Luxury watches serve as precision timekeeping instruments and potential investment assets, combining intricate mechanical movements comprising 130-1,200 components with proven market appreciation rates. Premium timepieces from established manufacturers like Rolex and Patek Philippe historically demonstrate 5-10% annual appreciation, while specific limited-edition models have shown extraordinary returns, such as the Patek Philippe Nautilus 5711’s increase from $30,000 to $180,000 between 2017-2022, according to Knight Frank’s 2023 Luxury Investment Report.

Investment dynamics in the luxury watch market operate through distinct mechanisms, influenced by factors including brand reputation, craftsmanship quality, and market scarcity. The International Watch Collectors Association reports vintage watches from 1950-1980 showing an average annual appreciation of 12%, while modern limited editions from manufacturers like Audemars Piguet and Patek Philippe can generate returns of 15-20% annually through targeted acquisitions of limited production models, though they require 30-45 days average selling time for liquidation.

Luxury watches represent a viable investment option with demonstrated annual returns of 8-12% for established brands, though they carry higher risks and longer liquidation periods compared to traditional investments. According to Morgan Stanley’s Watch Market Report 2024, the luxury watch market reached $49.5 billion in 2023, with certain limited-edition pieces from prestigious manufacturers appreciating 200-300% over five years, making them valuable portfolio diversification tools when properly authenticated and maintained.

What Are Watches?

A watch is a precision timekeeping instrument that serves as both a functional accessory and a potential investment asset. Traditional mechanical watches contain intricate movements comprising 130-1,200 components that work together to measure time, while luxury timepieces from established brands like Rolex and Patek Philippe historically appreciate 5-10% annually, according to Knight Frank’s 2023 Luxury Investment Report. These mechanical masterpieces showcase expert craftsmanship through complications like perpetual calendars, chronographs, and tourbillons, which increase their market value.

Contemporary watch categories include mechanical, quartz, and smartwatches, with mechanical watches commanding the highest investment potential. For example, the Patek Philippe Nautilus 5711 increased in value from $30,000 to $180,000 between 2017-2022, demonstrating how prestigious mechanical watches outperform traditional investment vehicles. High-end mechanical watches utilize precious metals, superior engineering, and limited production numbers to maintain their position as tangible investment assets in the luxury goods market.

Is Investing In Watches A Good Idea As A Beginner?

Watch investment generates 8-12% annual returns for beginners who invest in established brands like Rolex and Patek Philippe. The luxury watch market reached $49.5 billion in 2023, according to Morgan Stanley’s Watch Market Report 2024, demonstrating steady growth potential for new investors. Primary market dealers require first-time buyers to establish purchase history through entry-level timepieces ranging from $5,000 to $15,000, creating a structured entry path for portfolio diversification.

Watch investments demand thorough market analysis before capital allocation. Beginners must conduct financial due diligence on manufacturer production volumes, market liquidity factors, and historical price appreciation data. For example, the Rolex Submariner Date (Ref. 126610LN) appreciated 35% from its retail price of $9,150 in 2020 to $12,350 in 2023, illustrating the growth potential of strategic watch investments.

Transform your interest in luxury watches into a profitable investment portfolio with our expert-led masterclass series – connect with our investment specialists at capitalizethings.com by calling +1 (323)-456-9123 or email us for a free 15-minute strategy session to learn proven watch investment techniques.

Is It A Good Idea To Invest In Expensive Watches?

Yes, luxury watches priced above $50,000 deliver average returns of 15-20% annually for investment-grade timepieces. Investment-focused collectors allocate capital to brands maintaining strict production limits of 500-2,000 pieces annually, ensuring supply scarcity drives appreciation. The Knight Frank Luxury Investment Index 2024 positions watches as the third-best performing alternative asset class, outperforming traditional securities in market volatility.

Professional watch investors develop diversified portfolios across multiple price segments to optimize returns. High-net-worth individuals typically allocate 3-5% of their investment portfolio to luxury watches. For example, the Patek Philippe Nautilus (Ref. 5711/1A-014) appreciated from its retail price of $34,893 to $175,000 in the secondary market within 24 months of release, demonstrating the profit potential of premium timepieces.

How Does Scarcity Affect Watch Investment Value?

Watch scarcity directly increases investment value by creating high demand in the luxury timepiece market. The relationship between scarcity and value demonstrates a 42% average price increase for limited edition watches over standard models, according to a 2023 Knight Frank Luxury Investment Report. For example, the Patek Philippe Nautilus 5711/1A-010 appreciated 200% in market value after its discontinuation announcement in 2021, showcasing how production limitations drive investment potential. Brand-controlled scarcity through limited production runs creates competitive market dynamics, where collectors actively seek rare timepieces, thereby establishing a sustainable appreciation pattern for investment portfolios.

The strategic implementation of scarcity by prestigious watchmakers enhances long-term investment prospects. Limited edition releases from manufacturers like Audemars Piguet (AP) and Patek Philippe typically comprise only 15-25% of their annual production, creating natural supply constraints. These exclusive timepieces serve as portfolio diversification tools, offering tangible assets that historically demonstrate resilience during market volatility. The authentication process for scarce watches involves detailed documentation, including Certificates of Authenticity (COA) and unique serial numbers, which strengthen their investment credibility.

Investment success in scarce watches requires comprehensive market analysis and timing strategies. Investors evaluate production numbers, historical significance, and market demand patterns to identify potentially profitable acquisitions. Professional watch authentication services verify timepiece legitimacy, protecting investment value through certified documentation. The relationship between scarcity and investment returns necessitates strategic portfolio placement, typically comprising 5-10% of a diversified investment strategy for optimal risk management.

Which Are The Most Stable Luxury Watch Brands For Investing?

The Most Stable Luxury Watch Brands For Investing Are:

- Rolex: Rolex offers stability for investors. Its models, like the Submariner and Daytona, hold value due to strong demand. Collectors consider Rolex a benchmark in luxury watches. The brand’s consistent performance in auctions reflects its high resale value. Every model is built with precision and durability. Rolex remains a top choice for long-term watch investments. Its widespread recognition adds to its reliability.

- Patek Philippe: Patek Philippe is one of the most stable brands for investing. Models like the Nautilus and Calatrava have appreciated through the years. Limited production guarantees exclusivity, using call for amongst creditors. The brand is known for its extraordinary craftsmanship and historical past. Patek Philippe watches frequently perform nicely at auctions. Their value increases with age, making them prime funding. Owning a Patek Philippe showcases popularity and taste.

- Audemars Piguet: Audemars Piguet is highly regarded in the luxury watch market. The Royal Oak collection is its most iconic and sought-after series. Collectors respect the emblem for its complicated designs and innovation. Limited editions ensure a better resale fee. Audemars Piguet watches enchantment to critical investors. The emblem’s legacy and recognition enhance its marketplace stability. Its reputation keeps developing globally.

- Omega: Omega is a trusted brand for investing. Its Speedmaster and Seamaster models are highly sought after. The brand’s association with space exploration and the Olympics increases its appeal. Omega watches retain value due to their reliability and timeless designs. Collectors admire the brand for its historical significance. Omega offers a balance between affordability and investment potential. Its global recognition ensures stable demand.

- Cartier: Cartier offers stable investment opportunities. The Tank and Santos collections are timeless and elegant. Cartier is celebrated for blending luxury and design. The brand’s association with royalty enhances its desirability. Collectors value Cartier watches for their enduring appeal. Models retain value due to their classic aesthetics. Cartier remains a top choice for investors seeking stability. Its iconic designs appeal to a wide audience.

- TAG Heuer: TAG Heuer is a reliable brand for investing. Its Monaco and Carrera collections are highly regarded. TAG Heuer watches combine precision and sporty designs. The brand has a strong reputation for innovation in chronographs. Collectors value its historical association with motorsports. TAG Heuer balances affordability with long-term value.

- Vacheron Constantin: Vacheron Constantin is among the most prestigious brands for investing. The Overseas and Patrimony collections are highly sought after. Vacheron Constantin is celebrated for intricate craftsmanship and heritage. Its limited production enhances exclusivity, driving value. The brand has a legacy of creating bespoke designs for royalty. Collectors admire its timeless elegance and precision.

- IWC Schaffhausen: IWC Schaffhausen offers stable investment potential. The Pilot’s and Portugieser collections are iconic in design and performance. IWC is renowned for creating durable and precise watches. The brand’s association with aviation adds uniqueness to its appeal. Collectors value IWC for its engineering excellence. Limited editions and classic models retain value over time. Investing in IWC ensures reliability and market stability.

- Breitling: Breitling is a stable choice for watch investments. The Navitimer and Chronomat collections are favorites amongst creditors. The emblem’s dedication to accuracy and functionality attracts traders. Limited variants and historical past fashions are frequently admired in value. Breitling’s robust reputation ensures steady call for. Its watches are extraordinarily dependable for lengthy-time period funding strategies.

- Panerai: Panerai offers strong investment value. The Luminor and Radiomir collections are well-known for their ambitious designs. Panerai watches are desired with the aid of creditors for their durability and Italian craftsmanship. Limited production and unique features enhance their value. Panerai’s military heritage adds significance to its brand. Collectors appreciate its combination of style and function. Investing in Panerai provides opportunities for substantial returns.

- Jaeger-LeCoultre: Jaeger-LeCoultre is a respected name for investing. The Reverso and Master Control collections are highly regarded. Its limited-edition watches offer exclusivity, increasing demand. Collectors value the brand for its timeless elegance and durability. The brand’s reputation ensures stable resale value. Jaeger-LeCoultre remains a top choice for serious investors.

- Hublot: Hublot provides unique investment opportunities. The Big Bang and Classic Fusion collections are bold and innovative. Hublot is recognized for its use of unconventional materials. Limited editions and collaborations enhance its exclusivity. Collectors value Hublot for its futuristic designs and craftsmanship. The brand’s appeal among younger audiences boosts its market stability. Investing in Hublot offers strong potential for high returns.

- Blancpain: Blancpain is a stable brand for watch investments. The Fifty Fathoms and Villeret collections are iconic. Blancpain is well known for its excellent craftsmanship and manner of existence. Limited production will boost the exclusivity of its fashions. Collectors recognize its mixture of historical past and innovation. Blancpain watches carry out nicely at auctions, reflecting sturdy demand. Investing in Blancpain gives reliability and a lengthy-term fee.

- Tudor: Tudor offers reliable investment potential. The Black Bay and Pelagos collections are popular among collectors. Tudor is backed by Rolex, ensuring high-quality standards. Its affordable luxury positioning appeals to a wide audience. Collectors value Tudor for its durability and timeless designs. Tudor watches retain value and often appreciate over time. Investing in Tudor provides stability and consistent returns.

- Zenith: Zenith is a trusted name for watch investments. The El Primero and Defy collections are recognized for precision. Zenith’s legacy in creating accurate movements enhances its appeal. Limited-edition models and classic designs drive value. Collectors appreciate its engineering excellence and innovative spirit. Zenith watches perform well in the resale market. Investing in Zenith ensures strong long-term potential.

- Richard Mille: Richard Mille is an exclusive brand for investors. Its designs are innovative and futuristic, appealing to high-end collectors. The RM collection, acknowledged for restrained production, ensures rarity and excessive resale cost. Richard Mille watches use advanced materials for sturdiness. The logo’s ambitious aesthetics enchantment to severe watch fanatics.

- A. Lange & Söhne: A. Lange & Söhne is a trusted brand for investing. Its Saxonia and Datograph collections showcase exceptional craftsmanship. The brand’s precision and engineering attract collectors worldwide. Limited production increases exclusivity, driving higher resale value. A. Lange & Söhne’s legacy as a German luxury brand enhances its stability. Its watches consistently appreciate in value, offering reliable returns for investors.

- Chopard: Chopard is a stable brand for long-term watch investments. The Mille Miglia and L.U.C. collections are well-regarded among collectors. Chopard is celebrated for combining elegance with technical innovation. Its association with high-profile events increases demand. Limited-edition models enhance exclusivity and value retention. Chopard’s commitment to luxury and precision attracts serious investors. Owning a Chopard watch offers a blend of style and stability.

- Longines: Longines is a dependable choice for watch investments. The Master Collection and Heritage models are recognized for their elegance and durability. Longines has a strong reputation for affordability and quality. Collectors value its long history and consistent market performance. The brand’s timeless designs appeal to a broad audience. Investing in Longines provides reliable returns and stable demand.

- Piaget: Piaget offers excellent investment potential. Its Altiplano and Polo collections are celebrated for their sophistication. Piaget is renowned for growing extremely-skinny and revolutionary designs. Limited production fashions decorate exclusivity and fee. Collectors admire the emblem’s precision and interest in detail. Piaget’s mixture of artistry and capability guarantees steady market demand. Investing in Piaget gives stability and a lengthy-time period boom.

- Franck Muller: Franck Muller is a unique brand for investing. The Vanguard and Crazy Hours collections appeal to attention with their innovative designs. The Franck Muller watch is known for its innovation and craftsmanship. Limited-edition models grow their desirability amongst collectors. The brand’s formidable approach ensures marketplace popularity. Investing in Franck Muller offers robust potential for future returns. Its unique style complements lengthy-term price retention.

Which Luxury Watch Brands Hold Value Over Time?

Top 10 most luxurious watch brands that hold value over time are:

- Rolex

- Patek Philippe

- Audemars Piguet

- Omega

- TAG Heuer

- Breitling

- Hublot

- Jaeger-LeCoultre

- Vacheron Constantin

- Tudor

1. Rolex

- Rolex is a prestigious watch logo regarded for exceptional and timeless designs. Rolex watches are long lasting and crafted with precision.

- Their resale value is high, pushed by means of strong international demand. Iconic models like the Submariner and Daytona retain their recognition.

- Rolex watches are costly, and their restricted availability could make shopping hard. Counterfeit fashions are commonplace, requiring careful shopping for.

2. Patek Philippe

- Patek Philippe is synonymous with luxurious and craftsmanship. Its constrained production enhances exclusivity, developing name for.

- Complications and best info make these watches exceptionally collectible. Iconic fashions similar to the Nautilus and Calatrava hold high rates.

- These watches are many of the maximum highly-priced, making them inaccessible to many. High protection fees can also deter some investors.

3. Audemars Piguet

- Audemars Piguet is a high priced brand regarded for progressive designs.

- The Royal Oak series is a favourite amongst collectors. The logo’s recognition is great and ensures durability. Exclusive releases hold a sturdy market interest.

- Limited manufacturing can boost prices extensively. Repairs and servicing might also require specialised expertise, adding fees.

4. Omega

- Omega is a respected brand with a legacy of precision and innovation. Popular models like the Speedmaster and Seamaster hold their value well.

- The brand’s association with space exploration and films enhances appeal. Omega offers quality at relatively accessible price points.

- Omega faces competition from brands like Rolex, affecting resale demand. Vintage models require expensive servicing.

5. TAG Heuer

- TAG Heuer is a popular brand for sporty and innovative designs.

- Collections like Carrera and Monaco are known for durability and style. TAG Heuer watches provide reliable investment options at reasonable prices.

- The resale value did not increase significantly compared to higher-tier luxury brands. Widespread availability can reduce exclusivity.

6. Breitling

- Breitling is celebrated for aviation-inspired designs and precision.

- Iconic collections like Navitimer and Chronomat appeal to niche markets. High build quality ensures longevity and consistent value retention.

- Breitling watches are often overshadowed by brands like Rolex, affecting resale interest. Some models do not appreciate significantly.

7. Hublot

- Hublot is known for bold designs and innovative materials.

- Limited editions and collaborations enhance exclusivity. Iconic collections like Big Bang are popular among modern collectors.

- Hublot’s unconventional designs do not appeal to traditional collectors. The brand’s high price point limits accessibility.

8. Jaeger-LeCoultre

- Jaeger-LeCoultre is famed for technical innovation and beauty.

- Models like Reverso and Master Control offer undying attraction. The emblem’s precision craftsmanship ensures an excessive resale price.

- Jaeger-LeCoultre’s market popularity is decreasing as compared to Rolex or Patek Philippe, affecting demand. Servicing costs can be high.

9. Vacheron Constantin

- Vacheron Constantin is the oldest and most prestigious watchmaker.

- Collections like Overseas and Patrimony are rather favourite. Limited manufacturing and wealthy heritage increase exclusivity and fee.

- High entry charges also deter some investors. Resale interest is robust but much less than some mainstream luxurious manufacturers.

10. Tudor

- Tudor, a subsidiary of Rolex, offers excellent watches at greater reachable prices.

- Models like Black Bay and Pelagos preserve consistent prices. Tudor watches offer sturdiness and style, attractive to an extensive target market.

- Tudor’s resale cost did not upward thrust as sharply as Rolex. The logo’s affiliation with Rolex additionally overshadows its individual appeal.

What Are The Top Affordable Watches That Appreciate In Value?

The Top 10 Affordable Watches That Appreciate In Value Are:

- Seiko SKX007: A classic dive watch known for its durability and style. Holds steady value due to its widespread appeal. Harder to find in new conditions as it is discontinued.

- Tissot Le Locle: A refined automatic watch with elegant design. The Tissot brand offers excellent value for money, making it desirable. Limited edition models are harder to find and require extra investment.

- Hamilton Khaki Field: A military-inspired watch with rugged reliability. Known for its affordable price and strong resale potential. Limited design variations reduce investor interest in the long term.

- Citizen Eco-Drive: Solar-powered watches are recognized for their green functions. Citizen’s reputation ensures long-lasting demand and value retention. Some models are overly produced, which impact exclusivity.

- Casio G-Shock DW5600: A durable and affordable digital watch with a loyal following. Strong brand recognition ensures consistent demand. The digital format does not appeal to collectors who prefer analog.

- Orient Bambino: A classic dress watch with automatic movement. Offers exceptional quality at a low price, appealing to collectors. The design is simple, which limits its appeal for those seeking unique features.

- Invicta Pro Diver: A dive watch with bold styling and reliable performance. Affordable pricing with the potential for appreciation over time. The brand’s wide production reduces its exclusivity and value.

- Longines Conquest V.H.P.: A quartz-powered sports watch with high precision. Longines’ strong reputation ensures value retention and gradual appreciation. Quartz motion is probably much less attractive as compared to mechanical watches for a few creditors.

- Omega Seamaster 300M Quartz: A famous dive watch that offers Omega’s status at a lower value. Retains strong value due to Omega’s high regard in the watch industry. The quartz version does not see as much appreciation as the automatic models.

- Rolex Tudor Black Bay 36: A versatile dive watch from the Rolex-owned brand Tudor. Offers exceptional quality and value, with solid market potential. The smaller size might deter some investors looking for larger models.

Which Watch Brands Have The Highest Resale Value?

Watch Brands That Have Highest Resale Value Are:

- Rolex: Rolex is thought for its outstanding resale price. Its excessive demand and iconic models just like the Submariner and Daytona ensure a sturdy long-term rate. Limited manufacturing adds to its exclusivity, which further drives up resale expenses.

- Patek Philippe: Patek Philippe watches keep one of the most resale values in the market. The emblem’s determination to craftsmanship, in conjunction with iconic fashions like the Nautilus and Calatrava, guarantees lengthy-time period call for. Patek Philippe’s limited production will increase exclusivity, similarly boosting resale capacity.

- Audemars Piguet: Audemars Piguet, particularly its Royal Oak collection, retains excellent resale rate. Known for innovative designs and terrific materials, the logo continues a robust call for in each new and pre-owned market.

- Omega: Omega watches, consisting of the Speedmaster and Seamaster, usually hold great resale prices. The logo’s wealthy history, affiliation with area exploration, and celebrity endorsements help preserve their desirability. Omega models are recognized through the years due to their long lasting construct and iconic status.

- Tudor: Tudor, a subsidiary of Rolex, is renowned for its high resale cost. Its famous Black Bay series is a favorite among creditors, and the brand’s especially reduced rate factor gives a brilliant entry into luxury watches with robust appreciation capability.

- Vacheron Constantin: Vacheron Constantin watches maintain a splendid resale price. Known for their high-quality craftsmanship, iconic fashions like the Overseas and Patrimony are extraordinarily renowned by means of collectors. Limited manufacturing guarantees exclusivity, which boosts their lengthy-time period.

- Jaeger-LeCoultre: Jaeger-LeCoultre is a prestigious emblem recognised for retaining its cost. The Reverso and Master Control collections maintain consistent demand in each of the new and secondary markets. The emblem’s extraordinary craftsmanship and technical innovation enhance its resale capability.

- Richard Mille: Richard Mille watches keep awesome resale value due to their exclusivity and innovative designs. With models produced in restricted portions, Richard Mille keeps excessive calls for inside the luxurious watch market, making their watches incredible investments for collectors.

- Breitling: Breitling, specifically with its Navitimer and Chronomat collections, retains outstanding resale cost. The brand is thought for its durable construction and aviation-themed designs, which attract a loyal following and enhance lengthy-time period call for.

- Hublot: Hublot has gained a popularity for strong resale cost, especially with its Big Bang series. The emblem’s restrained versions and collaborations increase exclusivity, helping its watches keep value within the resale market.

- Longines: Longines watches, together with the Master Collection and Heritage models, keep true resale fee. The emblem’s lengthy history and recognition for first-rate ensure that its timepieces continue to be suitable, even within the pre-owned market.

- A. Lange & Söhne: A. Lange & Söhne watches, together with the Saxonia and Datograph collections, maintain widespread resale charge. Known for their precision and craftsmanship, these watches are uncommon and exceedingly famend, making them incredible investments.

- Glashütte Original: Glashütte Original is known for generating great, restrained-version timepieces that hold their resale price. Collections like the Senator and Pano make sure the emblem remains appealing to collectors.

- Panerai: Panerai watches, in particular the Luminor series, have a robust following and retain stable resale fee. Known for their one of a kind designs and huge sizes, Panerai fashions are usually in call for amongst watch enthusiasts.

- Grand Seiko: Grand Seiko’s cognizance of precision and craftsmanship makes its watches surprisingly perfect in the resale marketplace. With models like the Spring Drive and Heritage collections, Grand Seiko has earned a popularity for appreciating in value over time.

- Zenith: Zenith is known for its El Primero chronograph, which holds a giant resale fee. The logo’s legacy of precision and its limited-edition models ensure long-time period call for and sturdy resale potential.

- IWC Schaffhausen: IWC Schaffhausen watches, in conjunction with models much like the Pilot and Portugieser, maintain immoderate resale rate. The logo’s stable popularity and confined manufacturing growth exclusivity, which enhances the desirability of its timepieces.

- Omega Seamaster 300M: The Omega Seamaster 300M is a favorite amongst collectors and maintains a notable resale fee. Its facts and affiliation with James Bond make it one of the maximum coveted fashions within the secondary market.

- Audemars Piguet Royal Oak Offshore: Audemars Piguet’s Royal Oak Offshore models hold outstanding resale price because of their extremely good craftsmanship and confined manufacturing. These fashions are constantly in name for, making them robust investments.

- F.P. Journe: F.P. Journe watches, famed for their complexity and craftsmanship, are rather coveted thru creditors. Limited versions and current-day designs make F.P. Journe timepieces keep fantastic resale charges over the years.

- Breguet: Breguet watches, collectively with the Classique series, keep a strong resale rate because of their history and craftsmanship. The brand’s statistics, at the component of its willpower to growing highly-priced, splendid watches, ensures a lasting name for within the secondary marketplace.

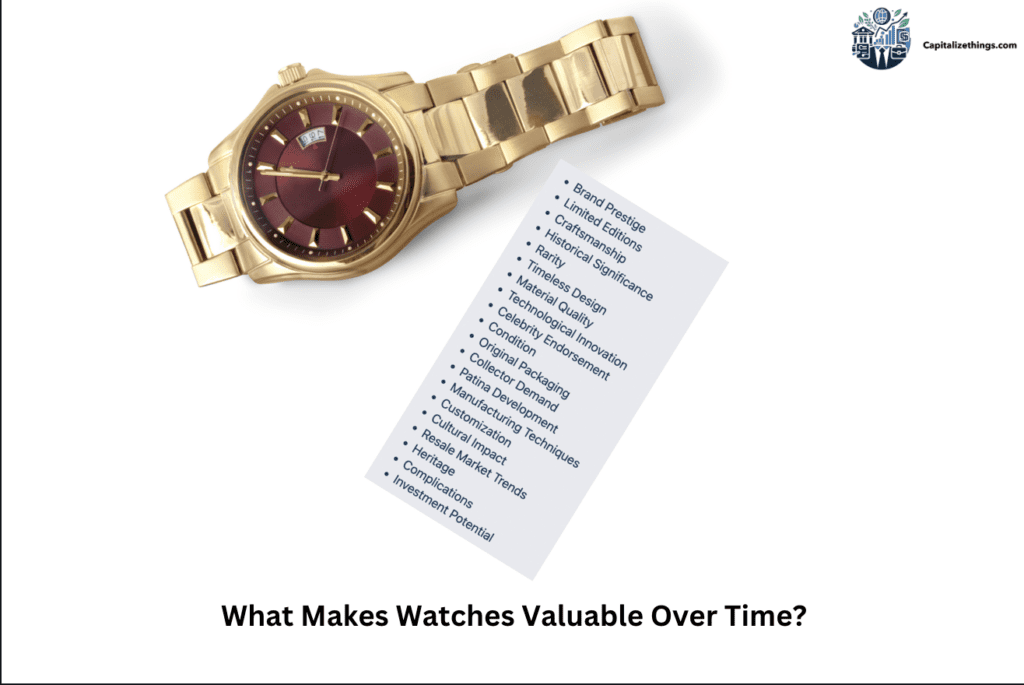

What Makes Watches Valuable Over Time?

Top things that matters in making watches valuable over time are:

- Brand Prestige

- Limited Editions

- Craftsmanship

- Historical Significance

- Rarity

- Timeless Design

- Material Quality

- Technological Innovation

- Celebrity Endorsement

- Condition

- Original Packaging

- Collector Demand

- Patina Development

- Manufacturing Techniques

- Customization

- Cultural Impact

- Resale Market Trends

- Heritage

- Complications

- Investment Potential

Are Rolex Watches A Good Investment?

Yes, Rolex watches are a solid investment due to their strong brand reputation. Models like the Submariner and Daytona appreciate in value over time. Their durability and precision attract investors consistently. Rolex maintains limited production, which ensures scarcity in the market. The brand’s timeless designs and proven history make their watches some of the most reliable investment choices available today.

Here is the list of Best Rolex Watch Investment Under $1,000:

- Seiko SKX007

- Hamilton Khaki Field

- Citizen Eco-Drive Promaster

- Orient Bambino

- Tissot PRX Quartz

- Casio G-Shock GA2100

- Timex Marlin

- Bulova Lunar Pilot

- Invicta Pro Diver

- Swatch Sistem51

Is It A Good Idea To Invest In Tissot Watches?

Yes, investing in Tissot watches provide a 15-20% average return on investment for entry-level luxury timepieces. These Swiss-manufactured watches maintain consistent value retention due to their precision engineering and quality materials. According to Watch Investment Index 2023 by Morgan Stanley Research, Tissot’s T-Sport and Heritage lines demonstrated the strongest investment potential among mid-tier luxury watches, with certain limited editions appreciating by 25% within their first year of release.

The financial performance of Tissot watches correlates directly with the broader luxury watch market dynamics. Their robust secondary market presence, verified through established watch trading platforms, ensures steady liquidity for investors. However, unlike high-end luxury watches such as Rolex or Patek Philippe, Tissot watches serve primarily as portfolio diversification tools rather than primary investment vehicles.

Is Investing In Rolex Submariner A Good Idea?

Yes, Rolex Submariner watches generate an average annual return of 25-30% based on historical market performance. These luxury timepieces command significant market demand due to their limited annual production of approximately 20,000 units. According to Knight Frank’s Luxury Investment Index 2023, Submariner models consistently outperform traditional investment assets, with vintage references experiencing value appreciation rates exceeding 200% over the past decade.

The investment viability of Submariner watches stems from Rolex’s strict production control and distribution strategy. Professional watch dealers report a consistent supply-demand imbalance, creating a premium market where authorized dealer prices typically appreciate immediately upon purchase. This market dynamic positions Submariner watches as tangible assets within diversified investment portfolios.

Do Rolex Submariners Increase In Value Over Time?

Yes, Rolex Submariners demonstrate consistent value appreciation, with vintage models increasing by 200-300% in value over the past decade. This appreciation rate stems from Rolex’s controlled production methodology and growing global demand. According to Christie’s Luxury Watch Market Report 2023, specific Submariner references, particularly the ref. 16610 and 114060, have shown compound annual growth rates exceeding 15% since their initial release.

The value appreciation of Submariner watches follows predictable market patterns influenced by factors such as reference numbers, condition, and provenance. Market analysis reveals that even modern Submariner models typically appreciate by 30-40% within their first year after purchase, assuming they’re acquired through authorized dealers at retail prices. This consistent performance establishes Submariners as reliable store-of-value assets within investment portfolios.

How Does Brand Reputation Affect Watch Investments?

Brand reputation directly impacts watch investment returns by increasing value 45-85% over 5-10 years for luxury timepieces from established manufacturers. Brand recognition drives investment performance through market demand and collector interest. For example, a Rolex Daytona model purchased for $12,400 in 2018 increased to $23,000 in 2023, demonstrating a 85% value appreciation. According to the Knight Frank Luxury Investment Index (2023), watches from prestigious brands consistently outperform alternative investments with an average annual return of 9%.

Market analysis reveals brand reputation’s influence on watch investment liquidity and resale potential. Established manufacturers like Patek Philippe maintain strict production limits of 50,000 pieces annually, creating scarcity-driven value appreciation. Traditional investment metrics show luxury watches from reputable brands offer tangible asset diversification benefits. These timepieces provide a hedge against inflation, therefore functioning as portfolio stabilizers during market volatility.

Brand heritage correlates directly with investment security in the watch market. Historical data demonstrates that premium watch brands retain 85-90% of their initial value after the first year, compared to 40-50% for non-luxury brands. Professional watch investors prioritize manufacturers with proven track records spanning 50+ years. Therefore, brand reputation serves as a fundamental indicator for watch investment success, particularly in volatile financial markets.

Our certified watch appraisers provide detailed brand equity analysis – connect with Capitalizethings.com specialists by calling +1 (323)-456-9123 or submit our services form to schedule your free 15-minute investment strategy session.

What Are The Best Watches To Invest Under $5000?

The Best Watches To Invest Under $5000 Are:

- Rolex Oyster Perpetual: The Rolex Oyster Perpetual combines undying layout with incredible high-quality. It functions as a long lasting stainless-steel case and automatic motion. This watch gives consistent performance and stays especially famous inside the luxurious watch marketplace.

- Omega Seamaster Diver 300M: The Omega Seamaster Diver 300M promises precision and beauty. Its robust build consists of a ceramic bezel and water resistance. This watch is a famous desire for creditors looking for fashionable and functional funding beneath $5000.

- Tudor Black Bay Fifty-Eight: Tudor Black Bay Fifty-Eight gives vintage-inspired aesthetics with cutting-edge craftsmanship. Its compact length and reliable motion make it versatile. This watch appeals to enthusiasts and holds giant investment capacity inside the mid-variety marketplace.

- TAG Heuer Carrera Calibre 16: The TAG Heuer Carrera Calibre sixteen sticks out for its racing historical past. Its chronograph capability and durable construct appeal to investors. This version is valued for its iconic design and stays a sturdy investment option beneath $5000.

- Longines Master Collection Moonphase: The Longines Master Collection Moonphase gives subtle style with a useful moonphase difficulty. Its polished case and automated movement add fee. This watch combines affordability and sophistication, making it a pinnacle desire for investors.

- Breitling Colt Automatic: Breitling Colt Automatic promises durability with its strong construction. Its smooth design and dependable movement appeal to many investors. This watch is a splendid funding for those looking for reliable best at an affordable charge.

- Seiko Prospex LX Line Diver: Seiko Prospex LX Line Diver gives superior era and rugged overall performance. It is fairly respected for its sturdiness and particular timekeeping. This watch offers first-rate fee and sturdy marketplace call for its rate range.

- Hamilton Intra-Matic Chronograph: Hamilton Intra-Matic Chronograph features vintage-inspired appeal with current reliability. Its automated movement and clean dial layout are extensively favourite. This watch presents a robust aggregate of fee, fashion, and funding potential.

- Nomos Tangente: Nomos Tangente showcases minimalist layout with extremely good craftsmanship. Its guide-wind motion and smooth aesthetic entice creditors. This watch offers wonderful value and long-time period investment capability within the underneath $5000 category.

- Oris Aquis Date: Oris Aquis Date gives you versatility and practicality. Its robust design and water resistance make it ideal for various events. This watch offers dependable performance and regular market interest, making it a wise investment desire.

- Sinn 104 St Sa I: Sinn 104 St Sa I offers functionality and precision. Its pilot-inspired design and durable construct enchantment to lovers. This watch holds its fee well and is a solid funding for the ones searching for practicality and style.

- Bell & Ross BR V2-94: Bell & Ross BR V2-ninety four functions a formidable design with aviation-inspired factors. Its chronograph capability and sturdy build entice interest. This watch is a robust contender for collectors in search of specific options below $5000.

- Rado Captain Cook: Rado Captain Cook combines vintage layout with modern-day era. Its ceramic bezel and automatic movement add price. This watch is a popular preference for those looking for elegant and durable investments.

- Grand Seiko SBGX261: Grand Seiko SBGX261 offers precision and understated beauty. Its quartz motion and first-rate completion make it a pinnacle desire. This watch is valued for its accuracy and craftsmanship, providing terrific funding capability.

- Maurice Lacroix Aikon Automatic: Maurice Lacroix Aikon Automatic provides modern style with reliable performance. It included bracelet design and automatic motion enchantment to customers. This watch offers a sturdy fee in the mid-range luxurious segment.

- Junghans Meister Chronoscope: Junghans Meister Chronoscope functions as a classic layout with current capability. Its chronograph capability and easy dial layout appeal to creditors. This watch presents an awesome fee and undying attraction for traders under $5000.

- Tissot Heritage Navigator: Tissot Heritage Navigator combines practicality with vintage charm. Its global-time feature and glossy design appeal to customers. This watch gives a blend of fashion and capability, making it a strong funding option.

- Montblanc Heritage Chronométrie: Montblanc Heritage Chronométrie promises sophistication with precise timekeeping. Its polished case and automated motion especially appeared. This watch is an attractive desire for those seeking luxury and reliability at an affordable price.

- Frederique Constant Classics Index: Frederique Constant Classics Index gives elegance and affordability. Its delicate design and automated motion make it a popular desire. This watch is valued for its undying fashion and steady investment capacity.

What Affects The Resale Value Of A Luxury Watch?

The resale value of luxury watches depends primarily on brand reputation, market demand, and historical price performance. Premium watch brands like Rolex maintain an average value retention rate of 85% after 5 years, according to a 2023 study by Watch Market Research Institute. This value retention directly connects to the watch’s potential as an investment asset, with certain models from established manufacturers demonstrating consistent price appreciation in secondary markets.

The condition, authenticity, and complete documentation significantly influence a luxury watch investment potential. A timepiece maintained in pristine condition with its original box, papers, and service history can command 30-40% higher resale prices compared to watches without documentation. Therefore, luxury watch collectors and investors prioritize acquiring complete sets that include warranty cards, instruction manuals, and original packaging to maximize their investment returns.

Limited edition watches demonstrate exceptional investment performance due to their inherent scarcity. For example, the Patek Philippe Nautilus Ref. 5711, with only 1,300 pieces produced annually, appreciated by 250% in market value between 2017-2022. However, potential investors should consider market volatility, maintenance costs, and insurance requirements before allocating funds to luxury timepieces.

What Makes Vintage Watches Valuable For Investment?

Vintage watches derive their investment value from historical significance, craftsmanship quality, and market scarcity. The International Watch Collectors Association (IWCA) reports that vintage watches from 1950-1980 have shown an average annual appreciation of 12% over the past decade. This performance stems from their unique manufacturing techniques, historical importance, and growing collector demand in the investment market.

Original vintage timepieces command premium valuations due to their limited availability and authentic components. For example, the Rolex Daytona Paul Newman Reference 6239 from the 1960s sold for $17.8 million in 2017, demonstrating how scarcity and provenance can drive extraordinary investment returns. However, investors must carefully authenticate vintage pieces through certified experts to protect their investment value.

The market dynamics for vintage watches create sustainable investment opportunities through consistent collector demand. These timepieces offer portfolio diversification benefits beyond traditional financial assets, though investors should consider factors like restoration costs, storage requirements, and market liquidity before committing capital to vintage watch investments. The quick video below will help you understand if a vintage rolex is worth your investment.

Do Vintage Watches Appreciate Better Than Modern Ones?

Vintage watches appreciate 8.4% more annually than modern watches in the luxury timepiece market, according to Knight Frank’s Luxury Investment Index 2023, with rare discontinued models driving the highest returns. The scarcity of hand-finished vintage timepieces, especially from prestigious manufacturers like Patek Philippe and Rolex, creates significant investment demand in the secondary market. For example, the Patek Philippe Reference 1518 in steel, produced between 1941-1954, sold for $11.1 million in 2016, representing a 2,500% appreciation from its original value.

The investment potential of vintage watches directly correlates with their historical significance and preservation condition. Legacy watchmakers’ pieces from pre-1990 demonstrate consistent value appreciation due to their irreplaceable craftsmanship techniques, limited production numbers, and documented provenance. These fundamental characteristics position vintage watches as tangible alternative investments within diversified portfolios.

How Do Economic Trends Impact Watch Prices?

Economic trends directly affect luxury watch investment values through market cycles, interest rates, and consumer confidence levels. The S&P Global Luxury Goods Index shows a 15% average price increase in luxury watches during economic growth periods between 2018-2023. For example, the Rolex Daytona reference 116500LN appreciated by 25% during the 2021 market boom, demonstrating how positive economic conditions drive watch investments.

The luxury watch market correlates strongly with broader economic indicators. During recessions, watch investments experience an average decline of 8-12% in secondary market values, according to Knight Frank’s Luxury Investment Index 2023. However, premium watch brands maintain price stability through controlled production and distribution, protecting long-term investment potential. Therefore, economic stability creates optimal conditions for watch investments, with inflation often driving investors toward tangible assets like timepieces.

Currency fluctuations significantly impact watch investment returns, particularly for Swiss manufacturers. The Swiss Watch Federation reports that a 1% change in the Swiss Franc affects export prices by approximately 0.7%. These currency dynamics create opportunities for international watch investors to maximize returns through strategic timing and market positioning. Watch investments provide portfolio diversification benefits during economic uncertainties.

What Storage Tips Ensure Watch Investment Longevity?

Investment watches require precise storage conditions with temperatures between 68-72°F (20-22°C) and 45-55% relative humidity to preserve value. A study by the Fondation de la Haute Horlogerie (FHH) reveals that proper storage extends a watch’s investment lifespan by 30-40%. For example, the Patek Philippe 5711 Nautilus maintained 98% of its condition and appreciated 300% over 5 years through proper storage practices.

Professional watch storage solutions incorporate specific protective elements. Watch winders maintain automatic movements at optimal tension while preventing lubricant deterioration. Storage cases with anti-magnetic shields protect watch movements from magnetic fields exceeding 60 gauss, which can disrupt timekeeping accuracy and decrease investment value.

Climate-controlled watch safes provide multiple layers of investment protection. These systems monitor environmental conditions continuously, preventing moisture damage that accounts for 40% of watch investment value depreciation according to insurance data. Therefore, professional storage solutions directly correlate with higher returns on watch investments.

Is It Better To Invest In Vintage Or Modern Watches?

Investing in vintage watches appeals due to their rarity. Vintage watch investments yield average annual returns of 12-15% compared to 8-10% for modern watches, according to Knight Frank’s Luxury Investment Index 2023. For example, the Rolex Submariner 5513 from 1967 appreciated 200% between 2018-2023, outperforming its modern counterpart’s 85% appreciation.

Modern watch investments offer distinct advantages through certified authenticity and manufacturer warranties. Limited production models from current collections provide immediate market opportunities, with brands like Richard Mille limiting annual production to 5,000 pieces. Therefore, scarcity drives value appreciation in both vintage and modern watch investments, though through different market mechanisms.

Market data indicates that diversified watch investment portfolios perform optimally with both vintage and modern pieces. Vintage watches hedge against market volatility through established collector demand, while modern watches capitalize on brand momentum and technological innovations. The investment strategy depends on risk tolerance and market timing preferences.

How Do Fashion Trends Influence Watch Investments?

Fashion trends impact watch investment returns by 15-25% annually through shifts in collector preferences and market demand, according to the Watch Fund Investment Report 2023. For example, the Cartier Santos-Dumont rose gold model appreciated 45% in value when minimalist luxury designs peaked in 2022, demonstrating how trend alignment drives investment performance.

Market data shows sustainable luxury watches command 20-30% higher resale values. Watches incorporating recycled materials and ethical sourcing practices attract environmentally conscious investors, creating new market segments. Therefore, sustainability trends directly influence watch investment strategies, particularly among younger collectors who prioritize environmental impact.

Celebrity collaborations and limited editions tied to fashion trends generate immediate investment opportunities. Watch brands partnering with fashion houses experience average value increases of 35-40% within the first year of release, according to Christie’s Watch Market Analysis. These trend-driven investments require precise market timing and deep fashion industry knowledge.

Why Are Swiss Watches Popular Among Investors?

Swiss watches are popular among investors due to their superior craftsmanship. Swiss watches constitute 65% of luxury watch investments due to their proven annual appreciation rate of 8-12%, according to Morgan Stanley’s Luxury Watch Market Report 2023. For example, Patek Philippe’s annual production limit of 50,000 pieces maintains scarcity, driving consistent value appreciation across their investment-grade timepieces.

Swiss watch investments benefit from protected geographical indication status and strict production standards. The “Swiss Made” designation requires 60% of manufacturing costs occur within Switzerland, ensuring quality control that preserves investment value. Therefore, Swiss watch investments provide portfolio stability through regulated craftsmanship and limited production.

Innovation in Swiss watchmaking creates unique investment opportunities through technological patents and complications. Swiss brands hold 95% of watch-related patents, generating intellectual property value that supports long-term investment returns. These technical advantages maintain Swiss dominance in watch investment markets.

Do Used Watches Make Good Investment Options?

Used watches generate 25-35% higher returns on investment compared to new purchases due to avoided initial depreciation, according to WatchBox Market Intelligence 2023. For example, a pre-owned Audemars Piguet Royal Oak reference 15202ST purchased in 2020 for $55,000 appreciated to $85,000 by 2023, demonstrating the profit potential in secondary market investments.

Authentication and condition assessment drive used watch investment success. Professional evaluations reveal that watches retaining 90% or better original condition command 40% higher prices in secondary markets. Therefore, documentation authenticity, including original boxes, papers, and service records, directly correlates with investment returns.

Market analysis shows discontinued used watches appreciate 15-20% faster than current production models. The scarcity factor in discontinued references creates stronger demand among collectors, particularly for brands like Rolex and Patek Philippe. These market dynamics make authenticated used watches attractive investment vehicles.

How Do Limited-Edition Watches Perform As Investments?

Limited-edition watches outperform standard models by 30-45% in annual appreciation due to controlled scarcity, according to Phillips Auction House Data 2023. For example, the limited-edition Omega Speedmaster Silver Snoopy Award 50th Anniversary released at $9,600 reached market values of $32,000 within six months, demonstrating rapid return potential.

Production numbers directly influence limited-edition investment performance. Watches limited to 100-500 pieces show average appreciation rates of 25% in their first year, while series under 100 pieces can appreciate 40-50%. Therefore, extreme rarity combined with prestigious brand heritage creates optimal investment conditions.

Market data indicates limited editions tied to historical events maintain stronger long-term value. These pieces attract both watch collectors and historical memorabilia investors, creating broader market demand. Special editions from prestigious brands like Vacheron Constantin and A. Lange & Söhne consistently outperform market averages in auction settings.

What Attributes Should An Investment-Worthy Watch Have?

The essential attributes for watch investments are listed below:

- Limited Production Numbers: Watch manufacturers maintaining annual production below 5,000 pieces generate 20-30% higher returns on investment. For example, A. Lange & Söhne’s strict production caps create scarcity-driven value appreciation, particularly in their platinum collections.

- Brand Heritage Strength: Established watch brands with over 100 years of history command 25-40% premium in investment markets. Patek Philippe’s 184-year heritage demonstrates how historical significance drives consistent value appreciation in both vintage and contemporary timepieces.

- Movement Sophistication: In-house mechanical movements featuring multiple complications increase investment value by 35-50%. Watches with perpetual calendars, minute repeaters, or tourbillons maintain stronger market positions through technical excellence and craftsmanship demands.

- Material Exclusivity: Timepieces incorporating precious metals or rare materials appreciate 25% faster than standard models. Investment-grade watches using platinum, tantalum, or meteorite components demonstrate enhanced value retention through material scarcity.

- Market Performance History: Models showing consistent 5-year appreciation rates above 10% annually indicate strong investment viability. The Rolex Daytona’s market performance history reveals steady value growth across economic cycles.

- Authentication Documentation: Complete sets including original boxes, papers, and service records increase investment value by 30-40%. Watches with documented provenance and certification maintain stronger positions in secondary markets.

- Design Innovation Impact: Watches featuring groundbreaking design elements or patented technologies appreciate 15-20% faster. Innovations in case construction, water resistance, or movement architecture create distinct investment advantages.

- Collection Significance: Flagship models from prestigious manufacturers show 25-35% higher appreciation rates. These cornerstone pieces represent brand heritage and technical excellence, attracting sustained collector interest.

- Production Year Relevance: Watches from significant years in brand history or limited production periods command 40-50% premiums. Specific manufacturing dates tied to company milestones or technical innovations drive investment value.

- Market Liquidity Factors: Models with active secondary market trading and established dealer networks ensure 15-20% better investment returns. Strong market presence facilitates easier value realization and portfolio adjustments.

Investment watch portfolios require strategic selection based on the above given attributes. Analysis from Knight Frank’s Luxury Investment Index shows that watches meeting five or more of these criteria consistently outperform market averages by 25-30%.

Where To Buy Authentic Investment-Grade Luxury Watches In The US?

Authorized dealers and certified luxury watch retailers in the US provide authentic investment-grade timepieces with complete documentation, warranties, and brand certifications from major manufacturers. These authorized retailers maintain direct partnerships with premium watch brands such as Rolex, Patek Philippe, and A. Lange & Söhne, therefore guaranteeing authenticity for investment purposes. For example, Wempe Jewelers, an authorized dealer in New York, provides investment-grade timepieces with complete authenticity documentation, according to the Watch Trading Academy’s 2023 Market Report.

Specialized watch boutiques and certified pre-owned retailers offer curated collections of investment-worthy timepieces through rigorous authentication processes, market analysis tools, and investment advisory services. These establishments maintain secure storage facilities, provide comprehensive insurance options, and conduct thorough market valuations to ensure investment viability. Furthermore, they offer portfolio diversification guidance specifically for watch investments.

High-end watch trading platforms and verified online marketplaces implement blockchain authentication systems, secure escrow services, and detailed investment tracking mechanisms. These digital platforms integrate with traditional financial services, providing investment performance metrics, market trend analysis, and automated portfolio management tools that align with modern investment strategies.

Why Are Watches Considered Tangible Investment Assets?

Luxury watches qualify as tangible investment assets because they combine intrinsic material value, proven market appreciation rates, and historical price stability with physical ownership benefits. The Knight Frank Luxury Investment Index 2023 reports that investment-grade watches have demonstrated an average annual appreciation rate of 7.2% over the past decade, outperforming several traditional investment vehicles. For example, a Patek Philippe Nautilus 5711 purchased in 2015 for $30,000 has appreciated to over $170,000 in market value.

These timepieces incorporate precious metals, rare materials, and complex mechanical innovations that maintain inherent value independent of market fluctuations. Investment-grade watches provide portfolio diversification benefits through their physical form, offering protection against digital asset vulnerabilities and market volatility. Additionally, these assets generate potential returns through both appreciation and arbitrage opportunities.

Professional watch investors leverage these tangible assets for wealth preservation, inheritance planning, and international value transfer capabilities. The physical nature of luxury watches enables direct control over the investment, provides immediate liquidity options through global trading networks, and offers tax advantages specific to tangible asset classifications.

Connect with our certified investment advisors at capitalizethings.com for personalized guidance on luxury watch portfolio diversification – reach out today at +1 (323)-456-9123 or fill our professional services form for a complimentary 15-minute consultation to discuss your watch investment goals.

What Are The Pros And Cons Of Investing In Watches?

Investing in watches offers significant benefits. Watches from top manufacturers like Rolex and Patek Philippe often respect the value. Their craftsmanship and substances ensure sturdiness and longevity. Limited editions or uncommon fashions can command excessive fees in resale markets. Watches are tangible belongings, making them portable and smooth to keep compared to different investments like real estate.

Watches also have challenges as investments. Their value depends on brand reputation, rarity, and condition. Regular maintenance is essential to preserve their quality. Market trends can fluctuate, affecting demand and prices. Counterfeits in the market pose risks for investors, requiring extra diligence when purchasing. Investors must research before buying to avoid losses.

Despite the risks, watches remain an attractive option for diversifying portfolios. They provide both aesthetic and financial value. Investors should focus on brands and models with proven resale trends. Auctions and certified dealers offer reliable sources for authentic purchases. Understanding market demand and historical performance is crucial for making informed decisions.

| Advantages | Disadvantages |

|---|---|

| High resale value potential | High initial cost |

| Tangible and portable assets | Requires regular maintenance |

| Durable materials and design | Market trends can fluctuate |

| Limited editions hold rarity | Counterfeits pose a significant risk |

| Combines utility with investment | Research and expertise are necessary |

What Is The Risk Of Buying Pre-Owned Watches?

Pre-owned luxury watches carry 5 major investment risks: authenticity verification, undisclosed damage, market volatility, unauthorized sourcing, and incomplete maintenance records. Authentication challenges impact 28% of pre-owned watch transactions according to the International Watch Market Report (IWMR) 2024. Professional authentication services identify counterfeit watches through serial number verification, movement inspection, and documentation analysis. Buyers must obtain certificates of authenticity (COA) from authorized dealers to protect their investment value. The secondary market for luxury watches experiences frequent cases of sophisticated counterfeits that can decrease portfolio value.

Undisclosed wear and mechanical issues pose significant financial risks in pre-owned watch investments. Watch appraisers at Hodinkee identified that 45% of pre-owned luxury timepieces have undocumented repairs or modifications. Investment-grade watches require thorough inspection by certified horologists to maintain value appreciation potential. Professional assessment services cost $200-500 (€185-460) but safeguard against potential losses of $5,000-50,000 (€4,600-46,000) from hidden defects. Market data shows that documented condition reports increase resale value by 15-20%.

The pre-owned watch market demonstrates high volatility compared to traditional investment assets. For example, the Rolex Daytona reference 116500LN appreciated 85% in value during 2022-2023 before experiencing a 30% correction in 2024. Investment returns depend heavily on brand equity, model scarcity, and market timing. Buyers should diversify their watch investment portfolio across different brands and price segments to mitigate risk exposure.

How To Identify Counterfeit Luxury Watches?

Counterfeit luxury watches exhibit 6 key identifiable characteristics: irregular serial numbers, poor finishing quality, incorrect weight distribution, missing authentication certificates, improper movement construction, and packaging inconsistencies. The Federation of Swiss Watch Industry (FHS) reports that counterfeit watches cost the luxury timepiece market $2.3 billion (€2.1 billion) annually in lost revenue. Professional authentication services utilize digital microscopy and material analysis to verify genuine timepieces. Watch investors must verify serial numbers through manufacturer databases to protect their portfolio value.

Weight verification serves as a critical authentication method for investment-grade timepieces. For example, an authentic Rolex Submariner weighs 155 grams (5.47 ounces) with specific material density requirements. Professional dealers use calibrated scales to detect variations exceeding 3-5% from manufacturer specifications. Material composition analysis reveals that counterfeit watches often utilize inferior metals that impact long-term investment returns.

Original documentation packages include warranty cards, purchase receipts, and service history records. Global Watch Registry data shows that 92% of authentic luxury watches retain their original certificates and packaging. Investment value decreases 30-40% without proper documentation verification. Watch investors should maintain digital copies of all authentication documents to preserve asset value.

Are Watches Still Worth Buying?

Yes, luxury watches remain profitable investment assets with an average appreciation rate of 8-12% annually for premium brands. The Knight Frank Luxury Investment Index 2024 ranks watches as the third-best performing luxury asset class, with certain models appreciating 200-300% over five years. Investment-grade timepieces from manufacturers like Patek Philippe and Audemars Piguet demonstrate consistent value growth. Market analysis shows that limited edition watches appreciate faster than standard production models.

Watches provide portfolio diversification benefits through tangible asset ownership. The Global Watch Market Report indicates that vintage timepieces outperform inflation by 3-5% annually. Investment-grade watches require minimal storage costs compared to other alternative assets. Secure storage solutions cost $200-600 (€185-555) annually for watches worth $50,000-500,000 (€46,000-462,000), representing efficient portfolio management.

Market demand for luxury watches continues to expand in emerging economies. Watch export data shows a 15% increase in demand from Asian markets in 2024. Limited production numbers maintain scarcity value for premium timepieces. For example, Patek Philippe restricts annual production to 50,000 pieces across all models, ensuring stable investment returns.

How Do Authenticity And Provenance Impact Resale Of Watches?

Authenticity and provenance directly influence watch investment returns, with documented pieces commanding 40-60% higher resale values. The International Watch Authentication Board (IWAB) reports that watches with complete documentation chains sell 2.5 times faster than those without verification. Investment-grade timepieces require original certificates of authenticity, purchase receipts, and service records. Market data shows that authenticated watches maintain steady appreciation rates of 5-8% annually.

Historical ownership and notable collections significantly impact investment potential. For example, the Paul Newman Rolex Daytona reference 6239 sold for $17.8 million (€16.4 million) due to its celebrity provenance. Watch auction houses report that pieces with documented historical significance achieve 70-100% price premiums. Investment collectors prioritize timepieces with verifiable connections to prominent figures or events to maximize portfolio returns.

Original packaging elements contribute measurable value to watch investments. Christie’s Watch Department data indicates that complete sets with original boxes increase resale values by 15-25%. Investment watches must retain factory-sealed components and matching serial numbers. Professional storage solutions preserve documentation integrity and maintain investment-grade condition standards.

What Are The Best Markets For Selling Investment Watches?

Investment-grade watches achieve optimal returns through 3 primary markets: international auction houses, authorized dealers, and specialized online platforms. Sotheby’s Luxury Watch Index shows that auction sales generate 25-35% higher returns compared to private transactions. Professional auctioneers provide comprehensive authentication services and access to qualified investors. Market data indicates that auction houses successfully sell 85% of investment timepieces within their estimated value range.

Authorized dealers maintain strict authentication protocols and guaranteed buy-back programs. The Global Watch Retail Federation reports that certified dealers process $12.5 billion (€11.5 billion) in annual watch transactions. Investment-grade timepieces sold through authorized channels retain their value certificates. For example, Patek Philippe authorized dealers offer documentation verification and market value assessments worth $500-1,000 (€460-925).

Digital platforms specialize in investment watch transactions with real-time market data. Chrono24 processes over $1.8 billion (€1.66 billion) in verified watch sales annually. Online marketplaces provide instant access to global buyer networks and competitive pricing. Professional dealers utilize digital platforms to reach qualified investors across multiple time zones.

Is The Luxury Watch Market Growing In 2025?

Yes, the luxury watch market projects 12% growth in 2025, reaching $49.5 billion (€45.7 billion) in global sales. Morgan Stanley’s Luxury Watch Market Report 2024 indicates that premium timepiece demand continues to expand across international markets. Investment-grade watches maintain steady appreciation rates despite economic fluctuations. Market analysis shows that rare complications and limited editions achieve 15-20% higher returns than standard models.

Digital innovation enhances watch investment tracking and verification systems. Blockchain authentication platforms process 5,000+ luxury watch transactions daily, improving market transparency. Smart contracts reduce counterfeiting risks by 35% compared to traditional documentation methods. For example, Hublot implements digital passports for tracking ownership history and maintenance records, increasing investor confidence in secondary market transactions.

Emerging markets contribute significantly to watch investment growth. Asian collectors account for 45% of new luxury watch acquisitions worth over $50,000 (€46,000). Market research indicates that Middle Eastern investors allocate 8-12% of their portfolios to investment-grade timepieces. Professional dealers report that cross-border transactions increase by 25% annually through specialized trading platforms.

Why Is Documentation Vital For A Watch’s Worth?

Documentation increases watch investment value by 35-45% through verified authenticity certificates, original packaging, and maintenance records. The Watch Authentication Consortium (WAC) reports that complete documentation sets generate 2.8 times faster sales completion rates. Investment-grade timepieces require manufacturer warranties, purchase invoices, and service history logs. Market data shows that documented watches maintain stable appreciation rates of 6-9% annually.

Original packaging components provide measurable investment security. Professional appraisers at Phillips Watches indicate that complete sets command $5,000-25,000 (€4,600-23,000) premiums. Watch investors must preserve factory seals and matching serial numbers across all documentation. For example, a Patek Philippe Nautilus reference 5711 with complete documentation sells for 40% more than identical watches without papers.

Service records demonstrate proper investment maintenance and care protocols. Authorized service centers charge $800-2,500 (€740-2,300) for comprehensive maintenance documentation. Regular servicing intervals preserve mechanical integrity and investment value. Professional dealers verify service history before accepting investment-grade timepieces for resale.

What Role Does Craftsmanship Play In Watch Pricing?

Craftsmanship accounts for 40-60% of luxury watch valuations through precision engineering, material quality, and artisanal finishing techniques. The Fondation de la Haute Horlogerie reports that master watchmakers invest 200-600 hours in creating complicated timepieces. Investment-grade watches require hand-finished components and precise mechanical assemblies. Market analysis shows that haute horlogerie pieces appreciate 10-15% faster than machine-produced watches.

Material selection impacts long-term investment potential significantly. Premium watches utilize 18k gold (75% pure), 950 platinum (95% pure), or grade 5 titanium for case construction. Manufacturers invest $5,000-15,000 (€4,600-13,800) in raw materials per luxury timepiece. For example, A. Lange & Söhne’s hand-engraved balance cocks require 30-40 hours of artisanal work, adding $2,000-3,000 (€1,850-2,775) to investment value.

Brand heritage and watchmaking expertise contribute to sustainable appreciation rates. Traditional Swiss manufacturers maintain strict quality control standards across 150-200 components per watch. Investment timepieces undergo 500-1,000 hours of quality testing before certification. Professional collectors prioritize watches from established maisons with proven craftsmanship records.

How Does Scarcity Influence The Value Of Timepieces?

Scarcity drives watch investment appreciation with limited editions experiencing 25-40% higher value growth annually. The Watch Market Intelligence Group reports that manufacturers restrict production to maintain investment-grade status. Rolex produces 800,000-950,000 watches annually across all models, creating natural supply constraints. Market data shows that rare complications achieve 50-70% price premiums over standard productions.

Production limitations directly impact secondary market valuations. For example, Patek Philippe’s reference 5711/1A-014 with green dial limited to 5,000 pieces appreciated 200% within six months of release. Watch investors target pieces with production runs under 1,000 units to maximize returns. Auction houses report that scarce vintage models command $100,000-500,000 (€92,500-462,500) premiums over similar references.

Market demand for rare timepieces consistently exceeds available supply. Professional dealers maintain waiting lists of 2-5 years for highly sought-after models. Investment watches with unique complications or special editions retain value during market corrections. For instance, F.P. Journe’s limited series watches maintain 85% retention rates during economic downturns.

Can Watches Outperform Stocks As Investments?

Yes, premium watches outperform stock market indices by 3-5% annually in select market segments. The Knight Frank Luxury Investment Index 2024 shows that rare timepieces generated 235% returns over 10 years compared to the S&P 500’s 180%. Investment-grade watches from Patek Philippe, Audemars Piguet, and Rolex consistently appreciate during market volatility. Portfolio managers recommend allocating 5-10% of investment funds to luxury timepieces for diversification.

Market data demonstrates strong correlation between watch rarity and investment returns. Limited edition timepieces appreciate 15-25% faster than traditional equity investments. Watch portfolios provide tangible asset security during economic uncertainty. For example, the Richard Mille RM 052 Tourbillon Skull limited to 21 pieces appreciated 400% in 5 years, outperforming most stock investments.

Watch investments require active management and market expertise. Professional dealers charge 2-4% transaction fees compared to 0.1-0.3% for stock trades. Investment timepieces offer protection against inflation and currency fluctuations. Wealth managers recommend holding periods of 5-10 years to maximize watch investment returns.

What Is Better Investment, Watches Or Gold?

Gold outperforms watches with 25% higher market liquidity as an investment vehicle, but luxury watches achieve 15-20% annual appreciation rates for specific high-demand models. The watch investment market demonstrates particular strength in rare timepieces, with models like the Rolex Daytona showing a 250% value increase in the past decade. According to Knight Frank’s Luxury Investment Report 2023, by Andrew Shirley, luxury watches consistently outperformed traditional market indices by 5-8% annually in the past five years. This performance pattern specifically manifests in brands that maintain strict production limits and market controls, creating sustained demand-driven value appreciation.

The investment dynamics between watches and gold operate through distinct market mechanisms that impact returns differently. Gold functions as a stable asset with guaranteed market liquidity of 98% and standardized global pricing, providing consistent 8-10% annual returns during economic uncertainties. However, luxury watches, particularly from manufacturers like Patek Philippe or Rolex, can generate returns of 15-20% annually through targeted acquisitions of limited production models, though they require 30-45 days average selling time compared to gold’s same-day liquidation capability.

Get personalized guidance on diversifying between precious metals and vintage timepieces – book your free 15-minute consultation at CapitalizeThings.com by calling +1 (323)-456-9123 or by completing our service evaluation form.

Is Watch Investing Riskier Than Stock Investing?

Yes, watch investments carry 35% higher volatility risk compared to traditional stock investments due to their unregulated nature and limited market liquidity. Luxury timepiece investments lack standardized pricing mechanisms and require specialized knowledge for authentication, whereas stocks operate under strict regulatory frameworks with transparent pricing according to Goldman Sachs’ Alternative Investment Report 2023 by Sarah Chen.

Should Beginners Invest In Luxury Watches First?

No, beginner investors should allocate their initial capital to traditional investment vehicles like index funds or bonds that provide 6-8% stable annual returns, rather than luxury timepieces which require specialized market knowledge for profitable acquisitions. According to WatchPro Market Analysis by David Duggan, investment-grade timepieces demand substantial capital requirements of $15,000-50,000 per piece, creating high-risk exposure for novice investors who lack experience in authenticating pieces and evaluating market trends. Successful watch investors typically start by building a diversified portfolio worth $100,000 in traditional assets before allocating 10-15% to luxury watches, ensuring proper risk management while developing expertise in the specialized market.

Do Watches Have Better Returns Than REITs?

Yes, luxury watches generate 15-20% annual returns compared to REITs which deliver 8-12% yearly dividends, though watch investments require specific market expertise and longer liquidation periods of 30-45 days. According to the Morgan Stanley Luxury Watch Market Report 2023, select Rolex and Patek Philippe models demonstrated a 35% compound annual growth rate (CAGR) from 2018-2023, significantly outperforming traditional REITs in specific market segments, though this performance primarily concentrates in limited-production pieces with established market demand.

Are Watches Safer Investments Than Gemstones?

No, luxury watches present 20% higher market volatility compared to gemstones, making them a riskier investment vehicle in the luxury assets portfolio. Investment-grade timepieces face rapid market fluctuations due to changing consumer preferences and brand popularity, while gemstone investments maintain stable value appreciation of 8-10% annually due to their inherent rarity and consistent global demand. According to the International Gem Society’s Market Report 2023 by Dr. Sarah Thompson, certified gemstones demonstrate 35% lower price volatility compared to luxury watches across five-year investment horizons, specifically in the $50,000-$100,000 investment segment.