Investment valuation analyses the current and future value of an asset or firm. The enterprise’s shares, equity, projected earnings, market value, and other measures are used to value an investment. There are two main investment valuation models: relative and absolute sectors. Absolute models estimate future cash flows for valuing assets. They use math to do things.

There are two main types of investment valuation models: absolute models and relative models. Market valuation ratios are used in the relative model to compare investments. By contrast, the absolute approach uses predicted cash flow to evaluate an asset. There are three primary investment valuation models, each with pros and cons: Basic absolute systems include the DDM. This strategy values an investment based on corporate dividends. It’s excellent for valuing an investment in a company with stable stock dividends. The objective is to estimate the company’s equity shares by valuing dividend cash flows.

DCF models are best for companies with intermittent stock distributions. The model forecasts and compares the company’s discounted future earnings to other investments. The organization needs solid, regular cash flows for this plan to work. These are usually older businesses that have grown through their normal stages. DCF’s precision is two-sided. Cash flow predictions, growth rates, and discount rates greatly affect it.

The CM can be considered a relative valuation. This strategy is utilized when indeterminable or negative cash flows prevent a discounted approach. Applying an investment security to the DCF and DDM models can determine its range or average value. If the stock is undervalued or overvalued, the CM compares business price multiples to an industry standard to evaluate. Using this logic, similar assets should cost similar prices. One of the disadvantages of the replacement cost technique is that it needs help finding the trustworthy and comparable assets. The asset’s kind, age, condition, marketability, location, substitutes, and competitors affect this.

What is valuation?

The analytical process of estimating an asset’s or company’s future value is called valuation. Valuation uses many methods. An expert who puts a value on a company works at the management of the business, the organization of its capital, the probability of future profits, and the market worth of its assets, among other things. Evaluation and valuation are essential for understanding economic processes and output (Valuation as Evaluating and Valorizing, F. Vatin, 2013).

What is the basic concept of valuation in economics?

Economic valuation is based on welfare economics. Economic worth depends on individual choices, perceptions, needs, worldviews, and natural scarcities. Traditional economic methods conflict with some perspectives. Living in harmony and balance with Mother Earth sees her as sacred and a living entity that can’t be transformed. There are two main types of valuation: analyzing and valorizing. It is essential to understand these two types of valuation to understand how economic processes affect production (Valuation as Evaluating and Valorizing, F. Vatin, 2013).

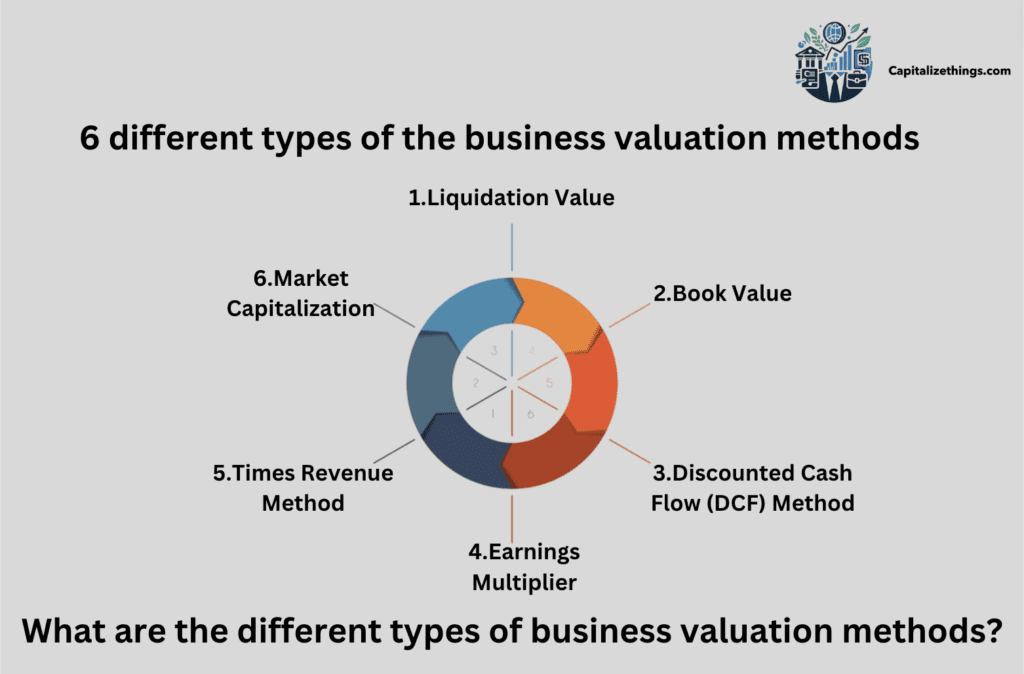

What are the different types of business valuation methods?

The 6 different types of the business valuation methods are:

- Liquidation Value

- Book Value

- Discounted Cash Flow (DCF) Method

- Earnings Multiplier

- Times Revenue Method

- Market Capitalization

1. Liquidation Value

If a business liquidates its assets and pays off its liabilities today, its liquidation value equals its net cash. This is a list of current business valuation approaches. Replacement value, asset-based valuation, breakup value, and others are used. Liquidation value is helpful because it estimates a company’s tangible assets’ value if liquidated rapidly, frequently under duress. Investors concerned about downside risk might use this strategy to determine the worst-case situation and set a baseline. Knowing a business’s floor value can reassure investors and creditors, particularly during economic uncertainty or near bankruptcy.

One big drawback is that it cannot reflect the company’s genuine concern. Forced sale conditions can undervalue assets, while this valuation approach overlooks intangible resources like brand reputation & intellectual property.

2. Book Value

Company’s book value is calculated by deducting liabilities from assets. The company’s shareholders equity is shown on its balance sheet. It typically doesn’t reflect asset market value, exceptionally when assets are maintained at historical cost instead of fair market value. This method is helpful since it calculates a company’s intrinsic value using past expenses. Book value, an unbiased measure of worth that excludes market speculation, helps investors find inexpensive equities. It also helps compare firms in identical industries using a standardized metric.

Book value doesn’t fully reflect intangible assets like goodwill or brand equity, which can distort the company’s value. Its dependence on cash flow assumptions, which are hard to estimate, is a significant drawback. Minor modifications in these assumptions can significantly impact valuation. A suitable discount rate also affects results subjectively.

3. Discounted Cash Flow (DCF)

The earnings multiplier and discounted cash flow(DCF) business valuation methods are identical. This strategy adjusts future cash flow predictions to get the company’s market value. Inflation is the fundamental difference between the cash flow discounting approach and the profit multiplier method for present value calculation. Discounted Cash Flow (DCF) valuation finds the current value of future firm cash flows, making it good and Innovative. This dynamic approach compensates for predicted growth and profitability by including the time value of money. It helps investors evaluate long-term investment prospects and strategic planning by assessing a company’s intrinsic worth based on its cash generation potential.

It can oversimplify value by ignoring growth rates, risk concerns, and industry conditions. It also implies past earnings predict future performance, which could not be accurate. Its dependence on cash flow assumptions, which are hard to estimate, is a significant drawback. Minor modifications in these assumptions can significantly impact valuation. A suitable discount rate also affects results subjectively.

4. Earnings Multiplier

The earnings multiplier can be used to estimate a company’s actual value unlike the times revenue technique, since profits are a better predictor of financial achievement than sales revenue. An easy and relative way to value a firm based on its present profits is the earnings multiplier approach, also known as the price-to-earnings (P/E) ratio. Investors like this strategy because it easily compares companies in a single industry or sector. Investors find growth stocks, measure market sentiment, and arrive at informed selections based on their willingness to pay per dollar of earnings using the earnings multiplier.

It can oversimplify value by ignoring growth rates, risk concerns, and industry conditions. It also implies that past earnings predict future performance, which is not true.

5. Times Revenue Method

The times revenue business valuation approach applies a multiplier based on industry and economy to a stream of revenues over time. An IT company can be valued at 3x revenue, and a service firm at 0.5x. The time’s revenue approach evaluates a corporation by multiplying current revenue by an established factor. This strategy is simple and successful, especially for startups or organizations with high revenue but low profitability. Revenue-driven industries employ it. The revenue-focused strategy can quickly produce a ballpark valuation, applicable in acquisitions and mergers.

It needs to include profitability and the company’s capacity to make money from revenue. This strategy can overvalue high-revenue, low-profit businesses. The technique also assumes a similar sales multiple across companies, which needs to be more practical given company-specific characteristics or industry norms.

6. Market Capitalization

Market capitalization is the easiest way to determine how much a business is worth. To find it, increase the share price of the company by the total number of shares that are still outstanding. For example, Microsoft Inc. was worth $86.35.2 on January 3, 2018. If there are 7.715 billion shares out there, the company could be worth $86.35 x 7.715 billion, which is $666.19 billion. This method gives an instant and current market valuation of a company. Based on real-time investor opinion, the financial industry uses it to classify companies into mid-cap, small-cap, and large-cap segments. Market capitalization enables investors to diversify and manage risk by showing a company’s size and strength.

Its volatility and market sentiment cannot represent the company’s genuine value. Non-company fundamentals like market speculation and macroeconomic variables might affect the market cap. non-publicly traded or illiquid stock businesses cannot be appropriately valued.

When is the business valuation required typically?

The business valuation is normally required when they sell all or part of their operations or combine with another. The valuation of a corporation uses objective measures and evaluates all factors to determine its present value. Management, future earnings, capital structure, and asset worth can all be examined in a business valuation. Evaluators, firms, and industries use different valuation tools. Financial statement reviews, discounted cash flow models, and company comparisons are typical business valuation methods. Tax reporting requires valuation. Businesses must be valued at fair market value by the IRS. The sale, purchase, or exchange of company shares can be taxed based on valuation.

What is the market approach in valuation techniques?

The market approach values a business, intangible asset, business ownership interest, or asset by comparing its market price to comparable assets or enterprises that have recently sold or are currently available. Common price indicators include book values, sales, and price-to-earnings. The market technique uses comparable asset prices to value any asset, adjusting for quantities, quality, and sizes. For instance, to value an investment, look at similar stocks’ most recent selling price. The fair value of company ownership shares can be estimated from their latest selling price as they are usually identical.

Public Company Comparables

The Public Company Comparables Method uses valuation indicators from publicly traded companies comparable to the subject company. Most public corporations are larger and more dissimilar, making direct comparisons difficult. However, the direct comparability level should be open so that public firms with similar business features can advise on the subject company’s valuation.

Advantage:

A major benefit of the public company comparable method is using real-time, publicly accessible information from similar companies. A contemporary and market-driven valuation view can be obtained by directly comparing financial parameters like EBITDA multiples, P/E ratios, and revenue multiples. Analysts prefer public company valuations because they are more reliable and transparent, and there is an abundance of data on them.

Disadvantage:

This method has the drawback of making it hard to discover related companies. Even within the same industry, public firms differ in size, corporate style, market conditions and geographic reach. Valuations can only be accurate if similar companies are carefully identified and adjusted for these variances. External factors and Market sentiment can also affect public company stock prices, distorting valuations if not adequately accounted for.

Precedent Transactions

The Precedent Transactions Method uses pricing multiples from industry transactions to calculate value. Based on the belief that thorough business financial data is scarce, transaction value is available. Conventional industry classification systems like SIC codes can investigate precedent transactions. Additionally, appraisal databases can provide historical data and valuation. Transactions can come from a majority or minority. Guide transactions could be from comparable companies in the same industry. When there is no precise comparability, other statistics might be used, but first, the company’s products or market should be evaluated.

Advantage:

The Precedent Transactions technique uses previous transaction data to benefit a company. This strategy shows buyers’ marketability to pay by examining costs paid for similar companies in historical acquisitions and mergers. This valuation method captures market trends, transfer premiums, and buyer-considered synergies, making it affordable and realistic.

Disadvantage:

The availability and significance of earlier deals can limit precedent transactions. Comparison transactions are affected by outmoded economic conditions, market fluctuations, or buyer strategic intentions. Due to a lack of transparency, private transactions cannot be fully reported, resulting in valuation errors. This method also involves extensive revisions to account for variances between the target firm and the prior transaction entities.

How do you calculate valuation?

Below is the Market capitalization valuation formula:

Valuation = Share Price * Total Number of Shares.

The market price of listed security usually reflects financial soundness, future revenue potential, and external variables.

What are the methods of investor valuation?

The 10 most important methods of investor valuation are:

- Cost-to-Duplicate Method: This strategy values the startup by assessing the cost of reproducing its product or service.

- Monte Carlo Simulation: This method simulates scenarios and estimates ROI using a statistical model.

- Decision Tree Analysis: This method uses a decision tree to assess investment scenarios.

- Real Options Analysis: This strategy evaluates a startup’s worth by weighing its future options.

- Scorecard Valuation: This technique scores startups based on management team strength, potential market size, and competitors.

- First Chicago Method: Early-stage investors estimate the startup’s exit value using this method. It entails predicting the startup’s future earnings and multiplying by its stage.

- Venture Capital Method (VC Method): Venture capitalists utilize this tactic. It estimates the startup’s exit value and divides it by the investors’ ownership share.

- Discounted Cash Flow (DCF) Analysis: This strategy discounts the company’s future cash flows to their current value. It aids investors in startup valuation.

- Precedent Transactions Analysis (PTA): This method analyzes the valuation of identical startups purchased or publicized. It helps investors assess startup acquisition value.

- CCA (Comparable Company Analysis): Startups’ financial indicators are contrasted to publicly traded corporations in the similar industry. Investors can assess the startup’s growth and revenue ratio.

What are the methods of valuation in private equity?

Private equity valuation involves complex methods, financial data, and regulations. If you don’t have it or the wrong one, you could make bad decisions, mess up your wealth, or even face legal or financial repercussions.

There are 3 methods of valuation in private equity:

- Discounted Cash Flow (DCF)

- Comparable Company Analysis

- Precedent Transactions

1. Discounted Cash Flow (DCF):

The DCF technique values an investment based on its predicted future cash flows. An investment’s worth today is the addition of its future cash flows depreciated to their present value. DCF is commonly utilized to predict and estimate future cash flows accurately. It works best for consistent, long-term investments and predictable earnings that depend on future earnings.

2. Comparable Company Analysis

The comparable company analysis strategy seeks public corporations with similar industry, business qualities, sector, and size to private assets. The market valuation multiples of these public corporations are then assessed. CCA estimates the fair market value of illiquid positions. This method is based on market comparability. CCA is utilized when public firms are similar to private companies or when assets are assessed. This strategy is suitable for private business or asset stakeholders who want to evaluate their market value before a sale or public offering.

3. Precedent Transactions

Precedent transactions helps value a private asset when you look at the recent sales of similar organizations. This method estimates a company’s value by looking at what investors paid for similar companies under identical conditions. It provides a practical baseline for current valuations by reflecting real-world market value from M&A activity. This strategy is effective when related organizations have recently transacted, particularly in the same sector or sector. It provides a realistic representation of market prices for similar assets, making it ideal for M&A stakeholders. This strategy is preferred when market trends and current transaction data are credible.

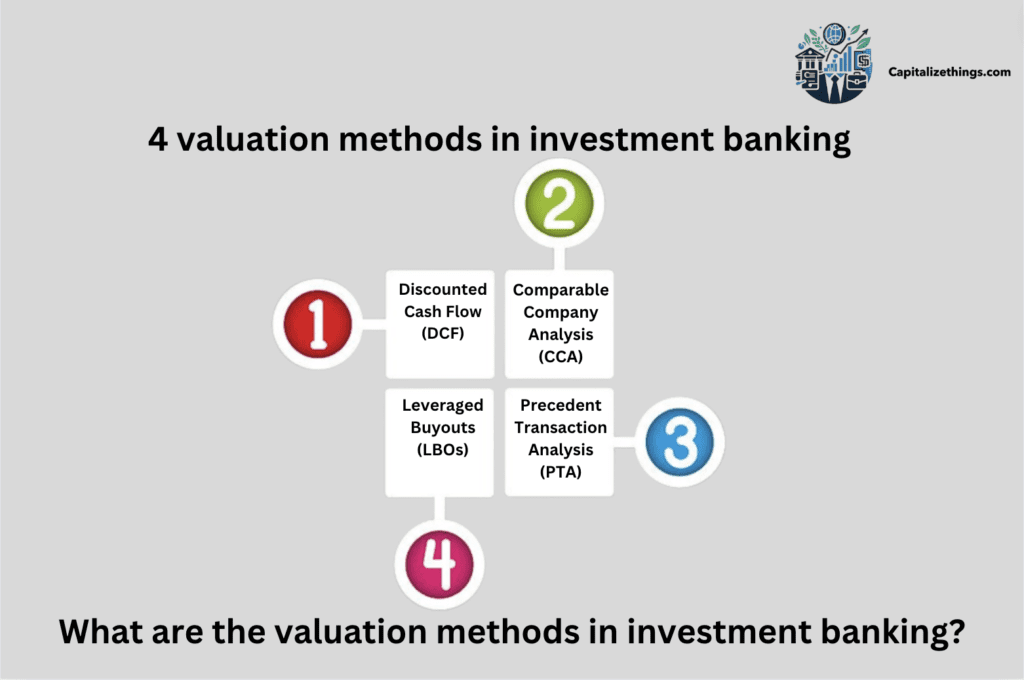

What are the valuation methods in investment banking?

Investment bankers value companies and assets using various methods. DCF, CCA, PTA, and LBOs are the most prevalent valuation methods.

There are 4 valuation methods in investment banking:

- Discounted Cash Flow (DCF)

- Comparable Company Analysis (CCA)

- Precedent Transaction Analysis (PTA)

- Leveraged Buyouts (LBOs)

1. Discounted Cash Flow (DCF)

DCF analysis is a popular investment banking valuation method. Discounting future cash flows to their present value with a discount rate determines their current value. Company capital cost generally checks the discount rate. The DCF method values a firm according to its predicted future cash flows. It acknowledges that inflation and interest make money now worth more than money tomorrow. DCF analysis also considers market conditions and new product introductions. However, the DCF analysis is only as good as its assumptions and inputs; hence, it should be used with other valuation methods to value a company fully.

2. Comparable Company Analysis (CCA)

CCA is another popular investment banking valuation method that compares a firm to market peers. Investment bankers compare companies using profit per share, price-to-profit ratios, and enterprise valuations. Initial public offerings apply CCA to help investors and underwriters assess a company’s market worth.

3. Precedent Transaction Analysis (PTA)

PTA is an investment finance valuation method that uses previous prices for similar companies to appraise a organization. Investment bankers evaluate businesses using financial indicators like sales multiple, EBITDA multiple, and enterprise value from prior transactions. A company under consideration for purchase or merger is valued using PTA.

4. Leveraged Buyouts (LBOs)

LBOs include heavily leveraged or debt-financed firm acquisitions. They are a prominent investment banking valuation method that uses a company’s capacity to produce cash flows to pay off its debt. Investment bankers assess LBOs using interest coverage, debt service coverage and debt-to-equity ratios.

What is the accounting stock/inventory valuation methods, along with examples?

Inventory can be valued in three ways:FIFO (First In, First Out), WAC (Weighted Average Cost) and LIFO (Last In, First Out).

First-In, First-Out (FIFO)

With the first-in, first-out (FIFO) method, items are sold in the order they were bought or made. FIFO sells the oldest inventory first. The FIFO inventory valuation way is the most popular because most organizations sell their items in the same order they get them.

Pros

- FIFO is popular with e-commerce enterprises because of its simplicity. Because each item supplied using this method costs the same, a corporation cannot influence revenue by choosing which item to sell.

- Inventory from the preceding fiscal year does not affect COGS.

- FIFO values inventory in the purchase and sale order, due to its simplicity and intuitiveness. Therefore, the price often matches the actual cost, making it hard to manipulate and avoid suspicion.

- Its simplicity comes from matching costs to cash flow and warehouse goods flow.

- Purchases performed at the end of the period do not affect revenue estimates because input cost is based on commodity creation order.

Cons

- Products usually increase in price over time, but sometimes, these costs rise quickly, especially for agricultural items affected by severe weather and climate.

- FIFO sometimes causes a mismatch between revenue and expenditure since paper estimates do not match inflated statistics.

- Even with regular inflation, earnings appear inflated, resulting in a higher tax burden than other alternatives. Accounting regulations are unchangeable; thus, they can’t help the company.

Last-In, First-Out (LIFO)

LIFO inventory value is the inverse of FIFO. It assumes the latest buying or manufacturing things sell first.

Pros

- LIFO has tax advantages over FIFO. LIFO increases COGS and decreases inventories during inflation.

- Firms pay less tax if COGS are greater while earnings are lower.

- LIFO’s key benefit is matching revenue better using the latest cost.

- Profits are lower because the corresponding net income is low. Because of this, many accountants and authorities use it to assess management profitability.

- It outperforms the FIFO system, which creates enormous paper profits.

Cons:

- LIFO isn’t used in realistic inventory. Few companies, particularly those selling cosmetics or other perishable goods, want to sell new inventory first.

- Accounting and finance can include older stock that is never “sold.” by using the most recent acquisitions as the cost of things sold.

- US GAAP and other accounting authorities disapprove of LIFO inventory valuation. Thus, country and regulation risks exist.

Weighted Average Cost (or Avg Cost)

Inventory and COGS are determined using the average cost of all things bought during a period with the Weighted Average Cost stock valuation method. Businesses with consistent inventories adopt this strategy.

Pros

- Organizations often use the weighted average cost approach with a lot of identical or comparable inventory. For example, if you offer simple T-shirts in multiple sizes and colors, you could have many SKUs but one pricing.

- A rigorous and scientific technique for inventory evaluation incorporating all three methodologies. The buying and selling dates don’t matter.

- Only the price of these transactions should be considered. Thus, it is straightforward to adopt, preserve, and audit.

- This technique, comparable to FIFO but more challenging to manipulate than LIFO, is best employed when the commodities are hard to identify, and it doesn’t matter how they got into the warehouse.

Cons

- The weighted average strategy risks losing money on sales. Using a conventional COGS markup to price an item won’t appropriately reflect its value if your costs unexpectedly jump.

- Inventory costs differ from market commodity prices, which pose issues due to complex computations.

What is inventory valuation allowance?

A valuation allowance reduces an asset or liability’s carrying value to its assessed fair value. It is usually used for assets or liabilities with unknown values or recoverability. The valuation allowance ensures that an entity’s financial statements reflect a more realistic asset or liabilities value estimate. Valuation allowances enable accounting and financial purposes to detect asset impairment losses and establish deductible or nondeductible status (Value Adjustments Established at the Balance Sheet Date, Accounting and Fiscal Treatments Applicable to Taxpayers, E. Stănciulescu, 2021).

A valuation allowance changes a company’s financial records directly. A valuation allowance reduces an asset or liability’s carrying value, affecting the entity’s profitability, financial position, and cash flows. This decline in value impact net income due to the more significant cost of goods sold. A valuation allowance on a contingent liability can raise income statement expenses. Note that a valuation allowance does not remove an asset or liabilities from financial statements. Instead, it changes the value carried to reflect a more realistic projection of future value or the possibility of recovery.

An inventory valuation allowance improves financial statements by accurately reflecting inventory value. This modification helps identify losses from outmoded or unsellable inventory, making the company’s financial condition more realistic. Financial reporting becomes more reliable, helping creditors, investors, and management make judgments. To comply with accounting requirements, inventory must be recorded at the lowest cost or market value. This proactive accounting method prevents financial disasters and promotes sensible financial resource management.

However, inventory valuation allowances have downsides. Setting aside the right amount might be complex and require a lot of judgment. Due to subjectivity, the inconsistency and manipulation can undermine financial statement comparability between periods or firms. Creating and maintaining an inventory value allowance needs ongoing evaluation and administrative work, which can be costly for the organization. Frequent allowance revisions can also cause profit volatility, perplexing stakeholders and hurting their opinion of the company’s financial condition.

Is inventory valuation important?

Inventory is an essential portion of a company’s assets, so its valuation can affect profitability, tax liabilities, and asset value. How a company values its inventory influences it’s COGS, gross income, and inventory value after each period. Thus, inventory valuation impacts a company’s profitability and accounting records. After choosing an inventory value technique, a corporation should stick to it. Companies must choose a method in their initial tax filing year and get approval to modify it in the following years.

What is the primary purpose of valuation?

Valuation determines item value and compares it to market price. This is done for many reasons, such as to attract investors, sell or purchase the business, sell off assets or parts of the business, get rid of a partner, or avoid problems with an estate.

How do you value a company based on earnings?

Earnings-based valuation methods use different metrics linked to a company’s earnings to determine its worth. For example, a company’s stock price and earnings per share are compared in the Price/Earnings (P/E) ratio to determine a market’s valuation of the business’s revenue potential.

What is the formula for the valuation of a company?

To determine a company’s worth based on its revenue, take its total revenue, subtract its running costs, and multiply it by a sector multiple. The industry multiple is determined by the average price at which companies in a certain field sell for.

How does Shark Tank calculate valuation?

3 of the major Shark Tank Valuation Methods are given below:

- Costs. Most businesses measure revenue without considering production expenses. The Sharks enquire about costs only the monetary number of overall sales. They could inquire about the company’s product’s manufacturing cost and selling price. This helps compute product margin. Marketing, R&D, and the owner or staff pay will be asked to determine how much profit the business makes.

- Revenue Multiple. In the revenue multiple method the entrepreneurs usually demand a fee for a share of the business. For instance, an entrepreneur’s approach the Sharks for $100,000 for 10% equity. Sharks assess its value from there. The Sharks usually concur that the entrepreneur values the company at $1 million in revenue. The Sharks would calculate that amount since 10% ownership equals $100,000, which means one-tenth of the business’s ownership is $100,000, while 100% equals $1 million. The Sharks would ask for last year’s sales if the company is worth $1 million. The company will reach $1 million in sales in four years if the reaction is $250,000. The Sharks might contest the owner’s $1 million valuation if sales were $75,000. If the sales from the previous year were $250,000 but the entrepreneur recently signed an arrangement for sales with Walmart to sell $600,000 worth of stuff, the Sharks would value the company higher. So, the valuation considers last year’s revenue and sales and the company’s sales pipeline.

- Earnings Multiple. Investors can’t examine equity shares or earnings multiples for Shark Tank companies because they’re not publicly traded. The Sharks can calculate an earnings multiple by comparing the company’s profit to its sales revenue valuation. If a company is worth $1 million and its owner makes $100,000, its earnings multiple are 10. No one knows if an earnings multiple of 10 benefits the company so that the Sharks could conduct comparable company research.

What is the earnings approach(affect) to valuation?

Earnings, which indicate profitability, affect firm valuation. They are used in valuation tools like the discounted cash flow (DCF) and price-to-earnings (P/E) ratio because they reflect firm profitability and performance.

Investors and analysts use a company’s earnings to determine its intrinsic value and forecast its cash flows. Investors value each share more if a corporation earns more than its shares. Analysts calculate EPS while assessing a company. Divide a company’s expected shareholder earnings by its outstanding shares to get EPS. A corporation with $100,000 in earnings and 50,000 shares of stock has a $2 EPS. Strong earnings are seen as an indication of financial health and potential for the future, raising a company’s valuation. Conversely, weak or deteriorating profitability indicate underlying difficulties and lower valuation. The video shared below is helpful to understand valuation approach to assets and earnings.

What are the limitations of valuation?

The valuation limitation of some procedures are simple, and some involve additional complexity. Sadly, there isn’t a single method that works best in all situations. Each company, business, or sector has distinct characteristics that demand several valuation methods.

What are the risks of value investing?

Value investments can be profitable but risky. One risk is that the market will never appreciate the company, and the stock price will never rise. Another risk is that the business has hidden issues, like an outdated industry or weak management. Value investors must be patient because the market takes time to appraise the company.

What are the benefits of investment valuation?

The benefits of investment valuation is that the potential real estate consumers want to assess the price against the expected return, so investment value is vital. After determining the rate of return, they can compare the investment’s results to the expected property price. This helps investors make smart purchases that meet their investing goals.

What is Investment Appraisal?

An investment appraisal looks at how profitable an investment will be over the life of an asset, as well as how affordable it is and how well it fits with the business’s overall goals. Market values change, so compare the property to comparable properties in the exact location that sold in the past 3–6 months. No two properties are the same. Thus, an evaluation is subjective and based on current data. Real estate brokers should be able to predict a selling price by analysing previous comparable sales.

What is the difference between valuation and appraisal?

The basic difference between valuation and appraisal is that an appraisal is usually done by a reputable, endured real estate agent who is an affiliate of the REIV (Real Estate Industry of Victoria Association). It is used to help set the price of a property for purchase or rent, and a valuation is done in Victoria by a Registered or Sworn Valuer who has a complete understanding of the asset being valued. This is a formal document that can be used in court.

It is often used for estates of people who have died divorces or contested business properties. There is an official and scientific way to find out how much your property is worth, and that is through forged valuation. An evaluation is just a guess or opinion about how much a property is worth on the market right now based on how the market reacts and other factors. This is something that real estate agents usually do for free. Valuation is the process of writing up a report about a property. This service costs money.

Is a valuation report the same as an appraisal report?

Valuation report and appraisal reports are not same but close to each other, the professional appraisers determine property values. Buyers pay market value. Those figures could be near or different. How you use it determines whether you require an appraisal or valuation. A licensed appraiser must follow USPAP criteria to create an appraisal, which is a more formal study. An appraisal is needed if the property is sold, renewed, insured, or funded by a lender. A professional appraiser or asset valuer can perform a valuation. The assessment helps determine the best approaches to market your property.

Which method of investment appraisal is most appropriate?

Net Present Value (NPV) makes investment project evaluation and selection more objective. Discount rates and cash flows must be accurately estimated, making it sensitive to these inputs.

What are the conventional methods of investment appraisal?

Conventional investment appraisal approaches are payback, discounted cash flow, accounting rate of return, net present value (NPV), and internal rate of return.

Conclusion

The process of figuring out an investment’s exact value is called investment valuation. Income-based, Asset-based, and market-based business valuation types are commonly used—asset-based firm investments. DCF discounts future cash flow estimates to present value to determine value. Market comparables compare prices of similar companies, while EBITDA multiples calculate value by multiplying profits before interest, depreciation, taxes, and amortization. This strategy cannot be used for single-client or irregular cash flow enterprises. Finally, comparables can overvalue or undervalue if industry multiples are affected by speculative activities or economic bubbles. DCF approach uses core financial theory to determine firm profitability. DCF helps you understand an enterprise’s financial dynamics by emphasizing cash generation possibilities. Businesses with irregular cash flows or a single client can make forecasting difficult and unreliable. It’s one of the drawbacks of DCF. Building a DCF model demands financial expertise and business knowledge to avoid erroneous assessments.

Market comparables provide transparency since they use real market data. Especially if your organization is in a similar transaction industry, this method can offer you a reasonable assessment of your business’s market value, which is helpful if you’re thinking about a sale or negotiating investment or partnerships. While beneficial, market equivalents have downsides. The technique relies on reliable and relevant data that can be scarce in niche sectors or single-client enterprises.

Larry Frank is an accomplished financial analyst with over a decade of expertise in the finance sector. He holds a Master’s degree in Financial Economics from Johns Hopkins University and specializes in investment strategies, portfolio optimization, and market analytics. Renowned for his adept financial modeling and acute understanding of economic patterns, John provides invaluable insights to individual investors and corporations alike. His authoritative voice in financial publications underscores his status as a distinguished thought leader in the industry.