A diversified investment approach spreads cash throughout distinctive asset types, like shares, bonds, real estate, and commodities, to reduce chance and enhance returns. By now not putting all your cash in one region, losses in one vicinity can be offset with the aid of profits in some other, providing greater balance.

To diversify efficiently, you ought to allocate your investments wisely, frequently rebalance your portfolio, fit your alternatives to your chance tolerance and desires, and live informed approximately the market. This enables you to manage your investments efficiently.

The primary advantages are reduced risk and more solid returns. However, diversification may be complicated, calls for ongoing control, and may have better charges and ability for decrease returns compared to high-threat investments. Despite those drawbacks, it’s a key method for lengthy-time period economic stability.

What is a Diversity Investment?

In finance, diversification is spreading money across special investments. This can consist of stocks, bonds, real property, and commodities. The intention is to reduce hazards. Diversification works by way of balancing profits and losses. If one investment loses cost, any other may have an advantage. This manner, usual risk is decreased, and returns are extra stable. To diversify well, break up your investments accurately. Regularly test and regulate your portfolio. Match investments on your threat degree and dreams. Stay knowledgeable about marketplace trends. This allows you to manage your money higher and attain a lengthy-time period balance.

What is a Diversified Investment Strategy?

A diversified funding strategy entails spreading money throughout diverse kinds of belongings, which include stocks, bonds, real property, and commodities. The number one purpose is to reduce threats by not putting all your cash into one kind of investment. By diversifying, if one investment loses fee, others might also take advantage, balancing out the losses and offering extra strong returns through the years. This approach allows guarding your typical investment portfolio from huge losses and can cause greater consistent and reliable financial growth.

What is a Corporate-Level Diversification Strategy?

A corporate-level diversification method is when an employer expands its operations into new markets or introduces new products. This method reduces business danger through now not relying totally on a single marketplace or product line. By diversifying, the corporation can achieve growth and stabilize its profits, although one marketplace or product performs poorly. This approach helps the agency continue to be aggressive and adapt to converting marketplace situations, in the long run assisting lengthy-time period commercial enterprise sustainability and profitability.

What are the Characteristics of Investments?

10 characteristics of investment are:

- Risk: Risk is the chance of dropping some or all the coins invested. Different investments have unique ranges of chance. Higher chance frequently means higher functionality returns, but also higher ability losses.

- Return: Return is the cash received or misplaced from a funding. It is usually proven as a percentage of the proper quantity invested. Positive returns mean profits, while terrible returns suggest loss.

- Liquidity: Liquidity refers to how without issues and funding may be transformed into coins. Some investments, like stocks, can be presented quickly. Others, like actual assets, take more time to promote.

- Time Horizon: Time horizon is the period an investor plans to keep an investment. Short-time period investments are held for a few months or years. Long-term investments are held for many years.

- Volatility: Volatility is the diploma to which a funding’s cost changes over time. High volatility means the fee can move up and down the loads. Low volatility way the rate stays extra strong.

- Income: Income from investments is the normal cash earned, like interest from bonds or dividends from shares. This earnings may be used or reinvested to buy more investments.

- Growth Potential: Growth potential is the possibility that an investment will increase in charge over time. Investments like shares or actual property frequently have excessive boom capability.

- Diversification: Diversification is spreading investments in some unspecified time in the future of specific property to lessen threat. By now not putting all cash into one funding, losses in an unmarried place may be balanced through earnings in every different.

- Tax Implications: Tax implications are the taxes that want to be paid on investment income. Different investments have precise tax guidelines. Knowing those can help manage common returns.

- Cost: Cost consists of fees and charges associated with attempting to find, protecting, or selling investments. These can include brokerage fees, control charges, and transaction costs. Lower fees can imply better internet returns.

What is the Fallacy of Time Diversification?

The Fallacy of Time Diversification is the improper notion that danger decreases over time when protecting shares. Some traders think that by means of holding shares for a longer period, the overall threat will lessen. However, while the average return can also stabilize, the ability for excessive losses can nonetheless be extensive. Over lengthy intervals, the variety of viable effects widens, and the impact of terrible overall performance in any given period can still be sizable.

Therefore, the fallacy lies in underestimating the threat associated with long-time period stock investments. Time by myself does not cast-off danger, and long-term investors need to recollect the possibility of sustained downturns and their impact on usual wealth.

What is the Paradox of Diversification?

The Paradox of Diversification refers to the situation in which including greater investments to a portfolio can firstly have lessen chance, but after a certain point, it can grow complexity and cost without sizable hazard reduction. Diversification objectives to spread risk across various properties, decreasing the effect of any unmarried funding’s negative performance. However, over-diversification can cause diminishing returns, in which the extra assets do not offer good sized danger reduction.

It also can boom management demanding situations and transaction charges. The paradox is that whilst diversification is beneficial up to some extent, immoderate diversification can make the portfolio harder to manipulate and may not provide additional danger blessings. Investors need stability diversification to optimize their portfolios correctly.

Is it Good to Diversify Your Investments?

Yes, it is ideal to diversify your investments. Diversification spreads your cash throughout distinct asset types like shares, bonds, and real estate. This reduces the hazard of dropping all of your cash if one investment plays poorly. By having a mixture of investments, you may stabilize potential losses with profits from different investments. Diversification can offer extra strong returns over the years. It enables you to protect your typical investment portfolio and can result in an extra constant economic boom.

Why is Diversification Important?

Diversification is vital because it reduces funding danger. By spreading your cash throughout various belongings, you keep away from relying on unmarried funding. This balance allows you to guard your portfolio from huge losses if one investment fails. Diversification also affords greater solid returns via balancing gains and losses throughout unique investments. It enables control of marketplace volatility and aligns with lengthy-term financial desires. Overall, diversification is a key approach for preserving monetary stability and attaining regular growth.

Why would one Prefer a Diversified Investment Portfolio?

A different investment portfolio is preferred as it spreads chance across distinctive asset kinds. By investing in quite a few assets like shares, bonds, and actual property, buyers reduce the effect of any single investment’s terrible performance. This method can result in more stable returns over the years, as gains in a few investments can offset losses in others. Diversification also presents opportunities to gain from special marketplace conditions, improving normal portfolio performance. It enables shields in opposition to extensive losses, making it a safer strategy for long-time economic boom.

What is Meant by Diversifying Investments?

Diversifying investments means spreading cash throughout unique forms of property to lessen threat. This includes investing in diverse sectors, industries, and asset training, which includes shares, bonds, real estate, and commodities. The goal is to ensure that if one investment plays poorly, others might also perform properly, balancing the general portfolio. Diversification helps protect towards substantial losses and decreases the volatility of returns. It is a key approach in handling investment threats and reaching a greater strong and steady overall performance over time.

Why do Investors Diversify their Portfolios?

Portfolio diversification manners spreading investments across various asset sorts and sectors. This consists of shares, bonds, real estate, and other assets. The goal is to reduce risk and keep away from relying on a single investment. By maintaining a mix of investments, losses in one vicinity may be offset by gains in any other. This allows to defend the overall portfolio cost and offers greater stable returns. Diversification is a key strategy to control funding threats successfully.

Investors diversify their portfolios to reduce threats and achieve more stable returns. By investing in numerous assets, they can protect themselves from big losses if one funding plays poorly. Diversification helps to balance the portfolio, as profits in a few investments can offset losses in others. This approach minimizes the effect of marketplace volatility and surprising occasions. Overall, diversification offers a safer and greater dependable way to grow wealth over the years.

What is the Formula for Portfolio Diversification?

There isn’t always a single formulation for portfolio diversification. Instead, it includes spreading investments across various asset instructions. This can encompass stocks, bonds, actual estate, and commodities. The secret is to stabilize specific styles of investments to reduce risk and growth potential returns. Asset allocation and regular rebalancing are crucial components of this strategy.

What is the Example of a Diversified Portfolio?

A diversified portfolio is a hard and fast of various investments designed to reduce danger. It includes numerous asset kinds, consisting of shares, bonds, actual property, and commodities. By spreading investments during unique property, a diversified portfolio lets in balance losses and gains, primarily to greater strong returns.

- Stocks: 50% of the portfolio in a mixture of large-cap, mid-cap, and small-cap stocks.

- Bonds: 25% in authorities and enterprise bonds.

- Real Estate: 15% in actual estate funding trusts (REITs).

- Commodities: 5% in gold and different valuable metals.

- Cash: five% in financial savings or cash marketplace debts.

This mixture manages hazards and gives potential for boom.

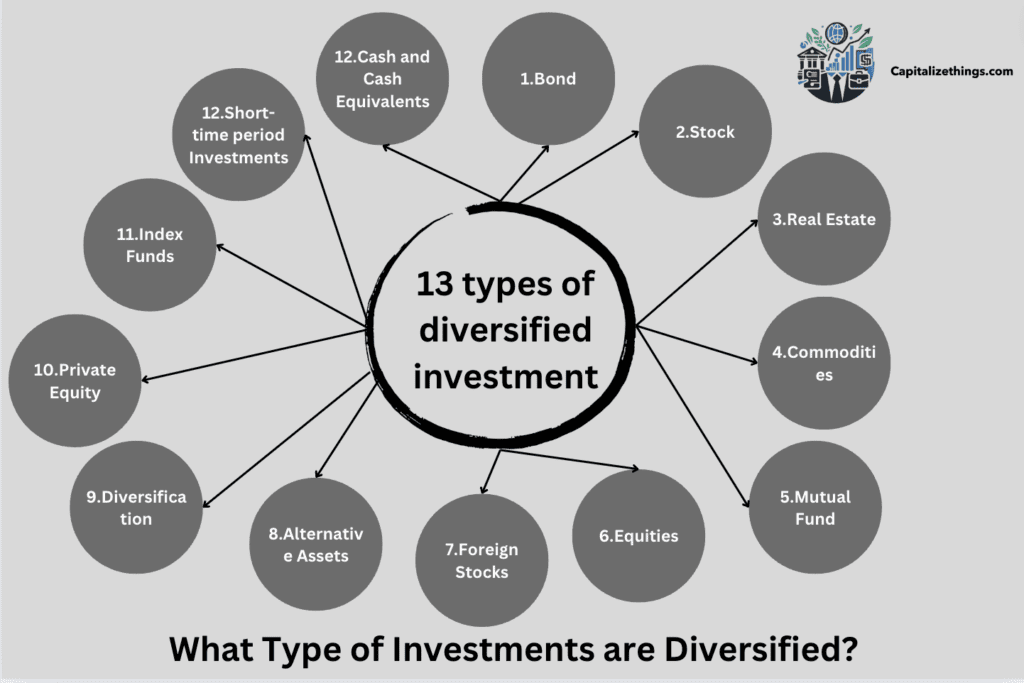

What Type of Investments are Diversified?

13 type of diversified investment options are:

- Bond

- Stock

- Real Estate

- Commodities

- Mutual Fund

- Equities

- Foreign Stocks

- Alternative Assets

- Diversification

- Private Equity

- Index Funds

- Short-time period Investments

- Cash and Cash Equivalents

- Bond: Bonds are loans to businesses or governments. They offer normal hobby profits. They are much less volatile however offer lower returns as compared to stocks. They add stability to a distinctive portfolio.

- Stock: Stocks constitute possession in an employer. They have excessive boom capability however can be very risky. They are right for prolonged-time period growth however growth portfolio threat.

- Real Estate: Real property entails investing in belongings. It can offer constant profits and capital appreciation. It is much less liquid and requires large capital but diversifies against marketplace volatility.

- Commodities: Commodities include gold, oil, and agricultural products. They hedge against inflation and financial downturns. Prices can be volatile and impacted by means of worldwide activities.

- Mutual Fund: Mutual charge pool cash from many buyers to shop for a diverse portfolio of stocks, bonds, or different securities. They are managed by professionals. They offer diversification and comfort but come with manipulated prices.

- Equities: Equities are shares of agencies. They provide excessive returns and possession benefits. They are incredibly unstable and risky but essential for lengthy-term growth in a different portfolio.

- Foreign Stocks: Foreign stocks are shares of agencies outside your own home u . S .. They offer publicity to worldwide markets and may provide immoderate returns. They supply foreign money risk and geopolitical hazard.

- Alternative Assets: Alternative assets consist of hedge finances, non-public equity, and collectibles. They offer excessive returns and coffee correlation with conventional markets. They are complex and frequently require big investments.

- Diversification: Diversification is spreading investments in the course of numerous belongings. It reduces threat by way of balancing profits and losses. It ensures no single funding significantly affects the portfolio.

- Private Equity: Private fairness includes making an investment in private corporations. It offers excessive returns however is illiquid and calls for an extended funding horizon. It is appropriate for knowledgeable investors.

- Index Funds: Index price range music a marketplace index, just like the S&P 500. They offer huge marketplace publicity and coffee expenses. They offer diversification but are subject to marketplace dangers.

- Short-time period Investments: Short-time period investments encompass cash marketplace charge range and short-term bonds. They provide liquidity and capital maintenance. They provide lower returns but are lots much less unstable.

- Cash and Cash Equivalents: Cash and cash equivalents encompass financial savings money owed and Treasury payments. They provide liquidity and protection. They provide very low returns however are important for emergency rate range and reducing portfolio threat.

What is an Automatic Investment?

An automated funding is a plan in which money is often invested into an economic account without manual intervention. This may be accomplished through automated transfers from a financial institution account to an investment account. The primary aim is to make an investment regular and clean, making sure that money is frequently put to paintings within the marketplace. Automatic investments assist construct wealth over the years with the aid of taking benefit of greenback-cost averaging and the power of compounding.

An example of an automated investment is putting in a monthly transfer of $200 from a checking account to a mutual fund. This method happens on the equal day every month without the want for manual movement. The investor does not need to keep in mind to make the transfer, and the money is continually invested. This approach enables in constructing a disciplined funding dependence and guarantees that the investor receives blessings from market fluctuations over the years.

For extra certain facts, confer with the studies paper The Impact of Automatic Investment Plans on Investor Behavior posted in the Journal of Financial Planning. This paper explores how automatic investments influence investor subject and lengthy-term economic boom.

What Type of Investment is Naturally Diversified?

Naturally diversified investment types are:

- Mutual Funds

- Exchange-Traded Funds(ETFs)

- Index Funds

- Target-Date Funds

- Balanced Funds

- Mutual Funds: Mutual finances pool money from many investors to shop for a huge style of shares, bonds, or different belongings. This spread reduces risk since performance of 1 asset might not closely affect the entire fund. Professional managers take care of these finances, making choices to maximize returns and manipulate threats. Investors benefit from diversification without having to select personal stocks or bonds themselves.

- Exchange-Traded Funds (ETFs): ETFs are just like mutual budgets however trade on stock exchanges like character stocks. They hold a diverse mix of belongings, which include shares, bonds, or commodities. This herbal diversification helps lessen danger. ETFs may be bought and bought easily at some point of the buying and selling day, supplying liquidity. They regularly have lower fees in comparison to mutual finances, making them a value-effective manner to diversify.

- Index Funds: Index finances track unique marketplace indexes, which include the S&P 500. They include an extensive variety of agencies in the index, offering natural diversification. Since they follow the market index, they typically have decreased prices and control costs. This passive investment approach reduces the threat and attempts to select character stocks. Investors can achieve large marketplace publicity with simply one funding.

- Target-Date Funds: Target-date price range are designed for retirement making an investment. They robotically regulate their asset blend because the goal date approaches. Early on, they make investments more in shares for growth. As the date nears, they shift to bonds for stability. This creates herbal diversification over time, balancing boom and chance. These price ranges simplify retirement making plans with the aid of coping with the asset allocation for the investor.

- Balanced Funds: Balanced budget spend money on a mix of stocks and bonds, presenting each growth and earnings. This diversification reduces risk because the overall performance of stocks and bonds regularly differs. They aim to balance the capacity for better returns from shares with the stability of bonds. These price ranges are controlled to keep a particular ratio of shares to bonds, making them a truthful way to attain diversification.

What is an Investment Holding Company?

A funding retaining company is a commercial organization created to hold and manipulate investments in different organizations. It does not produce objects or services itself. Instead, it owns stocks of numerous companies to control and oversee their operations. The number one purpose is to generate income from these investments, alongside facet dividends, interest, or capital earnings. By protecting several investments, the business enterprise pursuits to reduce danger and growth returns for its shareholders.

List of Top 10 Investment Holding Companies Worldwide:

- Berkshire Hathaway: An American multinational conglomerate led by Warren Buffett, acknowledged for proudly owning agencies like Geico, Dairy Queen, and Duracell.

- SoftBank Group: A Japanese multinational keeping industrial enterprise agency with investments in technology, energy, and finance sectors, together with stakes in Alibaba and Arm Holdings.

- BlackRock: An American international funding manipulate organization, one of the international’s largest asset managers, with holdings in several corporations during numerous industries.

- KKR & Co. Inc.: An American global funding business enterprise that specialize in personal equity, credit score, and actual assets, regarded for its leveraged buyouts of massive corporations.

- Tencent Holdings: A Chinese multinational conglomerate preserving company, with investments in internet services, synthetic intelligence, and generation, along with WeChat and Tencent Music.

- Alphabet Inc.: An American multinational conglomerate and the determined enterprise of Google, with investments in several tech and innovation sectors.

- Samsung Group: A South Korean multinational conglomerate, with investments in electronics, production, and shipbuilding, and recognized for Samsung Electronics.

- Icahn Enterprises: An American conglomerate shielding corporation led by Carl Icahn, with investments in energy, vehicle, food packaging, metals, actual assets, and home fashion.

- 3G Capital: A Brazilian-American international funding agency, recognized for its investments within the food and beverage enterprise, alongside Kraft Heinz and Anheuser-Busch InBev.

- Sequoia Capital: An American venture capital commercial enterprise focused on era investments, with stakes in agencies like Apple, Google, and LinkedIn.

What is Diversified Shareholding?

Diversified shareholding is whilst an agency’s ownership is spread among many shareholders. No unmarried shareholder owns a controlling hobby. This reduces the threat of any person, man or woman or group having an excessive amount of management. It encourages truthful control and choice-making. Diversified shareholding can enhance company balance and entice greater investors. This shape is commonplace in huge, publicly traded businesses.

A massive tech corporation, like Apple, has different shareholding. Its shares are owned by way of hundreds of thousands of people, mutual budget, and institutional traders. No unmarried entity controls the bulk of shares. This vast ownership facilitates making certain balanced choices. It prevents any shareholder from making selections that most effectively benefit them. This form of shareholding can assist guard the interests of all shareholders.

For greater special facts, talk over with the research paper titled The Impact of Ownership Structure on Corporate Performance: Evidence from China by Xu and Wang, published inside the Journal of Corporate Finance in 1997. This paper discusses how assorted shareholding systems can affect corporate performance and governance. The examination gives empirical proof and analyzes the blessings of spreading possession amongst many shareholders.

What is the Difference Between Holding and Investment Company?

The table provides the major difference between a holding company and an investment company below:

| Aspect | Holding Company | Investment Company |

|---|---|---|

| Primary Function | Owns stocks of other corporations | Takes money from investors to invest |

| Main Objective | Control other companies | Generate returns for investors |

| Operational Involvement | Manages and oversees owned companies | Does not directly manage invested companies |

| Regulation | Generally less regulated | Regulated by U.S. SEC |

| Management | Manages subsidiary companies | Managed by professional fund managers |

| Investor Access | Generally not open to public investors | Open to public investors |

| Diversification Approach | Through ownership of different companies | Through investments in various assets |

| Structure | Single umbrella for multiple businesses | Various forms (mutual funds, ETFs, etc.) |

What are the Best U.S. Diversified Stock Funds?

Here is a table showing some of the best U.S. diversified stock funds, their symbols, and their 5-year annual returns.

| Company Name | Symbol | 5-Year Annual Return |

| Vanguard 500 Index Fund Admiral | VFIAX | 13.16% |

| Schwab S&P 500 Index Fund | SWPPX | 13.15% |

| Fidelity 500 Index Fund | FXAIX | 13.14% |

| Fidelity Zero Large Cap Index | FNILX | 13.12% |

| T. Rowe Price Equity Index 500 | PREIX | 13.08% |

These funds offer a mix of stability and growth by investing in a broad range of U.S. companies.

What is a Diversified Mutual Fund?

A diverse mutual fund is a funding fund that spreads its property throughout several securities. This can include shares, bonds, and different belongings. The purpose is to reduce hazard with the aid of now not placing all of the money into one kind of funding. By diversifying, the fund aims to stabilize capacity losses with gains, providing more solid returns for buyers. This sort of mutual fund is managed by using experts who determine the great mix of investments to attain the fund’s goals.

What are the Best Diversified Mutual Funds?

The exceptionally diverse mutual funds are those that offer an awesome blend of assets and have a robust overall performance. Examples consist of the Vanguard Total Stock Market Index Fund, the Fidelity Contrafund, and the T. Rowe Price Capital Appreciation Fund. These budgets are acknowledged for his or her huge diversification and constant returns. When choosing a different mutual fund, look for those with low costs, sturdy control, and effective historical performance. For more specific evaluation related to investment, refer to research papers and economic opinions from sources like Morningstar and the Financial Times.

What are Individual Investments?

Individual investments are belongings offered by one individual to develop their wealth. Examples encompass shares, bonds, and actual estate. Each investment type has different dangers and returns. Stocks constitute ownership in an enterprise, whilst bonds are loans made to governments or groups. Real estate includes buying assets. Individual investors pick based on their goals and chance tolerance. A study by Barber and Odean (2000) discovered that man or woman investors often underperform due to overtrading and shortage of diversification. These investments allow humans to tailor their portfolios to private monetary dreams, but cautious planning and research are vital to success.

What is a LifePath Investment?

LifePath investments are goal-date funds designed to adjust chances over time. They start with greater competitive investments when you are younger and step by step grow to be extra conservative as you close to retirement. For example, a LifePath 2040 fund will have greater shares now and extra bonds in the direction of 2040. This computerized adjustment facilitates managing threats as you age. A study via Mitchell and Utkus (2004) indicates that a budget can simplify retirement making plans for investors by way of imparting a various, age-suitable funding blend. LifePath investments are ideal for the ones looking for a hands-off method to retirement savings.

What is a Sector in Investing?

A sector in making an investment is a collection of organizations that function within the same enterprise. Examples include technology, healthcare, and strength sectors. Investing in a zone way shopping for stocks or other securities within that industry. For example, shopping for stocks in Apple, Microsoft, and Google means investing within the generation zone. According to Chen and Ranciere (2012), quarter performance can range broadly due to economic situations, technological advances, and regulatory changes. Diversifying throughout sectors can assist reduce threat. Investors often use zone evaluation to become aware of increased possibilities and manipulate their portfolios efficiently.

How Many Sectors Should a Diversified Portfolio have?

A diversified portfolio must have investments in at the least 5 to 10 exclusive sectors. This helps spread danger across various parts of the economy. Sectors can encompass generation, healthcare, finance, consumer items, strength, and others. By investing in multiple sectors, poor overall performance in a single sector may be balanced by using higher performance in every other. This technique facilitates greater strong returns and decreases the effect of zone-particular downturns on the general portfolio.

What is a Well Diversified Investor?

A nicely assorted investor spreads their investments throughout various asset types, along with shares, bonds, actual estate, and commodities. This reduces the hazard of vast losses. If one investment performs poorly, others might perform nicely, balancing the general portfolio. This technique allows to shield the investor’s cash and offers greater strong returns over time. Diversification involves regularly checking and adjusting investments to make sure they healthy the investor’s economic dreams and threat tolerance.

A well diverse investor always considers extraordinary industries and geographical places. Investing in numerous sectors, like generation, healthcare, and finance, similarly reduces threat. Additionally, they could put money into both domestic and international markets. This strategy guarantees that their portfolio isn’t overly suffering from changes in any person, enterprise or vicinity. By spreading investments extensively, the investor can reap an extra solid and reliable increase over the long time.

What is Diversified Asset Allocation?

Diversified Asset Allocation is the strategy of spreading investments across different asset training. These can consist of shares, bonds, real property, and commodities. The purpose is to reduce hazard by means of now not relying on one kind of funding. If one asset magnificence plays poorly, others may additionally carry out well, balancing the general returns. This approach allows the investment portfolio from big losses and ambitions for greater strong returns over time.

A various investment method includes dispensing cash across various styles of investments. This can include stocks, bonds, actual property, and other asset sorts. The principal purpose is to lessen danger by way of not placing all cash into one sort of investment. By diversifying, losses in one region may be offset by way of profits in every other. This method facilitates in achieving more solid returns and protecting the investment portfolio from considerable losses.

What is a Diversified Asset?

A diversified asset is a fund that spreads its holdings across numerous asset kinds. This reduces hazard by now not relying on an unmarried investment. By combining one-of-a-kind belongings, like shares, bonds, and real property, it balances capability losses and gains. This approach ambitions for greater strong returns through the years.

A mutual fund is a superb instance of an assorted asset. It pools cash from many traders to shop for a mix of stocks, bonds, and different securities. This blend facilitates lessen risk. If one stock performs poorly, others in the fund may perform properly, balancing the overall go back.

For more specific statistics, you may discuss the study’s paper The Benefits of Diversification in Investment Portfolios, through Markowitz, H. (1952). It is available in the Journal of Finance. This paper explains how diversification reduces risk and improves returns in investment portfolios.

How does Diversification Affect Variance?

Diversification reduces the overall variance of an investment portfolio. By spreading investments throughout exceptional property, the effect of any single investment’s negative overall performance is minimized. This is because exclusive investments regularly react differently to the identical financial activities. When one investment goes down, another would possibly go up, balancing the general overall performance. As a result, the portfolio’s returns come to be more solid, and the hazard of massive losses decreases. Diversification, consequently, leads to decreased variance and greater consistent returns.

How does Diversification of Investment Work?

Diversification of funding works by way of spreading cash across diverse asset lessons like shares, bonds, and real estate. This reduces the chance of losing all your cash in one sort of investment. When one investment loses fee, others would possibly take advantage, balancing basic returns and minimizing losses. Investing in specific sectors and geographic regions facilitates similarly lessened danger and stability returns. Regularly reviewing and adjusting your portfolio keeps proper diversification. This approach affords greater stable and dependable long-term returns by smoothing out market volatility and taking advantage of various growth opportunities.

How do you Manage a Diversified Portfolio?

To control a diverse portfolio, often review and adjust your investments to maintain the favored asset allocation. Monitor market conditions and character funding overall performance. Rebalance your portfolio periodically to ensure it aligns with your threat tolerance and monetary dreams. Diversify across numerous asset lessons, sectors, and geographic areas. Stay knowledgeable about economic tendencies and marketplace adjustments. Use expert recommendations if you have to optimize your method. This approach allows in minimizing hazard and attaining constant, long-time period boom.

What is the Earning Strategy in Investing?

The earning method in making an investment specializes in producing returns through distinct techniques. This includes earning dividends from stocks, hobby from bonds, and condominium profits from real estate. Capital appreciation is every other key technique, in which the price of investments will increase through the years. Investors also use strategies like reinvesting income to compound returns. Diversifying investments and balancing risk and reward are essential. The purpose is to achieve steady earnings and develop wealth over the long time.

What is a Diversified Investment Company?

A diversified investment company pools money from many buyers to spend money on loads of property and is regulated by U.S. Securities and Exchange Commission. These belongings can include shares, bonds, real property, and different securities. The purpose is to lessen danger via spreading investments across specific asset classes and sectors. Examples of assorted investment corporations consist of Vanguard, Fidelity Investments, and BlackRock. These groups offer mutual price range and trade-traded funds (ETFs) that offer buyers with assorted portfolios, supporting to balance risk and go back.

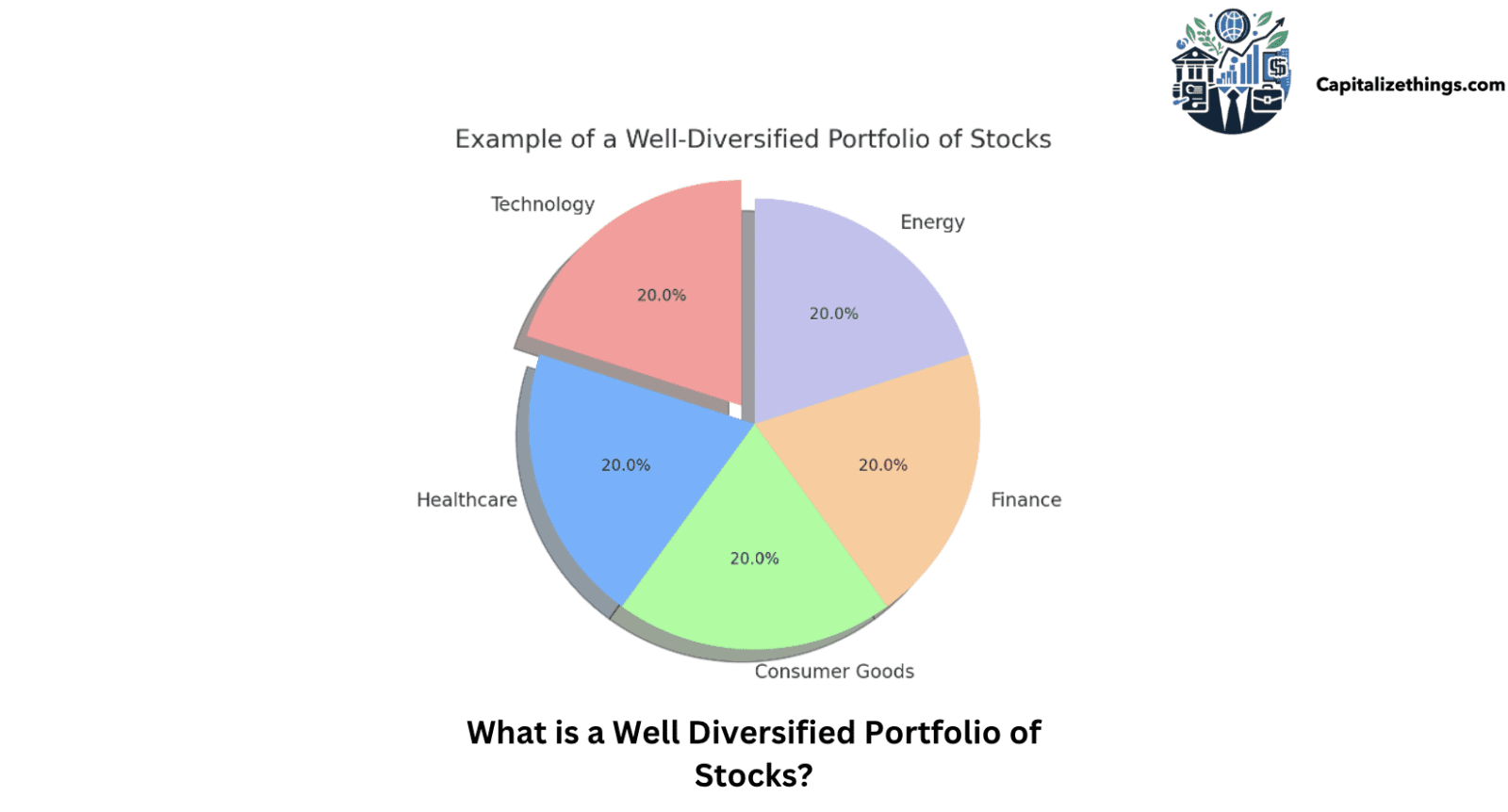

What is a Well Diversified Portfolio of Stocks?

A properly diversified portfolio of stocks consists of quite a few stocks across extraordinary sectors. This reduces risk and balances capacity losses and gains. For example, it would include era, healthcare, client items, finance, and strength shares. By diversifying, if one region plays poorly, others may perform properly, stabilizing the general portfolio.

Let’s create a pie chart to visualize this:

Technology: 20%

Healthcare: 20%

Consumer Goods: 20%

Finance: 20%

Energy: 20%

I’ll create the pie chart for you.

What’s the Best Investment Right now in 2024?

10 Best assorted investments to spend money on to get excessive returns are:

- Stocks

- Bonds

- Real Estate

- Mutual funds

- Exchange-Traded Funds (ETFs)

- Cryptocurrency

- Commodities

- International Investments

- Index Funds

- High-Yield Savings Accounts

- Stocks: Investing in a variety of shares can offer high returns. Focus on generation, healthcare, and renewable electricity sectors. These sectors are expected to expand notably. Diversify throughout large-cap, mid-cap, and small-cap shares to stability chance and return.

- Bonds: Bonds are a safer investment and provide constant returns. Consider an aggregate of presidency and company bonds. High-yield corporation bonds can offer higher returns but encompass extra threat. Diversifying bonds allows protection towards hobby charge changes and economic downturns.

- Real Estate: Real assets investments can provide giant returns. Invest in residential, business, and business homes. Consider Real Estate Investment Trusts (REITs) for diversification without managing houses. Real assets can provide apartment income and admiration in rate through the years.

- Mutual Funds: Mutual rate range pools money from many investors to buy a diversified portfolio of shares and bonds. This reduces danger at the same time as presenting right returns. Choose a price variety managed by way of experienced experts. Look for a price range with a strong song document of usual overall performance.

- Exchange-Traded Funds (ETFs): ETFs provide diversification through investing in a giant variety of assets. They can include shares, bonds, commodities, and extra. ETFs change like stocks on exchanges, making them clean to shop for and sell. They offer suitable returns and lower hazard because of diversification.

- Cryptocurrency: Cryptocurrency can offer excessive returns but in all fairness volatile. Invest in well-known cryptocurrencies like Bitcoin and Ethereum. Diversify by way of the usage of which includes different promising digital currencies. Be prepared for massive charge fluctuations and invest handiest a small part of your portfolio.

- Commodities: Commodities like gold, silver, and oil can diversify your portfolio. They often flow independently of inventory markets. Investing in commodities can hedge in opposition to inflation and financial uncertainty. Use commodity ETFs or mutual finances for easier access to and diversification.

- International Investments: Diversify via using funding in international markets. This reduces the chance related to any unmarried United States of America’s financial system. Consider shares, bonds, and actual estate in emerging markets for better returns. International mutual price range and ETFs offer easy entry to global investments.

- Index Funds: Index price range tune the general performance of a specific market index, just like the S&P 500. They offer large market publicity and low costs. Investing in index finances affords diversification and consistent returns. They are perfect for prolonged-term increase and minimizing investment chances.

- High-Yield Savings Accounts: While not as high-returning as unique investments, excessive-yield financial savings debts offer stable and consistent returns. They are best for quick-time period financial savings and emergency budget. These payments earn higher interest than conventional economic financial savings debts, presenting a reliable and coffee-chance alternative.

How to Diversify $1,000?

To diversify $1,000, unfold it across one of a kind asset instructions. Invest in a mixture of shares, bonds, and perhaps a low-cost mutual fund or ETF. Consider setting some cash into high-hobby financial savings money owed or certificates of deposit for safety. Use on-line funding systems to shop for fractional stocks, permitting you to personal components of steeply-priced stocks. Regularly assess and regulate your investments to live assorted and aligned together with your monetary goals and chance tolerance.

Where to get 10 Percent Return on Investment?

Achieving a ten percent return on investment may be challenging and often includes better danger. Historically, stock markets just like the S&P 500 have averaged around this return over the long time. Consider making an investment in a different portfolio of stocks or index price range. Real property and peer-to-peer lending systems additionally offer potential for better returns. Always assess the risks and recognize that better returns include greater volatility and ability for loss.

Do Diversified Portfolios have High Returns?

A diversified portfolios purpose is to balance risk and reward, not necessarily to achieve the highest returns. Investors spread investments throughout special property to lessen risk. While this approach won’t always offer the highest returns, it gives extra balance and protects towards big losses. Over the long term, diverse portfolios can yield stable, regular returns by smoothing out the United States of America and downs of man or woman investments and market fluctuations.

What is a Positive Investment?

A nice positive investment occurs while the cash placed into investments exceeds the money withdrawn or depreciated. This method of general funding grows over the years. Positive net funding shows wholesome financial boom and expansion. It indicates that new belongings are being created or present property are being improved. For instance, a corporation investing extra in new machinery than it loses in vintage equipment depreciation is creating an effective internet investment. This leads to multiplied production capacity and capability earnings.

According to Investopedia, nice net investment is essential for monetary growth because it enhances effective capacity. By continuously investing in new belongings, both people and businesses can make certain sustained growth and advanced monetary fitness. This approach is fundamental to long-term achievement.

Is 7% Return on Investment Realistic?

A 7% return on funding is realistic, relying on different factors. Historical statistics indicate that certain investments, like stocks, frequently achieve this return over the long time. For instance, the common annual return of the S&P 500 has been around 7% after adjusting for inflation. However, returns can range broadly 12 months to year.

Achieving a 7% go back continually calls for a properly diversified portfolio and a protracted-time period investment method. It additionally involves accepting some stage of threat, as better returns usually include higher volatility. Factors such as financial conditions, market performance, and man or woman funding alternatives play a large position. While now not guaranteed, a 7% return is achievable with cautious making plans and a balanced investment technique.

What are Diversified Growth Funds?

Diversified growth finances are investment price ranges that spread cash throughout diverse asset lessons. These can include stocks, bonds, actual property, and commodities. The purpose is to obtain a positive net investment return over the long term. By diversifying, those budgets reduce threats and are seeking a stable boom.

A diverse boom fund might spend money in the U.S. And international stocks, authorities and company bonds, actual property, and gold. This mix aims to gain high quality positive net investment returns by means of balancing profits and losses across one-of-a-kind property. For instance, if shares underperform, profits in bonds or real property can assist the usual boom.

How to Diversify with Gold?

Diversifying with gold includes adding gold to your investment portfolio. You should buy physical gold, including cash or bars, and store it securely. Alternatively, put money into gold ETFs (Exchange-Traded Funds), which track the price of gold with no need for a bodily garage. Another option is purchasing stocks in gold mining organizations that could take advantage of rising gold prices. Gold mutual funds, which put money into various gold-associated belongings, are also a choice. Including gold enables shields towards inflation and marketplace volatility, supplying stability for your portfolio.

Are 1 Oz Gold Bars a Good Investment?

1 oz gold bars can be a terrific investment for the ones searching for a hedge in opposition to inflation and financial uncertainty. They are tangible property and might provide portfolio diversification. However, they don’t generate income and may have garage and coverage expenses. Assessing non-public monetary goals and risk tolerance is vital earlier than making an investment.

Are ETFs a Good Way to Diversify?

ETFs are a powerful way to diversify. They permit funding in an extensive range of assets, such as shares, bonds, or commodities, inside an unmarried fund. This reduces danger with the aid of spreading investments across a couple of sectors or markets. ETFs are also value-powerful and provide clean buying and selling, making them famous for diversification.

How Many ETFs are Needed for a Diversified Portfolio?

An assorted portfolio normally wishes five to ten ETFs. This variety affords exposure to numerous asset training, sectors, and geographic regions, balancing danger and go back. The genuine number depends on a person’s monetary desires, hazard tolerance, and investment approach. It’s essential to ensure every ETF adds specific value to the portfolio.

What is the Simplest Rule of investment diversification?

The simplest rule of investment diversification is to avoid setting all your cash into one type of funding. This manner spreads your money across numerous asset training like shares, bonds, actual property, and commodities. By doing this, you lessen the risk of losing everything if one funding plays poorly. For instance, in case you make investments most effectively in shares and the stock marketplace crashes, you may lose a widespread sum of money.

However, if you additionally have investments in bonds and real estate, the ones assets may not be as affected by the stock market crash. This stability enables guarding your universal portfolio and provides extra stable returns over time. Diversification goals to achieve a mixture of investments to lessen chance and enhance lengthy-term boom.

What are the 7 Rules of Investing?

The 7 investment rules are:

- Start early to capitalize on compounding

- Diversify your portfolio to lessen risk

- Invest for the long term to trip out marketplace fluctuations

- Maintain costs low by means of minimizing fees

- Stay knowledgeable and behavior research

- Keep away from emotional decisions

- Regularly investigate and rebalance your portfolio to hold your favored asset allocation.

What is the 5% Rule for Diversification?

The 5% rule for diversification shows that no more than 5% of your funding portfolio need to be in any single asset or inventory. This permits spread danger for the duration of investments. If one funding plays poorly, it closely impacts your traditional portfolio. This rule promotes a balanced and less risky funding method.

What is the 75 5 10 Diversification Rule?

The 75-5-10 diversification rule is a guiding principle for mutual charge variety. It means that at the least 75% of the fund’s property must be in diverse investments. No extra than five% of the fund’s property can be in an unmarried inventory, and no greater than 10% of an organization’s voting inventory may be owned with the resource of the fund.

What is the 5 50 Diversification Rule?

The 5-50 diversification rule shows that you have to know to not invest greater than 5% of your portfolio in any single asset or commercial enterprise organization. Additionally, you want to have at the least 50 unique investments for your portfolio. This helps unfold risk and guarantees that terrible basic performance in a single funding does not notably affect your established portfolio.

What is the 2% Rule in Real Estate Investing?

The 2% rule in real estate investment states that a rental property wants to generate month-to-month condo income of at least 2% of the purchase charge. For instance, if you buy an asset for $100,000, it wants to hire for at least $2,000 per month. This rule facilitates making certain the belongings will generate sufficient coins drift.

What is the Diversification Strategy in Real Estate?

The diversification method in real estate involves investing in a single-of-a-kind types of residences and places. This includes residential, industrial, and enterprise homes, further to homes in various geographic areas. Diversifying in real assets reduces hazard and may cause more stable returns with the aid of spreading investments across one-of-a-kind markets and belonging types.

What is the 120 Rule in Investing?

The 120 rule in making an investment is a guiding principle for asset allocation based totally on age. Subtract your age from a hundred and twenty to decide the share of your portfolio that must be in shares. The rest need to be in bonds. For example, if you are 30 years old, ninety% (100 twenty-30) of your portfolio should be in stocks, and 10% in bonds.

What is the Allocation Rule for Investments?

The allocation rule for investments entails dividing your portfolio among extremely good asset lessons like stocks, bonds, and cash. A common rule is to allocate a percentage based totally completely on your hazard tolerance and investment goals. For example, extra younger traders might have a higher percent in shares, while older buyers would probably decide upon more bonds for balance. Regularly rebalancing is vital.

What are the Pros and Cons on Investment Diversification?

Investment diversification involves spreading investments across diverse asset classes to lessen danger and improve profits. By now not putting all money into one type of funding, it enables balance profits and losses. This approach aims to offer more solid and dependable returns over time, making it a key principle in coping with investment portfolios.

| Pros | Cons |

|---|---|

| Reduces risk | Can be complex |

| Provides more stable returns | Requires ongoing management |

| Balances gains and losses | Potential for lower returns |

| Protects against market volatility | Higher fees and transaction costs |

| Offers growth opportunities | Requires regular monitoring |

Diversification in investments gives considerable blessings, inclusive of threat reduction and strong returns, by balancing profits and losses throughout different properties. However, it also comes with challenges like complexity, ongoing management, and capacity decrease returns. Understanding these execs and cons is crucial for correctly dealing with a varied funding portfolio.

What Does Lack of Investment Cause?

Lack of investment can result in gradual or no increase in companies and economies. It hampers the capacity to innovate, expand, and improve infrastructure. Without investment, companies may additionally war to compete, leading to capability activity losses and financial stagnation. Additionally, it may result in old technology and techniques, lowering universal performance and productivity.

What would Happen to a Business if it Lacked Capital?

If an enterprise lacked capital, it’d struggle to fund day by day operations and growth initiatives. This ought to lead to missed opportunities and lack of ability to compete successfully. The enterprise would possibly face coin drift issues, resulting in delayed bills to suppliers and employees. Ultimately, a loss of capital could pressure the business to downsize or shut down.

What is One Way to Lower Risks in Investment to Diversify?

One powerful manner to decrease dangers in investment is to diversify your portfolio. This entails spreading investments across one of a kind asset training, sectors, and geographic regions. By now not counting on a single funding, you lessen the capacity for sizable losses. Diversification enables stability profits and losses, providing more strong and reliable returns over time.

What is the Difference Between Diversifiable and Non-Diversifiable?

Diversifiable danger, additionally referred to as unsystematic threat, is specific to an agency or industry. It can be decreased through diversification by way of spreading investments across specific assets. Examples encompass commercial enterprise failures or industry downturns.

Non-diversifiable chance, or systematic risk, affects the complete marketplace and cannot be removed via diversification. Examples consist of financial recessions or international events.

Which Type of Investment is Best for Beginners?

For beginners, mutual price range or trade-traded price range (ETFs) are regularly the exceptional investments. These finances pool cash from many investors to shop for a diversified portfolio of stocks, bonds, or different property. They provide diversification, which reduces danger, and are managed by way of experts, making them less complicated for beginners.

Additionally, these finances frequently have decreased charges and require much less lively control. Starting with mutual finances or ETFs permits novices to invest with much less hazard whilst studying approximately the marketplace.

What are the 4 Main Investments?

The four foremost styles of investments are stocks, bonds, real estate, and coins or coins equivalents. Stocks represent possession in a business enterprise. Bonds are loans you provide to governments or organizations. Real property consists of residences like houses and commercial homes. Cash equivalents are low-hazard investments like financial savings debts and certificate of deposit. These principal investment kinds offer numerous tiers of threat and go back.

What is the Best Asset to Own?

There is no universally “high-quality” asset to own; it depends on personal financial goals, hazard tolerance, and funding horizon. For a lengthy-term boom, shares are frequently advocated. For stability, bonds are favored. Real estate can provide income and appreciation. Diversifying across more than one asset type normally offers the first-class balance of risk and return for maximum traders.

Is Gold a Good Diversification?

Yes, gold is taken into consideration as an amazing diversification device. It frequently plays nicely during financial downturns and inflation, providing a hedge in opposition to marketplace volatility. Including gold in a portfolio can assist lessen ordinary danger. However, gold must now not be the only investment. It is first-rate used along different assets like stocks and bonds to stabilize the portfolio.

What are the Standard Short-term Investments?

Standard short-term investments encompass savings accounts, certificate of deposit (CDs), Treasury bills, and cash market price range. These investments are low-threat and offer quick get right of entry to cash. They are best for preserving capital and earning modest returns over a quick duration, typically much less than 3 years if all investment principles are considered before taking action. They provide liquidity and security, making them appropriate for brief-time period economic desires.

What is the Difference Between Allocation and Diversification?

The difference between allocation and diversification is that allocation refers to the way you distribute your investment budget across exclusive asset training, including stocks, bonds, and actual estate. Whereas diversification is about spreading investments within the ones asset training to reduce risk. For instance, in stocks, you might diversify by making an investment in various industries. Allocation is the broader strategy, at the same time as diversification is a particular tactic to manipulate risk.

Conclusion

Diversification is fundamental to coping with investment hazards and attaining solid returns. By spreading investments throughout extraordinary asset instructions and sectors, you could balance gains and losses. This method enables you to guard your portfolio from big losses and market volatility, leading to extra dependable lengthy-term growth.

Proper asset allocation and diversification work collectively to optimize your funding method. While allocation plans where to invest, diversification guarantees your investments aren’t focused in one vicinity. This mixed method allows monetary desires, aligns with risk tolerance, and navigates marketplace changes efficiently, ensuring a balanced and resilient portfolio.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.