Yes, investments can be taxed. There are different types of taxes on investments. Calculations vary based on the type of investment and tax. Precautions are necessary to manage these taxes. There are many types of taxes on investments. Some are capital gains tax, dividend tax, and interest tax. Each type has its own rules. Capital gains tax is on profit when you sell an asset. Dividend tax is on income from stocks. Interest tax is on income from bonds or savings accounts.

To calculate investment taxes, first know the type of tax. For capital gains tax, subtract the purchase price from the sale price. For dividend tax, use the amount of dividends received. For interest tax, use the interest earned. Then, apply the tax rate. Each type has a different rate. Check current tax laws for the correct rate.

Take precautions to manage investment taxes. Keep records of all transactions. Know the holding period for assets, as it can affect the tax rate. Use tax-advantaged accounts like IRAs. Stay updated with tax laws. Consult a tax professional if needed. Proper planning can reduce the tax burden and maximize returns.

When Do You Pay Taxes on Investments?

You pay taxes on investments when you realize a gain or receive income. This includes selling an asset for a profit, receiving dividends, or earning interest. Capital gains tax is triggered when you sell an investment for more than you paid. Dividends and interest are usually taxed when received. The timing of tax payments depends on the type of investment and the nature of the gain or income.

Do You Have To Pay Taxes On Money Withdrawn From An Investment Account?

Yes, you may have to pay taxes on money withdrawn from an investment account. The tax depends on the type of account and the nature of the investments. For taxable accounts, withdrawals may incur capital gains tax if you sell investments for a profit. For tax-advantaged accounts like IRAs or 401(k)s, withdrawals may be taxed as ordinary income. Roth IRAs allow tax-free withdrawals under certain conditions.

Do You Pay Taxes On Investments If You Don’t Sell?

You generally don’t pay taxes on investments if you don’t sell them. However, you still owe taxes on dividends and interest received. Unrealized gains, which are increases in the value of investments you haven’t sold, are not taxed until you sell the asset. Some exceptions include certain mutual funds and exchange-traded funds (ETFs) that distribute capital gains even if you don’t sell shares.

How Much Tax Do I Have To Pay On Investments?

The amount of tax you pay on investments depends on the type of investment income and your tax bracket. Here’s a detailed breakdown:

- Capital Gains Tax: There are two types of capital gains: short-term and long-term. Short-term capital gains (on assets held for one year or less) are taxed as ordinary income. Long-term capital gains (on assets held for more than one year) are taxed at lower rates.

- Dividend Tax: Qualified dividends are taxed at long-term capital gains rates, while non-qualified dividends are taxed as ordinary income.

- Interest Tax: Interest income from savings accounts, CDs, and bonds is taxed as ordinary income.

| Income Range (Single) | Income Range (Married Filing Jointly) | Short-Term Capital Gains and Ordinary Income Tax Rate | Long-Term Capital Gains and Qualified Dividends Tax Rate |

| Up to $11,000 | Up to $22,000 | 10% | 0% |

| $11,001 – $44,625 | $22,001 – $89,250 | 12% | 0% |

| $44,626 – $44,725 | $89,251 – $89,450 | 12% | 15% |

| $44,726 – $95,375 | $89,451 – $190,750 | 22% | 15% |

| $95,376 – $182,100 | $190,751 – $364,200 | 24% | 15% |

| $182,101 – $231,250 | $364,201 – $462,500 | 32% | 15% |

| $231,251 – $492,300 | $462,501 – $553,850 | 35% | 15% |

| Over $492,300 | Over $553,850 | 37% | 20% |

| Over $578,125 | Over $693,750 | 37% | 20% |

Example Calculations

- Short-Term Capital Gain: If you are single and earn $50,000 in salary and $5,000 in short-term capital gains, the capital gain is taxed at your ordinary income tax rate. You fall into the 22% bracket for the gain.

- Long-Term Capital Gain: If you are married, filing jointly, and your total income (including a $20,000 long-term capital gain) is $100,000, the gain is taxed at 0% since your total income is below $89,250.

- Qualified Dividends: If you are single with a total income of $60,000, your qualified dividends are taxed at 15% since your income is between $44,626 and $492,300.

These rates and brackets can change, so always check the latest tax laws or consult with a tax professional.

Is Interest From An Investment Taxable Income?

Yes, interest from an investment is taxable income. This includes interest earned from savings accounts, certificates of deposit (CDs), bonds, and other interest-bearing investments. Here’s a detailed breakdown:

- Interest earned on money deposited in savings accounts and CDs is taxable. Banks report this income to the IRS using Form 1099-INT.

- Bonds: Interest earned from bonds, including government, corporate, and municipal bonds, is usually taxable. However, some bonds, like municipal bonds, may be exempt from federal and/or state taxes.

- Interest earned from money market accounts is also taxable and reported similarly to savings account interest.

- Interest from U.S. Treasury bonds, bills, and notes is taxable at the federal level but exempt from state and local taxes.

Tax Treatment

- Ordinary Income: Interest income is taxed as ordinary income. This means it is added to your other income (such as wages, salaries, and dividends) and taxed at your regular income tax rate based on your tax bracket.

- Reporting: Financial institutions will provide Form 1099-INT if your interest income is $10 or more. You must report this income on your federal income tax return, even if you do not receive a 1099-INT.

If you have a savings account that earned $500 in interest over the year, and you are in the 22% tax bracket, you will owe $110 in federal taxes on that interest income ($500 x 22%).

Tax Planning

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts, like Individual Retirement Accounts (IRAs) or 401(k)s, where interest income can grow tax-deferred or tax-free (in the case of Roth IRAs).

- Municipal Bonds: Investing in municipal bonds can provide tax-free interest income at the federal level, and sometimes at the state level if the bonds are issued within your state of residence.

By understanding how interest income is taxed, you can better plan your investments and manage your tax liability. Always consult with a tax professional for personalized advice.

What Interest Income Is Not Taxable?

Some types of interest income are not taxable. Municipal bonds provide tax-exempt interest at federal, and sometimes state, levels. U.S. savings bonds like Series EE and I are exempt from state and local taxes and can be federal tax-free if used for education.

Treasury securities’ interest is state and local tax-exempt but federally taxable. Interest in tax-advantaged accounts like IRAs and 401(k)s grows tax-deferred or tax-free. For example, interest from a state-issued municipal bond is usually exempt from both federal and state taxes. Always consult a tax professional for personalized advice.

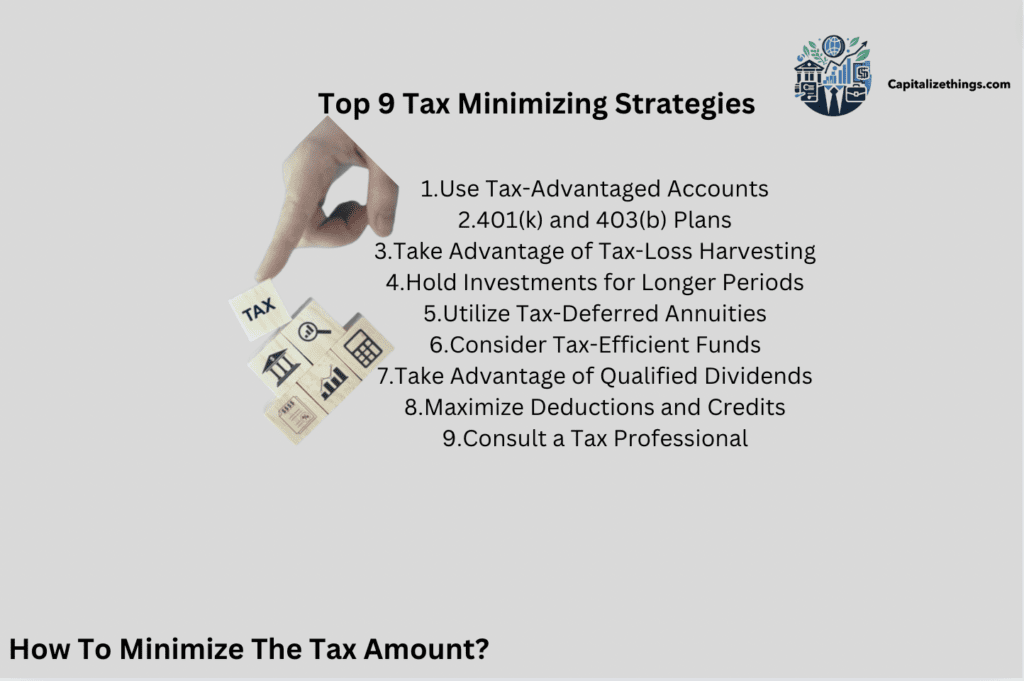

How To Minimize The Tax Amount?

Minimizing taxes on your investments involves strategic planning and using available tax benefits. Here are top 9 tax minimizing strategies:

- Use Tax-Advantaged Accounts

- 401(k) and 403(b) Plans

- Take Advantage of Tax-Loss Harvesting

- Hold Investments for Longer Periods

- Utilize Tax-Deferred Annuities

- Consider Tax-Efficient Funds

- Take Advantage of Qualified Dividends

- Maximize Deductions and Credits

- Consult a Tax Professional

- Use Tax-Advantaged Accounts

Individual Retirement Accounts (IRAs): Contribute to Traditional IRAs for tax-deferred growth or Roth IRAs for tax-free growth if conditions are met.

401(k) and 403(b) Plans: Maximize contributions to employer-sponsored retirement plans for tax-deferred growth. Many employers offer matching contributions, further enhancing your savings.

- Invest in Tax-Exempt Securities

Municipal Bonds: These bonds offer tax-free interest at the federal level and may be exempt from state and local taxes if issued in your state. This is particularly beneficial for investors in higher tax brackets.

- Take Advantage of Tax-Loss Harvesting

Definition: Sell investments at a loss to offset gains from other investments. This can reduce your taxable income.

Application: If you have stocks or other assets that have lost value, selling them can offset gains from other investments, lowering your overall tax liability.

- Hold Investments for Longer Periods

Long-Term Capital Gains: Investments held for more than one year are taxed at lower long-term capital gains rates. This is significantly lower than short-term capital gains, which are taxed as ordinary income.

Example: If you sell a stock held for over a year, you may pay a 15% tax on the gain instead of up to 37% if held for a shorter period.

- Utilize Tax-Deferred Annuities

Annuities: These financial products allow your investment to grow tax-deferred until you withdraw the funds. This can help manage taxes, especially in high-income years.

- Consider Tax-Efficient Funds

Index Funds and ETFs: These funds typically generate fewer taxable events compared to actively managed funds, resulting in lower taxable distributions.

Tax-Managed Funds: Specifically designed to minimize capital gains distributions.

- Take Advantage of Qualified Dividends

Qualified Dividends: These dividends are taxed at the lower long-term capital gains rates if you meet the holding period requirements, providing significant tax savings compared to ordinary dividends.

- Maximize Deductions and Credits

Tax Deductions: Contribute to health savings accounts (HSAs), deduct mortgage interest, and take advantage of other allowable deductions to lower your taxable income.

Tax Credits: Utilize credits such as the Earned Income Tax Credit (EITC) and education credits to reduce your tax liability directly.

Consult a Tax Professional

Personalized Advice: Tax laws are complex and change frequently. A tax professional can provide advice tailored to your specific situation, helping you implement the most effective tax strategies.

Example

Imagine you invest $10,000 in a municipal bond with a 3% annual return. The $300 interest earned each year is exempt from federal and state taxes. Additionally, by holding a stock for over a year, you could benefit from the lower long-term capital gains tax rate of 15% instead of a higher short-term rate.

By combining these strategies, such as using tax-advantaged accounts, harvesting tax losses, and investing in tax-exempt securities, you can significantly reduce your overall tax burden and maximize your investment returns. Always consult with a tax professional for personalized advice tailored to your specific financial situation.

What Are The Common Types Of Taxes?

5 of the Most Common Types of Taxes Are:

- Tax on capital gains

- Tax on dividends

- Taxes on investments in a 401(k)

- Tax on mutual funds

- Tax on the sale of a house

- Tax on Capital Gains

This tax is levied on the profit made from selling an asset, such as stocks or real estate. Capital gains can be classified as short-term (for assets held for one year or less) and long-term (for assets held longer). Short-term gains are taxed at ordinary income rates, while long-term gains benefit from lower rates. To reduce capital gains tax, hold investments for over a year to qualify for long-term rates, and use tax-loss harvesting to offset gains with losses. - Tax on Dividends

This tax applies to income earned from shares of stock or mutual funds. Qualified dividends are taxed at the lower long-term capital gains rates, while non-qualified dividends are taxed at ordinary income rates. To minimize dividend tax, invest in stocks or funds that pay qualified dividends and use tax-advantaged accounts like IRAs or 401(k)s to defer or eliminate tax. - Taxes on Investments in a 401(k)

Contributions to a 401(k) are tax-deferred, meaning taxes are not paid until withdrawals are made. Withdrawals during retirement are taxed as ordinary income. To manage these taxes, consider using a Roth 401(k) where contributions are made with after-tax dollars, and qualified withdrawals are tax-free. Additionally, plan withdrawals carefully to minimize your tax bracket during retirement. - Tax on Mutual Funds

Taxes on mutual funds include capital gains distributions and dividend income. Investors are taxed based on the type of income distributed by the fund—capital gains are subject to capital gains tax, while dividends are taxed as ordinary income or qualified dividends. To reduce this tax, choose tax-efficient funds, such as index funds or ETFs, which typically generate fewer taxable distributions. - Tax on the Sale of a House

This tax is on the profit earned from selling real estate. If the home is your primary residence, up to $250,000 ($500,000 for married couples) of gain can be excluded from tax under certain conditions. To minimize this tax, ensure you meet the residency requirements for the exclusion and keep track of any home improvements that can increase your property’s basis.

How Does Capital Gains Tax Work For Dummies?

Capital gains tax for dummies is the tax on the profit you make from selling an asset, like stocks or real estate, for more than you paid. Short-term gains (from assets held for one year or less) are taxed at your regular income rate, while long-term gains (from assets held over a year) are taxed at lower rates. To reduce taxes, hold investments longer, use tax-loss harvesting, and invest through tax-advantaged accounts like IRAs. Report your gains using Form 1099-B on your tax return.

Does Investment Income Tax Apply To Capital Gains?

Yes, investment income tax does apply to capital gains. Capital gains tax is a specific type of investment income tax levied on the profit from selling an asset, such as stocks, bonds, or real estate, for more than its purchase price. Short-term capital gains, from assets held for one year or less, are taxed as ordinary income rates, which can be as high as 37%. Long-term capital gains, from assets held for more than a year, are taxed at reduced rates of 0%, 15%, or 20%, depending on your income level. Thus, the tax you owe on capital gains depends on how long you’ve held the asset and your overall income.

What Is The Capital Gains Tax On Investors?

The capital gains tax on investors is a tax on the profit from selling assets like stocks, bonds, or real estate. If you sell an asset for more than you paid for it, the profit is called a capital gain. Short-term capital gains, from assets held for one year or less, are taxed at your regular income tax rate, which can be as high as 37%. Long-term capital gains, from assets held for more than a year, benefit from lower tax rates of 0%, 15%, or 20%, depending on your income level.

What Is The 6 Year Rule For Capital Gains Tax?

The 6-year rule for capital gains tax is a specific rule related to property sales. If you sell a property and it has been your primary residence for at least 2 out of the last 5 years, you can exclude up to $250,000 of capital gains ($500,000 for married couples) from tax. However, if you do not meet this rule and sell the property within 6 years of buying it, the gain may be subject to additional tax rules or recapture provisions. This rule helps prevent tax avoidance by ensuring that only genuine long-term residences benefit from the capital gains exclusion.

How Are Investment Dividends Taxed?

Investment dividends are taxed based on their type. Qualified dividends, which are paid by U.S. companies or qualified foreign companies and held for a specific period, are taxed at lower rates—0%, 15%, or 20%, depending on your income level. Non-qualified dividends, from investments that do not meet the qualifications, are taxed at your regular income tax rate, which can be higher.

For example, if you receive $500 in qualified dividends and you fall into the 15% tax bracket, you will owe $75 in taxes on those dividends. It’s important to understand the type of dividends you receive to calculate your tax correctly. You report dividends on your tax return using Form 1099-DIV, provided by your investment broker.

Are You Taxed On Dividends That Are Reinvested?

Yes, you are taxed on dividends that are reinvested. When you receive dividends, even if they are automatically reinvested to buy more shares, they are considered taxable income. You must report these dividends on your tax return and pay taxes based on whether they are qualified or non-qualified. Qualified dividends are taxed at lower rates, while non-qualified dividends are taxed at your regular income tax rate.

How Much In Dividends Do I Have To Make To File Taxes?

You need to file taxes if your total income, including dividends, exceeds certain thresholds set by the IRS. For the 2024 tax year, single filers must file a tax return if their gross income is at least $13,850. For married couples filing jointly, the threshold is $27,700. If your dividend income, combined with other income sources, meets or exceeds these amounts, you must file a tax return. Even if your dividend income alone is below these thresholds, you might still need to file depending on other factors like additional income or specific tax credits and deductions.

How To Calculate Tax On Investment Income?

To calculate tax on investment income, follow these steps:

- Determine Total Investment Income: Add up all sources of investment income, including dividends, interest, and capital gains.

- Calculate Capital Gains: Subtract the purchase price (cost basis) of an asset from the selling price to find the capital gain. For short-term gains, use the ordinary income tax rate. For long-term gains, use the long-term capital gains rate.

- Apply Tax Rates:

- Ordinary Income: Interest and non-qualified dividends are taxed at your regular income tax rate.

- Qualified Dividends: Taxed at the long-term capital gains rate, which is typically 0%, 15%, or 20%, depending on your income level.

- Capital Gains: Short-term gains are taxed at ordinary rates, while long-term gains benefit from lower rates.

- Calculate Total Tax: Multiply your taxable income from each source by the appropriate tax rate and sum the results.

Formula:

- Capital Gains Tax: (Selling Price – Purchase Price) x Tax Rate

- Dividend Tax: Dividend Income x Tax Rate (ordinary or qualified)

Suppose you bought 10 shares of stock at $50 each and sold them for $70 each, and you earned $200 in qualified dividends. Your capital gain is $200 (10 shares x $20 gain per share). If you’re in the 15% long-term capital gains bracket, your tax on the gain is $30 ($200 x 15%). If the $200 in dividends qualifies for the same 15% rate, your tax on dividends is also $30 ($200 x 15%). Your total tax on investment income is $60 ($30 + $30).

By understanding how to calculate and apply the correct tax rates, you can accurately determine the tax owed on your investment income.

How To Calculate Investment Dividends Taxed?

To calculate the tax on investment dividends, follow these steps:

- Determine Dividend Income: Identify the total amount of dividends received from your investments. This information is typically reported on Form 1099-DIV, which you receive from your brokerage.

- Classify Dividends: Determine if the dividends are qualified or non-qualified. Qualified dividends, which meet certain IRS requirements, are taxed at lower long-term capital gains rates. Non-qualified dividends are taxed at ordinary income rates.

Apply the Tax Rates:

- Qualified Dividends: Taxed at 0%, 15%, or 20% based on your income level.

- Non-Qualified Dividends: Taxed at your ordinary income tax rate, which can range from 10% to 37% depending on your income bracket.

Formula:

- Calculate Taxable Dividends: Total dividends received.

- Apply Tax Rates: Multiply the amount of qualified dividends by the qualified dividend tax rate and non-qualified dividends by the ordinary income tax rate.

Suppose you received $1,000 in qualified dividends and $500 in non-qualified dividends. If you fall into the 15% tax bracket for qualified dividends and the 22% tax bracket for non-qualified dividends, your tax calculation would be:

Qualified Dividends Tax: $1,000 x 15% = $150

Non-Qualified Dividends Tax: $500 x 22% = $110

Total Tax on Dividends: $150 + $110 = $260

By following these steps, you can determine how much tax you owe on your investment dividends based on their classification and your applicable tax rates.

What Are The Precautions For Investment Income Tax?

When managing investment income tax, it’s important to keep accurate records of all your investment transactions, including purchase prices, sale prices, and dates. This will help you calculate gains or losses correctly and report them accurately. Additionally, stay informed about the types of dividends and their tax rates. Knowing whether your dividends are qualified or non-qualified can affect the tax rate applied.

Moreover, consider using tax-advantaged accounts like IRAs or 401(k)s to defer taxes on investment income or avoid taxes altogether. Also, be aware of tax-loss harvesting, where you sell investments at a loss to offset gains from other investments, which can reduce your taxable income. Finally, regularly review changes in tax laws or consult a tax professional to ensure you’re compliant and to optimize your tax strategy.

How To Avoid Taxes On Brokerage Account?

To minimize taxes on a brokerage account, consider these strategies, firstly, use tax-advantaged accounts like IRAs or 401(k)s, where investments can grow tax-deferred or tax-free. Second, implement tax-loss harvesting by selling investments at a loss to offset gains. Third, be mindful of holding periods; long-term capital gains are taxed at lower rates than short-term gains. Additionally, invest in tax-efficient funds like index funds or ETFs that generate fewer taxable distributions.

Do I Have To Report Investments On My Taxes?

Yes, you must report investments on your taxes. This includes any gains or losses from selling assets, dividends received, and interest income. Brokerage firms provide Form 1099s detailing this information, which you need to include when filing your tax return. Accurate reporting ensures you comply with tax laws and avoid penalties.

How Do I Avoid Capital Gains Tax On Investment Income?

To avoid capital gains tax, consider holding investments for over a year to benefit from lower long-term capital gains rates. Use tax-advantaged accounts like IRAs or 401(k)s, where gains can grow tax-deferred or tax-free. Additionally, take advantage of tax-loss harvesting by offsetting gains with losses from other investments. Be strategic about when you sell investments to manage your tax liability. This video below will increase your knowledge about making your capital gains tax zero.

How To Avoid Paying Taxes On Interest Income?

To reduce taxes on interest income, invest in tax-exempt securities such as municipal bonds, which offer tax-free interest at the federal and sometimes state level. Use tax-advantaged accounts like IRAs or 401(k)s, where interest income can grow tax-deferred or tax-free. Additionally, consider moving investments to accounts with lower interest rates to minimize taxable income.

Do I Need To Report Interest Income Less Than $10?

Yes, you need to report all interest income, even if it is less than $10. While financial institutions are required to issue Form 1099-INT only for interest income of $10 or more, you are still responsible for reporting all interest earned on your tax return. Accurate reporting ensures compliance with tax laws and helps avoid potential issues with the IRS.

What More Taxes Are There As An Investor?

As an investor, you encounter several types of taxes that can affect your overall financial returns. These taxes include capital gains tax, which is levied on the profit from selling investments; dividend tax, which applies to income earned from stocks and mutual funds; and interest income tax, which is taxed on earnings from savings and bonds.

The Alternative Minimum Tax (AMT) is a separate tax calculation designed to ensure that high-income earners pay at least a minimum amount of tax, regardless of deductions and credits they claim.

AMT applies if your income exceeds a certain threshold, and you benefit from many tax breaks. It requires calculating your tax liability under both the regular tax system and the AMT system. You pay the higher of the two amounts. This tax often affects investors who have substantial deductions or complex investment strategies.

Unrelated Business Taxable Income (UBTI) is income earned by tax-exempt organizations, such as charities or retirement accounts, from business activities unrelated to their primary purpose.

If a tax-exempt entity, like a retirement fund, earns income from business activities that are not related to its primary tax-exempt purpose, that income is subject to UBTI. For instance, a retirement fund that invests in a business might owe tax on the income generated from that business. This ensures tax-exempt entities do not gain an unfair advantage over taxable businesses.

Foreign taxes refer to taxes imposed by foreign countries on income earned abroad. This can include taxes on dividends, interest, and capital gains from foreign investments.

If you invest in foreign assets or receive income from foreign sources, you may be liable for foreign taxes. To avoid double taxation, you can often claim a foreign tax credit or deduction on your U.S. tax return for taxes paid to foreign governments. This helps ensure that you are not taxed twice on the same income.

Can Investment Property Be Depreciated?

Yes, investment property can be depreciated. Depreciation is a tax deduction that allows you to spread the cost of the property over its useful life. For real estate, this typically means you can deduct a portion of the property’s value each year, reducing your taxable income. This helps lower your tax bill over time.

Do Beginner Investors Have To Pay Tax?

Beginner investors do have to pay taxes. Taxes apply to any income or gains earned from investments, regardless of your experience level. This includes capital gains from selling assets, dividends from stocks, and interest from bonds. It’s important to understand these tax obligations to avoid surprises and ensure compliance.

What Are Investment Valuation Techniques?

Investment valuation techniques are methods used to determine the value of an investment. Common valuation techniques include discounted cash flow (DCF), which estimates the value based on future cash flows, and comparable, which assesses value by comparing similar investments. Other methods include asset-based valuations and earnings multiples.

What Is The Difference Between Investment Banking And Hedge Funds?

Investment banking and hedge funds are different financial entities. Investment banking involves helping companies raise capital, advising on mergers and acquisitions, and managing financial assets. Hedge funds, on the other hand, are investment funds that use various strategies to achieve high returns for their investors. They often take more risks and use complex financial instruments compared to traditional investments.

Conclude

Understanding various taxes related to investments is crucial for effective financial planning. Taxes such as capital gains, dividend, and interest income tax can impact your overall returns. Utilizing strategies like tax-advantaged accounts and depreciation can help manage these costs. Staying informed and seeking professional advice. Ensures that you make the most of your investments. Additionally, differentiating between investment banking and hedge funds helps you choose the right investment approach. While investment banking focuses on capital raising and financial advising, hedge funds employ diverse strategies for high returns. Knowing these distinctions, along with proper valuation techniques, allows you to make informed investment decisions and optimize your financial outcomes.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.