Denmark is home to many investment businesses. These companies work in personal equity, challenge capital, banks, asset control, stocks, coverage, hedge price range, fintech, and IoT. These companies assist people grow their money. One big participant is Nordic Capital. It specializes in non-public fairness. Another is SEED Capital, which is excellent in task capital. Danske Bank is the biggest financial institution, presenting sturdy monetary offerings.

Denmark’s funding companies also encompass massive asset management companies like Nordea Asset Management. They manage cash for people. Insurance businesses like Tryg help defend belongings. Hedge budget like Cevian Capital control investments with precise techniques. Fintech firms like Lunar make banking less complicated. IoT funding is growing, with organizations like Trifork leading. These various firms help people and corporations reach monetary goals with tailored services.

Building a diversified portfolio? Denmark could be the missing piece. CapitalizeThings.com (+1 (323) 456-9123) offers free 15-minute consultations to explore Danish investment opportunities.

What Is An Investment Company In Denmark?

An investment corporation in Denmark enables humans and organizations to control money. These agencies provide offerings like shopping for stocks, managing belongings, and giving financial advice. They also can offer coverage, control pensions, and spend money on new generations. Some consciousness on non-public equity or venture capital, assisting new groups grow. Others work in fintech or IoT, using era to enhance monetary offerings. These corporations guide customers to attain economic desires.

What Are The Top Investment Companies In Denmark?

Denmark has many investment companies, the top among those companies are:

- Danske Bank Wealth Management

- Nordea Asset Management

- PFA Pension

- ATP

- SEED Capital

- Sunstone Capital

- Axcel

- Nordic Capital

- Tryg

- Nykredit Asset Management

These companies offer various services like wealth management, private equity, venture capital, and insurance.

| Company Name | Number of Clients |

| Danske Bank Wealth Management | 2,000,000+ |

| Nordea Asset Management | 1,000,000+ |

| PFA Pension | 1,300,000+ |

What Are The Top Investment Management Companies In Denmark?

Investment management companies in Denmark play a big role. The best rated investment management companies include:

- Danske Bank Wealth Management

- Nordea Asset Management

- PFA Pension

- ATP

- Nykredit Asset Management

- Sampension

- BankInvest

- Jyske Bank Private Banking

- Carnegie Investment Bank

- AP Pension

- Maj Invest

- Merkur Cooperative Bank

- Danica Pension

- Lægernes Pension

- PensionDanmark

- MP Pension

- Unipension

- Topdanmark

- Sydbank Private Banking

- Nordnet

These companies manage assets, pensions, and more for many clients.

| Company Name | Number of Clients |

| ATP | 5,000,000+ |

| PensionDanmark | 750,000+ |

| Sampension | 300,000+ |

Is Denmark A Good Place To Invest In?

Denmark is a superb location to make investments, due to its robust economy and strong political environment. Country helps innovation and has a skilled workforce. Denmark’s financial area is properly-regulated. This makes it secure for traders. The marketplace is numerous, with possibilities in generation, strength, and extra. Many worldwide buyers find Denmark attractive for lengthy-term growth.

What Is A Private Equity Firm In Denmark?

A private equity organization in Denmark invests in groups to help them grow. These firms buy shares in agencies, regularly taking control. They work closely with the companies to enhance their operations and price. After a while, they promote their stocks for a profit. These firms play a key role in helping the boom of Danish businesses.

What Are The Top Private Equity Firms Of Denmark?

Denmark has several pinnacle non-public equity companies like Nordic Capital, Axcel, and Polaris. These firms are recognised for making an investment in success groups. They assist agencies develop by means of supplying capital and know-how. These companies often pay attention to precise sectors, like healthcare or technology. They have a strong track file of generating returns for his or her traders.

What Is A Venture Capital Company In Denmark?

A venture capital business enterprise in Denmark invests in new and developing businesses. These agencies offer investment to startups that have sturdy capability. They take a stake in the commercial enterprise in exchange for his or her funding. Venture capital firms help startups with money, recommendation, and connections. They focus on modern industries like generation, healthcare, and renewable power, supporting the increase of the Danish startup atmosphere.

What Are The Best Rated Venture Capital Investment Companies In Denmark?

The quality-rated venture capital businesses in Denmark encompass SEED Capital, Sunstone Capital, and Northzone. These firms are recognised for their successful investments in startups. They have a robust tune report of figuring out promising groups. These companies now offer not just investment, but additionally steering and resources. Their investments have helped many Danish startups develop into hit businesses, making them leaders inside the industry.

What Companies Do Venture Capitalists Invest In Within Denmark?

Venture capitalists in Denmark invest in progressive corporations like Trustpilot, Vivino, and Pleo have obtained undertaking capital investment. They regularly pay attention to startups in generation, healthcare, and renewable strength. These agencies show robust increased ability and disruptive thoughts. Venture capitalists offer the necessary capital to assist them scale. They search for businesses with a clean imaginative and prescient and a successful team.

Who Is The Largest Venture Capital Firm In Denmark?

The largest venture capital organization in Denmark is SEED Capital. It is famous for making an investment in early-degree startups. SEED Capital has sponsored many successful groups, consisting of Trustpilot and Vivino. The corporation focuses on modern sectors like technology and healthcare. SEED Capital’s huge fund length and successful tune report make it the main assignment capital company in Denmark, helping the growth of the Danish startup environment.

What Are The Top Investment Banks In Denmark?

Top investment banks in Denmark are Danske Bank, Nordea, Jyske Bank, and Nykredit. These banks offer an extensive variety of services, together with wealth management, corporate finance, and funding recommendation. They assist people and agencies manipulate their finances and investments, making them critical players in Denmark’s economic area.

Which Is The Best Investment Bank In Denmark?

The pleasantly funded financial institution in Denmark is Danske Bank. It is the biggest financial institution within the country. And offers a huge variety of offerings. Danske Bank is thought for its robust customer support and know-how in wealth management. It enables individuals and companies with their investment needs. The bank has a strong popularity for turning in steady and reliable financial recommendations.

What Is An Asset Management Company In Denmark?

An asset management organization in Denmark facilitates clients to manage their investments. These corporations manipulate portfolios of stocks, bonds, and other property for individuals, companies, and establishments. They offer advice on the way to develop and shield wealth. Asset management companies make investment selections on behalf of their customers, aiming to acquire nice returns. They play a key function in Denmark’s monetary market.

What Are The Top Asset Management Companies In Denmark?

The Top Asset Management companies in Denmark consist of Nordea Asset Management, Danske Bank Wealth Management, and PFA Pension. These firms manage big portfolios for his or her customers. They provide services like investment recommendation, portfolio management, and retirement making plans. These businesses have a robust music document of turning in suitable returns. They are depended on by using many individuals and establishments for their expertise and reliability.

How Much Does Danish Asset Managers Make A Year?

Danish asset managers earn competitive salaries, On average, they make around DKK 800,000 to DKK 1200,000 per 12 months. Senior asset managers with more revel in can earn even extra. Their earnings rely upon their abilities, the scale of the company, and the property they manipulate. Bonuses and overall performance incentives also can upload notably to their profits. Asset control is a properly paying profession in Denmark.

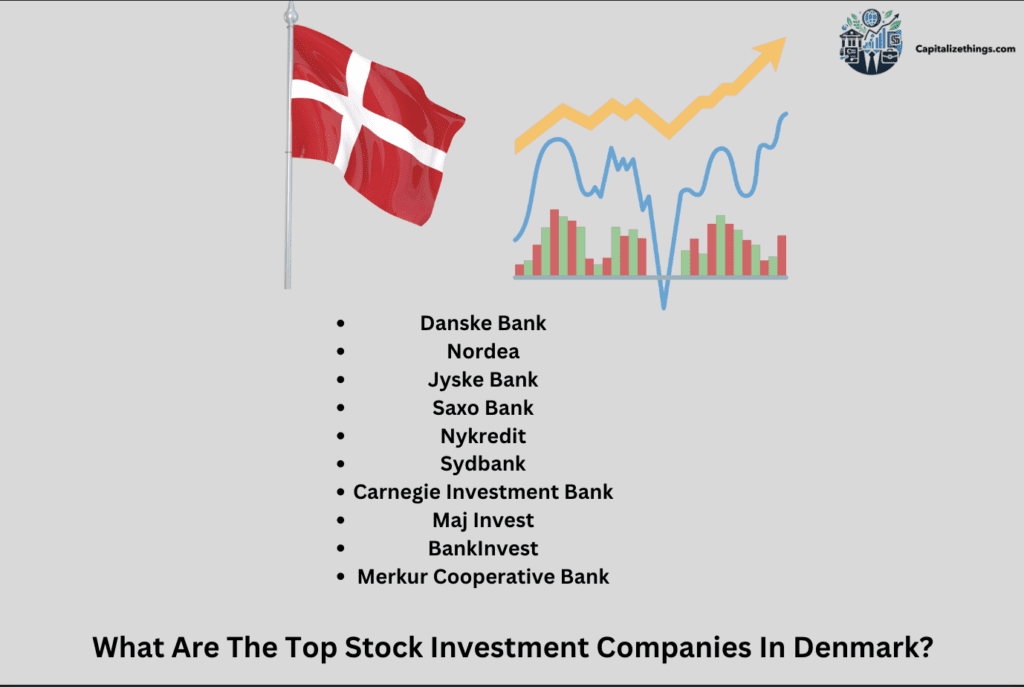

What Are The Top Stock Investment Companies In Denmark?

The top 10 stock investment companies in Denmark:

- Danske Bank

- Nordea

- Jyske Bank

- Saxo Bank

- Nykredit

- Sydbank

- Carnegie Investment Bank

- Maj Invest

- BankInvest

- Merkur Cooperative Bank

These companies are known for helping people invest in stocks and other financial assets.

| Company Name | Number of Clients |

| Danske Bank | 2,000,000+ |

| Nordea | 1,000,000+ |

| Jyske Bank | 500,000+ |

| Saxo Bank | 800,000+ |

| Nykredit | 1,000,000+ |

What Are The Top Insurance Companies In Denmark?

Denmark has many top insurance companies covering life, non-life, and other financial services. Here are 20 of them:

- Tryg

- Topdanmark

- Danica Pension

- PFA Pension

- Alm. Brand

- GF Forsikring

- Codan Forsikring

- Lægernes Pension

- PensionDanmark

- AP Pension

- If Forsikring

- Sygeforsikringen “danmark”

- Nordea Liv & Pension

- Skandia

- ATP

- Lærernes Pension

- MP Pension

- PenSam

- Topdanmark Livsforsikring

- Unipension

These companies offer various insurance services, from life insurance to non-life insurance and pensions.

| Company Name | Number of Clients |

| Tryg | 2,000,000+ |

| Topdanmark | 1,300,000+ |

| Danica Pension | 800,000+ |

| PFA Pension | 1,300,000+ |

| PensionDanmark | 750,000+ |

What Is A Fintech Investment Company In Denmark?

A fintech investment organization in Denmark is an organization that uses era to improve monetary offerings. These organizations focus on making banking, making an investment, and different monetary activities less complicated and faster. They offer services like online banking, digital bills, and automatic funding systems. Fintech businesses in Denmark are at the forefront of innovation, using technology to create new approaches to control money and investments. Their purpose is to provide extra available and green monetary answers for customers and agencies.

What Are The Top Fintech Startup Investment Companies In Denmark?

Denmark is home to several leading fintech startups that are making waves in the financial sector. Here are the top 22 fintech investment companies:

- Pleo

- Lunar

- Astro.io

- British Gold Bank

- CrediWire

- Female Invest

- Saxo Bank

- Capdesk

- Coinify ApS

- Complyon

- Dreamplan.io

- Factofly

- Klimate.co

- Novo Holdings

- Scaleup Finance ApS

- Simple

- Sustainify

- Tradeshift

- ViaBill

- Copenhagen Fintech

- NewBanking

- Paiblock

These companies are known for using technology to innovate financial services. They cover various aspects of fintech, including payments, investment platforms, compliance, and sustainability.

| Company Name | Number of Clients |

| Pleo | 25,000+ |

| Lunar | 500,000+ |

| Saxo Bank | 800,000+ |

| ViaBill | 1,000,000+ |

| Coinify ApS | 50,000+ |

These fintech companies are at the forefront of transforming the financial landscape in Denmark by offering new, innovative solutions for businesses and consumers.

What Is An IOT Investment Company In Denmark?

An IoT funding corporation in Denmark focuses on investing in corporations that develop and use Internet of Things (IoT) technology. These organizations help improvements in which gadgets are connected to the internet, allowing smarter answers. IoT funding agencies fund startups and tasks that improve industries like healthcare, production, and clever homes. They aim to drive growth on this swiftly expanding subject.

What Are The Top IOT Investment Companies In Denmark?

The Top 20 IOT investment companies in Denmark:

- Trifork

- Nordic IoT Centre

- IoT Denmark

- Nordic Alpha Partners

- Vækstfonden

- PreSeed Ventures

- SEED Capital

- Sunstone Technology Ventures

- InQvation

- DTU Skylab

- Capnova

- Maersk Growth

- Accelerace

- Danfoss Ventures

- Borean Innovation

- North-East Venture

- Copenhagen Fintech

- Blue Ocean Robotics

- Scion DTU

- KMD Ventures

These companies support the growth of IoT technology in Denmark by providing funding and resources.

What Are The Metaverse Companies In Denmark?

Denmark is home to numerous companies concerned in the Metaverse, These companies focus on growing virtual worlds and digital reports. Notable ones encompass Unity Technologies (3-D development), Khora (VR/AR solutions), and HoloCap (holographic technology). These corporations are at the vanguard of growing the Metaverse, offering gear, platforms, and services that make digital interactions greater immersive and on hand.

Which Countries Invest In Denmark?

Several nations like Germany, Sweden, the United States, the UK, and the Netherlands put money into Denmark because of its strong financial system and solid enterprise environment. These countries put money into numerous sectors like technology, electricity, prescription drugs, and manufacturing. Denmark’s favorable policies, skilled personnel, and strategic location make it an appealing destination for global funding.

What Are The Top Hedge Funds In Denmark?

The Leading hedge funds in Denmark include CQS, Vækstfonden, Nordea Investment Management, Saxo Bank, Nykredit, Danish Capital, Kromann Reumert, Qvest Capital, Monument Group, and Investeringsforeningen. These firms use numerous techniques to manage chance and generate returns, catering to state-of-the-art buyers.

What Are The Most Innovative Companies In Denmark?

Denmark is home to many progressive businesses that include Novo Nordisk (pharmaceuticals), Vestas (wind energy), Maersk (shipping), Coloplast (medical devices), LEO Pharma (biotech), Jabra (audio era), Trifork (software improvement), Haldor Topsøe (catalysts), Ørsted (renewable strength), and Danfoss (engineering). These agencies lead in generation and sustainable solutions.

What Is An Investment Consultant In Denmark?

A funding representative in Denmark gives recommendations on dealing with investments. They assist people and companies create and manipulate investment portfolios. Their function includes assessing monetary desires, recommending funding techniques, and reading market tendencies. Investment experts’ manual clients on shares, bonds, and different economic products, aiming to optimize returns and control threats effectively.

What Are Top 10 Investment Consultants In Denmark?

Top investment specialists in Denmark include Danske Bank, Nordea, Jyske Bank, PFA Pension, Saxo Bank, Nykredit, Carnegie Investment Bank, Sampension, MP Pension, and SEB Investment Management. These corporations offer expert advice on investments, supporting customers with portfolio management and economic planning to acquire their monetary goals.

Future-proof your finances with CapitalizeThings.com’s top-rated investment consultants. Reach out to us and make investments through us for remarkable profits.

Do Investors In Denmark Have To Pay Tax?

Yes, traders in Denmark must pay tax on their earnings. This includes taxes on capital gains, dividends, and hobbies. The tax price varies depending on the kind of investment and the amount earned. Denmark’s tax system is designed to be fair and transparent, making sure buyers contribute their proportion primarily based on their investment profits.

Can Companies From Cape Verde Invest In Denmark?

Yes, companies from Cape Verde can invest in Denmark. Denmark welcomes overseas investment and offers a solid and open commercial enterprise environment. Cape Verdean groups can put money into diverse sectors, together with era, power, and manufacturing. They should follow Danish policies and meet nearby requirements to make certain an easy investment process.

Do Investors In Denmark Use Dividend Discount Model?

Yes, traders in Denmark use the Dividend Discount Model (DDM). This model enables estimating the fee of an inventory based on predicted future dividends. It is a not unusual tool used to evaluate the price of dividend-paying stocks. Danish investors use DDM to make knowledgeable selections and examine the capability to go back on their investments.

Do Investors In Denmark Diversify Their Investments Usually?

Yes, buyers in Denmark commonly diversify their investments. Diversification allows manipulation of threats via spreading investments throughout special asset classes, together with shares, bonds, and real estate. Danish buyers use diversification to defend their portfolios from marketplace fluctuations and gain greater solid returns over time. It is a commonplace exercise in investment strategies.

Can Companies From China Invest In Denmark?

Yes, corporations from China can put money into Denmark. Denmark’s open financial system and favorable funding climate appeal to overseas buyers. Chinese corporations invest in numerous sectors, such as era, strength, and infrastructure. They need to follow Danish rules and may gain from Denmark’s strategic region and strong monetary ties within Europe.

Can Companies From Usa Invest In Denmark?

Yes, organizations from the US can spend money on Denmark. Denmark offers a welcoming commercial enterprise environment and strong economic stability. American organizations invest in diverse sectors like generation, healthcare, and manufacturing. They want to comply with Danish regulations and may benefit from Denmark’s strategic place and skilled body of workers, improving their business operations in Europe.

Can An Investment Property Be Depreciated In Denmark?

Yes, a Investment property may be depreciated in Denmark. Depreciation lets asset owners to lessen taxable earnings with the aid of accounting for wear and tear over time. Danish tax laws offer recommendations on a way to depreciate funding houses. This can help property proprietors control their price range and decrease their tax burden.

What Are The Principles Investors Should Follow In Denmark For Investing?

Investors in Denmark ought to follow principles like diversification, risk management, and lengthy-time period planning. They ought to research investments thoroughly and keep in mind their economic desires. Ethical investing and adhering to Danish rules are also important. By following those concepts, investors could make knowledgeable choices and work closer to reaching their monetary goals successfully.

Do Investors Use ESG Investing In Denmark?

Yes, investors in Denmark use ESG to make an investment. ESG stands for Environmental, Social, and Governance criteria. Danish traders focus on businesses that meet those requirements. They do not forget environmental effects, social responsibility, and corporate governance while making funding choices. ESG investment aligns with moral values and sustainable practices, which might be crucial to many Danish buyers.

Do Investors In Denmark Use Impact Investing?

Yes, traders in Denmark use effective investing. Impact investment specializes in producing high-quality social and environmental outcomes alongside monetary returns. Danish buyers assist projects and businesses that goal to deal with social troubles and sell sustainability. This funding approach facilitates acquire measurable effect whilst meeting financial goals, reflecting a developing fashion in responsible investing.

Conclude:

Denmark gives a dynamic funding panorama with possibilities across diverse sectors, consisting of fintech, IoT, hedge budget, and coverage. The country’s stable economic system, open business surroundings, and modern organizations make it an appealing destination for nearby and worldwide traders. With a focal point on moral and impact making an investment, Danish buyers are shaping a forward-searching financial market that values sustainability and increase.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.