Yes! Investment property can be depreciated. Investment Property covers land and structures owned for rental or capital appreciation. Investment properties are determined initially at cost and, with some exclusion, can be measured using a cost-based or fair value model, with fair value adjustments recognized in profit or loss. Investment Property depreciation uses market value loss & the cost of purchasing and renovating a property during its useful life to reduce taxes. Every year you own and rent a property, the IRS lets you deduct 3.636 percent from your taxable income.

To calculate it, divide your building value (depreciable basis) by its lifespan of use value to depreciate your property, not its land. Subtract the land value from the building value and divide by 27.5.

An example: Suppose you buy a $450,000 duplex. The land costs $95,000. Building value is calculated by subtracting land value from purchase price: $450,000 minus $95,000 yields $355,000 for the building. Next, divide $355,000 by 27.5 years of residential useful life. Your annual depreciation is $12,909.

Depreciated rentals sold during the owner’s lifetime must be taxed on the “recapture of depreciation.” It’s a significant drawback.

What is investment property depreciation?

Depreciation allocates net cost to periods when the company expects to benefit from the asset. Depreciation reduces the price of an asset over its lifetime. Varied asset classes have varied valuable lives. An asset is depreciable. Although it affects asset value on the balance sheet, depreciation is a measure of allocation, not valuation.

How much can you depreciate on an investment property?

You depreciate 25% on an investment property. Tax depreciation on rental property lets owners deduct some of the cost of income-producing property. By depreciating the property, a taxpayer can deduct some of the cost from their tax return. Your customer may save money on taxes by reducing their tax burden. When rental property is used for income, depreciation begins. When the client is fully recovered, the price or other basis of the property is no longer used to produce income and depreciation stops.

What type of property cannot be depreciated?

Non-depreciable assets include land, bonds, stocks, and inventory. These assets don’t depreciate and preserve their value. In complex finance, some assets defy depreciation norms. Accurate financial reporting and effective decision-making require understanding these non-depreciable assets. This article discusses non-depreciable assets and their effects on enterprises. Land is a non-depreciable asset. Land does not wear out like machinery or structures. It cannot depreciate because its value usually rises or stays the same. The land has intrinsic value and is a critical real estate investment. Its durability makes it a safe and desirable asset for investors and companies, from great commercial sites to vast agricultural acreage.

Other depreciation-exempt assets include investments and securities. Stocks, mutual funds, and bonds are valued by market swings and economic situations, not physical deterioration. Their market value may fluctuate, but they do not depreciate. Instead, their pricing reflects market dynamics and investor emotion, making them essential to diverse investment portfolios.

Non-depreciable assets are varied, valued resources that defy depreciation. These assets—from property to financial investments and inventory—help organizations expand and create value. Understanding the characteristics and management of non-depreciable assets can improve financial reporting and help organizations allocate resources and invest. Transparent and accurate financial reporting builds stakeholder trust and drives profitable and sustainable growth in today’s dynamic business climate.

Why is there no depreciation on investment property?

Investment properties can and normally be depreciated for tax purpose. Instead of being used for business activities, investment assets like rental properties or capital appreciation properties are held for their income-generating potential or future resale worth. Depreciation is a tax subtracted for commercial assets that gets old over time. Enhancements, renovations, and substantial repairs boost property value and are reimbursed when sold.

Investment property income is usually recorded as revenue from rentals or capital gains. These properties’ income is unaffected by depreciation. Investment property owners can deduct mortgage interest, taxes on property, maintenance costs, and some repairs to maintain the property and create rental income instead of depreciation.

Is depreciation charged on investment property?

Yes! Depreciation is charged on investment property. If you buy rental properties, depreciation lets you pay for them over decades, lowering your tax bill. Of course, the depreciation recapture tax applies if you sell the property for more than its depreciated worth. When starting, running, and selling a rental property business, consult a tax accountant, as rental property tax regulations are difficult and change frequently. That way, you can get the best tax treatment and avoid surprises.

When should you not depreciate rental property?

You should not depreciate rental property when it stops losing value, when the customer has completely returned to its cost or other base, or when it is no longer being used to make money.

What happens when you fully depreciate a rental property?

Depreciating your rental property lets you deduct some of the cost from your taxes each year. The deduction amount is determined by property type and ownership duration. For example, if you purchase a $200,000 rental house and depreciate it over 27.5 years, you can subtract $7,273 from your taxes each year.

You can save thousands on your investment with this. Depreciation is a beneficial tax deduction, but it doesn’t lower property value. Rental property income is compensating by noncash depreciation. Depreciation on rental property is explained in IRS Publication 527, Residential Rental Property. Real estate investors can make money by planning their purchases well and taking advantage of depreciation. Depreciation must be recouped as taxable revenue when you sell your property. For this reason, you should consult a tax specialist to verify you’re taking advantage of all real estate investor tax benefits.

Due to natural wear and tear, rental property owners receive a significant tax benefit for depreciation. However, the government must be reimbursed for depreciation when selling the property. Depreciation is delayed income that becomes taxable when the asset is sold. Your cost basis in the property (the original cost plus any capital upgrades) and the depreciation schedule for your property type will determine how much depreciation must be reclaimed. With this information, subtract the depreciation made from your cost base to find your recapture rate.

Is there depreciation recapture on rental property?

Yes! There is depreciation recapture on rental property. Depreciation recapture tax is a capital gains tax on assets sold for more than their depreciated worth. The asset type and holding period determine the tax rate. The top real estate depreciation recapture rate is 25%, depending on an investor’s federal income tax level.

How do we avoid paying depreciation recapture?

Complete a 1031 exchange to avoid paying depreciation recaptures. A 1031 exchange is a famouse strategy for delaying depreciation recovery.

Does the fair value model include depreciation?

Yes! The fair value model includes depreciation. The cost model values investment property at a price less depreciation and losses from impairment.

Do you depreciate investment property in FRS 105?

Yes! You depreciate investment property in FRS 105. The adoption of FRS 105 needs investment property to be restated at depreciated historical costs. There is no escape from complete retrospective restatement, but it is administered differently.

Is investment property measured at fair value?

Yes! Investment property is measured at fair value. It is initially measured at cost and, with some exclusion, can be measured using fair value or a cost model, with fair value adjustments recognized in profit or loss.

Can you claim depreciation on a 2nd home?

Yes! You can claim depreciation on a 2nd home. This depends on your home’s usage. If the house is a personal living, you can deduct mortgage interest up to $750,000 and state and local taxes up to $10,000. The IRS allows you to deduct house ownership, maintenance, and operation costs if the home is an investment property.

Can a second home be considered an investment property?

Yes! A second home can be considered an investment property. It can be rented to generate money. However, turning a second home into an investment property can result in tax repercussions, so check local rental property rules.

Are interest rates lower for a second home or investment property?

Yes! Interest rates are lower for a second home or investment property. Even with the same down payment and loan period, an investment property mortgage will usually have a higher interest rate than a second house mortgage.

How to avoid a 20% down payment on an investment property?

You can buy an investment property without a 20% down payment to avoid a 20% down payment. Seller financing, cash-out refinancing, and HELOCs can decrease or eliminate the requirement for a substantial upfront payment.

What is the difference between a 2nd home and an investment property?

Let’s examine each component to learn how finance investment property and second house differs.

| 2nd home | Investment property |

| Cash reserves are a minimum of 2 monthsThe number of units is one mortgage per propertyDebt-to-income ratio is 45% with a 620 to 680 credit score | Cash reserves are a minimum of 6 monthsMultifamily unit financing is availableDebt-to-income ratio is 45% with a 700 or higher credit score |

Even with the same down payment and loan period, an investment property mortgage will usually have a higher interest rate than a second-home mortgage. According to the Fannie Mae Eligibility Matrix, a second-home loan requires a 10% down payment. Investment property minimal down payments range from 15% to 25%. Like a primary home mortgage, a higher credit score means a lower down payment.

According to Bank Rate, lenders may consider 620–680 credit scores for second home purchases. However, lenders may want a 700 score or above for investment property mortgage financing. To qualify for an investment property or second home mortgage, aim for a DTI of 45% or below. Investment property origination fees are usually greater than second-home rates.

Only single-unit properties can be mortgaged as second homes. Up to four units can be mortgaged for investment or rental properties. A second-home mortgage requires two months of financial reserves. An investment property requires six months of financial reserves. In addition to knowing second home and investment property mortgage requirements, you need to know their tax consequences. Check with your tax advisor. Break down tax factors.

Is your primary residence considered an investment property?

Yes! Your primary residence is considered an investment property when it is rented to make money. Your home is usually your permanent dwelling. It is where you sleep, raise kids, and watch TV. An investment property can be a home, yet it generates revenue. Making money is the priority, not a home.

Does depreciation affect investing cash flow?

No! Depreciation does not affect investing cash flow by itself. It indirectly affects cash flow by changing the organization’s tax liabilities, which lowers income tax outflows.

Depreciation is a deduction on your company’s revenue tax return. You report less taxable income to the government, which minimizes your business’s cash outflow. Accelerated depreciation strategies like double-declining depreciation can boost depreciation’s impact on cash flow. This boosts tax-deductible depreciation, lowering your taxes further. Since net income is used to determine a business’s operational cash flow (along with net variation in operating finances and other adjustments), lower taxes mean more cash on the statement of cash flows.

Should investment property be cash flow positive?

Yes! Investment property should be cash flow positive. Favorable cash flow properties improve serviceability and lender appeal. Property investors seek the ‘holy grail’ of cash flow-positive, rapidly appreciating properties. Starting with a monthly revenue stream is appealing to first-time investors. Cash flow properties help balance your portfolio by covering the shortfall from high-capital-growth assets.

How do you determine if a rental property will cash flow?

You can determine by the 50% rule that rental property running expenses average 50% of income. No mortgage principal or interest is included in operating costs. The remaining 50% can cover mortgage payments. This estimates investment cash flow and gain rapidly.

Can I write off the mortgage on the investment property?

Yes! You can write off a mortgage on an investment property. Mortgage interest is a paradigm of rental property deduction. For rental properties, mortgage interest usually is deductible as a business expense. Your mortgage company offers you an IRS Form 1098 each year to tell about your interest payments. If your mortgage payment includes escrow funds for taxes and insurance, your mortgage firm should notify you. Rental estate mortgage interest is included on Schedule E of the 1040/1040-SR tax form, while house mortgage interest is on Schedule A.

Can I deduct mortgage interest and depreciation on rental property?

Yes! You can deduct mortgage interest and depreciation on rental property. Rental owners can deduct operating, maintenance, and ownership costs. The IRS depreciates most residential rental property at 3.636% every year for 27.5 years, its productive life. Only building value can be discounted. Since land never gets utilized up. You can’t depreciate it. Taxes on rental property revenue and losses depend on your involvement. Paying cash for private costs, fees, fines, or uncollected rent is frequently not tax-deductible.

Can I capitalize mortgage interest on an investment property?

Yes! You can capitalize mortgage interest on investment property. Section 266 lets you add taxes and interest to the investment property base. You must file a tax statement under 1.263(a)-3(n).

Can I deduct my mortgage payment from my rental income?

Yes! You can deduct my mortgage payment from my rental income. When you own an investment property, like a rental, you can write off the mortgage interest as a business cost.

Can investment property reduce taxable income?

Yes! Investment property reduced taxable income. Real estate investors with income-producing rental property can deduct depreciation on their taxes. Lowering your taxable income can lower your tax liability. Similar to the amortization of construction claims, this tax deduction applies to investment property fittings. Based on their lifespan, carpets, cooktops, blinds, ovens, and cooling systems depreciate in new homes. Second-hand businesses can no longer claim existing possessions, but new items are depreciable from purchase.

Professional building surveyors may determine the cost of depreciation on fixtures and buildings, indicating how much their worth declines over time. Depreciation rates are based on building and asset prices, which can result in considerable ongoing tax deductions.

How does depreciation work with real estate investments?

The value of a real estate asset is deducted to account for its use over its lifetime. It allows tax deductions on asset income and recovery of improvements. The IRS regulates depreciation and tax deduction claims on these kinds of assets. Since depreciation accounts for assets that wear out over time, land value is not included on an overall basis.

What happens after 27.5 years of depreciation?

Your original purchase depreciates over 27.5 years. After that, everything depreciates. If you purchase a new roof in year 5 or 30, it depreciates over 27.5 years, not 27.5 since you bought the home. A fence or driveway lasts 15 years, a large appliance 5 years.

Can bonus depreciation be used for real property?

Yes! Bonus depreciation can be used for real property. Bonus depreciation is not for all investable real estate. Only certain types of real estate qualify for bonus depreciation because (a) they are eligible for depreciation under the altered accelerated cost recovery system (“MACRS”) and (b) they have a MACRS recovery time of 20 years or less. Gas stations and car washes qualify. Other corporate assets, including machinery and equipment, are depreciable under MACRS, but not the land.

Typically, real estate investors use Section 1031 exchanges to defer income taxes by switching investments. Reinvesting capital gains in qualifying opportunity funds that invest in eligible opportunity zone projects is another typical tax deferral approach. Many real estate investors are considering bonus depreciation as a third alternative before it disappears. The investor may receive considerable bonus depreciation on the total purchase price and MACRS depreciation on an additional asset basis by buying a qualified real estate asset. After holding the asset long enough, the sale proceeds can be used to purchase other real property in a Section 1031 exchange, delaying gain recognition.

What are depreciable assets in a rental property?

Improvements, including fresh roofing, landscaping, water heaters, refrigerators, furnishings, and rental property, are depreciable. All services, utilities, fees, and consumables (such as cleaning supplies, light bulbs, smoke detectors, and batteries) are deducted from expenses. The “used up” fraction of an asset’s cost can be deducted year after year until it’s gone or you no longer own it. It covers asset wear and tear. Unlike expenses, depreciation subtracts the asset’s cost over time.

Is depreciation different for short-term rental property?

Most short-term rentals are residential, but mixed-use or commercial properties have varying depreciation schedules. Due to their extended lifespan and differing usage patterns, commercial real estate is depreciated over 39 years. Short-term rental owners should also evaluate how utilization impacts depreciation. High turnover and wear & tear might affect depreciation. Due to more regular repairs and replacements, tax planning may need to be adjusted. Understanding these details will help you optimize your tax benefits and avoid losing money.

Depreciation goes beyond the building. Property upgrades like new appliances, furnishings, and landscaping can be depreciated. Due to their shorter depreciation lifetimes, you can recoup the cost of these things faster. By keeping detailed records and knowing depreciation standards, you can maximize these deductions and boost property profitability.

How many years to depreciate residential rental property?

Residential rental property is depreciated for 27.5 years.

How do you calculate depreciation expense for rental property?

Formula to calculate depreciation expense for rental property:

Annual Depreciation Value = Property cost basis/27.5

Example:

Divide the property’s cost basis by 27.5 years to calculate yearly rental property depreciation:

$369,000 property cost basis / 27.5 years = $13,418.18 annual depreciation.

The investor claimed $53,672.72 in depreciation expenses over four years to lower taxable net income. Due to rental property depreciation, an owner would only spend taxes on $6,372.28 if the rental property generated $60,000 in pre-tax net income over four years:

$60,000 pre-tax income – $53,672.72 depreciation = $6,372.28 taxable income

Rental property owners profit from depreciation. When the property is sold, the IRS recaptures the depreciation expense and taxes it as ordinary income.

To demonstrate, consider our Austin real estate investor.

The investor claimed $53,672.72 in depreciation expenses over four years to minimize taxable income. When real estate is sold, investors must pay tax on $53,672.72 up to 25%, even if they are in a higher federal tax bracket. The maximum tax from depreciation recapture is $13,418.18, with any residual capital gain taxed at 0%, 20%, or 15% based on the investor’s tax level. Many real estate investors use a 1031 tax-deferred exchange to delay capital gains and depreciation recapture taxes. Investors buy more rental properties to build their real estate portfolio instead of paying taxes to the federal and state governments.

Considerations

Finding Basis: The core of the property is the money you paid for it, whether cash, mortgage or otherwise. The basis includes settlement expenses, closing charges, recording fees, surveys, legal fees, transfer taxes, title insurance, and whatever sum you pledged to pay (such as back taxes) when you bought the property.

Not all settlement and closing expenses can be added to your basis. Fire insurance, pre-closing rent, and loan fees, including points, mortgage insurance, credit report fees, and appraisal fees, are included. Suppose you paid $255,375 for a home. Using the latest real estate tax assessment, which splits the property into buildings and land tax value, will help you establish your basis. This information is usually available from your county’s tax office. Your foundation in residence would be $217,068.75 (85% of $255375). A $38,306.25 will be land basis. Then, calculate depreciation using your adjusted basis.

Finding Adjusted Basis: Certain events between buying the property and renting it may require basis adjustments. Increases to base include the cost of any additions or renovations with a useful life of at least one year made before you put the property in operation, money spent restoring damaged property, introducing utilities to the property, and specific legal fees. Insurance payments for damages or theft, casualty losses not covered by insurance, and easement payments might lower the base.

How do you calculate depreciation on rental property when selling?

Formula to calculate depreciation on rental property when selling:

Annual Depreciation Value = Property cost basis/27.5

Example: Consider capital gains tax (CGT) while selling a property. Many individuals think CGT is the difference between selling and buying a property. Let’s say you buy the property for $500,000, own it for ten years, depreciate $10,000 a year, and pay 32.5% tax on $37,001–$90,000. By deducting $10,000 annually, you save $3,250 in taxes; over ten years, you save $32,500. The video below explains calculation of rental property depreciation.

How do you calculate depreciation over seven years?

You can calculate depreciation over 7 years by Straight Line Depreciation. The straight-line depreciation method minimizes an asset’s value constantly over time until its salvage value. Straight-line depreciation is the most frequent and straightforward approach for capital asset cost allocation. Divide the asset’s cost minus its salvage value by its usable life to calculate it.

Straight Line Depreciation Formula:

Annual Depreciation Expense = (Cost of the Asset – Salvage Value) / Useful Life of the Asset

The formula for straight line depreciation rate:

Straight Line Depreciation Rate = Annual Depreciation Expense / (Cost of the Asset) – Salvage Value)

Company A spends $100,000 on a machine with a 5-year useful life and a $20,000 salvage value. Machine straight-line depreciation is calculated as follows:

Asset cost: $100,000

The asset’s cost less its estimated salvage value is $80,000 in depreciable cost.

Lifespan: 7 years of asset use

$80,000 / 7 years = $11,428 annually for depreciation.

Thus, Company A would depreciate the machine at $11,428 per year for 7 years.

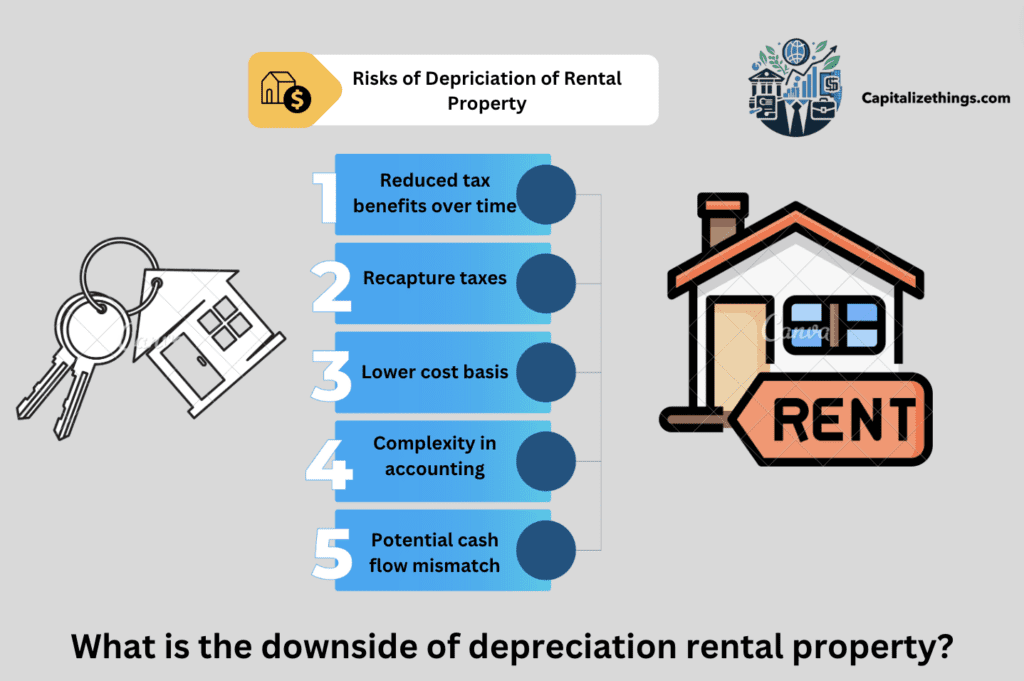

What is the downside of depreciation rental property?

The downside of depreciation is recapture when an asset is sold. The potential downsides include reduced tax benefits over time, recapture taxes, lower cost basis, complexity in accounting and potential cash flow mismatch. Depreciation recapture is the fraction of your gain attributable to accumulated depreciation on your property. Depreciation recapture is taxed as regular income up to 25%.

What property qualifies for accelerated depreciation?

For accelerated depreciation, a useful life of 20 years or less is necessary. Accelerated depreciation increases asset depreciation early on. In real estate, this means you can depreciate fixtures and transportable assets like appliances quicker than the property’s useful life. This lets you subtract more depreciation in the first 5-7 years after purchasing a home.

An excellent rental property accounting software will help you keep correct records of claim depreciation and track accelerated amortization over time. Accelerated depreciation methods include a double-declining balance (DDB), which increases depreciation expenses in the first few years and decreases as the asset ages. Along with straight-line depreciation, which properly distributes costs across an asset’s life? It would help if you undertook a cost segregation analysis for real estate to estimate the value of the assets you want to depreciate separately from the property’s worth.

Can you accelerate the depreciation on a commercial property?

Yes! You can accelerate the depreciation on a commercial property. Business property, including office buildings, storage facilities, and factories, might be depreciated faster. Personal property like homes and cars isn’t covered.

Real estate investors accelerate depreciation for two reasons. First, accelerated depreciation can be scheduled during a year with a higher tax rate and higher regular income. Claiming more depreciation on property reduces taxable income. Second, the investor can save money on taxes by subtracting the total asset price in the first year or several years. Accelerated depreciation affects taxable income, not cash flow, in the short run.

Are interest rates lower for a second home or investment property?

Yes! Interest rates are lower for second homes or investment properties. However, the interest rate on a mortgage for an investment property is higher than the rate on a mortgage for a second house.

What is the difference between asset management and investment banking?

Asset managers assist clients in building and selling assets. Businesses and individuals use asset managers to oversee their investment portfolios. Asset managers operate for their practice, investment firms, or banks and often have several clients. Asset managers mitigate risk, analyze market conditions, interact with clients, prepare financial reports and predictions, and help clients manage their portfolios. Asset managers need financial, math, discussions, interaction, decision-making, and analytical skills.

Investment banking entails advising clients on investments. Investment banks often connect clients and markets. They serve governments, corporations, startups, and people. Investment bankers advise clients, create financial models, investigate, provide suggestions, and more. They also help with risk management, M&As, and more. Investment bankers usually have a bachelor’s degree in accounting, finance, business administration, or similar fields.

There is a significant difference in investment banking and asset management lifestyles. Investment bankers often work over 70 hours each week, especially early on. Asset managers often work 50 hours a week. Both occupations may require weekend work and travel. Thus, asset management and investment banking have different work-life balances, so your personality and goals may suit one over the other.

Can investments be taxed?

Yes! Investments can be texted at the income tax rate.

Conclusion:

When you purchase an investment property as an investment, you inherit all maintenance, improvement, and management expenditures. Renting and owning property is a business because you make money. Earnings must be included in taxes. You can make money with the property, like a factory with its equipment or machines. As they age, manufacturing machines and rental property lose value. The IRS assumes that renting and maintaining your investment property will devalue it, giving you a break. Spreading costs and value loss over the years lets you deduct it. Property and significant equipment can depreciate economically. Economic depreciation occurs when unfavorable factors, such as falling real estate prices, lower asset value. To understand, take an example with calculation.

If a $375,000 rental home includes $100,000 for land and $275,000 for improvements, the owner can depreciate $10,000 annually. Understanding the cost basis is crucial. Simply put, the investor paid this for the property. Whatever financing they utilized to buy the home doesn’t matter. The cost base decreases with depreciation. Claimed depreciation will lower the cost base by $50,000 to $325,000 after five years. If the investor offers the property for $500,000, the gain is $175,000 (500,000 – 325,000). Capital gains tax applies to this sum. Remember that the taxable gain is independent of the selling proceeds or investor profit. They might refinance before selling, withdrawing equity, and selling for $50,000. Still, it is a $175,000 gain.

When a property owner gives a rental property that has lost value, they usually have to pay taxes on the recapture of depreciation. That’s a big downside.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.

![How to Calculate Taxable Gain from Selling a Rental [Tax Smart Daily 020]](https://www.capitalizethings.com/wp-content/cache/flying-press/VFqIr0GQKSk-hqdefault.jpg)