Reinvestment risk is the danger that an investor gains from not being able to reinvest profits from funding at an identical or better price for going back. This typically impacts fixed-profit investments like bonds that pay for interest over the years. When interest rates drop, the investor can also reinvest at a decreased fee, decreasing typical profits. Bonds are especially prone to this because of their constant interest bills.

There are no particular components to calculate reinvestment threat. However, it can be measured by evaluating the go-back of contemporary funding with potentially lower returns from new investments. If the distinction between these costs is big, the reinvestment threat increases. For instance, if a bond will pay a 5% interest rate, but Destiny Investments offers 3%, the investor faces a high reinvestment risk.

To manage reinvestment chances, traders can take a few steps. They can pick out lengthy-time period bonds to lock in interest costs for a longer time, spend money on zero-coupon bonds that pay at adulthood, or diversify their portfolio with property-like shares, which can be much less suffering from interest charge changes. This way, they lessen their exposure to lower future returns and better defend their income.

Maximize your returns while minimizing Reinvestment Risk through our comprehensive analysis services. Our specialists at CapitalizeThings.com are ready to help you navigate market fluctuations. Don’t hesitate to call +1 (323)-456-9123 and take advantage of our free 15-minute assessment to learn how we can protect your financial future.

What Is Reinvestment Risk?

Reinvestment risk is a financial risk that impacts investments, particularly fixed-earnings securities like bonds. It happens when an investor can’t reinvest interest or returns on the identical or better charge. This risk comes from lower interest quotes in the marketplace. If prices drop, the brand-new investments can also supply decreased returns, lowering total income.

Bonds and different constant-income securities are most affected by reinvestment chances. For example, if you maintain a bond that pays five interest but interest rates drop to 3%, you cannot get equal returns if you reinvest the cash. Reinvestment risk is critical for those relying on constant profits from those investments.

Managing this hazard means considering how lengthy the bond lasts and what other funding alternatives are available. If you pick bonds that mature inside the remote destiny, you avoid wanting to reinvest too soon. This helps maintain your earnings stable even if rates pass down. Diversifying your investments into stocks or other property also reduces this threat.

What Is Reinvestment Risk For Dummies?

Reinvestment risk for dummies is the chance that you won’t be able to reinvest future cash flows at the same or higher rate of return as your current investment. This usually occurs while interest quotes within the marketplace cross down. Bonds and different fixed-earnings securities are most affected because they pay a hard and fast fee for interest.

For example, consider procuring a bond paying 5% interest. When it matures, interest charges have dropped to 3%. You’ll get less income because of the lower rates if you need to reinvest your cash. This is what reinvestment chance manners. It reduces your general income.

Some buyers pick out bonds closing longer or search for different investments like stocks to decrease reinvestment chances. They additionally consider zero-coupon bonds that pay all interest at adulthood because of this much less reinvestment during the bond’s lifestyles.

What Is Reinvestment Risk In Investment?

Reinvestment risk in investment is a financial risk that mainly impacts fixed-earnings securities like bonds. It refers to the hazard that money earned from those investments should be reinvested at a lower rate. When interest costs move down, buyers find it harder to reinvest and get the same or better returns.

For example, you can invest in a bond that will pay 6% interest, but interest charges have dropped to 4% after the bond matures. If you reinvest the cash, you’ll acquire a lower return. This is why reinvestment chances can decrease your overall income, specifically with bonds.

A few buyers spread their cash through extraordinary assets to manipulate reinvestment danger. They additionally purchase bonds with longer maturities, which can lock in fees for an extended time. Some would possibly search for shares or other property, for which adjustments in interest quotes can be much less tormented.

What Is The Reinvestment Risk Of A Bond ETF?

The reinvestment risk of a bond ETF is the equal financial risk that comes with bonds. A bond ETF holds many bonds, but the interest from these bonds is reinvested when the costs are lower. This reduces the full return on the investment over time.

For example, if a bond ETF has bonds paying 4% interest, but interest charges drop to 2%, the ETF reinvests the earned interest at a decreased price. This can reduce the income for those who hold stocks within the bond ETF. It is one of the dangers that come with investing in bond ETFs.

To manipulate this hazard, a few people put money into one-of-a-kind forms of ETFs or pick out ETFs that concentrate on longer-term bonds. Diversifying investments can assist in reducing the effect of reinvestment risk on the general go-back. People additionally watch the interest price surroundings when identifying which bond ETF to buy.

What Increases Reinvestment Risk?

Reinvestment risk will increase while interest prices drop inside the marketplace. This occurs because traders cannot reinvest their money in the identical price they used to get. Bonds and other fixed-profit securities are more affected by this threat because they pay interest regularly, and while quotes drop, new investment supply decreases returns.

The longer the funding lasts, the less reinvestment risk there. However, while quick-term bonds mature, the investor needs to reinvest money quickly. If the costs have dropped, the investor faces a higher reinvestment risk. The sort of investment additionally impacts how many threats there are.

Investors can pick longer-term bonds or search for investments like stocks to lessen this hazard. Zero-coupon bonds are any other choice. They pay all the interest at the give-up, so there’s no need for reinvestment till the bond matures. Diversifying the investment portfolio also enables lower chances.

What Is The Reinvestment Risk Of A Mutual Fund?

The reinvestment risk of a mutual fund relies upon what sort of property the fund holds. Mutual finances that spend money on bonds and other constant-profits securities face reinvestment chances. This occurs when the profits from those investments need to be reinvested at decreasing interest quotes, reducing ordinary returns.

For instance, a bond mutual fund would possibly earn 5% on its bonds, but if interest costs drop to a few, the fund must reinvest at that decreased price. This can lessen the profits for those who keep stocks inside the mutual fund. It is a crucial threat for budgets that target fixed-income investments.

Investors can control reinvestment risk in a mutual fund by deciding on finances that maintain longer-time bonds or diversify into distinctive assets. Funds that spend money on stocks, for example, do not face the identical reinvestment risk as bond price range. This is why looking at the fund’s method helps investors apprehend their publicity to this risk.

What Is The Reinvestment Risk In Bonds?

The reinvestment risk in bonds is the risk that interest earned from a bond must be reinvested at a lower price. Bonds pay ordinary interest; if interest prices drop, the investor can’t reinvest on the identical or better charge. This reduces the investor’s universal returns.

For example, you buy a bond paying 4%; however, after the bond matures, rates have dropped to two%. If you reinvest the money, you’ll get less income. This makes reinvestment risk a critical trouble for individuals who spend money on bonds. It can influence how much money they earn over time.

Investors reduce reinvestment chances by choosing bonds with longer maturities or using different investment alternatives. Zero-coupon bonds are another desire because they best pay at maturity, so there is less reinvestment during the bond’s life. Diversification into other belongings, like stocks, also facilitates lessening the impact of reinvestment danger.

Can You Reinvest Bond Coupon Payments?

Yes, you can reinvest bond coupon payments. Bond coupons are everyday interest bills you get hold of from bonds. If you don’t want the money right away, you can reinvest those payments to earn more income. This helps increase your expected returns over the years. However, reinvesting at decreasing interest charges reduces future profits. Reinvesting bond coupon payments is an excellent way to develop your money; however, it comes with reinvestment danger.

If interest rates fall, the new investments can also deliver lower returns. This makes it essential to consider when and wherein to reinvest the bills. Some buyers pick out bonds with higher coupon quotes to reduce this risk. Diversifying into other forms of investments also can assist shields towards decreasing interest costs.

What Bonds Are Subject To Reinvestment Rate Risk?

Bonds with periodic interest payments (coupon-bearing bonds) are subject to reinvestment rate risk. This risk occurs while interest earned from the bond should be reinvested at decreased charges. If marketplace interest rates drop, the investor can not earn an equal return on new investments. Short-term bonds are more uncovered to reinvestment price hazard because they mature fast. In this approach, the investor must reinvest the cash faster, often at lower charges.

Zero-coupon bonds are less affected by this danger because they pay all interest at maturity, so there’s less common reinvestment. Longer-time period bonds also reduce this risk, permitting investors to lock in charges for an extended duration.

Do Zero Coupon Bonds Have Reinvestment Risk?

No, zero-coupon bonds no longer have reinvestment risks. They do not now pay for interest all through the bond’s lifestyles. The investor gets one lump sum charge while the bond matures. Because there are no periodic interest bills, there is no need to reinvest money. The bondholder receives the total value at maturity, meaning their return is fixed. This is why zero-coupon bonds defend traders from the hazard of reinvesting at lower interest charges.

However, investors want to wait till adulthood to get any go-back. The money is tied up for the bond’s complete time period. If the bond matures at some point a time of excessive interest fees, the investor passes over better opportunities in advance. Still, the reality that 0-coupon bonds keep away from the need to reinvest interest payments makes them one of the most secure alternatives for keeping off reinvestment danger.

Master the art of bond laddering to minimize reinvestment risk in zero coupon bonds. Our team at CapitalizeThings.com provides comprehensive workshops and one-on-one coaching and service to handle your investments. Contact +1 (323)-456-9123 to book your no-obligation 15-minute introductory session, or email us today and our someone from our financial advisor team would reach you out back within 3-5 business days.

Which Type Of Bond Will Not Be Affected By Reinvestment Risk?

Bonds that don’t pay regular interest aren’t tormented by reinvestment risk. Zero-coupon bonds are a crucial example. The best pay while the bond matures. This kind of bond doesn’t have ordinary interest payments that need reinvestment. Because of this, there’s no risk of earning a decreased price when reinvesting interest bills.

Other bonds that reduce the threat of reinvestment are long-term bonds. These bonds lock in an interest price for decades. The longer the bond lasts, the less often an investor wishes to worry about reinvesting. The locked-in charge protects the investor for the bond’s life. This makes 0-coupon and lengthy-term bonds friendly for averting the hazard of reinvesting at lower quotes.

What Are The Two Types Of Bonds Designed To Eliminate Reinvestment Rate Risk?

Zero-coupon and long-term bonds have been designed to do away with reinvestment risk. Zero-coupon bonds most straightforwardly pay at maturity, so there aren’t any everyday interest payments to reinvest. The investor gets one lump sum price, which gives them a safe desire to avoid reinvestment threats.

How Does Reinvestment Risk Exacerbate The Vulnerability Of Callable Securities?

Reinvestment risk increases the vulnerability of callable securities by potentially forcing investors to reinvest proceeds at lower rates if the issuer calls the security when interest rates decline. These bonds are repaid through the issuer before adulthood. When interest costs drop, issuers frequently call back those bonds. They do this to trouble new bonds at a decreased interest fee. The investor is then compelled to reinvest the returned money at a lower price. This situation increases the investor’s reinvestment threat.

The risk is worse because buyers lose the high interest rate they had originally received. Callable securities are more vulnerable to reinvestment chances because they could cease early. Investors in those bonds are left with fewer good investment selections when the prices are lower. This makes callable securities riskier than non-callable bonds, especially while interest fees drop extensively.

What Is The Reinvestment Rate Formula?

The reinvestment rate formulation shows how a great deal of returns you get when you reinvest earnings from funding. It measures how properly the interest you earn can grow over time. The components are simple:

Reinvestment Rate = (Future Value of Investment – Present Value) / Present Value

This method allows traders to see how much of a destiny price their income can have if they reinvest at a given charge. The better the price, the greater the profits you’ll get. Investors use this formulation to understand how much risk they face while reinvesting. If the rate is low, they will face reinvestment chances.

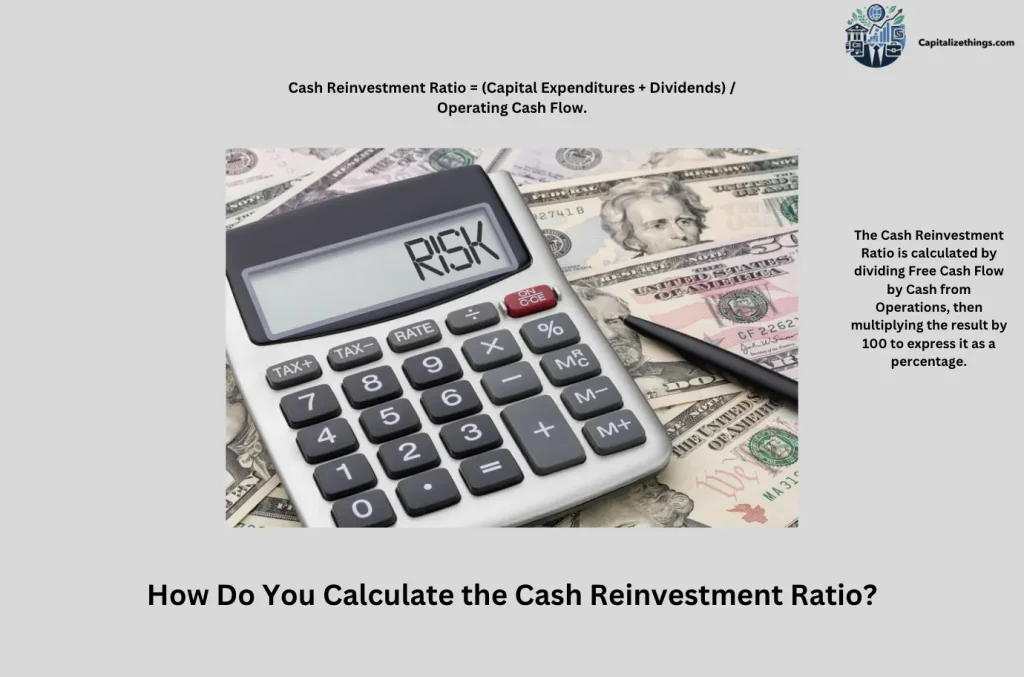

How Do You Calculate the Cash Reinvestment Ratio?

The cash reinvestment ratio measures how a whole lot of a business enterprise’s income is reinvested. It is used to apprehend how properly the organization invests money into developing its commercial enterprise. The method is:

Cash Reinvestment Ratio = (Capital Expenditures + Dividends) / Operating Cash Flow.

This ratio allows traders to see how much cash the employer is using to develop. In a high-ratio approach, the employer is reinvesting nicely. A low ratio might indicate that the organization isn’t always focusing sufficiently on increasing. The cash reinvestment ratio is a vital tool for buyers to judge how nicely a company uses its profits to grow its commercial enterprise.

How may reinvestment risk Be avoided if an investor purchases it?

An investor can keep away from reinvestment risk by buying zero-coupon bonds. These bonds pay best at maturity, and not using normal interest bills. Because there is no want to reinvest, the investor is not exposed to reinvestment risk. Another way to avoid chance is to shop for long-term bonds that lock in an interest fee for many years.

Investors also can observe bonds with name safety. This feature prevents the company from repaying the bond early. With call protection, the investor is guaranteed to receive interest bills for a hard and fast length. Purchasing zero-coupon bonds, long-term bonds, and bonds with call protection are three exquisite ways to avoid reinvestment danger.

How To Avoid Reinvestment Risk?

There are several approaches to keep away from reinvestment chances. One option is to shop for 0-coupon bonds, which do not now have interest payments that need reinvestment. Another way is to invest in lengthy-term bonds that lock in interest rates for decades. Investors can also search for bonds with name safety, which stops early compensation using the issuer.

Diversifying investments is another right method. Investing in quite a few assets, including shares and bonds, can lessen publicity and reinvestment danger. Investors can also use bond laddering, which entails buying bonds with one-of-a-kind maturity dates. This method has spread the chance over the years. These strategies assist investors in managing and reducing the probability of going through reinvestment threats.

Do Treasury Bonds Have Reinvestment Risk?

Yes, treasury bonds do have reinvestment risk. These bonds pay interest every six months. Investors must reinvest the interest bills at cutting-edge interest charges. If interest charges drop, the investor can only reinvest at a decreased fee. This makes Treasury bonds susceptible to reinvestment chances, especially in a falling interest fee environment.

However, Treasury bonds are considered one of the most secure investments. They are subsidized through the government, so there is little chance of default. While they face reinvestment threats, protecting the major investment makes them appealing to many buyers. To avoid reinvestment threat, traders ought to recall lengthy-term Treasury bonds or 0-coupon Treasury bonds.

What Is An Example Of Reinvestment?

Reinvestment occurs when an investor uses income from an investment to buy new investments. For example, you are reinvesting if you earn interest from a bond and use that money to buy any other bond. This process lets in your cash to maintain development over time. However, reinvestment comes with a chance if interest charges drop.

If costs fall, you could reinvest your profits at a lower fee. This reduces your typical return and creates reinvestment risk. An investor who earns 5% interest on a bond most effectively can reinvest at three% while the bond matures. This suggests how reinvestment, while beneficial for growth, can also reveal you to the danger of earning much less in the future.

What Is A Reinvestment Rate Risk Example?

A reinvestment rate risk example can be when an investor buys a bond paying 6% interest. When the bond matures, interest rates have fallen to 3%. The investor cannot reinvest the principal at the same rate. The drop in rates lowers the returns from future investments. This risk is often seen with bonds because they pay fixed interest rates. When interest rates fall, reinvesting becomes harder. The lower rates mean the investor earns less from future investments.

The risk is even higher if the investor depends on steady returns. This is a challenge with long-term bonds, where reinvestment happens at the end of the bond’s term. Understanding reinvestment risk helps investors plan for changing interest rates.

What Is An Example Of Reinvestment Risk Zero Coupon Bond?

An example of reinvestment risk with a zero-coupon bond is when interest rates fall after the investor has bought the bond. A zero-coupon bond is a bond that does not pay interest until maturity. This bond avoids reinvestment risk since there are no periodic payments to reinvest. Since the bond pays no interest until it matures, it is unnecessary to reinvest any payments during the bond’s life. The reinvestment risk comes only when the bond matures.

If the investor wants to reinvest the lump sum payment and interest rates have dropped, they might face lower returns. However, there are no interest payments to worry about reinvesting throughout the bond’s life. Zero-coupon bonds reduce some aspects of reinvestment risk by focusing on a single, final payout.

What Is The Lowest Level Of Reinvestment Risk?

The lowest level of reinvestment risk happens with long-term bonds or investments that do not require frequent reinvestment. Bonds with longer durations, like 30-year bonds, allow investors to lock in their interest rates for a long. This reduces the need to reinvest income at potentially lower rates. Zero-coupon bonds also have low reinvestment risk since they pay out only at maturity.

Another way to avoid reinvestment risk is by using investments like stocks or real estate. These asset classes do not depend on fixed interest rates. Diversifying investments into various types can also lower reinvestment risk. The less reliant an investor is on reinvesting at lower rates, the lower their risk becomes.

Do Longer Term Bonds Have Higher Interest Rate Risk?

Yes, longer-term bonds have higher interest rate risk. This is because longer bonds are more sensitive to changes in interest rates. If rates go up, the price of a long-term bond can drop significantly. Investors in long-term bonds might face a larger loss in value if they need to sell the bond before it matures. This makes the bond riskier.

The longer the bond, the more time there is for interest rates to change. The value of future payments becomes less attractive if new bonds offer higher interest rates. Investors demand higher returns for longer-term bonds to compensate for this risk. Balancing interest rate risk with reinvestment risk is key to smart investing.

Why Do Short-Term Bonds Have More Reinvestment Risk?

Short-term bonds have more reinvestment risk because they mature quickly. This means the investor must reinvest the principal and interest more often. If interest rates drop after the bond matures, the investor must reinvest at a lower rate. This constant need to reinvest increases the risk of lower future returns.

The frequent maturity of short-term bonds forces investors to find new investments sooner. If rates have fallen, this can lead to lower earnings. To avoid this risk, investors can mix short-term and long-term bonds. This strategy helps balance the reinvestment risk by spreading out when investments mature.

How Does Maturity Affect Reinvestment Risk?

Maturity affects reinvestment risk by determining how often an investor must reinvest their money. Short-term investments mature faster, leading to more frequent reinvestments. This increases reinvestment risk, especially if interest rates fall. Long-term investments lock in returns for a longer period, reducing the need to reinvest as often.

When a bond or other investment matures, the investor must find a new place to put their money. If interest rates are lower than when the initial investment was made, future returns could be less. By choosing longer-term investments or diversifying, an investor can reduce the impact of reinvestment risk over time.

What Is Macaulay Duration Interest Rate Risk?

Macaulay duration measures a bond’s sensitivity to interest rate changes. It calculates the time it takes for an investor to get back their bond investment through payments. Bonds with a longer Macaulay duration are more sensitive to interest rate changes. A bond with a longer duration has higher interest rate risk because its price is more affected by rate changes.

Interest rate risk is tied to how much bond prices change when rates move. Macaulay duration helps investors understand this risk. The higher the Macaulay duration, the greater the price drop if rates rise. This tool helps investors manage risk when choosing bonds. It’s important to balance duration with reinvestment risk.

What Is The Price Risk Of A Bond?

The price risk of a bond is the chance that its price will change before it matures. When interest rates rise, bond prices usually fall. This means that if an investor sells a bond before maturity, they could sell it for less than they paid. The longer the bond’s term, the more sensitive it is to price risk.

Price risk happens because of changing interest rates. New bonds offer higher returns, making older bonds less attractive. This reduces their market value. Investors who hold bonds to maturity don’t face price risk since they get the full value back at the end. However, those who sell bonds early are affected by it.

What Is The Difference Between Interest Rate Risk And Reinvestment Risk?

Interest rate risk and reinvestment risk are related but different. Interest rate risk is the chance that the price of a bond will drop if interest rates rise. New bonds offer better returns when rates go up, making older bonds less valuable. Reinvestment risk, on the other hand, is the risk that future returns will be lower when an investor reinvests income or principal from an investment. Interest rate risk affects the value of a bond while it’s still held.

Reinvestment risk occurs when income from the bond needs to be reinvested, often at a lower rate. Both risks can affect an investor’s returns but happen at different points in the investment timeline.

What Is The Difference Between Reinvestment Risk And Refinancing Risk?

Reinvestment risk and refinancing risk are two different concepts. Reinvestment risk happens when an investor needs to reinvest income or principal from an investment at a lower rate than before. This can lead to reduced returns. Refinancing risk occurs when a borrower needs to renew a loan or bond at higher rates than before, making it more expensive to pay back. Reinvestment risk affects investors while refinancing risk affects borrowers.

Investors worry about lower future returns, while borrowers worry about paying more for future loans. Both risks are related to changes in interest rates but impact different sides of financial agreements.

What Is The Difference Between Reinvestment Risk And Price Risk?

Reinvestment risk and price risk both affect bonds but in different ways. Reinvestment risk happens when the investor cannot reinvest bond income at the same rate. This risk grows when interest rates fall. Price risk, on the other hand, affects the bond’s market price. If rates rise, the bond’s price falls, and selling it before maturity could result in a loss. Reinvestment risk affects future returns, while price risk impacts the bond’s value if sold before maturity.

Investors who plan to hold bonds until maturity mostly face reinvestment risk. Those who might sell bonds early need to consider price risk. Managing both risks is key to smart bond investing.

What Is The Difference Between Duration And Reinvestment Risk?

Duration measures a bond’s sensitivity to interest rate changes, while reinvestment risk refers to the challenge of reinvesting income at a lower rate. Bonds with longer durations are more sensitive to rate changes, meaning they have higher price risk. Reinvestment risk happens when rates fall, making it harder for investors to get the same returns when reinvesting their income.

Duration helps investors understand how much a bond’s price could change with rate shifts. Reinvestment risk happens after an investor receives payments from an investment. Both factors are essential when managing bond investments. Understanding both duration and reinvestment risk helps investors make better choices with bonds.

Are Treasury Receipts Subject To Reinvestment Risk?

Treasury receipts face reinvestment risk. These receipts pay constant interest over time. When interest rates fall, the bills additionally want to be reinvested at lower costs. This lowers the return for the investor. Treasury receipts are acknowledged for having the safest returns but still convey reinvestment chances. Long-term Treasury receipts are extra susceptible to this risk because they mature later. The investor’s potential to earn a better return is additionally reduced over the years.

Treasury receipts offer substantial profits, but reinvestment risk can lessen lengthy-time period profits. To avoid this, some investors search for other belongings with fewer risks tied to lower interest prices.

Is Reinvestment Risk Inversely Related To Interest Rate Risk?

Reinvestment risk and interest rate risk are opposites. When interest fees drop, the reinvestment threat will increase. When interest rates upward push, reinvestment threat decreases. Interest rate threat is the hazard that growing interest prices will lower the cost of fixed-income investments.

Reinvestment chance grows when rates fall, forcing buyers to simply accept lower returns on new investments. High-interest fee changes occur with lengthy-term bonds when costs rise. Low-interest price threats frequently mean higher reinvestment risk because decreasing prices offer fewer methods to reinvest on identical charges. Investors want to balance each risk to guard their returns through the years.

What Is Interest Reinvestment Rate Risk?

Interest reinvestment rate risk is the chance of reinvesting profits at a decreased rate. This happens when interest fees drop. Investors who acquire ordinary interest payments can also face a decreased return once they reinvest that cash. Bonds and different fixed-income investments have this risk. If interest rates fall after a bond is sold, future bills will earn less.

This can reduce an investor’s overall return. Interest reinvestment charge hazard is extra severe for buyers with lengthy-time period bonds. To lessen this danger, a few buyers blend their bonds with investments that grow even when rates fall.

Is Dividend Reinvestment A Good Idea?

Yes, dividend reinvestment can be a very good idea for long-term traders. It lets them buy more stocks without spending more money. Instead of getting cash, the investor uses dividends to shop for extra stock. Over time, this can help increase the investment fee. Dividend reinvestment works first-rate for shares that grow regularly. It builds up extra stocks through the years.

This plan can increase total returns without a whole lot of attempts. However, it is not great for individuals who need coins properly. Dividend reinvestment works excellent for people who plan to keep their cash inside the market for a long time.

Which Is Better, Dividend Reinvestment Or Growth?

Dividend reinvestment and growth each have benefits. Dividend reinvestment offers buyers greater shares over the years. Growth investing focuses on shares that boom in value. Dividend reinvestment is ideal for constant earnings, while growth can bring larger profits. Investors who want balance often choose dividend reinvestment.

Growth investing is riskier; however, it can cause better returns. Both alternatives work properly depending on the investor’s desires. Dividend reinvestment helps grow wealth slowly, while growth investing offers faster profits, however, with extra danger. Investors must pick the one that suits their needs and risk level.

Which Asset Classes Are The Most Risky?

The most volatile asset classes are shares, commodities, and actual estate. Stocks can cross up and down quickly, making them risky. Commodities, like oil and gold, often trade-in prices. Real property is volatile because belongings costs depend upon the economic system. These asset lessons have the highest capability for losses. However, they also provide excessive rewards. Stocks can grow a lot; however, they also can lose price fast.

Commodities can upward thrust in charge in the course of times of inflation; however, they can drop while demand falls. Real estate is risky because it’s tough to sell quickly if the market is going down.

What Is The Risk Of Expected Return?

The risk of expected return is the chance that the actual return will be less than expected. Investors calculate expected returns based on past performance. However, there is always the risk that things will not go as planned. Markets change, and returns can fall short. The risk increases with more volatile investments like stocks. The more uncertain the return, the higher the risk.

Expected returns are just estimates, not guarantees. Investors need to understand that even safe investments have some risk of expected return. When choosing an investment, it is important to weigh how likely the return will match expectations.

How To Measure Risk In Investment?

Investment risk is measured by how much the value of an investment can change. One way to measure the investment risk it is through standard deviation. This shows how much returns vary over time. Another way is by looking at beta, which compares an investment’s risk to the market. A higher beta means higher risk. Investors also measure risk by looking at volatility.

High volatility means an investment’s value changes a lot. Risk can also be seen in the chance of losing money. Some investors use financial ratios to measure risk and compare it to the expected return.

How To Determine Investment Risk Tolerance?

To determine investment risk tolerance, investors should think about their goals and timeline. Younger investors might be able to take more risk because they have time to recover. Older investors might need safer options. Investors should also consider how they feel about losing money.

Those comfortable with ups and downs in the market might have a high tolerance. People who worry about every loss might need safer investments. Risk tolerance is personal and can change over time. The best way to know is to understand how much risk feels comfortable.

What Type Of Investment Has the Highest Risk?

The investments with the highest risk are stocks, cryptocurrencies, and commodities. Stocks can lose value quickly when the market drops. Cryptocurrencies are new and very unstable. Their prices can change a lot in a short time. Commodities, like oil or gold, depend on supply and demand, which can change fast. These investments offer high returns but can also lead to large losses. Stocks have a long history of rising and falling quickly.

Cryptocurrencies are known for their big price swings. Commodities react to global events. Investors should know these risks before putting money in these types of investments.

How Much Risk Should You Take When Investing?

The amount of risk to take depends on the investor’s goals and time frame. Young investors can take more risks because they have time to recover from losses. Older investors need to take less risk since they need their money sooner. Investors also need to consider how much risk they are comfortable with. If losing money would cause stress, they should choose safer investments. Investors with a long-term view can take more risks since the market usually grows over time. The key is to balance risk with the potential return and make choices that fit individual goals.

Can Beta Investing Reduce Reinvestment Risk?

Beta investing can help reduce reinvestment risk. Beta measures how an investment moves with the market. A low-beta investment is less sensitive to market changes. This can protect investors when reinvesting. By choosing investments with lower beta, an investor lowers the risk of reinvesting at lower returns.

Beta investing looks at risk compared to the overall market. A higher beta means more risk. Investors can lower their risk by focusing on assets that move less with the market. This makes reinvestment safer, especially when interest rates fall.

What Role Does Alpha Investing Play In Mitigating Reinvestment Risk?

Alpha investing focuses on finding investments that outperform the market. This helps reduce reinvestment risk because these investments often offer higher returns. With a higher return, the investor is less affected by the risk of reinvesting at lower rates. Alpha investing looks for hidden value in the market. It finds investments that have the potential to beat the average return. By doing this, investors can lessen the risk of losing returns when reinvesting. Alpha investing requires careful research, but it can protect against future losses tied to reinvestment risk.

How Does Reinvestment Risk Influence Investment Management Decisions?

Reinvestment risk plays a big role in investment management decisions. When interest rates drop, investors face the risk of reinvesting at lower returns. To avoid this, managers often choose long-term bonds or diversified portfolios. They also use zero-coupon bonds, which don’t pay regular interest, reducing the need to reinvest. Reinvestment risk can lead managers to focus on assets less affected by interest rate changes. They balance this risk with other types of market risks. Understanding reinvestment risk helps managers protect clients’ returns and make better long-term investment choices.

Conclude:

Reinvestment risk is a key issue for investors, particularly those with constant-earnings investments like bonds. It takes place while interest costs drop, forcing reinvestment at lower returns. Investors face this danger after reinvesting interest payments or matured investments during declining prices. Managing this risk calls for careful planning, along with investing in long-term bonds, diversifying property, and using techniques like alpha and beta to make an investment. By focusing on properties that both outperform the market or move much less with it, buyers can reduce exposure to falling rates. Understanding the role of reinvestment hazard enables traders to guard their long-term period returns and avoidability losses. Informed selections based on chance tolerance, time body, and financial goals are crucial for preserving regular growth in the face of reinvestment chance.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.