Growth investing involves investing in firms, sectors, or industries likely to increase. It is considered provocative in the investment industry. Growth investing is a more effective way to improve your portfolio and earn more. Meanwhile, defensive investing favours passive income-generating investments like blue-chip or bond companies with stable dividends to protect your money.

Some notable investors, such as Warren Buffett, said that value and Growth are the same (“Growth and Value Investing are linked at the hip”) because Growth is always a factor in value calculation and can have a positive or negative impact. Buffett’s famous quote, “It’s more advantageous to buy a wonderful company at an appropriate cost than a fair company at a wonderful price,” reflects the influence of his business colleague Charlie Munger. Thomas Rowe Price, Jr., “the father of growth investing” due to his efforts to define and advance Growth investing through his 1937-founded publicly traded global investment business T. Rowe Price. Investment growth can be calculated with ROI. The formula to calculate ROI is:

ROI = Current Value of Investment – Cost of Investment/Cost of investment

What is Growth investing?

The growth investing approach emphasizes capital appreciation. Growth investors invest in companies with above-average Growth, even though the share price appears costly based on criteria like price-to-earnings or price-to-book ratios. In common usage, “growth investing” contrasts with value investing. Growing firms invest in actual assets and acquire other companies with growth capital. Retail, cafe, and healthcare management use growth capital, which accounts for 12% of VC-backed IPOs. Growth capital-backed IPOs have had mean three-year style-adjusted buy-and-hold returns of +25.2% since 1980, compared to zero for other VC- and buyout-backed IPOs. One-third of Growth capital-backed IPOs are rollups, which offer higher investor returns than rollups without a financial sponsor (Growth Capital‐Backed IPOs, J. Ritter, 2015).

What is the difference between Growth and value investing?

The major differences between growth investing and value investing are given below:

| Growth Investing | Value Investing |

|---|---|

| Growth investment involves buying young, early-stage companies with rapid profit, revenue, or cash flow growth. | Value investors invest in undervalued stocks. |

| Growth investment targets companies with faster-than-average sales, profit, or cash flow growth. | Value investing targets undervalued older corporations. GARP investors uncover attractively priced growth firms using intrinsic value. |

| Recent research shows growth investing outperforms value investing. | In the long term, value investing exceeded growth investing. Recent research shows growth investing outperforms value investing. Value and growth mutual funds have returned 624% and 1,072%, respectively, since 1995. |

| A recent article indicated that Growth investing outpaced value investing over 25 years. |

What is Growth at a reasonable price strategy?

Growth at a reasonable price (GARP) is an equity investment technique that uses Growth and value investing to pick stocks. GARP investors exclude companies with high valuations and strive for consistent earnings growth above market norms. The idea is to avoid extremes in Growth or value investing. Hence, GARP investors often buy growth stocks with low P/E multiples in regular markets.

How much should investments grow?

Investments should grow 10% or more annually. This question has multiple answers. Several elements determine a “good” ROI. A strong ROI depends mainly on your financial requirements. Consider a young couple is investing in their newborn’s graduation fees. Their ROI should allow their starting and ongoing investments to grow enough to pay for college 18 years from now. Retirees looking to supplement their income would define a good ROI differently than a young family.

A good ROI for a retiree generates enough recurring income to live comfortably. Naturally, retirees’ definitions of living comfortably and a good ROI vary. Based on Maurice Scott’s previous work, it recommends a capital accumulation approach to growth analysis in developing and industrial countries. The rate of investment, the societal rate of investment return, and the investment-induced returns on employment are all affected by economic policy quality and affect economic Growth (Investment and Economic Growth, Dennis Anderson, 1990).

How do you calculate the loss on investment?

To calculate your gain or loss, deduct the initial purchase price from the selling price and divide it by the stock’s purchase price. That number multiplied by 100 gives the percentage change. Gains enhance an asset’s market worth from its initial purchase price, whereas losses reduce it. Realized and unrealized gains and losses exist. Unrealized profits and losses occur while owning the asset.

They are realized when you buy the investment, resulting in capital gains or losses. Gains arise when an asset’s price rises above its purchase price. Amazon (AMZN) shares ended at $120.45 on May 11, 2020, indicating an unrealized gain if you bought it on Sept. 3, 2013, for $13.23. When you lose money, an asset or investment is worth less than when you bought it. You lost money if you needed a single AT&T (T) share for $33.63 on May 10, 2021, then sold it for $23.17 on Dec. 15, 2021.

What are the different growth investment vehicles?

There are 2 categories of growth investment vehicles:

- Indirect investments

- Direct Investments

1. Indirect investments

Indirect investments hold direct investments chosen by experienced portfolio managers. Portfolio managers charge investors for selecting and monitoring direct investments.

Indirect investments involve pooled investments, which dominate indirect investing. Pooled investment vehicles include open-end, closed-end, and exchange-traded funds. Sponsors like Vanguard and iShares construct and manage pooled investment vehicles. A sponsor-hired portfolio management team chooses direct investments for pooled vehicles. Shareholders own the pooled investment vehicle, not its individual investments.

2. Direct Investments

Direct investments are asset classes or securities that produce returns. Bonds, Stocks, and rental property are direct investments. A professional portfolio management team does not choose direct investments for investors; instead, the investor decides on all assets and securities.

Direct and indirect investments can be classified as public or private.

- Public Investment Vehicles

The public can buy public investment vehicles. A broker facilitates the purchase of most public investment vehicles. Exchange-traded ETFs and closed-end funds are public investments. The exchange pairs suppliers and buyers. A brokerage business can help buy open mutual funds, but they are purchased straight from the sponsor.

- Private Investment Vehicles

The public cannot buy private investment vehicles. Private investment entities require income or net worth requirements for investors. Accredited investors and legal purchasers can invest in private investment vehicles in the U.S. Blackstone’s BREIT, hedge funds, and venture capital limited partnerships are private investment entities. Many private investment vehicles invest outside the debt and public stock markets, making them different investments.

How do we calculate the Growth of investment?

The Formula to calculate Growth of investment is given below:

=((EV/BV))1/n *100

- Divide the end-of-period investment value by the start amount.

- Increase the result by one divided by years.

- Subtract one from the result.

- Multiply by 100 to get a percentage.

The compound annual growth rate is a depiction, not an exact return. It represents the pace at which an investment would have increased if it had grown at the same rate each year and reinvested its profits. This helps stock market investors compare stock performance. The CAGR ignores the discount rate, crucial to calculating future returns’ present value.

What are the ways of measuring investment returns?

The most common way to measure investment returns is by using ROI technique. The formula to calculate ROI is:

The Current Value of Investment is the interest investment selling proceeds. This figure incorporates investment lifetime cash flow and maintenance costs. ROI, as a percentage, can be matched to other investment returns, enabling one to compare different investments.

The efficiency or profitability of an investment or a group of investments is measured by return on investment (ROI). ROI measures an investment’s return according to its cost. ROI depends on original investment, ongoing expenses, and cash flow. The outcome is a ratio or percentage. ROI is renowned for its adaptability and simplicity. ROI is a primary indicator of investment profitability. A company’s factory expansion ROI, stock investment ROI, or real estate transaction ROI are examples.

The calculation is simple and easy to grasp for its many applications. Investments with positive ROIs are likely profitable. If higher-return opportunities exist, these signals can assist investors in choosing the best ones. Investors should prevent net losses from negative ROIs. John bought $1,000 in Slice Pizza Corp. in 2017 and sold it for $1,200 in 2018. This investment’s ROI is 20%, calculated by dividing net profits ($1,200 – $1,000 = $200) by investment cost ($1,000).

With this data, Slice Pizza’s investment can be compared to others. If John invested $2,000 in Exclusive-Sale Stores Inc. in 2014 and traded the shares for $2,800 in 2017, John’s Exclusive-Sale assets yielded 40%, or $800/$2,000. Consider the years each investment was held while comparing them.

What is the formula for Growth of compound interest?

The formula for Growth of compound interest is following:

P[(1+i)n-1]

Where i = annual interest rate, P = principal, n = number of compounding periods.

Compound interest applies to an investment or loan’s initial principal and previous interest. So, compound interest means generating or owing interest on interest. Compounding accelerates money growth compared to simple interest on the principal. More compounding periods mean more compound interest growth. Compound interest accelerates money growth for funds and investments. However, interest that accumulates can make debt harder to repay.

Compound interest is available with zero-coupon bonds. Traditional bond issuance pays investors interest according to their terms. Because these payments are made by check, debt does not compound. Investors receive no interest from zero-coupon bonds. This bond is bought beneath its original value and increases over time. Zero-coupon bond issuers use compounding to raise the bond’s value to expiration.

Growth of compound interest Pros and Cons

Pros:

- It helps build long-term savings and investments

- Lowers wealth erosion risks

- Compounding helps with debt payments.

Cons

- Works to prevent borrowers from making the minimal payments required on credit card debt or high-interest loans

- There is a tax on returns.

- Hard to compute

What is the formula for exponential Growth?

The formula for exponential Growth is given below:

f(x)=a(1+r)x

Where, r = growth rate, f(x) = exponential growth function, a = initial amount,

{x} = number of time intervals

In exponential development, a quantity grows slowly at first and then rapidly. We utilize exponential Growth to calculate population increase, compound interest, and doubling time. Exponential Growth is a data pattern that enhances with time using an exponential function curve. Consider a cockroach population that grows exponentially yearly from 3 to 9 to 729 to 387420489. This population grows by 3 per year. Exponents make up the exponential growth formula. Multiple formulas are used in exponential growth models.

What is the formula for exponential interest growth?

The formula for exponential interest growth is given below:

V = S* (1 + R)t

S is the initial value, R is the interest rate, and T is the number of periods. This formula calculates V, the current value.

Due to exponential Growth, data increases with time, forming an exponential function curve. To illustrate exponential Growth, suppose a mouse population grows by two per year, beginning with two, then four, eight, 16 and so on. Here, population growth is twice a year. You get 4, 64, 16, and 256 if mice have four pups. Exponential Growth is multiplicative, while linear and geometric Growth is additive and increased to a power.

Suppose you invest $1,000 in a guaranteed 10% account. An account with an introductory interest rate earns $100 every year. Without deposits, interest remains the same. If the account has a compound interest, you’ll receive interest on the total. The lender will then apply the interest rate to the initial deposit and any past interest each year. 10% or $100 interest is received in the first year. Yet the 10% rate is applied to $1,100 in the second year, yielding $110—interest paid increases exponentially each year. Your account would be worth $17,449.40 after 30 years without deposits.

What is the formula for calculating investment in Pension Funds?

The formula for calculating investment in Pension Funds is following:

FV = P* ((1+r)n-1/r)

Where P = periodic payment, FV = Future value of the investment, r = Annual interest rate, and n = Years of investment.

What is the formula for dividend growth rate?

The formula for dividend growth rate is given below:

DGR = [(Recent dividend (D2) – Previous dividend (D1)) x 100] / Previous dividend

What is the growth rate of stock dividends?

A dividend growth rate evaluates a company’s capacity to raise shareholder payouts. Compare the current dividend per share to the preceding period’s dividend per share to get this rate as a percentage. Consider a stock with substantial dividend growth. That signals that the company will pay more significant dividends in the future. You can expect stock income to rise. Businesses with higher payout ratios are prone to have more stable share prices and a better ability to return funds to shareholders, especially if they pay out so much of their profits as dividends that they must continue rewarding investors. This makes it a good alternative for security and a reliable revenue source. If a stock’s dividends are rising regularly, its earnings can also indicate the possibility for capital gains.

However, poor dividend growth imply financial difficulty. A corporation that cannot boost its dividend payments needs to do more to produce sufficient revenue from operations.

Companies with low or decreasing dividends also need more stability to attract investors. Existing shareholders lose their value over time. For many investors, this warning indication is enough to avoid the stock.

What is ROI?

ROI compares an investment’s return or loss to its cost to determine its profitability. It estimates stock and company investment returns. ROI is usually a percentage computed using a formula. One of the most prominent industry analysis performance metrics is ROI. ROI analysis can help evaluate information systems and make software acquisition and other project decisions when appropriately used.

ROI was coined decades ago as a financial term based on a careful and quantifiable analysis of economic returns and expenditures. ROI is now widely accepted in financial management and private and public companies. Today, ROI is seen as a non-rigorous, amorphous bundle of diverse methodologies prone to inaccuracy and prejudice due to its widespread use. This paper gives an organized look at ROI by naming and grouping different types of ROI based on important characteristics. The ROI taxonomy talks about traditional ROI extensions, virtualizations, and copies. Simple instances and business cases explain all ROI categories. ROI’s inherent limits are addressed, and guidance is given to make ROI-based recommendations meaningful. The document targets information systems, technological solutions, business management researchers, information specialists, program managers, project managers, technology executives, and information systems assessors (A Return on Investment as a Metric for Evaluating Information Systems: Taxonomy and Application, A. Botchkarev, 2011).

Formula to calculate ROI:

ROI = Net Return on Investment/Cost of Investment * 100%

Remember these points When analyzing ROI estimates: ROI typically appears as a percentage because it’s simpler than a ratio. Second, because investment returns can be negative or positive, ROI includes net return in the numerator.

When ROI calculations are optimistic, net returns are positive (because total returns exceed total costs). However, a negative ROI means the net return is negative since total expenses exceed total returns. Finally, total returns and costs should be incorporated for accurate ROI calculation. For a fair comparison of investments, use annualized ROI. Simple ROI formulas can be misleading. It requires precise cost accounting. That’s easy with stock shares. Sometimes, it’s more complex, like estimating a business project’s ROI.

How does compound interest work on stocks?

Stocks can assist you in earning compound interest faster and longer. Stocks have higher risk but higher profits. Stocks returns 10%-15% annually, compared to 2% from a high-yield savings account. Stock compound interest works like savings account compound interest. The rate of return depends on the following:

- The amount you invest

- Earned interest

- Duration of investment

Longer market time means longer compound interest benefits.

How do you calculate investment property return?

You can calculate the investment property return by subtracting annual operating costs from annual rental revenue and dividing by mortgage value is the easiest technique for determining rental property ROI. However, you can also use additional calculations to estimate a property’s return.

Cash flow properties create monthly cash after operating expenses. The cash flow ROI formula is simple:

Gross rent – expenses = cash flow

The operating costs for rental property include advertising and marketing while empty, property management services if you hire someone, property taxes, maintenance, repairs, and insurance. Based solely on income and expenses, the cash flow ROI calculation estimates monthly rental property income.

Based on cash invested, cash-on-cash return assesses a rental property’s annual cash flow. How to find rental property cash-on-cash return:

Cash-on-cash return = Total cash invested x 100 / Annual cash flow

This ROI formula estimates its annual performance based on how much money you put into a rental property. Below is the calculator to calculate your ROI.

This investment will be worth -

| Year | Starting Amount | Annual Contribution | Total Contribution | Interest Earned | Total Interest Earned | End Balance |

What is the formula for Compound Annual Growth Rate (CAGR)?

Compound Annual Growth Rate (CAGR) calculates an investment’s annual growth rate, including compounding. It is widely used to assess investment performance or predict future returns. Calculating the Compound Annual Growth Rate formula involves only the investment’s ending value, initial value, and compounding years. Divide the ending amount by the beginning value, raise it to the opposite number of years, and deduct one.

CAGR = [EV/BV]1/n – 1

Where BV= Beginning Value, EV= Ending Value, N = Number of Compounding Periods.

How does Investing work?

Investments are made to create income or appreciation. Asset appreciation is the gradual increase in value. Resources like energy, time, or cash must be invested now to generate a profit later. Investors must comprehend their investments. Whether buying a single share of a well-known corporation or a risky alternative investment, investors should research.

Before investing, people should have adequate money for monthly needs and an emergency fund. Be aware of liquidity constraints. Particular investments are more liquid and more accessible to sell. Locked investments like CDs are difficult to dispose of. Investors should know short- and long-term capital gains tax costs. Investing is risky. Investors can lose money. Investors who are uncomfortable with this approach can invest just what they can lose or diversify to lessen risk.

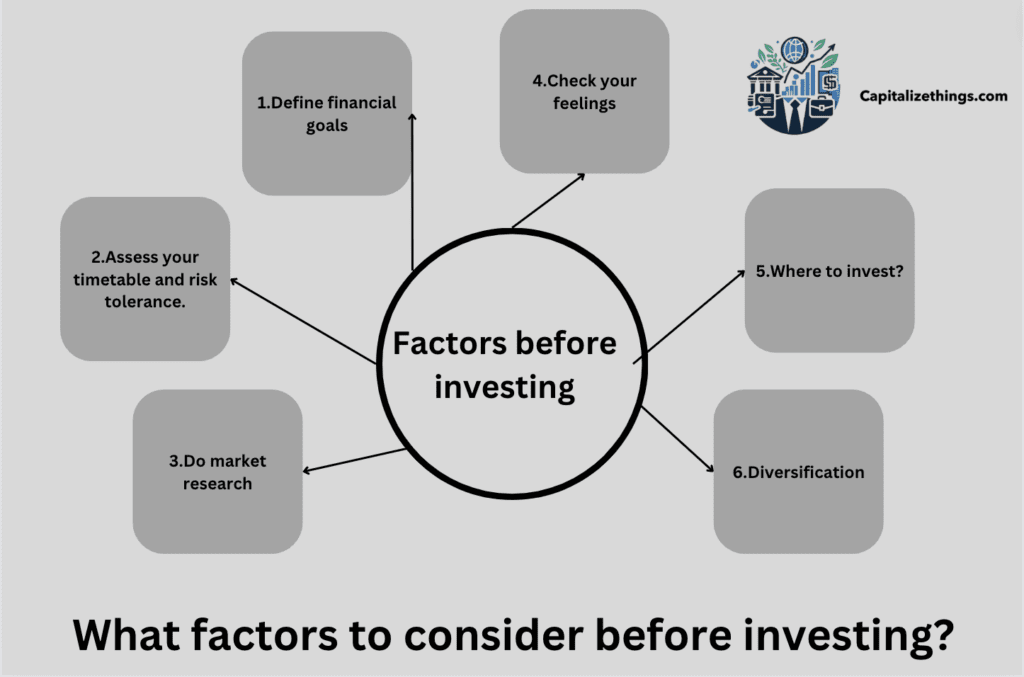

What factors to consider before investing?

The following 6 points are essential to consider before investing:

- Define financial goals

- Assess your timetable and risk tolerance.

- Do market research

- Check your feelings

- Where to invest?

- Diversification

1. Define financial goals

Think about planning before investing. This helps you prioritize your investment goals and how to attain them. It can also assist you avoid emotional investing. Start by determining your investment goals. Are you saving for retirement, a house down payment, or your child’s education? Your goals can affect your investment approach and risk tolerance.

2. Assess your timetable and risk tolerance

Before investing, consider how much time and risk you will take to reach your financial goal. Younger investors look at retirement investment strategy differently. If you want to withdraw your money quickly, staying invested through market fluctuations takes time. Therefore, a less risky investment is better.

3. Do market research

Before investing, you should research the factors affecting your investments to make informed judgments. Domestic and global market trends, such as Growth, interest rates, unemployment, price increases, and political events, can affect your investments.

4. Check your feelings

Undoubtedly, investing is emotional. Sometimes, you are tempted to modify your investment plan because some of your portfolio is underperforming or you have heard that the market will fall. These circumstances normally prompt you to sell your assets, but you should analyze your investment strategy. Making decisions according to short-term market volatility can drastically impact your long-term plan. Consider this before investing.

5. Where to invest?

Before investing, consider your investment destination. You can invest in a single asset class, like a home, or a mix of asset classes, like stocks, cash, and bonds.

6. Diversification

Risk diversification is a significant benefit of investing in multiple asset classes. If one investment underperforms, your losses are less since your other investments will compensate. It needs more effort because you must stay current across multiple market areas.

What are the Risks and Returns for Investments?

Risk and return refers to the economic effect of investing in securities. Return on investment is a gain for an investor. Risk is the chance that the investment will lose money. An investor’s return on a low-risk asset is usually low. In contrast, a high-risk investment is more likely to benefit.

Consider investing in Bond X or Bond Z. Consider Bond X’s 15% non-payment and 45% failure (loss) probability. Without additional facts, you are more likely to choose Bond A because it increases your chances of keeping your money. Bond Z must raise interest rates until the profit outweighs the non-payment risk to succeed. Bond Z can lure you back despite increasing risk.

Riskier investments must earn more to offset the risks. The risk deters some investors, but the gains entice others. However, as investors seek security rather than better returns, a less hazardous investment yield lower returns.

How much Money is required for investment in the beginning?

Beginners need a little money to invest from $1 to anywhere. Zero-fee brokerages and fractional shares allow $1 stock market investing. It depends on your finances and investment goals. if you starting to invest as newbie with a lot of money, you don’t need in a savings or checking account, want to save for retirement, and have many years until you need it, your “right amount” will be different from someone who’s exceeded out their credit cards and wants to buy a house.

After those initial calculations and financial goals, you should be ready to determine a monthly investment amount—every month! Saving one big sum and thinking about it pays off, but putting a little more each month can help you attain your financial objectives faster. A possible monthly amount is $2,000. It can be $10 a month. The total amount only matters if you can dedicate it to it every month.

Conclusion:

Growth investing increases an investor’s capital. Growth investors buy growth stocks, which are new or tiny companies with predicted earnings growth above the industry sector and market average. Many investors choose growth investments because developing companies can yield substantial profits if they succeed. However, untested companies are risky. You can compare Growth investing to value investments. The value investing technique involves buying stocks that appear to be undervalued.

ROI measures investment returns. It helps you find the best investment from multiple possibilities. Your financial objectives and risk tolerance help you analyze the investment. Check the cost of your investment and for hidden fees that could reduce your profits. Return on investment typically represents a percentage. The return on investment is a financial ratio that compares investment benefits to costs. The formula for calculating return on investment: ROI = Net Profit / Investment Cost * 100 ROI shows investors their investment profitability. Return on investment demonstrates the advantage of mutual fund programs. ROI might be good or bad. If the ROI is negative, you lose money. Choose an investment with the highest long-term return.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.