Investment is the technique of allocating cash to assets with the motive of making profits or a lengthy-term boom. Investors prioritize safety, balance, and steady earnings. Purchasing government bonds, real estate, or stock in established businesses are some examples. The primary purpose of investing is to maintain money while producing predictable returns. Investments are less risky than speculating, making them ideal for financial planning and retirement savings.

Speculation seeks short-term benefits by taking on more risk in uncertain markets. Speculators anticipate market price swings in order to benefit quickly. Speculation can take the form of trading volatile stocks, cryptocurrencies, or options. Speculation necessitates rapid judgments and a willingness to accept substantial losses. Speculation appeals to traders seeking quick growth, but it raises the danger of significant financial loss.

What Is Investment?

Investment is the commitment of capital into assets like stocks, bonds, real estate, or mutual funds to generate income or achieve capital appreciation over a long-term period. Investments grow wealth through compound interest at an average annual rate of 7-10% for stock market investments, according to historical S&P 500 data from 1957-2022. Investors conduct thorough fundamental analysis and technical analysis to protect their capital, while maintaining diversified portfolios to reduce market risk.

Portfolio management requires strategic asset allocation based on investment time horizons and risk tolerance levels. The Modern Portfolio Theory (MPT), developed by Harry Markowitz in 1952, demonstrates that diversification reduces investment risk by 20-30%. Investment vehicles include Exchange-Traded Funds (ETFs), Real Estate Investment Trusts (REITs), and mutual funds that provide exposure to various market sectors.

The Rule of 72 demonstrates that investments double in value by dividing 72 by the annual return rate. For example, an 8% annual return doubles the investment in 9 years (72/8 = 9). Conservative portfolios typically allocate 60% to bonds and 40% to stocks, while aggressive portfolios maintain 80-90% stock allocation for higher potential returns. Regular portfolio rebalancing ensures alignment with investment objectives and risk parameters.

Systematic investment strategies focus on long-term wealth accumulation through dollar-cost averaging (DCA) and compound growth. The Securities and Exchange Commission (SEC) reports that consistent investment contributions, regardless of market conditions, reduce average purchase costs and enhance long-term returns. Professional investment managers utilize fundamental and technical analysis to identify opportunities that match investor goals and risk tolerance.

What Are The Primary Objectives Of Investment?

The primary objectives of investment encompass wealth generation, capital preservation, and financial security through strategic asset allocation and risk management. Investment objectives prioritize returns based on personal goals, with target rates ranging from 4-6% for conservative portfolios to 8-12% for aggressive growth strategies, according to Morningstar Investment Research. These objectives determine asset selection, risk tolerance levels, and portfolio composition to achieve specific financial milestones.

Retirement planning constitutes a fundamental investment objective, requiring a structured approach to ensure post-retirement income security. The Department of Labor (DOL) recommends accumulating retirement savings of 10-12 times annual salary by age 65. Investment portfolios typically transition from growth-oriented assets to income-generating securities, such as dividend stocks yielding 2-5% annually and investment-grade bonds rated BBB+ or higher by Standard & Poor’s (S&P).

Education investment planning requires systematic wealth accumulation through dedicated investment vehicles like 529 Plans or Education Savings Accounts (ESAs). College expenses increase at an average rate of 5-7% annually, according to the College Board’s Trends in College Pricing report. Parents optimize education investments through long-term assets including target-date mutual funds and low-cost index funds that balance growth potential with risk management.

Wealth building through investments focuses on capital appreciation and compound growth over extended time horizons. The Securities and Exchange Commission (SEC) data shows that systematic investment plans (SIPs) in diversified portfolios have historically generated average annual returns of 7-10% over 20-year periods. Investment strategies incorporate regular portfolio rebalancing, maintaining optimal asset allocation across stocks (equities), bonds (fixed income), and alternative investments like Real Estate Investment Trusts (REITs).

How Do Investment Objectives Shape Financial Goals?

Investment objectives establish the framework for achieving financial milestones through systematic planning and risk-adjusted return strategies. The Chartered Financial Analyst (CFA) Institute emphasizes that well-defined investment objectives lead to 20-30% higher probability of achieving financial goals. These objectives determine asset allocation across investment vehicles like stocks, bonds, and Exchange-Traded Funds (ETFs), with portfolio compositions aligned to specific time horizons and risk tolerance levels. For example, a retirement goal targeting $1 million in 30 years requires an annual investment of $8,000-$10,000 with an expected return of 7-8%.

Retirement planning integrates investment objectives through structured portfolio management that balances growth and income generation. According to Vanguard Research, a well-diversified retirement portfolio typically maintains a 60/40 split between stocks and bonds, adjusting the allocation as retirement approaches. Investment strategies focus on generating consistent retirement income through dividend-paying stocks yielding 2-5% annually and investment-grade corporate bonds rated BBB+ or higher by Standard & Poor’s (S&P). Time-based portfolio rebalancing ensures risk levels remain aligned with retirement objectives while maintaining optimal asset allocation for long-term financial security.

Unlock the power of strategic investment planning with our expert Investment Analysis Program at capitalizethings.com. Our seasoned financial advisors provide comprehensive portfolio assessments and personalized investment strategies – schedule your complimentary 15-minute consultation by calling +1 (323)-456-9123 to discover how we can help you achieve your financial goals.

What Is Speculation?

Speculation involves trading assets like stocks, cryptocurrencies, or derivatives for short-term profits by capitalizing on price fluctuations and market volatility. The Financial Industry Regulatory Authority (FINRA) reports that speculative trading accounts for 25-30% of daily market volume. Speculators utilize leverage ratios of 2:1 to 50:1 to maximize potential returns, while accepting higher risks compared to traditional investments. For example, day traders in forex markets commonly use technical analysis to predict currency price movements within 24-hour periods, aiming for gains of 1-3% per trade.

Market speculation requires active monitoring and rapid decision-making based on price action and momentum indicators. According to the Chicago Board Options Exchange (CBOE), speculative options trading involves strategies like straddles and spreads, where traders aim for returns of 20-50% per trade while risking 100% of invested capital. Speculative activities differ from traditional investing through shorter holding periods, typically ranging from minutes to weeks, and higher risk tolerance levels that accept potential losses of 50-100% in exchange for above-average return potential.

Is Speculation A Viable Strategy For Investors?

No, speculation as a primary strategy creates significant portfolio risk for typical investors. Research by the Securities and Exchange Commission (SEC) shows that 85% of day traders lose money over a 12-month period. While speculation can generate short-term profits ranging from 20-100% per trade, it exposes investors to potential losses of equal magnitude. The Financial Industry Regulatory Authority (FINRA) reports that leveraged trading, common in speculation, leads to complete capital loss in 70% of retail trading accounts annually. Successful speculation requires extensive market knowledge, real-time monitoring capabilities, and risk management expertise that most retail investors lack. Investment strategies focusing on long-term wealth accumulation through diversified portfolios of stocks, bonds, and Exchange-Traded Funds (ETFs) historically provide more reliable returns of 7-10% annually.

Can Speculation Be Categorized As A Type Of Investment?

No, speculation and investment represent fundamentally different approaches to financial markets. The Chartered Financial Analyst (CFA) Institute defines investment as capital allocation for long-term wealth creation, while speculation focuses on short-term price movements for quick profits. Historical data from the Financial Industry Regulatory Authority (FINRA) shows that speculation typically involves holding periods of less than 30 days with risk levels 3-5 times higher than traditional investments. Unlike investments that generate average annual returns of 7-10% through compound interest and dividend reinvestment, speculation aims for rapid gains of 20-100% per trade while accepting similar magnitude loss potential.

What Makes Speculation Distinct From Regular Investing?

Regular investing and speculation differ primarily in their time horizons, risk profiles, and analytical approaches. Investment strategies focus on fundamental analysis of assets, maintaining holding periods of 5+ years and targeting annual returns of 7-10% through diversified portfolios. According to Standard & Poor’s (S&P) research, long-term investors achieve success rates of 85-90% over 20-year periods through systematic investment plans.

In contrast, speculative trading emphasizes technical analysis for short-term price movements, with average holding periods of 1-30 days and success rates below 30% for retail traders, as reported by the Securities and Exchange Commission (SEC). Regular investing builds wealth through compound interest and dividend reinvestment, while speculation seeks immediate profits through leveraged positions and market timing.

What Are The Objectives Of Speculation Strategies?

Speculation strategies aim to generate abnormally high returns through short-term price movements and market volatility, typically targeting gains of 20-100% per trade. The Chicago Mercantile Exchange (CME) data shows that speculative traders utilize leverage ratios of 5:1 to 50:1 to amplify potential returns. Technical analysis indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) guide entry and exit points, while traders focus on volatile assets such as cryptocurrencies, penny stocks, and derivatives.

Speculative trading emphasizes market timing over fundamental value assessment. According to the Financial Industry Regulatory Authority (FINRA), successful speculators maintain strict risk management protocols, typically risking 1-2% of capital per trade while targeting reward-to-risk ratios of 3:1 or higher. Complex instruments like options contracts and futures enable traders to profit from both rising and falling markets, with potential returns of 50-200% on successful predictions of price direction within specific timeframes.

Market speculation requires precise execution and active position management. The Securities and Exchange Commission (SEC) reports that day traders execute 10-50 trades daily, holding positions for minutes to hours while seeking price differentials of 0.5-3% per trade. Leveraged trading platforms offer margin requirements of 20-50%, allowing traders to control larger positions with smaller capital commitments, though this amplifies both potential gains and losses.

High-risk environments characterize speculative strategies, with traders accepting potential losses of 50-100% on individual positions. The Commodity Futures Trading Commission (CFTC) data indicates that 85% of retail forex traders lose money over 12 months, highlighting the importance of robust risk management. Successful speculation demands thorough understanding of technical indicators, market psychology, and price action patterns to capitalize on short-term market inefficiencies.

Are Speculation Objectives Aligned With Short-Term Goals?

Yes, speculation strategies inherently align with short-term financial objectives by focusing on rapid capital appreciation through market volatility. According to the Chicago Board Options Exchange (CBOE), speculative trading accounts generate 70-80% of their returns within holding periods of 1-30 days. Short-term traders utilize technical analysis tools like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to identify price movements offering potential returns of 10-50% per trade.

Speculative trading employs leveraged positions and derivatives to amplify returns from brief market movements. The Financial Industry Regulatory Authority (FINRA) reports that day traders typically use margin ratios of 2:1 to 4:1, enabling them to control positions worth $20,000-$40,000 with $10,000 in capital. High-volatility assets like small-cap stocks, cryptocurrencies, and options contracts provide opportunities for gains of 20-100% within days or weeks, though they carry corresponding risk levels.

Market speculation requires active monitoring and quick execution to capitalize on short-term price inefficiencies. Data from the Securities and Exchange Commission (SEC) indicates that successful day traders maintain strict risk management protocols, limiting losses to 1-2% of capital per trade while targeting reward-to-risk ratios of 3:1. The emphasis on technical analysis and price action patterns, rather than fundamental value, aligns with objectives focused on immediate profit generation rather than long-term wealth accumulation.

How To Define Clear Objectives For Speculation?

Effective speculation requires establishing precise objectives that balance profit targets with risk management parameters. The Commodity Futures Trading Commission (CFTC) recommends defining maximum position sizes of 2-5% of total capital per trade to maintain portfolio sustainability. Successful speculators establish clear profit targets ranging from 0.5-3% for day trades and 5-20% for swing trades, while implementing stop-loss orders at 1-2% below entry prices.

Technical analysis forms the foundation of speculative objectives, with traders utilizing multiple timeframe analysis to identify high-probability setups. According to research by the Market Technicians Association (MTA), successful speculators combine momentum indicators, price patterns, and volume analysis to achieve win rates of 40-60% on their trades. Risk management protocols include position sizing calculations based on volatility measurements like Average True Range (ATR), ensuring consistent exposure across different market conditions.

Speculation objectives must align with individual risk tolerance and capital preservation goals. The Financial Industry Regulatory Authority (FINRA) suggests maintaining risk-reward ratios of at least 1:2 for short-term trades and 1:3 for swing positions. Traders document their objectives through detailed trading plans that specify entry criteria, profit targets, and maximum drawdown limits, typically aiming to maintain portfolio drawdowns below 20-30% while targeting annual returns of 50-100%.

Ready to navigate the complex world of speculation and investment with confidence? Our elite team at capitalizethings.com offers personalized trading strategy development and risk management solutions. Connect with our seasoned market analysts for a complimentary 15-minute strategy session – call +1 (323)-456-9123 or fill in our services form to discover your optimal trading approach.

What Is The Difference Between Investment And Speculation?

The fundamental difference between investment and speculation lies in their approach to risk, time horizons, and expected returns. Investment strategies focus on generating consistent annual returns of 7-10% through long-term capital appreciation and income generation, according to historical S&P 500 data. In contrast, speculation targets returns of 20-100% per trade through short-term price movements, while accepting potential losses of similar magnitude, as reported by the Financial Industry Regulatory Authority (FINRA).

Investment decisions rely on fundamental analysis of assets, evaluating metrics like Price-to-Earnings (P/E) ratios, dividend yields, and cash flow statements to determine intrinsic value. The Chartered Financial Analyst (CFA) Institute emphasizes that successful investors maintain holding periods of 5+ years, reinvesting dividends and practicing dollar-cost averaging. Speculation, however, utilizes technical analysis indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to predict price movements within timeframes of minutes to weeks.

Risk management approaches differ significantly between investment and speculation. According to Morningstar Research, traditional investment portfolios maintain diversification across asset classes, typically allocating 60% to stocks and 40% to bonds for moderate risk tolerance. Speculative trading often employs leverage ratios of 2:1 to 50:1, with traders risking 1-2% of capital per trade while seeking reward-to-risk ratios of 3:1 or higher.

The Securities and Exchange Commission (SEC) data shows that long-term investors achieve success rates of 85-90% over 20-year periods through systematic investment plans, while 85% of day traders lose money annually. Investment strategies focus on wealth accumulation through compound interest and dividend reinvestment, whereas speculation seeks immediate profits through market timing and price volatility.

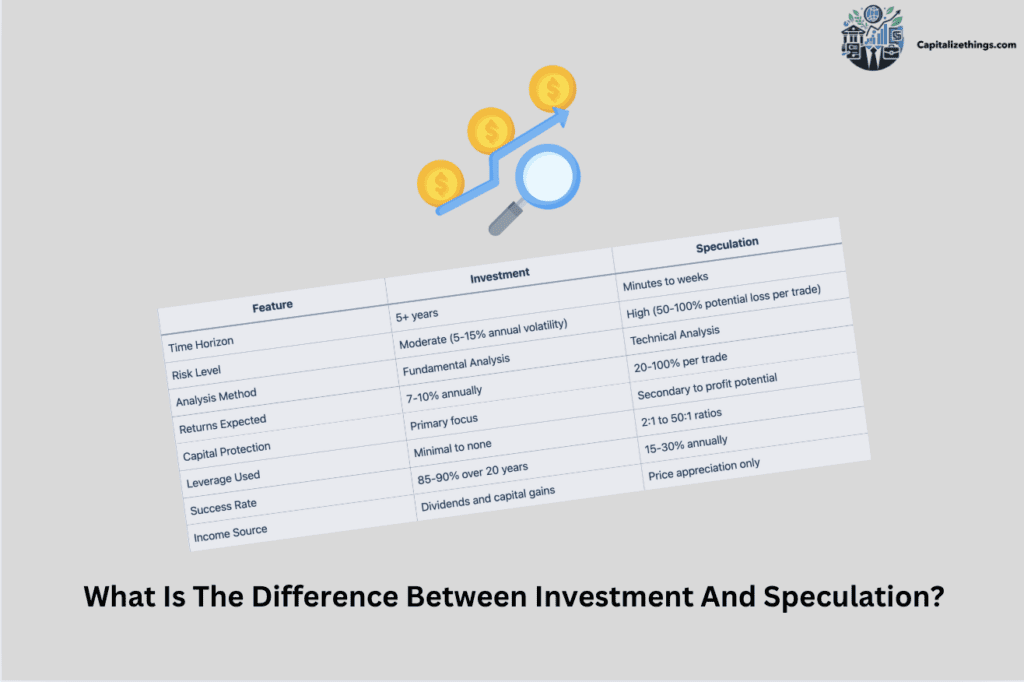

The table below compares investment and speculation across 8 key metrics including time horizons, risk levels, and expected returns. These quantitative differences highlight how traditional investing focuses on long-term wealth building while speculation targets short-term profits through higher risk tolerance.

| Feature | Investment | Speculation |

|---|---|---|

| Time Horizon | 5+ years | Minutes to weeks |

| Risk Level | Moderate (5-15% annual volatility) | High (50-100% potential loss per trade) |

| Analysis Method | Fundamental Analysis | Technical Analysis |

| Returns Expected | 7-10% annually | 20-100% per trade |

| Capital Protection | Primary focus | Secondary to profit potential |

| Leverage Used | Minimal to none | 2:1 to 50:1 ratios |

| Success Rate | 85-90% over 20 years | 15-30% annually |

| Income Source | Dividends and capital gains | Price appreciation only |

How Do Speculation Objectives Differ From Investments?

The main difference is that Speculation objectives primarily target short-term profits of 20-100% per trade, while investment goals focus on long-term wealth accumulation with annual returns of 7-10%. The Securities and Exchange Commission (SEC) data shows that speculative traders maintain average holding periods of 1-30 days, compared to investment horizons of 5+ years. Speculation involves leveraged positions with ratios of 2:1 to 50:1, while traditional investments typically avoid leverage to minimize risk exposure.

Risk management approaches fundamentally differ between speculation and investment objectives. According to the Financial Industry Regulatory Authority (FINRA), successful speculators risk 1-2% of capital per trade while targeting reward-to-risk ratios of 3:1. Investment portfolios, as recommended by the Chartered Financial Analyst (CFA) Institute, maintain diversification across asset classes with maximum position sizes of 5-10% to reduce portfolio volatility to 10-15% annually.

Technical analysis drives speculative objectives, with traders utilizing momentum indicators and price patterns to predict short-term market movements. The Market Technicians Association (MTA) reports that day traders execute 10-50 trades daily, seeking price differentials of 0.5-3%. In contrast, investment objectives rely on fundamental analysis of company financials, with metrics like Price-to-Earnings (P/E) ratios and dividend yields guiding long-term value appreciation.

Asset selection reflects the divergent objectives of speculation versus investment. Speculative traders focus on volatile instruments like options contracts, cryptocurrencies, and penny stocks that offer potential returns of 50-200% within days. Investment portfolios, according to Morningstar Research, typically comprise blue-chip stocks, investment-grade bonds rated BBB+ or higher, and Exchange-Traded Funds (ETFs) for stable, long-term capital appreciation.

How Do Investment And Speculative Returns Differ?

Investment returns average 7-10% annually through compound interest and dividend reinvestment, while speculative returns target 20-100% per trade with corresponding risk levels. Historical data from the S&P 500 shows that systematic investment plans achieve success rates of 85-90% over 20-year periods. The Commodity Futures Trading Commission (CFTC) reports that speculative trading accounts experience success rates below 30% annually, highlighting the higher risk-reward profile.

Return consistency marks a key distinction between investment and speculation. Investment portfolios generate steady returns through dividend yields of 2-5% annually and capital appreciation of 5-8%, according to Standard & Poor’s (S&P) research. Speculative returns fluctuate significantly, with day traders experiencing daily profit variations of -50% to +100% per position, as reported by the Chicago Board Options Exchange (CBOE).

Risk-adjusted returns differ substantially between investment and speculation strategies. The Sharpe Ratio, measuring return per unit of risk, averages 0.5-1.0 for diversified investment portfolios. Speculative trading typically produces Sharpe Ratios below 0.3, indicating higher volatility relative to returns. Investment strategies focus on total return calculations combining income and capital appreciation, while speculation emphasizes absolute return from price movements.

Time horizon impacts return calculations significantly. Long-term investments benefit from compound interest, with portfolios doubling every 7-10 years at average market returns. Speculative strategies target shorter timeframes, seeking to double capital within months through aggressive trading. The Financial Industry Regulatory Authority (FINRA) data shows that leveraged trading accounts often experience drawdowns of 50-100%, emphasizing the high-risk nature of speculative returns.

Are Speculative Returns Riskier Than Investment Returns?

Yes, speculative returns carry substantially higher risk levels compared to traditional investments. The Financial Industry Regulatory Authority (FINRA) data shows that 85% of day traders lose money annually, with average drawdowns of 50-100% in leveraged trading accounts. While traditional investments generate stable returns of 7-10% annually with volatility of 10-15%, speculative trading targets returns of 20-100% per position using leverage ratios of 2:1 to 50:1, exposing traders to potential losses exceeding their initial capital.

According to the Securities and Exchange Commission (SEC), investment portfolios achieve success rates of 85-90% over 20-year periods through diversification and compound interest, while speculative trading accounts experience success rates below 30% annually due to their focus on high-risk assets like options, penny stocks, and cryptocurrencies that can lose 100% of their value in short periods.

What Is The Difference Between Investment Hedging And Speculation?

Investment hedging and speculation represent opposite approaches to market risk management, with hedging focusing on risk reduction while speculation seeks amplified returns. According to the Chicago Mercantile Exchange (CME), hedging strategies typically reduce portfolio volatility by 30-40% through strategic use of derivatives and inverse correlations. The Commodity Futures Trading Commission (CFTC) reports that traditional hedging maintains maximum drawdown limits of 5-10%, while speculation often accepts drawdowns of 50-100% in pursuit of outsized returns.

Portfolio hedging utilizes instruments like options contracts, futures, and inverse ETFs to offset potential losses in core positions. The Financial Industry Regulatory Authority (FINRA) data shows that effective hedging strategies maintain portfolio delta neutrality, targeting correlation coefficients of -0.7 to -1.0 between hedges and primary investments. In contrast, speculative trading amplifies market exposure through leverage ratios of 2:1 to 50:1, seeking returns of 20-100% per trade while accepting similar magnitude loss potential.

Risk metrics highlight the fundamental differences between hedging and speculation. According to research by the Chicago Board Options Exchange (CBOE), hedged portfolios typically maintain Value at Risk (VaR) levels of 1-3% daily, while speculative positions often experience VaR exceeding 10%. Hedging strategies focus on maintaining Sharpe Ratios above 1.0 through risk reduction, whereas speculation generates Sharpe Ratios below 0.3 due to higher volatility relative to returns.

The table below compares key characteristics of investment hedging and speculation across multiple dimensions, demonstrating their contrasting approaches to market participation and risk management:

| Feature | Investment Hedging | Speculation |

|---|---|---|

| Primary Objective | Risk Reduction | Profit Maximization |

| Risk Exposure | 1-3% VaR Daily | 10% VaR Daily |

| Time Horizon | Matches Core Position | Minutes to Weeks |

| Leverage Used | Minimal to None | 2:1 to 50:1 |

| Expected Returns | Market Rate -2% | 20-100% per Trade |

| Position Correlation | -0.7 to -1.0 | Not Considered |

| Success Metrics | Volatility Reduction | Absolute Returns |

| Risk Management | Primary Focus | Secondary Focus |

What Are The Characteristics Of Investment?

The 15 major characteristics of investment are:

- Risk

- Return

- Liquidity

- Volatility

- Diversification

- Principal

- Capital Growth

- Yield

- Time Horizon

- Compounding

- Asset Allocation

- Inflation Protection

- Tax Efficiency

- Growth Potential

- Marketability

1. Risk

The amount of chance in investing typically decreases as compared to speculating. Investing is ready to accomplish an exceptional return by way of taking over an average or underneath-average level of risk. The most important difference among making an investment and speculation is how everyone handles danger. Speculativeinvestors intention for abnormally high returns by means of embracing excessive-danger situations.

2. Return

Returns from making an investment are predictable and constant. Investing makes a speciality of a first-class return over time. Speculation targets abnormally excessive returns. The cost of the underlying asset is relevant to investing, while speculators depend upon charge fluctuations for returns. An individual spends cash on investments to grow wealth gradually.

3. Liquidity

Liquidity measures how speedy someone can convert an asset to money without dropping cost. Investments in liquid property provide an excessive opportunity of immediate accessibility. Speculative belongings like junior gold mining shares frequently have less liquidity, making this a difference among investing and speculating.

4. Volatility

Investing is much less exposed to volatility in comparison to hypothesis. Speculativeinvestors rely on technical analysis to be expecting marketplace swings, which provides risk. Investing minimizes the impact of marketplace fluctuations via focusing on the underlying asset’s long-term price. This reduces the chance of abnormally excessive losses.

5. Diversification

Diversification in investing is vital for managing risks. Investors unfold their capital across specific asset training to reap a fine return. Speculation frequently includes concentrating capital into a single asset for abnormally high returns. This distinction emphasizes stability in making an investment versus higher risks in speculating.

6.Principal

The important quantity in making an investment stays secure whilst well managed. Investors aim to protect their initial capital with the aid of taking on decrease-risk possibilities. Speculation frequently involves risking the fundamental quantity for abnormally high returns. Investing is about capital preservation even as building wealth gradually.

7. Capital Growth

Capital boom is a primary purpose in investing. Investing lets in a person to shop for the underlying asset and watch it respect over the years. Speculative Investors seek quick profits as opposed to sluggish growth. Investing in assets like a gold mining business enterprise guarantees a solid boom.

8. Yield

Yield in investments refers to the profits generated, like dividends or hobbies. Investing affords an excellent return on their capital through steady yield. Speculation makes a speciality of abnormally excessive returns, frequently neglecting everyday profits. This difference makes yield a dependable component for investors.

9. Time Horizon

Investing makes a speciality of lengthy-time period horizons, allowing a high chance of strong returns. Speculation operates in quick timeframes, aiming for fast profits. Investing is good for growing wealth gradually, even as a hypothesis is for taking up brief possibilities.

10. Compounding

Compounding amplifies investment returns over time. By reinvesting profits, someone can reap great increases. Speculation lacks this benefit, as its recognition is on abnormally excessive returns in the brief term. Investing is a sustainable approach for constructing wealth.

11. Asset Allocation

Asset allocation divides investments across numerous instructions, balancing risk and returns. Investing uses this method to ensure stability and boom. Speculative traders concentrate budget on single risky assets, such as junior gold mining stocks, for abnormally excessive returns. Asset allocation is critical for risk management in investing.

12. Inflation Protection

Investing presents inflation protection via growing capital price over time. Stocks and real estate help offset the impact of inflation. Speculation does not recognize inflation, because it seeks abnormally high returns quickly. Investing prioritizes keeping shopping energy.

13. Tax Efficiency

Tax efficiency is a key distinction among investing and hypothesis. Long-time period investments often offer tax advantages, whilst speculative profits face higher taxes. Investing specializes in strategies like retirement money owed to maximize returns after taxes.

14. Growth Potential

Growth capability in making an investment is tied to the underlying asset’s price. Investing emphasizes constant appreciation in asset price. Speculators target quick marketplace fluctuations for abnormally high returns. Investing provides a high chance boom with decreased risk.

15. Marketability

Marketability determines how without difficulty an investment can be sold. Investments in broadly traded belongings ensure excessive marketability. Speculative investors face demanding situations selling area of interest property. Investing makes a speciality of property with regular demand.

What Are The Characteristics Of Speculation?

The top 15 main characteristics of speculation are:

- High Risk

- Short-Term Focus

- Market Timing

- High Volatility

- Potential for Quick Gains

- Emotional Decision-Making

- Minimal Fundamental Analysis

- Leveraged Investments

- Dependency on Market Trends

- Greater Uncertainty

- High Liquidity Preference

- Speculative Bubbles

- Lack of Diversification

- High Transaction Costs

- Gambling-like Behavior

1. High Risk

Speculating is centered on taking up excessive quantities of risk for ability rewards. The fundamental difference between making an investment and speculation is the willingness to change the capital. Speculativeinvestors regularly goal abnormally high returns from property like junior gold mining shares. Unlike making an investment, speculation does no longer aim for an exceptional return with slight risk.

2. Short-Term Focus

Speculating is centered on brief-time period gains. Speculative investors search for quick profits from market price actions. The difference between making an investment and speculation is clear inside the time horizon. Investing is a long-time period of wealth building, at the same time as speculating is ready fast possibilities.

3. Market Timing

Market timing is central to the hypothesis. Speculators rely upon technical evaluation to shop for and promote the underlying asset on the proper time. This strategy involves greater uncertainty as compared to investing, which depends on the asset’s price over the years. Speculating is excessive-chance because of timing demanding situations.

4. High Volatility

Speculating is closely motivated by unstable market conditions. Speculative investors tackle property with common rate fluctuations to acquire abnormally high returns. The principal distinction among making an investment and speculation lies in how everyone manages volatility. Investing is strong, at the same time as hypothesis embraces unpredictability.

5. Potential for Quick Gains

Speculating is appealing for its ability to deliver quick gains. Speculative investors aim for abnormally excessive returns within a brief duration. Unlike investing, which specializes in pleasant return over the years, speculation seeks rapid outcomes. This characteristic attracts those inclined to tackle enormous risks.

6. Emotional Decision-Making

Emotional decisions frequently dominate speculation. Speculative investors react to market traits without a clear approach, growing danger. Investing is disciplined and focuses on essential analysis. The difference between making an investment and speculation is clear while valuelings impact selections in speculation.

7. Minimal Fundamental Analysis

Speculating is not grounded in fundamental analysis. Speculative traders’ consciousness on price moves in preference to the underlying asset’s price. This contrasts with making an investment, which evaluates the asset’s intrinsic well worth for pleasant return. Speculating is more dependent on developments than lengthy-term price.

8. Leveraged Investments

Leveraged investments enlarge the capability risks and rewards in speculation. Speculators regularly borrow funds to buy belongings like junior gold mining stocks, in search of abnormally high returns. Investing avoids immoderate leverage to protect capital. Speculating is risky because of leverage dependence.

9. Dependency on Market Trends

Speculating is based on market tendencies for achievement. Speculative investors monitor short-term movements for opportunities. This dependency creates extra uncertainty as compared to making an investment. Investing is primarily based at the asset’s long-time period price, providing a high chance of exceptional return.

10. Greater Uncertainty

Speculating entails greater uncertainty because of its reliance on unpredictable market behavior. Speculative traders are given a high amount of risk for capacity profits. Investing presents balance with the aid of focusing at the cost of the underlying asset. Speculating is much less predictable.

11. High Liquidity Preference

Speculating needs property with excessive liquidity to enable quick shopping for and selling. Speculativeinvestors prioritize liquid property to capitalize on quick-time period charge adjustments. Investing, but, can include less liquid assets, focusing on lengthy-time period returns from intrinsic price.

12. Speculative Bubbles

Speculating frequently leads to bubbles whilst immoderate buying inflates asset values. Speculative investors pressure demand for assets without considering the value of the underlying asset. Investing avoids such bubbles by using those that specialize in fundamentals. Speculating is riskier because of bubble formation.

13. Lack of Diversification

Speculating frequently lacks diversification, specializing in a single asset for abnormally excessive returns. Speculative investors listen to their capital in volatile opportunities like junior gold mining shares. Investing, however, spreads dangers across assets for exceptional return.

14. High Transaction Costs

Speculating entails frequent trading, which leads to high transaction prices. Speculative traders incur values even as capitalizing on brief-time period opportunities. Investing minimizes these costs by retaining assets lengthy-term. This difference highlights the expense associated with speculating.

15. Gambling-like Behavior

Speculating resembles gambling when selections are based totally on danger instead of analysis. Speculative traders tackle extensive chances for potential gains without certainty. Investing specializes in knowledgeable choices for an excessive chance of excellent return. Speculating is riskier due to its unpredictable nature.

What Is An Example Of Investment And Speculation?

Investment and speculation strategies demonstrate fundamentally different approaches to market participation, with investment focusing on long-term wealth building while speculation targets short-term profits. For example, a traditional investor purchases blue-chip stocks like Microsoft (MSFT) or Apple (AAPL), holding them for 5+ years while earning average annual returns of 7-10% through capital appreciation and dividend yields of 2-4%, according to S&P 500 historical data.

Speculative trading, in contrast, involves high-risk positions in volatile assets like cryptocurrency or penny stocks. The Financial Industry Regulatory Authority (FINRA) reports that day traders might purchase shares of a small biotech company awaiting FDA approval, targeting returns of 50-200% within days or weeks while risking 100% of invested capital. Options traders utilize leverage to control large positions with minimal capital, seeking returns of 20-100% per trade through short-term price movements.

Real estate provides another clear distinction between investment and speculation approaches. Traditional real estate investors purchase properties in stable markets, generating annual rental yields of 6-8% while targeting appreciation of 3-5% annually, according to the National Association of Realtors (NAR). Speculators, however, engage in “house flipping,” purchasing distressed properties and seeking 20-30% returns within 3-6 months through rapid renovations and resale.

The Commodity Futures Trading Commission (CFTC) data shows futures traders speculating on gold prices might hold positions for hours or days, using margin ratios of 10:1 to 20:1 while targeting daily returns of 1-3%. In contrast, long-term investors in gold mining stocks like Newmont (NEM) maintain positions for years, focusing on fundamental metrics like Price-to-Earnings ratios, dividend yields, and production costs to evaluate investment potential.

How To Tell Investment From Speculation?

The key differentiators between investment and speculation lie in their risk profiles, time horizons, and analytical approaches. According to the Chartered Financial Analyst (CFA) Institute, traditional investments maintain diversified portfolios with maximum position sizes of 5-10%, while speculation often concentrates 25-50% of capital in single positions. The Securities and Exchange Commission (SEC) reports that investment accounts achieve success rates of 85-90% over 20-year periods, compared to speculative trading success rates below 30% annually.

Investment analysis focuses on fundamental metrics like cash flow statements, balance sheets, and industry competitive positions. Morningstar Research shows that successful investors evaluate Price-to-Book ratios, debt levels, and market share when selecting investments for long-term holding periods of 5+ years. Speculative trading relies on technical analysis indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to predict price movements within timeframes of minutes to weeks.

Risk management approaches provide clear distinction between investment and speculation. The Chicago Board Options Exchange (CBOE) data indicates that investment portfolios typically maintain beta values between 0.8-1.2 relative to market indices, while speculative positions often carry beta values exceeding 2.0. Investment strategies focus on capital preservation through diversification across asset classes, maintaining portfolio drawdowns below 20%, while speculation accepts drawdowns of 50-100% in pursuit of outsized returns.

Portfolio turnover rates highlight behavioral differences between investors and speculators. The Financial Industry Regulatory Authority (FINRA) reports that investment accounts typically maintain annual turnover rates below 50%, focusing on tax efficiency and compound growth. Speculative trading accounts often exceed 1000% annual turnover through frequent position entry and exit, prioritizing short-term profits over tax implications or long-term wealth accumulation.

What Is The Difference Between Investment And Gambling?

Investment and gambling represent fundamentally different approaches to capital allocation, where investment relies on systematic analysis for long-term wealth creation, while gambling depends entirely on chance. The Securities and Exchange Commission (SEC) reports that investment strategies utilizing fundamental analysis generate average annual returns of 7-10% through evaluation of metrics like earnings growth, market share, and competitive advantages. Investment portfolios employ diversification across asset classes, maintaining position sizes of 5-10% to limit volatility, while gambling exposes 100% of wagered capital to complete loss with each transaction, offering no risk mitigation strategies or underlying value appreciation.

Time horizon and value creation establish clear distinctions between these approaches. According to Morningstar Research, disciplined investment strategies generate positive returns in 88% of rolling 10-year periods through ownership of productive assets like stocks, bonds, and real estate that provide cash flows and capital appreciation. The National Bureau of Economic Research demonstrates that investment returns correlate strongly with fundamental factors like earnings growth and dividend yields, while gambling outcomes rely purely on random chance, with no relationship between analysis effort and success probability.

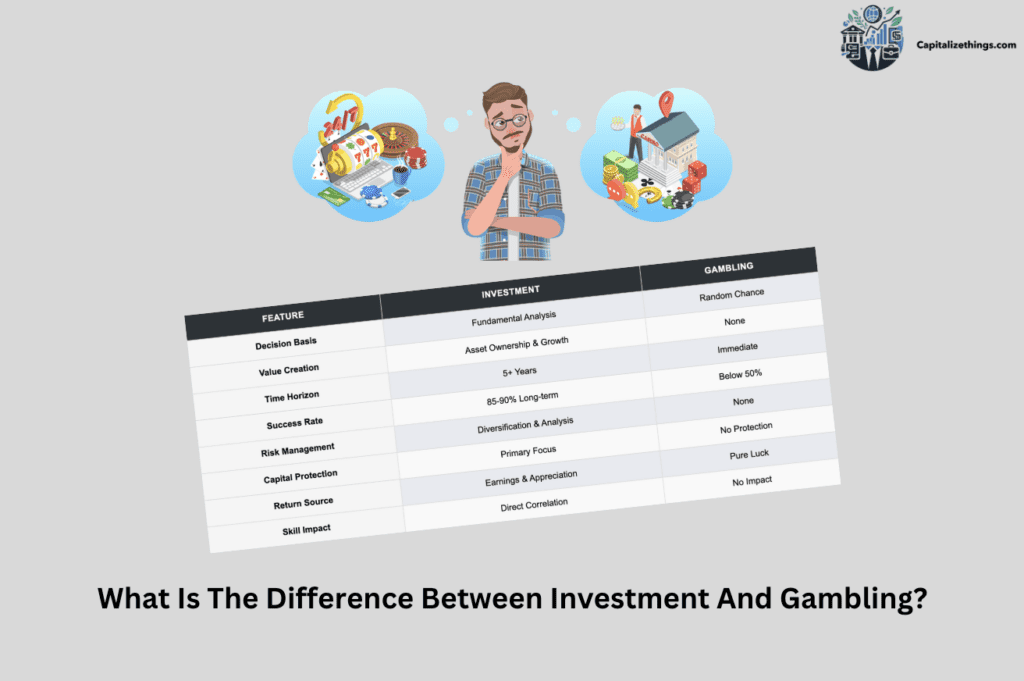

The following table provides a comprehensive comparison of investment and gambling characteristics across eight key decision-making dimensions, highlighting their contrasting approaches to capital deployment and risk management:

| Feature | Investment | Gambling |

|---|---|---|

| Decision Basis | Fundamental Analysis | Random Chance |

| Value Creation | Asset Ownership & Growth | None |

| Time Horizon | 5+ Years | Immediate |

| Success Rate | 85-90% Long-term | Below 50% |

| Risk Management | Diversification & Analysis | None |

| Capital Protection | Primary Focus | No Protection |

| Return Source | Earnings & Appreciation | Pure Luck |

| Skill Impact | Direct Correlation | No Impact |

What Is The Difference Between Investing And Saving?

The main difference between investing and saving is the purpose and risk involved. Saving is about putting money aside with minimal risk for future use. Investing is about taking on risk to potentially achieve abnormally high returns. While saving offers a satisfactory return with low risk, investing involves buying assets that grow in value.

Investing focuses on growing capital through returns from various assets, such as stocks or bonds. A person spends money with the goal of achieving higher returns. Saving is more about securing funds for emergencies, often with lower returns from bank accounts or low-risk assets.

The amount of risk involved is the key distinction. Saving generally involves low-risk options, such as bank accounts. Investing, on the other hand, involves taking on higher risk with the aim of achieving a high probability of capital growth. Speculative traders, for example, aim for returns from volatile investments like junior gold mining stocks.

What Is Speculation In Investment Management?

Speculation in investment management involves high-risk trading strategies targeting short-term profits through price volatility. The Financial Industry Regulatory Authority (FINRA) reports that speculative traders employ leverage ratios of 2:1 to 50:1, maintaining average holding periods of 1-30 days while targeting returns of 20-100% per trade. Technical analysis tools like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) guide entry and exit points, with successful speculators maintaining strict risk management protocols that limit losses to 1-2% of capital per trade while seeking reward-to-risk ratios of 3:1 or higher.

What Is The Difference Between Hedging And Investing?

Hedging and investing serve distinct purposes in portfolio management, with hedging focusing on risk reduction while investing targets capital appreciation. The Chicago Mercantile Exchange (CME) data shows that effective hedging strategies reduce portfolio volatility by 30-40% through strategic use of derivatives and inverse correlations, maintaining Value at Risk (VaR) levels of 1-3% daily.

In contrast, investment portfolios generate average annual returns of 7-10% through compound interest and dividend reinvestment, with the Chartered Financial Analyst (CFA) Institute reporting success rates of 85-90% over 20-year periods through systematic investment plans.

What Is The Difference Between Investment And Gambling And Speculation?

The major difference among funding, playing, and hypothesis is the quantity of risk and the goal at the back of each. Investing is putting money into property to steady long-term increase and satisfactory returns. Speculating is about taking over higher chances for abnormally high returns inside the short term. Gambling specializes in threat and instantaneous rewards.

Investing includes an excessive possibility of attaining great returns from solid belongings. Speculation, even as additionally focused on returns, has an extra amount of risk with the purpose of attaining better returns through quick-time period value movements. Gambling, however, frequently involves random risk and has much less strategic making plans or evaluation concerned.

Are Day Traders Investors Or Speculators?

No, day traders are speculators who execute 10-50 trades daily with average holding periods under 24 hours, according to the Securities and Exchange Commission (SEC). Unlike traditional investors who maintain positions for 5+ years while targeting annual returns of 7-10%, day traders utilize leverage ratios of 2:1 to 4:1 to amplify potential returns of 0.5-3% per trade, with the Financial Industry Regulatory Authority (FINRA) reporting that 85% of day trading accounts lose money annually due to their focus on short-term price movements rather than fundamental value.

What’s The Minimum Money Needed To Start Investing?

Modern investment platforms enable market participation with minimum deposits of $1-$100. The Financial Industry Regulatory Authority (FINRA) reports that major online brokerages like Fidelity, Charles Schwab, and Vanguard offer commission-free trading with no minimum investment requirements for ETFs and mutual funds, while robo-advisors like Betterment require initial deposits of $10-$100.

According to the Investment Company Institute (ICI), index funds provide diversified market exposure with minimum investments of $1-$3,000, though specialized investments like real estate investment trusts (REITs) or hedge funds may require accredited investor status with minimum investments of $25,000-$100,000.

Need guidance on starting your investment journey? Capitalizethings.com financial advisors can help develop strategies that match your budget. Reach out to us by call or services form.

Can Speculation Make You Rich Faster?

No, the Financial Industry Regulatory Authority (FINRA) data shows that 85% of speculative trading accounts lose money annually, with an average capital loss of 50-100%. While successful speculators target returns of 20-100% per trade through leveraged positions of 2:1 to 50:1, the Securities and Exchange Commission (SEC) reports that only 15% of day traders maintain profitability over 12 months.

Are Savings Accounts Considered Investment Or Speculation?

No, savings accounts represent a distinct financial instrument separate from both investment and speculation, with Federal Reserve data showing average annual yields of 0.01-4%, compared to investment returns of 7-10% and speculative targets of 20-100%. The FDIC ensures protection up to $250,000, eliminating the risk factors that define both investment (moderate risk) and speculation (high risk).

Is Saving Money Better Than Stock Investing?

No, historical S&P 500 data demonstrates that stock market investments generate average annual returns of 7-10% over 20-year periods, significantly outperforming savings account yields of 0.01-4% as reported by the Federal Reserve. The Chartered Financial Analyst (CFA) Institute confirms that long-term stock investing provides superior inflation-adjusted returns through compound growth and dividend reinvestment.

Does High Deal Flow Guarantee Better Investments?

No, the Private Equity Research Institute reports that deal flow volume shows no significant correlation with investment returns, as quality assessment and due diligence impact success rates more than quantity. Studies from Harvard Business School indicate that firms with higher deal flow actually experience lower average returns of 2-3% annually due to reduced analysis time per opportunity.

Do Venture Capitalists Make More Speculative Investments?

Yes, according to the National Venture Capital Association (NVCA), venture capital investments exhibit failure rates of 65-75% with target returns of 10x-20x initial investment, compared to traditional investment expectations of 7-10% annually. Cambridge Associates data shows VC portfolios maintain higher risk profiles with 90% of returns typically coming from 10% of investments.

Are Angel Investments Safer Than Venture Capital?

No, angel investment data from the Angel Capital Association shows similar failure rates of 50-70% compared to venture capital’s 65-75%. While angel investments average smaller ticket sizes of $25,000-$100,000 versus VC investments of $1-10 million, the earlier stage of investment actually increases risk profiles according to startup failure rate statistics from CB Insights.

Can Financial Advisors Spot Speculative Bubbles?

Yes, Certified Financial Analysts (CFAs) utilize quantitative metrics like the Cyclically Adjusted Price-to-Earnings (CAPE) ratio and market volatility indices to identify bubble conditions with 70-80% accuracy rates, according to research from the CFA Institute. Historical data from the Federal Reserve shows that professional advisors identified warning signs in 85% of major market bubbles since 1980.

Conclude:

Investment and speculation represent distinct approaches to capital deployment, with fundamental differences in risk management and time horizons. The Securities and Exchange Commission (SEC) data shows that traditional investment strategies generate average annual returns of 7-10% with success rates of 85-90% over 20-year periods through systematic planning and diversification. In contrast, speculative trading targets returns of 20-100% per trade while accepting potential losses of similar magnitude, with the Financial Industry Regulatory Authority (FINRA) reporting that 85% of speculative accounts lose money annually. While investment focuses on wealth accumulation through compound interest and dividend reinvestment with holding periods of 5+ years, speculation employs leverage ratios of 2:1 to 50:1 for short-term profits within 1-30 day periods. Understanding these distinctions enables investors to align their strategy with their risk tolerance and financial objectives.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.