Investment companies are businesses or financial institutions that hold, administer, and trade securities. These firms invest investor funds in various financial instruments and asset classes. Whether privately or publicly owned, an investment firm distributes the investor’s profit and loss based on share size. Some corporations only invest in a portfolio of assets to reduce risk. Bancolombia, an investment banking company in Colombia, followed with a market worth about $8 billion.

Colombia has a multi-sector private equity firm. Buyouts are used for growth equity, public-to-private, and recapitalizations. Business, consumer and leisure, health care, financial services, industrial, retail, and computing are core sectors.

The Colombian venture capital sector has grown rapidly due to numerous factors. Start-ups in Colombia are increasingly funded by venture capital, which provides funding, skills, and networks. Venture capital offers entrepreneurs rapid growth and scalability and the chance to collaborate with seasoned investors who can help them succeed.

Continental Gold Limited Sucursal Colombia, Colombia’s most significant gold company and precious metals extractor earned 1.88 trillion pesos in 2022. Next came Aris Mining Segovia, which earned 1.69 trillion Colombian pesos that year.

The Colombian Petroleum Enterprise (Ecopetrol) exports and profits by selling its products. Through Ecopetrol, the government subsidizes gasoline and additional fuels by selling them locally below worldwide market prices. Ecopetrol produced a surplus of around 3% of GDP net of tax and domestic subsidies in 2004, while the central government had a fiscal deficit of about 5%. Additionally, domestic fuel subsidies cost 1–2% of GDP. Ecopetrol is the largest petroleum investment company in Colombia.

Sustainable development investing (SDI) uses the SDGs to determine how capital is used to advance sustainable development. According to UNCTAD’s World Investment Report 2023, mineral extraction, construction, banking, transport, transportation, and communication technologies drove 82% of FDI to Colombia in 2022 to USD 17 billion. FDI increased USD 233.9 billion, 68% of GDP, during the same period.

Asset management companies in Colombia are Client-oriented, administering and investing assets. These firms provide portfolio management, investment advice, and risk assessment for both private and commercial customers. Investing in real estate in Colombia is also a good option.

What is an investment company in Colombia?

An Investment company in Colombia is a financial entity that pool capital from investors to invest in assets like stocks, bonds, real estate, and other securities. These companies are regulated by the Colombian Financial Superintendence (Superintendencia Financiera de Colombia, SFC) and are compartmented into different types based on their investment schemes and structures.

In March 2024, Colombia’s greatest public corporation was Bogota-based petroleum refiner Ecopetrol, which had an international market cap of 22.1 billion U.S. dollars.

Seeking the right investment partner in Colombia? CapitalizeThings.com (+1 (323) 456-9123) connects you with top investment firms. Get a FREE 15-minute consultation with our experts!

What are the best investment companies in Colombia?

The best 10 investment companies in Colombia are:

- Katapult Commerce

- Pro Investing App Inc

- Kravata

- Mis Finanzas Personales

- Partners 4 Startups

- Corp Alianza 2030 Para el Progreso

- HomeParte

- Nauta Land

- CREACO

- HomeParte Colombia

- Katapult Commerce

Katapult, established by several-time venture-backed founders Bruno Ocampo and Andres Blumer, uses its 10+ years of start-up development and investing experience and vast talent system to help propel other companies.

- Pro Investing App Inc

PRO INVESTING APP INC., a fintech platform, offers a diverse, affordable investment fund for Latin American middle-class investors.

- Kravata

They designed the new financial era. Their platform realizes the global benefits of financial technology. They provide secure and broad offerings to connect banks to digital innovation. Their financial and technological professionals will advise, equip, and support you. They can raise your business in the digital age. They welcome any organization ready to change and investigate the future of finance with competence and innovation.

- Mis Finanzas Personales

This marketplace lets you choose the correct financial goods.

- Partners 4 Startups

Partners for Startups supports the growth of Latin American ICT businesses and the entrepreneurship ecosystem. They recognize that new companies need support and cooperation to succeed. They offer services to advance, promote, and market new ICT ventures.

- Corp Alianza 2030 Para el Progreso

Social organizations founded Alliance 2030 for Progress, a non-profit, to encourage regional effect investment. The Alliance has 26 incubators and program accelerators at Regional Nodes nationwide. A solid governance system includes non-profits, government authorities, research centers, the corporate sector, and social entrepreneurs.

- HomeParte

HomeParte’s crowdfunding concept matches real estate marketers or property owners with significant profit potential and investors who want a bigger return on their funds. HomeParte lets anyone buy a fraction of a property from any location, anytime, without the hassle of real estate investment.

- Nauta Land

Nauta, an investment website for real estate tokenization, lets investors buy partial ownership of high-quality properties. Colombian buyers and investors face many hurdles. Inflation is rising, diminishing investors’ purchasing power and increasing material, labor, interest rates, and property. Complicated and bureaucratic real estate deals are daunting. The down payment is up to 30% of the property value.

- CREACO

Business consultation, Web3 education, asset engineering, and blockchain development help Creaco foster and accelerate knowledge economy enterprises by closing tech, cultural, and funding gaps. Their protocol’s projects form the first DAO-governed decentralized country brand. Science, culture, and tech save Colombia’s cultural and ecological treasures. They make investing in Colombia easy.

- HomeParte Colombia

HomeParte enables anyone to invest in real estate fast and efficiently from any platform, anytime, with no complicated formalities. HomeParte facilitates real estate investment, where only the wealthy can earn high returns without debt. HomeParte makes it accessible to all.

What are the top 5 investment management companies in Colombia?

The top 5 investment management companies in Colombia are:

- Citi

- Location: Colombia

- Employees: 10,000 +

- Type: Investment and Asset Manager

- J. P Morgan

- Location: Colombia

- Employees: 10,000 +

- Type: Investment and Asset Manager

- Allianz

- Location: Colombia

- Employees: more than 10,000

- Type: Investment and Asset Manager

- BTG Pactual

- Location: Colombia

- Employees: 1001-5000

- Type: Investment and Asset Manager

- Banco de Bogota

- Location: Colombia

- Employees: 10,000 +

- Type: Investment and Asset Manager

Invest confidently in Colombia. CapitalizeThings.com (+1 (323) 456-9123) connects you with top investment management companies and provides free consultations to get you started.

What are the top financial companies in Colombia?

Bancolombia is the top financial company in Colombia. Bancolombia offers services for rich and poor Colombians. The #1 Colombian bank, Bancolombia, has over 700 branches and 2300 ATMs and serves over 6.4 million people. Additionally, its Banagrícola sector has 100 locations in El Salvador.

Is Colombia a good place to invest?

Yes! Colombia is an excellent place to invest. To attract foreign real estate investment, the government has also offered tax advantages for some real estate investments and streamlined visa requirements for international investors. These initiatives have increased foreign investment in Colombia’s real estate industry and made the country an appealing investment destination.

Tourism has also shaped Colombian real estate trends. Colombia attracts travelers from throughout the world with its stunning beaches, different culture, and rich history. Thus, rental properties, vacation homes, and business spaces in tourist destinations like Cartagena and the Coffee Triangle are desired.

Substantial economic success makes Colombia an excellent real estate investment. A strong manufacturing sector, rising foreign investment, and an unchanging political atmosphere have fuelled economic growth in recent years. This economic stability has made real estate investment attractive, giving investors trust in the country’s future.

Where to invest money in Colombia?

Invest money in Colombia in the following sectors listed below:

- Real estate investing

- Investing in commodities

- Investing in local companies

- Investing in local companies

- Real estate investing

For various reasons, real estate investing in Colombia is easy and popular among expatriates. Colombians, like Asians, cherish property ownership in a way Westerners don’t grasp. Colombians use real estate as an alternative bank due to currency fluctuations and a need for hard assets. There are awful real estate deals here, but savvy buyers can find home runs.

If you’re ready to invest more, I’ve seen several penthouses that can yield 12% annually without much management. You can do better by working hard and renting out your real estate.

- Investing in commodities

Colombia is rich in gold and copper. Colombia has long been a center of commodities enterprises, so people here “get” natural resource investing. An attendee from Colombia mentioned a place outside the city where inhabitants spend one month a year mining for gold in a thick stream. They break their bums that month and fund most of their annual revenue. Mines and other resource developments are polarizing. Physically receiving a valuable metal is different from investing in manufacturing.

- Investing in local companies

Starting a Colombian corporation for $22,000 earns a resident visa that can be converted into citizenship in ten years; investing $158,000 reduces that to five years. You can form a corporation and gain residency without investing a little money. Investors without entrepreneurial ambitions can finance rising Colombian enterprises. This weekend, I glanced at one of these companies and found the proposition compelling. Businesses that have contracts with large enterprises require funds to fulfill orders and sell their goods. Colombia’s developing economy and global markets for resources, traveling, and services offer a few intriguing venture finance opportunities for start-ups beyond the seed stage.

What are the top private equity investment companies in Colombia?

The top 10 private equity investment companies in Colombia are listed below:

- HarbourVest Partners

- Advent International

- L Catterton

- HIG BioHealth Partners

- Incofin Investment Management

- H.I.G. Growth Partners

- Southern Cross Group

- H.I.G. Europe

- H.I.G. Private Equity

- TEAK Capital

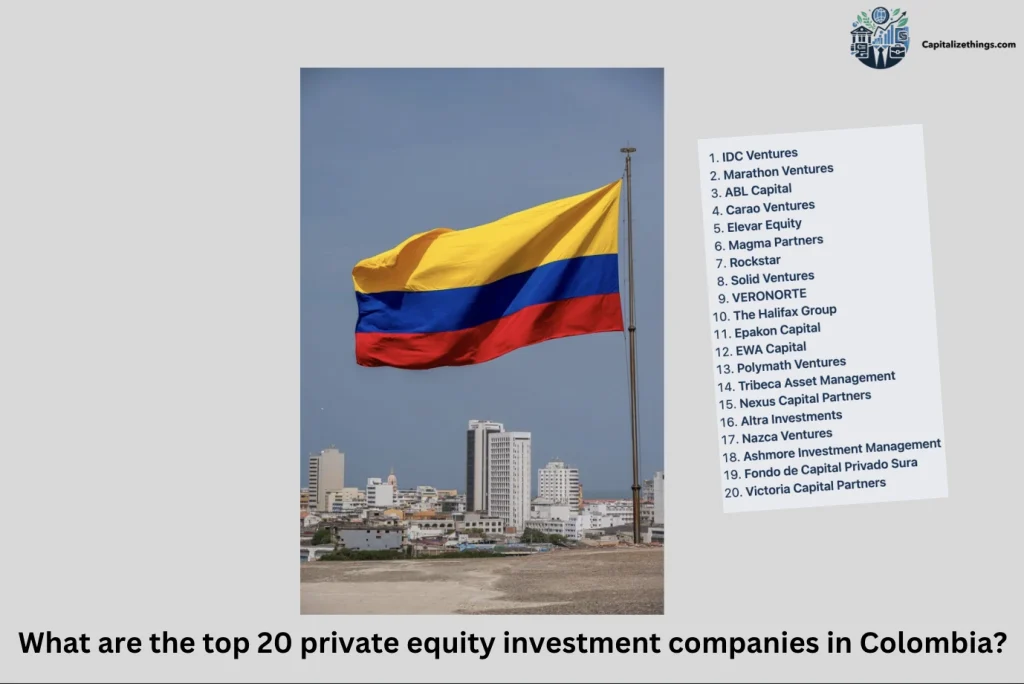

What are the top 20 private equity investment companies in Colombia?

The top 20 private equity investment companies in Colombia are listed below:

- IDC Ventures

- Marathon Ventures

- ABL Capital

- Carao Ventures

- Elevar Equity

- Magma Partners

- Rockstar

- Solid Ventures

- VERONORTE

- The Halifax Group

- Epakon Capital

- EWA Capital

- Polymath Ventures

- Tribeca Asset Management

- Nexus Capital Partners

- Altra Investments

- Nazca Ventures

- Ashmore Investment Management

- Fondo de Capital Privado Sura

- Victoria Capital Partners

- IDC Ventures

Venture fund IDC Ventures engages in initial and fast-growth internet and tech firms. The firm wants global enterprises. Grudo IDC, a Latin American investment bank, founded IDC Ventures in 2018. Pre-series A to series B startups suit the fund. IDC Ventures invests in wage application platforms, car subscription platforms, banking platforms, online stores for large and small retailers, and robotics commercialization platforms.

- Marathon Ventures

Marathon Venture Capital is an Athens-based VC. Established in 2017, the fund targets Latin American early-stage B2B start-ups. It invests in robotics, hardware, e-commerce, software, and health tech. The fund offers technical advice, mentorship, and introductions to industry experts. Marathon Venture Capital provides venture capital investment, business growth, and innovative partnerships.

- ABL Capital

ABL lends against balance sheet assets. Account receivables, inventory, machinery and tools, and real property are used to calculate the borrower’s debt availability. ABL facilities can calculate availability using brands and patents. Some lenders offer one-stop cash flow financing beyond the asset base in addition to the main ABL credit. Account receivables and inventories are usually entirely revolving, while machinery, plants, and real estate are term loans. To periodically refresh debt availability, borrowers must submit collateral assets to the lender with a borrowed base certificate.

- Carao Ventures

Early-stage venture capital firm Carao Ventures invests in Latin American innovation-driven firms. Carao Ventures considers every Spanish-speaking Latin American country for investment. They like Central American, Colombia, Ecuador, Dominican Republic, and Peruvian enterprises. Since practically every industry in the area is uncompetitive and needs an innovation revamp, they believe early-stage venture investment for Latin America’s exceptional entrepreneurs is essential. They invest to create competitive, valuable firms in most industries. Weapons, tobacco, alcohol, and gambling are not their investments.

- Elevar Equity

Elevar Equity helps underserved clients, Entrepreneurial Households, and communities thrive economically. It invests early growth money in entrepreneurs building inclusive, affordable, and gigantic-scale businesses.

- Magma Partners

Magma’s team spans Latin America. They are Silicon Valley and Latin American founders or early employees of businesses ready to support your entrepreneurship path.

- Rockstar

They empower creators to impact the world through a global network based in Copenhagen, Amsterdam, and Bogotá. Research suggests that most early-stage founders suffer in three areas when growing their companies. Successful business owners help you maximize your resources and period for output in business. Their mentor-driven programs, tailored market introductions, and financing from pre-seed to series B support energy, agrifood, and new technology entrepreneurs in scaling swiftly.

- Solid Ventures

Dutch and Colombian technology startups receive equity expansion finance from Solid Ventures. After Robert Wilhelm launched 300M NeSBIC Converging Technologies Funds in June 1997, Solid Ventures was established in December 2005. Solid Ventures sources proprietary deal flow and (co-)invests in promising tech growth companies through its 30+ year networks with successful serial entrepreneurs and collaborative agreements with IMPROVED Corporate Finance, Drake Star Partners, and other M&A Corporate Finance Advisory firms like Capital Mind Investec.

Solid Ventures has strategic collaborations with Rockstart Colombia and Monseratte Ventures in Bogota, Colombia, and a solid network of local venture capitalists and respected family offices. It uses this network to source proprietary deal flow and (co-)invest in promising tech growth startups in this expanding market, which has significant opportunities for bringing Latin America digitally on a level with U.S. and Western-European online industries. Solid Ventures uses its 30 years of venture capitalist tech investing in mature markets to share its expertise.

Solid Ventures partners have co-invested with General Atlantic, inQlab, Tiger Capital, Harlan Capital Partners, FJ Labs, Monseratte Venture, Kennet Capital, Hummingbird Ventures, Volt Ventures, Newion, HenQ, C4Ventures, DN Capital, etc.

- VERONORTE

In 2015, Venture finance business Veronorte was built in Medellin, Colombia. The firm targets early-stage profitable company investments.

- The Halifax Group

Halifax Group is a well-known private equity business that invests with industry leaders and management of profitable, expanding firms.

- Epakon Capital

Epakon Capital is an early-stage, rapidly expanding VC fund That invests in category-defining companies. It invests in the Logistics/ Marketplaces, Web3/ Fintech, and Software business areas.

- EWA Capital

EWA Capital, rebranded from Mountain Nazca Colombia, is raising money EWA II ($30 Mn target) to invest in early-stage companies with disruptive models that use technology to improve LAC education, healthcare, financial services, and retail. EWA Capital, operated by women, recognizes women’s power as customers and their economic impact. The team supports entrepreneurs in emerging industries in achieving high profits and social change using a gender-smart approach.

- Polymath Ventures

It’s Latin America’s top Seed Fund and Venture Studio, founded by serial entrepreneurs. They create and fund revolutionary Latin American middle-class firms. A stronger middle class underpins a more equitable, stable, and affluent society. The organization aims to disrupt and develop an abundant Latin America.

- Tribeca Asset Management

Tribeca Asset Management, a Colombian private equity fund manager (GP), acquires partial and total company shares in growth-potential industries. Most investors look for chances in mature markets but think emerging economies will grow fastest. That’s why they’ve seized on Latin America’s enormous potential, especially Colombia, where they base us in Bogotá, attracting global investors and Colombian investment abroad.

- Nexus Capital Partners

Real estate investment firm Nexus Capital Partners was founded in Bogota, Colombia 2009. The firm prefers Colombian logistics, offices, commercial, and housing investments. The firm develops Colombian homes employing core & core + opportunistic rental investment methodologies.

- Altra Investments

Altra, founded in early 2005 in Bogotá, Colombia, manages private equity funds in Central America and the Andean Region, focusing on Peru and Colombia. The investment team has 80 years of directly relevant expertise in the region. Private pension funds, leading public funds, groups of funds, family offices, development funds, sovereign wealth funds, endowments, and foundations attract investors. Altra operates in Colombia, Central America, and Perú, Chile.

- Nazca Ventures

Mountain Partners manages the 2017 vintage Mountain Nazca Colombia venture capital fund. The Bogata, Colombia-based fund will invest in DC.

- Ashmore Investment Management

Ashmore Management Company specializes in investments, specifically private equity infrastructure funding management. It operates in Bogota.

- Fondo de Capital Privado Sura

IDB Invest wants to be Latin America and the Caribbean’s premium private sector partner. They fund clean energy, transportation, agriculture, and financing projects. They are part of the Inter-American Development Bank (IDB) Group and stand for economic growth & social inclusion. They prioritize the private sector.

As IDB Group’s private sector arm, IDB Invest knows the area well. It works with clients to provide unique finance options and expert advice for their industry and market. IDB Invest is held by 48 member countries, 26 of which are Caribbean and Latin American. Each country’s voting power corresponds to its IDB Invest shares.

- Victoria Capital Partners

Victoria Capital Partners is a private equity firm founded in 2008 in Buenos Aires. Its specialty is South American investments.

Who is the largest private equity company in Colombia?

HarbourVest Partners is the largest private equity company in Colombia. If you are seeking a Colombian private equity partner, CapitalizeThings.com can connect you with colombian private equity companies and can delivers expert analysis.

Who are the largest investors in private equity funds in Colombia?

HarbourVest Partners is the largest investor in private equity funds in Colombia.

What is the highest-paying private equity firm?

With Associates earning over $450k annually, Apollo Global Management is often considered the highest-paying firm. They have a large fund and an excellent track record. Yes, they’re intense, but this is private equity.

What is a venture capital investment company in Colombia?

Fundraising OS is a venture capital investment company in Colombia. Colombia’s venture capital sector is estimated to raise US$1,229.0m by 2024. Later Stage is expected to top the market with US$891.1m in volume from the previous year. Globally, the US is expected to raise the most capital, US$264,500.0m, in 2024. Colombia’s tech-savvy businesses and government backing for innovation draw worldwide investors to its thriving Venture Capital sector.

What are the top 10 venture capital investment companies in Colombia?

The top 10 venture capital investment companies in colombia are following:

- MassChallenge

- Rockstar

- QED Investors

- Magma Partners

- Bonsai Venture Capital

- CV VC

- Ai fund

- Solid Ventures

- Carao Ventures

- Veronorte

- MassChallenge

Startup accelerator MassChallenge provides early-stage finance and mentorship to North American and European entrepreneurs.

- Rockstar

Rockstart invests pre-seed in series B energy, agriculture, food, and new technology.

- QED Investors

The QED, headquartered in Virginia, specializes exclusively in U.S., U.K., and Latin American fintech start-ups.

- Magma Partners

Magma invests in Latin American pre-seed to series A start-ups.

- Bonsai Venture Capital

Bonsai Venture Capital has invested in start-ups since 1999.

- CV VC

Blockchain-focused venture capital CV Labs was launched in 2016.

- Ai fund

Ai Fund only invests in businesses solving significant problems with AI, ML, and deep learning.

- Solid Ventures

Late-stage venture finance firm Solid Ventures invests in Western European and Colombian software start-ups.

- Carao Ventures

Early-stage VC Carao Ventures invests in medium-market and Latam small founders.

- Veronorte

Multistage venture financing firm Veronorte invests in sustainable development in Latin America and the well-being of start-ups.

What are the top 10 gold investment companies in Colombia?

The top 10 gold investment companies in Colombia are:

- AngloGold Ashanti Colombia

- Gran Colombia Gold

- Red Eagle Mining Corporation

- Cordoba Minerals

- Continental Gold

- Mineros S.A.

- Royal Road Minerals

- B2Gold Corp.

- Atico Mining Corporation

- Fura Gems

What are the top 10 banks in Colombia?

The top 10 banks in Colombia are:

- Bancolombia

- Banco de Bogotá

- BBVA

- Davivienda

- Banco del Occidente

- GBN Sudameris

- Helm

- HSBC Colombia

- Procredit

- Citibank Colombia

- Bancolombia

It is one of the biggest banks in the country and is known for its financial product selections and technology innovations to simplify user operations. The 2017 Nequi platform, a virtual application for various transactions, was its latest innovation.

- Banco de Bogotá

As the first financial organization in the country, it has earned awards for its innovative student credit card and loan programs.

- BBVA

This Spanish-born bank stands out for its free investment loans. It has offices in 122 Colombian municipalities, 1,300 ATMs, and the most mortgages.

- Davivienda

With its slogan your cash can be in the wrong place, it is one of the country’s largest banks, offering financial services to rural and mining areas. It has 672 offices nationwide.

- Banco del Occidente

It was founded in 1965 and is based in Cali. It offers personal and business products, including at no cost investment credit. It operates over 200 branches nationwide.

- GBN Sudameris

Colombia’s Gilinski Group, a significant local bank, owns GNB Sudameris. It was founded in 1920 but merged with Banco Sudameris Colombia and Banco Tequendama, bought from Credicorp in 2004. The bank expanded after acquiring Suma Valores (2008) and Nacional de Valores (2010).

- Helm

Helm Charts allows you to define, install, and upgrade even the most complicated Kubernetes application. They also make charts easy to create, version, share and publish.

- HSBC Colombia

When the Hong Kong along with Shanghai Banking Corporation opened its Panama City representative office in 1972, the HSBC Group began operating there. Banking licenses were given in Panama City in 1973 and in the Colón free-trade zone in 1993. Following the HSBC Group’s objective of building the global brand HSBC, HSBC Bank (Panama) was founded in 1999. Chase Manhattan Bank’s Panama operations were bought by HSBC in 2000. HSBC bought Financomer, which joined the Panamanian personal lending sector in 1986, in 2005.

- Procredit

ProCredit Bank Deutschland is located in Frankfurt am Main. It is the newest bank of ProCredit Holding, which operates in Southeastern, South America, and Eastern Europe. The bank aims to promote equitable economic growth through responsible banking. Germany received the customer business in March 2013.

- Citibank Colombia

Citi, founded in 1916, is the preferred bank for foreign trade, FX trading, cash management, and offshore investments. Multinational and Colombian clients, the government, and local banking institutions need seamless connectivity, market intelligence, and transactional networks for local, global, and regional activities, making Citi’s global network unique.

What is a petroleum investment company in Colombia?

Ecopetrol is a petroleum investment company in Colombia. It is a mainly state-owned integrated oil and gas business that earned USD 38.23 billion in 2022. Ecopetrol is Colombia’s largest oil firm. It explores, produces, transports, refines, and sells Colombia’s oil, gas, and petrochemicals.

Fuel your financial future with Colombian petroleum investments. CapitalizeThings.com offers expert guidance and free consultation to help you maximize your returns.

What are the top 5 petroleum investment companies in Colombia?

The top 5 petroleum investment companies in Colombia are:

- Ecopetrol

- Gran Tierra Energy

- Pacific Rubiales Energy

- Occidental Petroleum Corporation (Oxy)

- Parex Resources

Who owns Ecopetrol Colombia?

The Republic of Colombia owns Ecopetrol.

Has Ecopetrol proved reserves?

Yes! Ecopetrol Group’s net proved reserves were 1,883 million barrels of oil or its equivalent at year-end 2023, keeping the 9-year average.

How big is Ecopetrol?

Colombia’s biggest oil firm Ecopetrol was the 313th-largest public firm in the 2020 Forbes Global 2000. CNN Money ranked it 303 in 2012. Due to its growth, Ecopetrol ranks 346 in the Fortune Global 500.

What is a sustainable development investment company in Colombia?

Sustainable Development Goals is a company that invests in sustainable development in Colombia. Colombia has actively promoted the UN’s Sustainable Development Goals. Since the goals set by the Millennium Development Goals were expiring, the government promoted the SDGs in Rio+20 in 2012. The Colombian proposal was adopted, and the 2030 Agenda for Sustainability, with seventeen Sustainable Development Goals and 169 goals, was released after three years of UN collaboration.

Colombia has presented the voluntary country report three times, using business sector indicators and the CONPES 3918 public policy document to demonstrate its progress in agenda goals like comprehensive sustainability, education, and gender equality. It’s also crucial to note the DNP’s formation of a technical secretariat for the SDGs and its engagement with strategic allies like the Global Compact Colombian network for promoting SDGs in business.

What are the top 10 sustainable development investment companies in Colombia?

Following are the top 10 sustainable development investment companies in Colombia:

- Fondo Acción

- Bancolombia

- Proparco

- Fondo para la Acción Ambiental y la Niñez

- Corporación Andina de Fomento (CAF)

- Fondo de Inversión Colectiva Sostenible (FICS)

- Grupo Argos

- Grupo Bolívar

- AshmoreAVENIDA

- Alianza Team

What organizations help the environment in Colombia?

Censat Agua Viva helps the environment in Colombia. It promotes environmental justice, pluriverse respect, and life care. Working with communities and organizations, it defends territory and articulation spaces. It wants to be known as a proactive organization that solves the environmental crisis and conceptualizes and builds environmental transitions, autonomy, and growth alternatives.

It focuses on four main areas: Common Good, Mining Conflicts, Water, Climate Justice, and Energy, as well as Forests and Biodiversity. It conducts support and instructional work in Antioquia, Caquetá, La Guajira, Cauca, Nariño, Putumayo, Meta, Santander, the coffee-growing region, Tolima, and the Caribbean. Its international communication and national and advocacy efforts diversify.

Is Colombia a sustainable country?

Yes! Colombia is a sustainable country. Colombia’s rising economy and dedication to sustainable development make it an attractive investment destination. B Corps are becoming more common in the country, a significant step toward sustainability.

Colombia is a vital transit and trade hub in Latin America. Colombia also has commerce agreements with over 60 nations, which gives tax and financial advantages to attract international business. Companies wishing to invest in a sustainable, growing nation will find Colombia appealing.

What is the top asset management company in Colombia?

Tribeca is an top rated asset management company in Colombia.

What are the top 10 investment management companies in Colombia?

The top 10 investment management companies in Colombia are given here:

- Bancolombia Asset Management

- BTG Pactual

- Grupo Aval

- Protección S.A.

- Davivienda Corredores

- Scotia Securities

- Fiduciaria Bogotá

- Old Mutual Colombia

- Alianza Fiduciaria

- Sura Asset Management

Who owns Sura Asset Management?

Grupo SURA owns Sura. An entity of Grupo SURA, SURA Asset Management, was founded in 2011 to get ING’s Pensions. It gets investment Funds assets in Chile and Life Insurance assets in Colombia, Perú, México, and Uruguay. The video below will share more about sura asset management to help you understand about it deeply.

What is the AUM of Sura asset management?

$140 billion is the AUM of Sura asset management.

What are the FDI sectors in Colombia?

The most FDI-receiving sectors are petroleum (22.8%), business and financial services (77.2%), quarrying and mining (including coal-16.0%), manufacturing (17.0%), storage, transportation, and communications (13.8). The preliminary three quarters of 2023 saw USD 12.7 billion in FDI (Central Bank). According to the Central Bank, the countries that invest most in colombia are the United States (21.3%), Panama (11.4%), Spain (11.9%), Switzerland (6.1%) and England (9.9%),

What are the top FDI companies in Colombia?

The top FDI companies in Colombia are Bavaria (owned by AB InBev), ExxonMobil, Unilever, and Procter & Gamble (P&G).

What is the foreign investment regime in Colombia?

Foreign investment is certified in all industries except general security, defense, and poisonous waste disposal. Colombia has no performance requirements for foreign investment and no national security-based or financial screening system.

What is a real estate investment company in Colombia?

Ambana is a real estate investment company in Colombia. It is developing LatAm real estate financing tech infrastructure. Ambana is Colombia’s first tech-enabled building alternative funding source. It is democratizing finance access for the $650 billion regional construction sector by addressing high credit prices, lengthy approval procedures, and irregular credit risk assessments. Ambana provides money, reduces loan deployment risks with AI-driven financing, and generates revenue from fees and SaaS.

What are the top 10 real estate investment companies in Colombia?

Following are the 10 best real estate investment companies in Colombia:

- Fiduciaria Bancolombia

- Terranum

- Constructora Bolívar

- Amarillo

- PEI Asset Management

- Arquitectura y Concreto

- Cimento Inmobiliario

- Conconcreto

- Grupo Oikos

- Acción Fiduciaria

Is buying real estate in Colombia a good investment?

Yes! Buying real estate in Colombia is a good investment.

What are the best real estate sites for Colombia?

In July 2024, fincaraiz.com.co was Colombia’s most viewed Real Estate website, followed by mitula.com.co and metrocuadrado.com.

Can a US citizen buy real estate in Colombia?

Yes! A US citizen buys real estate in Colombia. US citizens can acquire Colombian property. You must obey the laws to buy a Colombian house.

How to get an investment visa in Colombia?

To get an investment visa in Colombia, applicants must put in 100 times of the Colombian monthly minimum income in a new or active firm. This amounts to COP 100 million, or US$25,000, in 2022. This 3-year visa is renewable if the capital invested is maintained.

What is the property owner visa in Colombia?

The Colombia Property Investor migrant visa is for those outsiders who are investing in Colombian real estate. It allows property investors to live in Colombia.

Invest in Colombia, gain residency. CapitalizeThings.com (+1 (323) 456-9123) helps you navigate the property owner visa with a free 15-minute consultation before you invest.

How do you find investment opportunities in Colombia?

The Portfolio of Opportunities consolidates current information on projects or firms seeking funding in Colombia and distributes it to foreign investors and ProColombia’s international staff.

What sectors are promising to invest in Colombia?

Residential and commercial real estate investments yield impressive profits, especially in large cities like Medellín, Bogotá, and Cartagena. Colombia has also make advancements in public utility infrastructure and transportation, attracting foreign investment.

What are the principles of investing in Colombia?

Colombia offers a unique investment landscape with opportunities and challenges. Key principles include understanding the country’s macroeconomic stability, political environment, and legal framework. Colombia has unique wealth: mega-diverse regions, competent, talented, and creative people who drive sustainable development, creation and transfer of science, reindustrialization, technology, knowledge, regional growth and strengthening of the Colombian business fabric, an energy transition, and decreasing inequality for total peace.

Can companies from China invest in Colombia?

Yes! Companies from China can invest in Colombia. Additionally, China has funded major infrastructure projects in Colombia, such as the Bogotá metro, Trans-Amazonian Railway, Medellín metro extensions, and Mar 2 highway construction in Antioquia and the Caribbean coast. China has bought faltering mining and energy assets in the nation, owned mainly by local and Western corporations.

In 2019, Zijin Mining bought the Continental Gold mine in Buriticá for $900 million. China has acquired Canadian oil businesses for billions and started fossil fuel projects with Colombia’s Ecopetrol. To strengthen its relationship with Colombia, China has invested billions in education, agriculture, electricity, and other industries. China’s investments can accelerate if Colombia joins the BRI.

Can companies from Australia invest in Colombia?

Australian corporations are investing in Colombia in oil, mining, quarries (Baraka Petroleum, Rio Tinto, and BHP), finance (QBE Insurance company), and agriculture and petrochemicals.

Can companies from Brazil invest in Colombia?

Yes! Companies from Brazil can invest in Colombia.

Can companies from Cape Verde invest in Colombia?

Yes! Companies from Cape Verde invest in Colombia.

Can companies from Belgium invest in Colombia?

Yes! Companies from Belgium can invest in Colombia.

Do investors in Colombia have to pay taxes?

Yes! Investors in Colombia have to pay taxes. Colombia taxes worldwide income for fiscal residents, but fiscally non-resident taxpayers only pay taxes on Colombian income.

Do investor companies use a dollar cost-averaging strategy in Colombia?

Yes! Investor companies use a dollar cost-averaging strategy in Colombia.

Do investors in Colombia use the dividend discount model?

Yes! Investors in Colombia use the dividend discount model. Income tax and capital regime exemptions apply to dividends or participations from entities that don’t reside in Colombia to CHCs—taxable dividends from CHC to Colombian residents. Although CHC distributes profits from international investments to non-tax residents, this is considered foreign-source income. The regime doesn’t apply to CHC shareholders in tax havens.

Colombian resident entities transmit dividends to CHCs with particular consideration. Profits from non-Colombia activities from the sale of CHC participation are tax-free. Foreign CHC shareholders’ income from the sale of their involvement is not taxed in Colombia since it is considered foreign-sourced revenue on the portion that matches revenues from non-Colombian activity.

Do investors in Colombia use the investment appraisal technique?

Yes! Investors in Colombia use the investment appraisal technique.

Do investors in Colombia usually diversify their investments?

Yes! Investors in Colombia diversify their investments usually.

Conclusion

An investment company collects investor funds and invests in numerous securities and asset classes. Investors fund these companies’ shares and debt-equity investments. The corporation receives interest and dividends from investments and distributes dividends and interest by investor share. Investment Company of Colombia Bancolombia followed with a market worth of $8 billion.

HarbourVest Partners is one of the best private equity firms in Colombia. Venture capital funding lets entrepreneurs concentrate on business growth rather than fundraising. Continental Gold Sucursal In 2022, Colombia’s most significant gold investment company and precious metals extractor earned 1.88 trillion pesos. Aris Mining Segovia was next, earning 1.69 trillion Colombian pesos.

Colombian Petroleum Enterprise (Ecopetrol) is a significant exporter and profitable. Ecopetrol distributes government-subsidized gasoline and other fuels at prices below the world market. In 2004, Ecopetrol had a surplus of roughly 3% of GDP after taxes and internal subsidies, while the central government had a budgetary deficit of about 5%. In addition, national gasoline subsidies cost 1–2% of GDP.

Sustainable development investing is transforming how businesses and investors invest. It has changed the globe by promoting social progress. Making investments more sustainable has also shown financial benefits for individuals and corporations. While solving the world’s biggest problems, purpose-driven CEOs and organizations thrive with sustainable business methods.

Asset management companies in Colombia offer mutual funds, ETFs, and other investments. These companies are vital to Colombia’s financial sector and economic growth. Clients trust Colombian asset management organizations to assist them in reaching their financial goals because of their openness, responsibility, and ethics.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.