The principles of investment are fundamental guidelines that help investors make informed decisions and achieve financial goals. They include diversification, risk management, long-term planning, and understanding investment opportunities.

Investing means putting your money to work for you. Basic rules include diversifying, setting goals, and knowing your risk tolerance. Diversifying means spreading your money across different investments to reduce risk. Setting goals helps you stay focused and measure progress. Knowing your risk tolerance ensures you choose investments that match your comfort level. Keep learning to make informed decisions.

There are many types of investments. Stocks let you own part of a company and can offer high returns but come with high risk. Bonds are loans you give to companies or the government and provide steady returns with lower risk. Mutual funds pool money from many investors to buy stocks and bonds, offering diversification. Real estate involves buying property, which can provide rental income and value appreciation. Diversify to spread risk. Keep learning about investments.

What Is the Principle Of Investment?

The principle of investment is to grow your money over time by putting it into different assets. This involves spreading your money across various investments to reduce risk. It requires setting clear financial goals and understanding your risk tolerance. By making informed decisions and continually learning, you can maximize returns and achieve financial growth.

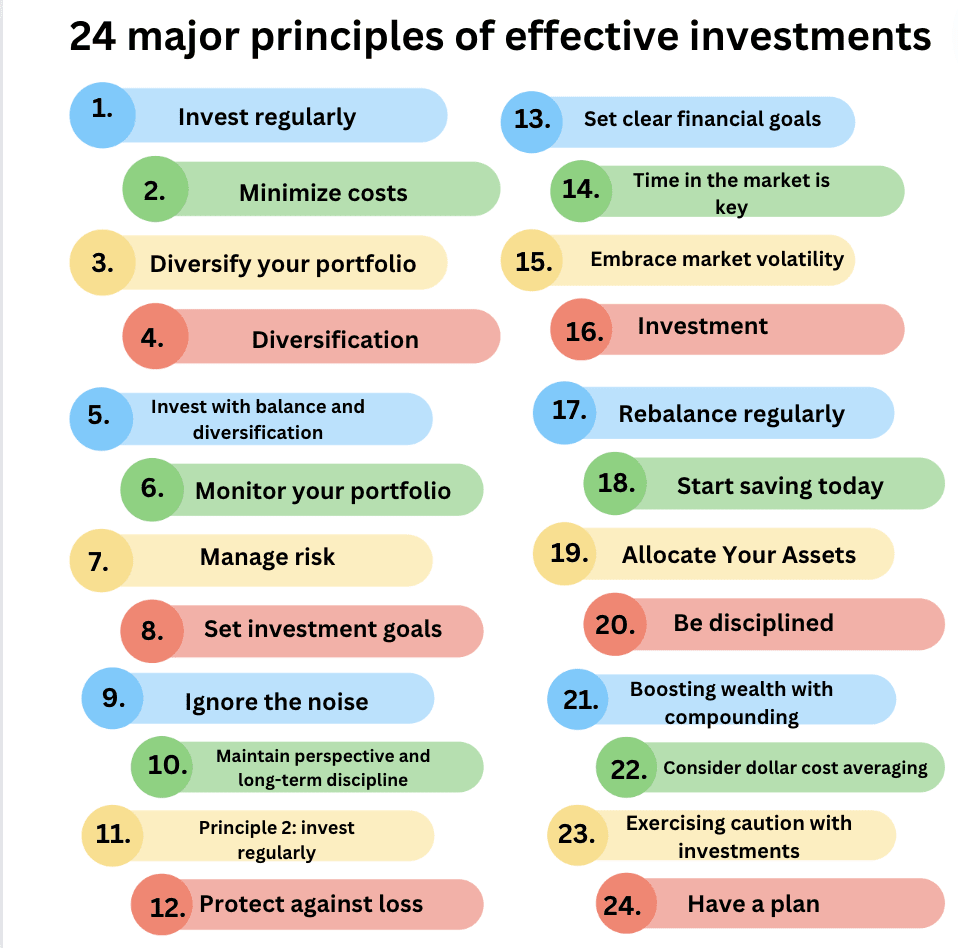

What Are The Major Principles Of Investment?

24 major principles of effective investments are:

- Invest regularly

- Minimize costs

- Diversify your portfolio

- Diversification

- Invest with balance and diversification

- Monitor your portfolio

- Manage risk

- Set investment goals

- Ignore the noise

- Maintain perspective and long-term discipline

- Principle 2: invest regularly

- Protect against loss

- Set clear financial goals

- Time in the market is key

- Embrace market volatility

- Investment

- Rebalance regularly

- Start saving today

- Allocate Your Assets

- Be disciplined

- Boosting wealth with compounding

- Consider dollar cost averaging

- Exercising caution with investments

- Have a plan

1. Invest Regularly

Investing regularly means putting money into your investment portfolio at consistent intervals, such as monthly or quarterly. This practice, known as dollar-cost averaging, helps reduce the impact of market volatility. By investing a fixed amount regularly, you buy more shares when prices are low and fewer when prices are high, which can lower your average cost over time.

2. Minimize Costs

Minimizing costs involves reducing fees, commissions, and taxes that can eat into your investment returns. Choose low-cost investment options like index funds or exchange-traded funds (ETFs). Pay attention to expense ratios, transaction fees, and tax implications. Keeping costs low helps maximize your net returns, allowing more of your money to grow.

3. Diversify Your Portfolio

Diversifying your portfolio means spreading your investments across different asset classes, industries, and geographic regions. This strategy reduces risk because it lessens the impact of any single investment’s poor performance on your overall portfolio. By holding a mix of stocks, bonds, real estate, and other assets, you can achieve more stable returns.

4. Diversification

Diversification involves allocating your investments among various financial instruments, industries, and other categories to reduce risk. By not putting all your eggs in one basket, you protect yourself from significant losses if one investment performs poorly. Diversification aims to optimize your risk-return profile, ensuring your portfolio can withstand market fluctuations.

5. Invest With Balance And Diversification

Investing with balance and diversification means maintaining a well-rounded portfolio that includes a variety of asset classes and investments. Balance ensures you are not overly exposed to any single investment or market sector. Diversification further spreads risk and can lead to more consistent performance over time, aligning with your financial goals.

6. Monitor Your Portfolio

Monitoring your portfolio involves regularly reviewing your investments to ensure they align with your financial goals and risk tolerance. Check performance, rebalance if necessary, and stay informed about market conditions. Regular monitoring helps you make informed decisions, address underperforming assets, and seize new opportunities.

7. Manage Risk

Managing risk means using strategies to protect your investments from significant losses. Diversification, asset allocation, and setting stop-loss orders are common risk management techniques. Understanding your risk tolerance and having a clear investment plan help mitigate potential downsides and ensure a more secure investment journey.

8. Set Investment Goals

Setting investment goals means identifying clear, specific financial targets you aim to achieve through your investments. These goals provide direction and motivation, helping you create a tailored investment plan. Goals can include saving for retirement, buying a house, funding education, or building an emergency fund. Clear goals help you measure progress and stay focused on achieving your financial objectives.

9. Ignore The Noise

Ignoring the noise means not letting short-term market fluctuations and sensational news impact your investment decisions. Markets can be volatile, and reacting to every piece of news can lead to poor choices. Instead, focus on your long-term strategy and investment goals. By avoiding the noise, you maintain a steady, disciplined approach that helps you achieve better long-term results.

10. Maintain Perspective And Long-Term Discipline

Maintaining perspective and long-term discipline involves focusing on your long-term investment goals and not getting swayed by short-term market movements. This means understanding that markets will have ups and downs, but over time, investments tend to grow. Long-term discipline helps you stay committed to your investment plan, reducing the risk of making impulsive decisions during market volatility.

11. Principle 2 Invest Regularly

Investing regularly, also known as dollar-cost averaging, means consistently putting money into your investments, regardless of market conditions. This approach helps you buy more shares when prices are low and fewer when prices are high, averaging out your investment costs over time. Regular investing builds wealth steadily and reduces the impact of market volatility on your portfolio.

12. Protect Against Loss

Protecting against loss involves using strategies to minimize potential investment losses. Diversification, stop-loss orders, and hedging are common techniques to reduce risk. By spreading your investments across different asset classes and using protective measures, you safeguard your portfolio against significant downturns, ensuring more stable returns and preserving your capital.

13. Set Clear Financial Goals

Setting clear financial goals means defining specific, measurable, achievable, relevant, and time-bound (SMART) objectives for your investments. Clear goals guide your investment strategy and decision-making process. Whether saving for a child’s education, a new home, or retirement, having well-defined goals helps you stay focused, track progress, and adjust your plan as needed to achieve your financial aspirations.

14. Time In The Market Is Key

Time in the market refers to the importance of staying invested over the long term rather than trying to time market entry and exit points. Historical data shows that long-term investments generally yield better returns compared to frequent trading. Staying invested allows you to benefit from compounding and recover from short-term market fluctuations, leading to more substantial growth of your investment portfolio.

15. Embrace Market Volatility

Market volatility is a normal part of investing. Instead of fearing it, see it as an opportunity. Volatility can lead to lower prices, allowing you to buy quality investments at a discount. Staying calm during market swings helps you avoid making emotional decisions that can harm your portfolio. Embracing volatility can lead to long-term gains.

16. Investment

Investing involves putting money into assets with the expectation of growth or income. These assets can include stocks, bonds, real estate, and mutual funds. The goal is to grow your money over time. Investing helps you build wealth and achieve financial goals. It requires knowledge, patience, and a strategy that fits your risk tolerance and objectives.

17. Rebalance Regularly

Rebalancing means adjusting your portfolio to maintain your desired asset allocation. Over time, investments may grow at different rates, altering your portfolio’s balance. Regular rebalancing ensures you stay aligned with your risk tolerance and investment goals. It involves selling high-performing assets and buying underperforming ones, which can enhance long-term returns and manage risk.

18. Start Saving Today

Saving money is the first step to investing. The earlier you start, the more time your money has to grow through compounding. Even small amounts saved regularly can add up over time. Having a savings habit helps you build an emergency fund, provides capital for investments, and supports long-term financial goals. Start saving today to secure your financial future.

19. Allocate Your Assets

Asset allocation is dividing your investments among different asset classes, such as stocks, bonds, and real estate. The right mix depends on your risk tolerance, time horizon, and financial goals. Proper allocation balances risk and return, helping you achieve steady growth while protecting against significant losses. It’s a key strategy for building a resilient investment portfolio.

20. Be Disciplined

Discipline is crucial in investing. Stick to your investment plan, even during market fluctuations. Avoid making impulsive decisions based on emotions like fear or greed. Regularly contribute to your investments and stay focused on your long-term goals. A disciplined approach helps you navigate market volatility, manage risk, and achieve consistent growth in your investment journey.

21. Boosting Wealth With Compounding

Compounding is when your investment earnings generate their own earnings. This accelerates the growth of your wealth over time. Reinvesting dividends and interest payments helps your investment grow faster. The earlier you start investing, the more time your money has to compound, leading to substantial long-term gains. Compounding is a powerful tool for building wealth.

22. Consider Dollar Cost Averaging

Dollar Cost Averaging (DCA) is an investment strategy where you regularly invest a fixed amount of money, regardless of market conditions. This approach reduces the impact of market volatility by spreading your investments over time. It helps you buy more shares when prices are low and fewer when prices are high, potentially lowering your average cost per share.

23. Exercising Caution With Investments

Exercising caution means being mindful of the risks involved in investing. Research thoroughly, understand the investment, and be aware of potential losses. Avoid chasing high returns without considering the risks. Diversify your portfolio to spread risk and avoid putting all your money into one investment. Cautious investing protects your capital and ensures steady growth.

24. Have A Plan?

Having a plan involves setting clear financial goals and developing a strategy to achieve them. A well-defined plan includes determining your risk tolerance, selecting appropriate investments, and setting a timeline for your goals. Regularly review and adjust your plan as needed to stay on track. A solid investment plan guides your decisions and helps you reach your financial objectives.

What Are Warren Buffett’s 7 Principles To Investing?

Warren Buffett’s 7 principles of investing provide a framework for making wise investment decisions. They emphasize investing in areas of personal knowledge, focusing on long-term growth, buying high-quality companies, practicing patience, avoiding debt, sticking to a consistent strategy, and seeking undervalued assets. These principles guide investors toward making informed choices that balance risk and return while aiming for substantial and sustainable growth.

- Invest in What You Know: Focus on companies and industries you understand well. This knowledge helps you make informed decisions and evaluate investments effectively. Investing in familiar areas reduces the risk of unexpected challenges and allows you to leverage your expertise.

- Think Long-Term: Hold onto investments for an extended period to benefit from their growth. Long-term investing allows your money to compound and reduces the impact of short-term market fluctuations. Patience is crucial for achieving substantial returns over time.

- Buy Quality: Invest in companies with strong fundamentals, such as robust financial health, competitive advantages, and a track record of success. Quality businesses are more likely to deliver steady returns and withstand economic downturns.

- Be Patient: Wait for the right investment opportunities and avoid making impulsive decisions based on short-term market movements. Patience allows you to benefit from long-term growth and avoids unnecessary trading costs.

- Avoid Debt: Minimize the use of borrowed money to invest, as leveraging increases financial risk. Avoiding debt helps you maintain financial stability and protects you from potential losses during market downturns.

- Stick to Your Strategy: Develop a clear investment plan and adhere to it, even during periods of market volatility. Consistency in following your strategy helps you stay focused on your long-term goals and avoids emotional decision-making.

- Focus on Value: Look for stocks that are undervalued compared to their intrinsic worth. Investing in undervalued companies with strong potential for future growth increases the likelihood of achieving significant returns.

What Is Buffett’s Investment Philosophy?

Warren Buffett’s investment philosophy centers on value investing, which involves buying stocks at prices below their intrinsic value. This approach focuses on investing in companies with strong fundamentals, durable competitive advantages, and competent management. Buffett emphasizes long-term holding, avoiding market speculation, and minimizing risk through thorough research and patience. His philosophy aims to achieve significant financial returns while maintaining ethical investment practices.

- Value Investing: Seek out stocks that are trading below their intrinsic value. This approach involves buying companies at a discount and holding them until their true value is recognized by the market, leading to long-term gains.

- Economic Moat: Invest in companies with a durable competitive advantage, or “economic moat.” These companies have unique strengths that protect them from competition, such as strong brand recognition or cost advantages.

- Margin of Safety: Ensure a substantial difference between the purchase price and the estimated intrinsic value of an investment. This buffer helps protect against potential errors in valuation and market downturns.

- Management Quality: Evaluate the competence and integrity of a company’s management team. Investing in companies with trustworthy and capable leaders is essential for achieving sustainable success and growth.

- Intrinsic Value: Determine a company’s true worth based on its financial performance and potential for future earnings. Investing decisions should be guided by a thorough analysis of intrinsic value, rather than market trends or speculation.

What Are The 5 Golden Rules Of Investing?

The 5 Golden Rules of Investing are foundational guidelines for achieving successful investment outcomes. They emphasize spreading investments to manage risk (diversification), thoroughly understanding investment choices, focusing on long-term growth rather than short-term fluctuations, making decisions based on logic rather than emotions, and regularly reviewing investment performance to stay aligned with financial goals. Following these rules helps in making informed and strategic investment decisions.

- Diversify Your Portfolio: Spread your investments across various asset classes, such as stocks, bonds, and real estate. Diversification helps reduce risk by ensuring that poor performance in one area does not significantly impact your entire portfolio.

- Understand What You Invest In: Thoroughly research and understand the investments you make. Knowing the details and risks associated with each investment allows you to make informed decisions and manage potential risks effectively.

- Invest for the Long Term: Aim to hold investments for an extended period to maximize potential returns. Long-term investing takes advantage of market growth and reduces the impact of short-term volatility.

- Avoid Emotional Decisions: Base your investment choices on analysis and logic rather than emotions. Emotional decisions can lead to impulsive actions and poor investment choices, negatively affecting your financial outcomes.

- Regularly Review Your Investments: Continuously monitor the performance of your investments and make adjustments as needed. Regular reviews help you stay aligned with your financial goals and respond to changing market conditions.

What Are The 6 Basic Rules Of Investing?

The 6 basic rules of investing are simple principles that guide successful investing to people looking to invest into new business. They involve setting clear financial goals, understanding your risk tolerance, diversifying investments to manage risk, investing regularly, keeping investment costs low, and staying informed about market conditions and investment options. These rules help you make informed decisions and achieve your financial objectives.

- Set Clear Goals: Define specific financial objectives for your investments, such as retirement savings or purchasing a home. Clear goals provide direction and motivation, helping you stay focused on achieving your financial targets.

- Know Your Risk Tolerance: Understand how much risk you are willing to take with your investments. Assessing your risk tolerance helps you choose investments that align with your comfort level and financial situation.

- Diversify Your Investments: Spread your investment across different asset types to reduce risk. Diversification ensures that a decline in one area does not severely impact your overall portfolio, helping you achieve more stable returns.

- Invest Regularly: Make consistent investments over time, regardless of market conditions. Regular investing helps smooth out market fluctuations and benefits from dollar-cost averaging, potentially lowering the average cost of your investments.

- Keep Costs Low: Minimize fees and expenses associated with investing, such as management fees and transaction costs. Lower costs help you retain more of your investment returns and enhance your overall financial performance.

- Stay Informed: Continuously educate yourself about investment options, market trends, and economic conditions. Staying informed enables you to make better investment decisions and adapt your strategy to changing circumstances.

What Are The Major Principles Of Islamic Investment?

The major principles of Islamic investment ensure that investments comply with Sharia (Islamic law). These principles include avoiding prohibited activities like gambling and alcohol, prohibiting interest (riba), promoting risk-sharing rather than fixed returns, ensuring ethical and socially responsible investments, maintaining transparency and honesty, backing investments with tangible assets, and avoiding excessive uncertainty or ambiguity in financial transactions.

- Sharia Compliance: Ensure all investments adhere to Islamic law (Sharia). Investments must not involve prohibited activities, such as gambling or alcohol. Compliance with Sharia principles is essential for ethical and lawful investing.

- Risk Sharing: Promote investment structures that involve shared risk and reward. Investments should be based on profit-sharing principles rather than fixed interest rates. This aligns with the Islamic emphasis on fairness and mutual benefit.

- Prohibition of Riba: Avoid interest (riba), which is prohibited in Islam. Investments should not generate returns based on interest or involve transactions where interest is charged. This principle ensures that profits are earned through legitimate means.

- Ethical Investments: Invest in businesses and projects that contribute positively to society. Avoid sectors that are harmful or unethical, such as those involved in illegal activities or exploitation. Ethical investments align with Islamic values of social responsibility and justice.

- Transparency and Honesty: Maintain transparency and honesty in all investment dealings. Clear and truthful disclosure of information is required to build trust and ensure that all parties are informed about the investment terms and conditions.

- Asset-Backed Investment: Ensure that investments are backed by tangible assets or real economic activities. Investments should not be speculative or involve transactions that lack underlying assets. This principle supports stability and real economic value.

- Avoidance of Gharar: Avoid excessive uncertainty or ambiguity in investment contracts. Contracts should be clear and precise to prevent disputes and ensure fairness. Avoid speculative activities that involve high uncertainty or ambiguity.

What Is The Investment Criteria In Corporate Finance?

In corporate finance, investment refers to the allocation of capital to various projects, assets, or ventures to generate returns over time. This involves assessing potential investment opportunities and deciding where to invest funds to achieve the company’s financial goals and maximize shareholder value. Investments can include acquisitions, new projects, asset purchases, or expansion initiatives.

- Net Present Value (NPV): Evaluate the difference between the present value of cash inflows and outflows. Positive NPV indicates that an investment is expected to generate more value than its cost, making it a worthwhile investment.

- Internal Rate of Return (IRR): Calculate the rate at which the net present value of cash flows equals zero. A higher IRR compared to the company’s cost of capital suggests a profitable investment.

- Payback Period: Determine the time required to recover the initial investment from cash inflows. Shorter payback periods are preferable as they indicate quicker returns on investment.

- Return on Investment (ROI): Measure the profitability of an investment by comparing the net profit to the initial investment cost. Higher ROI reflects better financial performance and effective use of capital.

- Profitability Index (PI): Assess the ratio of the present value of future cash flows to the initial investment cost. A PI greater than 1 indicates that the investment is expected to be profitable.

- Risk Assessment: Analyze the risks associated with the investment, including market, operational, and financial risks. Investments with manageable risks relative to their potential returns are more attractive.

- Strategic Fit: Ensure the investment aligns with the company’s strategic goals and objectives. Investments should support the company’s long-term vision and enhance its competitive position.

- Cash Flow Analysis: Evaluate the projected cash flows from the investment to ensure they are sufficient to cover the initial investment and provide positive returns over time.

What Are The Operating Principles Of Investment?

Operating principles of investment refer to the fundamental guidelines and practices that govern effective and strategic investing. These principles help ensure that investments are managed wisely and align with financial goals. Key operating principles include:

- Diversification: Spread investments across various asset classes and sectors to reduce risk and avoid overexposure to any single investment.

- Risk Management: Assess and manage the risks associated with investments by evaluating potential returns and using strategies like diversification and hedging.

- Long-Term Perspective: Focus on long-term goals and resist the temptation to react to short-term market fluctuations. Long-term investing allows for growth and compounding.

- Research and Analysis: Conduct thorough research and analysis before making investment decisions. Understanding market conditions, company fundamentals, and economic factors is crucial.

- Cost Efficiency: Minimize investment costs, including fees, commissions, and taxes. Lower costs help maximize net returns.

- Regular Monitoring: Continuously review and monitor investment performance to ensure it aligns with financial goals and adjust strategies as needed.

- Liquidity: Ensure that investments provide sufficient liquidity to meet short-term needs and financial obligations without incurring significant losses.

What Are Vanguard Core Investment Principles?

Vanguard’s core investment principles focus on creating a disciplined and effective approach to investing. These principles include:

- Invest for the Long Term: Emphasize a long-term investment horizon to capitalize on market growth and compounding returns. Avoid short-term trading and market timing.

- Maintain a Balanced Portfolio: Diversify investments across various asset classes to manage risk and achieve balanced returns. A well-diversified portfolio reduces the impact of volatility.

- Minimize Costs: Focus on low-cost investment options to enhance net returns. Lowering expenses through index funds and cost-effective strategies supports long-term growth.

- Stay Disciplined: Adhere to a clear investment plan and avoid making emotional decisions based on market fluctuations. Discipline ensures that investments stay aligned with long-term goals.

- Invest in Quality: Prioritize investments in high-quality assets with strong fundamentals. Quality investments tend to offer more stable and sustainable returns over time.

What Is Impact Investment Management?

Impact investment management focuses on directing capital into projects, companies, or funds that generate positive social or environmental outcomes alongside financial returns. This approach involves identifying investment opportunities aligned with specific social or environmental goals, such as renewable energy, affordable housing, or education.

It requires measuring and monitoring the impact of these investments to ensure they achieve their intended objectives, using various metrics and reporting frameworks. Impact investment management balances the pursuit of competitive financial performance with the goal of addressing pressing global challenges. It also involves engaging with stakeholders to enhance investment effectiveness and managing associated risks, including financial, operational, and reputational risks, to ensure sustainable results.

What Is The Principle Of Impact Investing?

The principle of impact investing is to generate measurable social or environmental benefits alongside a financial return. This approach focuses on directing capital to investments that address critical issues such as climate change, poverty, and inequality, while seeking to achieve sustainable and competitive financial performance. Impact investing integrates the goal of positive change with traditional investment criteria.

- Intentionality: Actively seeking investments that aim to achieve specific social or environmental outcomes.

- Measurability: Using metrics and frameworks to assess and track the impact of investments, ensuring that goals are met.

- Financial Returns: Balancing the pursuit of financial returns with the intention of creating positive impact, aiming for both competitive performance and meaningful outcomes.

- Accountability: Holding investments accountable for their impact and financial performance through regular reporting and evaluation.

- Additionality: Ensuring that investments create additional benefits beyond what would have occurred without the investment, enhancing overall impact.

What Is ESG Principle In Investment?

ESG stands for Environmental, Social, and Governance. It means investing in companies that perform well in these areas. Environmental focuses on how companies manage natural resources. Social looks at how they treat people and communities. Governance is about how they are run and their business ethics. This principle of investing aims to support responsible and sustainable practices.

What Is Impact Investment Management?

Impact investment management involves putting money into projects or companies that aim to create positive social or environmental change. It seeks investments that address issues like climate change or poverty while also aiming for financial returns. The goal is to achieve both a positive impact and good financial performance.

What Are Basic Investment Strategies?

Basic investment strategies are approaches to managing and growing investments by employing methods like diversification, dollar-cost averaging, and long-term holding. These strategies aim to balance risk and return to achieve financial goals.

Basic investment strategies include:

- Diversification: Spread your money across different investments to reduce risk.

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions.

- Buy and Hold: Purchase investments and keep them for a long time.

- Value Investing: Look for undervalued assets and buy them for future growth.

- Growth Investing: Invest in companies expected to grow quickly.

What Skills Are Needed For Investment?

Skills needed for investment include strong research and analytical abilities to evaluate opportunities and manage risks. Financial knowledge and patience are major investing skills that are crucial for making informed decisions and achieving long-term growth.

Key skills for investing include:

- Research: Ability to gather and analyze information.

- Analytical Thinking: Evaluating data to make decisions.

- Risk Management: Understanding and managing potential risks.

- Financial Knowledge: Understanding financial statements and market trends.

- Patience: Waiting for investments to grow over time.

What Are The Fundamentals Of Investment?

The fundamentals of investment involve understanding key concepts such as risk and return, diversification, and asset allocation. These investment principles guide investors in making informed decisions to achieve their financial goals and manage risks effectively.

Investment fundamentals are:

- Risk and Return: Higher returns come with higher risk.

- Diversification: Spread investments to reduce risk.

- Time Horizon: The length of time you plan to invest.

- Asset Allocation: Distributing investments across various asset types.

- Compounding: Earning returns on previous returns over time.

What Are The Principles That New Investors Should Learn?

New investors should learn to diversify their investments to manage risk and set clear financial goals to increase their investment strategy. They should also understand their risk tolerance and stay informed about market trends to make informed decisions.

New investors should learn:

- Start Early: The earlier you invest, the more you benefit from compounding.

- Diversify: Spread investments to manage risk.

- Set Goals: Have clear financial goals and a plan.

- Understand Risk: Know how much risk you can handle.

- Stay Informed: Keep learning about investment options and market trends.

Conclude

Investing accurately requires expertise and applying key concepts like investment diversification, risk control, and purpose placing. These practices help construct a stable portfolio and gain monetary objectives while managing ability risks. By following fundamental funding strategies and standards, traders can navigate market fluctuations and work in the direction of sustainable growth.

Continuous getting to know and adaptation are critical for investment success. New buyers ought to be conscious of gaining information about diverse investment alternatives and developing abilities inclusive of research and analytical wandering. By adhering to those concepts and staying knowledgeable, investors can make properly-knowledgeable choices and work in the direction of accomplishing their financial desires.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.