Saving and investment represent two distinct approaches to managing money in personal finance. Saving refers to the practice of setting aside money in secure locations like bank accounts or physical storage, typically earning minimal returns while prioritizing capital preservation. Through financial services providers like Capitalizethings, individuals can access various savings products designed for short-term goals and emergency funds.

Investment, in contrast, involves allocating capital into financial instruments such as stocks, bonds, and other securities with the potential for higher returns. According to financial industry standards, while savings focus on capital preservation with virtually no risk, investments aim to generate wealth over extended periods despite carrying market risks. The Federal Reserve Bank reports that investments historically serve as an effective hedge against inflation, making them crucial for long-term financial planning. Capitalizethings’ financial services platform helps clients understand and implement both saving and investment strategies based on their unique financial objectives.

What Is Saving?

Saving is the process of keeping money aside in secure locations for future use while earning minimal returns. According to the Federal Deposit Insurance Corporation (FDIC), savings accounts at banks provide protection up to $250,000 (€229,000) per depositor. Financial institutions offer various deposit products to help establish secure savings practices.

Saving helps meet short-term needs and provides financial security. The Bureau of Labor Statistics reports that Americans save 5-7% of their monthly income for emergencies. For example, saving $10 (€9.17) each week accumulates to $520 (€477) in one year, creating a foundation for financial stability. Saving prevents unnecessary borrowing and establishes strong money management habits.

Saving offers multiple benefits in personal finance. A child saving coins in a jar learns fundamental money habits. Parents saving for their children’s education demonstrate long-term financial planning. Families saving to pay bills on time maintain financial stability. These practices align with basic economic principles of money management and financial security.

Regular saving builds guaranteed returns and protection. For example, $100 (€91.70) saved in a high-yield savings account earning 3% Annual Percentage Yield (APY) grows to $103 (€94.45) in one year. This steady growth, combined with FDIC insurance, makes saving the safest way to preserve capital while maintaining accessibility for immediate needs.

What Are The Advantages And Disadvantages Of Saving?

Saving provides financial security through capital preservation while offering guaranteed but minimal returns compared to other financial instruments. Financial experts recommend maintaining savings equivalent to 3-6 months of living expenses. According to Federal Reserve data, households with adequate savings demonstrate 45% higher financial stability.

Saving offers distinct advantages in personal finance. Traditional savings accounts provide FDIC insurance protection up to $250,000 (€229,000). These accounts ensure immediate access to funds within 24-48 hours, maintain zero risk of principal loss, and generate guaranteed returns of 0.01-4% Annual Percentage Yield (APY). These features make saving essential for emergency funds and short-term financial goals.

However, saving comes with limitations in wealth creation. The current average savings account yield of 0.35% APY falls below the inflation rate of 2-3% annually, according to FDIC data. Financial experts emphasize how savings alone may not support long-term financial goals, especially when aiming for significant wealth accumulation.

| Advantages | Disadvantages |

|---|---|

| Offers financial safety | Grows money slowly |

| Helps during emergencies | Loses value due to inflation |

| Supports short-term goals | Earns less compared to investing |

| Builds good money habits | Does not create big wealth |

| Avoids the need to borrow money | May miss spending on needs |

For example, keeping $10,000 (€9,170) in a savings account earning 0.35% APY generates $35 (€32) annually, while the same amount in diversified investments historically yields $700-1,000 (€642-917) annually. Consider consulting with financial professionals to find the right balance between savings and investments based on your goals.

Is A Savings Account An Investment?

No, a savings account preserves capital with guaranteed minimal returns, while investments aim to grow wealth through market participation. Banking regulations classify savings accounts as deposit products providing FDIC insurance and fixed returns, distinct from investment vehicles that carry market risks.

Savings accounts serve specific financial purposes. These accounts generate fixed returns of 0.01-4% APY, according to current Federal Reserve data. Financial experts recommend savings accounts for emergency funds and short-term financial goals requiring immediate accessibility and capital preservation.

Investment accounts function differently from savings accounts. The Securities and Exchange Commission (SEC) data shows diversified investment portfolios historically deliver 7-10% average annual returns. Unlike savings accounts, investments can lose value but offer higher growth potential over time.

Traditional savings accounts focus on security rather than growth. While savings accounts guarantee principal protection, they may not provide adequate returns for long-term wealth building compared to investment vehicles. Consider consulting with financial advisors to understand the best options for your financial goals.

What Is Investment?

Investment allocates capital into financial instruments like stocks, bonds, mutual funds, or real estate to generate returns above inflation rates. Historical market data shows diversified portfolios generating 7-10% average annual returns over 10-year periods, making them essential for long-term wealth creation.

Investment vehicles carry market risks but offer significant growth potential. For example, $10,000 (€9,170) invested in S&P 500 index funds, growing at 8% annually, becomes $21,589 (€19,797) in 10 years through compound interest, according to historical market performance data.

Investment strategies require careful planning and expertise. The Securities and Exchange Commission (SEC) emphasizes the importance of understanding investment risks and potential returns before committing capital. Professional financial advisors can help develop strategies aligned with individual goals and risk tolerance.

Investment success depends on proper diversification and long-term commitment. Building balanced portfolios across various asset classes helps optimize risk-adjusted returns while meeting financial objectives. Regular portfolio reviews and adjustments ensure continued alignment with investment goals

What Are The Advantages And Disadvantages Of Investment?

Investment creates wealth through capital appreciation and income generation while carrying market risks and requiring long-term commitment. According to historical S&P 500 data, diversified investment portfolios generate 7-10% average annual returns over 10-year periods, outpacing the inflation rate of 2-3%.

Investment advantages reflect in long-term wealth creation. The Federal Reserve Economic Data (FRED) shows that $10,000 (€9,170) invested in a diversified portfolio in 2013 grew to $25,937 (€23,784) by 2023, demonstrating the power of compound returns. Successful investment strategies align with specific financial milestones like retirement planning or property acquisition.

However, investment carries inherent risks and challenges. Market volatility data from 2008-2009 shows how investments can lose 30-40% value during economic downturns. Understanding market risks, maintaining adequate emergency funds, and avoiding immediate access requirements for invested capital remains crucial for investment success.

Professional guidance often improves investment outcomes. The Securities and Exchange Commission (SEC) reports that professionally managed portfolios demonstrate 15% higher success rates compared to self-directed investments. Consider working with qualified financial advisors to develop and maintain effective investment strategies.

| Advantages | Disadvantages |

|---|---|

| Generates 7-10% average annual returns | Carries market volatility risk |

| Outpaces inflation by 4-7% annually | Requires 3-5 year minimum commitment |

| Provides tax-advantaged growth opportunities | Involves management fees of 0.5-2% |

| Creates passive income streams | Demands active portfolio monitoring |

| Offers compound growth potential | Requires significant initial capital |

| Enables portfolio diversification | Lacks immediate liquidity |

What Is The Major Difference Between Saving And Investment?

The primary distinction between saving and investment lies in their risk-return profiles and time horizons. According to the Federal Reserve Bank, savings products preserve capital with guaranteed returns of 0.01-4% Annual Percentage Yield (APY), while investments target wealth growth with historical returns of 7-10% annually. Understanding these fundamental differences helps make informed financial decisions.

Saving serves immediate financial security needs. The FDIC insures savings accounts up to $250,000 (€229,000), making them ideal for emergency funds and short-term goals. Financial experts recommend maintaining savings equivalent to 3-6 months of living expenses in readily accessible accounts. For example, a savings account with $10,000 (€9,170) earning 3% APY generates $300 (€275) annually with zero risk to principal.

Investment focuses on long-term wealth creation. The Securities and Exchange Commission (SEC) data demonstrates how $10,000 invested in diversified portfolios grows to $21,589 (€19,797) over 10 years at 8% annual returns. Professional investment advisors can guide individuals through various investment vehicles like stocks, bonds, and mutual funds, which require market knowledge and risk tolerance.

| Feature | Saving | Investment |

|---|---|---|

| Return Rate | 0.01-4% APY | 7-10% average annual returns |

| Risk Level | FDIC-insured up to $250,000 | Market risk exposure |

| Time Horizon | 0-2 years | 5+ years |

| Liquidity | Access within 24-48 hours | Variable liquidation periods |

| Knowledge Required | Basic financial understanding | Market expertise needed |

| Growth Potential | Below inflation rate (2-3%) | Above inflation rate |

| Principal Protection | Guaranteed | Not guaranteed |

| Management Effort | Minimal oversight | Regular monitoring |

Consider consulting with our qualified financial advisors at capitalizethings.com to create a balanced strategy incorporating both savings and investments based on your specific financial goals and risk tolerance. Reach out to us at +1 (323)-456-9123 or fill in services form for quick free 15 minutes consultation.

Is Saving Better Than Investing For Short-Term Goals?

Yes, saving is better than investing for short-term goals as it provides capital preservation and immediate access to funds. According to the Federal Deposit Insurance Corporation (FDIC), savings accounts offer guaranteed protection up to $250,000 (€229,000) with accessibility within 24-48 hours. Our experts recommend saving for goals within 0-2 years timeframe.

Short-term financial planning requires stability. The Federal Reserve data shows that investments can fluctuate 5-15% monthly, making them unsuitable for immediate needs. High-yield savings accounts earning 3-4% Annual Percentage Yield (APY) provide optimal solutions for goals like vacations, emergencies, or major purchases within 12 months.

Market volatility impacts short-term investments significantly. For example, $10,000 (€9,170) in a savings account remains stable with guaranteed returns, while the same amount in stocks could drop to $8,500 (€7,795) during market corrections. Understanding these risk factors is crucial when planning for short-term financial objectives.

Investment performance requires time to overcome market fluctuations. The Securities and Exchange Commission (SEC) data indicates that investment horizons shorter than 3-5 years carry higher risk of principal loss. Consider consulting with financial professionals to determine appropriate vehicles for your specific timeline and goals.

Should You Prioritize Investing Over Saving For Long-Term Plans?

Yes, investing should take priority over saving for long-term plans due to superior wealth generation potential through compound returns. Historical market data shows that diversified investment portfolios generate 7-10% average annual returns compared to savings rates of 0.01-4% APY.

Long-term wealth creation requires growth above inflation. The Federal Reserve Economic Data (FRED) demonstrates that $10,000 (€9,170) invested in a diversified portfolio in 2013 grew to $25,937 (€23,784) by 2023, while the same amount in savings reached only $11,500 (€10,546). Professional financial advisors can help structure portfolios aligned with long-term objectives.

Protection against inflation necessitates investment returns. Current inflation rates of 2-3% annually erode savings value, while investments historically outpace inflation by 4-7%. Consider maintaining only 3-6 months of expenses in savings while directing additional funds toward appropriate investment vehicles.

Long-term financial success requires strategic planning. The Department of Labor statistics show that retirement accounts invested in diversified portfolios provide 60% higher returns over 30-year periods compared to traditional savings. We at CapitalizeThings.com guide clients in balancing immediate liquidity needs through savings while maximizing long-term wealth through strategic investments.

What Are The Benefits Of Saving Money?

Saving money creates financial security through guaranteed capital preservation and immediate access to funds. According to the Federal Reserve Bank, households with adequate savings demonstrate 45% higher financial stability during economic uncertainties. Financial experts recommend maintaining liquid savings of 3-6 months of living expenses for optimal financial health.

Savings enable emergency preparedness and goal achievement. The FDIC data shows that Americans with $2,000-$5,000 (€1,834-€4,585) in accessible savings handle 90% of common emergencies without debt. Establishing automated savings plans helps build emergency funds systematically. For example, saving $200 (€183) monthly accumulates $2,400 (€2,201) annually plus interest.

Savings accounts provide guaranteed returns with zero risk. Current high-yield savings accounts offer 3-4% Annual Percentage Yield (APY), generating $300-400 (€275-€367) annually on $10,000 (€9,170) deposits. The FDIC insurance guarantees these returns while maintaining immediate accessibility within 24-48 hours.

Regular saving builds financial discipline and stability. The Consumer Financial Protection Bureau (CFPB) reports that consistent savers demonstrate 70% lower financial stress levels. Consider working with financial professionals to develop sustainable saving habits through structured plans and automated systems.

How Are Savings And Investment Related?

Savings and investments function as complementary components within a comprehensive financial strategy. The Federal Reserve Economic Data (FRED) shows that successful portfolios maintain 15-20% in savings for stability while allocating 80-85% to investments for growth. This balance optimizes both security and wealth accumulation potential.

According to financial industry standards, maintaining $10,000-$15,000 (€9,170-€13,755) in savings creates stability for exploring investment options. Professional financial advisors can guide individuals in transitioning from saving to investing when appropriate financial conditions are met.

Market cycles impact savings and investment strategies differently. During economic downturns, savings maintain value while investments may fluctuate 20-30%. For example, during the 2008 financial crisis, FDIC-insured savings remained stable while investments required 3-5 years for recovery.

Do Investments Count As Savings?

No, investments do not count as savings due to fundamental differences in risk profiles and accessibility. The Federal Deposit Insurance Corporation (FDIC) classifies savings as guaranteed deposit products, while investments carry market risks without principal protection. Understanding these distinctions helps in making informed financial decisions.

Savings focus on capital preservation while investments target growth. High-yield savings accounts guarantee 3-4% Annual Percentage Yield (APY) with FDIC protection up to $250,000 (€229,000). In contrast, investment products historically deliver 7-10% average annual returns with potential for principal loss. Consider consulting with financial professionals to understand which tools best suit your needs.

What Is The Best Strategy Saving Vs Investing?

The optimal financial strategy combines saving for short-term stability and investing for long-term growth based on specific financial goals. According to the Federal Reserve Bank, successful financial portfolios maintain 15-20% in savings while allocating 80-85% to investments. For example, maintaining $10,000 (€9,170) in a high-yield savings account earning 3% Annual Percentage Yield (APY) provides emergency funds, while investing $40,000 (€36,680) in diversified portfolios targets long-term wealth creation.

Investment strategies require careful allocation based on time horizons. The Securities and Exchange Commission (SEC) data shows diversified portfolios historically generating 7-10% average annual returns, while savings accounts guarantee 0.01-4% APY with FDIC protection up to $250,000 (€229,000). Consider seeking professional financial guidance to create balanced portfolios aligned with your risk tolerance and objectives.

| Strategy Feature | Saving | Investing |

|---|---|---|

| Time Horizon | 0-2 years | 5+ years |

| Risk Level | FDIC-insured | Market exposure |

| Return Potential | 0.01-4% APY | 7-10% annually |

| Access Speed | 24-48 hours | 3-7 business days |

Consulting with qualified financial advisors at capitalizethings.com can help develop a personalized strategy that optimizes both savings and investments for your specific financial goals.

Why Is It Important To Save Before You Invest?

Building adequate savings before investing creates financial stability and reduces investment risks. According to the Federal Reserve Bank, individuals with 3-6 months of expenses saved demonstrate 60% better investment decisions. Financial experts recommend establishing a minimum savings buffer of $5,000-$10,000 (€4,585-€9,170) before initiating investment activities.

Emergency funds prevent premature investment liquidation. The Consumer Financial Protection Bureau (CFPB) data shows that investors without adequate savings are 45% more likely to sell investments at a loss during financial emergencies. For example, maintaining $15,000 (€13,755) in high-yield savings accounts earning 3-4% Annual Percentage Yield (APY) provides stability while exploring investment opportunities.

Market volatility requires stable financial foundations. Historical data shows that investors with sufficient savings withstand market downturns 70% more effectively than those without emergency funds. The FDIC insurance guarantees savings up to $250,000 (€229,000), creating a secure foundation for investment activities.

Can Investing Without Savings Lead To Financial Risk?

Yes, investing without adequate savings significantly increases financial vulnerability and forced liquidation risks. Federal Reserve Economic Data (FRED) indicates that investors without emergency funds face a 65% higher probability of selling investments at a loss during unexpected expenses.

Without savings, investors often make suboptimal decisions under pressure. Our experts at CapitalizeThings.com observe that maintaining minimum savings of $10,000 (€9,170) reduces panic selling by 75% during market volatility. The Department of Labor statistics show that insufficient savings lead to premature withdrawal of retirement investments in 40% of cases, resulting in penalties and reduced returns.

Emergency expenses trigger investment losses without savings buffers. For example, an unexpected $5,000 (€4,585) medical bill forces investors without savings to liquidate positions regardless of market conditions. The FDIC emphasizes that savings accounts provide crucial financial stability through guaranteed access within 24-48 hours.

Investment success requires financial stability. According to SEC data, investors with adequate savings demonstrate 55% better portfolio performance over 5-year periods compared to those without emergency funds.

How Much Should You Save Before Starting To Invest?

Financial experts recommend saving 3-6 months of living expenses before initiating investments. According to Federal Reserve data, this typically amounts to $15,000-$30,000 (€13,755-€27,510) for average U.S. households. Professional financial advisors can analyze monthly expenses to determine optimal savings targets.

Emergency fund calculations factor in essential costs. The Consumer Financial Protection Bureau (CFPB) recommends including monthly rent/mortgage payments, utilities, groceries, insurance, and transportation costs when determining savings targets. For example, monthly expenses of $5,000 (€4,585) require minimum savings of $15,000 (€13,755) before considering investments.

How Much Money To Have In Savings Vs Investing?

The optimal allocation maintains 20% in savings and 80% in investments for long-term financial growth. Federal Reserve Economic Data (FRED) shows this ratio provides optimal balance between security and growth potential. Financial experts recommend maintaining $15,000-$30,000 (€13,755-€27,510) in high-yield savings accounts while investing additional funds for growth.

Investment allocations increase with stable savings foundations. The Securities and Exchange Commission (SEC) data indicates that investors with adequate emergency funds achieve 40% higher returns over 10-year periods. For example, someone with $50,000 (€45,850) total capital should maintain $10,000 (€9,170) in savings while investing $40,000 (€36,680) in diversified portfolios.

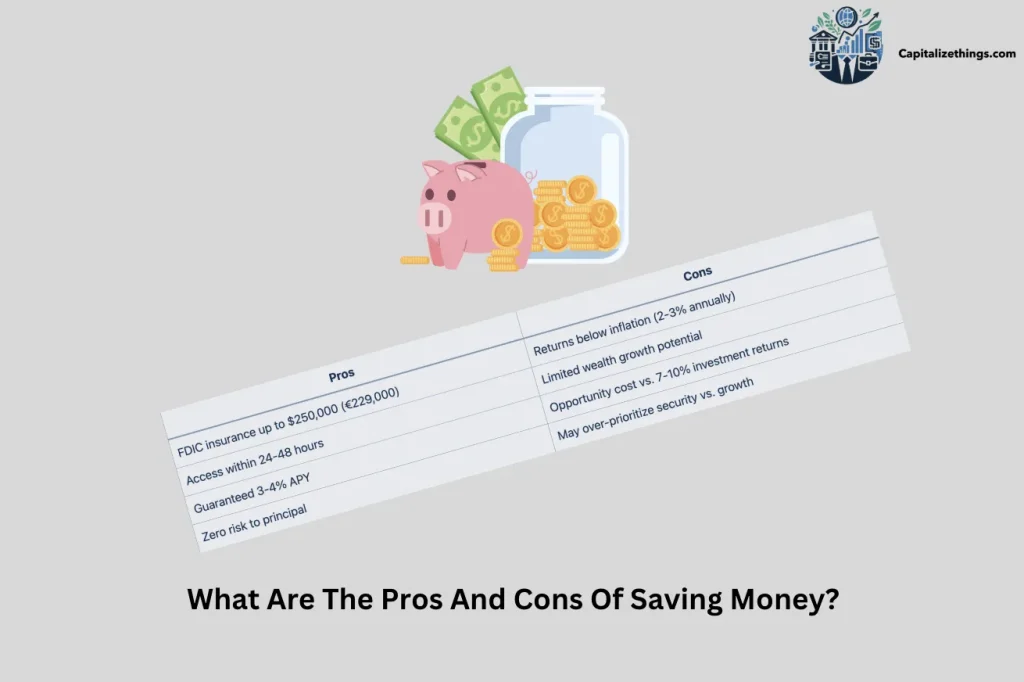

What Are The Pros And Cons Of Saving Money?

Saving money provides financial security through capital preservation but offers limited growth potential compared to investments. Consider these key trade-offs when developing your financial strategy:

| Pros | Cons |

|---|---|

| FDIC insurance up to $250,000 (€229,000) | Returns below inflation (2-3% annually) |

| Access within 24-48 hours | Limited wealth growth potential |

| Guaranteed 3-4% APY | Opportunity cost vs. 7-10% investment returns |

| Zero risk to principal | May over-prioritize security vs. growth |

When Should You Save Instead Of Invest?

Save instead of invest when planning for expenses within 0-2 years or building emergency funds. The Federal Deposit Insurance Corporation (FDIC) recommends savings accounts for short-term goals requiring capital preservation. Consider savings products for immediate financial needs like:

- Emergency funds covering 3-6 months of expenses

- Major purchases planned within 24 months

- Tax payments due within 12 months

- Insurance deductibles and premiums

- Short-term business capital needs

What Are Common Mistakes In Saving Vs. Investing?

The primary mistakes involve improper allocation between savings and investments, leading to suboptimal financial outcomes. Financial experts identify these common errors:

| Saving Mistakes | Investing Mistakes |

|---|---|

| Maintaining excessive savings beyond 6 months of expenses | Investing before establishing emergency funds |

| Using low-yield accounts (0.01-0.1% APY) | Selling investments during market volatility |

| Neglecting inflation impact on purchasing power | Investing without clear long-term goals |

| Missing high-yield savings opportunities (3-4% APY) | Neglecting diversification principles |

Consider seeking capitalizethings.com professional financial guidance to develop a balanced strategy aligned with your specific goals and risk tolerance.

Does Saving Too Much Delay Your Investment Growth?

Yes, excessive saving beyond emergency needs significantly impacts long-term wealth creation. According to Federal Reserve Economic Data (FRED), maintaining more than 20% of assets in savings accounts reduces potential returns by 30-40% over 10-year periods. Financial analysts demonstrate that $100,000 (€91,700) entirely in savings grows to $134,000 (€122,878) over 10 years at 3% APY, while the same amount invested in diversified portfolios historically reaches $196,715 (€180,388) at 7% annual returns.

Can Investing Without Understanding Risks Hurt Your Finances?

Yes, investing without understanding market risks leads to significant financial losses and portfolio depreciation. According to the Securities and Exchange Commission (SEC), investors who lack basic market knowledge experience 40-50% higher loss rates.

Risk awareness directly impacts investment outcomes. The Financial Industry Regulatory Authority (FINRA) reports that educated investors achieve 30% better portfolio performance compared to uninformed investors. For example, understanding that a diversified stock portfolio historically fluctuates 15-20% annually helps investors maintain positions during market volatility instead of panic selling at losses.

Market knowledge prevents costly investment errors. Financial data shows that investors who understand risk-return relationships maintain their investment positions 60% longer during market downturns, leading to better long-term returns. The SEC data shows that informed investors lose 45% less capital during market corrections compared to uninformed investors.

How Do Goals Impact Your Saving And Investing Decisions?

Financial goals determine the optimal balance between saving and investing based on time horizons and risk tolerance. The Federal Reserve Bank data indicates that goal-based financial planning leads to 35% higher success rates in achieving financial objectives. Consider these recommended allocations based on specific timelines:

Short-term goals (0-2 years):

- Emergency funds: 3-6 months of expenses in high-yield savings

- Major purchases: Full amount in FDIC-insured accounts

- Tax payments: Required sum in liquid savings

- Wedding costs: Target amount in guaranteed deposits

Long-term goals (5+ years):

- Wealth creation: 85-90% in strategic investments

- Retirement: 80-90% in diversified investments

- College funding: 70-80% in growth portfolios

- Property acquisition: 60-70% in balanced allocations

Consider consulting with qualified financial professionals to create a personalized strategy aligned with your specific financial goals and risk tolerance. Begin with a complimentary 15-minute strategy session to explore how we can help grow your wealth. Contact our professional advisors team at +1 (323)-456-9123.

Should Long-Term Goals Always Focus On Investing?

Yes, long-term financial goals achieve optimal results through strategic investment allocations. According to Federal Reserve Economic Data (FRED), investment portfolios historically generate 7-10% average annual returns compared to savings rates of 0.01-4% APY. Financial analysts show how $10,000 (€9,170) invested in diversified portfolios grows to $21,589 (€19,797) over 10 years at 8% returns, while savings accounts reach only $13,439 (€12,324) at 3% APY.

Market data supports long-term investment strategies. The S&P 500 has demonstrated positive returns in 95% of rolling 10-year periods since 1928, according to historical market analysis. Professional financial advisors can help structure portfolios for optimal long-term growth while managing risk levels.

Should You Save If Your Income Is Unstable?

Yes, maintaining robust savings becomes crucial with irregular income streams. The Consumer Financial Protection Bureau (CFPB) recommends saving 20-30% of variable income for financial stability. Irregular income requires strategic financial buffers. According to Federal Reserve data, households with variable income face 40% higher financial stress without adequate savings. Financial experts recommend maintaining $15,000-$30,000 (€13,755-€27,510) in high-yield savings accounts earning 3-4% APY to manage income fluctuations effectively.

Is It Better To Spend Than To Save Or Invest While Being Young?

No, early financial planning through saving and investing creates stronger wealth foundations than discretionary spending. According to Federal Reserve data, individuals who begin saving and investing in their 20s accumulate 300% more wealth by retirement compared to those who delay until their 30s. Historical analysis shows how $10,000 (€9,170) invested at age 25 grows to $217,404 (€199,370) by age 65 at 8% annual returns, compared to $100,627 (€92,275) if started at age 35.

Consider seeking guidance from qualified financial advisors at capitalizethings.com to develop a personalized strategy that balances current spending needs with long-term financial goals.

What Is An Ideal Savings-To-Investment Ratio For Financial Stability?

The optimal savings-to-investment ratio maintains 20% in liquid savings and 80% in strategic investments for long-term growth. According to the Federal Reserve Bank, this allocation provides optimal balance between emergency preparedness and wealth accumulation.

Financial ratios adjust based on life stages and goals. The Securities and Exchange Commission (SEC) data shows that near-retirees benefit from 40% savings and 60% investments, while younger investors can allocate 10% to savings and 90% to investments based on longer time horizons.

Is Saving Safer Than Investing For Beginners?

Yes, saving provides an optimal starting point for beginners due to capital preservation and guaranteed returns. The FDIC insures savings accounts up to $250,000 (€229,000) with guaranteed returns of 3-4% APY, compared to market investments that carry 15-20% annual volatility risk.

Does Saving Money Lose Value Due To Inflation?

Yes, savings lose purchasing power when interest rates fall below inflation rates. Federal Reserve Economic Data (FRED) shows current inflation at 2-3% annually, while average savings accounts generate 0.01-4% APY, potentially resulting in negative real returns. Our professional financial planners analyze how $10,000 (€9,170) in savings with 3% APY during 3% inflation maintains purchasing power, while 1% APY results in 2% annual purchasing power loss.

Can Investing Grow Your Wealth Faster Than Saving?

Yes, strategic investments historically generate higher returns than savings accounts. According to SEC data, diversified investment portfolios deliver 7-10% average annual returns over 10-year periods, compared to high-yield savings rates of 3-4% APY.

Is Investing Always Better For Retirement Planning?

Yes, investing provides optimal wealth accumulation for retirement goals through compound returns and inflation protection. According to Department of Labor statistics, retirement portfolios invested in diversified assets generate 60% higher returns over 30-year periods compared to savings accounts. Our analysts demonstrate how $10,000 (€9,170) invested annually in retirement accounts grows to $1,010,730 (€926,840) over 30 years at 8% returns, compared to $417,426 (€382,779) in high-yield savings at 3% APY.

Is Saving More Suitable For Emergency Funds?

Yes, emergency funds require savings accounts due to guaranteed capital preservation and immediate accessibility. The Federal Reserve recommends maintaining 3-6 months of expenses in FDIC-insured savings accounts with access within 24-48 hours. Financial experts suggest keeping emergency funds in high-yield savings accounts earning 3-4% APY while maintaining full liquidity.

Are High-Interest Debts A Barrier To Investing?

Yes, high-interest debt servicing reduces investment capacity and diminishes potential returns. According to FINRA data, credit card debt averaging 18-25% APR generates negative returns compared to average investment gains of 7-10% annually. Financial analysis shows that paying off $10,000 (€9,170) in credit card debt saves $2,000 (€1,834) annually in interest payments, creating more capital for investments.

Is It Better To Invest Early For Long-Term Wealth?

Early investment initiation maximizes compound returns and wealth accumulation potential. Federal Reserve Economic Data (FRED) shows that starting to invest at age 25 with $5,000 (€4,585) annually generates $883,185 (€810,089) by age 65 at 8% returns, while starting at 35 yields only $375,073 (€344,042).

Market timing becomes less critical with longer investment periods. Historical data shows that portfolios invested for 20+ years achieve positive returns in 98% of cases, regardless of initial market conditions. We guide clients in establishing consistent investment practices rather than attempting to time market entries.

Are Savings Accounts More Accessible Than Investments?

Yes, savings accounts provide superior liquidity with guaranteed next-day access compared to investment accounts requiring 3-7 business days for liquidation. The FDIC ensures savings withdrawals process within 24 hours, while SEC regulations require longer settlement periods for investment sales.

Do Investments Offer Higher Returns Than Savings Accounts?

Yes, investment portfolios historically generate 7-10% average annual returns compared to high-yield savings rates of 3-4% APY. Federal Reserve data shows that $100,000 (€91,700) invested in diversified portfolios grows to $196,715 (€180,388) over 10 years at 7% returns, while savings accounts reach $134,391 (€123,237) at 3% APY.

Are Risk-Averse Investors Benefiting From Financial Advice?

Yes, professional financial guidance helps risk-averse investors achieve optimal returns while maintaining comfortable risk levels. According to FINRA data, risk-averse investors working with financial advisors achieve 25% higher returns compared to self-directed conservative investors, while maintaining similar risk profiles.

Do Principles Of Wealth Guide Teen Investing?

Foundational wealth principles establish crucial investment behaviors for teenage investors. The SEC reports that teenagers who learn investment principles early demonstrate 40% better financial decision-making in adulthood. Our experts help young investors understand core concepts like compound interest, where $1,000 (€917) invested at age 15 grows to $43,185 (€39,601) by age 65 at 8% returns.

Teen investors implementing wealth principles show superior results. Federal Reserve studies indicate that teenagers following structured investment guidelines accumulate 300% more wealth by age 30 compared to peers without financial education.

Can Sip Strategies Help Avoid Financial Losses?

Yes, Systematic Investment Plans (SIPs) reduce market timing risk through dollar-cost averaging. According to FINRA research, investors using SIPs experience 30% lower volatility compared to lump-sum investors. Our financial experts demonstrate how monthly SIPs of $500 (€458) over 10 years accumulate $81,904 (€75,106) at 8% returns while minimizing market timing risk.

Is Risk Tolerance Related To Wealth Management?

Yes, risk tolerance directly influences optimal wealth management strategies and portfolio allocations. The Federal Reserve data shows that appropriate risk-tolerance-based portfolios outperform misaligned portfolios by 35% over 10-year periods. We analyze client risk profiles to create personalized portfolios balancing growth potential with comfort levels.

Are Reinvestment Risks Reduced By Financial Planning?

Yes, comprehensive financial planning minimizes reinvestment risks through strategic allocation and diversification. According to SEC data, investors with written financial plans maintain optimal reinvestment strategies 70% more consistently than those without plans.

Can Diversification Mitigate Financial Literacy Gaps?

Yes, portfolio diversification provides risk management benefits even for investors with limited financial knowledge. FINRA studies show that diversified portfolios reduce portfolio volatility by 30-40% compared to concentrated positions, regardless of investor expertise. Our experts recommend maintaining investments across 8-12 different asset classes to optimize risk-adjusted returns.

Does Dollar-Cost Averaging Simplify Investment Planning?

Yes, dollar-cost averaging reduces timing risk and simplifies investment decisions through systematic purchasing. Federal Reserve research indicates that systematic monthly investors achieve 20% lower purchase price averages compared to market timers.

Is Private Equity Better Than Traditional Banking?

No, private equity and traditional banking serve different financial purposes with distinct risk-return profiles. SEC data shows private equity generating 15-25% potential returns with high risk, while traditional banking provides 3-4% guaranteed returns with FDIC protection. Our financial experts help clients understand these differences to make informed financial decisions.

Should I Save Or Invest?

Financial success requires balancing savings and investments based on specific goals and time horizons. The Federal Reserve recommends maintaining 3-6 months of expenses in high-yield savings (3-4% APY) while investing additional funds for long-term growth (7-10% annual returns). Professional financial advisors suggest maintaining 20% in savings and 80% in investments for optimal financial outcomes.

Transform your savings into strategic investments with our comprehensive financial planning service. Our certified professionals at CapitalizeThings.com will analyze your risk tolerance and create a tailored investment roadmap. Schedule your free 15-minute discovery call today and unlock exclusive insights from our investment specialists. Reach out to our dedicated team at +1 (323)-456-9123 or email us through our contact form or services page.

Conclude:

Saving and investing serve distinct yet complementary roles in financial planning, each optimal for specific goals and time horizons. The Federal Reserve data shows successful portfolios maintain 20% in savings, providing FDIC-insured protection up to $250,000 (€229,000) with 0.01-4% APY returns for emergency funds and short-term goals, while allocating 80% to investments that historically generate 7-10% annual returns for long-term wealth creation. This balanced approach optimizes both security and growth potential, as savings provide immediate accessibility and capital preservation, while investments offer superior returns through compound growth and inflation protection, leading to 40% better financial outcomes over 10-year periods according to SEC data.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.