The Dividend Discount Model (DDM) is a method utilized in monetary economics to cost a corporation’s inventory price based on the existing value of its expected destiny dividends. This model’s roots can be traced back to the early 20th century while economists started exploring methods to decide the intrinsic price of stocks. The DDM has become greatly formalized with the work of Myron J. Gordon and Eli Shapiro inside the Fifties, who brought the Gordon Growth Model (GGM), a specific form of the DDM. The GGM assumes a steady boom rate in dividends, making it beneficial for valuing mature corporations with stable dividend growth charges.

The DDM system, which calculates the present fee of anticipated destiny dividends, is expressed as:

P = D1/(r-g)

Where:

P is the price of the stock.

D1 is the expected dividend next year.

r is the required rate of return.

g is the growth rate of the dividends.

Example:

Let’s say a corporation is expected to pay a dividend of $2 in the following year. The required fee of go back is 10%, and the dividends are predicted to develop at a rate of five% per year. Using the DDM method:

P = frac20.10 – zero.05 = frac20.05 = $40

So, the inventory is valued at $40 in keeping with proportion.

The Dividend Discount Model (DDM) has several extremely good drawbacks. First, it assumes that dividends will develop at a constant charge, which may not be practical for many groups because dividend growth can be irregular and prompted by various factors. Additionally, the DDM is generally suitable for organizations that pay regular and predictable dividends, making it inapplicable to agencies that don’t pay dividends or have erratic dividend regulations.

Lastly, the assumptions of the model can be overly simplistic, particularly for companies in dynamic industries in which boom charges can trade unexpectedly. These obstacles imply that whilst the DDM may be a useful device, it must be used with warning and supplemented with different valuation techniques.

What is Dividend Discount Model (DDM)?

In financial economics, the Dividend Discount Model (DDM) is a method used to value the price of an organization’s capital stock or enterprise fee. This version calculates the prevailing price of predicted destiny dividends to decide the stock’s intrinsic well worth. It assumes that an inventory’s authentic price is the sum of all its destiny dividend bills, discounted again to their gift value. The DDM is generally used for agencies that often pay dividends.

What are the Different Types of Dividend Discount Model (DDM)?

The Dividend Discount Model (DDM) is a technique used to fee an organization’s stock based on the present value of its anticipated destiny dividends. Several versions of the DDM are tailor-made to exclusive assumptions approximately how dividends will develop over time. Here are the principal types listed below:

- Zero Growth DDM

- Gordon Growth DDM

- Two-Stage DDM

- Three-Stage DDM

1. Zero Growth DDM

The Zero Growth DDM assumes that dividends stay regular indefinitely. This model is suitable for organizations which have stable dividend payments without a predicted boom. The method for the Zero Growth DDM is:

P = D/r

Where:

P is the price of the stock.

D is the yearly dividend.

r is the specified price of return.

This version is simplistic and applies satisfactorily to mature corporations with steady dividend rules.

2. Gordon Growth DDM

The Gordon Growth DDM, also known as the Constant Growth DDM, assumes that dividends will develop at a regular fee indefinitely. This model is widely used because it applies to organizations which are anticipated to develop at a strong rate over the years. The formulation for the Gordon Growth DDM is:

P = D1/(r-g)

Where:

P is the rate of the stock.

D1 is the anticipated dividend next 12 months.

r is the desired rate of return.

g is the regular boom charge of dividends.

This model, advanced with the aid of Myron J. Gordon, is good for valuing groups with a predictable boom pattern of their dividend bills.

3. Two-Stage DDM

The Two-Stage DDM money owed for two distinct stages of dividend growth. The first section entails a higher, likely variable increase rate, observed via a second section of solid, decrease increase. This model is useful for companies expected to experience fast increase initially before settling into a constant boom charge. The formula combines the prevailing value of dividends at some stage in the excessive-boom section and the prevailing fee of dividends during the stable phase. This model captures the transition from excessive boom to solid increase, making it versatile for organizations in specific ranges in their boom lifecycle.

4. Three-Stage DDM

The Three-Stage DDM further extends the Two-Stage DDM by incorporating three distinct increase phases, preliminary excessive-increase segment, a transitional segment, and a very last strong boom segment. This model is the maximum bendy and may accurately reflect the complex growth patterns of many corporations. The method is a combination of the present values of dividends in each of the three levels. The Three-Stage DDM is in particular beneficial for valuing organizations with an preliminary length of rapid increase, a next period of slower increase, and eventual stabilization.

These versions of the DDM offer quite a number gear for buyers to evaluate agencies at unique ranges of boom and with specific dividend regulations. By choosing the ideal model, buyers can better estimate the intrinsic price of an inventory based totally on its expected future dividends.

How To Use DDM For Investments?

The Dividend Discount Model (DDM) is a powerful tool use while investing for valuing shares primarily based on the prevailing fee in their predicted destiny dividends. Here is an in-depth guide on a way to use the DDM for making investment choices.

Step-by-Step Process

Identify a Dividend-Paying Company Begin by selecting an agency that pays regular dividends. The DDM is best for corporations with a stable and predictable dividend policy.

Collect Necessary Data Gather the subsequent records for the organization

- Current dividend (D0)

- Expected dividend increase charge (g)

- Required charge of go back (r)

Select the Appropriate DDM Model. Depending on the dividend boom characteristics of the corporation, pick from the distinct styles of DDM.

- Zero Growth DDM: Use if dividends are anticipated to stay steady.

- Gordon Growth DDM: Use if dividends are anticipated to develop at a consistent rate.

- Two-Stage DDM: Use if there are specific increase stages.

- Three-Stage DDM: Use if there are three wonderful boom stages.

Calculate the Stock’s Intrinsic Value apply the applicable DDM method to calculate the intrinsic cost of the inventory. Here’s a short on the formulation:

Zero Growth DDM:

P=Dr

Where

P is the rate of the inventory,

D is the once-a-year dividend, and

r is the required price of go back.

Gordon Growth DDM:

P=D1/(r-g)

Where

D1 is the anticipated dividend next year,

r is the specified fee of go back, and

g is the constant growth price.

Compare Intrinsic Value to Market Price after calculating the intrinsic value of the DDM, examine it to the present day marketplace price of the inventory. If the intrinsic value is higher than the marketplace fee, the stock may be undervalued and a terrific funding possibility. Conversely, if the intrinsic cost is decreased than the marketplace rate, the stock may be hyped up.

Consider Additional Factors while the DDM offers a quantitative measure of a stock’s price, taking into account other qualitative elements such as market conditions, monetary outlook, and employer-particular news. This holistic technique guarantees a greater informed investment selection.

Example

Let’s apply the Gordon Growth DDM to a hypothetical organization:

Current dividend (D0): $2.00

Expected dividend increase rate (g): five% or 0.05

Required fee of go back (r): 10% or zero.10

First, calculate the anticipated dividend subsequent 12 months, Next, observe the Gordon Growth DDM formula to get and 42.

So, the intrinsic price of the stock is $42. If the current market fee is $35, the stock is probably undervalued and a bargain.

The DDM is a useful device for valuing dividend-paying shares, especially people with strong and predictable dividends. By following the steps mentioned above, buyers can decide the intrinsic value of an inventory and make knowledgeable funding choices. Always recall supplementing the DDM with other analyses to account for marketplace situations and organization-unique factors.

How does DDM Work?

The Dividend Discount Model (DDM) is a way used to cost a business enterprise’s inventory based on the existing cost of its anticipated destiny dividends. The underlying principle of the DDM is that the cost of a stock is the sum of all future dividend payments, discounted returns to their present cost. Here’s a step-by-step explanation of the way the DDM works:

- Concept of Present Value

The DDM is based on the concept of present fee, which entails discounting destiny coins flows (dividends) to their cost these days. This accounts for the time fee of money, which posits that a greenback acquired today is worth more than a dollar obtained within the destiny because of its capacity earning ability.

- Dividends as Cash Flows

In the context of DDM, dividends are taken into consideration the coin flows generated by way of the stock. Investors purchase shares to get hold of these dividends, which could provide a steady income flow. The assumption is that dividends will remain paid and can be projected into the future.

- Discount Rate

The cut price (r) is a crucial element of the DDM. It represents the specified fee of go back that traders expect from the inventory. This rate is used to cut the future dividends back to their present price. The discount price can be influenced by factors which include the threat-free rate, the stock’s beta (a degree of its volatility relative to the marketplace), and the equity threat top class.

- Calculating Intrinsic Value

To calculate the intrinsic price of a stock using the DDM, observe these steps:

- Estimate Future Dividends: Forecast the dividends the organization is anticipated to pay inside the destiny. For the GGM, this includes estimating subsequent yr’s dividend and the increased price.

- Apply the Appropriate DDM Formula: Depending on the increased assumptions, use the applicable components to calculate the present value of the future dividends.

- Sum the Present Values: For fashions with more than one increase levels, sum the prevailing values of dividends from every phase to achieve the overall intrinsic price.

Example Using the Gordon Growth Model (GGM)

Consider a company that paid a dividend of $2.00 this yr. and is anticipated to grow dividends at five% according to year. If the desired rate of go back is 10%, the intrinsic cost (P) may be calculated as follows.

Estimate next year’s dividend and apply the GGM components. So, the intrinsic cost of the inventory is $42. If the modern-day market price is below this price, it is probably considered undervalued.

The DDM presents a scientific method to valuing dividend-paying shares by specializing in the present price of future dividends. By applying the proper DDM version based totally on dividend increase assumptions, traders can estimate an inventory’s intrinsic fee and make informed investment decisions.

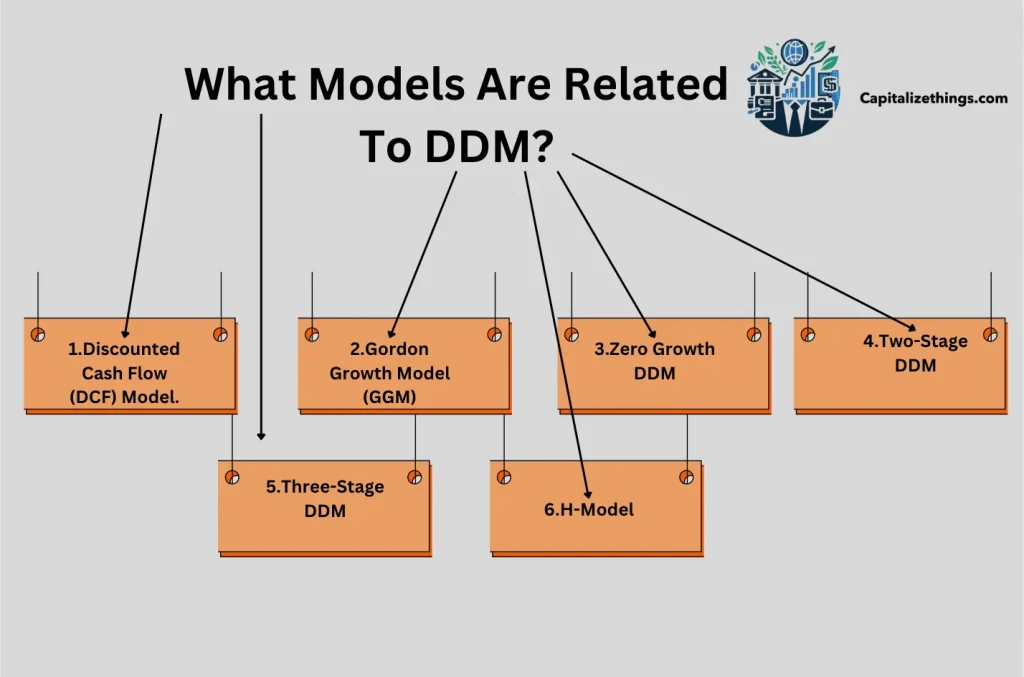

What Models Are Related To DDM?

The Dividend Discount Model (DDM) is related to following other models listed below that are used for financial stocks valuation and assessing the value of investments:

- Discounted Cash Flow (DCF) Model.

- Gordon Growth Model (GGM).

- Zero Growth DDM

- Two-Stage DDM

- Three-Stage DDM

- H-Model

- Discounted Cash Flow (DCF) Model: The DCF model estimates the overall value of a company by estimating the present value of its expected future cash flows. This includes all cash inflows, not just dividends.

- Gordon Growth Model (GGM): GGM Also called the steady-boom DDM, this version assumes that dividends will develop at a consistent price indefinitely. The method is P=D1/(r-g), in which D1 is the expected dividend subsequent year., r is the specified charge of go back, and g is the steady growth fee of dividends.

- Zero Growth DDM: This model assumes that dividends will continue to be consistent over the years. The system is P=Dr, where D is the yearly dividend and r is the discount fee. It is a simplified version of the DDM used whilst no increase in dividends is expected.

- Two-Stage DDM: This version money owed for 2 one of a kind boom levels. The first segment is a duration of excessive growth, observed by a 2nd phase of strong, decrease increase. It is beneficial for agencies anticipated to have varying increased fees over the years.

- Three-Stage DDM: Extending the Two-Stage DDM, this version includes 3 phases: a preliminary high-growth duration, a transitional length, and a final strong boom section. It is suitable for groups with complicated growth styles.

- H-Model: A version of the Two-Stage DDM, the H-Model assumes a sluggish decline inside the dividend increase rate over time. It begins with an excessive growth charge that declines linearly until it reaches a solid, lengthy-term boom charge.

These fashions provide unique techniques to valuing shares primarily based on predicted dividend bills, permitting traders to select the maximum appropriate method based on their assumptions about the destiny dividend boom.

What Are the Different Properties Of DDM?

The Dividend Discount Model (DDM) has several key properties which are vital for understanding how it works in valuing stocks. Here are the primary homes:

- Zero Growth DDM: When the boom price (g) is zero, the DDM simplifies to a formulation where the existing stock cost (P0) is the dividend (D1) divided by way of the required go back rate (r). The components is P0 = D1/r. This asset indicates that the dividend is capitalized, that means the inventory price is decided entirely with the aid of the dividend and the required return charge without thinking about increase.

- Estimating the Cost of Capital: The DDM can also be used to estimate the value of capital. By solving for the desired return fee (r), the formula becomes r=D1/p0+g. This equation helps buyers determine the price of return needed to justify the cutting-edge stock fee, given the anticipated dividends and their growth charge.

- Gordon Growth Model (GGM): The DDM is equivalent to the Gordon Growth Model (or Yield-plus-boom Model) when applied with a regular boom rate. The components for the GGM is P0=D1/(k-g), wherein P0 is the present stock cost, D1 is the predicted dividend consistent with share 365 days from now, g is the fee of growth of dividends, and K is the specified go back charge for the fairness investor. This version assumes that dividends will grow at a constant rate indefinitely and gives an honest manner to feed an inventory based totally on its anticipated destiny dividends and growth charge.

These properties illustrate the ability and software of the DDM in exceptional situations, from zero increase situations to estimating the price of capital and applying a regular boom version.

What Is the Difference Between DCF And DDM Model?

The main difference between Discounted Cash Flow (DCF) model and the Dividend Discount Model (DDM) is that both strategies are used to cost an organization, but they differ in their awareness and application.

The DCF version values an organization based on the existing fee of its predicted future coin flows. It considers all of the coin flows that an organization generates, along with working cash flows, capital expenses, and modifications in operating capital.

The DDM version values a business enterprise based totally on the prevailing cost of its expected future dividends. It focuses completely on dividends, if they represent the cash flows to shareholders. The DDM is great suited for companies with strong and predictable dividend payments.

Why Use DDM Instead Of DCF?

The reasons behind using DDM instead of DCF are based on following factors:

Dividend-Focused Investors: Investors who are commonly interested in the income generated from dividends may choose the DDM because it without delay values the stock primarily based on anticipated dividend payments.

Simplicity: The DDM is less difficult to apply for groups with a stable dividend policy, because it calls for fewer inputs and assumptions as compared to the DCF version.

Relevance for Certain Sectors: The DDM is useful for valuing agencies in sectors acknowledged for paying consistent dividends, together with utilities and patron staples.

What Is Constant Growth Dividend Discount Model DDM?

The Constant Growth Dividend Discount Model, additionally known as the Gordon Growth Model (GGM), is a method used to value a business enterprise’s inventory charge based totally on the assumption that dividends will grow at a constant rate indefinitely. This version is particularly useful for valuing mature agencies with solid and predictable dividend growth.

Assumptions

Constant Growth: The version assumes that dividends will develop at a regular charge forever, that is a reasonable assumption for mature corporations with a stable dividend coverage.

Application

The Constant Growth DDM is high-quality perfect for agencies that have a record of paying dividends and are expected to preserve paying and growing those dividends at a consistent charge. It is typically used within the valuation of software businesses, client staples, and other mature groups.

What Is the Multi-Stage Dividend Discount Model?

The Multi-Stage Dividend Discount Model (DDM) is a technique used to cost a company’s stock that includes different increase costs for dividends over distinctive periods. This model is greater bendy than the Constant Growth DDM (Gordon Growth Model) and is useful for groups which are predicted to revel in varying increase stages.

Types of Multi-Stage DDM

- Two-Stage DDM: This version assumes that dividends will develop at one rate for an preliminary length after which transition to a distinctive, commonly lower, fee indefinitely.

- Three-Stage DDM: This version includes 3 awesome phases: an initial high-boom section, a transition phase where increase charges steadily decline, and a final stable-boom segment.

Application of Multi-Stage DDM

The Multi-Stage DDM is especially useful for valuing companies which might be anticipated to undergo unique growth levels, consisting of startups transitioning to mature organizations or agencies in industries with fluctuating boom charges.

What Is the H Model Of Dividend Discount?

The H Model of Dividend Discount is a version of the Dividend Discount Model (DDM) designed to value agencies experiencing a sluggish transition from excessive increase to stable increase. It gives a greater realistic method for groups that are not predicted to shift from an excessive increase phase to a stable boom segment.

The H Model is specifically useful for valuing groups which might be expected to regularly shift from an excessive growth section to a stable boom section, which includes generation companies transitioning to greater mature industries.

What Is the 25% Dividend Rule?

The 25% Rule in dividend making an investment is a guiding principle suggesting that no more than 25% of a commercial enterprise employer’s net income must be paid out as dividends. This rule permits make certain that an enterprise business continues sufficient profits to reinvest in its increase and maintain monetary balance.

Key Points of 25% Dividend Rule

- Dividend Payout Ratio: The rule implies a conservative dividend payout ratio. A payout ratio of 25% means that for each greenback of net profits, the employer distributes $0.25 as dividends and keeps $0.75.

- Sustainability: By restricting the dividend payout, the commercial enterprise corporation can keep enough cash reserves to weather financial downturns and spend money on growth opportunities.

- Growth vs. Income: This rule balances the goals of earnings-looking for customers with the ones of boom-targeted traders. It guarantees that dividends are paid without compromising the business enterprise’s destiny to increase prospects.

- Risk Management: Following the 25% rule can help mitigate the chance of dividend cuts throughout periods of lower earnings.

Investors use the 25% Rule to assess the sustainability of an agency’s dividend insurance. A corporation adhering to this rule is probably to have a solid and sustainable dividend payout, making it an attractive desire for conservative dividend traders.

How To Value a Stock Using The Dividend Discount Model?

The Dividend Discount Model (DDM) values an inventory by way of calculating the existing price of expected future dividends. This model assumes that the price of a stock is the sum of all its destiny dividends, discounted back to their present cost.

Steps to Value a Stock Using DDM

- Estimate Future Dividends: Forecast the expected dividends that the organization pays in the future. This may be based on ancient dividend bills, organization increase costs, and payout regulations.

- Determine the Required Rate of Return (r): This is the return that buyers count on to get hold of from the inventory. It can estimate the usage of the Capital Asset Pricing Model (CAPM) or other techniques that take into account the threat-free price, the inventory’s beta, and the marketplace risk top class.

- For the Multi-Stage DDM: Calculate the existing value of dividends during the excessive-growth period one by one from the solid increase length and sum them up.

- Calculate Present Value: Discount the destiny dividends returned to their gift value using the specified fee of return.

- Sum the Present Values: Add up the present values of all future dividends to get the inventory’s intrinsic cost.

What Is the Discounted Dividend Model for Banks?

The Discounted Dividend Model (DDM) for banks follows the same primary standards because the DDM for other companies however takes under consideration the elements of the banking enterprise. Banks regularly have more strong dividend payout guidelines and one-of-a-kind regulatory and economic factors influencing their boom charges.

Key Considerations for Banks

- Stable Dividends: Banks typically pay regular and predictable dividends due to regulatory necessities and the character of their income.

- Regulatory Environment: Banking regulations can affect dividend payouts and increase charges. These policies need to be factored into the DDM evaluation.

- Growth Rates: Banks’ growth rates can be prompted with the aid of monetary cycles, interest fees, and regulatory adjustments. Analysts regularly use conservative increase costs for banks because of their exposure to these factors.

Applying DDM to Banks to price a bank the usage of the DDM:

- Estimate Future Dividends: Forecast the financial institution’s future dividends based totally on its historic dividend payments, earnings, and payout ratios.

- Determine the Required Rate of Return (r): This can be derived from the usage of the CAPM or other models, considering the chance associated with the banking region.

- Use the DDM Formula: Apply the Gordon Growth Model or a Multi-Stage DDM if the financial institution’s dividends are predicted to grow at extraordinary charges over one-of-a-kind durations.

- Adjust for Risk Factors: Incorporate any bank-particular chance factors, inclusive of exposure to financial downturns or changes in regulatory guidelines, into the required rate of go back.

What is the DDM of a REIT?

The Dividend Discount Model (DDM) for Real Estate Investment Trusts (REITs) is a valuation approach that assesses the value of a REIT’s inventory based on the prevailing charge of its expected destiny dividends. REITs are specific because of the fact they’re required with the aid of using regulation to distribute at least 90% of their taxable income as dividends, making them appropriate for DDM evaluation.

The DDM for a REIT evaluates the cost of the REIT’s stocks via discounting the projected destiny dividends returned to their present fee. This version is especially useful for REITs because of their attention on imparting consistent income to traders through dividends.

The DDM system for a REIT is much like the general Dividend Discount Model however often uses a steady boom assumption:

P0 = D1/(r-g)

in which

P0 = Present cost of the REIT’s stock

D1 = Expected dividend subsequent year

r = Required fee of return

g = Dividend growth rate

Example

Assume a REIT is expected to pay a dividend of $four in keeping with the percentage of the subsequent year, with a regular growth price of three% and a required charge of return of 8%. Using the Gordon Growth Model. The intrinsic cost of the REIT’s stock is $80 per share.

Drawbacks of Using DDM for REITs

- Growth Assumptions: The version assumes a regular boom price for dividends, which won’t correctly reflect the real-global volatility or converting boom fees of REITs.

- Dividend Cuts: If a REIT experiences economic problems, it may lessen or get rid of dividends, which could affect the accuracy of the version.

- Economic Sensitivity: REITs may be affected by monetary situations, hobby rates, and belongings market fluctuations, which won’t be absolutely captured by means of a simple dividend discount technique.

What is the 90% rule for REITs?

The 90% rule for Real Estate Investment Trusts (REITs) is a regulation requiring REITs to pay at least 90% of their taxable earnings to shareholders in the form of dividends. This rule is one of the requirements that an organization must fulfill in order to be classified as a REIT under the United States Internal Revenue Code.

Key Points of the 90% Rule

- Tax Advantages: By complying with the 90% rule, REITs avoid paying company earnings taxes at the federal stage. Instead, the tax burden is exceeded directly to shareholders who pay taxes at the dividends they get hold of.

- Income Distribution: This rule ensures that a large part of a REIT’s earnings is again to traders, supplying a consistent earnings stream.

- Qualification Requirement: Meeting the 90% distribution requirement is one of several criteria a business enterprise wants to fulfill to preserve its fame as a REIT. Other requirements include having at least seventy five% of its belongings in actual assets and deriving as a minimum 75% of its gross earnings from actual assets-related assets.

The 90% rule for REITs is a critical regulatory requirement that guarantees these entities distribute the bulk of their profits to investors, fostering a dependable profits supply while keeping tax overall performance. However, it additionally poses challenges by manner of proscribing the REIT’s capability to keep profits for growth and enlargement.

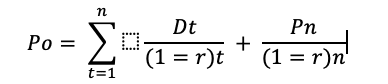

What is the formula for Dividend Discount Model(DDM)?

The trendy formulation for the DDM is:

P0 = ∑^∞(t=1) = Dt/((1+r)t)

in which:

P0 = present value of the stock

Dt = dividend in time period

r = discount fee or required rate of go back

Variations

Gordon Growth Model (GGM)

The Gordon Growth Model assumes that dividends will develop at a constant charge indefinitely. The components is:

Po = D1/(r-g)

in which:

D1 = anticipated dividend in the next 12 months

g = constant growth rate of dividends

r = required rate of return

This version is useful for businesses with stable, predictable dividend growth quotes.

One-Period Dividend Discount Model

The One-Period DDM values a stock primarily based on the dividends anticipated to be received over an unmarried period plus the stock price anticipated at the end of that length. The method is:

Po = (D1+ P1)/(1+r)

in which:

P1 = predicted stock charge on the quit of the duration

This version is useful for short-term investors seeking to value a stock over a single period.

Multi-Period Dividend Discount Model

The Multi-Period DDM considers dividends over a couple of periods and sums their present values. The components is:

in which:

This version is useful for lengthy-term buyers who want to not forget multiple periods of dividends and the ability stock rate at the stop of the funding horizon.

The DDM and its variations are effective tools for valuing dividend-paying stocks, each applicable to distinctive funding horizons and boom assumptions.

What is the formula for constant growth rate of DDM?

The Constant Growth Dividend Discount Model (DDM), also called the Gordon Growth Model, is used to cost an inventory that is expected to develop its dividends at a regular fee indefinitely. This version assumes that dividends will boom at a fixed fee every year, making it beneficial for groups with predictable and solid dividend increase.

The formulation for the Constant Growth DDM is:

Po = D1/(r-g)

where:

Po = modern stock fee

D1 = predicted dividend within the subsequent 12 months

r = required price of go back (bargain price)

g = consistent increase fee of dividends

Example

Suppose an organization is anticipated to pay a dividend of $five subsequent 12 months (D_1), and the dividends are expected to grow at a charge of 4% according to 12 months (g). If the desired fee of go back is 8% (r), the inventory fee may be calculated. So, the current stock rate is $one hundred twenty five.

Benefits

- Simplicity: The version is simple and easy to apply, making it suitable for investors who choose a simple valuation approach.

- Predictability: It works properly for businesses with solid dividend increase records, imparting a clean valuation based totally on predicted future dividends.

Risks

- Assumption of Constant Growth: The model assumes dividends will grow at a constant rate for all time, which might not be realistic for organizations with variable increase rates.

- Sensitivity to Inputs: Small modifications within the boom charge or required return can notably influence the calculated stock charge, leading to potential inaccuracies.

The Constant Growth DDM is a useful device for valuing dividend-paying shares with solid increase, but it has barriers in instances of variable or unpredictable dividend growth.

How to calculate dividend growth model in Excel?

To calculate the Dividend Growth Model in Excel, comply with these steps:

- Open Excel and Set Up Your Spreadsheet

- Enter Initial Data

- Calculate Future Dividends

- Calculate Stock Price Using the Gordon Growth Model

- Open Excel and Set Up Your Spreadsheet:

- Open a new Excel workbook.

- Create column headers for “Year,” “Dividend,” and “Stock Price.”

- Enter Initial Data:

- In cellular A2, input the first year (e.G., “Year 1”).

- In cell B2, input the cutting-edge dividend quantity (e.G., “$2.00”).

- In cell C2, enter the increased fee of the dividend (e.G., “four%” or “0.04”).

- Calculate Future Dividends:

- In mobile A3, input the following 12 months (e.G., “Year 2”).

- In cell B3, use the components to calculate the dividend for Year 2 quick

- Drag the fill deal with (a small rectangular at the lowest-proper corner of the mobile) all the way down to fill in future years’ dividends.

- Calculate Stock Price Using the Gordon Growth Model:

- In cellular D2 (or some other cellular where you need the stock fee), input the components for the Gordon Growth Model.

- For an extra accurate version, you can upload additional rows for multiple years of dividends and calculate the present price of each dividend.

How to do a DDM valuation?

The Dividend Discount Model (DDM) values an inventory based totally on the present fee of its predicted destiny dividends. Here’s how you may perform a DDM valuation. Identify the anticipated dividends for each year. You can use historic dividend records and future dividend growth estimates. Select the Appropriate DDM Model. Gordon Growth Model (Constant Growth Model): For companies with dividends developing at a regular charge. Two-Stage or Multi-Stage Models: For companies with changing growth charges. Calculate the Present Value of Dividends. For the Gordon Growth Model:

P0 = D1/(r-g)

wherein:

P0 = Stock price

D1 = Dividend anticipated next yr

r = Required fee of go back

g = Growth fee of dividends

For a Multi-Stage Model:

Calculate the present value of dividends at some stage in the high-boom segment. Calculate the prevailing fee of dividends for the duration of the stable boom phase. Add the prevailing values of both stages. Sum the Present Values. Add the existing values of all destiny dividends to determine the intrinsic fee of the stock.

How to calculate terminal value for DDM?

The terminal price represents the value of the inventory beyond the express forecast length, assuming a regular boom price. Here’s the way to calculate it:

- Estimate the Dividend at the End of the Forecast Period.

- Use the dividend increase charge to estimate the dividend for the first year after the forecast length.

- Apply the Gordon Growth Model.

- Discount the Terminal Value to Present Value.

What is the Formula for Gordon Dividend Growth Rate?

The Gordon Growth Model, also called the Constant Growth Dividend Discount Model, is used to decide the intrinsic price of a stock based totally on a series of dividends that develop at a consistent fee indefinitely.

The method for the Gordon Growth Model is:

P0=D1/(r-g)

where:

P0 = Current inventory fee

D1 = Dividend predicted next yr

r = Required fee of return

g = Growth charge of dividends

Suppose a enterprise is anticipated to pay a dividend of $4 next year, the increase fee of dividends is 6%, and the desired price of go back is 10%. The intrinsic value of the stock is calculated, and the intrinsic value of the inventory is $ 1 hundred.

Benefits

- Simple to apply and understand.

- Useful for businesses with stable and predictable dividend increase prices.

Risks

- Assumes a consistent boom charge, which won’t be realistic for all agencies.

- Sensitive to the estimates of the boom price and required rate of return.

How do you Calculate the Cost of Equity using the Dividend Discount Model?

The value of fairness represents the return that buyers require for investing in a company’s fairness. Using the Dividend Discount Model, it is able to be anticipated by fixing for the required charge of go back r.

The formulation to calculate the fee of equity the use of the Dividend Discount Model is:

r= D1/Po+g

wherein:

r = Cost of equity

D1 = Dividend expected subsequent year

P0 = Current inventory charge

g = Growth fee of dividends

If an enterprise’s present day stock rate is $50, it’s far expected to pay a dividend of $3 next yr., and the growth fee of dividends is five%, the value of fairness is calculated. Then, the value of fairness is eleven%.

Benefits

- Provides a straightforward way to estimate the cost of equity.

- Incorporates both dividend payments and growth expectancies.

Risks

- Relies on the accuracy of dividend forecasts and increase rates.

- May now not be suitable for corporations that do not pay ordinary dividends or have risky dividend regulations.

This video shared below is a practical example of calculation the cost of equity using the dividend discount model.

What are the Problems/Drawbacks with Constant Dividend Growth Form of Model?

The drawbacks with constant dividend growth are following:

- Assumption of Constant Growth: The version assumes that dividends will develop at a consistent charge indefinitely, which won’t be practical for lots of companies, mainly those in volatile or hastily changing industries.

- Applicability: It is particularly applicable to mature groups with stable dividend growth. Companies with abnormal or no dividend payments can’t be as it should be valued the usage of this version.

- Sensitivity to Estimates: The model is distinctly touchy to the predicted growth charge and required fee of go back. Small adjustments in those inputs can considerably impact the valuation.

- Ignore Non-Dividend Factors: It does not account for different methods in which an employer would possibly create fees, together with through stock buybacks or reinvestment into the enterprise.

What are the Advantages of the Dividend discount Model(DDM)?

The benefits of dividend discount model are given below:

- Theoretical Soundness: The DDM is grounded in a stable monetary concept, offering a clean intent for valuing shares primarily based on predicted future dividends.

- Focus on Cash Flows: It focuses on dividends, which are real coins flows to the investor, making it a more concrete degree of fee as compared to a few different models.

- Simplicity: The model is highly simple to apply and recognize, making it accessible for many traders and analysts.

- Stability Indication: Companies that match properly with the DDM are usually solid, mature companies with a record of consistent dividend payments, indicating a certain stage of economic stability.

Why use DDM instead of DCF?

The reason behind using DDM instead of DCF is that DDM values a stock by assuming the fee is the present fee of all future dividends expected to be paid via the agency. This model is easy and at once ties stock value to dividend payments, making it particularly appropriate for corporations with a stable dividend coverage.

The DCF model values a stock by way of estimating the existing price of its anticipated destiny cash flows, which includes each operating coin flows and terminal fee. It is more complete than DDM because it considers all aspects of an agency’s financial performance.

Reasons to Use DDM Over DCF:

- Simplicity: DDM is easier to apply as it focuses totally on dividends, averting the complexity of forecasting coin flows and terminal values.

- Direct Cash Flow to Shareholders: DDM ties the cost without delay to the coins flows shareholders acquire, making it extra tangible for valuing dividend-paying shares.

- Stability: It is especially useful for valuing mature, solid organizations with predictable dividend bills.

Why might a dividend discount model be flawed when using to value equity?

DDM assumes a steady dividend growth charge, which won’t be practical for corporations with fluctuating earnings and dividend regulations. The model is confined to corporations that pay ordinary dividends, except for companies that reinvest profits or have irregular dividend policies. Sensitivity to Estimates: Small changes in boom rate and bargain price estimates can appreciably affect the valuation, making it less reliable.

What is the difference between GGM and DDM?

The major difference between GGM and DDM is that GGM is a particular type of DDM, the GGM assumes that dividends will develop at a regular rate indefinitely. A broader version that values an inventory primarily based on the present value of all destiny dividends. It may be adapted for a couple of boom intervals or levels, no longer simply regular increase.

Key Differences:

- Scope: DDM can cope with a couple of increased rates and ranges, while GGM is constrained to a constant boom fee.

- Application: GGM is a simplified version of DDM, suitable for strong businesses with predictable increase, at the same time as DDM can be used for greater complicated situations.

Can the Dividend Discount Model Be Used to Value Startups?

The Dividend Discount Model (DDM) is regularly wrong for comparing startups. This is because the DDM is totally predicated on the notion that an organization would offer regular, predictable dividends, that is regularly now not the case for startups.

Reasons Why DDM is Unsuitable for Startups:

- Lack of Dividends: Startups regularly reinvest all their profits again into the business enterprise to fuel growth in place of paying dividends to shareholders. The DDM calls for a history of dividend payments, which startups generally do not have.

- Unpredictable Growth: Startups generally enjoy volatile and unpredictable growth costs. The DDM assumes a solid, regular boom rate in dividends, which does not align with the excessive-growth, excessive-uncertainty nature of startups.

- Early-Stage Investment: Beginners in investment have to notice that early-degree businesses are valued based on ability, destiny cash flows, market possibilities, and revenue increase rather than cutting-edge dividend payments.

Alternatives for Valuing Startups:

- Discounted Cash Flow (DCF): This method estimates the prevailing fee of anticipated future cash flows, making it more adaptable to companies without a history of dividends.

- Comparable Company Analysis: Comparing the startup to comparable corporations inside the enterprise can provide a benchmark for valuation.

- Venture Capital Method: This technique involves estimating the future go out value of the startup and discounting it returned to the prevailing fee.

- Using DDM for startups isn’t always practical due to the lack of dividends and the unpredictable nature of early-stage agencies. Beginners investors ought to remember alternative investment valuation techniques higher proper to the traits of startups.

What are the alternative Models to Dividend Discount Model?

The 5 alternative models to dividend discount model are:

- Discounted Cash Flow (DCF) Model.

- Comparable Company Analysis (CCA)

- Precedent Transactions Analysis

- Asset-Based Valuation

- Gordon Growth Model (GGM)

1. Discounted Cash Flow (DCF) Model:

Estimates the cost of a funding based totally on its expected future cash flows, discounted again to their present cost. Used widely for valuing groups that might not pay dividends but have predictable future cash flows.

2. Comparable Company Analysis (CCA):

Values an employer based at the valuation multiples of similar agencies in the same enterprise. Useful for benchmarking and providing a marketplace-primarily based valuation.

3. Precedent Transactions Analysis:

Values a company primarily based on the charges paid for similar agencies in past transactions.

4. Asset-Based Valuation:

Values an organization based at the net value of its belongings, subtracting liabilities. Often used for companies with significant tangible property, like actual property or manufacturing corporations.

5. Gordon Growth Model (GGM):

Gordon growth model is a version of the DDM that assumes dividends grow at a steady rate indefinitely. Suitable for mature groups with stable dividend increase costs.

Can We Use Investment Valuation Techniques In DDM Models?

Yes, investment valuation techniques can be included into DDM models to enhance their accuracy and applicability. For example, the assumptions and projections used in DCF fashions (like future coin flows and discounts) can inform the inputs of a DDM. Additionally, comparable agency statistics and marketplace traits can be used to validate the boom costs and required returns used inside the DDM.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.