Brazil’s investment companies focus on main industries such as non-public justice, petroleum, fintech, and cryptocurrency. Brazilian non-public fairness companies engage in groups throughout a wide range of industries, helping them in developing and improving their operations. They often target mid-sized firms with super expansion potential. These corporations play a vital position in Brazil’s economic increase by way of imparting capital and knowledge.

Brazil’s petroleum quarter draws sizable investment, mainly in offshore drilling. Petrobras, Brazil’s nation-run oil enterprise, is a major player. International agencies which include Shell and ExxonMobil additionally make sizable investments in exploration and manufacturing. Pre-salt oil deposits off Brazil’s coast are a chief emphasis, as is investment and an economic increase. These agencies provide new monetary solutions, starting from digital banking to fee processing. The place is unexpectedly expanding, drawing neighborhood and international buyers. Brazil’s large, underbanked population has widespread possibilities for a fintech explosion.

The cryptocurrency sector in Brazil is expanding, with corporations along with Mercado Bitcoin and Bitso leading the manner. These systems permit the purchase, promotion, and finance of digital belongings. The regulatory environment is converting, with the authorities attempting to stabilize innovation and customer protection. Crypto investments are increasing in popularity, particularly amongst more youthful, tech-savvy clients.

What Is An Investment Company In Brazil?

In Brazil, an Investment Company is an economic entity that pools cash from customers to spend money on diverse assets such as shares, bonds, actual estate, or groups. These companies regulate the charge range on behalf of their clients with the intention to maximize returns. They also be aware about positive industries, which include private fairness, oil, fintech, or cryptocurrency. Investment corporations assist people, groups, and establishments develop their wealth by means of making smart investments in Brazil’s various and dynamic financial structures.

What Are The Top Rated Investment Companies In Brazil?

The 20 top-rated investment companies in Brazil are:

- NXTP Labs S.R.L.

- Olimpia Partners

- Astella Investimentos

- Positive Ventures

- Valor Capital

- 3G Capital

- Proterra Investment Partners

- Canary

- Crescera Capital

- Monashees

- Alothon Group LLC

- Bossanova Investimentos

- Construtech Ventures

- Din4mo

- Domo Invest

- General Atlantic

- Kaszek

- Redpoint Ventures

- DGF Investimentos

- Easynvest

These companies are highly regarded for their strategic investments, management expertise, and contributions to Brazil’s economic growth.

What Are The 4 Biggest Investment Companies In Brazil?

The 4 Biggest Investment companies in Brazil based on their market size and influence are:

| Company Name | Market Cap (USD) | Total Clients |

| Banco Bradesco | $61.5 billion | 70 million |

| Itaú Unibanco | $48.1 billion | 55 million |

| BTG Pactual | $10.8 billion | 1.6 million |

| XP Investimentos | $11.9 billion | 3.5 million |

These companies dominate Brazil’s investment landscape, offering a wide range of financial services, including banking, asset management, and investment brokerage.

What Are The Best 10 Investment Companies In Brazil To Invest In As A Beginner?

The 10 best investment companies for beginners in Brazil are:

| Company Name | Market Cap (USD) | Total Clients |

| Nubank | $21.8 billion | 75 million |

| ModalMais | $2.1 billion | 2 million |

| Easynvest | $3.5 billion | 1.5 million |

| Ágora Investimentos | $4.2 billion | 2.2 million |

| Clear Corretora | $1.3 billion | 1.3 million |

| Genial Investimentos | $4.5 billion | 1.8 million |

| Warren Investimentos | $1.1 billion | 600,000 |

| Guide Investimentos | $1.2 billion | 700,000 |

| Órama Investimentos | $850 million | 500,000 |

| Toro Investimentos | $1.0 billion | 650,000 |

These companies are beginner-friendly, providing easy access to various investment options and educational resources.

What Is A Corporate Venture Capital Firm In Brazil?

A Corporate Venture Capital (CVC) corporation in Brazil is a subsidiary of a larger agency that invests in startups and small organizations. These firms use their determined company’s finances to invest in progressive companies that align with their strategic dreams. The motive is to gain admission to new technologies, markets, or products. CVCs in Brazil frequently recognize sectors like generation, healthcare, and energy, helping startups which have high boom ability.

How Many Corporate Venture Capital Firms Are In Brazil?

There are over 50 CVCs inside, with foremost groups like Petrobras, Vale, and Bradesco organizing their personal funding palms. Brazil has seen an upward thrust inside the wide variety of company venture capital (CVC) firms. These companies are crucial in fostering innovation and assisting the growth of startups across various sectors. The fashion is developing as greater agencies recognize the blessings of making an investment in new ventures that align with their strategic desires.

What Type Of Companies Do Venture Capitalists Invest In?

Venture capitalists in Brazil generally put money into startups and small to mid-sized businesses with excessive boom ability. They look for groups which can be innovative and feature scalable services or products. Sectors that entice assignment capital encompass generation, fintech, healthcare, and renewable electricity. These companies often have sturdy teams, precise solutions, and a clear route to profitability. The intention is to obtain widespread returns via the employer’s growth or eventual exit, like an acquisition or IPO.

Which Country Is Best For Venture Capital?

The United States is broadly considered the best for venture capital. For mission capital, specifically Silicon Valley. It gives a mature environment with considerable funding, a robust community of investors, and access to top expertise. Other leading international locations consist of China, the United Kingdom, and Israel, which also have thriving startup ecosystems. Brazil is emerging as a robust player in Latin America, with developing venture capital interest, specifically in sectors like fintech and era.

What Is The Investment Promotion Agency Of Brazil?

Apex-Brasil, or the Brazilian Trade and Investment Promotion Agency, facilitates attracting foreign investments into the US and promotes Brazilian products and services overseas. It provides help to investors with the aid of presenting marketplace intelligence, guidance on regulatory troubles, and assistance in setting up operations in Brazil. Apex-Brasil performs an important role in enhancing the use of a commercial enterprise environment and facilitating global trade and investment.

What Are The Main Investing Countries In Brazil?

The major investing countries in Brazil are the USA, China, and Spain. These countries have extensive investments throughout numerous sectors in Brazil, which include energy, telecommunications, and finance. The United States is the biggest investor, observed by China, which has elevated its presence in Brazil’s infrastructure and energy sectors. Spain has a robust footprint in telecommunications and banking. These nations contribute to Brazil’s monetary growth through bringing in capital, era, and know-how.

What Are Brazil’s Largest Energy Companies?

Brazil’s biggest energy companies include Petrobras, Eletrobras, and Raízen. Petrobras is the nation-owned oil giant, dominating the petroleum quarter. Eletrobras is the most important electric utility company in Latin America, focusing on power generation and distribution. Raízen, a joint task between Shell and Cosan, is a pacesetter in biofuels and ethanol manufacturing. These organizations play an essential function in powering Brazil’s economy, with considerable investments in traditional and renewable electricity assets.

What Is The Best Renewable Energy Company To Invest In?

One of the satisfactory renewable energy organizations to spend money on Brazil is Neoenergia. Neoenergia is considered one of the biggest electricity companies in Brazil, that specialize in renewable electricity assets like wind and sun electricity. It is a part of the Iberdrola Group, a worldwide leader in easy power. The enterprise is expanding its renewable power portfolio, making it an attractive alternative for traders interested in sustainable and environmentally pleasant investments. Neoenergia is properly positioned for increase in Brazil’s strength marketplace.

Does Brazil Invest In Renewable Energy?

Yes, Brazil invests closely in renewable energy. This country is a global leader in easy power, with around 80% of its energy generated from renewable resources, especially hydropower. Brazil is likewise expanding its investments in wind and solar energy. The government and personal region are both dedicated to growing the percentage of renewables in the strength blend, driven via the want for sustainable increase and to lessen dependence on fossil fuels. Watch the video below so you can understand deeply.

Who Are The Leading Investors In Renewable Energy?

Leading traders in renewable strength in Brazil include agencies like Neoenergia, Engie Brasil, and CPFL Energia. Neoenergia, a part of the Iberdrola Group, focuses on wind and sun projects. Engie Brasil, a subsidiary of the French multinational, invests in wind, sun, and biomass power. CPFL Energia, managed through the State Grid Corporation of China, is another principal participant, with a robust attention on expanding its renewable electricity portfolio. These organizations drive Brazil’s transition to easy power.

What Is A Private Equity Firm In Brazil?

A Private equity firm in Brazil is an enterprise that invests in private businesses not indexed on inventory exchanges. These corporations boost price range from investors and use this capital to acquire or put money into businesses, regularly searching for to enhance their overall performance and profitability. They commonly have the cognizance of attaining excessive returns over a medium to long-term horizon. The companies provide strategic steerage and operational aid to the businesses they spend money on, aiming for boom and accelerated fees.

What Are The Top Best Private Equity Firms In Brazil?

The top private equity firms in Brazil encompass names which include Advent International, GP Investimentos, and Kinea Investimentos. Other extremely good companies are Vinci Partners, 3G Capital, and Bozano Investimentos. There are also FIP (Fundo de Investimento em Participações) firms like Patria Investimentos and Blackstone. Each of these firms has a sturdy music document and tremendous impact on Brazil’s personal fairness marketplace, demonstrating expertise in producing excessive returns for their buyers.

Is Brazil’s Private Equity Market Continuing To Grow?

Brazil’s private equity market is displaying signs and symptoms of endured growth. The zone benefits from a huge and dynamic economic system, with growing investments flowing into numerous industries. Improved financial situations, along with favorable regulatory modifications, help this growth. Additionally, Brazilian personal equity corporations are increasingly attracting worldwide buyers. This growth trend displays broader self-assurance in Brazil’s monetary capability and the splendor of its investment opportunities, driving sustained interest and activity in the private equity space.

What Is A Petroleum Company?

A petroleum organization is an enterprise concerned in the exploration, extraction, refining, and distribution of oil and gas merchandise. These businesses operate throughout the complete oil supply chain, from drilling oil wells to refining crude oil into usable products like gasoline, diesel, and jet fuel. They can also interact within the development of the latest technology and infrastructure to decorate production efficiency. Petroleum organizations play a crucial role in meeting global energy needs and riding industrial increase.

What Are the Best Petroleum Companies In Brazil?

The high-quality petroleum companies in Brazil consist of Petrobras, which is the largest and most distinguished. Other giant gamers are Shell Brasil, TotalEnergies, and BP. These agencies are key in Brazil’s oil and gasoline enterprise, undertaking massive exploration, production, and refining activities. They contribute to both home strength delivery and export markets. Their operations affect the country’s economy and power sector, showcasing their significance and influence in Brazil’s petroleum panorama.

What Is Petrobras Company?

Petrobras is a country-managed oil enterprise based in Brazil, officially called Petróleo Brasileiro S.A. It is one of the most important oil companies in the global, involved in the exploration, manufacturing, refining, and distribution of oil and gas. Founded in 1953, Petrobras performs a crucial position in Brazil’s electricity quarter and is a primary player in the worldwide oil marketplace. The enterprise is also involved in various power-associated ventures, which includes biofuels and renewable energy tasks.

Who Owns The Petrobras In Brazil?

Petrobras is predominantly owned by the Brazilian authorities, which holds most of its stocks through the National Treasury and different kingdom-owned entities. The authorities ownership lets in it to exert widespread manage over the organization’s operations and strategic decisions. Private buyers additionally keep a part of the shares, but the government’s stake guarantees that Petrobras remains under countrywide management, aligning its operations with Brazil’s broader monetary and strength guidelines.

Is Petrobras The Largest Oil Company In Brazil?

Yes, Petrobras is the largest oil organization in Brazil. It dominates the Brazilian oil industry with good sized operations in exploration, production, refining, and distribution. As a state-managed entity, it has giant resources and infrastructure, making it a key player in each of the home and international oil markets. Petrobras’ size and influence make it imperative to Brazil’s strength quarter, impacting national strength policies and financial balance.

Who Are Petrobras Competitors In Brazil?

Petrobras faces competition from numerous main organizations in Brazil’s oil and fuel area from Shell Brasil, TotalEnergies, and BP, which operate in diverse segments of the industry. These agencies engage in exploration, manufacturing, and refining, challenging Petrobras’ dominance. Additionally, neighborhood companies and new marketplace entrants also make contributions to the aggressive panorama, driving innovation and performance inside Brazil’s petroleum enterprise.

What Is The Richest Company In Brazil?

As of the modern-day information, Petrobras is the richest company in Brazil. Its wealth is basically attributed to its large reserves of oil and fuel, big infrastructure, and dominant function inside the strength area. The employer’s operations span exploration, manufacturing, and refining, contributing extensively to Brazil’s financial system. Additionally, Petrobras benefits from its strategic importance in international power markets, in addition boosting its monetary standing and making it the wealthiest enterprise in Brazil.

What Is A Fintech Investment Company?

A fintech funding employer is a firm that makes a speciality of making an investment in financial era ventures. These organizations aid startups and modern technologies that remodel monetary services, including payments, lending, and asset management. They additionally offer capital, strategic steerage, and sources to help these tech-driven companies develop and be successful. By making an investment in fintech, those organizations aim to capitalize on improvements in generation that enhance economic operations and services, providing higher efficiency and new answers inside the monetary zone.

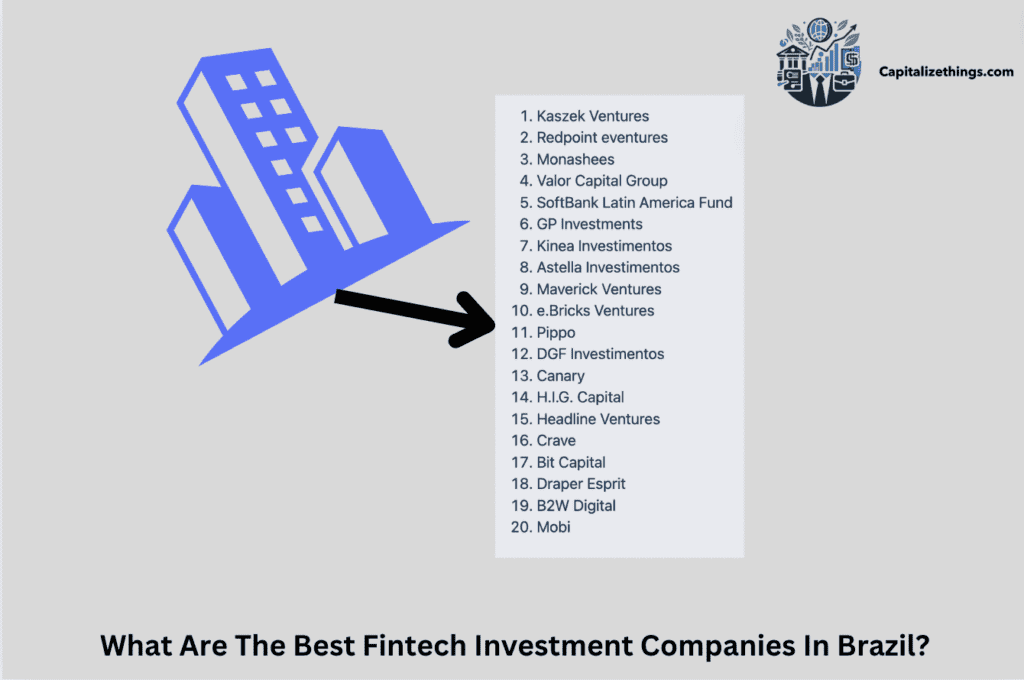

What Are The Best Fintech Investment Companies In Brazil?

The 20 Best Fintech Investment Companies in Brazil are:

- Kaszek Ventures

- Redpoint eventures

- Monashees

- Valor Capital Group

- SoftBank Latin America Fund

- GP Investments

- Kinea Investimentos

- Astella Investimentos

- Maverick Ventures

- e.Bricks Ventures

- Pippo

- DGF Investimentos

- Canary

- H.I.G. Capital

- Headline Ventures

- Crave

- Bit Capital

- Draper Esprit

- B2W Digital

- Mobi

For more precise information, especially on client numbers, specific reports or company disclosures would be needed.

Who Is The Top Fintech In Brazil?

The top fintech in Brazil is Nubank. Nubank is a virtual bank that offers a range of monetary services, which includes credit playing cards, non-public loans, and virtual payment solutions. It is known for its modern technology and person-friendly app, which has attracted tens of millions of customers. Nubank’s rapid boom and massive market presence make it the leading fintech in Brazil.

What Is The Most Successful Fintech Company In Brazil?

Nubank is likewise identified as the most hit fintech agency in Brazil. Its success stems from its capability to disrupt conventional banking by providing accessible and efficient financial offerings via a cell platform. With enormous investment backing and a massive patron base, Nubank has become an outstanding participant in the fintech zone, demonstrating great market impact and innovation.

What Are The Top Crypto Currency Companies In Brazil?

5 Top Cryptocurrency Companies in Brazil Are:

- Mercado Bitcoin- A leading cryptocurrency exchange in Brazil, dealing with Bitcoin, Ethereum, and other major cryptocurrencies.

- Foxbit- A popular exchange for trading Bitcoin, Ethereum, and various altcoins.

- Bitso- A cryptocurrency exchange that offers trading in Bitcoin, Ethereum, and Ripple.

- NovaDAX- Known for trading a wide range of cryptocurrencies, including Bitcoin and Ethereum.

- Bitcoin Trade- Provides trading services for Bitcoin and other cryptocurrencies like Ethereum and Litecoin.

These companies are prominent in Brazil’s cryptocurrency market, providing platforms for buying, selling, and trading a variety of digital currencies.

What Is The Biggest Crypto Exchange In Brazil?

The biggest crypto exchange in Brazil is Mercado Bitcoin. It is the largest and most famous platform for buying and selling cryptocurrencies within the country. Mercado Bitcoin supports diverse virtual currencies like Bitcoin and Ethereum. It offers users with gear to shop for, promote, and manage their crypto property. The alternative’s massive consumer base and high trading quantity make it the main platform in Brazil’s cryptocurrency market.

What Is The Name Of The Crypto Company In Brazil?

Several notable crypto groups function in Brazil, one distinguished name is Mercado Bitcoin. It is well-known for its function in the cryptocurrency marketplace. Another huge business enterprise is Foxbit, which additionally performs a prime role. These organizations provide platforms for buying and selling various cryptocurrencies and have a big effect on Brazil’s digital foreign money space.

What Is The Best Company To Invest In Cryptocurrency?

The exceptional company to invest in cryptocurrency in Brazil is Nubank. While Nubank is usually a fintech, it’s miles increasing its services into cryptocurrency. For direct crypto investment, Mercado Bitcoin and Foxbit are notable choices. They offer stable structures for buying and selling and making an investment in a variety of cryptocurrencies. Choosing a reliable platform is important for successful cryptocurrency investments.

Does Brazil Invest In Cryptocurrency?

Yes, Brazil is actively making an investment in cryptocurrency. Both people and establishments are concerned within the crypto marketplace. Brazilian businesses and traders are increasingly attractive with virtual currencies. This developing hobby reflects a broader global fashion in the direction of cryptocurrency adoption. The Brazilian authorities are likewise exploring guidelines to control and support the increasing crypto zone.

Is Crypto Legal In Brazil?

Yes, cryptocurrency is legal in Brazil. The authorities permit trading and use of digital currencies. However, guidelines are still evolving. The Central Bank of Brazil and different authorities are operating on regulations to make certain transparency and safety. While legal, it is crucial to follow regulations and live knowledgeable approximately felony developments within the crypto region.

Is Investing In Brazil A Good Idea?

Investing in Brazil can be an excellent idea. The country has a massive and growing economy with numerous investment opportunities. Brazil offers potential in sectors like era, finance, and herbal assets. However, traders must be aware of monetary and political risks. It is vital to conduct thorough research and not forget the possibilities and challenges before making an investment.

Can An Investment Company Be Taxed In Brazil?

Yes, a funding organization can be taxed in Brazil. Companies are subject to various taxes, including company profits tax and other levies. The tax machine in Brazil requires companies to comply with guidelines and document everyday returns. Understanding tax obligations is essential for investment firms working in Brazil to make certain compliance and avoid prison issues.

Should A Beginner Invest In A Crypto Company In Brazil?

A novice must be cautious when investing in a crypto organization in Brazil. It is crucial to recognize the risks and volatility of cryptocurrencies. Beginners must teach themselves about the marketplace and select legit systems. Consulting with our financial professionals and beginning with small investments can help manipulate risks and make knowledgeable choices.

What Rules Are There For Beginner Investors?

Beginner buyers should observe some key regulations. They should begin by discovering and information about the investment marketplace. Setting clean dreams and limits is important. Diversifying investments can help manage chances. It is likewise crucial to keep away from making an investment multiple can have enough money to lose. Seeking advice from economic advisors can guide beginners in making smart investment picks.

What Are The Top Skills Needed As An Investor?

Top skills wished as an investor include monetary analysis and studies skills. Understanding marketplace trends and danger management is vital. Strong choice-making investing skills and endurance are also essential. Investors must be able to set clear goals and stay disciplined. Knowledge of funding motors and monetary making plans complements an investor’s achievement in handling property.

What Investment Valuation Strategies Are Needed While Investing In Brazil?

Investment valuation strategies in Brazil consist of the usage of fundamental analysis and financial ratios. Evaluating employer overall performance and market situations is fundamental. Investors ought to determine cash waft, income, and boom potential. Comparing valuations with enterprise peers facilitates in making knowledgeable selections. Using discounted cash go with the flow fashions and different valuation techniques can manual investment picks in Brazil.

What Is The Investment Grade Rating For Brazil?

Brazil’s investment grade rating has fluctuated over the years. As of the contemporary reports, Brazil is rated as a speculative grade with the aid of primary rating corporations. This score reflects monetary and political factors affecting investment risk. Investors ought to assess modern-day scores from corporations like S&P, Moody’s, and Fitch for the maximum updated information on Brazil’s funding grade.

Conclude:

Brazil’s financial and funding panorama offers sizable possibilities, especially inside the fintech and cryptocurrency sectors. Companies like Nubank and Mercado Bitcoin stand out for his or her effect and growth capability. While making an investment in Brazil presents promising possibilities, it’s essential for traders to live informed about regulatory trends and marketplace dynamics to make sound choices.

Understanding the risks and advantages related to making an investment in Brazil is critical. With a numerous range of sectors available, which include fintech and cryptocurrencies, careful research and strategic making plans can cause successful results. By staying up to date on market traits and looking for professional recommendation, buyers can navigate Brazil’s economic environment correctly.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.