Investment opportunities include stocks, bonds, real estate and mutual funds. Investment opportunities are assessed for profits, risks and liquidity. They can occur in technology, finance, energy, and healthcare. Financial issues like interest rates, price increases, and geopolitics can also affect them. Individuals must identify and evaluate investment possibilities to make accurate choices about time and method of arranging their portfolios. It takes rigorous research of market trends, corporate financials, and other data to find investment possibilities with good returns while minimizing risk.

To find investment opportunities, have a thorough understanding of the company. You should grasp the company’s operations and philosophy so much that acquiring it excites you and aligns with your values. Invest in ethical companies to make a portfolio of proud investments. A company requires a moat to defend itself from competitors. This advantage could be brand strength, private knowledge, or cost.

You should put your investment on solid ground and boost its chances of success by thoroughly evaluation of financial parameters and waiting for the right price.

An exit strategy is an approach a venture capitalist, investor, or company proprietor takes to liquidate a financial asset. It is used to sell tangible business assets after meeting or exceeding preset conditions. An exit strategy closes a losing investment or firm and limits losses. An exit plan can be used when a venture or company’s endeavor meets its profit goal. Angel investors in new companies can organize an IPO as an exit opportunity.

What is an investment opportunity?

Investment opportunities are possibilities but not guarantees of investing in a stock, mutual fund, startup, or cryptocurrency with growth potential. Investment Owners have many options, but most buy securities with a brokerage account. Many financial goods can be purchased using an account with a brokerage company.

Investments can fluctuate. Most rise and fall, and some respond more to economics or world politics. Therefore, investors should consider all relevant risks and investment costs when assessing potential opportunities in a given year.

Investment opportunities involve purchasing assets and allowing them to appreciate, investing in real estate, or starting a business. Every choice has risks and advantages, but if you want to invest this year, you want to investigate many. Every proposal must be examined, and due diligence is needed before investing. Only you can determine whether prospects fit your goals and long-term ambitions.

Discover untapped investment opportunities & navigate challenges with expert guidance from CapitalizeThings.com (+1 (323)-456-9123).

What to consider while investing?

The following 10 things should be considered before investment:

- Financial Plan

- Prioritize Saving

- Understand Compounding Power

- Consider Risk

- Understand Asset Allocation and Diversification

- Spend Less

- Learn Classic Investment Strategies

- Stay disciplined

- The owner or Lender’s Mindset

- Don’t invest in something you don’t understand

- Financial Plan

For successful investment, develop an investment strategy with goals and milestones. These goals and milestones include targets for saving sums by dates. Goals include saving money to buy a home, supporting your children’s education, developing an emergency fund, financing an entrepreneurial enterprise, or retirement.

As many individuals consider investing for retirement, early financial freedom is considerably better. A movement, The Financial Independence, Retire Early movement, promotes this. You can develop a comprehensive financial plan independently. If you’re new to the process, you should consider hiring a financial advisor or organizer, preferably a CFP®. Finally, act quickly. Begin and revise a plan early in life when circumstances change.

- Prioritize Saving

You need money before investing. For most individuals, this means saving part of each pay check. If your employer matches your contributions to a 401(k), this can be an enticing way to make saving automatic.

Along with employer-sponsored plans, you should explore other automatic savings options while creating your financial strategy. Building wealth involves aggressive saving and smart investing to build your money.

- Understand Compounding Power

Saving and investing regularly early in life will help you take advantage of the phenomenon of compounding to enhance your wealth. The prolonged period of historically low interest rates has reduced the power of compounding. However, it has also made beginning early to build savings and assets more critical since dividend-paying and interest-bearing investments will take longer to double in value than before.

- Consider Risk

Investment risk involves bond default risk and stock volatility. Additionally, risk and return or reward are usually traded. More significant investment returns often require more risk, including the chance of losing all or a portion of your investment. Determining your risk tolerance is crucial to planning. Knowing how much you can lose if a potential investment declines in value and how much price fluctuation you can tolerate without worrying can help you choose suitable investments.

- Understand Asset Allocation and Diversification

Asset allocation and Diversification are closely connected ideas that manage investment risk and optimize returns. Diversification involves spreading your investment portfolio among several investments in hopes that above-average returns or profits in others will offset below-average returns or losses in some. Asset allocation involves spreading your portfolio over equities, bonds, and cash. Your financial planning strategy should also review your asset allocation and diversification decisions.

- Spend Less

You can control expenses but not investment results. Transaction charges, investment account fees, management fees, and other fees can also hurt investment performance. For instance, high-cost mutual funds do not guarantee higher performance.

- Learn Classic Investment Strategies

Beginners should grasp active versus passive investing, value against growth investing, and income-oriented versus gains-oriented investing. Competent investment managers can outperform the market, but only some do it consistently. This causes some investment gurus to propose low-cost passive investing strategies, especially index funds that track the stock market.

Value investors help equities with low price-earnings ratios (P/E) compared to the market, looking upward potential and low adverse risk. Even though they’re costly, growth investors see more possibility in firms with solid revenue and earnings growth.

Income-oriented investors want a continuous source of dividends and interest to meet their cash needs, reduce investment risk, or both. Income-oriented investments include dividend-growing stocks. Gains-oriented investors don’t care about income streams and pursue investments with the most significant long-term price rise.

- Stay disciplined

Invest long-term with a well-planned financial plan and be disciplined. Avoid getting excited or startled by transitory market movements and exaggerated media coverage of markets. Only doubt market commentators if they have long, independently validated forecasting streaks.

- The owner or Lender’s Mindset

Stocks are business ownership shares. Investors lend money to issuers through bonds. If you want to be a savvy long-term entrepreneur, think like a business owner or lender before buying a stock or bond.

- Don’t invest in something you don’t understand

Given the rise of complex and unique investment products and companies with complex and unusual business models, starting investors face an extensive array of investment choices they still need to grasp fully. Only invest in something you understand, especially its risks.

What is the best opportunity for investment?

8 best opportunities for investment are the following:

- Dividend Stocks

- Fixed Income

- Small-Cap Stocks

- Emerging-Market Stocks

- International Developed-Market Stocks

- Value Stocks

- Commodities

- Energy Stocks

- Dividend Stocks

Dividends have contributed 33% of the S&P 500’s return since 1924, per the September 2023 S&P Dow Jones Indices analysis. Despite AI growth stocks like Nvidia’s fast-moving anticipation, dividends are vital to investors. Dividend stocks help smooth returns and mitigate market drops with continuous cash flow. Many value companies and utility stocks have been booming pay dividends. A company with a lengthy history of dividend increases will try to keep up that pattern because a cut would telegraph management pessimism while sending investors fleeing.

Dividend Aristocrats have improved shareholder payouts for 26 years or more. Walmart Inc. (WMT), PepsiCo Inc. (PEP), Target Corp. (TGT), Lowe’s Cos. (LOW), and McDonald’s Corp. (MCD) are among such stocks. In 2024, dividend stocks remain stable income sources irrespective of market and economic circumstances.

- Fixed Income

Investors and traders could get excited about stocks. Fixed income reduces stock volatility and provides income. Since 2020, rising interest rates have lowered bonds. However, bond investors in 2024 could gain. Tamara Witham, a CFP and certified financial analyst with GreenLife Advisors in Harrison, New York, says investors who want regular income but higher yield than savings accounts or money market funds choose bonds. Witham advises establishing a bond ladder to capitalize on market possibilities.

- Small-Cap Stocks

Due to the rapid expansion of the US market, many larger companies are still monitored in small-cap indexes. Hamasaki says these equities offer investors more growth, volatility, and risk than large-cap stocks. Small caps have outperformed larger companies over time, but that premium has faded as more significant equities have dominated. Since small caps rotate into leadership, diversified portfolios usually include them. In 2024, stable or lower interest rates will boost small-cap performance.

- Emerging-Market Stocks

Trading emerging-market stocks in fast-growing countries with less sophisticated financial and regulatory systems or political uncertainty is risky. Rising living standards in emerging nations generally spur investment, boosting those markets.

- International Developed-Market Stocks

International stocks fall behind US stocks, but they help diversify a balanced portfolio.

- Value Stocks

You’ve certainly seen that rundown property in a clean area that was renovated and sold for a lot. Look at value stocks similarly. These stocks are undervalued based on cash flow, income, and profitability. Despite advances, value equities have outperformed growth in recent years. Since each asset class can excel at any period in a market cycle, many financial experts recommend a diversified portfolio with growth and value.

- Commodities

Agricultural futures, the metal copper, and crude oil can hedge equities market volatility and inflation. Lower interest rates, strong demand, and supply limits should boost commodity prices in the following quarters, according to TD economist Marc Ercolao. Supply shortages are raising livestock costs. Exchange-traded funds like the First Trust Global Tactical Commodity Strategy Fund (FTGC) and the Invesco DB Agriculture Fund allow investors to use commodities without trading futures.

- Energy Stocks

Technical investors have noted that the Energy Select Sector SPDR ETF (XLE) has been correcting methodically since mid-April, suggesting new advances. Summit Midstream Partners LP (SMLP) led the sector’s pricing this year, followed by Gran Tierra Energy Inc. (GTE), Overseas Shipholding Group Inc. (OSG), and Teekay Tankers Ltd. Multiple trends helped energy sector growth this year. Domestic shale oil businesses like EOG Resources Inc. (EOG) and Diamondback Energy Inc. (FANG) steal market share from foreign oil producers.

Discover untapped potential in energy investments with expert insights from CapitalizeThings.com by contacting us through email or hit a call at +1 (323)-456-9123.

What should I look for in an investment opportunity?

It would help if you define your criteria before looking for investment opportunities. What are your investment goals? How much can you invest? How long will you wait for returns? Are you comfortable with how much risk? These inquiries will help you choose the best ones for your profile. Your criteria can filter and evaluate potential investments by industry, growth, sector, size, profitability, valuation, dividends, etc., as an investment opportunity.

Next, research the market and your desired industries, sectors, and geographies. Financial websites, podcasts, newsletters, blogs, studies, and publications can help you track investment trends, possibilities, and problems. Stock screeners, market indexes, and ETFs can help you compare investments based on fundamentals, performance, and technical indications.

The third step is to assess your possible investments’ past and future performance. ROI, NPV, payback period, IRR, cash flow analysis, and other measures can be used to evaluate your investments. Financial statistics, charts, and graphs can help you compare your investments’ profitability, solvency, liquidity, efficiency, and growth.

The fourth phase is to evaluate the risk of your potential investments and how market volatility, competition, economic cycles, legislation, etc., affect them. Fifth, diversify your portfolio among investments, sectors, industries, and geographies to reduce risk. Diversification can lessen the effect of any single investment on your portfolio and boost your probability of higher returns with lower volatility.

What is the best opportunity for investment in the USA?

Stocks are always the best investment option. I’ve never seen a billionaire without stocks! Investors are artists and wealth-builders!

Let’s look at the 6 most crucial stock market investment tips here:

- Always follow the lovely saying, Be Patience and Keep Calm. Never enter the stock market if you can’t follow this sentence.

- Only invest up to 5% of your capital in one investment. 3% usually covers one stock.

- Always undertake basic and technical analysis while investing. Fundamental research explains finances, whereas technical analysis determines whether to acquire a stock.

- No investor ever loses or buys terrible stocks! Thus, selling loss-giving stocks first is better than selling profit-giving equities to book profit.

- Avoid stacking stocks in the same industry. Diversify your investments across sectors. Except during recessions, all industries rarely bear!

- Track your portfolio quarterly and read the news everyday as an investor.

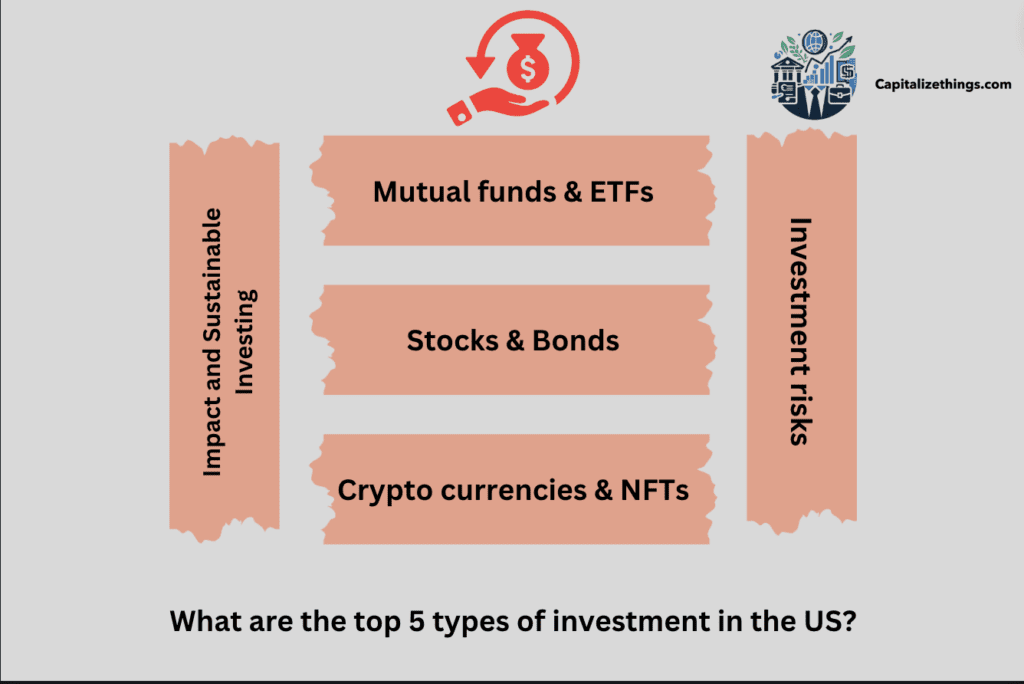

What are the top 5 types of investment in the US?

The top 5 types of investment in the US are:

- Mutual funds & ETFs

- Stocks & Bonds

- Crypto currencies & NFTs

- Impact and Sustainable Investing

- Investment risks

- Mutual funds & ETFs

Mutual funds and ETFs demand lower investments to establish diverse portfolios; therefore, numerous fresh investors have started with them.

- Stocks & Bonds

Stocks can do well in one year but fall in the next. Energy stocks rise while tech companies fall. The combination of investment types you choose will affect your portfolio performance more than the individual items you own.

- Crypto currencies & NFTs

Cryptocurrency and NFTs are innovative ways to use blockchain technology in investment. However, these assets are risky and volatile, so investors should be careful when allocating them.

- Impact and Sustainable Investing

Socially conscious investors include ESG elements in their portfolios. More advanced techniques and screening capabilities allow you to match your investments with your ideals without sacrificing return potential.

- Investment risks

Losing money is the most significant risk of any venture. Some investments have lower returns because they are safer. If it’s right for you, consider its risks and advantages before investing.

Which investment is best in the future?

The best investments for the future are high-yield savings accounts and Long-term corporate bond funds.

What are the top investment banking opportunities?

The top 15 investment banking opportunities are:

- Investment advisor

- Banking Associate

- Account manager

- Finance expert

- Finance associate

- The investment banker

- Analyst portfolio

- Investor relations manager

- Invest analyst

- Investment manager

- Managing director

- Portfolio manager

- Finance modeler

- Treasury chief

- Finance vice president

- Investment advisor

Professional investment advisers advise customers on money investments. They can help clients evaluate fresh investment options and choose trustworthy partners with solid financial growth potential. Investing consultants assess clients’ investment goals and resources. Using this knowledge, they plan their asset growth over time.

- Banking Associate

investment banking colleague and data, calculate and present financial prospects to clients. Using software and equations, they create financial models, forecast income, and value enterprises. Bank colleagues produce proposals and documentation and organize financial records. They help with equity offers, stock repurchasing, and other economic activities to comply with regulations.

- Account manager

Account managers manage client connections, renew contracts, place orders, and resolve concerns. Investment banking account managers educate prospective investors on their financial possibilities and offer services based on their financial situation. They inform investors and customers and negotiate account specifics based on their business agreements.

- Finance expert

Financial analysts make budgeting and finance recommendations based on a company’s economic activity and transactions. They analyse financial data to find trends and predict how they affect a company’s finances. They list all income, spending, investments, and funding choices. They also recommend financial controls and procedures to boost their clients’ profits.

- Finance associate

Finance colleagues handle clients’ accounting and compile their clients’ financial health reports using economic data. They record transactions and compile and track taxes. They cover their budgets and notify AC if their spending exceeds funds. Finance colleagues make payments, invoices, and expenses for each pay cycle.

- The investment banker

IBs’ trade exceeds, and they invest to make money for their clients. They analyze economic circumstances and market activity to decide which investments will yield a good return. Investment bankers weigh the risks and benefits of each investment before selling. Customers receive guidance on when to sell and buy stocks and assets for maximum profit.

- Analyst portfolio

Portfolio analysts analyze a client’s financial portfolio and suggest ways to boost profitability or stability. They help clients identify which assets make their money and which lose money. They anticipate long-term revenues and losses of a client’s assets using statistical modelling software and other techniques based on financial portfolio scenarios.

- Investor relations manager

Investment relations managers find and retain investors. They inform clients about investment options and financial developments, report to customers, and change financial packages according to their aims. Investor relations managers also arrange meetings, help investors manage risks, and work with investment bankers.

- Invest analyst

Investment analysts study financial performance and investment opportunities. They analyse commodity, stock, and currency changes to find the best investments. Investment analysts can investigate a specific investment type or all of their clients’ investments.

- Investment manager

Investment managers handle clients’ portfolios. They invest assets and direct corporate funds using a budgetary & financial strategy developed with customers. Investment managers find stocks, analyse returns, and buy and sell them.

- Managing director

Managing directors plan a company’s strategy. Investment banking managing directors recruit clients and urge them to invest with them. They negotiate M&As and other financial arrangements. Managing directors review market activities and fresh investment opportunities with clients.

- Portfolio manager

Portfolio managers assist clients in creating a financial portfolio to fulfil their goals. They assess clients’ finances and meet with them to determine their best investment strategy. The portfolio manager tailors investment opportunities to the client’s risk tolerance.

- Finance modeler

Financial modelers use financial data and market behaviour to forecast short- and long-term earnings and losses. Research helps them predict industry demand, social trends, and government regulations that could affect the stock market. Financial modellers utilize statistics and complex technologies to illustrate client financial opportunities and hazards.

- Treasury chief

Treasury managers oversee client bank accounts. They also keep track of company cash flow by collecting receipts, invoices, and purchase orders. They evaluate actual expenses against budgets and recommend spending adjustments to fulfil financial goals. They approve large transactions and verify corporate funding.

- Finance vice president

Finance VPs manage a company’s financial operations and strategy. They provide explicit spending and investment guidelines. A vice president of finance trains financial and accounting staff to manage risk, comply with regulations, and create investor relationships.

Do investment bankers make investments?

Yes! Investment bankers make investments and assist companies and governments in raising funds. Financial advisors help clients price money, allocate resources, and oversee investments.

Do investment bankers make 7 figures?

Yes! Investment bankers make seven figures. Total remuneration is in the high six to low seven figures, with a base salary in the mid-six figures.

What are global investment opportunities?

The best global investment opportunities are mutual funds, foreign direct investments and exchange-traded accounts. Global or international investment is a portfolio approach that selects global investments. Global investments allow you to diversify and hedge risk, as stock market theorists have advised for years. Financial cycles affect individual economies. Your portfolio can achieve smoother returns by investing in multiple economies. Diversification and global investing reduce hazard and improve portfolio returns. Spreading investments among countries becomes more critical when no country tops the list each year.

What is an example of global investment?

3 examples of global investments are:

- Global direct investment

- Feeder funds invest in global funds

- Funds that invest in numerous funds for global exposure

What is globalization investment?

Investment globalization is the percentage of worldwide invested capital owned by non-nationals (Chase-Dunn, 2000). The modern world system’s economic, trade, and investment globalization aids transnational economic integration, including investment growth.

What are the investment opportunities in the current market?

The top 6 investment opportunities in the current market of which you can buy shares are:

- Stocks

- Bonds

- Mutual Funds and Exchange-Traded Funds

- Vanguard S&P 500 UCITS ETF

- Commodities

- Property

- Stocks

When you buy shares, you buy a small share of a corporation. The performance of the organization whose shares you purchase will determine the value of your investment. Thus, when considering stock market investments, it is crucial to analyse the company and determine if buying its shares is a good idea.

- Bonds

Fixed income investments like bonds involve lending money to the issuer. The bond issuer promises the investor a fixed interest rate for a set time. After that period, the bond expires, and the issuer must return the principal. Both governments and businesses issue bonds, which are considered safe investments but involve risk. Any debt carries the danger of default. This risk relies on the issuing body and affects the bond’s yield, with lesser-risk bonds yielding less and vice versa.

- Mutual Funds and Exchange-Traded Funds

ETFs and mutual funds offer quick Diversification across various assets with a single investment, unlike bonds and stocks, which expose investors to one company or bond. Both types of funds acquire stocks and bonds with investor money. These assets represent a stock index, sector, or economy and can be actively or passively managed. Actively managed funds find the best instruments in their industry to outperform the market, while passively managed funds reflect it. These attributes can make ETFs & mutual funds ideal for beginners or investors who need more time or competence to analyse specific assets.

- Vanguard S&P 500 UCITS ETF

ETFs & mutual funds can be based on anything, but passively tracking stock indices has become very popular. These funds will hold interests in all index businesses. Vanguard S&P 500 UCITS ETF (VUSA) passively tracks the index. This ETF exposes investors to 500 top US firms by market cap.

- Commodities

There are various asset classes to invest in besides stocks and bonds. Commodities are intriguing investments for portfolio diversification. Gold is the most popular investment commodity, but crude oil, copper, and cotton are options.

- Property

Property is another non-stock market investing option. In any situation, individuals will require property, a physical asset. As with any market, the property market has peaks and troughs. Not everyone can manage to pay for a home, but there are numerous ways to invest in property. REITs are a standard option. REITs use investor funds to buy, build, and handle income-generating assets. Therefore, REITs allow investors to reap some benefits of owning income-producing assets without the hassles.

What are good investment opportunities for retirement?

7 of the Good investment opportunities for retirement are:

- Dividend stocks.

- Money market funds.

- High-yield savings accounts.

- Certificates of deposit.

- Ultra-short fixed-income ETFs

- Annuities.

- Treasury bonds

Where should I invest my retirement savings?

You should invest retirement savings in the following 9 plans:

- Defined contribution plans

- Solo 401(k) plan

- IRA plans

- Traditional pensions

- Cash-value life insurance plan

- The Federal Thrift Savings Plan

- Guaranteed income annuities (GIAs)

- Cash-balance plans

- Nonqualified deferred compensation plans (NQDC)

What are 3 ways of investing for retirement?

3 ways of investing for retirement are:

- Plan Defined Benefit

- Company and 401(k) Plans

- Traditional IRAs

- Plan Defined Benefit

Pensions are employer-funded retirement plans that promise a retirement benefit based on salary and tenure. They are rare outside the public sector nowadays.

- Company and 401(k) Plans

Employee-funded defined contribution plans are employer-sponsored. Automatic savings, matching contributions, and tax incentives are offered. In 2023, you can contribute $22,500/$30,000 if you are older than 50. You can contribute $23,000 in 2024 or $30,500 if you are over 50.

- Traditional IRAs

Tax-deferred retirement investing is possible with an IRA. You can subtract conventional contributions to an IRA if you qualify. Your individual income tax rate applies to retirement withdrawals. You can donate $6,500 in 2023 or $7,500 if you’re 50 or older (with the $1,000 catch-up). Your 2024 contribution can be $7,000 or $8,000 if you’re over 50.

What are the top investment opportunities in Kenya?

The top 6 investment opportunities in Kenya are:

- Agriculture

- Agro-Processing

- Chicken Products

- Fisheries

- Products made of leather

- Livestock

- Agriculture

About 75% of the population relies on agriculture. The agricultural sector can diversify and expand through increased food crop production and non-traditional exports. Packaging, transportation technology, and storage can be improved. Intensified irrigation and additional value processing are investment opportunities.

Seed production, pesticide and sprayer manufacturing, dam veterinary services, borehole construction, irrigation systems, and other products offer investment prospects. Support services like cold storage and refrigerated transport for perishables also provide opportunities.

- Agro-Processing

Many investing options exist in this field. Butter, ghee, margarine, sunflower, rapeseed, sesame, cottonseed, coconut, and corn are produced locally, while palm oil is imported in significant quantities. Palm oil import replacement investments are appreciated.

Beer made from local barley is good in Kenya. Grape and Papaya wines can now be exported to regional and worldwide markets. Coffee grinding and roasting offer opportunities, as does exporting decaffeinated coffee.

- Chicken Products

Chicken hatcheries for regional and domestic consumption are undervalued.

- Fisheries

Kenya has abundant fishing opportunities in the Indian Ocean, Lake Victoria, and other freshwater lakes. Deep sea fishing, prawn, and trout farming are young but rising fast. Fish processing (filleting, fishmeal) and fisheries-support infrastructure (frozen transport, cold storage) offer opportunities.

- Products made of leather

Most skins and hides are shipped to the wet blue stage, while finished leather production offers opportunities for shoe and other leather manufacturing.

- Livestock

Meat and dairy farming offer investment opportunities. The dairy business has been liberalized, opening up local and regional milk processing investment options. Investments in non-traditional animal husbandry like ostrich and crocodile farming are promising. Kenyan beekeeping and honey production are undervalued.

Which investments have the highest returns in Kenya?

Bonds investments have the highest returns in Kenya. Low-risk government bonds pay 8–10% annually. Treasury bills and bonds are outstanding for long-term wealth growth. ETFs diversify investments, reducing the chance of significant losses.

How to invest $100,000 in Kenya?

To invest $100,000 in Kenya, visit the stock market. Stock market investing can be done directly through equities or indirectly through mutual funds or ETFs. Bonds are less risky than stocks but give smaller rewards. Rental properties, crowdfunding, and REIT platforms are alternative options. For short-term objectives or emergencies, try a high-yield savings account or CD.

Retirement accounts like IRAs or 401(k) s offer tax benefits and are intelligent long-term investments, while peer-to-peer lending crypto currencies and platforms are riskier. Crowd funding and angel investment networks allow investors to invest in startups and small enterprises, but they demand careful thought. Your financial goals, investment period, and risk tolerance determine the ideal investing approach. Diversifying across asset types reduces risk and boosts long-term returns.

Turn your $100,000 into Kenyan prosperity. CapitalizeThings.com crafts personalized investment plans. Call for a free consultation: +1 (323)-456-9123.

How to invest 10,000 shillings in Kenya?

To invest 10,000 shillings in Kenya, you need a CDSC account to buy T-Bills or Bonds. Register through your bank or approved agency. With 10K, you can invest in shorter-term T-Bills, which normally require this amount.

Where do the rich invest in Needney in Kenya?

The rich in Needney Kenya invest their money in tourism. Investors have used their money on farms and leisure in the past year. Dunford says 77.5 percent of Kenya’s wealthiest are investing in farmlands, and 69.4 percent hope to capitalize on the return of leisure and tourism after COVID-19.

What are the Best real es, investments, and opportunities?

The 5 Best real estate investment opportunities are:

- Real estate investment trusts

- Online investment platforms

- Renting properties

- House flipping

- Multifamily Homes

- Real estate investment trusts

REITs own and operate real estate and related assets—many REITs trade COVID-19. REIT investments include retail outlets, data canters, cell towers, self-storage facilities, warehouses, medical buildings, and residential units. REIT shares give you exposure to asset capital appreciation & rent income.

- Online investment platforms

Online platforms like RealtyMogul and Fundrise offer new methods to engage in private real estate and public nontraded REITs. These platforms provide unique property kinds and regions for real estate investments that would otherwise be impossible to access. Some investments employ leverage for investing returns.

- Renting properties

Investment in a rental property allows you to become a private landlord, which involves a lot of money and time. Start with a down payment. With a typical national home price of $417,000 in the fourth quarter of 2023 and an average down payment of 14.7% in the third quarter, you’re looking at $61,300.

Owning a rental property and collecting rent requires work. Landlords pay property taxes, insurance, maintenance, and other expenditures. Tenant management is also crucial for landlords. Screening tenants prevents overdue payments, but this costs more when outsourced to a property management company.

- House flipping

Like stock market day trading, home flipping is a short-term real estate investment. For example, a down deposit, real estate agency fees, and mortgage arrangements are required when investing in a rental property. Instead of renting, the purpose is to market the property for a monetary gain. This method works well in a fast-appreciating home market or with a fixer-upper that needs repairs before selling.

- Multifamily Homes

Multifamily homes are among the best real estate investments, argues American Prosperity Group founder and CEO Mark Charnet. Having numerous tenants under one roof diversifies. It decreases the single-family home risk of nonpayment by the sole tenant. Charnet thinks multifamily homes have a higher return than single-family homes. Compared to single-family homes, multifamily residences cost more upfront. Charnet advises putting 20% down so that “the financial institution will lend that amount without hesitation.” This makes it difficult. Remember, this is a long-term sale, he says. Make the rental property like your home to raise the rent.

Is Kenya an excellent place to invest in real estate?

Yes! Kenya is an excellent place to invest in real estate. Kenyan real estate is marketable, and the most significant benefit of its real estate sector is rental income. Kenya has more real estate investment pros than other countries, increasing the chances of profit. Remember to do it right to prevent financial losses.

How much do you need to start investing in real estate in Kenya?

Industry experts say Kenya’s finest real estate investments start at Ksh. 5 million ($38,000), which buys a studio or one-bedroom apartment in Kileleshwa, Kilimani, Westlands, and Lavington.

Is the US an excellent place to invest in real estate?

There are better places to invest in real estate. Start by knowing that US property investors face the most significant litigation risk in the world.

Is Europe an excellent place to invest in real estate?

Yes! Europe is an excellent place to invest in real estate. Real estate investors have many options in Europe, which provides something for everyone, whether they want to live, retire, or make money.

Is Dubai a good place to invest in real estate?

Yes! Dubai is an excellent place to invest in real estate. It is favourable for 2024 real estate investment due to its tax-free environment, rising economy, robust tourism industry, affordable rates, and world-class developers.

Is the United Kingdom an excellent place to invest in real estate?

Yes! The United Kingdom is an excellent place to invest in real estate. One of Europe’s most prominent real estate markets, the UK has seen high returns & long-term value growth for real estate investments over the previous decade.

How to find an investment opportunity?

Finding minor business investment prospects requires proactive networking, research, and attending relevant events. Networking with entrepreneurs, business owners, and angel investors is invaluable. Once you start investing, angel investor organizations can help you access more possibilities by combining resources, exchanging deal flow, and doing due diligence.

Attending industry events, networking gatherings, and pitch events lets you meet other investors and founders and learn about early-stage businesses and their potential. Investing in new and smaller businesses is risky, so do your research and consult financial professionals. Before investing, you must understand the startup’s business concept, market potential, and staff. Make sure you can afford to lose money and expect long-term profits.

How to find small business opportunities to invest in?

To find small business opportunities, you have 2 primary options:

- Equity investments

- Debt investments

- Equity investments

Equity investments swap money for firm shares. This method allows you to become a firm owner, share revenues and losses, and possibly make business choices.

- Debt investments

Small business proprietors receive debt investments for interest payments over time. Entrepreneurs retain full ownership by paying back the sum plus interest. These two concepts underpin most transactions, even though each deal is unique and involves stock and debt. Like any investment, each choice has benefits and cons.

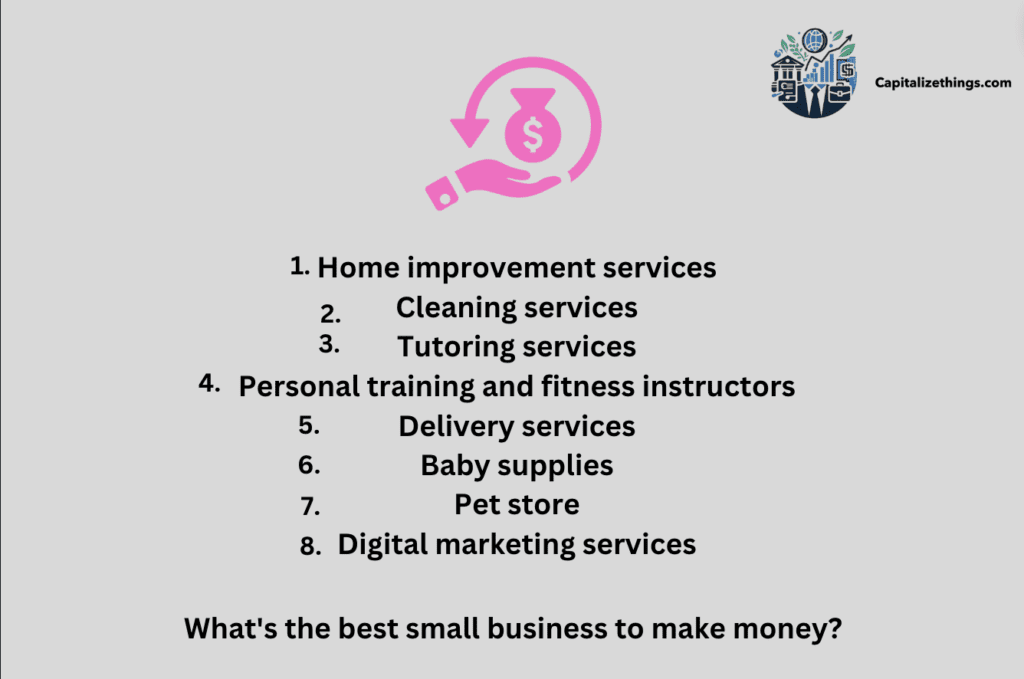

What’s the best small business to make money?

The 7 best small businesses to make money are:

- Home improvement services

- Cleaning services

- Tutoring services

- Personal training and fitness instructors

- Delivery services

- Baby supplies

- Pet store

- Digital marketing services

What is the best business to invest in right now?

List of the 7 best businesses to invest in right now:

- Real estate sales and management

- Accounting

- Copywriting

- Personal training and fitness

- Cleaning services

- Storage facilities

- Party and event services

Is investing in small private businesses a good idea?

Yes! Investing in small private businesses is a good idea. Small business investments can yield more significant returns than market investments. Most Main Vest offers have 10%–25% expected returns.

What are the Small business investment opportunities for beginners?

8 best Small business investment opportunities for beginners are:

- T-shirt designer

- Digital freelancer

- Affiliate marketer

- House or pet sitter

- Tutor

- Baker

- House cleaner

- Car washer

What is investment evaluation?

An investment evaluation determines whether a project is worthwhile and helps make smart financial judgments. Investment decisions can be evaluated before, during, and after. A pre-investment evaluation determines if the venture will yield a profit. It assesses the company’s financial health, management team, and market climate. A post-investment evaluation assesses investment merits. It evaluates the company’s performance, finances, and prospects. Evaluation after an investment determines its benefits. It considers the company’s profitability, competitiveness, and debt repayment.

What are the steps to evaluate an investment opportunity?

The 10 steps to evaluate an investment opportunity are:

- Understanding the fundamentals of Investment Evaluation

- Assessing and Identifying Investment Risks

- Potential Investment Financial Performance Evaluation

- Analyzing Market Demand and Trends

- Competitive Landscape Assessment

- Evaluation of Management and Leadership

- Analysis of Law and Regulation

- Due Diligence and Research

- Potential ROI evaluation

- Things to Think About

- Understanding the fundamentals of Investment Evaluation

Understanding the fundamentals is crucial before starting the evaluation process. This involves understanding bonds, stocks, real estate, commodities, and investment strategies, including growth, value, and income investing.

- Assessing and Identifying Investment Risks

Assessing and comprehending investing risks is essential to making smart choices. Consider these crucial points:

Market risk: Market swings can cause losses in any investment. Analyze how market downturns have affected the asset type you are considering.

Industry-specific risks: Regulations, technology, and customer preferences vary by industry. Assess how these industry-specific risks affect the investment.

Financial risk: Evaluate the investment opportunity’s debt, cash flow, and profitability. Red flags signify financial instability or an unsustainable business model.

- Potential Investment Financial Performance Evaluation

Financial analysis of possible investments is vital to the evaluation process. You should consider:

A solid and profitable firm has stable sales and earnings growth. Benchmark the investment opportunity’s economic performance against competitors and industry standards. Evaluate the investment opportunity’s gross, operational, and net profit margins. Check these margins against industry averages to see if the opportunity is lucrative and well-managed. Assess the investment opportunity’s operating, investing, and financing cash flows. Assess the investment opportunity’s liabilities, assets, and equity. To weather financial storms, look for a substantial capital framework, low debt, and adequate liquidity.

- Analyzing Market Demand and Trends

Knowing the dynamics of markets and demand is crucial to finding growth-oriented investments. Research the investment opportunity’s industry and growth potential. Look for new trends, technology, and customer preferences to generate growth. Assess market supply and demand. Does the investment opportunity’s product or service have high demand? Are there entry hurdles that impede competition? Find the investment opportunity’s competitive edge, such as distinctive products or services, high brand awareness, or patent protection. These advantages give a lasting competitive edge.

- Competitive Landscape Assessment

A detailed competitive landscape study is necessary to understand how an investment opportunity fits the market. Identify indirect and direct competitors and assess their market share, products, price, and positioning. Compare the investment possibility to its competitors and evaluate its merits and disadvantages. Check for market entrance obstacles that avoid new competitors from entering the market. Technical knowledge, regulatory restraints, and expensive financial requirements could be hurdles. Using a SWOT analysis, compare the investment opportunity’s internal and external strengths and weaknesses with market opportunities and threats.

- Evaluation of Management and Leadership

The level of leadership and management can significantly affect investment performance. Check the investment opportunity’s management team’s track record. Look for successful executives in related industries or businesses. Assess the investment opportunity’s corporate governance. Look for a strong board, independent surveillance, and transparent decision-making. Check if management and shareholders’ interests correspond.

- Analysis of Law and Regulation

Assessing hazards and compliance requires knowledge of an investment opportunity’s legal and regulatory environment. Assess the investment’s legal compliance. Legal difficulties, historical infractions, and continuing investigations offer legal or reputational hazards. Check if the investment requires industry-specific permits or restrictions. Evaluate the investment’s litigation history. Significant legal issues can hurt a company’s finances and reputation.

- Due Diligence and Research

Due diligence and study are necessary before investing. Consult corporate websites, SEC filings, and other business reports. Get advice from industry analysts and specialists who understand the investment opportunity and market. Their viewpoints can illuminate and validate your research. Ask existing and past customers and suppliers about the investment possibility. This can verify firm claims and reveal client loyalty.

- Potential ROI evaluation

Considering ROI is crucial while assessing investment options. Examine the investment opportunity’s revenue, cash flow, and profit estimates. Historical performances and market conditions should be used to evaluate these projections. Value the investment opportunity utilizing price-to-earnings, price-to-sales, discounted cash flow, or similar company analysis. Check industry averages to see if the prospect is overvalued or underrated. Adjust the ROI to account for opportunity risks. Adjust the predicted return based on the investment’s beta, which reflects market sensitivity.

- Things to Think About

Consider how the investment fits into your portfolio. Diversifying assets across different asset classes, industries, and locations reduces risk. Evaluate the investment’s risks and advantages. Consider how predicted returns match your risk profile and financial objectives. Decide how to leave the investment. Do you plan to hold the investment for a long time? It would help to consider liquidity, tax ramifications, and market conditions while planning your exit.

What is an investment exit strategy?

Exit strategies are used by business owners, traders, investors, and venture capitalists to sell financial assets after satisfying specific requirements. Exits are how investors prepare to leave investments.

The top 12 exit opportunities are:

- Venture capital

- Management consulting

- Private equity

- Startup company

- Hedge funds

- Asset management

- Corporate finance

- Corporate Development

- Advisory for corporate

- Business development

- Investment banking

- Technology

Don’t wing your investment exit! CapitalizeThings.com (+1 (323)-456-9123) provides expert exit strategy guidance.

What is an exit opportunity for investors?

Your startup investors can “exit” for a profit by selling their investments. This could occur through an IPO, exchange, or buyout. An exit is also possible when the startup closes and sells its assets. This is a lousy exit since investors won’t get their money back.

Exits usually benefit the startup and investors. They allow investors to recover their investments and allow the firm to acquire new funds. Investors in your startup should consider several factors while exiting. First, make sure the exit fits the company’s strategy. The exit hurts the corporation if it doesn’t match its long-term aims. Second, make sure the exit is realistic and will profit investors. Preparing an exit that is unfeasible or won’t profit investors is pointless.

Finally, time the exit accurately. If the withdrawal is early enough, investors can retain money. If the exit is late, the business can have missed its growth potential. Exit planning is crucial for startups. You can assure your startup’s long-term success by carefully structuring an exit that fits corporate and investor criteria.

What are exit opportunities for investment banking?

5 Exit opportunities for investment banking are:

- Growth equity and Private equity

- Venture capital

- Hedge funds and asset management

- Start-ups & entrepreneurship

- Corporate development and corporate finance.

Other options include investor relations, equities research, an additional organization or bank, or an MBA; however, these are not exit opportunities. Bankers enter these industries because the work is more challenging to the mind, the money is higher, and the working hours are better.

What are the exit opportunities for real estate finance?

Real estate investment banking offers exit options in REITs, real estate private equity, lodging/gaming/development enterprises in corporate finance or development, RE-focused hedge fund investments, and more. Comparing real estate to other specialized sectors, REPE firms outnumber private equity companies in financial institutions and energy. You could work in real estate financing, debt funds, or CMBS. You have fewer alternatives outside of real estate, regardless of whether you performed with standard companies in the field.

Companies still favor people with relevant experience; hence, healthcare PE firms will always choose healthcare IB Analysts. The other drawback is that real estate investment banking only prepares you for some real estate opportunities. When you work in PowerPoint and Excel all day, you must acquire the bolts and nuts of construction; thus, property development is a stretch for REIB.

What are exit opportunities for online businesses?

Top exit opportunities for online business are:

- E-Commerce Business Sale

- Combining E-Commerce Businesses

- E-commerce asset liquidation

- Transfer of ownership to Successor

- Business Portfolio Diversification

- Creating passive income

- Close Your E-Commerce Business

- E-Commerce Business Sale

Selling their business is a frequent exit strategy for e-commerce entrepreneurs. This requires finding a buyer for your e-commerce store. A profitable, scalable, and growth-potential firm is essential for a successful sale.

- Combining E-Commerce Businesses

A strategic exit from e-commerce involves merging with another company. Partnering with a complementary firm can strengthen your company and increase market share, operational efficiency, and profitability.

- E-commerce asset liquidation

If you can’t sell or integrate your e-commerce assets, liquidating them can be ideal. This entails selling goods, equipment, and other assets to maximize value. Although it does not offer the biggest returns, it lets you leave the sector swiftly and reduce losses.

- Transfer of ownership to Successor

Passing on your e-commerce business is another exit route. This could be a family member, trusted employee, or mentee willing to lead. Grooming and training your Successor ensures an easy transition and business continuity.

- Business Portfolio Diversification

Diversify your business portfolio instead of leaving e-commerce. This comprises entering new markets, offering new products, or trying new business strategies. Diversifying reduces the danger of relying on any e-commerce venture.

- Creating passive income

E-commerce entrepreneurs like passive income exit strategies, which entail creating low-maintenance revenue streams. Examples of this include affiliate marketing, drop shipping, and eBook and online course creation. By generating passive revenue, you can gradually lessen your e-commerce involvement while making money.

- Close Your E-Commerce Business

The only option is to close your e-commerce firm. Financial issues, market saturation, or apathy can cause this. Responsible operation closure requires completing responsibilities and communicating with clients and suppliers.

What is the difference between investment banking and hedge funds?

The main difference between investment banking and hedge funds is their function. Investment banks raise corporate money and provide financial advice. Hedge funds buy securities with capital and aim for investor returns. Investment banks work with companies and governments, but hedge funds serve wealthy people.

What is the difference between investment banking and private equity?

The difference between investment banking and private equity is that the Private equity (PE) firms acquire and improve companies, whereas investment banks raise cash and manage significant financial transactions. Private equity involves investing in private enterprises. Consider buying a private company piece, improving it, and selling it for earnings. Private equity firms orchestrate this. They buy firms with investor money and improve their value.

On the other hand Investment banking focuses on helping large firms, governments, and other institutions manage their finances. It involves raising funds, advising on acquisitions and mergers, and ensuring equity and debt securities. Investment banks help clients navigate complicated financial transactions and obtain the money they need to expand.

What is the difference between investment banking and asset management?

Investment banking and asset management require talented people with good numeracy and excellent verbal and written communication abilities. While a bachelor’s degree is required for any job, many pursue higher degrees like a master’s in finance or MBA after a few years to further their careers. Professional certification is another approach to show competence. Asset managers appreciate CAIA, CFA, and Chartered Wealth Manager credentials; thus, this approach is becoming more popular.

Can investment opportunities be deprecated?

Yes! Investment opportunities can be deprecated.

Should we diversify our investment opportunities?

Yes! It would help if you diversify your investment opportunities. Most investment professionals believe diversification is essential to long-term financial success and risk reduction.

What is the role of intermediaries and collective investment funds (CIF) in investment opportunities?

The role of intermediaries and collective investment funds (CIF) in investment opportunities is that CIFs are trusts made up of trusted clients’ assets. Collected assets from qualifying clients form a collective investment fund (CIF). Banks or trust corporations hold CIFs. CIFs are fiduciary funds that aggregate assets from CIF participants. A bank’s board of directors or an approved board committee must adopt all CIF plans, outlining how the bank handles and manages fund assets.

Intermediaries link channel partners in the distribution process, although their functions are more complex. Wholesalers, or merchant wholesalers, distribute commodities between manufacturers and retailers.

Does investing in opportunities get taxed?

Yes! Investing in opportunities gets taxed.

Conclusion

Investment opportunities include any tangible or intangible product or service advertised, sold, or traded based on past, current, or future income, revenue, or growth.

To get investment opportunity, the leadership group plays an integral part. They should show shareholder interests and long-term ownership. Company leadership’s belief in their organization often matches internal information traders’ trading actions. These executives’ pay must be linked to the company’s and investors’ success. Steven Ballmer and Bill Gates from Microsoft are examples of top leaders who give a lot of their fortune to their companies, demonstrating their long-term dedication. Examine the company’s financial history and growth prospects to determine its fiscal reliability. Invest in a company’s shares when its market price is at least half its intrinsic value. The Margin-of-Safety guarantees that the cost contains a safety margin, keeping the investment reasonable.

Evaluation of Investment opportunities is necessary to check its project’s worth. An exit strategy includes all positive and negative scenarios, independent of the kind of investment or business enterprise. Planning is crucial to assessing investment or business risk. A business owner’s exit strategy is to offer ownership to shareholders or another company. It describes how to sell a business and make a lot of money.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.