousness and professionalism. Knowing the importance of property purchases, sales, and rentals, the team, with real-world experience, is available to answer all your inquiries.

They promise competent and rigorous work, from an accurate and realistic evaluation of your real estate to the signature of the authentic deed of sale or lease contract due to many real estate transactions.

- Switch

SWITCH Immo, a prominent corporate real estate player in Brussels, is now promoting itself as an expert for professionals looking to sell, rent, or buy a home. They can help you find the ideal property, whether it’s a commercial space on the High Street, an office in the city centre, a workshop or warehouse in a zoning, or a property search.

- BARNES

BARNES redefines premium real estate and offers customized solutions through an integrated international network. Over 600 competent and dedicated BARNES professionals work in 15 countries and 90 offices. BARNES’s promise is superb real estate in top worldwide capitals and resorts. BARNES, a family firm, instils competence, respect, and distinctive expertise in its personnel. BARNES has more than 10 enterprises that offer transactions and financial advice.

What is BIO (Belgian Investment Company)?

BIO supports developing nations’ socioeconomic growth by investing in SMEs, banking institutions, and infrastructure.

The Belgian Investment Company for Developing Countries (BIO) supports a robust private sector in emerging and developing nations to enable growth and equitable development under the Sustainable Development Goals.

In what sectors BIO serves in?

BIO serves in:

- Enterprises

- The financial sector

- Infrastructure Projects

Learn more about investment strategies of BIO in the video below.

What is a venture capital investment company?

Venture capital (VC) is private equity that funds entrepreneurs and early-stage firms with growth prospects. Startups sell ownership holdings to venture capital funds for money, technical support, and management.

VC investors help young firm CEOs make growth-focused decisions. VCs guide new companies, while startup founders are experts in their field but lacks the abilities and expertise needed to expand a company.

Venture financing has other benefits for entrepreneurs. Portfolio firms have access to VC fund partners and specialists. Additionally, the VC Company can help them raise further funding in the future. Investments in venture capital are usually restricted to institutional and accredited investors. Pension funds, large banks, HNWIs, and wealth managers invest in VC funds.

What are the top venture capital investment companies in Belgium?

The top 24 venture capital companies in Belgium are:

- Hummingbird Ventures

- Smartfin

- Gimv

- Volta Ventures

- Scale Investment Funds Belgium

- Capricorn Partners

- Nine point five ventures

- Inventures SA

- Rivean Capital

- Verlinvest

- DN Capital

- Smile Invest

- Force Over Mass

- Freshmen Fund

- Kharis Capital

- Investsud

- LRM

- Newton Biocapital

- Aconterra Capital Partners

- Pitchdrive

- Ninepointfive

- Altasinvest

- SRIW

- Limburgse Reconversie Maatschappij

Who is the largest venture capital firm in Belgium?

Capricorn Partners is the largest venture capital firm in Belgium. Deals make Capricorn Partners one of Belgium’s best VC firms. They target digital, clean tech startups. VC firms typically invest in new enterprises that benefit people and the earth. The VC firm seeks financial and strategic value for its portfolio firms. In that instance, the VC firm’s unique technology and investing experience create an ecosystem where innovative ideas, investible capital, and capable entrepreneurship generate superior returns. Initial investments by Capricorn Partners vary from €1M to €3M.

What are the taxes for companies in Belgium?

In Taxes, the companies must pay 6.75% more, after authorities review their corporation tax bill. Belgian corporate tax will stay at 25% in 2024. Companies with more than 50% individual ownership or lower profitability pay less.

What is the tax on ETF in Belgium?

ETF taxes in Belgium range from 0.12% to 1.32% of the transaction value. ETFs with a 0.12% tax rate documented in the EU but not in Belgium are preferred. Buying or selling securities costs it. Belgium taxes transactions are also known as (“beurstaks” or “taxe sur les opérations de bourse” or TOB).

What is the Federal Holding and Investment Company in Belgium?

Brussels’ Federal Holding & Investment Company (SFPI-FPIM) develops the economy. The organization was formed in 2006 when the Federal Participation Company & Federal Investment Company merged. The SFPI-FPIM centrally controls the federal government’s shareholdings, works with the government on initiatives, and pursues its investment policy for the Belgian economy.

How do investors find startups to invest in?

To uncover startup investment prospects, join online and in-person networks and create long-term relationships with entrepreneurs and investors.

Who are the owners of the European Investment Fund?

The European Investment Bank (62%), the European Commission (29%), and 30 financial institutions (9%) are its owners.

Which countries invest in Belgium?

France is Belgium’s top foreign investment source, with 38 projects launched last year. The US came in second with 29 projects, followed by the Netherlands with 21. British investment in Belgium fell from 37 in 2021 to 27 in 2022 and 18 in 2023.

How many venture capital firms are there in Europe?

The number of active investments in venture capital firms climbed from 657 in 2013 to 2,122 in 2017.

Should a new foreign investor invest in Belgium for good profits?

It is hard to say yes or no if new foreign investors should invest in belgium for great profits due to markets competition.Belgium has an open market and superior connections to major economies. It is a competitive market and site for US investment due to its logistical gateway to Europe’s largest economies and its hosting of EU institutions and NATO.

Are there any principles of investment to follow when investing in Belgium?

The major principle of investing in belgium is to avoid investing in environmentally harmful enterprises. This excludes non-renewable energy, wrong products, weaponry, and contentious enterprises.

What are the top 3 skills investors should learn before investing in Belgium?

The top 3 skills investors should learn before investing in Belgium are:

- Basic math skills

- Intelligent thinking on BUSINESS

- Valuation and Portfolio management skills

Intellectual curiosity is essential. You must read constantly. Stock investment requires a willingness to lose money, sometimes a lot. This is temporary because market volatility is typical, but few can handle it effectively. Finally, know your limits. Invest in what you know.

Should the investor diversify their investment portfolio in Belgium?

One goal of index investment is to spread out your money as much as possible. Diversifying across sectors and countries reduces risk. You also gain from the expansion of the world’s top companies, not only French, German, or American ones.

What is the highest ROI of investing in Belgium?

The highest ROI of investing in belgium can go up to 100% if you invest in certain stocks(UCB (UCB), D’Ieteren Group (DIE), Lotus Bakeries (LOTB)). Belgium also has the highest ROI in biotechnology and pharmaceuticals because of its robust R&D infrastructure and government backing.

What are the valuation techniques for investment in Belgium?

The valuation techniques for investment in Belgium are:

- Book Value

- Discounted Cash Flows

- Market Capitalization

- Enterprise Value

- EBITDA

- Growing Perpetuity

Conclusion

Private and public investment companies administer, sell, and market funds. Investment companies hold and handle securities for investors, but they also offer portfolio management, custodial, recordkeeping, accounting, legal, and tax management services. Investment companies can be corporations, partnerships, business trusts, or LLCs that combine investor funds. The pooled money is invested, and investors share corporate gains and losses according to their stake. Example: An investment company invested $10 million from several clients, representing its owners. A $1 million donor will have a 10% stake in the organization, which includes losses and earnings.

Belgian Investment Company for Developing Countries (BIO) supports a robust private sector in emerging and developing nations to enable growth and equitable development under the Sustainable Development Goals.

Private equity and venture capital are both firms that invest in startups and exit through equity financing, such as initial public offerings. However, firms using the two funding methods operate differently. Venture capital (VC) and Private equity invest in various kinds and sizes of firms, commit varying amounts of money, and acquire different equity percentages.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.