Collective investment funds (CIFs) are bank or trust company’s pools of accounts. The financial institution combines individual and organizational assets to create a diverse portfolio. Collective investment funds have 2 types: A1 funds and bundled investment/reinvestment assets. Second is federal income tax-exempt A2 accounts, retirement, stock bonus, profit sharing, and other entities. CIFs are usually only offered through employer-sponsored retirement savings plans, pension schemes, and insurance firms. They are also called common trust funds, commingled, and collective trust funds.

Collective Investment Funds functions by using both individual and organizational assets to create diverse portfolios managed by banks or trust companies, typically within employer-sponsored retirement plans. These funds, benefiting from reduced operational expenses due to SEC reporting exemptions, offer a cost-effective alternative to mutual funds. The process involves financial intermediaries like banks, mutual funds, and pension funds, which facilitate the efficient movement of funds between savers and borrowers. By pooling resources and conducting thorough research, these intermediaries streamline transactions, manage risks, and enhance the overall efficiency of financial operations.

Most importantly, CIFs have cheaper operations expenses than mutual funds because they don’t have to satisfy SEC reporting requirements like prospectuses or unbiased boards of directors. Collective investment funds provide you exposure to a variety of assets, reducing risk. This is one of the best advantages about collective investing funds. A mutual fund can make investments in bonds, stocks, and other assets to offset losses in one area. Management, administration, and other costs are a disadvantage of collective investment funds. These fees limit profits and investment value. Check fund fees before investing.

What is a financial intermediary in economics?

A financial intermediary is an organization that serves as an intermediary in a financial transaction, such as a mutual fund, investment bank, commercial bank, or pension fund. Consumers gain from financial intermediaries’ security, availability, and banking and managing assets economies of scale. In some areas, like investing, technology aims to remove the financial intermediary, but there is less risk in insurance and banking.

There aren’t many definitions in the literature for the group of actions called “intermediation,” especially regarding financial intermediation. Intermediaries’ functions have yet to be precisely defined despite their prevalence in the economy. Instead, scholarly and pragmatic literature agrees that banks, insurance firms, etc. are intermediates. This research represents an intermediate, distinguishing intermediation from other economic activities (Financial Intermediation and the Theory of Agency, D. Draper, James W. Hoag, 1978).

What are the most important types of financial intermediaries?

There are 4 types of financial intermediaries. The main financial intermediaries are mutual funds, life insurance firms, pension funds, and banks.

- Banks

Financial intermediaries like banks link savers and project borrowers. Banks are popular financial intermediaries. Savings and Checking deposits from customers are money they want to save for later. These individuals receive savings interest on deposits from the bank. They get a little return on this cash, usually for instantaneous transactions. The bank uses these funds to lend. The bank earns by charging more significant interest than on savings accounts.

- Life Insurances

One financial intermediary is life insurance firms. If the policyholder dies, life insurance is designed to pay beneficiaries unexpectedly. This can benefit families whose children depend on their income, but the life insurance policy owner can choose any beneficiary.

- Pension funds

Pension funds are another financial intermediary like mutual funds. They are rare. Most workers have to save for retirement, but many businesses use a financial intermediary. Employees determine their contributions, retirement income, and investments. These financial intermediaries impact an individual’s retirement account, which supports them after retirement, which makes them crucial. Pension funds work like mutual funds but have various laws and restrictions, especially addressing preferential tax status for eligible retirement savings accounts like pensions.

- Mutual Funds

Owning firm stocks is risky because the return depends on the company’s performance. Instead of buying shares of a single company or a group of connected companies, investors might reduce risk by investing in a broad portfolio of equities. Financial consultants suggest mutual funds for diversified stock portfolios. Other assets like real estate, bonds, and cash can boost wealth with equities. Diversification reduces risk and hedges losses.

Developing a diversified stock portfolio can result in substantial transaction costs (especially brokerage fees) for investors with limited funds because they buy a small number of shares in numerous businesses; that’s when mutual funds become helpful. Open-end funds, or Mutual funds, enable investors to diversify without excessive transaction costs.

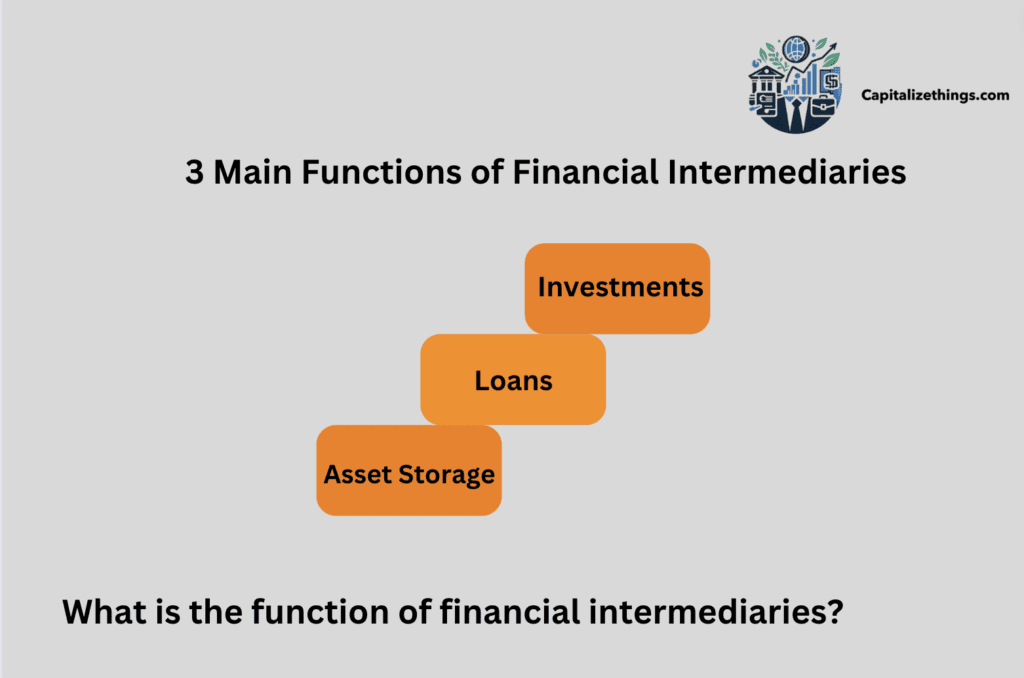

What is the function of financial intermediaries?

Financial intermediaries store, lend, and invest assets. Traditional theories of intermediation depend on transaction costs and unequal information. They are meant to explain institutions that take deposits, sell insurance policies, and send money to firms. Transaction costs and unequal information have decreased, but intermediation has increased. For example, new markets for financial futures and options are primarily for intermediaries instead of individuals or firms. These changes are hard to describe with traditional theories, so they have a discussion about the role of intermediation in this new setting, focusing on risk trading and contribution costs (The Theory of Financial Intermediation, Franklin Allen, Anthony M. Santomero, 1997).

3 main functions of financial intermediaries are the following:

- Investments

Financial intermediaries play a significant role in investment. Investment bank and Mutual fund clients can benefit from in-house investment specialists who help them develop their money. The companies use their industry expertise and thousands of investment portfolios to find assets that maximize earnings and minimize risk.

- Loans

Loans are another financial intermediary function. Financial intermediaries mostly advance short- and long-term loans. They connect depositors with extra cash to borrowers. Loans buy capital-intensive assets like commercial real estate, cars, and factories.

- Asset Storage

One of the most essential functions of financial intermediaries is asset storage. Commercial banks store coins, cash, and other valuables like silver and gold for protection and safety, and depositors have tools to secure and access their money. These include checks, ATM, debit, and credit cards. The bank can also show depositors’ allowed withdrawals, savings, and direct payments.

Is a financial intermediary a bank?

Yes! Financial and commercial banks are licensed to take deposits and offer loans to borrowers. Trade credit, banks, and conglomerates are financial intermediaries. However, these institutions vary in how much aggregate intermediary risk they get, whether a financial specialist intermediates, the projects they fund, and the claims they give to investors. The paper proposes a simple unified model to explain why these different kinds of intermediation coexist and differ. Applications to conglomerate corporations, banking, and trade credit, addressed (Bank and Nonbank Financial Intermediation, P. Bond, 2004).

Is a credit union a financial intermediary?

Yes! A credit union is a type of financial intermediary. People and other business stakeholders can use banks and credit unions to manage their money. Banks and credit unions take deposits from depositors and lend funds to borrowers.

Is IBM a financial intermediary?

No! IBM is not a financial intermediary. IBM offers technology support and financial industry infrastructure. Financial institutions use software, hardware, and cloud computing solutions to secure, handle, and optimize large amounts of data. IBM actively promotes and develops blockchain technology. Financial institutions employ IBM Blockchain to provide safe and transparent cross-border payments, trade finance, and supply chain finance solutions.

IBM’s Watson AI platform helps financial institutions build and deploy AI apps. The apps aid with risk assessment, customer service, fraud detection, and individualized financial advice.

IBM develops new solutions with fintech companies and financial institutions. These partnerships often produce new financial services and goods using IBM’s technology and the fintech’s experience. Financial institutions receive consultancy and advising services from IBM Global Business Services. Service offerings include digital transformation, company procedure optimization, and implementation of technology.

Is RBI a financial intermediary?

Yes! RBI is a financial intermediary. The RBI in Mumbai helps the financial market in numerous ways. The bank sets the overnight interbank loan rate. Mumbai Interbank Offer Rate (MIBOR) is an Indian interest rate benchmark. The RBI oversees India’s financial institutions, commercial banks, and non-banking financing organizations. The RBI has restructured bank inspections, introduced off-site surveillance, and strengthened auditors.

First, the RBI creates, executes, and oversees India’s monetary policy. Maintaining price stability and providing loans to active economic sectors is the bank’s managerial goal. The 1999 Foreign Exchange Management Act gives the RBI control over all foreign exchange. This statute authorizes the RBI to support external commerce and payments to strengthen India’s foreign exchange market.

How do financial intermediaries reduce transaction costs?

Financial intermediaries manage resources to boost transactions and lower transaction costs. By doing research and investigation for their clients, they reduce transaction costs caused by information asymmetry.

Imagine a world without banks. Any borrower would require finding someone ready to lend that amount, discuss the interest rate, and arrange collateral and loan terms. It would be time-consuming and expensive, with significant transaction costs. The transaction cost is significantly reduced when a bank organizes resource pooling and lends to borrowers. Financial intermediaries also reduce default costs and risk. These include evaluations of credit, loan assurances, diversification of risks, and loan spreads over many borrowers. Thus, banking intermediaries and transaction expenses are an ongoing exercise for saving money. This dynamic relationship shapes macroeconomic activities, affecting savers, lenders, and national financial plans.

Intermediation costs are a significant issue for lenders and borrowers. Banks must reduce transaction costs while enhancing lending quality as consumer lending grows and competition increases. Transaction costs related to knowledge asymmetry between banks and borrowers can also affect bank lending decisions and quality. Transaction expenses help reduce information asymmetry and improve monetary transmission and lender credit access. This article models how borrower transaction information impacts lending relationships and portfolio delinquency. This suggests that transaction information can lower transaction costs and expand lending since banks can set more significant loan limits. This study extends empirical research for other Indian credit market countries. It also examines empirical research on transaction expenses and tries to show how they diminish retail portfolio delinquency (Transaction Costs and Efficiency in Intermediation, Dinabandhu Bag, 2013).

What are financial intermediaries and market intermediaries?

Financial intermediation connects investors and borrowers. Mediators strive to satisfy both parties’ financial demands as third parties. Intermediaries deliver services at a grander scale, benefiting consumers and enterprises.

To cover their margin, the intermediary passes on the investor or lender’s deposit to the lender at a high interest rate. Scaling up these activities makes the marketplace more efficient and cuts business costs. Banks can take deposits as financial intermediaries. Other intermediaries don’t require deposits. Intermediation transfers funds between parties. The intermediary manages cash flow. This kind of intermediary includes financial advisors that connect investors with firms and pension funds that collect member funds and pay pensioners.

Financial markets and financial intermediaries are both parts of a complicated monetary system. We separate financial intermediaries into two groups based on whether they issue full or partial contingent contracts. Runs can happen on intermediaries, like banks that offer unfinished contracts and demand deposits, but the market is still intact. A complex financial system has full markets for limited market involvement and group risk. If the middle-men make full contingent contracts, the structure is incentive-efficient. If they make incomplete contracts, the system is constrained and efficient. Controlling the flow of money might be helpful in a situation where markets for overall risks aren’t fully developed (Financial Intermediaries and Markets, Franklin Allen, Douglas Gale, 2004).

What is a collective investment fund?

A collective investment fund (CIF) is a trust that is run by a bank and holds combined assets that meet certain criteria set by 12 CFR 9.18. The bank is the fiduciary for the CIF and has legal title to the fund’s assets. CIFs save banks money because they don’t have to buy expensive small lot investments for their limited fiduciary accounts.

Collective investing pools individual investors’ funds and manages them for successful allocation by a professional fund manager. Due to their affordability, mutual investment funds are a new and appealing investment option for Russian investors, even novices. The article describes major collective investment entities. Mutual investment funds offer pros and cons compared to alternative collective investment institutions. The article defines investment institutions, compares their primary features, and describes mutual investment funds, common stock investment funds, and private pension funds’ investment instruments (Investment Funds and Other Collective Investment Tools, E. S. Nedorezova, O. Evseev, I. A. Lunin, 2020).

What is RBS collective investment fund?

RBS Collective Investment Funds Limited is a business founded on June 23, 1969, and its legal office is in Edinburgh, City of Edinburgh. It has been 55 years since RBS Collective Investment Funds Limited opened for business. The most recent confirmation statement, sent on June 19, 2024, says there are 6 active members and 1 active secretary.

What is a collective investment fund scheme?

Collective investment fund schemes are typically defined by components: In a property scheme, participants do not have daily control over fortune management but they can consult or get directions. The operator handles the fortune as a whole, and/or participations and profits are pooled. The SFO broadly defines property as money, products, choices in action, and real estate, whether in the country or overseas.

What is a collective investment scheme in Mauritius?

Under Mauritius fiduciary, a CIS is a scheme constituted as a business, trust, or other legal entity authorized by the Financial Services Commission (“FSC”). Its primary function is collectively investing funds in a portfolio of investments or other financial assets, non-financial assets, or real property that are accepted by the FSC. The scheme operates on the principle of risk diversification and has the responsibility, on request, to diversify risk.

What is the collective investment scheme in Singapore?

Collective investment schemes apply to any property that meets these criteria:

- Participants need daily property management control.

- The manager oversees the entire property.

- Participants’ contributions and payout profits/income are pooled (Purported). The arrangement allows groups to share in goods profits/income.

What is a collective investment undertaking CIU?

Companies that only spend the money they get from investors in other companies are called CIUs. They work by spreading out the risk of investing in different companies. When you look up “CIUs,” you can find closed-end and open-ended funds.

What is a collective investment account?

Section 235(1) of The Financial Services and Markets Act 2000 (“FSMA”) defines a collective investment scheme as any deal with respect to property of any explanation, including money, that enables participants (whether by becoming individuals of the property or a portion of it or otherwise) to take part in or receive profits or income from acquiring it, holding it, managing it, or disposing of the property.

This implies that a CIS is a security for community investment and profit sharing, but participants have no daily control over the management of properties. Thus, the investment is likely not a CIS if investors have daily oversight. The Financial Conduct Authority (“FCA”) must agree the establishment and operation of CIS. An official can only promote a CIS to the general population if it is FSMA-accredited or recognized, with few exceptions.

What is the process of a collective investment scheme (funds)?

The process of a collective investment scheme is that they disperse your money with other shareholders throughout the fund’s holdings. Your unit holdings indicate your proportionate ownership of the fund’s assets, earnings, and capital growth. Due to the fluctuating value of the assets, the cost of these units’ changes, and your share will fluctuate as the number of units distributed splits the fund’s worth.

Different funds risk differently. Some invest primarily in cash and are low-risk. Others take more significant risks, investing in new companies or markets for faster growth. The video below makes it easier to understand the collective investment scheme(CIS).

Is CIF risky?

Under CIF, the customer is at risk if the products are not insured in the container until they have been loaded on the vessel. Thus, CIF agreements are unsuitable for containerized cargo. CIF is an international shipment agreement in which a seller pays for a buyer’s order’s insurance, costs, and freight while it’s enroute.

The products are shipped to the sales contract buyer’s port. After loading the items onto the vessel, the customer assumes risk of damage or loss. However, the seller is responsible for paying and insuring freight. CIF is like shipping and insurance paid to (CIP). However, CIF is exclusively used for sea shipments, while CIP can be utilized for trucking.

Is CIF more expensive?

People think that CIF is an expensive way to buy things. That’s because the seller can pick any shipping company they want, and that company would charge the consumer more to make more money out of the deal.

What are the pros and cons of a collective investment account?

Collective investment accounts are popular investments. These funds buy a variety of assets with money from many investors. This lowers investment expenses and diversified portfolios. Collective investment funds, like any investment, have pros and cons.

| Pros | Cons |

|---|---|

| All taxpayers pay 10% or 20% CGT based on their other taxable income. | Fund shifts can cause personal CGT. |

| CGT base cost of investment is revalued on death. | Other than transferring to a spouse, ownership changes might trigger CGT events, including trusts. |

| Reduce taxable gains with personal or trustee CGT in the yearly exempt amount. | Switching funds within 30 days requires share identification. |

| If losses are registered, they can be carried forward forever. | Collectives are usually included in the local government residential care means testing. |

| Pricing transparency. | Income-producing assets allow consumers or trustees to receive annual tax returns. |

| Real income-producing or growth investments. | If disposal revenues exceed $50 0000, HMRC self-assessment disclosure is needed even if no gain is realized, or the gain is less than the yearly exempt level. |

| It can be used for trust investments with multiple income or capital beneficiaries. | Without allowance/exemption, all accumulation and income units are taxed up to 45%. . |

| The first $500 of discretionary trust earnings per year is tax-free. | Complex part destruction calculations for regular withdrawals. |

| Can use minor’s income tax and CGT allowances (parental settlement restrictions limit use to $100 per tax year). | |

| Non-UK investors’ IHT-excluded property. | |

| Fund of funds — changes within such funds do not incur personal CGT. | |

| Gains made while non-resident are tax-free in the UK (depending on length). |

Many investors find collective investment funds beneficial. However, you should carefully weigh the advantages and cons of these funds and choose one that matches your financial goals and risk tolerance.

What is a collective investment management company?

In a collective investment management company, the Investment managers invest client money. They pick the right investments—risky stocks and safe, slow-growing bonds—and attempt to give clients the return they need at a risk they can handle. Investment management organizations create portfolios for clients and introduce new investment options. All categories of clients use investment management firms. Some target wealthy investors. Companies, trusts, charities, and corporations employ others.

What are the examples of financial intermediaries and collective investment?

Some of the most common examples of financial intermediaries and collective investment are commercial banks, stockbrokers, financial institutes, insurance and leasing companies, pension funds, pooled investment funds, and stock markets. The financial intermediary facilitates the indirect movement of money between lenders and users.

What is the difference between an ETF and a Collective investment scheme?

The difference between an ETF and a collective investment scheme is that some people decide how to spend money in mutual funds because they are constantly managed. Most ETFs are passively managed and follow market indices or indexes for specific industries. Passive index funds comprise a large share of mutual funds’ holdings under management, but actively managed ETFs are becoming more popular. Overall, mutual funds have a more exceptional minimum investment than ETFs. Some funds have expensive investment, most retail funds demand $500–$5,000. Minimums vary by fund and company. The Vanguard 500 Index Investor Fund Admiral Options requires a $3,000 minimum commitment, whereas American Funds’ Growth Fund of America is only $250.

For an entrance position, ETFs can price as little as one share plus fees or charges. Institutional investors issue or redeem ETFs in huge lots, and investors trade them like stocks throughout the day. ETFs can be shorted like stocks. Traders and speculators value those provisions, while long-term investors do not. The market values ETFs regularly, and trading at a cost other than the genuine NAV can allow arbitrage.

Are ETFs a good investment?

ETFs can be a great choice if you want something easy while investing. When you purchase bonds, shares, or both, ETFs usually give you a diversity of those investments. And you want to do it with little work.

Is ETF better than mutual funds?

Actively managed funds are less tax-efficient than ETFs and index mutual funds. Overall, ETFs are tax-efficient compared to index mutual funds. Want niche exposure? ETFs that track businesses or products can expose you to specific markets. Although some actively operated niche mutual funds are available, index mutual funds rarely allow specialized investing.

ETFs are bought as whole shares and have no minimum initial investment as they trade like stocks. You can obtain an ETF for one share, its standard price. Mutual fund minimums are usually a simple cash sum, not the fund’s cost for shares. Mutual funds can be bought in fractions or fixed quantities, unlike ETFs.

Do ETFs make you money?

ETF traders and investors can profit by selling them for more than they paid. ETFs that track dividend stocks also pay dividends. Transaction expenses and fund expense ratios are ETF providers’ key revenue sources.

What is the difference between collective investment trusts vs. mutual funds?

The difference between collective investment trusts vs. mutual funds is Like the Fidelity Contrafund Commingled Pool, a CIT does not have a prospectus as a mutual fund does. Also, the assets and results of a CIT are not available to the public. Their investment policy declaration controls CITs and trust statements, not a prospectus.

Why are CITs cheaper than mutual funds?

CITs are cheaper than Mutual Funds and free from regulations, because they do not interrelate with regular investors. Collective Investment Trusts, like Mutual Funds, are tax-exempt, pooled investments available only to financial institutions and 401(k) plan participants.

What is a joint investment account?

Joint accounts are banking, or brokerage accounts shared by multiple people. Trusted relatives, couples, and business partners most often utilize joint accounts. A joint account works like a savings or checking account and lets anyone named on it access its funds. Every owner can write checks, withdraw cash, and pay online.

Unlike ordinary accounts, open accounts can have several authorized users. Couples can open permanent joint accounts to pay their salaries. A temporary account for two parties to donate funds is also possible. Joint bank accounts can have an “or” or “and” among the account holders’ names. Both individuals must sign in to access funds in an “and” account, while only one party must sign an “or” account.

Jointly held accounts include bank deposits, savings and checking accounts, loans, credit cards, LOCs, and mortgages. Joint status allows everyone on the account full use but also shares accountability for payments, fees, and charges. Joint accounts are as easy as single accounts. A mortgage, deposit account, or loan should be opened with both parties present at the bank. Credit cards are like joint accounts when adding a secondary or approved user. This usually needs a second signature.

Conclusion

Collective investment funds (CIFs) are tax-exempt pooled investment funds in employer-sponsored retirement savings plans. The SEC does not regulate CIFs, which are structured like mutual funds, and the FDIC does not insure them. Due to decreased management and operational costs, CIFs are becoming more common in 401(k) plans. CIFs are governed by the Office of the Comptroller of the Currency, not the SEC or the Investment Act of 1940. Like mutual funds, CIFs are pooled but unapproved investment entities like hedge funds. Investment workers who know how to choose investments and handle risk oversee the fund. This is CIFs’ advantage. This can be especially helpful for investors who don’t have the time, skills, or tools to handle their own finances. Its disadvantage is you must give the fund manager control of your money when you put it into a collective investment fund. In terms of skilled investment management, this can be helpful, but it also means you have less power over your investments.

The goal of a collective investment fund is to minimize expenses through economies of scale and profit-sharing pensions and funds. CIFs are trusts. Thus, the bank or trust business acts as trustee or executor over the pooled monies in the master trust account. Several banks use investment or mutual fund sub-advisors to handle portfolios. For instance, Invesco offers Global Opportunities and Balanced-Risk Commodity Trusts. Franklin Templeton, Fidelity, and T. Rowe Price operate CIFs. Intermediaries optimize marketplaces and minimize corporate costs.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.