Gold investment Companies assist people and businesses in investing in gold and other valuable metals. These companies acquire, sell, and store gold and offer gold-backed IRAs and other financial products. Goldco is the finest gold investment company in the USA due to its strong track record, ratings, and instructional content. As of April 26, 2024, the company has an A+ BBB rating, AAA Business Consumer Alliance rating, and 4.7 Trustpilot rating. An Inc 5000 Award as a Fastest Growing Private Company for seven years is another honor. The American Business Awards named it 2022 Company of the Year.

Gold bullion refers to any certified form of pure or nearly pure gold. It includes gold coins, bars, and different kinds of any size. Gold bars have serial numbers for security. Gold IRAs are alternative individual retirement accounts for people who desire to retain precious metals like gold. Your gold IRA custodian secures and manages the actual gold. The IRA balance changes when you buy and sell gold and its value changes.

Gold investments include physical gold. You can purchase a proportional amount of gold without physical gold. The investment is in bullion and gold mining firms. No Demat account is needed. A gold IRA lets you hold gold Bullion and enjoy traditional retirement account tax benefits. We don’t suggest this form of IRA for most investors. None of the largest, most renowned brokerage firms offer gold IRAs. If you need a gold IRA, we’ve listed the top possibilities. Remember that even the finest investments for retirement could be better.

The Gold Mining policies define responsible gold mining. We are glad to have worked with the ICMM to establish an equivalence table that indicates our frameworks are highly aligned with other mining industry standards. Companies utilizing both frameworks will benefit from efficient implementation and assurance. It will also help investors, customers, and other stakeholders who are rightfully interested in miners’ responsible mining practices.

What is a gold investment company?

Gold Investment Company buys gold directly or through equities, futures, and gold-backed ETFs. The yellow metal has intrinsic worth and retains its purchasing power. Gold has historically hedged inflation & market volatility. Many investors choose gold as a “haven” during financial and geopolitical upheaval.

What are the top-rated gold investment companies in the USA?

10 top-rated gold investment companies in the USA are:

- Silver Gold Bull

- JM Bullion

- Allegiance Gold

- Lear Capital

- Orion Metal Exchange

- American Bullion

- Birch Gold Group

- Apmex

- Goldco

- American Hartford Gold

What is the most trusted gold company?

Augusta Precious Metals is the most trusted gold firm for many reasons. Its excellent reputation, large assortment of high-quality products, outstanding customer service, and commitment to honesty and integrity make it a fantastic option for investors. Augusta Precious Metals can assist you invest in gold and silver bullion, open a precious metals IRA, or learn about their benefits.

Investing in valuable metals is a big decision, so choose Augusta Precious Metals to protect and manage it. Augusta Precious Metals’ education, customized service, and ethical business methods make it the industry leader.

Are 1 oz gold bars a good investment?

Yes! 1 oz gold bars are a good investment. 1-ounce bars are cheaper than larger bars or quality numismatic coins. This cost democratizes gold ownership, leaving it accessible to more investors.

What are the most trusted gold investment companies in the USA?

The 5 most trusted gold investment companies in the USA:

- Augusta Precious Metals

- Noble Gold

- Goldco

- Advantage Gold

- Patriot Gold Group

- Augusta Precious Metals

Augusta Precious Metals’ clients pay less and know what they’re getting. For straightforward pricing, Augusta is our top gold IRA Company.

- Noble Gold

Noble Gold is our top gold IRA business for new investors due to its low commitment and rich instructional materials.

- Goldco

Our gold IRA firm with the most outstanding customer support is Goldco because its account reps go above and beyond to give prospective and current clients the data they need to make a decision.

- Advantage Gold

Advantage Gold is the most significant gold IRA firm for first-time buyers because of its low minimum investment, cheap fees, and extensive instructional resources.

- Patriot Gold Group

Patriot Gold Group provides competitive, investor-direct pricing that eliminates gold, platinum, silver, and palladium bullion and coin fees.

What are the top 3 gold investment companies in the Northeast of the USA?

The Top 3 investment companies in the northeast of the USA, which includes states like New York, New Jersey, Pennsylvania, Massachusetts, and the New England states (Connecticut, Rhode Island, New Hampshire, Vermont, and Maine), are:

- Rosland Capital

- JM Bullion

- Apmex

What are the top 3 gold investment companies in the Midwest of the USA?

The Top 3 investment companies in the Midwest of the USA which include the states Often referred to as the “heartland,” this contain states like Ohio, Indiana, Illinois, Michigan, Wisconsin, Minnesota, Iowa, Missouri, and the Dakotas:

- Blanchard and Company, Inc.

- Goldline

- Midwest Bullion Exchange

What are the top 3 gold investment companies in Southeast of USA?

The Top 3 investment companies in the Southeast of the USA, which includes states like Virginia, West Virginia, Kentucky, Tennessee, North Carolina, South Carolina, Florida, Alabama, Georgia, Mississippi, and sometimes Arkansas and Louisiana, are:

- Augusta Precious Metals

- Regal Assets

- American Bullion

What are the top 3 gold investment companies in Southwest USA?

The Top 3 investment companies in the Southwest of the USA, which includes states like Texas, Oklahoma, New Mexico, and Arizona, are:

- Noble Gold Investments

- Goldco

- Birch Gold Group

What are the top 3 gold investment companies in the Mid-Atlantic of the USA?

The Top 3 investment companies in the Mid-Atlantic of the USA, which includes states like New York, Pennsylvania, New Jersey, Delaware, Virginia, Maryland, and West Virginia, are:

- Monex

- Advantage Gold

- Gold Alliance

What are the top 3 gold investment companies in the Mountain States of the USA?

The Top 3 investment companies in the Mountain States of the USA, which include states like Montana, Idaho, Wyoming, Colorado, Utah, Nevada, Arizona, and New Mexico, are:

- GoldSilver

- Oxford Gold Group

- APMEX

What are the top 3 gold investment companies in the Pacific States of the USA?

The Top 3 investment companies in the Pacific States of the USA, which includes states like California, Oregon, Washington, and sometimes Alaska and Hawaii, are:

- Golden State Mint

- Patriot Gold Group

- Provident Metals

What are the top 3 gold investment companies in the Pacific Northwest of the USA?

The Top 3 investment companies in the Pacific Northwest of the USA, which includes states like Washington, Oregon, and sometimes Idaho and Alaska, are:

- Northwest Territorial Mint

- Provident Metals

- CoinsPlus

What are the top 3 gold investment companies in the Deep South of the USA?

The Top 3 investment companies in the Deep South of the USA, which includes states like Georgia, Alabama, South Carolina, Mississippi, and Louisiana:

- Advantage Gold

- Goldco

- JM Bullion

What are the top 3 gold investment companies in the Great Plains of the USA?

The Top 3 investment companies in the Great Plains of the USA, which includes states like North Dakota, Nebraska, South Dakota, Kansas, and Oklahoma, are:

- American Precious Metals Exchange (APMEX)

- Asset Strategies International

- Midwest Bullion Exchange

What is IRA gold?

Specialized individual retirement accounts (IRAs) allow investors to hold gold as an eligible retirement investment. The best gold IRAs allow investors to hold Bullion, coins, and precious metals-related assets. A gold IRA must be carried separately from a typical retirement account, but contribution and distribution requirements are the same. Broker-dealers and custodians provide gold IRAs.

What are the top 5 gold IRA companies?

The top 5 gold IRA companies are:

- Silver Gold Bull

- JM Bullion

- Allegiance Gold

- Lear Capital

- Orion Metal Exchange

- Silver Gold Bull

The company Silver Gold Bull is Canadian and was founded in 2009. A Las Vegas branch is part of a small corporation with 50 employees. The company has grown effectively.

- JM Bullion

JM Bullion, a famous gold broker-dealer, and IRA provider launched in 2011. For 2023, the corporation processed over $10 billion in revenues. It sells gold coins and bars and stores gold with TDS Vaults.

- Allegiance Gold

Inc. recognized California-based Allegiance Gold as a top precious metals dealer and one of the fastest-growing private enterprises in the nation. Full-service metal dealer sells palladium, gold, silver, and platinum. Items can be bought directly or through IRAs.

- Lear Capital

Lear Capital began trading precious metals in 1997. Individuals like Glenn Beck advocate the Los Angeles-based company. The organization offers free coin setup and storage and cheap annual and maintenance expenses.

- Orion Metal Exchange

Orion Metal Exchange is a top California precious metals dealer. Founded in 2017, it sells gold, palladium, platinum, and silver. A reduced premium above American Gold Eagle, coin spot prices, offset its high investment requirement.

Who is the best gold IRA custodian?

The best gold IRA custodian is American Bullion, founded in 2009 in California. Consumers can buy coins, gold, and other valuable metals from IRAs. American Bullion’s minimal premium over the spot cost of American Gold Eagle coins and minimum IRA pricing set it apart from its competitors. At $125 per year, its fees are cheaper than typical. Customer evaluations are high, and special deals may make the company more affordable than its competitors.

Is the free gold IRA kit legit?

Yes! The gold IRA kit is legit. It educates potential investors regarding IRA precious metal investments. Choose a company based on openness, customer service, and reputation.

What is the gold IRA program?

A gold IRA program is a different kind of individual retirement account made for people who want to save money for retirement by investing in rare metals like gold. The actual gold is not kept in an account that you can visit. Instead, the custodian of your gold IRA holds and manages the gold.

Is a gold IRA tax-free?

No! Gold IRA is not tax-free. They offer tax incentives for retirement savings. They also pay taxes. Different taxes apply to each of the three gold IRAs.

What are the pros and cons of a gold IRA?

Gold IRAs have benefits and drawbacks you should consider before investing.

| Pros | Cons |

|---|---|

| Portfolio diversification | Liquidity concerns |

| Tax advantages | Costs and fees |

| Holding precious metals physically secure | Regulatory considerations |

What are the top 3 IRA gold investment companies in the Northeast of the USA?

The Top 3 IRA gold investment companies in the Northeast of the USA, which include states like New York, New Jersey, Pennsylvania, and Massachusetts, and the New England states (Connecticut, Rhode Island, New Hampshire, Vermont, and Maine), are:

- Fidelity Investments

- Rosland Capital

- Goldco

What are the top 3 IRA gold investment companies in the Midwest of the USA?

The top 3 IRA gold investment companies in the Midwest of the USA, which include states like Ohio, Indiana, Illinois, Michigan, Wisconsin, Minnesota, Iowa, Missouri, and the Dakotas, are:

- GoldStar Trust Company

- Advantage Gold

- New Direction IRA

What are the top 3 IRA gold investment companies in Southeast Asia?

The top 3 IRA gold investment companies in the Southeast of the USA which include the states like Virginia, West Virginia, Kentucky, Tennessee, North Carolina, Florida, South Carolina, Georgia, Alabama, Mississippi, and sometimes Arkansas and Louisiana:

- Augusta Precious Metals

- Regal Assets

- American Hartford Gold

What are the top 3 IRA gold investment companies in Southwest USA?

The top 3 IRA gold investment companies in the Southwest of the USA, which includes states like Texas, Oklahoma, New Mexico, and Arizona:

- Noble Gold Investments

- Goldco

- Birch Gold Group

What are the top 3 IRA gold investment companies in the Mid-Atlantic of the USA?

The top 3 IRA gold investment companies in the Mid-Atlantic of the USA, which include states like New York, Pennsylvania, New Jersey, Delaware, Maryland, Virginia, and West Virginia, are:

- Gold Alliance

- Monex

- Advantage Gold

What are the top 3 IRA gold investment companies in the Mountain States of the USA?

The top 3 IRA gold investment companies in the Mountain States of the USA, which include states like Montana, Idaho, Wyoming, Colorado, Utah, Nevada, Arizona, and New Mexico, are:

- Oxford Gold Group

- GoldSilver

- Birch Gold Group

What are the top 3 IRA gold investment companies in the Pacific States of the USA?

The top 3 IRA gold investment companies in the Pacific States of the USA, which include states like Washington, Oregon, and sometimes Idaho and Alaska, are:

- Regal Assets

- Patriot Gold Group

- GoldSilver

What are the top 3 IRA gold investment companies in the Pacific Northwest of the USA?

The top 3 IRA gold investment companies in the Pacific Northwest of the USA, which includes states like California, Oregon, Washington, and sometimes Alaska and Hawaii, are:

- Northwest Territorial Mint

- Regal Assets

- Provident Metals

What are the top 3 IRA gold investment companies in the Deep South of the USA?

The top 3 IRA gold investment companies in the Deep South of the USA, which includes states like Georgia, Alabama, South Carolina, Mississippi, and Louisiana, are:

- Augusta Precious Metals

- American Hartford Gold

- Goldco

What are the top 3 IRA gold investment companies in the Great Plains of the USA?

The top 3 IRA gold investment companies in the Great Plains of the USA, which includes states like North Dakota, South Dakota, Nebraska, Kansas, and Oklahoma, are:

What is physical gold?

Gold that you can hold in your hands, like coins, bars, and jewelry, is called “physical gold.” On the other hand, “paper gold” is gold that you own on paper or online.

How do I start buying physical gold?

To start buying physical gold, follow the given procedure:

- Research trustworthy sellers or dealers. Find merchants with a good reputation for honesty, reliability, and fair pricing.

- To avoid high gold premiums, compare dealer prices and buy precious metal bars or coins at reduced premiums over the gold spot price.

- Larger gold purchases can lower the premium per ounce. Consider your financial capabilities and secure storage choices for larger quantities.

- Choose a safe gold storage solution. Bank private vaults, safe deposit boxes, and home safes are options. Choose a secure storage option that is resistant to theft, damage, and natural calamities.

- Consider protecting your gold from theft, loss, and destruction. Many storage facilities offer insurance, or you can buy gold insurance separately.

- Store large amounts of gold in multiple locations to reduce risk. This decreases the risk of losing all your gold to theft or other calamities.

- Keep up with gold price trends and factors. Geopolitical events, economic indices, and monetary policy choices affect gold demand and value.

- Avoid selling gold at low demand or reduced prices. Monitor market circumstances and sell when prices are reasonable. Sell to trusted dealers or online platforms to optimize returns.

- Sell gold with transaction fees in mind. Consider commissions or fees from dealers when buying back gold when selling.

- For tax reasons and a paper trail, keep meticulous gold buy and sale records.

Can you make money on physical gold?

Yes! You can make money on physical gold. Although investors aim to protect their investments, gold can be traded like stocks and shares to gain money. However, earning money from gold requires patience rather than quick trade.

Is physical gold hard to sell?

No! Physical gold is relatively easy to sell. The problem is that there are a lot of options for people who are interested in selling their gold, and they’ll get a different price from each one. You really have to do your make enquiries and learn the value of your gold before trying to find a buyer. You also typically lose an amount of what you paid for your gold if you buy it and then try to sell it.

What is the best way to trade physical gold?

Trusted dealers and online platforms sell precious metals and coins if you desire actual ownership. Gold ETFs, mining stocks, and futures contracts offer exposure without ownership.

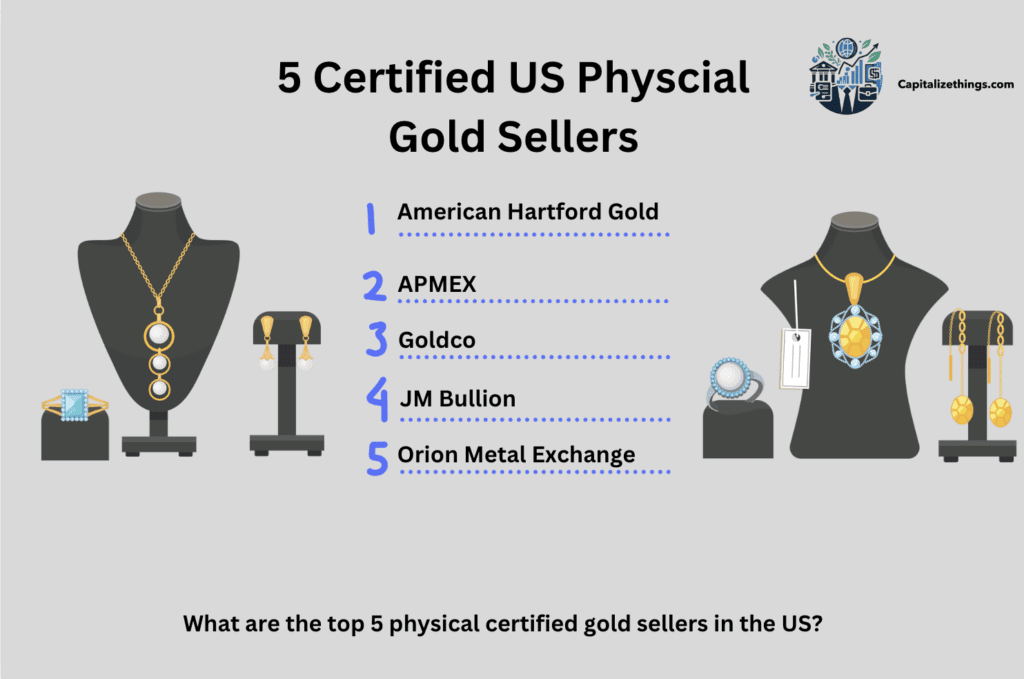

What are the top 5 physical certified gold sellers in the US?

The top 5 physical certified gold sellers in the US are:

- American Hartford Gold

- APMEX

- Goldco

- JM Bullion

- Orion Metal Exchange

How to invest in gold in the USA?

To invest in gold in the USA, You can approach direct gold investors. Direct gold investors can buy the physical metal, stocks of a mutual or exchange-traded fund (ETF) that mimics gold, or commodities futures and options. Advanced investors use gold futures options, while average investors acquire gold coins from the most trustworthy online gold dealers.

Should a beginner investor invest in gold?

Yes! Even beginner investors can invest in gold. Owning some gold is one method of diversifying your portfolio (experts normally recommend limiting it to 5 to 10 percent). If you want to invest in gold, think about connecting with a financial advisor who will help you choose how to include it in your general investment strategy.

Can you buy gold in the US from a bank?

Yes! Americans can buy gold and silver coins from some banks. This may be an intelligent option for investors who want federal regulation.

Is gold a good investment?

Yes! Gold is a good investment. Those looking to diversify, hedge against inflation, and protect their assets during economic uncertainty may benefit from investing in gold. Gold’s longevity and safe-haven status make it a good investment, especially in tumultuous markets.

What is the best gold investment for beginners?

Beginners should prioritize mutual funds and ETFs. Each share of these securities reflects a specific quantity of gold, and you may easily trade them in your brokerage or retirement account.

How to invest in digital gold in the USA?

If you prefer digital gold to precious metal bars and coins, consider these options to invest in digital gold in the USA:

- Gold stocks

- Gold ETFs

- Gold mutual funds

- Gold futures

- Sovereign gold bonds

- Gold stocks

Gold stock investing involves buying shares in gold mining, production, or exploration firms. Gold mining stocks allow investors to participate in the gold market without owning gold.

- Gold ETFs

Gold ETFs monitor gold prices. Investors can trade shares in these gold-backed ETFs on stock exchanges.

- Gold mutual funds

Gold mutual funds invest in gold-related assets such as mining company equities and Bullion.

- Gold futures

Gold futures contracts require buyers and sellers to acquire or sell a certain amount of gold at a specific price at a future date. Although they have advantages, gold futures are a more advanced digital gold investment.

- Sovereign gold bonds

Government-backed securities called sovereign gold bonds (SGBs) are measured in gold grains. These bonds are ideal for risk-averse gold investors seeking security.

What is the best way to invest in gold in the US?

ETFs are the best way to invest in gold in the US. They are optimal for portfolio diversification with gold. To defend yourself from a systemic crisis, buy actual metal.

How to invest in gold stocks in the USA?

Buy physical gold to invest in gold stocks in the USA. Your gold investment should not limit to coins or Bullion. Shares of gold mining firms or gold ETFs are other gold investments. Trade options and futures are good investments in gold.

Why was gold Bullion illegal?

The US gold prohibition was an emergency measure to combat the Great Depression. The US dollar was pegged to a accurate amount of gold because it was on a gold standard.

Is gold bullion 100% gold?

No! Gold bullion is not 100% pure gold. Although both 24-karat and 999.9-fine gold are considered pure, present technology cannot generate 100% pure gold.

Is it worth investing in Gold Bar?

Yes! It is worth investing in Gold Bar. As a long-term investment, gold bars may yield high returns. A hedge against geopolitical tensions, inflation, and recession, gold bars protect your money despite currency losses.

Why does gold make you rich?

Gold makes you rich because, as a commodity, its prices rise. Investors view the rise as favorable since they do not account for inflation.

What are the top 10 reasons to invest in gold?

The top 10 reasons to invest in gold are:

- Gold’s value preservation has been shown time and over again. Other than gold, no money has survived over 5,000 years. Gold’s low correlation with other assets makes it a good diversifier.

- Gold regains historical money status.

- Physical gold cannot default on promises or go bankrupt.

- Miners cannot produce more gold. Demand exceeds supply, and the 2008 “credit crunch” has made it harder for gold producers to finance new projects that could boost production.

- Government incapacity to balance budgets and low interest rates could cause hyperinflation. Governments depreciate currencies by printing billions of dollars and euros, causing inflation and hyperinflation. All prices rise nominally when more money is spent on fewer goods, causing inflation.

- Warren Buffett says derivatives are “financial weapons of mass destruction” that destabilize banks. They total $1 quadrillion, 16 times global GDP. This time bomb might ruined the banking system.

- Gold remains undervalued compared to the massive amount of manufactured money. If hyperinflation occurs, money and its purchasing power will be annihilated, according to some analysts. Dollar and paper currency holders will lose a lot of purchasing power. By watching the money supply, gold can assist investors in avoiding asset price volatility and currency debasement.

- There is rising awareness that numerous gold investment products (ETFs, gold certificates) may not own the gold they claim to own.

- The dollar’s collapse as an international reserve currency is inevitable.

- Central banks acquire gold net. Gold sales by central banks have stopped. They are cutting supplies and buying gold to limit their risk of losing the purchasing value of their reserve currencies, mostly dollars. As the Federal Reserve issues billions of dollars, Asian, Middle Eastern, and Russian central banks’ dollar holdings lose value. India, Russia, and China are quickly stockpiling gold, hurting Western powers.

How much does a standard gold coin weigh?

A 1 oz 24k gold coin weighs 31.1035 grams.

Is gold jewelry a good investment?

Yes! Gold jewelry is a good investment. It is also a beautiful investment since it holds value and resists inflation and economic fluctuations. The value of this currency fluctuates little.

How to invest in gold efts?

Gold ETFs can be invested in directly or passively.

Direct route: Stock brokers require demat accounts to buy gold ETFs. As with shares, gold ETFs can be bought directly from stock exchanges.

Indirect route: Gold funds that indirectly invest in gold ETFs are an alternative to the demat. It invests in HDFC Gold ETFs. We call these funds of funds. Investors who find mutual fund investing through their app can easily choose this alternative.

How do you invest in gold mutual funds?

Bullion and gold firms are joint holdings of mutual funds. Investors should note that few mutual funds invest entirely in gold; most own other commodities. Some funds invest in mining company indices, while others track gold prices. Others are still actively controlled. Read their brochures for details. Traditional mutual funds have active managers, while ETFs monitor indexes passively and offer lower expense ratios.

How can futures and options trading be used to invest in gold?

Trading gold options needs a margin brokerage account with options markets. Check with your broker or look for an options trading account.

What is the difference between IRA and Physical gold?

The main differences between Gold IRAs and Physical Gold are accessibility, storage, liquidity, and tax advantages.

| IRA | Physical gold |

|---|---|

| Gold IRAs allow withdrawals, making them more liquid. | Selling real gold requires buyer identification. |

| Some Gold IRA withdrawals are banned before retirement. | Physical gold gives consumers direct access to their investments. |

| Gold IRAs often have secure storage. | Physical gold requires extra expenditures and considerations. |

Is gold IRA a good investment?

Yes! A gold IRA is a good investment. Investors who want to diversify their retirement investments and hedge against paper money and stocks should consider one. Financial advisors propose 5%–10% gold in a portfolio.

What are the gold mining policies in the USA?

The policy of gold mining according to the General Mining Act of 1872 authorizes and regulates gold, platinum, and silver exploration and mining on federal public lands. This statute, passed on May 10, 1872, codified the informal system of California and Nevada prospectors securing and defending mining claims on public land from the late 1840s to the 1860s, including the California Gold Rush. Under the 1872 mining statute, all US citizens 18 or older can locate a lode (hard rock) or placer (gravel) mining claim on federal land that is open to mineral entry. These claims can be start after finding a locatable mineral. Platinum, copper, gold, silver, lead, zinc, uranium, and tungsten are found.

Is it legal to mine gold in the USA?

No! It is not legal to mine gold in the USA. Foreigners cannot buy land claims and mine it for gold. You can invest in a US-owned gold mine or work as a miner with a work visa.

What is the Mine Act USA?

The mine act of United States Department of Labor’s Mine Health and Safety Administration (MSHA) must inspect all mines annually to protect miners’ safety and health.

What are the top gold mining stock companies?

The top 5 gold mining stock companies are:

- Newmont Corporation

- Agnico Eagle Mines Limited

- Barrick Gold Corporation

- Franco-Nevada Corporation

- Kinross Gold Corporation

What other investment companies and options are available in the US?

10 Other investment companies and options available in the US are:

- Franklin Templeton Investments

- BlackRock

- E-TRADE

- T. Rowe Price

- Fidelity Investments

- Charles Schwab

- J.P. Morgan Asset Management

- TD Ameritrade

- American Funds

- Vanguard

Do we have to pay tax on investments?

You have to pay tax on gain, not on investment.

What are the significant principles of investment?

The 7 significant principles of investment are:

- Plan your finances. Current Section,

- Start saving and making investments immediately.

- Develop a diverse portfolio.

- Reduce taxes and fees.

- Guard against significant losses.

- Reset your portfolio regularly.

- Ignore the noise.

What is the difference between investment banking and asset management?

Investment bankers help companies raise funds or acquire through M&A. Asset managers manage Personal and corporate investment portfolios. A bachelor’s degree is required in both investment banking and asset management industries, and certification helps in furthering one’s career.

Conclusion

Gold investment companies let investors diversify with gold. These companies help investors buy coins, bars, ETFs, mutual funds, and mining stocks. Services like advice help clients make informed gold investment selections.

These are the top gold investment companies in the USA. The decision is your personal. Your finest gold IRA option depends on which firm best meets your monetary needs and aspirations. Comparing gold IRA businesses will help you choose the best one for you. All of the following companies can respond to your questions and help you decide. Before investing, ask your accountant or financial counselor to confirm if it fits your portfolio plan or use our financial advisory service to help you.

Oxford Gold Group’s teaching features make it an excellent company for beginning gold IRA investors. The organization offers real-time gold price data, historical and annual performance figures, and a precious metals spot pricing table. Oxford Gold Group account managers can answer your inquiries and help you open a SEP, conventional, or Roth gold IRA. A representative can assist you in choosing gold, silver, palladium, OR platinum for your gold IRA. Delaware Repository Service Company (DDSC) or Brinks Global Services, keep your metals in a climate-controlled repository.

Gold IRAs are precious metals IRAs. They might be pre tax or Roth IRAs. Unlike others, these IRAs require gold purchases and storage. Thus, gold IRAs need a custodian—usually a bank or brokerage firm.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.